Market

Why Are These Altcoins Are Trending Today, October 18?

Today, October 18, several altcoins are seeing mild price increases, suggesting that many could finish the week on a positive note. Interestingly, while some tokens have managed to hold their ground, not all of today’s trending altcoins are performing similarly.

The top three for today are Solidus Ai Tech (AITECH), Turbo (TURBO), and Dog Food Token (OISHII). Here’s why these altcoins are trending and what could be next for their prices.

Solidus Ai Tech (AITECH)

AITECH is one of the top trending altcoins for the second consecutive day. Yesterday, BeInCrypto suggested that AITECH’s price might undergo a slight decline. As of this writing, the price has lost 3% of its value in the last 24 hours.

According to the daily chart, the altcoin has fallen below the 20-day Exponential Moving Average (EMA). Typically, when the cryptocurrency’s price rises above this indicator (in blue), it gives more credence to an upswing.

But a decline indicates otherwise. As such, AITECH’s value risks undergoing another decline. Furthermore, the token is around the same spot as the 50 EMA (yellow), suggesting an extended downturn to $0.082.

Read more: 10 Alternative Crypto Exchanges After Bybit Exits France

However, the altcoin’s price might rebound if bulls push it back above the 20 EMA. if that happens, AITECH could jump to $0.12.

Turbo (TURBO)

Turbo’s emergence as one of the trending altcoins marks its third consecutive appearance and is trending today due to increasing investor interest. Over the past 30 days, TURBO’s price has surged by 100%, making the AI-themed meme coin a token to watch closely.

However, its value has dropped by 5% within the last 24 hours. The daily chart shows that bulls are defending the $0.10 support so the crypto can escape another downturn. If sustained, TURBO’s price can bounce and move toward $0.015, which would represent a 47% price increase.

On the contrary, the altcoin might not be able to reach this point if bears push bulls out of the way. If that happens, TURBO might decline to $0.0079.

