Market

What It Means for Ethereum’s Reputation

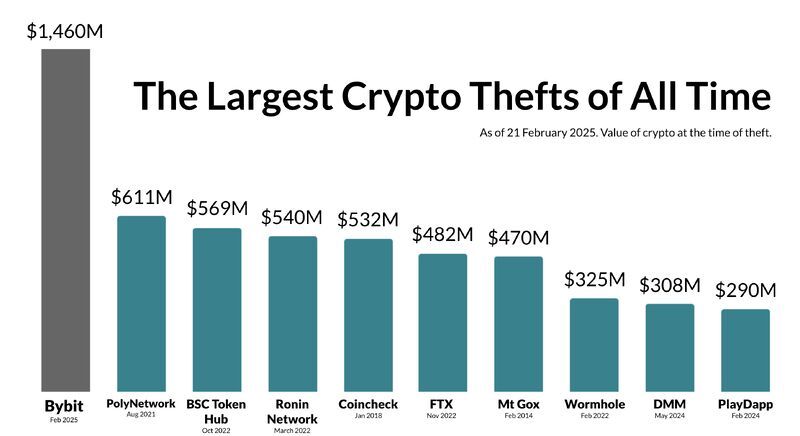

The recent $1.5 billion Bybit hack turned North Korean Lazarus Group into one of the top 15 Ethereum holders in the world. The breach sent shockwaves through the crypto space, alerting users who previously thought Ethereum was among the safest and most decentralized networks.

In a conversation with BeInCrypto, representatives from Holonym, Cartesi, and Komodo Platform discussed the implications of this breach, steps to curb similar situations in the future, and how public trust in Ethereum can be restored.

A Different Kind of Breach

The Bybit hack shook the crypto community not just because of the quantity of funds stolen but also because of the nature of the breach.

While other crypto exchange breaches, like the 2014 Mt. Gox episode or the 2018 Coincheck hack, involved private keys or direct compromises of exchange wallets, Bybit’s situation was different.

Rather than stealing private keys, the hackers manipulated the transaction signing process, indicating that it was an infrastructure-level attack. The transaction signing process was targeted instead of the asset storage itself.

Forensic analysis of the Bybit hack traced the breach to Safe Wallet, a multi-signature wallet infrastructure provided by a third party. Safe Wallet uses smart contracts and cloud-stored JavaScript files on AWS S3 to process and secure transactions.

Hackers could secretly modify transactions by injecting malicious JavaScript into Safe Wallet’s AWS S3 storage. Therefore, although Bybit’s system was not directly hacked, the hackers altered the destination of transfers that Bybit had approved.

This detail exposed a serious security flaw. Third-party integrations become weak points even if an exchange locks down its systems.

Lazarus Group Among Ethereum’s Top Holders

Following the monumental hack, North Korea is among the top 15 largest Ethereum holders.

According to on-chain data, Gemini, which previously held the 15th position, holds 369,498 ETH in its Ethereum wallet. Since Bybit hackers stole over 401,000 ETH, they now overtook Gemini in ownership.

The fact that an infamous group like Lazarus, responsible for several high-profile hacks in the crypto sector, now holds such an important amount of Ether raises several trust issues. While initial speculation pointed toward a weakness in Ethereum’s decentralized nature, Nanak Nihal Khalsa, Co-Founder of Holonym, discards this claim.

Given that Ethereum’s governance and consensus mechanisms rely on validators rather than token holders, the Lazarus Group holding such a substantial amount of ETH does not compromise the network’s overall decentralization.

“Lazarus still owns less than 1% of ETH in circulation, so I don’t see it as highly relevant beyond simple optics. While it’s a lot of ETH, they still own less than 1%. I’m not worried at all,” Khalsa told BeInCrypto.

Kadan Stadelmann, Chief Technology Officer at Komodo Platform, agreed, emphasizing that Ethereum’s infrastructure design is the source of its weakness.

“It proves a vulnerability in Ethereum’s architecture: illicit actors could expand their holdings further by targeting exchanges or DeFi protocols, and thus wield an influence over market dynamics and possibly change governance decisions in Ethereum’s off-chain processes by voting on improvement proposals. While Ethereum’s technical decentralization has not been compromised, Lazarus Group has eroded trust in Ethereum,” Stadelmann told BeInCrypto.

