Market

What It Means for BTC’s Price

The leading coin, Bitcoin, has been trading within a narrow range since the beginning of February. It has struggled to break out of consolidation as both buying and selling pressures remain subdued.

On-chain data suggests that this period of sideways movement could persist due to weakening activity on the Bitcoin network.

Bitcoin Could Face Prolonged Sideways Movement as Network Activity Drops

According to a recent report by pseudonymous CryptoQuant analyst Avocado_onchain, Bitcoin network activity has been steadily declining, contributing to BTC’s recent narrow price movements. If this continues, “we must consider the possibility of another prolonged consolidation phase, similar to what began in March 2024,” the analyst says.

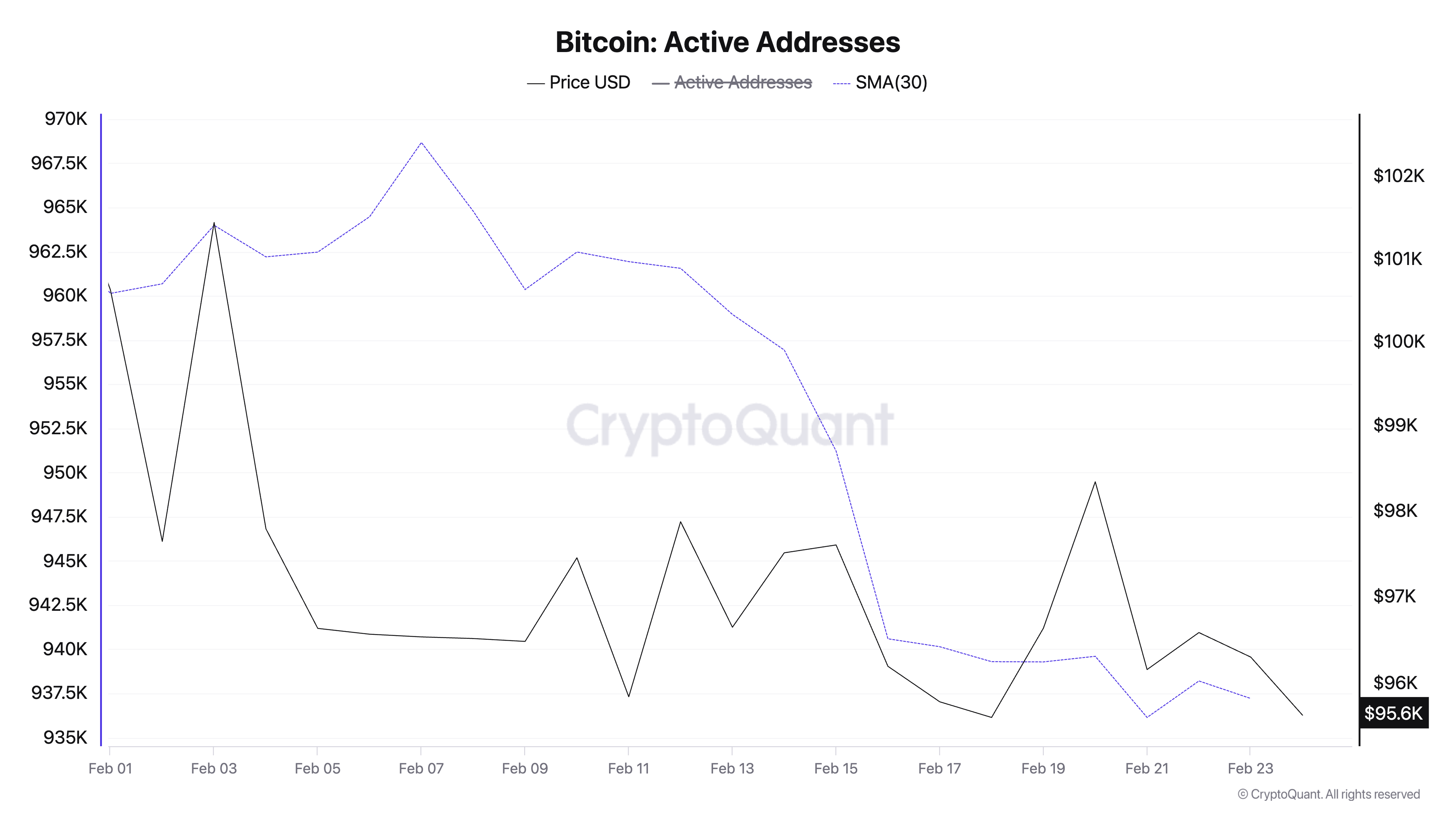

One such data Avocado considers is the number of daily active wallet addresses on the Bitcoin network. According to CryptoQuant’s data, when observed using a 30-day small moving average (SMA), the daily count of addresses that have completed at least one BTC transaction has plummeted by 2% since February 1.