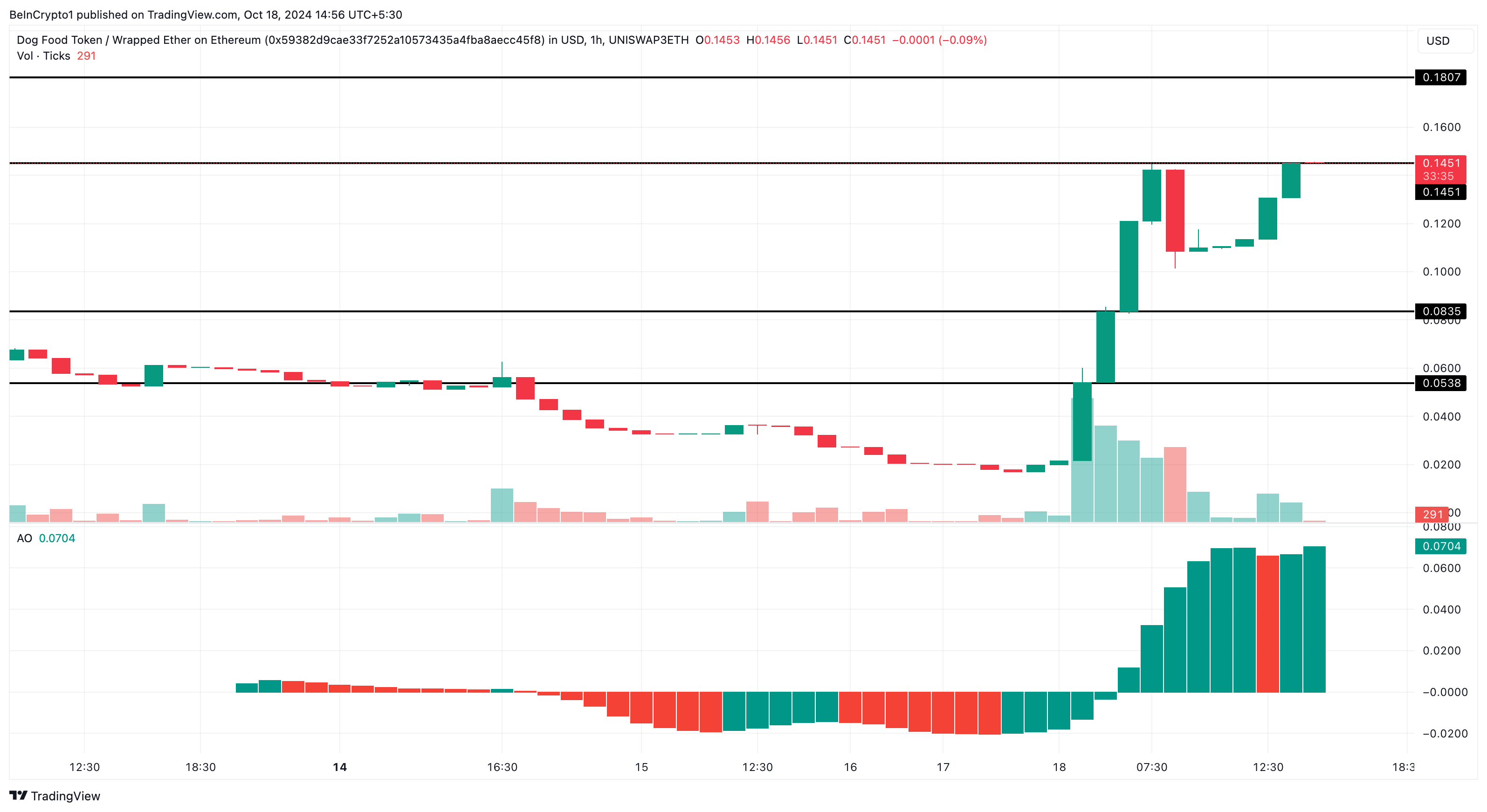

Dog Food Token (OISHII)

Out of the top altcoin trading today, Dog Food Token is the only one with a significant price increase over the last 24 hours. Within the mentioned period, OISHII, built on Ethereum, experienced an astonishing 565% price surge.

This remarkable increase is the key reason why it is trending. According to the daily OISHII/WETH pair, the Awesome Oscillator (AO), which measures historical price movements with recent ones, is positive. This positive reading suggests rising momentum with OISHII despite the massive increase.

Should momentum stay bullish and buying pressure increases, then OISHII’s price could break the resistance a $0.14. If that happens, the altcoin’s price could rally to $0.18.

Read more: Which Are the Best Altcoins To Invest in October 2024?

In the event that profit-taking climbs, this prediction might be invalidated, and OSHII could sink to $0.084 or as low as $0.054 in a highly bearish scenario.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

5 RWA Altcoins to Watch In April 2025

Ondo (ONDO), Parcl (PRCL), Mantra (OM), OriginTrail (TRAC), and Clearpool (CPOOL) are five RWA altcoins worth keeping an eye on in April 2025.

ONDO holds a $2.4 billion market cap despite a 7% drop this week, while PRCL has fallen nearly 40% amid broader market weakness. Mantra is down just 1.5% over the same period, showing relative strength, though its actual on-chain impact is still debated. TRAC and CPOOL are both in correction phases, but key support and resistance levels could define their next moves.

