Market

Traders dump Cardano and IOTA as they move to Vantard

Cardano and IOTA, two of the best-known players in the crypto industry, have underperformed the market over time as they evolved into ghost chains. A ghost chain is a blockchain whose coin is popular, but one that lacks a supportive ecosystem.

Cardano and IOTA are ghost chains

Cardano is a layer-1 blockchain that became popular in 2021 as a good alternative to Ethereum, which was a proof-of-work network at the time. Its popularity was partly because it was promoted as a peer-reviewed chain that would become a disruptive force in the industry.

Years later, Cardano has no major developers working in its blockchain. For example, there are no popular decentralized exchanges (DEXes) and lending protocols. It has a total value locked (TVL) of less than $350 million. In contrast, newer blockchain networks like Base and Sui have attracted over $1 billion in assets.

IOTA, on the other hand, became popular for its insistence that it was not a blockchain network. Instead, it is a distributed ledger technology that uses a technology known as tangle.

IOTA launched Shimmer, its EVM-enabled blockchain network in 2023 with a lot of hype. Many months later, it has also not attracted major developers.

Therefore, many investors have abandoned ADA and IOTA as their prices have continued to underperform the market. Cardano price has crashed by 60% from its highest level this year, while IOTA has plunged by 75%.

Traders flock to Vantard

At the same time, traders are flocking to Vantard, an upcoming meme coin fund token that is in its presale stage.

Data on its website shows that the developers have now raised $808,240 tokens in less than three weeks. This trend makes it one of the best performing token sales this year.

The idea of a meme coin index fund is inspired by Vanguard’s success. For over three decades, Vanguard has become a financial juggernaut with over $8 trillion in assets. Most of these funds are made up of mutual funds and exchange-traded funds that track either stocks or bonds.

Vantard hopes to create a fund made up of the top-performing meme coins in the industry. It is based on the view that meme coins do better than other traditional cryptocurrencies, especially during bull markets.

Some of the most notable performers were cryptocurrencies like Popcat, MICHI, Fwog, Gigachad, and Moo Deng.

Vantard’s performance will also be influenced by the ongoing interest rate cuts by the Federal Reserve. Analysts expect the Fed to slash interest rates by 0.25% on Wednesday this week. It will also hint that it will deliver more cuts in the coming meetingss.

Bitcoin and meme coins like Vantard thrive when the Fed is cutting rates. You can learn more about Vantard and buy the VTARD token here.

Market

Bitcoin Price Still In Trouble—Why Recovery Remains Elusive

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a recovery wave from the $81,200 zone. BTC is consolidating losses and facing hurdles near the $83,500 resistance level.

- Bitcoin started a decent recovery wave above the $82,200 zone.

- The price is trading below $83,200 and the 100 hourly Simple moving average.

- There is a connecting bearish trend line forming with resistance at $83,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $83,500 zone.

Bitcoin Price Faces Resistance

Bitcoin price extended losses below the $82,500 support zone and tested the $81,200 zone. BTC formed a base and recently started a decent recovery wave above the $82,200 resistance zone.

The bulls were able to push the price above the $82,500 and $83,000 resistance levels. The price even tested the 23.6% Fib retracement level of the recent decline from the $89,042 swing high to the $81,177 low. However, the price is struggling to continue higher.

Bitcoin price is now trading below $83,500 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $83,200 level. The first key resistance is near the $83,500 level. There is also a connecting bearish trend line forming with resistance at $83,500 on the hourly chart of the BTC/USD pair.

The next key resistance could be $84,500. A close above the $84,500 resistance might send the price further higher. In the stated case, the price could rise and test the $85,500 resistance level. Any more gains might send the price toward the $86,000 level or 61.8% Fib retracement level of the recent decline from the $89,042 swing high to the $81,177 low.

Another Decline In BTC?

If Bitcoin fails to rise above the $83,500 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $82,200 level. The first major support is near the $81,200 level.

The next support is now near the $80,500 zone. Any more losses might send the price toward the $80,000 support in the near term. The main support sits at $78,800.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $82,200, followed by $81,200.

