Market

What Are Crypto Whales Buying After the Market Crash?

Whales bought heavily during the recent market downturn, signaling renewed confidence in WLD, VIRTUAL, and ONDO. WLD ended 2024 with an 8% decline, but whale accumulation has pushed large holder addresses to all-time highs.

VIRTUAL, one of the hardest-hit AI tokens with a 71% drop, is now seeing a resurgence in whale buying, hinting at a potential recovery. Meanwhile, ONDO remains strong, up 5% in the last week, with steady accumulation from large investors reinforcing its position as a leading Real-World Assets (RWA) project.

Worldcoin (WLD)

Worldcoin ended 2024 with a disappointing 8% decline, frustrating many investors. This underperformance was even more noticeable as crypto AI agents gained traction late in the year, attracting users and capital.

Despite this, whales bought heavily during the recent market downturn, indicating renewed confidence in WLD’s long-term potential.

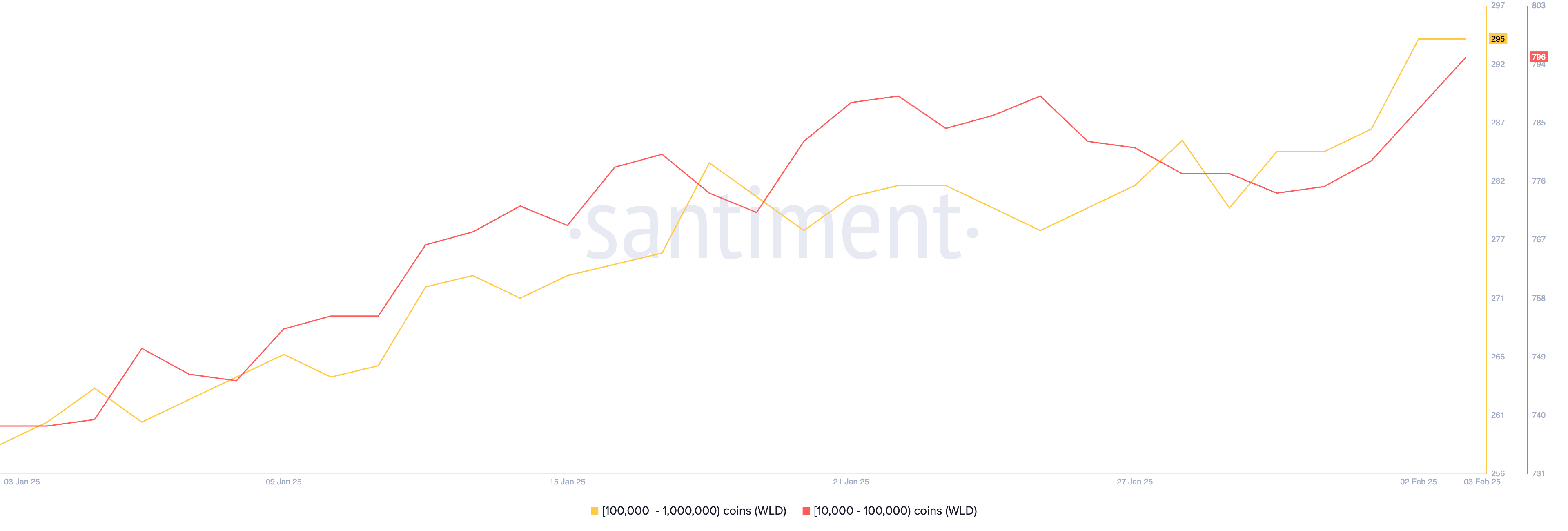

Since January 31, the number of whales holding between 10,000 and 100,000 WLD, as well as those holding between 100,000 and 1,000,000 WLD, has surged to new all-time highs.

This aggressive accumulation suggests that large investors see value at current levels, despite WLD and the overall artificial intelligence market struggles. If whale buying continues, it could provide much-needed support for a potential recovery in the coming weeks.

