Market

Vugar Usi Zade Discusses Bitget’s Meteoric Rise

Bitget has emerged as a significant player in the International crypto scene, recently claiming the fourth spot among global exchanges.

In an exclusive interview, Vugar Usi Zade, Chief Operating Officer of Bitget, offers insights into the current state of the crypto market, the success of Bitget Wallet, and the future of meme coins.

Some people think that Bitget’s growth is part of a larger phenomenon of splitting Binance’s share among competitors. Do you agree?

It is true, but more importantly, we don’t see the market cap growing and that’s why the industry has become very fierce. We must compete for the same customers.

Changing from one exchange to another is just one click for every user, and an average user would have 3-4 apps on their phones or on the desktop. There will be completed KYCs on all of them and they will choose which to use depending on the transaction fees or availability of the tokens and projects.

We’ll be looking at different ways how we can attract customers. The total market cap is not growing, but still, the user number is growing. There are more and more new users coming or exploring the industry.

What is the current market trend that keeps the market cap from growing while the user base is expanding?

People have less disposable income. And we saw a recession and unemployment in the greatest economies like Japan and the US. In such circumstances, we usually see two trends: either that people come to do a dollar-cost averaging(DCA) kind of long-term holding strategy with large tokens like Bitcoin, Ethereum, and top 10, or that people become keen on meme tokens or early-stage projects they can still do 10x, 20x.

Especially for the latter, we see a huge influx from the underdeveloped economies of the CIS, Africa, and Latin America. That was the narrative of the crypto from the beginning: get rich quick, and people are still chasing that dream.

Bitget Wallet scored the top in the App Store charts in Nigeria in July. What was special about Nigeria?

Last month Bitget Wallet became the most downloaded wallet and it surpassed Metamask. Therefore, it’s not only in Nigeria. We see the same trend globally happening.

In the middle of the bear market, we invested $30 million in BitKeep and rebranded to Bitget Wallet. While everyone was holding back and cutting costs, we believed in decentralization and long-term goals. We wanted to have a decentralized wallet and centralized product engaged with our decentralized app where users can access more and more opportunities out there.

As an exchange, we list around 800-900 projects, while in Bitget Wallet there are 23,000 projects listed and more and more people come to explore what the decentralized side of the crypto has to offer. It functions almost like an exchange. We have the best cataloging when it comes to finding projects.

Moreover, we provide unique features. I heard those Bitget Wallet users in Southeast Asia were earning some money by doing the tasks that are given on the wallet, whether it is social activation or collecting some airdrops. People in underdeveloped countries could have a lot of interest in these features.

Bitget was the first among major exchanges to list some memecoins like CATI. How do you see the future of meme coins?

Meme tokens are the hot topic of this market cycle. They offer the opportunity to make 20x or 30x, which aligns with the ‘get rich fast’ narrative of crypto. They’ve become vital for many crypto projects and bring a lot of transactions, wallet holders, and user interaction.

We’re seeing interest from institutions and family offices too. However, they’re very risky assets. I always tell people to only invest money they’re ready to lose in meme tokens, as almost 90 percent of investors lose their money.

For the last two years, we have been very loud with our Make it Count campaign with Lionel Messi. He was our official ambassador previously. We also did a lot of brand partnerships with Juventus. Football was a core topic when it came to Bitget and people know us for football.

We are proud that we will sponsor the Spanish league, La Liga, and bring Spanish football to 2.5 billion people globally. And you’ll be seeing a lot of Bitget brand activation and marketing campaigns around La Liga, all the teams and sportsmen that will be competing for the Cup.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BNB Springs Back From $531 With Unshaken Bullish Conviction

My name is Godspower Owie, and I was born and brought up in Edo State, Nigeria. I grew up with my three siblings who have always been my idols and mentors, helping me to grow and understand the way of life.

