Market

What Stages Should Crypto Startups Approach VCs for Fundraising?

For any cryptocurrency startup, deciding when to approach venture capitalists (VCs) is a crucial problem. The best time to look for outside funding varies greatly, depending on the particular requirements of the project and the interests of the venture capitalists (VCs) involved.

The investment thresholds of various VCs vary. While some investors are satisfied with the founding team’s strength and the idea alone, others look for concrete results like a Minimum Viable Product (MVP) or obvious market traction. All agree that raising money should never be seen as the final goal. Instead, it’s a strategic tool that must align with a startup’s growth trajectory.

“Founders shouldn’t feel pressured to chase VC funding unless it aligns with their growth strategy. The goal should be building sustainable businesses with healthy revenue streams, not just fundraising for the sake of it,” Leonarda Rajeckyte from The VC Whisperer states.

With this principle in mind, we’ve gathered insights from experts at Axia8 Ventures, Bing Ventures, Capitable Group, Outlier Ventures, and The VC Whisperer to shed light on the right stages for crypto startups to approach VCs.

Pre-Seed Stage: Building a Vision and Team

For some VCs, investing begins even before an MVP exists. Axia8 Ventures, led by Wayne Lin, focuses on the very early stages of a startup’s journey. For them, the most important criterion is not necessarily the technical advancement of the project but the strength of the founder’s vision and adaptability.

“We invest at the truly early stage, often before a deck or product is even developed. The critical factor for us is the founder’s vision, passion, and capability to pivot through multiple iterations. We’ve worked with founders who failed twice but succeeded on their third try,” As Wayne Lin explains.

This approach highlights the importance of having a strong, committed team with the ability to persevere and pivot through failures.

Seed Stage: Concept Validation with Whitepaper and Deck

As a project progresses from ideation to conceptualization, having a well-crafted whitepaper and a solid deck becomes crucial. According to Bruce Lan from Bing Ventures, the whitepaper plays a pivotal role in bridging the gap between an idea and its execution.

“In the early stages, a well-crafted whitepaper or deck can bridge the gap between an idea and execution. It’s essential for teams to communicate a clear vision and path forward. VCs are more likely to engage when they see that the project is grounded in a solid, thoughtful concept, even if it’s still in its infancy.”

This is particularly important for startups looking to raise funds at the seed stage, where they may not yet have a fully functional MVP but can present a compelling argument for the viability of their idea.

A whitepaper can serve as an essential document that articulates the project’s vision, technology, and potential market impact. It gives VCs a clear roadmap of where the project is headed and how it plans to get there.

MVP Stage: Gaining Credibility and Minimizing Risk

As a project advances past the ideation stage, having a Minimum Viable Product (MVP) becomes a critical factor in demonstrating both credibility and progress to VCs. Matthew Tang from Capitable Group emphasizes the importance of an MVP in instilling confidence in investors.

“A working MVP demonstrates progress and eliminates any suspicion of vaporware or scams. At this stage, VCs are more confident in the team’s ability to build and deliver,” says Tang.

For many VCs, especially those who enter the later stages of seed funding, having an MVP is a concrete indicator that the project has moved beyond the theoretical phase and into practical application. The presence of a functioning MVP also provides investors with an opportunity to evaluate the product’s technical feasibility and potential market fit.

Scaling Stage: Approaching VCs for Growth Capital

A cryptocurrency project should look for venture funding to support its next stage of growth once it has begun to attract users and has demonstrated its product-market fit. When a startup is prepared to grow into new markets, accelerate product development, or scale operations, Pietro Negri of Outlier Ventures suggests that they approach venture capitalists.

“When a crypto project needs funding to take its ventures to the next level, it should approach venture capitalists. VCs look for indications of strong product-market fit and growth potential at this stage, whether it’s expanding the product or entering a new market,” says Negri.

Venture capitalists are currently searching for projects that have already demonstrated their concept and now need funding to grow. They will evaluate important measures of product-market fit, like revenue generation, user adoption, and the project’s capacity to draw in partnerships.

