Market

Trump’s Crypto Summit Disappoints, Sparking Backlash

Donald Trump’s long-awaited White House Crypto Summit disappointed the crypto space. Its promises were underwhelming, and the community was undervalued. Bitcoin’s price fell slightly instead of an anticipated jump.

Several Trump-aligned crypto executives praised the President’s attempts to curtail federal regulators and suggested the industry was “doomed” without his intervention. Still, this frustration hasn’t boiled over into an all-out schism yet.

Trump’s Crypto Summit Fails to Deliver

Donald Trump announced the first-ever White House Crypto Summit last week, and the community was expecting an opportunity for positive new regulations.

Specific policy ideas and a potential guest list were hotly debated, and the bubble of anticipation helped fuel a pump in token prices. Today, the long-awaited Summit finally happened.

“Welcome to the first ever White House Digital Assets Summit. I know that many of you have been fighting for years for this, and it’s an honor to be here with you. Last year, I promised to make America the Bitcoin capital of the world… and we’re taking historic action to deliver on that promise,” Trump claimed.

However, the most bullish expectations of Trump and the Crypto Summit quickly fell. He addressed his Crypto Reserve plans in brief detail, offhandedly suggested that he could help FIFA launch a token, and postponed his timetable for friendly regulations to become law.

Mostly, crypto executives praised him as a savior of the industry, sparking backlash:

“That Summit was the most embarrassing thing I’ve ever witnessed. This is really what we’ve come to? Is everyone just worshipping Trump? Meanwhile, he has no idea what he’s reading off of, he’s just riffing on what David Sacks wrote him. We used to be cypherpunks, we used to be anti-government, now we [just] want the price to go up,” popular NFT trader Clemente claimed.

Excessive Deference Causes Pushback

Specifically, the televised Crypto Summit only lasted a little over 20 minutes, most of which did not involve Trump himself speaking.

Several close allies, such as Coinbase CEO Brian Armstrong, excessively praised the President’s attempts to curtail the SEC and other regulators. They suggested that Trump saved the industry from excessive enforcement under Gary Gensler.

This deferential attitude towards Trump, the Summit’s short duration, and lack of substantial promises created an overall negative impression.

By suggesting that the industry was “doomed” without Trump’s help, these executives ignore the community’s strength, resilience, and innovative spirit. Is it any wonder Bitcoin’s price fell afterward?

Participants at Trump’s Crypto Summit lauded his attempts to totally defang financial regulators, which is already sparking unprecedented turmoil within the federal government.

Several Summit participants like Cameron Winklevoss openly wish to take this agenda even further.

“The Crypto Summit is a disgrace. It’s a national embarrassment. The crypto faction that has captured the White House is precisely what our Founding Fathers warned us about. It will be a blight on whatever legacy Trump leaves and marks a low point for the presidency and the USA,” wrote Peter Schiff, financial commentator and crypto critic.

Ultimately, it doesn’t look like this Crypto Summit will precipitate a real break between Trump and the community overnight. People are dissatisfied, true, but some may yet benefit.

For example, Armstrong already announced that Coinbase will hire 1,000 more employees. It may take real economic losses for this ambient frustration to boil over.

However, overall, the summit remained largely underwhelming. It did not offer any significant positive development signal for the industry outside of the US market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Rises Steadily—But Can the Rally Hold This Time??

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a fresh increase above the $82,500 zone. BTC is now consolidating gains and might attempt to clear the $85,850 resistance.

- Bitcoin started a fresh increase above the $83,200 zone.

- The price is trading above $82,500 and the 100 hourly Simple moving average.

- There was a break above a connecting bearish trend line with resistance at $84,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $85,500 zone.

Bitcoin Price Rises Again

Bitcoin price started a fresh increase above the $81,500 zone. BTC formed a base and gained pace for a move above the $82,500 and $83,200 resistance levels.

The bulls pumped the price above the $84,500 resistance. A high was formed at $85,850 and the price recently started a downside correction. There was a move below the $84,500 support. The price dipped below the 23.6% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high.

However, the price remained stable above $82,200. Bitcoin price is now trading above $82,500 and the 100 hourly Simple moving average. There was a break above a connecting bearish trend line with resistance at $84,500 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $85,500 level. The first key resistance is near the $85,850 level. The next key resistance could be $86,500. A close above the $86,500 resistance might send the price further higher. In the stated case, the price could rise and test the $88,000 resistance level. Any more gains might send the price toward the $88,800 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $85,500 resistance zone, it could continue to move down. Immediate support on the downside is near the $84,200 level. The first major support is near the $82,200 level and the 50% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high.

The next support is now near the $81,200 zone. Any more losses might send the price toward the $80,500 support in the near term. The main support sits at $80,000.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $84,500, followed by $82,200.

Major Resistance Levels – $85,500 and $85,800.