My parents are literally the backbone of my story. They’ve always supported me in good and bad times and never for once left my side whenever I feel lost in this world. Honestly, having such amazing parents makes you feel safe and secure, and I won’t trade them for anything else in this world.

I was exposed to the cryptocurrency world 3 years ago and got so interested in knowing so much about it. It all started when a friend of mine invested in a crypto asset, which he yielded massive gains from his investments.

When I confronted him about cryptocurrency he explained his journey so far in the field. It was impressive getting to know about his consistency and dedication in the space despite the risks involved, and these are the major reasons why I got so interested in cryptocurrency.

Trust me, I’ve had my share of experience with the ups and downs in the market but I never for once lost the passion to grow in the field. This is because I believe growth leads to excellence and that’s my goal in the field. And today, I am an employee of Bitcoinnist and NewsBTC news outlets.

My Bosses and co-workers are the best kinds of people I have ever worked with, in and outside the crypto landscape. I intend to give my all working alongside my amazing colleagues for the growth of these companies.

Sometimes I like to picture myself as an explorer, this is because I like visiting new places, I like learning new things (useful things to be precise), I like meeting new people – people who make an impact in my life no matter how little it is.

One of the things I love and enjoy doing the most is football. It will remain my favorite outdoor activity, probably because I’m so good at it. I am also very good at singing, dancing, acting, fashion and others.

I cherish my time, work, family, and loved ones. I mean, those are probably the most important things in anyone’s life. I don’t chase illusions, I chase dreams.

I know there is still a lot about myself that I need to figure out as I strive to become successful in life. I’m certain I will get there because I know I am not a quitter, and I will give my all till the very end to see myself at the top.

I aspire to be a boss someday, having people work under me just as I’ve worked under great people. This is one of my biggest dreams professionally, and one I do not take lightly. Everyone knows the road ahead is not as easy as it looks, but with God Almighty, my family, and shared passion friends, there is no stopping me.

Market

XRP Futures Traders Increase Bets on Upside

Over the past week, XRP’s price has remained range-bound amid the broader market’s recovery attempt.

However, with a growing bullish bias toward the altcoin, XRP may be on the brink of breaking free from this range and trending upward. This analysis explains why.

XRP Futures Traders Bet on Upside as Long Positions

The momentum shift towards the bulls has become evident, particularly within the futures market, where long bets on XRP are now surpassing short positions. This is reflected by the token’s XRP’s long/short ratio, which is currently at 1.07.

The long/short ratio measures the proportion of long positions (bets on price increases) to short positions (bets on price declines) in the market.

When its value is below one, it indicates that the number of short positions outweighs long positions in the market, suggesting bearish sentiment or a lack of confidence in the token’s future price performance.

As with XRP, when an asset’s long/short ratio is above one, it means there are more long positions than short ones. It indicates that traders are predominantly bullish on XRP and hints at a higher likelihood of an upward breach of its narrow range.