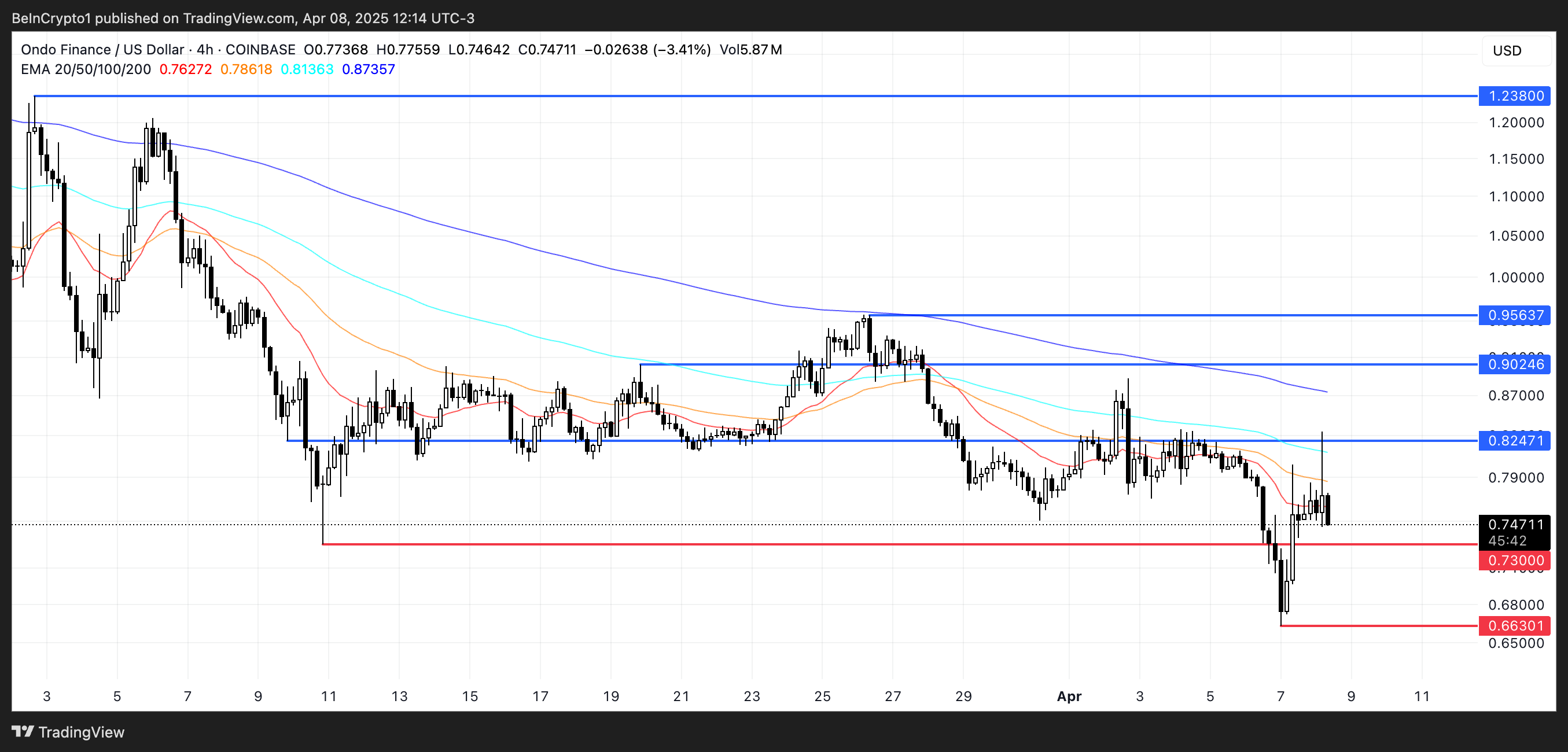

Ondo (ONDO)

Despite a 7% decline over the past seven days, ONDO remains one of the leading RWA altcoins in crypto. It holds a strong position with a market cap near $2.4 billion.

If the downtrend persists, ONDO could first test key support at $0.73. A breakdown below that level may trigger further losses toward $0.66, and if selling pressure accelerates, the token could slide below $0.60 — a level not seen since early 2024.

However, if bulls regain control and reverse the current trend, ONDO could begin climbing toward resistance at $0.82. A successful breakout could lead to a retest of $0.90 and $0.95, and if the momentum holds, the token could even rally up to $1.23 — signaling a strong return of bullish sentiment.

Parcl (PRCL)

Parcl, a decentralized real estate trading platform, current has a market cap nearing $16 billion.

However, the last seven days have been rough for PRCL, with its price plummeting nearly 40% amid a broader altcoin correction and waning market sentiment.

If PRCL can recover from its current downturn, the first key resistance level to watch is $0.073.

A break above that could open the door for a move toward $0.10, potentially signaling a shift in momentum and restoring some confidence among investors looking for a rebound in the RWA space.

On the flip side, if bearish pressure continues, PRCL may slide down to test critical support at $0.050.