A decline in active daily wallets on the Bitcoin network signals reduced user demand. This can contribute to downward price pressure on the coin, as decreased network activity typically aligns with lower buying interest.

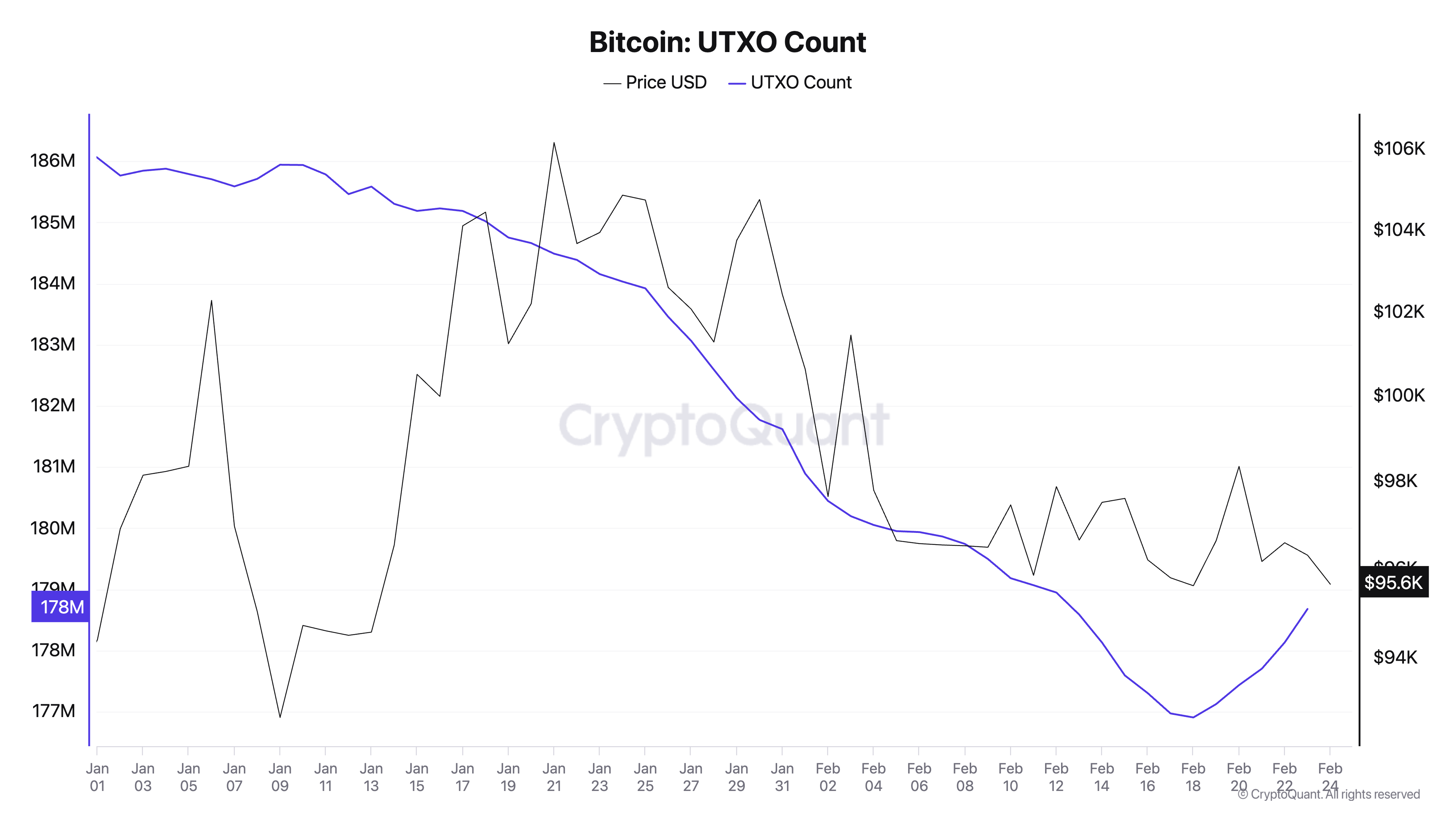

In addition, Avocado reports that “the number of UTXOs is also decreasing, with the magnitude of the decline similar to the correction period in September 2023.”