However, while token holders cannot influence Ethereum’s consensus mechanisms, they can manipulate markets.

Potential Impacts and Market Manipulations

Though the Bybit hackers have already finished laundering the stolen ETH, Stadelmann outlined a series of possible scenarios that the Lazarus Group could have carried out with the massive wealth they originally accumulated. One option is staking.

“Ethereum’s Proof-of-Stake security relies on honest validators and resilience of wallets, exchanges, and dApps. While the Lazarus Group’s haul doesn’t threaten the blockchain’s consensus mechanism, since their holdings are not known to be staked, it certainly raises the spectre that this could be achieved. They’re unlikely to do this, as the funds they’ve stolen have been tracked,” he explained.

Along equally unlikely lines, the Bybit hackers could cause a significant market downturn by selling their holdings altogether.

“Their holdings do give them an opportunity to manipulate markets, such as if they dump their holdings. This would be difficult to do since their ETH are flagged. If they try to exchange the ETH via selling, their assets could be frozen,” Stadelmann added.

What Stadelmann is most worried about looking toward the future is the impact hacks can have on Ethereum’s Layer 2 protocols.

“Lazarus and its partners could attempt to attack Layer 2 protocols like Arbitrum and Optimism. A censorship attack on layer 2 could undermine dApps and cause the ecosystem to move towards centralized transaction sequencers. That would underscore Ethereum’s weakness,” he said.

While Ethereum’s network was not compromised, Safe Wallet’s attacks underscored the vulnerabilities in the security of the greater ecosystem.

“The breach has certainly increased tensions in the ecosystem, and created an uneven token distribution. The question remains: will Lazarus or other hacking groups associated with state actors attempt to exploit the Ethereum ecosystem, particularly at layer 2?” Stadelmann concluded.

It also raised questions about the need for better security standards.

Verification Over Trust

Khalsa argued that the Bybit hack, while not a threat to Ethereum’s core security, highlighted the need for improved security standards among users.

“Saying the hack is Ethereum’s problem is like saying death by car accident is the car’s problem when the driver didn’t wear a seatbelt. Could the car have more safety measures? Yes, and it should. But as a seatbelt has little to do with the car, the hack had little to do with Ethereum. It’s a protocol and it worked exactly as intended. The problem is the lack of convenience and know-how for securely custodying digital assets,” he said.

Specifically, the incident exposed vulnerabilities within multi-signature wallets, demonstrating that reliance on third-party integrations can introduce significant risks, even with robust internal security. Ultimately, even the most sophisticated wallet security measures become ineffective if the signing process can be compromised.

Khalsa emphasized that proven self-custody security measures exist, while multi-signature wallets are not among them. He added that government agencies should have long ago advocated for superior security standards and practices.

“The repercussion we can all hope for is getting serious about stopping North Korea from stealing more funds. While it’s not the government’s place to change how self-custody is carried out, it is absolutely the government’s place to encourage better industry ‘best practices.’ This attack was due to the myth that multisigs of hardware wallets are secure. Sadly it took this attack for it to be acknowledged, but better standards set by government agencies could encourage safer practices without the need for $1.5 billion compromises to wake up the industry,” he asserted.

The incident also exposed the need to verify transactions rather than trust third-party applications.

A Solution to Front-End Vulnerabilities

By injecting malicious JavaScript into vulnerable Safe Wallet cloud servers, the Lazarus Group launched a sophisticated attack, enabling them to mimic the interface and trick users.

According to Erick de Moura, co-founder of Cartesi, this exploit highlights a critical vulnerability. The issue lies in the reliance on centralized build and deployment pipelines within a system intended for decentralization.

“The SAFE incident serves as a stark reminder that Web3 is only as secure as its weakest link. If users cannot verify that the interface they interact with is genuine, decentralization becomes meaningless,” he said.

De Moura also added that a common misconception in Web3 security is that smart contract breaches are among the most effective forms of hacking exchanges. However, he deems that the Lazarus Group’s strategy on Bybit proves otherwise. Injecting malicious code into the front-end or other off-chain components is much more seamless.