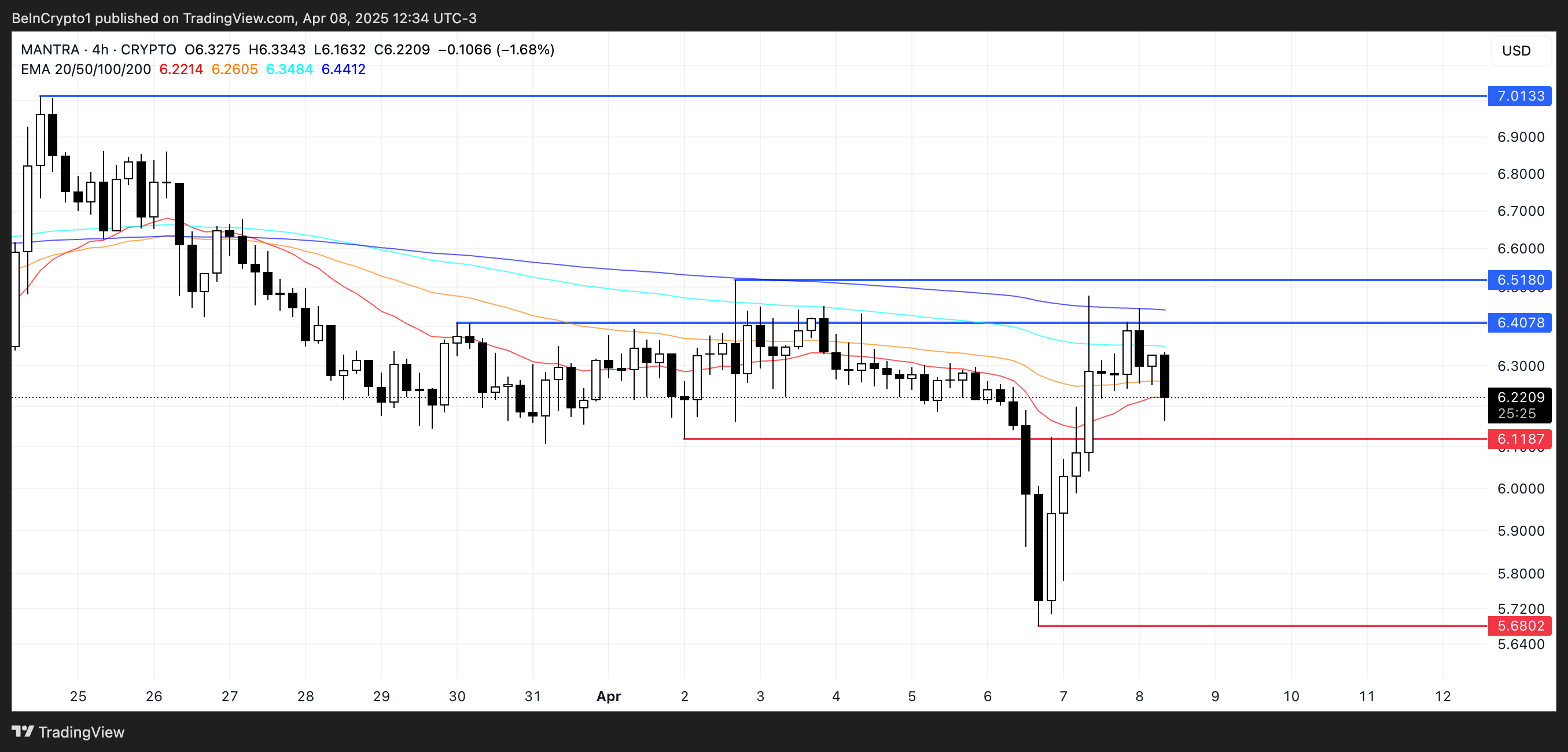

Mantra (OM)

Mantra has emerged as one of the standout RWA altcoins in recent months, with its market cap reaching an impressive $6 billion. Unlike many of its peers, OM has held up relatively well during the latest market correction, dropping just 1.5% over the past seven days — a much smaller decline compared to other RWA altcoins. Recently, Binance Research published that RWA altcoins remain safer than Bitcoin during tariffs.

However, according to Marcos Viriato, CEO of Parfin, it’s too early to declare Mantra as the winner of this cycle:

“It’s still too early to declare a definitive winner. Mantra has executed well and gained momentum, but the RWA space is vast and still maturing. We’re likely to see a multi-platform landscape, with different players excelling in different segments, whether it’s institutional custody, yield generation, or settlement infrastructure. The winners will be those who combine regulatory readiness, composability, and real-world utility and there’s still a lot of room for innovation,” Viriato told BeInCrypto.

OM is still technically in a short-term downtrend. If the correction continues, the token could retest support at $6.11, and a break below that level could push prices down to $5.68. A loss of that support may signal weakening momentum, especially if broader market sentiment remains bearish.

However, if buyers regain control and the trend reverses, Mantra could begin moving higher toward key resistance at $6.40 and $6.51. A successful breakout above these levels could trigger a stronger rally, potentially taking OM back to $7 — a level that would reinforce its bullish long-term outlook.