Key Criteria VCs Look for in Crypto Startups

Several universal factors help VCs evaluate the potential of crypto startups, regardless of the stage. These criteria include:

- Founding team

- Technological innovation

- Market potential and capacity for problem-solving

- Strategic partnerships

For a deeper look into each of these criteria and insights from experts like Wayne Lin (Axia8 Ventures), Bruce Lan (Bing Ventures), and Pietro Negri (Outlier Ventures), refer to our article on Key Criteria VCs Prioritize When Assessing a Crypto Project.

Common Pitfalls to Avoid When Seeking VC Funding

Even though raising money can be exciting, a lot of cryptocurrency startups risk failing because they make simple mistakes that could have a negative impact on their chances of success. Red flags are easily spotted by VCs, and a startup’s attractiveness can be greatly increased by avoiding these pitfalls.

- Unclear vision and goals: Uncertain vision and goals: One of the most frequent errors is to propose an extremely ambitious or vague vision without providing a clear plan for how to get there. Startups need to be able to clearly explain both their long-term objectives and the precise actions they plan to take to get there. “Investors need to see a well-defined plan that demonstrates how the project intends to grow and scale,” says Leonarda Rajeckyte of The VC Whisperer.

- Incomplete tokenomics: Many crypto projects fail to adequately design a sustainable and transparent tokenomics model. VCs are particularly cautious of projects where the token’s utility and value growth are unclear or poorly thought out. A solid tokenomics model should outline how the token functions within the ecosystem and its long-term value potential.

- Lack of compliance: Legal and regulatory issues are often overlooked in the rush to launch, which can be disastrous in the long run. Failing to consider compliance can turn VCs away and also lead to legal complications down the line. Bruce Lan from Bing Ventures stresses, “Compliance is crucial. Crypto projects need to be mindful of regulations, especially if they plan to expand internationally.”

Final Thoughts: Aligning Funding with Growth Strategy

Raising venture capital is a critical step for many crypto startups, but it must align with the startup’s growth trajectory. As emphasized by experts from Axia8 Ventures, Bing Ventures, Capitable Group, Outlier Ventures, and The VC Whisperer, there is no one-size-fits-all approach to securing VC funding.

The decision to approach VCs should be driven by the project’s readiness, market fit, and clear long-term strategy. Startups should not view fundraising as an achievement in itself but as a means to support sustainable growth. Leonarda Rajeckyte from The VC Whisperer wisely advises that startups should pursue funding only when it enhances their business strategy.

Timing is essential. VCs are more likely to invest when there is demonstrable progress—whether it’s a strong team, an MVP, or early market traction. Ultimately, the goal should be to use funding as a tool to scale, without losing focus on the project’s core mission and vision. Clear objectives and a solid growth strategy will always attract the right investors at the right time.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Market

Tokens Big Players Are Buying

Crypto whales are making bold moves heading into May 2025, and three tokens are standing out: Ethereum (ETH), Artificial Superintelligence Alliance (FET), and Onyxcoin (XCN). All three have seen a noticeable uptick in large-holder accumulation over the last week, signaling growing interest from big players despite recent volatility.

While ETH and XCN are both coming off sharp corrections, whale buying suggests confidence in a potential rebound. Meanwhile, FET is riding renewed momentum in the AI sector, with whale activity accelerating alongside rising prices.

Ethereum (ETH)

The number of Ethereum crypto whales—wallets holding between 1,000 and 10,000 ETH—has been steadily climbing since April 15. Back then, there were 5,432 such addresses.

That number has now risen to 5,460, the highest count since August 2023. At the same time, the concentration of ETH held by these whales is also hitting new highs, signaling growing accumulation by large holders.

While this can be interpreted as confidence in Ethereum’s long-term value, it also raises concerns about centralization and potential selling pressure if whales decide to take profits.

Ethereum price is currently down more than 19% over the last 30 days. If the correction continues, the price could retest support at $1,535. Losing that level might send ETH toward deeper support at $1,412 or even $1,385.