Market

Bitcoin’s Price Under $85,000 Brings HODlers Profit To 2-Year Low

Bitcoin’s price continues to struggle below the psychological $85,000 mark, failing to break past this critical level over the past two months.

Despite some attempts to secure a rise, the leading cryptocurrency has remained stagnant, increasing pressure on long-term holders (LTHs). These investors, once enjoying solid profits, are now seeing a decline in their unrealized gains.

Bitcoin Investors Are Pulling Back

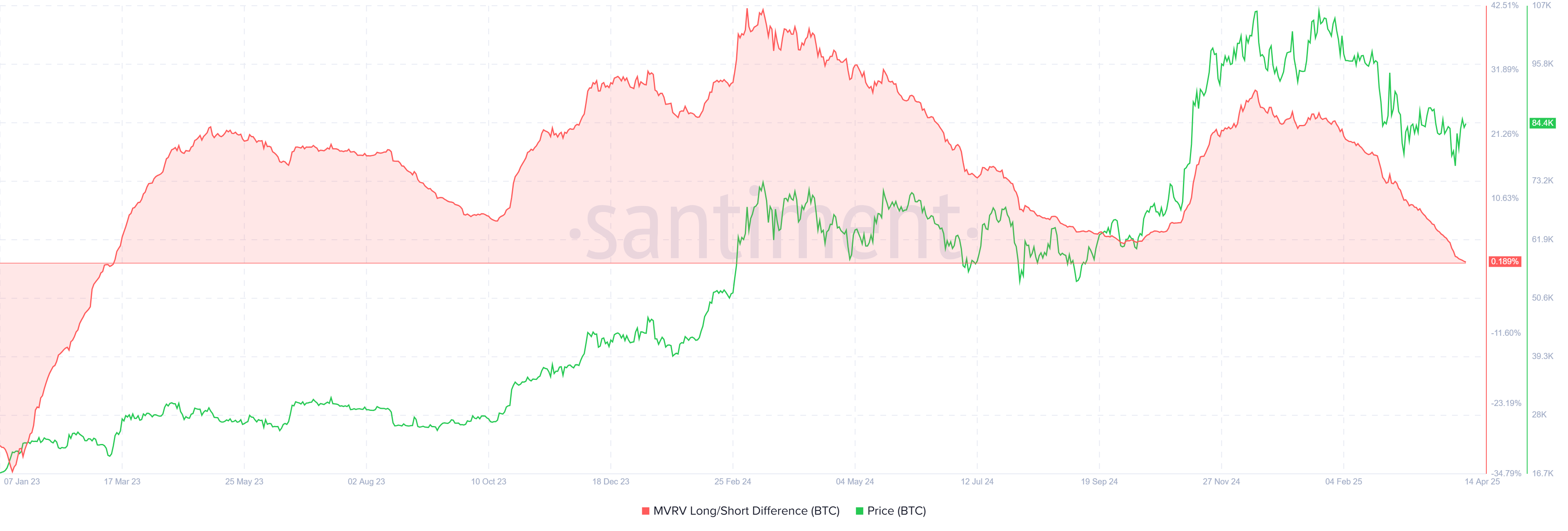

The MVRV Long/Short Difference, a key metric used to gauge market sentiment, reveals a concerning trend for LTHs. The indicator recently hit a two-year low, suggesting that long-term holders’ profits are at their lowest since March 2023. This shift indicates that the market conditions are increasingly unfavorable for LTHs.

As Bitcoin’s price fails to recover, short-term holders (STHs) are beginning to dominate, capitalizing on the price fluctuations. Meanwhile, long-term holders (LTHs), facing diminishing profits, hold off on buying or holding more.