Kevin Rusher, founder of DeFi RWA lending and borrowing ecosystem RAAC.io, defends that despite price action, Mantra’s value to the whole RWA ecosystem isn’t that big:

“I think it’s definitely too soon to say that Mantra has cornered the RWA market. If you want to talk about price action, you might declare them the winner so far, but the value they have actually brought on-chain is minimal. According to DeFi Llama, Mantra’s current TVL is just $4.3m – this does not even place it within even the top 45 of RWA projects by TVL,” Rusher told BeInCrypto.

OriginTrail (TRAC)

TRAC is the native token of OriginTrail, a decentralized ecosystem focused on building a trusted knowledge infrastructure for artificial intelligence. Its mission is to create a Verifiable Web for decentralized AI.

Despite being down 8.6% over the past seven days, TRAC is showing signs of recovery, bouncing 7.6% in the last 24 hours. If this rebound gains momentum, the token could soon test resistance at $0.37.

A breakout above that level could pave the way for a move toward $0.44, signaling a stronger bullish reversal and renewed interest in the OriginTrail project.

However, traders are closely watching the $0.31 support level, which remains a critical zone for maintaining the current structure. If TRAC drops and fails to hold that support, the price could slip below $0.30, potentially triggering another wave of downside pressure.

Clearpool (CPOOL)

Clearpool is a decentralized capital markets ecosystem that allows institutional borrowers to access unsecured loans directly from the DeFi apps. In a major development, the project recently introduced Ozean — a new blockchain initiative focused on enabling real-world asset (RWA) yield.

CPOOL, Clearpool’s native token, has declined by 7.5% over the past seven days, dropping below the $0.12 mark.

If the current correction continues, the token may test support at $0.106, and a breakdown from that level could push CPOOL below $0.10 — a psychologically significant threshold that may increase bearish sentiment.

However, if the trend reverses and bullish momentum around RWA coins returns, CPOOL could aim for resistance at $0.137. A breakout above that could open the path toward $0.154 and potentially $0.174, depending on the strength of the recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