Unspent Transaction Output (UTXO) tracks the amount of Bitcoin left after a transaction, which can be used as input for future transactions. It represents the available balance that can be spent on the network. When the number of UTXOs declines, fewer new coins are being distributed or moved, suggesting reduced transaction activity. This indicates a period of consolidation, where investors are holding rather than spending their coins.

“If this trend continues, we could see signs of investor exodus similar to the market cycle peak of 2017. However, a simple decline in UTXOs alone is not enough to confirm the end of the current cycle, as other indicators still suggest a bullish outlook,” Avocado writes.

Bitcoin Hovers Near Key Support—Will It Hold or Break Lower?

As of this writing, BTC trades near the support line of its horizontal channel at $95,527. If the Bitcoin network activity wanes, further affecting the demand for the king coin, its price could break below this level. In this scenario, BTC could drop to $92,325.

On the other hand, if market trends shift and the buying pressure gains momentum, the coin could rally toward the resistance at $99,031 and attempt a crossover. If successful, BTC could reach $102,665.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cronos (CRO) Jumps 7%, Tops Altcoin Gainers Today

Cronos (CRO) has been gaining serious momentum in recent weeks after Trump Media announced a partnership with Crypto.com. The news helped drive CRO’s price above the $0.10 mark for the first time since early February, triggering a wave of bullish technical signals.

Indicators like RSI, BBTrend, and EMA alignment all point toward strong upward momentum, with CRO even becoming the top-performing altcoin in the past 24 hours. As traders eye key resistance and support levels, the question now is whether this rally has enough fuel to carry CRO toward $0.20.

CRO RSI Is Back To Neutral After Reaching Its Highest Levels In Years

Cronos has captured market attention in recent weeks, especially following the announcement of a partnership between Trump Media and Crypto.com.

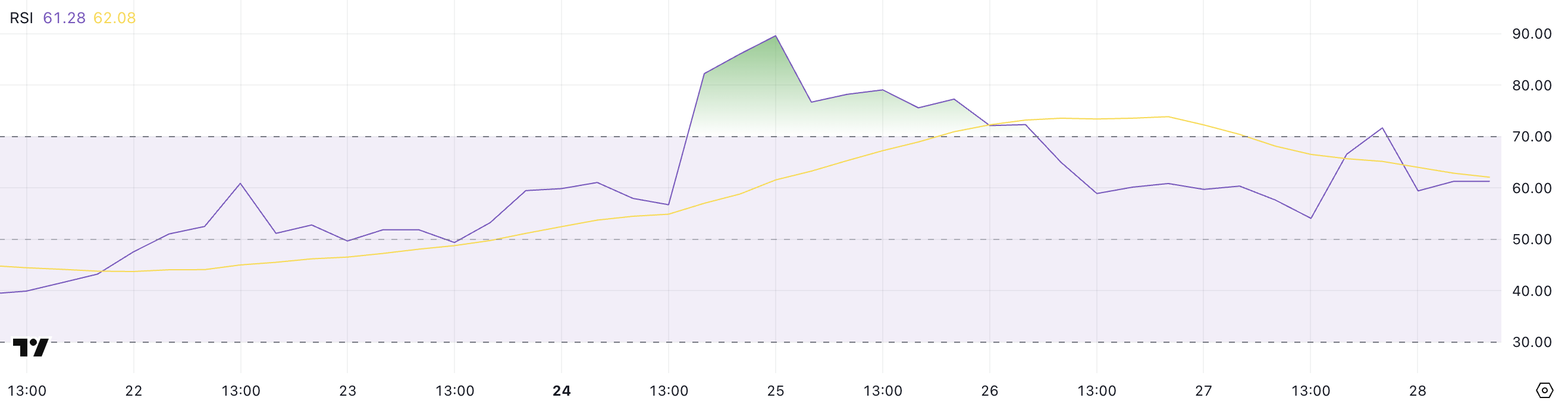

This surge in interest drove CRO’s Relative Strength Index (RSI) to a peak of 89.64 just three days ago—its highest level in over a year—signaling intense buying pressure.