However, if the trend reverses, key resistance zones lie at $1,669 and $1,749—with a potential push toward $1,954 if bullish momentum builds.

In this context, the growing dominance of whales could act as either a stabilizing force or a looming risk, depending on how they respond to market shifts.

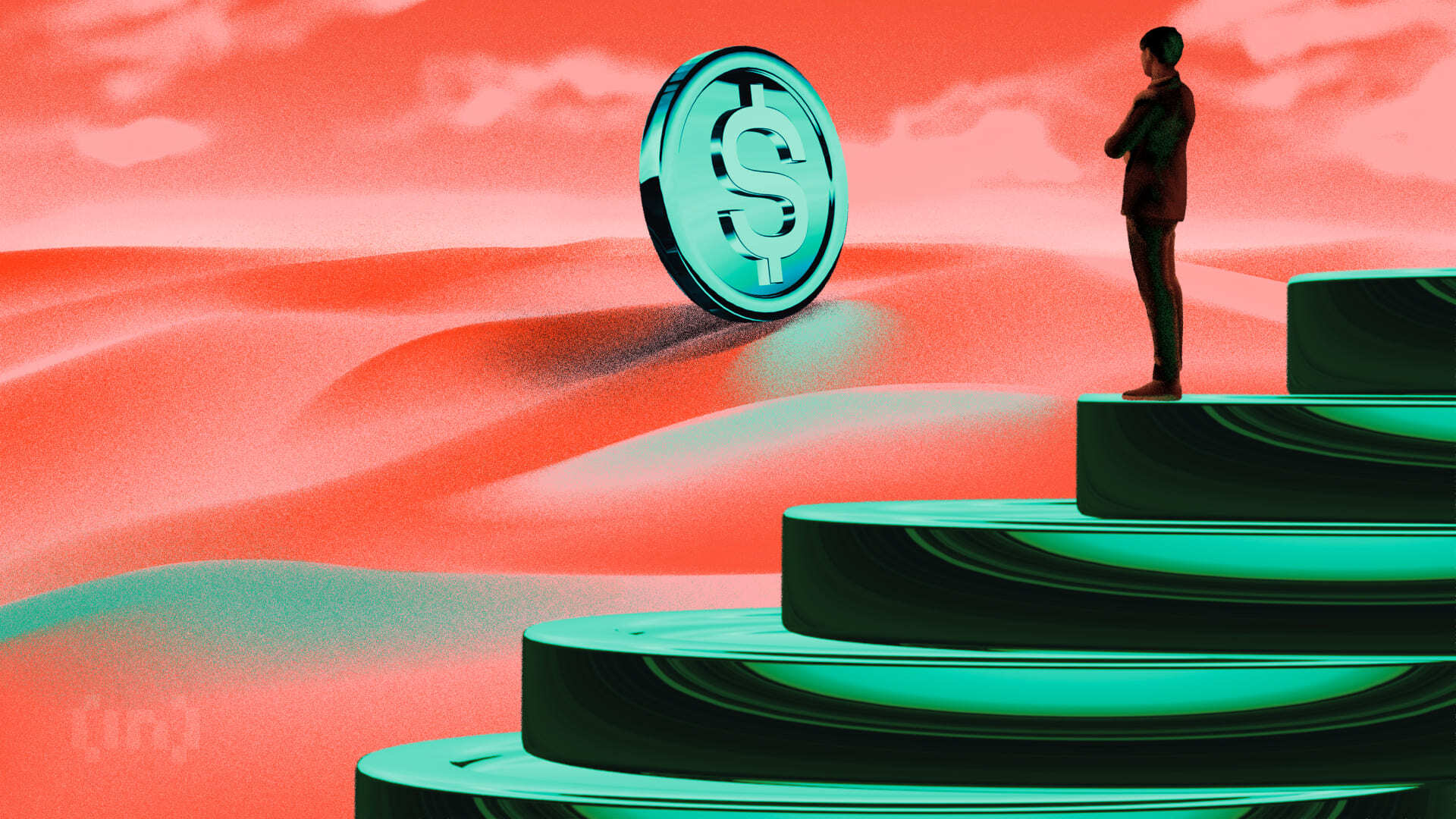

Artificial Superintelligence Alliance (FET)

The number of FET whales—wallets holding between 10,000 and 1,000,000 tokens—increased from 572 on April 13 to 586 by April 19.