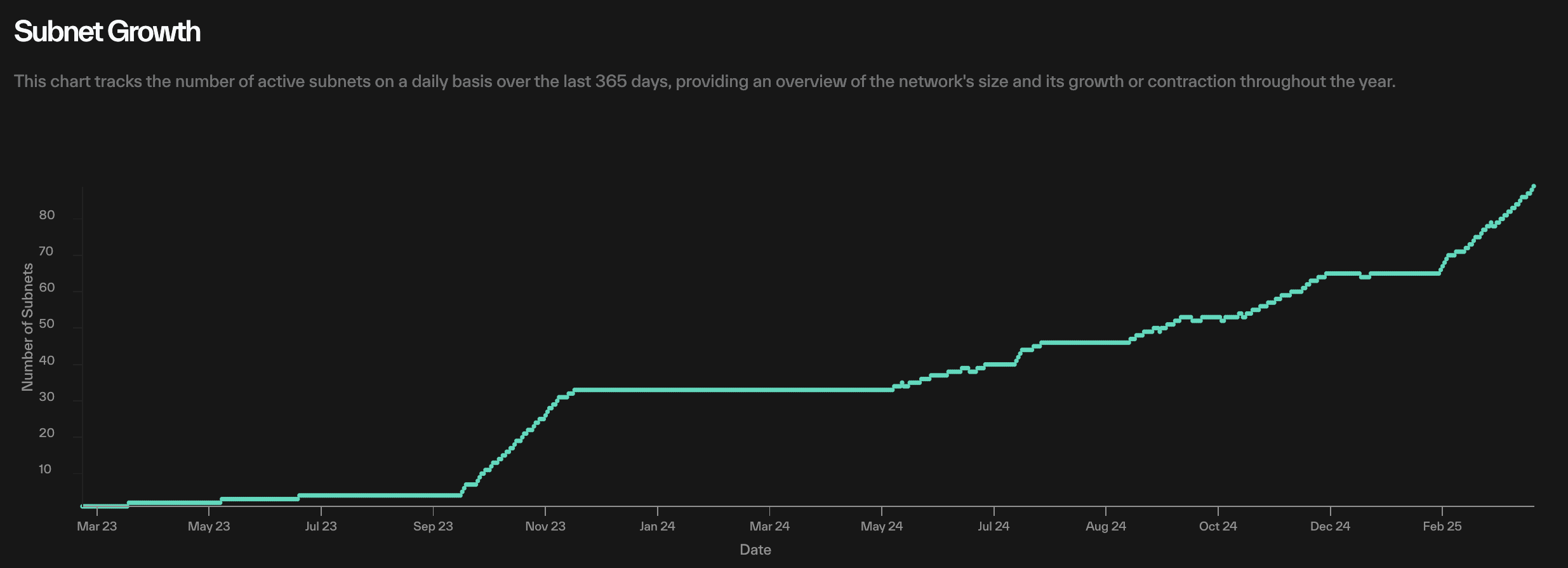

Bittensor’s Subnet Ecosystem Grows Despite Market Uncertainty

Despite tariff fears having an outsized impact on AI tokens, Bittensor’s subnet ecosystem is posting impressive returns. In two months, its subnet tokens’ market cap grew from $4 million to over $200 million.

The total number of subnets has tripled in the last year, and community enthusiasm could fuel further growth. Each one can improve Bittensor’s machine-learning capabilities, potentially creating further gains.

Bittensor Network Grows Thanks to Subnets

Bittensor, a decentralized AI learning network, has been going through a few changes lately. It became the biggest AI cryptoasset last December and rallied again after a Coinbase listing.

Although its token price has since had a period of decline, there are a few key signals of long-term potential. Essentially, the key factor for Bittensor is growth in its subnets.

“Venture capitalists chasing gas hashrate stars is old news. Bittensor subnets are open source projects with Bitcoin-like currencies bolted on top. ~50 days in, < 100 subnets are worth $6 billion+ with billions in emission pouring in over coming months. The bar is LOW. There should be thousands of subnets today!” Joseph Jacks claimed.

Subnets are how Bittensor keeps its machine-learning capabilities decentralized. Each subnet is a specialized partition of the network that focuses on a specific area of expertise, and they’re growing.

In the last year, the number of total active subnets on the network has nearly tripled:

Some of the leading subnet tokens in Bittensor’s ecosystem have market caps well in excess of $10 million. Indeed, despite a slight hiccup yesterday, the total market cap of all subnet tokens has been growing dramatically.

This figure rose from around $4 million in February to over $200 million today, an impressive rate of growth.

This growth is impressive enough in a vacuum, and even more so in today’s unstable crypto market. However, Bittensor’s subnet performance is particularly noteworthy for another reason.

According to a recent report, tariff instability is heavily impacting AI tokens, with only meme coins suffering worse damage. In other words, Bittensor should be feeling pressure.

Despite these broader concerns, Bittensor’s ecosystem is actually expanding. This high performance has led some advocates to declare that Bittensor might be “the next generational opportunity.”

If the subnet ecosystem is growing under these circumstances, it’ll provide higher utility for Bittensor’s machine learning and a possible source of market stability.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Stocks Suffer As Trump Confirms 104% Tariffs on China