Since then, the RSI has cooled down to 61.2, as the price consolidates after its strong rally. Despite the slight RSI drop, Cronos remains the top-performing altcoin in the past 24 hours, with a 7% price increase, showing that momentum is still in its favor.

The RSI (Relative Strength Index) is a momentum indicator used to assess whether an asset is overbought or oversold. It ranges from 0 to 100, with levels above 70 typically suggesting overbought conditions, and levels below 30 indicating oversold territory.

With CRO’s RSI now at 61.2, the asset is no longer in an overbought state but still shows healthy bullish momentum. This suggests the price could continue climbing, especially if renewed interest or news catalysts emerge.

At the same time, the cooldown from extreme RSI levels may be giving the market room to build a more sustainable rally.

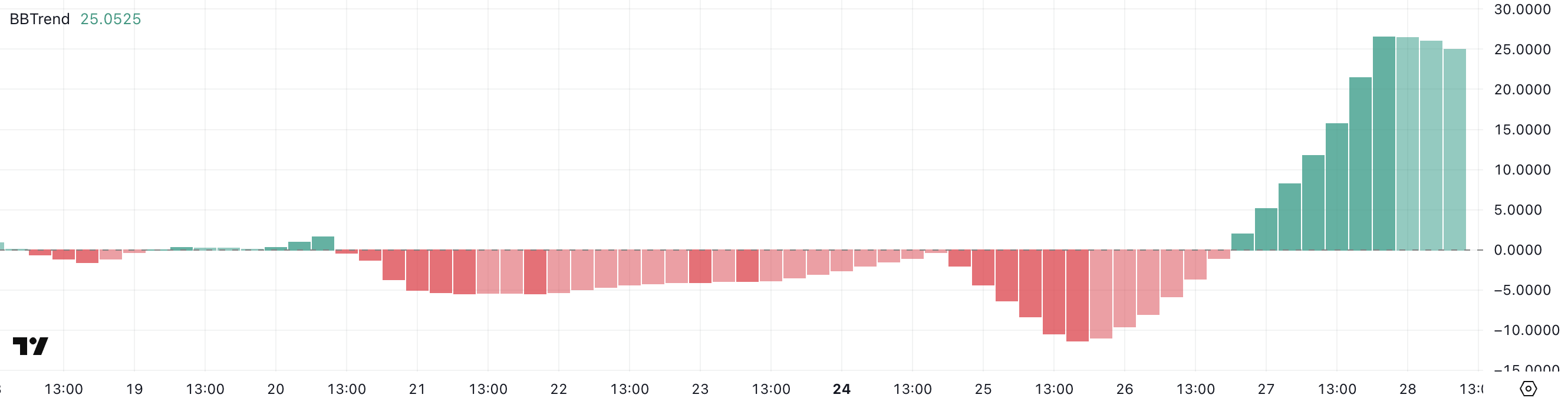

Cronos BBTrend Is Still Very Positive, But Down From The Recent Peak

Cronos has recently flipped its BBTrend indicator back into positive territory, currently sitting at 25.05—down slightly from a recent peak of 26.56 reached just yesterday.

This shift comes after five consecutive days of negative BBTrend values, suggesting a notable change in market momentum.

The move into positive territory indicates that bullish pressure has returned, aligning with the broader uptick in price and sentiment surrounding CRO following its recent surge in visibility and trading activity.

BBTrend, or Bollinger Band Trend, is a momentum indicator that helps identify whether an asset is trending upwards, downwards, or moving sideways.

A positive BBTrend value generally indicates bullish momentum, while a negative value points to bearish sentiment. The higher the value, the stronger the trend.

With CRO’s BBTrend at 25.05, the asset is showing strong bullish momentum, though the slight drop from yesterday’s peak could signal early signs of a cooldown or brief consolidation.