“The hackers didn’t need to breach smart contracts or manipulate ByBit’s systems directly. Instead, they injected malicious code into the front-end interface, deceiving users into thinking they were engaging with a trusted platform,” he explained.

Despite these vulnerabilities, a transition from trust-based to verifiable security is possible.

The Case for Reproducible Builds

De Moura views the Bybit hack as a wake-up call for the Web3 community. As exchanges and developers reassess their security, he argues that verifiable, reproducible builds are essential to prevent future attacks.

“At its core, a reproducible build ensures that when source code is compiled, it always produces the same binary output. This guarantees that the software users interact with hasn’t been altered by a third party somewhere in the deployment pipeline,” he said.

Blockchain technology is vital to ensure that this process takes place.

“Imagine a system where every software build generates binaries and resources in a verifiable way, with their fingerprints (or checksums) stored on-chain. Instead of running such builds on cloud servers or computers that are prone to security breaches, they can be executed on dedicated blockchain co-processors or decentralized computational oracles,” De Moura told BeInCrypto.

Users can compare the checksum of the front-end resources they are loading against on-chain data through a browser plugin or feature. A successful match indicates an authentic build interface, whereas a discrepancy signals a potential compromise.

“If a verifiable reproducible builds approach had been applied to SAFE, the exploit could have been prevented. The malicious front-end would have failed verification against the on-chain record, immediately exposing the attack,” De Moura concluded.

This approach presents a helpful alternative to relying on users with varying levels of self-custody knowledge.

Addressing Gaps in User Knowledge

As attacks grow more sophisticated, the lack of user knowledge about how to securely custody digital assets presents a significant vulnerability.

The Bybit hack frustrated users who originally thought that reliance on third-party integrations would be enough to safeguard their assets. It also affected the broader perception of cryptocurrency security.

“It shows crypto is still in the Wild West and in its growing phase in terms of security. I think in a couple years we will have superior security but in its current state, the public fear is well-justified,” Khalsa said.

Ultimately, embracing different approaches will be essential for the Web3 community to build a more secure and resilient ecosystem. A good starting point is to demand better industry practices and evaluate the integration of verifiable, reproducible builds.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Recovers Some Losses—Is a Full Rebound in Sight?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a fresh decline below the $86,000 zone. BTC is now correcting losses and might struggle near the $84,000 and $85,000 levels.

- Bitcoin started a fresh decline below the $85,000 zone.

- The price is trading below $84,000 and the 100 hourly Simple moving average.

- There was a break above a key bearish trend line with resistance at $82,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another decline if it fails to clear the $84,000 resistance zone.

Bitcoin Price Faces Resistance

Bitcoin price started a fresh decline below the $85,000 level. BTC traded below the $82,000 and $80,000 support levels. Finally, the price tested the $76,500 support zone.

A low was formed at $76,818 and the price recently started a recovery wave. There was a move above the $78,000 and $80,000 resistance levels. The bulls pushed the price above the 23.6% Fib retracement level of the downward move from the $91,060 swing high to the $76,818 low.

There was a break above a key bearish trend line with resistance at $82,000 on the hourly chart of the BTC/USD pair. Bitcoin price is now trading below $84,000 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $83,200 level. The first key resistance is near the $84,000 level.

The 50% Fib retracement level of the downward move from the $91,060 swing high to the $76,818 low is also near $84,000. The next key resistance could be $85,000.

A close above the $85,000 resistance might send the price further higher. In the stated case, the price could rise and test the $86,500 resistance level. Any more gains might send the price toward the $88,000 level or even $96,200.

Another Drop In BTC?

If Bitcoin fails to rise above the $84,000 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $81,200 level. The first major support is near the $80,000 level.

The next support is now near the $78,000 zone. Any more losses might send the price toward the $76,500 support in the near term. The main support sits at $75,000.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $81,000, followed by $80,000.

Major Resistance Levels – $84,000 and $85,000.