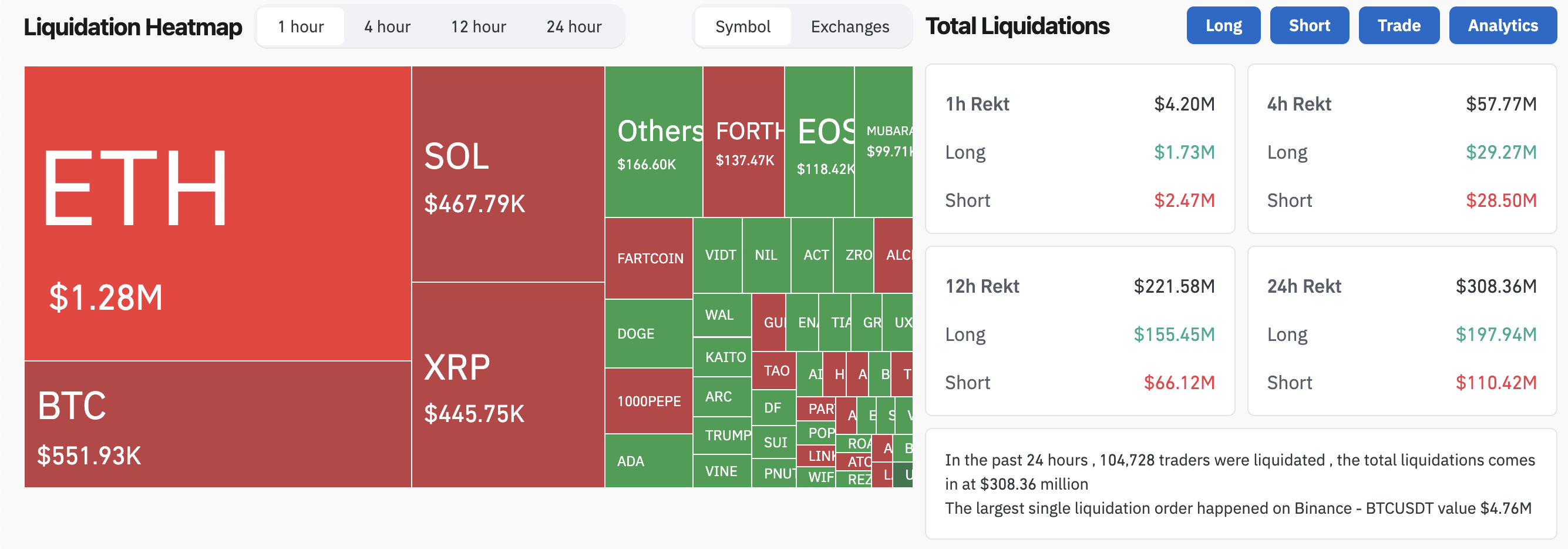

The White House confirmed that 104% tariffs against China will go live at midnight tonight, much to the woe of the crypto market. After a brief recovery to $79,000, Bitcoin fell to $76,000 amid $300 million in total crypto liquidations.

There are a few points of optimism, as Bitcoin’s long positions rose to 54%. Tomorrow will be a critical day to follow; it may bring chaos to TradFi, but crypto could potentially weather the storm.

Trump’s Tariffs Massacre Crypto Market

Trump’s tariffs are about to take effect, and the markets are in a profound moment of uncertainty. Yesterday, over $1 billion was liquidated from the crypto market, but optimism about a potential deal buoyed prices today.

The White House subsequently confirmed that 104% tariffs against China would take effect at midnight, prompting crypto to drop again:

China is America’s largest trading partner, and these sweeping tariffs could devastate the markets. Crypto, however, has been especially devastated. Publicly listed crypto companies faced another day of harsh drops after the tariff confirmation, as MicroStrategy’s MSTR slumped over 11%.

Additionally, Coinbase, Robinhood, and publicly traded Bitcoin miners all approached a 5% drop.

Bitcoin might be in a particularly dangerous position. Although a recent report claimed that it has been one of the crypto sector’s most tariff-proof assets, its risk profile might be changing.

It dropped 2.6% today, approaching the $75,000 price mark as more than $300 million was liquidated from crypto. If Bitcoin falls below this point, it could trigger further price routs.

Bitcoin Long-Short Ratio Fuels Optimism

As this morning’s price gains clearly demonstrated, the market still has a lot of remaining optimism. This could help all of crypto withstand tariff threats, including Bitcoin.

Its long positions have surged to 54%, showing that most traders are betting on BTC to rebound back to a higher price point.

Ultimately, tomorrow will be a very critical day for tariffs, crypto, and TradFi markets as a whole. It’s probably too late to hold out hope that Trump will decide not to escalate with China.

However, it remains to be seen whether the crypto market will continue to co-relate with the stock market after the tariffs are live or at-risk assets will reverse course and hedge against potential inflation fears.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoEthereum Price Rebound Stalls—Can It Reclaim the Lost Support?

-

Market21 hours ago

Market21 hours agoXRP Price Recovery Fades—$2 Remains A Tough Nut to Crack

-

Market24 hours ago

Market24 hours agoRWA Tokenization Takes Center Stage in Hong Kong

-

Market16 hours ago

Market16 hours agoBitcoin Price Recovery In Play—But Major Hurdles Loom Large

-

Market23 hours ago

Market23 hours agoHedera (HBAR) Drops 8% as Market Signals Remain Mixed

-

Altcoin16 hours ago

Altcoin16 hours agoBitcoin +6%, Ethereum +10% Amid Tariff Uncertainty; FARTCOIN Skyrockets +38%, Recovery or Bubble?

-

Ethereum16 hours ago

Ethereum16 hours agoHere’s Where Ethereum’s Last Line Of Defense Lies, According To On-Chain Data

-

Altcoin19 hours ago

Altcoin19 hours agoBinance Announces KERNEL As 4th Megadrop Project; Here’s The Listing Date