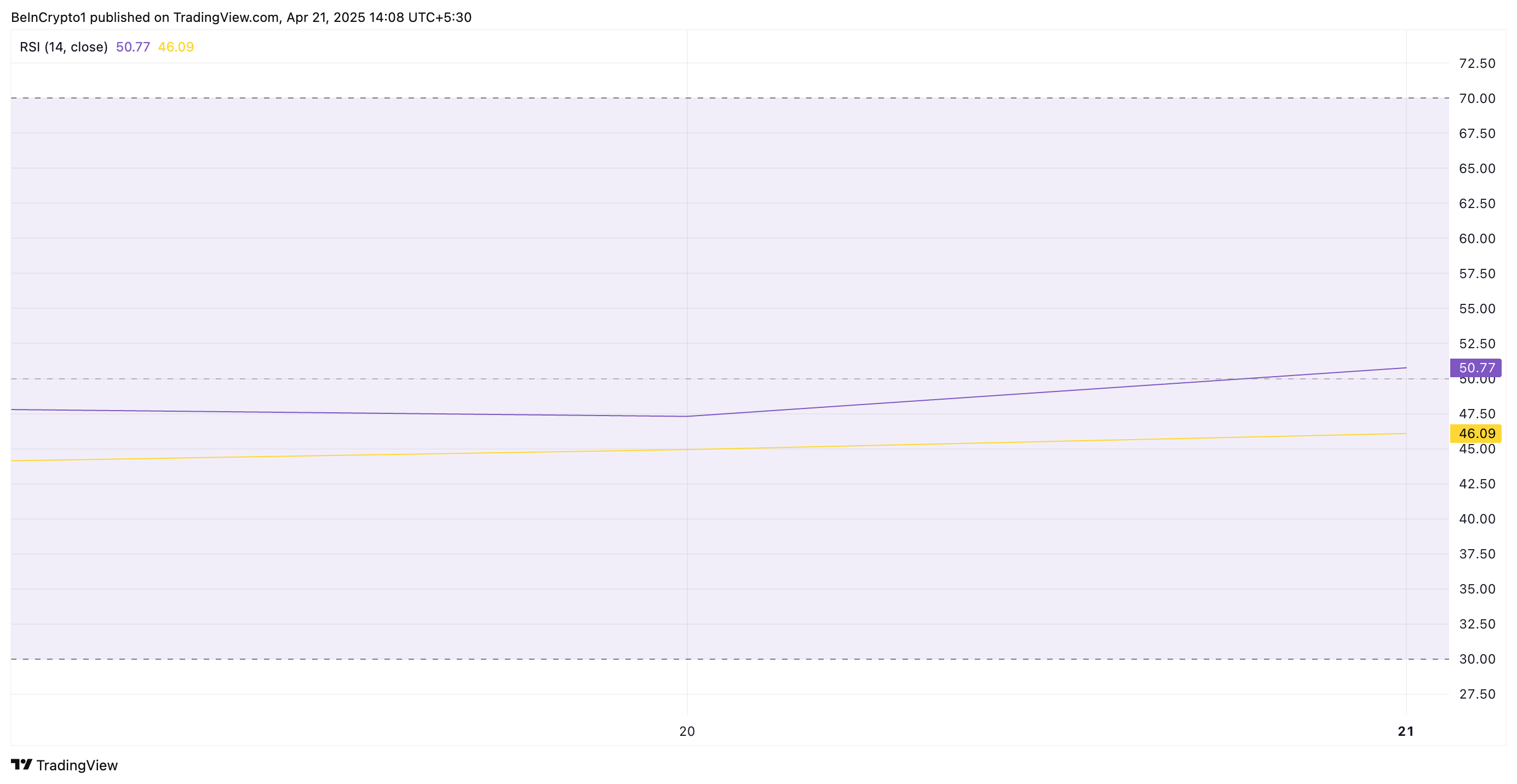

In addition, XRP’s relative strength index (RSI) has climbed steadily, indicating a gradual rise in demand for the token. The key momentum indicator, at 50.77, currently rests above the neutral line and is in an uptrend.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 50.77, XRP’s RSI signals a shift toward bullish momentum. It indicates that buying pressure is starting to outweigh selling pressure, and the asset may be poised for further price increases.

XRP Eyes $2.18 Resistance as Bulls Look to Push for $2.29

XRP currently trades at $2.13, just 3% away from its next significant resistance level, $2.18. If buying pressure intensifies and the altcoin successfully flips this price point into a support floor, it could trigger further price growth. In this scenario, XRP could potentially climb to $2.29.

However, if demand weakens and the bears regain control, XRP may remain range-bound. It could even break below the $2.03 support and fall to $1.99.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Optimism, Aztec, and Huma Finance

The crypto market is attempting a recovery, with Bitcoin (BTC) nearing the $90,000 milestone. Amidst improving sentiment, several startups are launching enticing airdrops, providing crypto enthusiasts with opportunities to engage with budding platforms without initial financial input.