Virtuals Protocol (VIRTUAL)

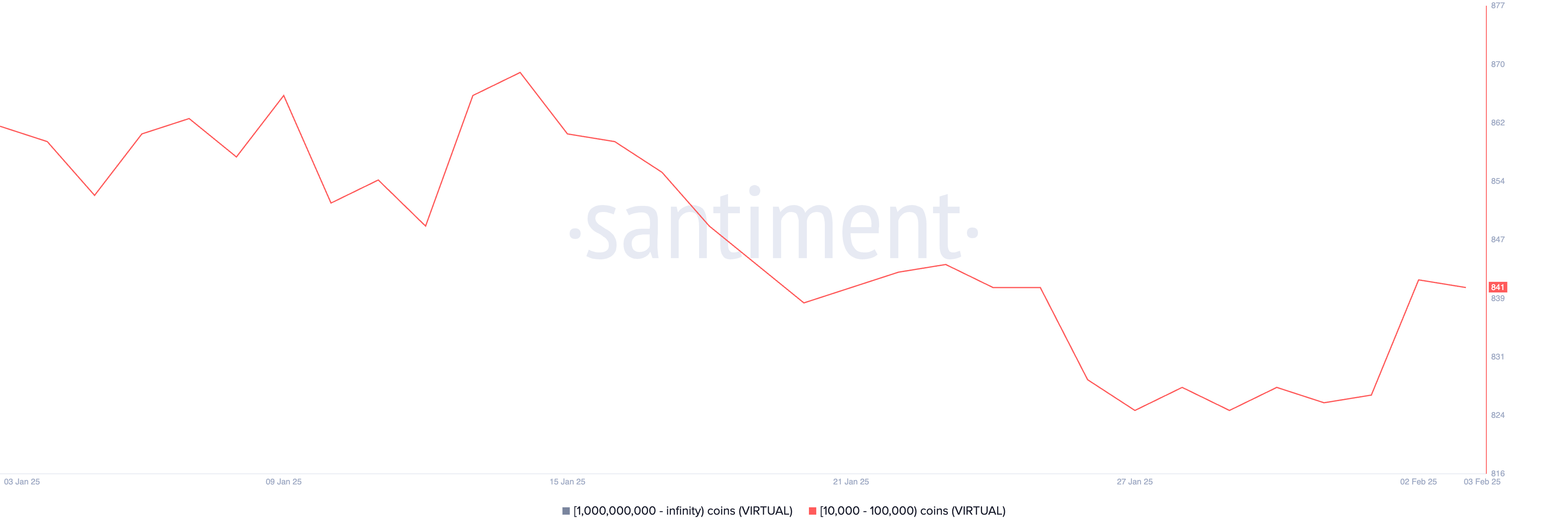

VIRTUAL was one of the hardest-hit AI tokens in the market, plunging 71% between January 3 and February 3.

This steep decline made it one of the biggest losers among top artificial intelligence cryptos, reflecting the broader sell-off in speculative sectors. Despite this, recent data suggests that whale activity could be signaling a potential shift in sentiment.

The number of whales holding between 10,000 and 100,000 VIRTUAL had stabilized after dropping from 841 on January 25 to 825 on January 27.

However, following the latest market crash, accumulation has resumed, with whale addresses rising from 827 on February 1 to 841 now.

Ondo (ONDO)

ONDO has established itself as one of the leading Real-World Assets (RWA) projects, surging 453% in 2024. Even amid the broader crypto market correction, ONDO has remained resilient, posting a 5% gain over the last seven days, as RWA is one of the most relevant crypto narratives for the next weeks.

