Market

What Crypto Whales Are Eyeing for Gains in August 2024

The past week has been marked by a decline in cryptocurrency market activity, highlighted by a 4% drop in global market capitalization recorded in just the past 24 hours.

However, some assets have witnessed a surge in crypto whales attention as these large investors attempt to trade against the general market trend in anticipation of a rally in the coming weeks.

Toncoin (TON) Sees Uptick in Crypto Whales Count

The price of Toncoin (TON), the cryptocurrency linked to the popular messaging app Telegram, has suffered a 17% price decline in the last month. However, on-chain data suggests that this has presented a buying opportunity, which the whales have noted.

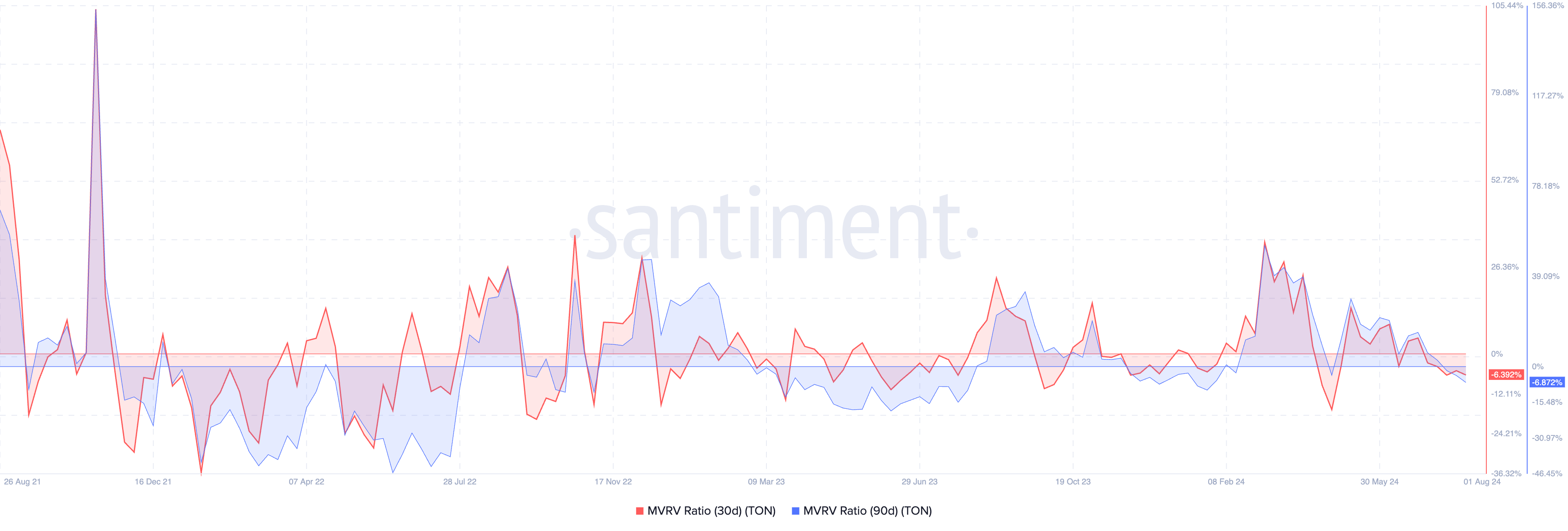

Readings from TON’s Market Value to Realised Value (MVRV) ratio show that the altcoin is currently undervalued, flashing a buy signal.

At press time, the token’s MVRV ratios assessed over different moving averages are negative. Its MVRV ratios for the 30-day and 90-day moving averages are -6.39% and -6.87%, respectively.

This metric measures the ratio between an asset’s current price and the average price at which all its coins or tokens were acquired. When it is below zero, the asset’s current market value is less than the price at which most investors acquire their holdings.

Historically, negative MVRV ratios offer a buying opportunity for traders looking to “buy the dip” and hoping to sell high at a later date.