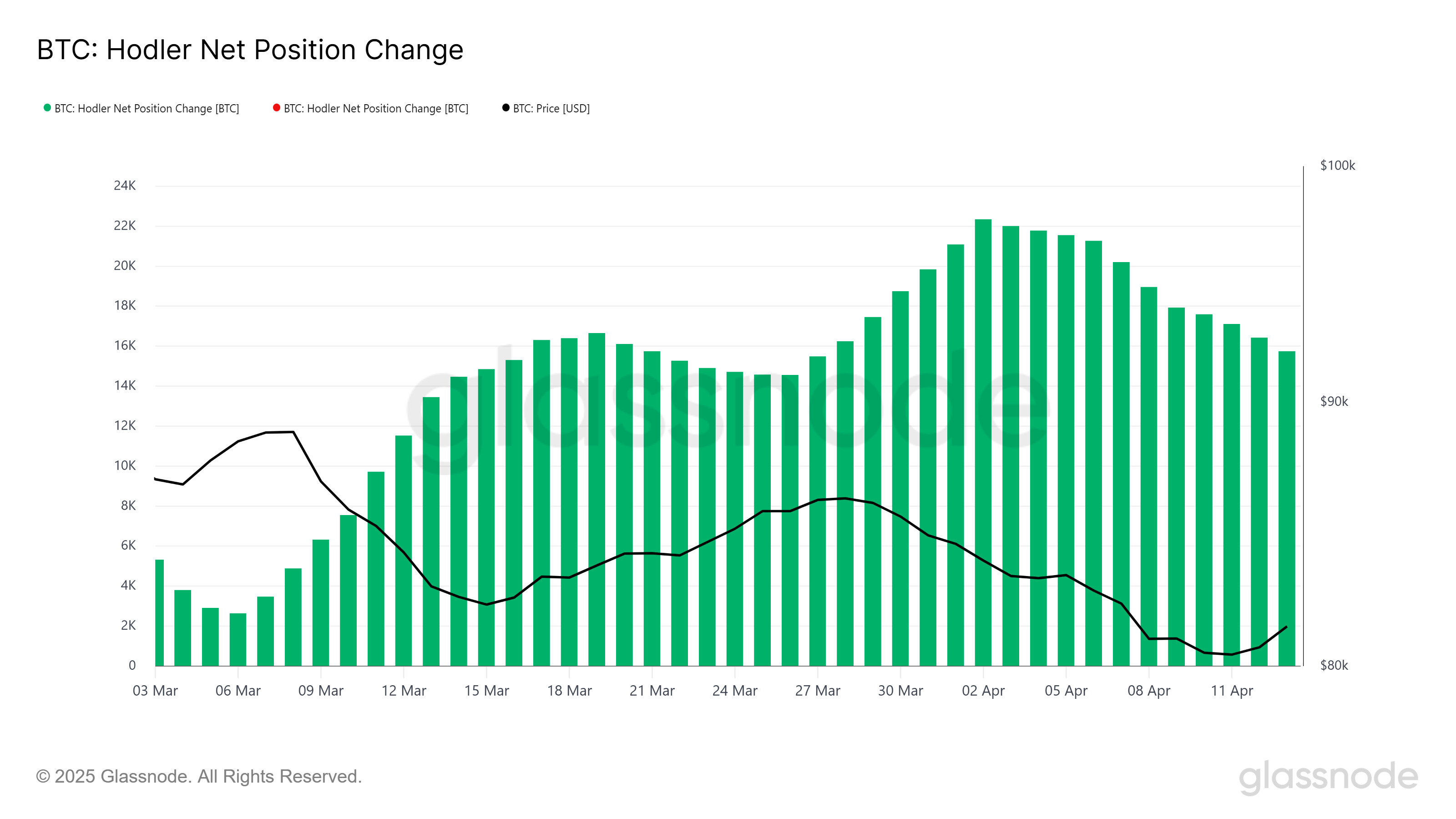

The overall momentum of Bitcoin, measured by technical indicators, also reflects bearish signals. The HODLer net position change further backs this narrative, as it shows that LTHs have sold a significant portion of their holdings over the last two weeks. In total, these sales amounted to more than 6,596 BTC, which is worth over $550 million.

Although this figure may not be enormous, the psychological shift from confidence to caution among LTHs is a larger concern. This lack of conviction could delay Bitcoin’s recovery and contribute to further price stagnation. In turn, this could further limit market activity and exacerbate the ongoing downturn.

BTC Price Is Facing A Decline

Bitcoin’s price is trading at $84,421, hovering just above the crucial support level of $82,619. The price remains trapped under the key $85,000 resistance level, which could cause further pressure if it fails to break above. If Bitcoin loses support at $82,619, a decline to the next major psychological support of $80,000 is possible.

If the bearish trend continues, the price could fall further, with $78,841 emerging as a critical level to watch. Losing this support would mark a more significant downturn, confirming the continued market weakness and deepening the bearish outlook for Bitcoin.

However, if Bitcoin manages to breach and hold $85,000 as support, it could ignite a recovery, pushing the price back up toward $86,848. A sustained rise above $85,000 would invalidate the current bearish trend and pave the way for a potential surge toward $89,800, reestablishing confidence among investors.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Turns Green, Sparks Hopes of a Fresh Upside Push

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Altcoin9 hours ago

Altcoin9 hours agoMantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Reclaims Key Support At $1,574, Here’s The Next Price Target

-

Market20 hours ago

Market20 hours agoDOGE Spot Outflows Exceed $120 Million in April

-

Market18 hours ago

Market18 hours agoFARTCOIN Is Overbought After 250% Rally – Is the Bull Run Over?

-

Bitcoin23 hours ago

Bitcoin23 hours agoScottish School Lomond Pioneers Bitcoin Tuition Payment In The UK

-

Market15 hours ago

Market15 hours agoHackers are Targeting Atomic and Exodus Wallets

-

Market14 hours ago

Market14 hours ago3 Token Unlocks for This Week: TRUMP, STRK, ZKJ

-

Bitcoin21 hours ago

Bitcoin21 hours agoCryptoQuant CEO Says Bitcoin Bull Cycle Is Over, Here’s Why