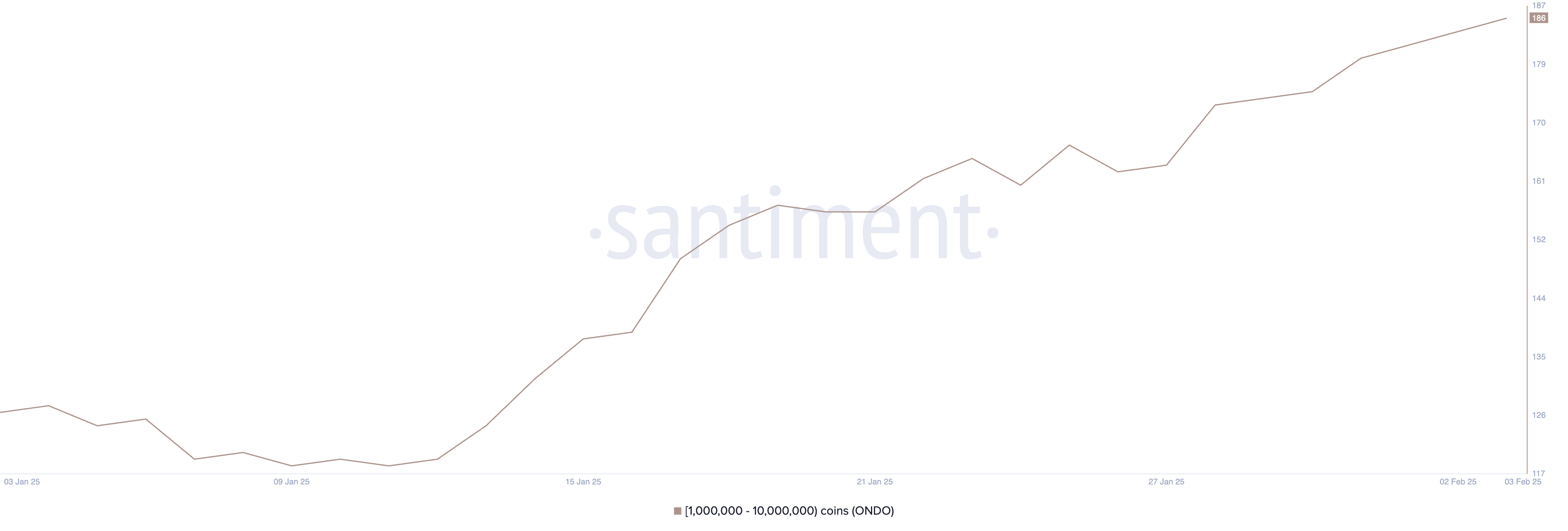

The number of addresses holding at least 1,000,000 ONDO has been steadily increasing since January 12, rising from 180 to 186 between January 31 and February 3.

This accumulation, especially after the recent market downturn, suggests that large holders remain confident in ONDO’s long-term potential. Despite market volatility, the steady growth in whale addresses indicates that institutional and high-net-worth investors are still positioning themselves in ONDO.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MEME Rallies 73%, BONE Follows

The meme coin market is experiencing a surge in investor interest, helping certain tokens recover from their all-time lows (ATLs). Memecoin (MEME) is one such token that has avoided a new ATL and also posted a significant 73% rise.

BeInCrypto has analyzed two other meme coins that have performed well over the past day, making them important tokens to watch.

Memecoin (MEME)

- Launch Date – November 2023

- Total Circulating Supply – 43.11 Billion MEME

- Maximum Supply – 69 Billion MEME

- Fully Diluted Valuation (FDV) – $135.37 Million

MEME had a rough week, hitting a new all-time low at $0.00137. However, the altcoin rebounded sharply, rising by 38% in the last 24 hours to trade at $0.00196. This surge marks a significant recovery, driven by renewed interest in meme coins.

The recent surge in MEME’s price was fueled by a sudden spike in interest for joke tokens, driving a 73% intraday high. To maintain its gains, MEME must successfully breach and flip the $0.00228 resistance into support, a critical level for sustaining its upward momentum.

If MEME experiences profit-taking from investors, it could reverse course and drop back down to the all-time low of $0.00137. A decline through this level would invalidate the bullish outlook and signal further challenges for the meme coin.

Bone ShibaSwap (BONE)

- Launch Date – July 2021

- Total Circulating Supply – 249.89 Million BONE

- Maximum Supply – 250 Million BONE

- Fully Diluted Valuation (FDV) – $71.67 Million

BONE posted an impressive 18.5% rise over the last 24 hours, trading at $0.285. The altcoin is currently under the key resistance of $0.295. Given the recent momentum, it seems poised to breach this level, signaling a potential upward trajectory for the token in the near future.