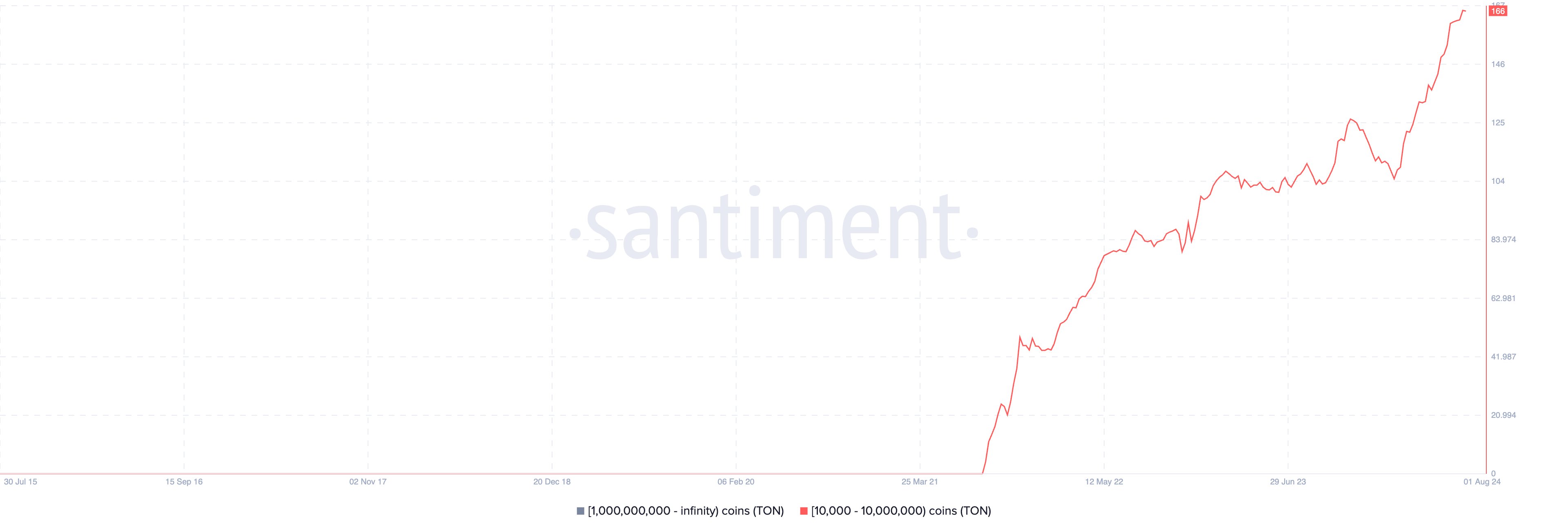

As TON’s price craters, its whales have increased their accumulation. According to Santiment, the number of TON whales holding between 100,000 and 10,000,000 tokens has increased by 2% in the last month. The number of addresses comprising this cohort of TON holders is currently at an all-time high.

Read more: What Are Telegram Bot Coins?

An increase in TON’s whale demand can also spike the interest of retail investors.

If this happens and the token initiates an uptrend, its price may climb to $6.81.