Market

SEC Delays XRP and Solana ETF Approvals

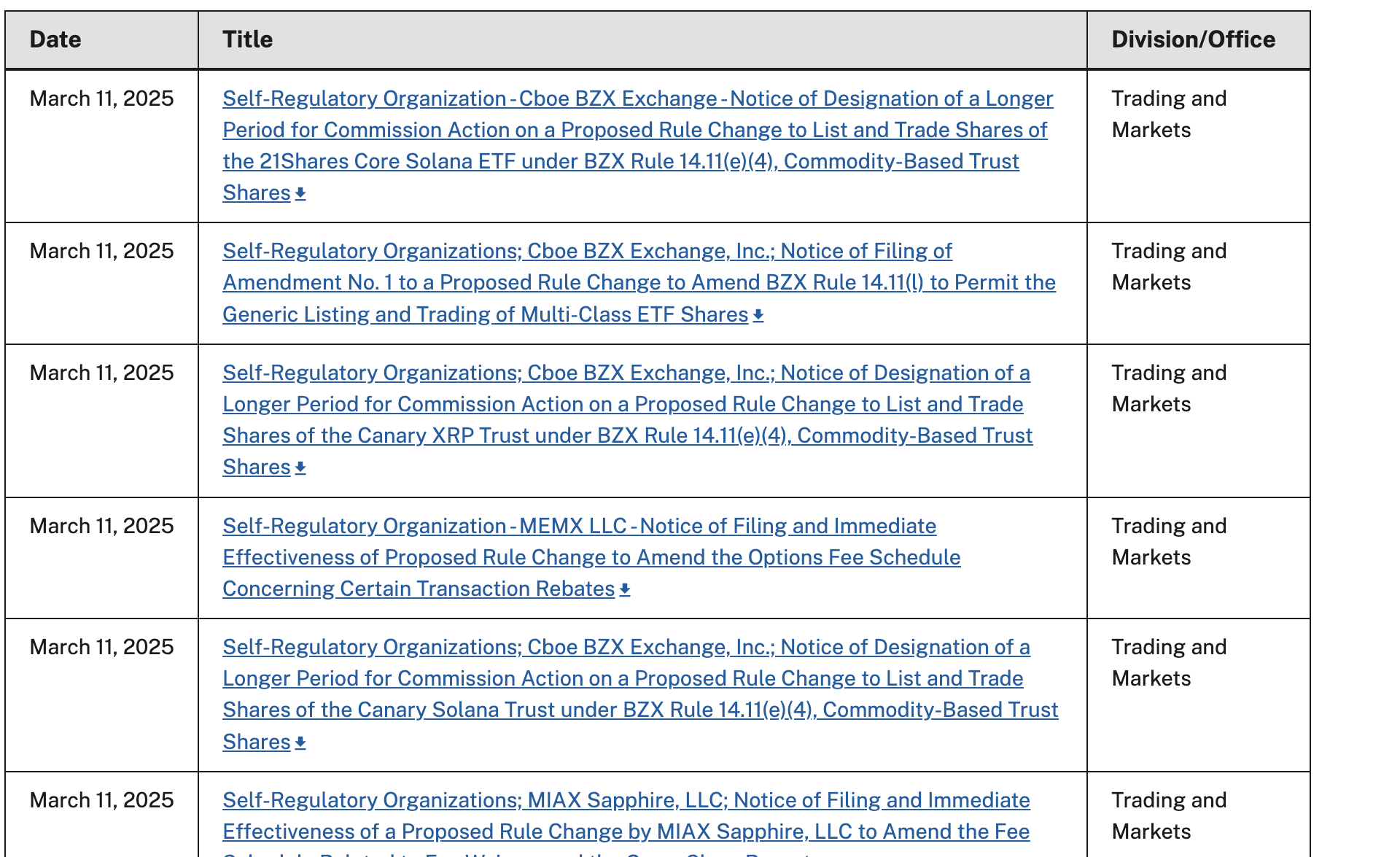

The SEC delayed several ETF applications today, specifically targeting those based on Solana, XRP, Litecoin, and Dogecoin. The Commission has faced recent criticism for its pro-crypto actions, and this may help buy it some time.

Nonetheless, it also acknowledged fresh applications shortly before delaying this group. Many of these filings came from the same issuers or applied to the same cryptoassets as the first group.