Flipping the $0.295 resistance into support would open the door for BONE to target its next major resistance at $0.348. A sustained push above this level could drive further bullish sentiment, propelling the token toward even higher price levels.

However, if BONE fails to breach $0.295, the bullish momentum could fade. A decline from this point could send the meme coin back towards $0.232, invalidating the optimistic outlook. Such a reversal would likely create caution among investors, delaying potential upward movement.

- Launch Date – April 2024

- Total Circulating Supply – 999.96 Million BAN

- Maximum Supply – 1 Billion BAN

- Fully Diluted Valuation (FDV) – $40.54 Million

BAN, a small-cap token, has caught the attention of investors, rising nearly 25% in the last 24 hours to trade at $0.040. This surge highlights the growing interest in the meme coin market, with BAN standing out despite its smaller market capitalization.

Inspired by the infamous banana taped to a wall, BAN gained significant fame after being purchased by Tron’s founder, Justin Sun, for $6.2 million last year. If the token continues its upward momentum, it could breach the $0.045 barrier and potentially flip it into support, securing its gains.

However, failing to break through the $0.045 resistance could lead to a drop back to $0.032. If this occurs, it would invalidate the bullish outlook and erase the recent gains, putting investors on alert for further price declines.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Volume Plunges 20% Amid Market Uncertainty