Large Holders Increase Their Tron (TRX) Holdings

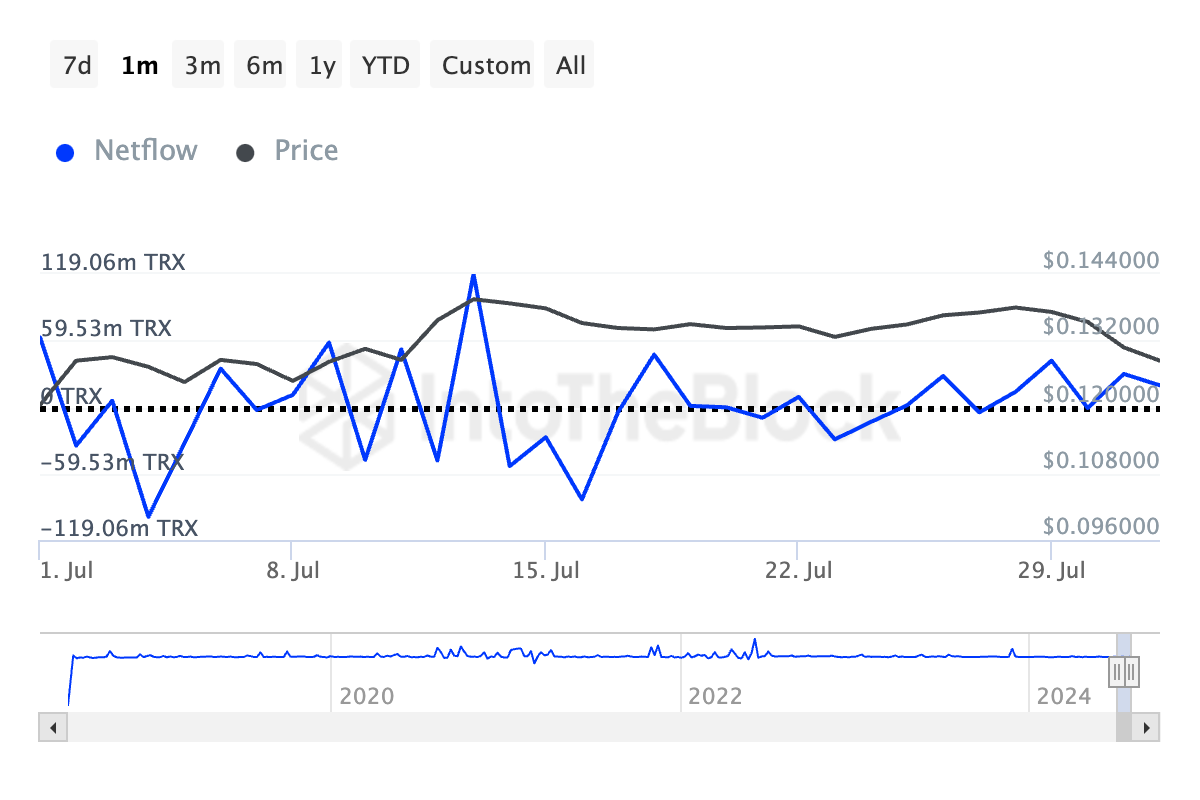

On-chain data from IntoTheBlock has revealed a significant 243% increase in TRX’s large holders’ netflow over the past 30 days.

Large holders refer to addresses that hold more than 0.1% of an asset’s circulating supply. Their netflow measures the the difference between the coins these investors buy and the amount they sell over a specific period.

When it rises, it means that crypto whales are buying more coins. It is regarded as a bullish sign which hints at a potential price rally.

It is key to point out that TRX’s whales have increased their accumulation despite the coin’s sideways movements in the last month. Readings from its daily chart show that the altcoin trended within a horizontal channel throughout July and broke below the lower line of this channel on the last trading day of the month.

Read More: How To Buy TRON (TRX) and Everything You Need To Know

If whale accumulation persists, it can trigger a more widespread demand for the coin. This may lead to a price rally, which can cause TRX to trade at $0.13.

Binance Coin (BNB) and Its Emerging Bullish Divergence

The relative balance between BNB’s buying and selling pressures has prevented its price from trending strongly in either direction over the past few weeks.

However, the coin’s Chaikin Money Flow (CMF) has maintained an uptrend during that period. This indicator measures money flow into and out of an asset’s market. As of this writing, BNB’s CMF is 0.24.

A sideways price movement while CMF is rising suggests a potential bullish divergence. It indicates a growing influx of money into the asset, often a sign of accumulation by larger investors.

Even though BNB’s price is consolidating sideways, its rising CMF suggests that the coin’s underlying strength might be increasing.

Read More: How to Buy BNB and Everything You Need to Know

If BNB successfully breaks out of this range upward, its price may touch $617.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Crashes 11%—Is More Pain Ahead?