SEC Delays Altcoin ETFs

The SEC has been undergoing many changes recently, which has prompted a wave of altcoin ETF applications from several potential issuers.

The Commission began acknowledging these applications, creating a series of deadlines to either approve or reject them. Today, the SEC punted on a tranche of applications, delaying proposals for Solana, XRP, and others.

In total, the SEC delayed approval for six different ETFs based on Solana, XRP, Litecoin, and Dogecoin. The acknowledged Solana ETF applications previously had a deadline set for today, and this extension gives the Commission a chance to consider the matter more fully.

By contrast, the XRP ETF, did not have an SEC deadline until several months from now. The Commission delayed applications from Canary and Grayscale but not Bitwise; this final proposal is the most recent of the three.

Bizarrely, the Commission acknowledged another application on its website today, an XRP ETF prospectus filed by Franklin Templeton.

In other words, the Commission’s rationale here is a bit difficult to understand. Even as the SEC delays several ETFs, it’s also acknowledging several fresh ones.

“Yes, the SEC just punted on a bunch of alt coin ETF filings including Litecoin, Solana, XRP & DOGE. It’s expected as this is standard procedure & Atkins hasn’t even been confirmed yet. This doesn’t change our (relatively high) odds of approval. Also note that the final deadlines aren’t until October for these,” wrote ETF analyst James Seyffart.

In addition to Franklin Templeton’s XRP ETF, it also recognized a Dogecoin ETF application and another based on Hedera.

There is one possible explanation for the SEC’s choice to delay ETF proposals. Approving fresh altcoin ETFs would significantly shake up the market, and it’s already in a moment of chaos.

The Commission is short a member until its new Chair gets confirmed by the Senate, and it may already be delaying other actions until this happens.

“Eth staking and in-kind also delayed. Everything delayed. It’s like the NYC-bound Amtrak on monday morning: Mechanical issues in DC,” wrote analyst Eric Balchunas.

One of the SEC’s Commissioners has dramatically broken with precedent to directly criticize its new pro-crypto turn, and the Commission has continued taking bold actions since.

If the SEC approves these altcoin ETFs immediately, it might invite further fractures of this nature.

Of course, the Commission hasn’t explicitly stated any of its intentions on this matter. The SEC took its time to consider ETF applications under Gary Gensler thoroughly, and the trend may simply be continuing.

One thing does seem clear, however. With this many postponements in one day, any new altcoin ETF approvals might take several more months to come.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Plunges 38% In a Month