However, as long as the BBTrend stays above zero, the upward bias remains intact, supporting the possibility of further CRO price appreciation.

Can Cronos Rise 100% In The Next Weeks?

Cronos price recently climbed above the $0.10 mark for the first time since early February.

The EMA (Exponential Moving Average) indicators are painting a bullish picture, with short-term EMAs positioned above the long-term ones and maintaining a healthy distance between them—often a sign of strong upward momentum.

If this trend holds, CRO could target the next resistance levels at $0.12, followed by $0.149 and $0.166.

In the case of a particularly strong rally, a move toward $0.20 is on the table. This would mark its highest price since the end of 2024, as conversations about a potential CRO ETF could gain more traction soon.

However, if bullish momentum starts to wane, CRO may pull back toward key support at $0.093. A break below that could accelerate the correction, with $0.082 and $0.068 as the next potential downside targets.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Argentine Judge Investigates Milei’s Assets for LIBRA Involvement

Investigations against Javier Milei are proceeding after his involvement in the LIBRA scandal. Judge Sandra Arroyo Salgado is examining his assets and whereabouts during the pump-and-dump incident.

This judge is also investigating similar topics regarding key political allies, especially his sister Karina. At present, it’s unclear if she will file criminal charges, but this scandal is not ideal for anyone’s political career.

How Much Was President Milei Involved With LIBRA?

Since the LIBRA scandal rocked the meme coin market and Argentina’s political space last month, legal consequences have been falling on many of the perpetrators. Arrest warrants were issued for market maker Hayden Davis, and civil suits are active against its private backers.

Now, prosecutors are also investigating President Javier Milei’s assets to determine his LIBRA involvement:

“The LIBRA case would exemplify a crypto scam maneuver…a form of fraud. The promotion of this type of investment can undermine economic and financial systems over which the National Government is obligated to control and regulate their activities to prevent the movement of illicit and extra-systemic capital,” warned Judge Sandra Arroyo Salgado.

Specifically, Judge Arroyo Salgado is investigating Milei’s connections to LIBRA, looking at several avenues. She wishes to determine his entire itinerary during the period that he publicly promoted the token.

Additionally, she ordered an investigation into his assets alongside his sister and several other prominent political allies.

The LIBRA scandal was so massive that investigations against Milei began almost immediately. Several US enforcement agencies were informed that they could also pursue charges against him, but none rose to the opportunity.

By looking at his assets and whereabouts, Arroyo Salgado wishes to nail down definitive proof of his involvement.

President Milei, for his part, immediately denied any direct connection to LIBRA, but a subsequent televised interview only damaged his reputation further. According to a recent poll, most Argentinians have lost trust in their President.

Regardless of the odds of criminal proceedings, factors like this could impede his ability to pass legislation or enact policy.

Ultimately, it’s unclear what specific consequences Milei may face from the LIBRA debacle. He is a sitting head of state, and charging him with a criminal offense would be a dicey prospect in any circumstance.

Still, investigations against him are intensifying. If he did engage in political corruption with the LIBRA backers, it would leave telltale clues.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why Did MUBARAK Drop 40% Despite Binance Listing?

MUBARAK’s sharp 40% drop after its Binance listing has reignited debate around centralized exchange listing practices and the broader state of the meme coin ecosystem.

This came alongside growing scrutiny over speculative meme coin launches like JELLY, which recently triggered a short squeeze and dragged HYPE down, sparking fears of deeper structural risks.

The steep drop in MUBARAK, now down 40% since its Binance debut, has reignited concerns about the quality of recent listings on centralized exchanges. Binance recently ended its first listing vote, with BROCCOLI and Tutorial surging.

Critics argue that these incidents undermine trust in both DeFi and CEX platforms, as meme coins continue to dominate headlines while more stable crypto sectors struggle for attention.

Still, some platforms like Pump.fun are pushing for innovation, introducing features like token burning and revenue sharing in an effort to steer meme coins toward a more sustainable future.

These concerns have only grown louder following the listing of speculative meme coins on Binance, including BNB Chain tokens like JELLY, which have added to the scrutiny.

Binance founder Changpeng Zhao (CZ) has addressed this criticism, stating that token listings should not dictate long-term price action.