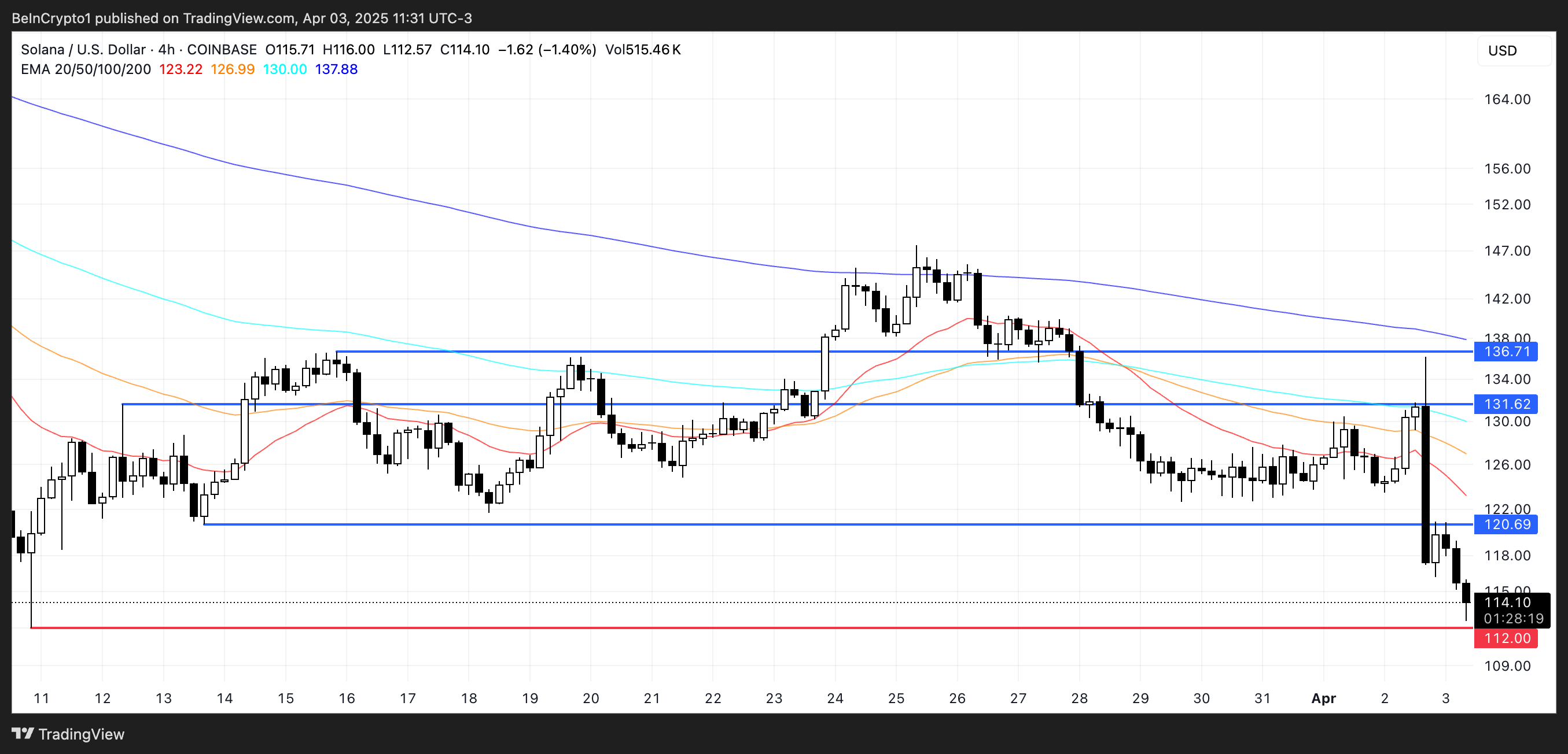

Solana (SOL) is under heavy pressure, with its price down more than 10% in the last 24 hours as bearish momentum intensifies across key indicators. The Ichimoku Cloud, BBTrend, and price structure all point to continued downside risk, with SOL now hovering dangerously close to critical support levels.

Technical signals show sellers firmly in control, while the widening gap from resistance zones makes a near-term recovery increasingly difficult.

Solana’s Ichimoku Cloud chart is currently flashing strong bearish signals. The price has sharply broken below both the Tenkan-sen (blue line) and Kijun-sen (red line), confirming a clear rejection of short-term support levels.

Both of these lines are now angled downward, reinforcing the view that bearish momentum is gaining strength.

The sharp distance between the latest candles and the cloud further suggests that any recovery would face significant resistance ahead.