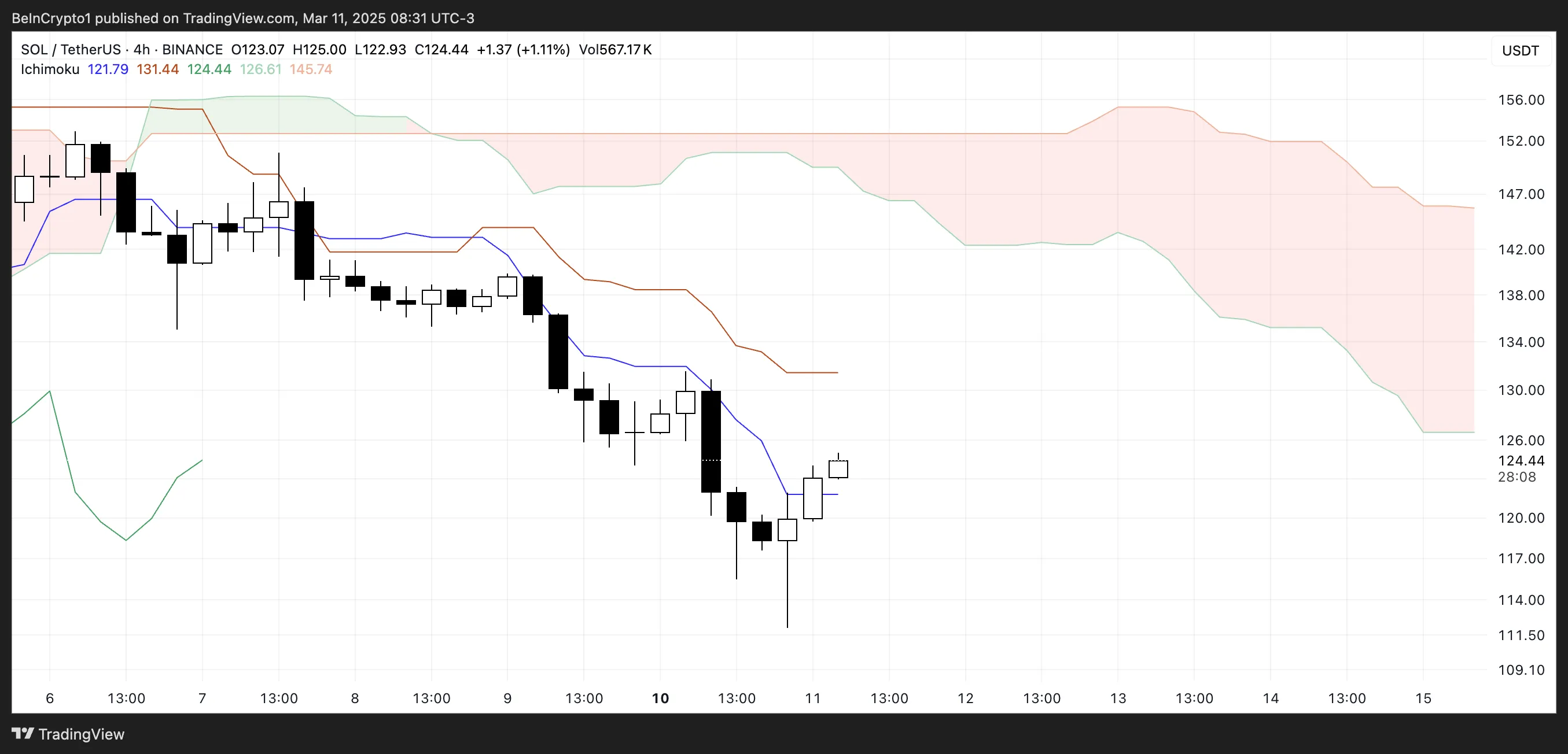

Solana (SOL) has faced intense selling pressure, recently dropping below $120 – its lowest level since February 2024. It has declined more than 38% over the past 30 days, reinforcing its bearish momentum.

With sellers firmly in control, SOL now faces a critical test of support levels, while any potential recovery would need to break through key resistance zones to signal a shift in momentum.

Solana Ichimoku Cloud Shows a Strong Bearish Setup

Solana Ichimoku Cloud shows that the price is currently trading below both the blue Tenkan-sen (conversion line) and the red Kijun-sen (base line), indicating that the short-term trend remains bearish.

The price recently bounced from a local low but has not yet reclaimed these key resistance levels. Additionally, the Ichimoku cloud (Kumo) ahead is red, reflecting bearish sentiment in the market.

The cloud itself is positioned well above the current price, suggesting that even if SOL experiences a short-term recovery, it will likely face strong resistance near the $130 – $135 region.

The positioning of the Tenkan-sen below the Kijun-sen further supports the bearish outlook, as this crossover typically signals downward momentum.

For any signs of a trend reversal, SOL would need to break above both of these lines and ideally enter the cloud, which would indicate a potential transition to a neutral phase.

Until then, the bearish cloud ahead and the current weak price structure suggest that any rallies may be temporary before the broader downtrend resumes.