While listings can offer liquidity and improve market access, CZ emphasized that any price impact should be short-term. In the long run, token value should reflect real fundamentals—such as team commitment, development activity, and network performance.

Still, even as the community pushes for more transparency, Binance Alpha has continued to list controversial tokens, including two Studio Ghibli-themed meme coins.

Hyperliquid Crisis Made Users Question Meme Coins

MUBARAK’s drop was not the only crisis in the meme coin ecosystem this week. HYPE experienced a sharp decline following the JELLY short squeeze, triggering widespread speculation about the role of Hyperliquid and meme coins in the crypto ecosystem.

Some users have even questioned if this could be the beginning of an FTX-style collapse as concerns grow over the unchecked volatility tied to meme coin derivatives.

The JELLY controversy has ignited debate around the fragility of emerging platforms and whether enough safeguards are in place to prevent systemic fallout from meme-driven market events. In response to the backlash, Hyperliquid announced it would strengthen its security measures to prevent similar incidents in the future.

Jean Rausis, co-founder of the decentralized finance ecosystem SMARDEX, told BeInCrypto that the DeFi ecosystem needs to think about the image it sends to the market:

“If we want DeFi to be adopted, the ecosystem needs to gain trust not only with its existing users but also in terms of the image it presents in the news. And it’s clear that with projects wrongly labelling themselves as “decentralized”, more incidents like this will happen.”

Sectors Like RWA Could Help To Grow Crypto Credibility

Kevin Rusher, founder of decentralized lending protocol RAAC, described the situation as a major blow to DeFi’s credibility. “This is another setback for DeFi adoption, but it’s not a surprise,” he said, noting that meme coins have reignited retail greed and diverted liquidity away from more sustainable sectors of the ecosystem.

He warned that tokens like TRUMP and MELANIA had captured too much mindshare during the last market surge, leaving DeFi vulnerable to speculative chaos.

Still, Rusher pointed to the growing involvement of institutions like BlackRock as a sign of hope:

“But it looks like institutions and big players like BlackRock also understand this need for stability in crypto, which is why they are now seriously focused on the tokenization of Real World Assets (RWAs). The unfortunate reality is that memecoins are likely here to stay, and they will be a real obstacle for DeFi growth in the short term. However, with RWAs bringing huge liquidity into the system from traditional finance, this sector will finally have the opportunity to grow without memecoin frenzies putting the whole ecosystem in danger.” – Rusher told BeInCrypto.

More Innovation Could Bring Renewed Interest In Meme Coins

In a recent conversation with Bankless, PumpFun co-founder Alon Cohen shared insights about the meme coins market, highlighting PumpFun’s 4Chan-inspired aesthetic, bonding curve pricing model, and new creator-focused initiatives.

Pump.fun has generated over 8.8 million tokens and once peaked with a record $14 million in daily revenue, totaling $600 million since launch.

Alon emphasized that while the meme coin market is cooling—down nearly 49% from its $125 billion peak in December 2024—Pump.fun remains committed to supporting creative and community-driven projects.

To boost long-term sustainability, the team is now introducing revenue-sharing mechanisms for token creators, a transparent fee structure, and token-burning features to reduce the extractive nature of meme coin launches.

With new mechanisms like this, more buyers could come in, and a new generation of meme coin traders could emerge as the ecosystem tries to become more sustainable.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoWhy BTC Price Stayed Unchanged

-

Market22 hours ago

Market22 hours agoBitcoin Price Stalls at $88K—Can Bulls Overcome Key Resistance?

-

Market20 hours ago

Market20 hours agoEthereum Price Struggles—Is Another Breakdown on The Horizon?

-

Altcoin20 hours ago

Altcoin20 hours agoBinance Adds Support For MUBARAK, CZ’s Dog, & These Crypto, Here’s All

-

Market19 hours ago

Market19 hours ago$14 Billion in Bitcoin and Ethereum Options Set to Expire Today

-

Market18 hours ago

Market18 hours agoDogecoin (DOGE) Faces Market Correction—Will Buyers Step Back In?

-

Bitcoin18 hours ago

Bitcoin18 hours agoStrategic Bitcoin Reserve Proposed by Brazil’s VP Advisor

-

Market17 hours ago

Market17 hours agoTerra’s Crypto Claims Portal Opens Soon: Key Dates and Info