Looking at the Kumo (cloud) itself, the red cloud projected forward is thick and sloping downward, indicating that bearish pressure is expected to persist in the coming sessions.

The price is well below the cloud, which typically means the asset is in a strong downtrend.

For Solana to reverse this trend, it would need to reclaim the Tenkan-sen and Kijun-sen and push decisively through the entire cloud structure—an outcome that looks unlikely in the short term, given the current momentum and cloud formation.

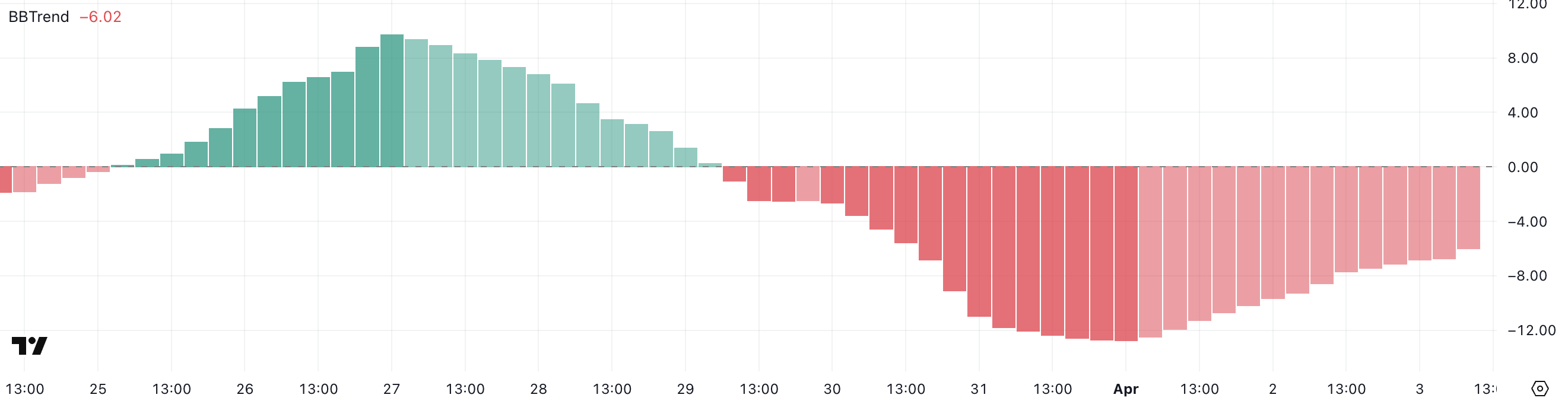

Solana’s BBTrend Signals Prolonged Bearish Momentum

Solana’s BBTrend indicator currently sits at -6, having remained in negative territory for over five consecutive days. Just two days ago, it hit a bearish peak of -12.72, showing the strength of the recent downtrend.

Although it has slightly recovered from that low, the sustained negative reading signals that selling pressure remains firmly in control and that the bearish momentum hasn’t yet been reversed.

The BBTrend (Bollinger Band Trend) measures the strength and direction of a trend using Bollinger Bands. Positive values suggest bullish conditions and upward momentum, while negative values indicate bearish trends.

Generally, values beyond 5 are considered strong trend signals. With Solana’s BBTrend still well below -5, it implies that downside risk remains elevated.

Unless a sharp shift in momentum occurs, this persistent bearish reading may continue to weigh on SOL’s price in the near term.

Solana Eyes $112 Support as Bears Test February Lows

Solana’s price has broken below the key $115 level, and the next major support lies around $112. A confirmed move below this threshold could trigger further downside. That could potentially push the price under $110 for the first time since February 2024.

The recent momentum and strong bearish indicators suggest sellers remain in control, increasing the likelihood of testing these lower support levels in the near term.

However, if Solana manages to stabilize and reverse its current trajectory, a rebound toward the $120 resistance level could follow.