This steady growth in large holders points to rising confidence among bigger players. It comes at a time when the broader AI crypto narrative is showing signs of a rebound.

Key AI coins like FET, TAO, and RENDER have all increased over 9% in the last seven days, with FET itself gaining more than 8% in the past 24 hours and 13.5% over the week. This suggests a possible comeback for the artificial intelligence narrative in crypto.

If this momentum continues, FET could push toward resistance at $0.659. A clean breakout from that level could open the door to further gains, with $0.77 and $0.82 as the next potential targets.

On the flip side, if the rally stalls, FET might drop back to test support at $0.54. A breakdown below that could send it as low as $0.44.

With whale activity heating up and the AI sector showing renewed strength, FET’s next move could be a key signal for where the narrative heads next.

Onyxcoin (XCN)

Onyxcoin was one of the standout performers in January, but its momentum has faded in recent months. After a strong bounce—up of over 57% in the last 30 days, the token is now correcting, down 19% in the past seven days.

Despite this pullback, accumulation continues. The number of crypto whales holding between 1 million and 10 million XCN has grown from 528 on April 16 to 541, suggesting some large holders may be buying the dip.

If the correction deepens, XCN could lose support at $0.0165. A drop below that may open the door to further declines toward $0.0139 and $0.0123.

But if the trend flips back upward, the token could first test resistance at $0.020. A strong breakout from there might lead to a move toward $0.027. With whale activity on the rise and volatility returning, XCN’s next move could be decisive.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