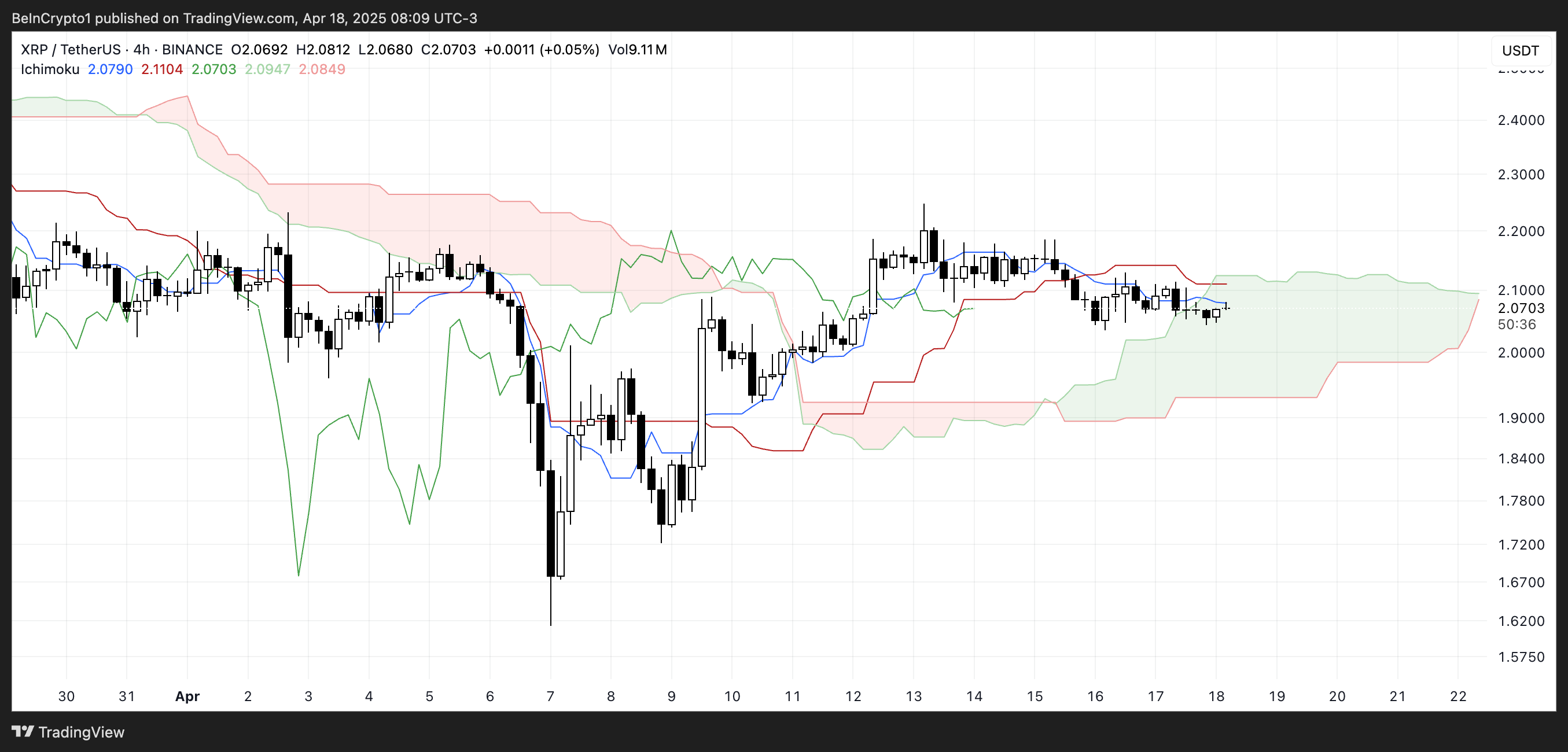

XRP is currently showing signs of indecision, trading sideways with limited momentum as traders await a clearer signal. Over the past 24 hours, XRP’s trading volume has dropped by 20.37%, now sitting at $2.4 billion—a decline that reflects cooling interest in the short term.

Technical indicators like the RSI and Ichimoku Cloud suggest a neutral trend, with no strong bullish or bearish dominance in play. Price action remains confined between key support and resistance levels, leaving the next breakout direction still uncertain.

Neutral RSI Reading Suggests Caution for XRP Traders

XRP’s Relative Strength Index (RSI) is currently sitting at 46.82, signaling neutral momentum in the market. This neutral zone has persisted since April 7, with no significant shifts into either overbought or oversold territory.

Notably, the RSI was at 57.30 just three days ago, indicating that XRP has experienced a recent decline in buying pressure.

The drop suggests cooling interest or a possible shift in sentiment among traders, as the asset now hovers closer to the midpoint of the RSI scale.

The RSI is a momentum oscillator that measures the speed and magnitude of recent price changes, typically on a scale from 0 to 100.

Readings above 70 often suggest an asset is overbought and could be due for a pullback, while readings below 30 indicate it may be oversold and potentially poised for a bounce. With XRP now at 46.82, the asset is neither overbought nor oversold, implying indecision in the market.

This level, combined with the recent dip from 57.30, may signal growing caution or weakening bullish momentum. It could potentially point to a consolidation phase or slight downward pressure in the short term unless buyers re-enter with conviction.

Ichimoku Indicators Show Indecision in XRP’s Price Action

XRP is currently trading inside the Ichimoku Cloud, reflecting a state of indecision or consolidation.

The Tenkan-sen (blue line) and Kijun-sen (red line) are flat and closely aligned, suggesting weak momentum and a lack of short-term trend direction.

The Senkou Span A and B (the cloud boundaries) are relatively flat as well, which typically indicates that the market is in equilibrium without strong pressure from either buyers or sellers.

The Ichimoku Cloud, or Kumo, helps visualize support, resistance, and trend direction at a glance. When the price is above the cloud, the trend is considered bullish; below it, bearish.

Inside the cloud, as XRP currently is, the trend is neutral, and volatility often contracts. The flatness of the cloud’s leading edges implies a consolidation phase, and the fact that price is not breaking clearly above or below the cloud reinforces the idea of market uncertainty.

For now, the lack of a decisive breakout suggests XRP could remain range-bound until a stronger trend develops.

$2.03 Support and $2.09 Resistance Hold the Key to XRP’s Next Move

XRP price is currently trading within a narrow consolidation range, with key support at $2.03 and resistance at $2.09.

The price action has been relatively muted, but the EMA lines are starting to show signs of potential weakness, as a death cross—where the short-term EMA crosses below the long-term EMA—appears to be forming.

If this bearish crossover confirms and XRP breaks below the $2.03 support, a move down to $1.96 becomes increasingly likely.

A strong continuation of the downtrend could trigger a steeper drop. It could potentially drive the price as low as $1.61 if selling pressure accelerates.

However, there’s still a bullish scenario on the table. If buyers manage to push XRP above the $2.09 resistance, it could open the door for a retest of the $2.17 and $2.35 levels.