Breaking above that would be the first sign of recovery, and if bullish momentum accelerates, SOL price could aim for higher targets at $131 and $136.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Market Mirrors Nasdaq and S&P 500 Amid Recession Fears

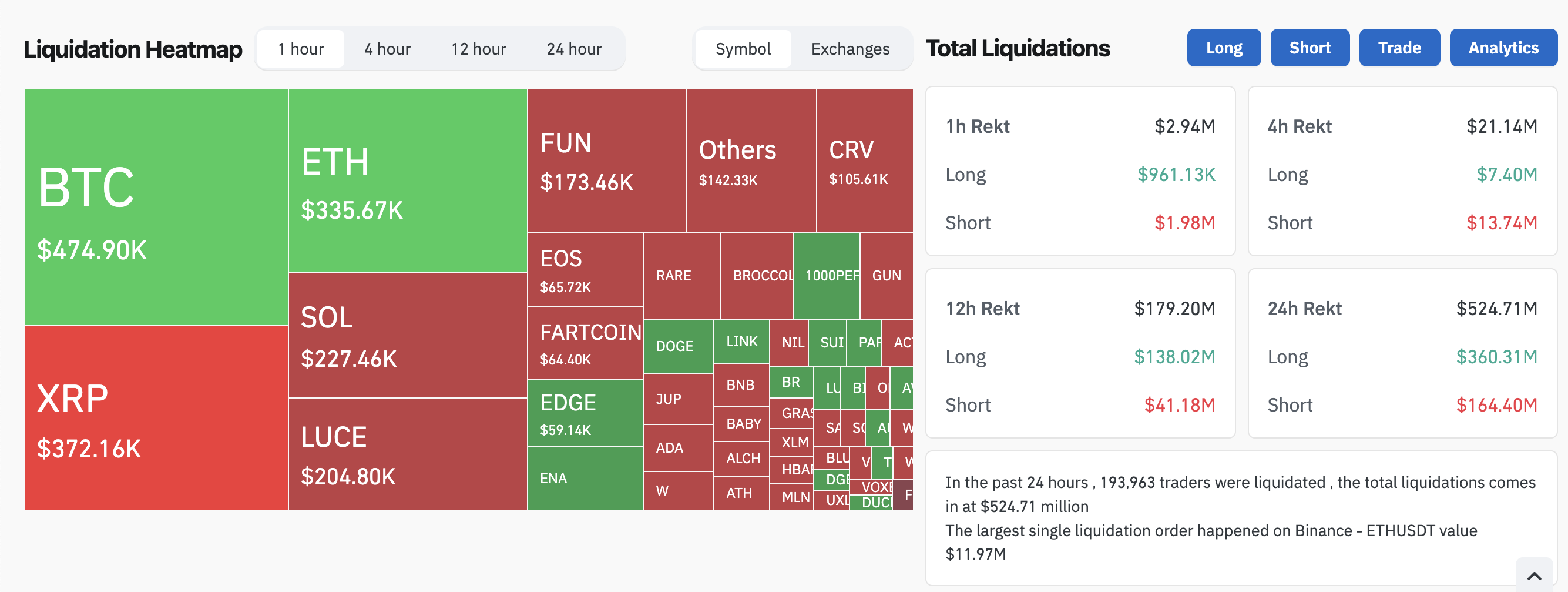

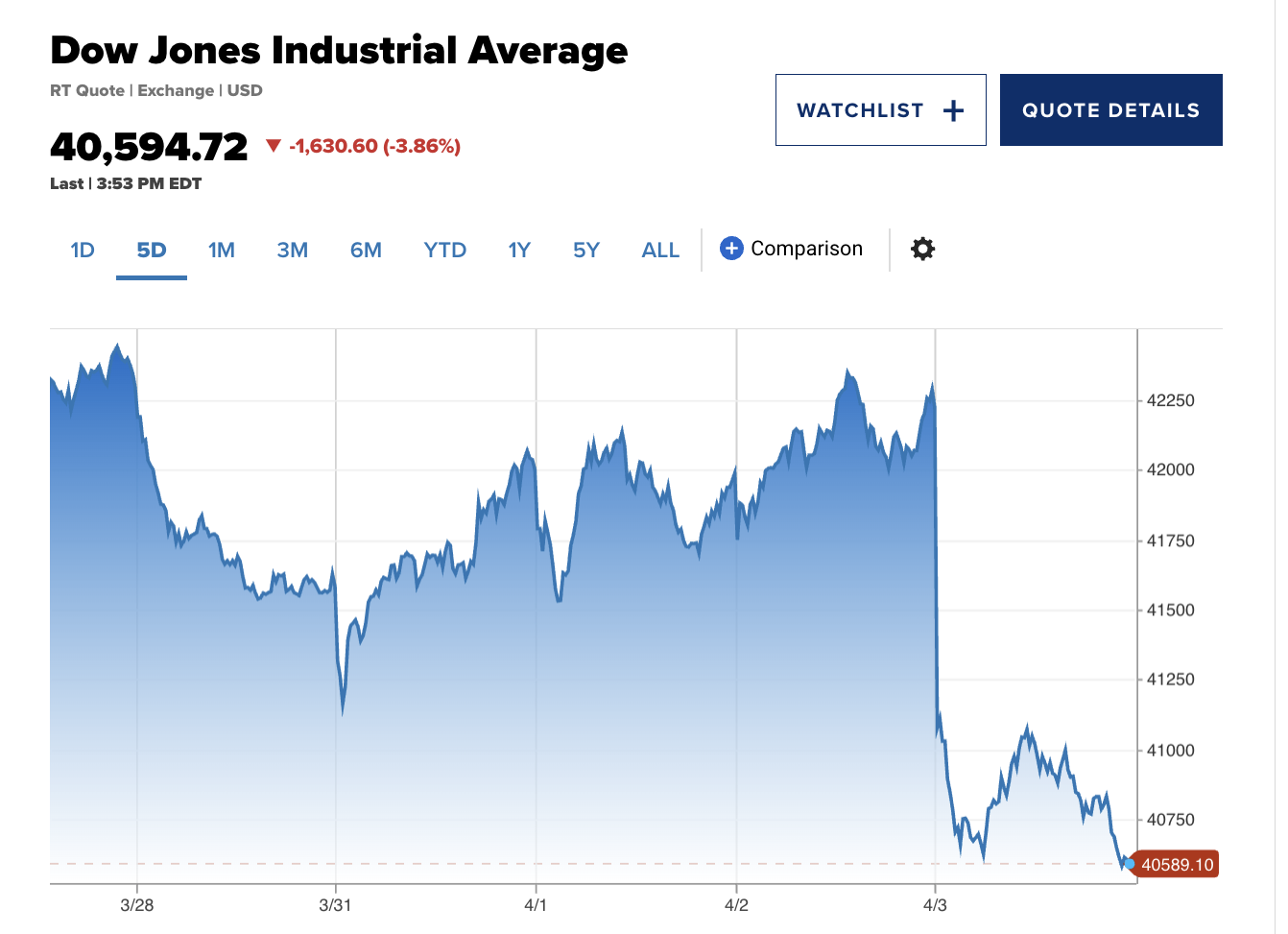

As traditional markets show clear signs of an impending recession, the crypto space is not immune from damage. Liquidations are surging as the overall crypto market cap mirrors declines in the stock market.

Even though the source of these problems is localized to the US, the damage will have global implications. Traders are advised to prepare for a sustained period of trouble.

How Will A Recession Impact Crypto?

Several economic experts have warned that the US market is poised for an impending recession. For all we know, it’s already here.

Since Donald Trump announced his Liberation Day tariffs, all financial markets have taken a real hit. The overall crypto market cap is down nearly 8%, and liquidations in the last 24 hours exceeded $500 million.

A few other key indicators show a similar trend. In late February, the Crypto Fear and Greed Index was at “Extreme Fear.” It recovered in March but fell back down to this category today.

Similarly, checkers adjacent to crypto, such as Polymarket, began predicting that a recession is more likely than not.

Although the crypto industry is closely tied to President Trump’s administration, it is not the driving force behind these recession fears. Indeed, crypto actually seems to be tailing TradFi markets at the moment.

The Dow dropped 1600 points today, and the NASDAQ and S&P 500 both had their worst single-day drops since at least 2020.

Amidst all these recession fears, it’s been hard to identify an upside for crypto. Bitcoin briefly looked steady, but it fell more than 5% in the last 24 hours.