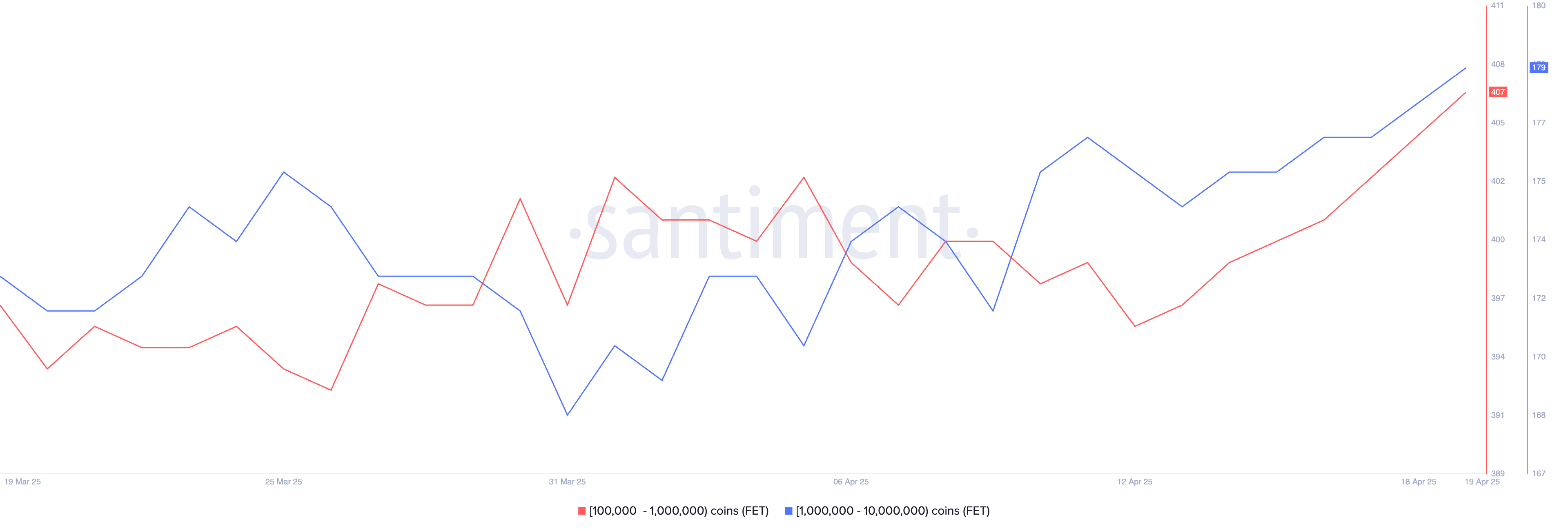

1 Year After Bitcoin Halving: What’s Different This Time?

Bitcoin (BTC) is now one year past its most recent halving, and this cycle is shaping up to be unlike any before it. Unlike previous cycles where explosive rallies followed the halving, BTC has seen a far more muted gain, up just 31%, compared to 436% over the same timeframe in the last cycle.

At the same time, long-term holder metrics like the MVRV ratio are signaling a sharp decline in unrealized profits, pointing to a maturing market with compressing upside. Together, these shifts suggest Bitcoin may be entering a new era, defined less by parabolic peaks and more by gradual, institution-driven growth.

A Year After the Bitcoin Halving: A Cycle Unlike Any Other

This Bitcoin cycle is unfolding noticeably differently than previous ones, signaling a potential shift in how the market responds to halving events.

In earlier cycles—most notably from 2012 to 2016 and again from 2016 to 2020—Bitcoin tended to rally aggressively around this stage. The post-halving period was often marked by strong upward momentum and parabolic price action, largely fueled by retail enthusiasm and speculative demand.

The current cycle, however, has taken a different route. Instead of accelerating after the halving, the price surge began earlier, in October and December 2024, followed by consolidation in January 2025 and a correction in late February.

This front-loaded behavior diverges sharply from historical patterns where halvings typically acted as the catalyst for major rallies.

Several factors are contributing to this shift. Bitcoin is no longer just a retail-driven speculative asset—it’s increasingly seen as a maturing financial instrument. The growing involvement of institutional investors, coupled with macroeconomic pressures and structural changes in the market, has led to a more measured and complex response.

Another clear sign of this evolution is the weakening strength of each successive cycle. The explosive gains of the early years have become harder to replicate as Bitcoin’s market cap has grown. For instance, in the 2020–2024 cycle, Bitcoin had climbed 436% one year after the halving.

In contrast, this cycle has seen a much more modest 31% increase over the same timeframe.

This shift could mean Bitcoin is entering a new chapter. One with less wild volatility and more steady, long-term growth. The halving may no longer be the main driver. Other forces are taking over—rates, liquidity, and institutional money.

The game is changing. And so is the way Bitcoin moves.

Nonetheless, it’s important to note that previous cycles also featured periods of consolidation and correction before resuming their uptrend. While this phase may feel slower or less exciting, it could still represent a healthy reset before the next move higher.

That said, the possibility remains that this cycle will continue to diverge from historical patterns. Instead of a dramatic blow-off top, the outcome may be a more prolonged and structurally supported uptrend—less driven by hype, more by fundamentals.