This week, we discuss airdrop participation opportunities from three projects with financial backing from renowned investors.

Optimism

Layer-2 blockchain Optimism is one of the top three crypto airdrops this week. The Optimism crypto airdrop comes after the network raised $267.50 million from key investors such as Andreessen Horowitz, Coinbase Ventures, Paradigm, and IDEO CoLab Ventures, among others.

The airdrop concerns a SuperStacks Campaign, which opened on April 16 and will remain until June 30.

“With many chains building as one, a new network structure is emerging to solve fragmentation in Ethereum. This network is modular, interoperable, and composable by default. We call it the Superchain: and it changes everything,” Optimism explained.

Rewards are in the form of points, awarded for interacting with the projects. Airdrop farmers also get rewarded for providing liquidity to superchains, scalable blockchains combined into a single ecosystem to solve Ethereum fragmentation.

Actual tasks bring 10 EXP (experience points) per $1 of daily liquidity. In the past, Optimism held five airdrops, giving away over 265 million tokens.

“You may be eligible for the 6th airdrop without realizing it. In the system, we collect badges as you perform operations on Optimism. However, since it counts your previous operations when you log in, you may have opened many badges.,” one airdrop farmer explained.

This means even minimal effort could yield rewards. However, participating in the Optimism airdrop does not guarantee future rewards. Instead, it only provides an opportunity to earn points.

Aztec

Another top crypto airdrop to watch this week is Aztec, bringing forth a privacy-focused Layer-2 zero-knowledge (ZK) rollup on Ethereum.

Aztec is backed by $119.1 million in funding from investors such as Andreessen Horowitz (a16z), Paradigm, Consensys, and Coinbase Ventures.

The project has garnered significant attention, following talks of a native AZTEC token and a confirmed retroactive airdrop for early users.

On April 17, the network announced the Aztec Sequencer Form, front-running a public testnet. Interested participants were asked to fill out the form to gain early access to the testnet.

Historically, blockchain projects reward testnet participants with tokens. Based on this, Aztec’s funding and investor backing increase the probability of an airdrop.

Huma Finance

This week, the watchlist also includes Huma Finance, the first PayFi (Payment Finance) network built on Solana. The project focuses on transforming global payment settlements using blockchain technology.

Huma Finance launched the second version of point farming, which is available only on the Solana network. Participants can deposit USDC tokens and earn Feathers (points). Notably, no KYC is needed in this version, and more pools are available.

Recently, the project announced social and deposit quests on Galxe, allowing users to complete these quests and try to win a share of $2,000. Notably, participants should have at least lvl 2 of Web3 Passport.

“Huma 2.0 is The Next Wave! Now anyone can earn real yield and stack rewards, exclusively on Solana. New quest is LIVE on Galxe Quest. Join the PayFi movement for a chance to grab a share of $2000 USDC,” the network shared.

The project also launched a point farming program, in which participants can deposit USDC tokens into one of the pools. For this activity, users must pass KYC.

Meanwhile, Huma Finance boasts up to $46.3 million in funds raised from backers such as HashKey Capital, Circle, ParaFi Capital, and Distributed Global.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Market21 hours ago

Market21 hours agoTokens Big Players Are Buying

-

Market23 hours ago

Market23 hours agoVOXEL Climbs 200% After Suspected Bitget Bot Glitch

-

Market20 hours ago

Market20 hours agoDogecoin Defies Bullish Bets During Dogeday Celebration

-

Market18 hours ago

Market18 hours agoWill XRP Break Support and Drop Below $2?

-

Market24 hours ago

Market24 hours agoHow Token Launch Frenzy Is Delaying 2025 Altcoin Season

-

Altcoin24 hours ago

Altcoin24 hours agoBinance Traders Go Big On Dogecoin—Majority Holding Long Positions

-

Bitcoin8 hours ago

Bitcoin8 hours agoUS Economic Indicators to Watch & Potential Impact on Bitcoin