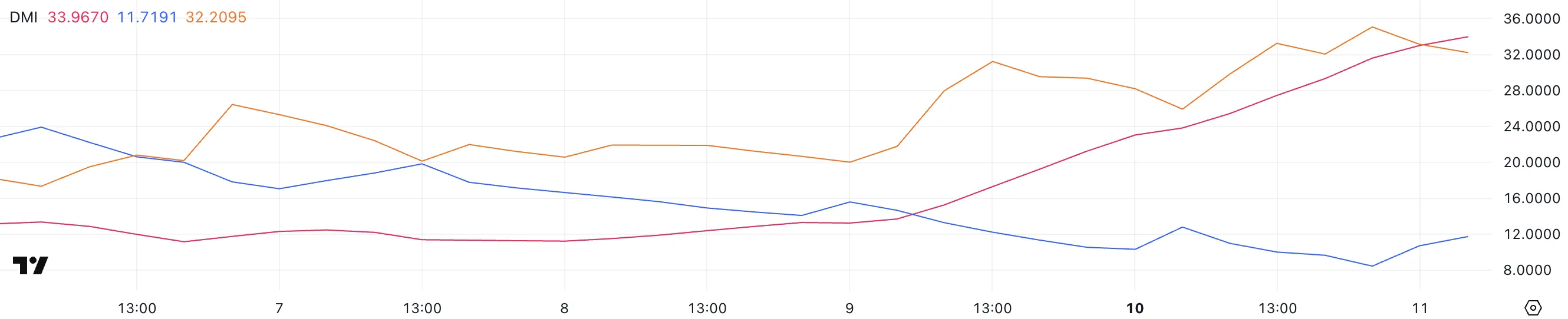

SOL DMI Shows Sellers Are Still In Control

Solana Directional Movement Index (DMI) chart reveals that its Average Directional Index (ADX) is currently at 33.96, a significant increase from 13.2 just two days ago.

The ADX measures trend strength, and a reading above 25 typically indicates a strong trend, while values below 20 suggest a weak or non-existent trend. Given this sharp rise, it confirms that SOL’s ongoing downtrend is gaining strength.

The +DI (positive directional index) has dropped to 11.71 from 15.5 two days ago but has slightly rebounded from 8.43 yesterday. In contrast, the -DI (negative directional index) sits at 32.2, up from 25.9 two days ago, though slightly down from 35 a few hours ago.

The relative positioning of the +DI and -DI lines suggests that sellers are still in control, as the -DI remains significantly higher than the +DI.

The recent dip in -DI from 35 to 32.2 could indicate some short-term relief, but with the ADX climbing quickly, it reinforces that the prevailing downtrend remains intact.

The slight bounce in +DI suggests minor buying pressure, but it’s not enough to shift momentum in favor of bulls. Until +DI rises above -DI or ADX starts declining, SOL’s bearish trend is likely to persist, with sellers dominating price action in the near term.

Will Solana Fall Below $110?

Solana Exponential Moving Average (EMA) lines continue to depict a bearish trend, with the short-term EMAs positioned below the long-term EMAs.

This alignment suggests that downward momentum remains dominant, even though the price is currently attempting a recovery. If this rebound gains strength, Solana’s price could face resistance at $130 and $135, key levels that must be cleared for any potential trend reversal.

A successful break above these resistances could push SOL toward $152.9, a significant level that, if breached with strong buying pressure, might pave the way for a rally toward $179.85 – the price level last seen on March 2, when SOL was added to the US crypto strategic reserve.

However, if the bearish structure remains intact and selling pressure resumes, Solana could retest the $115 and $112 support levels, both of which have previously acted as key price floors.

A failure to hold these supports could open the door for a deeper decline, possibly pushing SOL below $110 for the first time since February 2024.

Given the EMAs’ current positioning, the downtrend remains in control unless Solana reclaims key resistance levels and establishes a bullish crossover, signaling a shift in market sentiment.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin15 hours ago

Altcoin15 hours agoBinance Unveils Key Update On CATI & These 5 Crypto, What’s Lies Ahead?

-

Bitcoin21 hours ago

Bitcoin21 hours agoWhales Panic Sell as Crypto Liquidations Near $1 Billion

-

Market20 hours ago

Market20 hours agoDogecoin (DOGE) Under Pressure—Continues Sliding Into Bear Territory

-

Market19 hours ago

Market19 hours agoOnyxcoin Whales Sell 630 Million XCN; Price Falls 34% In A Week

-

Ethereum18 hours ago

Ethereum18 hours agoBitcoin drops to $76k after Trump fails to rule out a recession

-

Market23 hours ago

Market23 hours agoBitcoin Plunges Below $80,000 Amid Rising US Recession Fears

-

Market17 hours ago

Market17 hours agoArbitrum Buyback Plan Arrives Ahead of Major ARB Token Unlock

-

Altcoin16 hours ago

Altcoin16 hours agoWake-Up Call for Meme Coin Investors?