What Long-Term Holder MVRV Reveals About Bitcoin’s Maturing Market

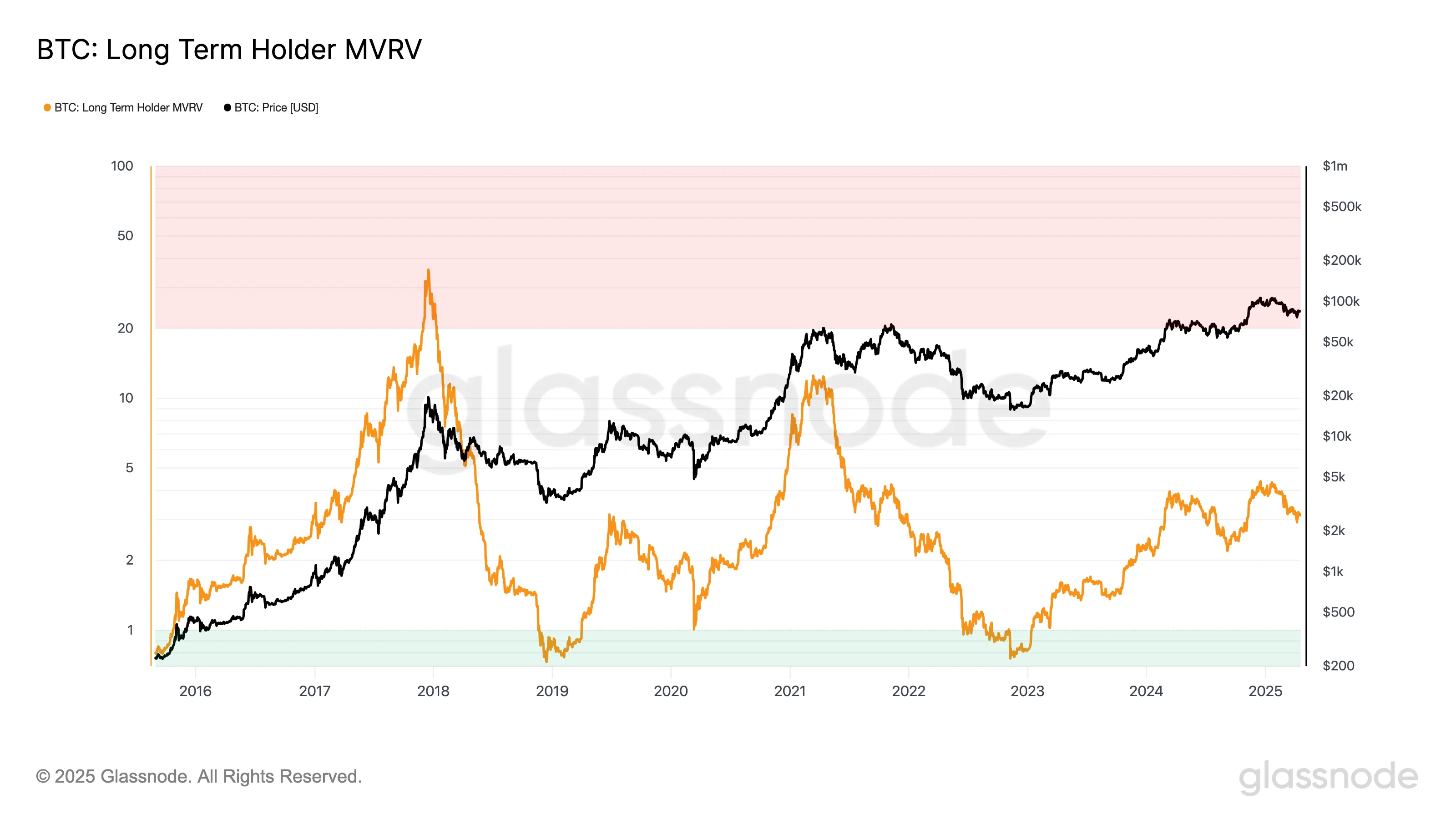

The Long-Term Holder (LTH) MVRV ratio has always been a solid measure of unrealized profits. It shows how much long-term investors are sitting on before they start selling. But over time, this number is falling.

In the 2016–2020 cycle, LTH MVRV peaked at 35.8. That signaled massive paper profits and a clear top forming. By the 2020–2024 cycle, the peak dropped sharply to 12.2. This happened even as Bitcoin price hit fresh all-time highs.

In the current cycle, the highest LTH MVRV so far is just 4.35. That’s a massive drop. It shows long-term holders aren’t seeing the same kind of gains. The trend is clear: each cycle delivers smaller multiples.

Bitcoin’s explosive upside is compressing. The market is maturing.

Now, in the current cycle, the highest LTH MVRV reading so far has been 4.35. This stark drop suggests long-term holders are experiencing much lower multiples on their holdings compared to previous cycles, even with substantial price appreciation. The pattern points to one conclusion: Bitcoin’s upside is compressing.

This isn’t just a fluke. As the market matures, explosive gains are naturally harder to come by. The days of extreme, cycle-driven profit multiples may be fading, replaced by more moderate—but potentially more stable—growth.