This doesn’t necessarily reflect its status as a secure store of value, as gold also looked steady before crumbling. To be fair, though, gold has only fallen 1.2% today.

In this environment, crypto enthusiasts worldwide should consider preparing for a recession. Trump’s proposed tariffs dramatically exceeded the worst expectations, and the resultant crisis is centered around the US.

Overall, current projections show that the crypto market will mirror the stock market to some extent. If the Nasdaq and S&P 500 fall further, the implications for risk assets could worsen.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance’s CZ is Helping Kyrgyzstan Become A Crypto Hub

Changpeng “CZ” Zhao, former CEO of Binance, is advising Kyrgyzstan on becoming a crypto hub. He signed an agreement with the Kyrgyz National Investment Agency to build the nation’s Web3 capacities.

A cornerstone of this plan is Kyrgyzstan’s A7A5 stablecoin, pegged to the Russian ruble and focused on emerging markets. CZ claimed that he has been advising several governments “officially and unofficially” regarding crypto.

CZ Helps Kyrgyzstan Drive Crypto Adoption

Countries worldwide are becoming more interested in crypto integration lately. Although Kyrgyzstan has not been a particular hub for crypto activity, it is trying to turn a new leaf.

According to the latest announcements, the country is developing a new A7A5 stablecoin pegged to the Russian ruble. Kyrgyzstan’s crypto turn is also being influenced by Changpeng “CZ” Zhao, the founder of Binance.

“A Memorandum of Understanding has been signed between the National Investment Agency under the President of the Kyrgyz Republic and Changpeng Zhao (CZ). In accordance with the Memorandum, the parties intend to cooperate in the development of the cryptocurrency and blockchain technology ecosystem in the Kyrgyz Republic,” claimed President Sadyr Zhaparov.

CZ is a very influential figure in crypto and has been involved with a few official governments in his career. For example, last month, allegations surfaced that he was working with President Trump to establish a new dollar-backed stablecoin.

Meanwhile, CZ acknowledged his business in Kyrgyzstan, claiming that he introduced President Zhaparov to X, the social media site.

“I officially and unofficially advise a few governments on their crypto regulatory frameworks and blockchain solutions for gov efficiency, expanding blockchain to more than trading. I find this work extremely meaningful,” CZ claimed via social media.

Although CZ’s connection with Kyrgyzstan’s new A7A5 stablecoin is not fully known, it would align with his recent alleged Trump dealings.

Zhaparov’s statement claimed that the Binance founder will provide infrastructural, technological support, technical expertise, and consulting services on crypto and blockchain technologies.

Also, the president went on to state that this agreement with CZ will strengthen Kyrgyzstan’s standing in the growing Web3 environment. The long-term plan is to help create new opportunities for Kyrgyz businesses and society as a whole.

Presumably, this will involve some cooperation with Russia, as A7A5’s press release mentions “a new class of digital assets tied to the Russian economy.” This stablecoin is bucking significant tradition by aligning with the ruble instead of the dollar.

However, this is part of its strategy to focus on emerging markets. This novel experiment could demonstrate new market opportunities and challenge the dominance of USD-pegged stablecoins in the region.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin21 hours ago

Altcoin21 hours agoBinance Sidelines Pi Network Again In Vote To List Initiative, Here’s All

-

Market19 hours ago

Market19 hours agoXRP Price Under Pressure—New Lows Signal More Trouble Ahead

-

Altcoin18 hours ago

Altcoin18 hours agoAnalyst Forecasts 250% Dogecoin Price Rally If This Level Holds

-

Market18 hours ago

Market18 hours agoCardano (ADA) Downtrend Deepens—Is a Rebound Possible?

-

Market22 hours ago

Market22 hours agoXRP Price Reversal Toward $3.5 In The Works With Short And Long-Term Targets Revealed

-

Regulation8 hours ago

Regulation8 hours agoUS Senate Banking Committee Approves Paul Atkins Nomination For SEC Chair Role

-

Market13 hours ago

Market13 hours agoIP Token Price Surges, but Weak Demand Hints at Reversal

-

Ethereum13 hours ago

Ethereum13 hours agoEthereum Trading In ‘No Man’s Land’, Breakout A ‘Matter Of Time’?