This would indicate renewed strength and a shift in momentum in favor of the bulls. Should the rally gain traction beyond these levels, XRP could make a run toward $2.50, marking a significant recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BONK Symmetrical Triangle Squeeze: Is A Mega Breakout Imminent?

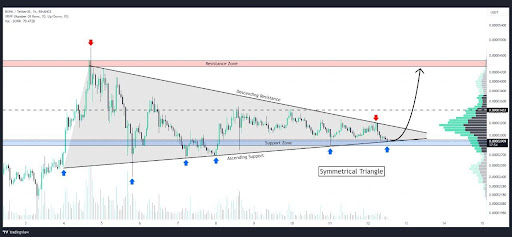

Bonk (BONK), one of the more energetic players in the meme coin space, is showing signs of a potentially explosive move as it coils tighter within a symmetrical triangle pattern. This classic chart formation, characterized by converging trendlines of lower highs and higher lows, often acts as a pressure booster for price action — the longer the squeeze, the more powerful the breakout tends to be.

The symmetrical triangle squeeze is a technical signal that often precedes sharp breakouts, and in BONK’s case, it couldn’t come at a more pivotal moment. With the broader meme coin market showing signs of strength and sentiment slowly shifting, a decisive move from this setup could define the next chapter for BONK. A breakout above the upper trendline might ignite fresh bullish momentum and open the door to new highs, while a break below support could trigger a sell-off toward lower key levels.

Bonk’s Recent Price Action: The Setup For A Big Move

According to a recent post by Whales_Crypto_Trading on X (formerly Twitter), Bonk is currently forming a symmetrical triangle pattern on the 1-hour chart. The price has just rebounded from the lower support trendline of the triangle, suggesting that buyers are stepping in to defend the structure and potentially build momentum for an upward breakout.

What makes this pattern particularly noteworthy is the potential upside. Whales_Crypto_Trading highlighted a profit target range of 70–80%, should BONK successfully break above the upper resistance trendline. With volatility tightening and volume starting to show signs of recovery, such a breakout could offer a substantial short-term trading opportunity.

However, traders are advised to keep a close eye on volume confirmation and key breakout levels to avoid possible fakeouts, as symmetrical triangles can break in either direction.

Will The Meme Coin Explode Or Fizzle Out?

Bonk’s symmetrical triangle pattern has reached a critical stage, raising speculations about whether the meme coin will break free with force or lose steam under pressure. The recent bounce off the support trendline suggests bullish interest is still alive, and if momentum continues to build, BONK could be gearing up for a powerful breakout, potentially delivering gains in the 70–80% range as projected by traders.

However, it’s important to remain cautious. Symmetrical triangles are neutral by nature, meaning a breakdown is still on the table if buyers fail to push through resistance. The next few candles on the 1-hour chart could provide key confirmation of BONK’s direction.

In the end, BONK is approaching a defining moment. Whether it explodes into a bullish run or fizzles out into another rejection will largely depend on volume, sentiment, and the strength of the breakout. Traders should stay alert, as a big move may be closer than it seems.

-

Altcoin22 hours ago

Altcoin22 hours agoDogecoin Price Breakout in view as Analyst Predicts $5.6 high

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Investors Suffer More Losses Than Bitcoin Amid Ongoing Market Turmoil

-

Ethereum14 hours ago

Ethereum14 hours agoEthereum Fee Plunges To 5-Year Low—Is This A Bottom Signal?

-

Altcoin21 hours ago

Altcoin21 hours agoTron Founder Justin Sun Reveals Plan To HODL Ethereum Despite Price Drop

-

Market18 hours ago

Market18 hours agoEthereum Price Fights for Momentum—Traders Watch Key Resistance

-

Market24 hours ago

Market24 hours agoCrypto Ignores ECB Rate Cuts, Highlighting EU’s Fading Influence

-

Altcoin18 hours ago

Altcoin18 hours agoExpert Predicts Pi Network Price Volatility After Shady Activity On Banxa

-

Market23 hours ago

Market23 hours agoBinance Leads One-Third of the CEX Market in Q1 2025