A growing market cap means it takes exponentially more capital to move the price significantly.

Still, it’s not definitive proof that this cycle has already topped out. Previous cycles often included extended periods of sideways movement or modest pullbacks before new highs were reached.

With institutions playing a larger role, accumulation phases could stretch longer. Therefore, peak profit-taking may be less abrupt than in earlier cycles.

However, if the trend of declining MVRV peaks continues, it could reinforce the idea that Bitcoin is transitioning away from wild, cyclical surges and toward a more subdued but structured growth pattern.

The sharpest gains may already be behind, especially for those entering late in the cycle.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

VOXEL Climbs 200% After Suspected Bitget Bot Glitch

Voxies (VOXEL), a little-known gaming token, surged by over 200% within 24 hours on April 20 following a suspected malfunction in Bitget’s trading system.

The unexpected glitch led to an explosive spike in activity, pushing the VOXEL/USDT contract’s trading volume to an eye-watering $12.7 billion. According to Coingecko data, this significantly outpaces Bitcoin’s $4.76 billion volume on the same platform.

Bitget Trading Error Reportedly Lets Users Earn Six-Figure Profits

The unprecedented spike drew attention across the crypto space, particularly given that VOXEL is a relatively obscure free-to-play blockchain game token with a market cap under $30 million.

According to on-chain analyst Dylan, the Bitget bot repeatedly executed trades within the narrow $0.125 to $0.138 price range. Savvy traders quickly caught on, using just $100 to scalp profits exceeding six figures.

Reports suggest that the glitch allowed some users to walk away with tens or even hundreds of thousands of USDT in a matter of hours.

In response, Bitget’s spokesperson Xie Jiayin confirmed the platform was aware of the irregular activity and has launched an internal investigation. The company also noted that affected accounts may face temporary restrictions, urging users to contact in-app support for further assistance.

“Every platform, at every stage of development, may encounter challenges and uncertainties, yet these are an inevitable part of the journey. Bitget will provide the event details and resolution within 24 hours,” Jiayin added.

Meanwhile, the incident has sparked criticism from market experts and traders, many of whom question Bitget’s internal safeguards and technical maturity.

Several community members have criticized Bitget’s response to the issue. Some have claimed that the exchange’s decision to forcibly settle VOXEL contracts at discounted rates breached user trust. Bitget’s hybrid custody model is also receiving backlash following the incident.

“The platform’s product design reveals concerning flaws: a hybrid custody risk pool exposes users to systemic risks, and unrestricted position sizes open the door to manipulation. If these issues are not addressed, more altcoins could be weaponized against Bitget—potentially making it the next catastrophic failure in the crypto space,” one analyst stated.

Meanwhile, the timing of the incident is also notable. VOXEL is currently listed on Binance’s “Vote to Delist” program. The campaign aims to improve transparency and give the community a voice in token listings.

Overall, the Bitget incident has amplified concerns about potential market manipulation involving the token and highlighted the broader risks tied to centralized exchanges.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin19 hours ago

Altcoin19 hours agoCardano Bulls Secure Most Important Signal To Drive Price Rally

-

Bitcoin22 hours ago

Bitcoin22 hours agoSwiss Supermarket Chain Welcomes Crypto Payments

-

Bitcoin15 hours ago

Bitcoin15 hours agoAnalyst Says Bitcoin Price Might Be Gearing Up For Next Big Move — What To Know

-

Market21 hours ago

Market21 hours ago5 Crucial Red Flags Investors Missed

-

Market20 hours ago

Market20 hours agoSUI Ranks 5th in DEX Volume, But Rally Lacks Strength

-

Altcoin17 hours ago

Altcoin17 hours agoRipple Expands In Asia With Debut XRP Investment Tool

-

Market23 hours ago

Market23 hours agoHedera Trading Slows 27% Even as Recovery Hints Emerge

-

Regulation21 hours ago

Regulation21 hours agoJohn Deaton Lays Out 5 To-Do List