Major Resistance Levels – $83,500 and $85,000.

Market

What to Expect After March’s Struggles

The leading altcoin, Ethereum, experienced a challenging month in March, marked by a series of bearish trends that reflected a broader market slowdown.

However, as the market begins to show signs of recovery, the key question for April remains: Can Ethereum regain its bullish momentum?

Ethereum’s March Woes: Price Crash, Activity Slump, and Growing Supply Pressure

On March 11, Ethereum plummeted to a two-year low of $1,759. This prompted traders to “buy the dip,” triggering a rally to $2,104 by March 24.

However, market participants resumed profit-taking, causing the coin’s price to fall sharply for the rest of the month. On March 31, ETH closed below the critical $2,000 price level at $1,822.

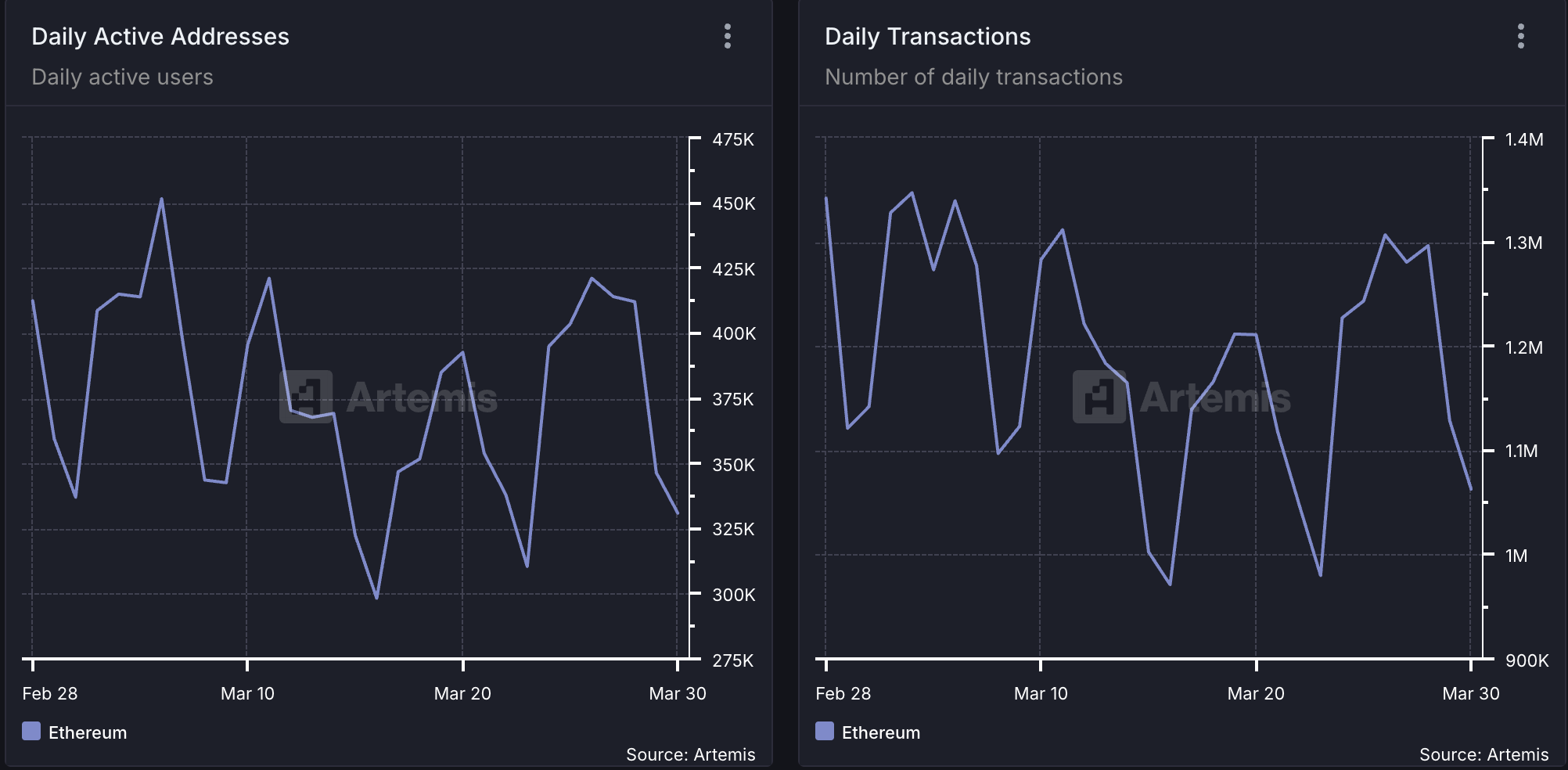

Amid ETH’s price troubles, the Ethereum network also experienced a severe decline in activity in March. Per Artemis, the daily count of active addresses that completed at least one ETH transaction fell by 20% in March.

As a result, the network’s monthly transaction count also plummeted. Totaling 1.06 million during the 31-day period in review, the number of transactions completed on Ethereum fell by 21% in March.

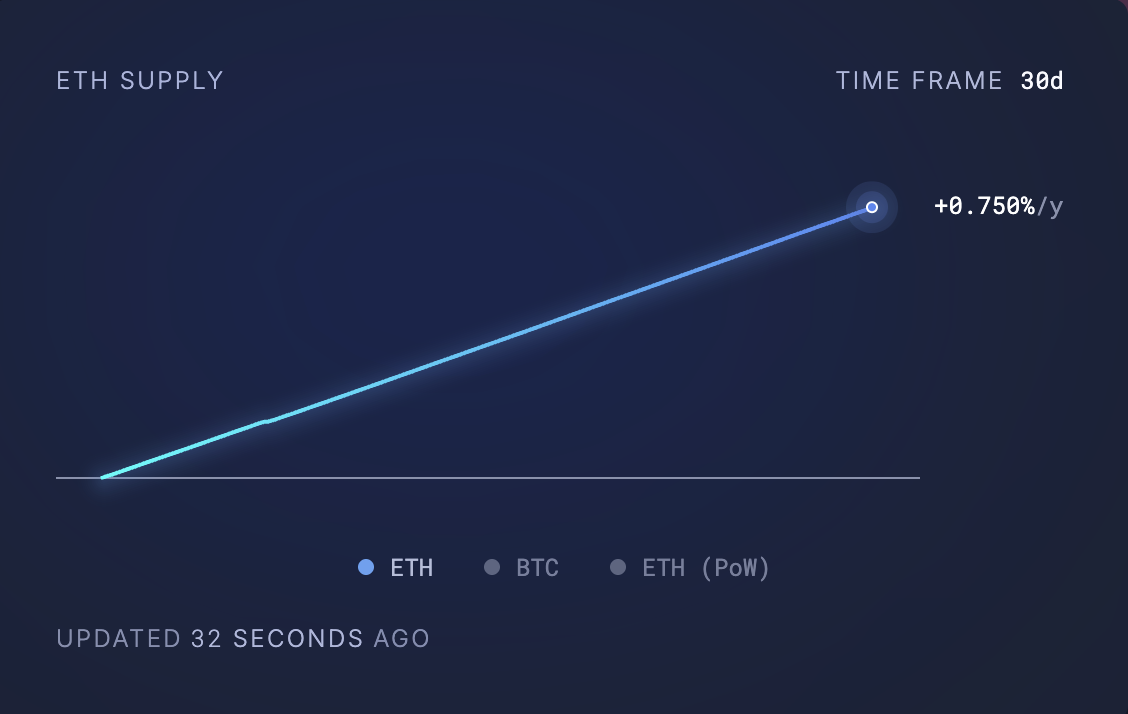

Generally, as more users transact and engage with Ethereum, the burn rate (a measure of ETH tokens permanently removed from circulation) increases, contributing to Ether’s deflationary supply dynamic. However, when user activity drops, ETH’s burn rate reduces, leaving many coins in circulation and adding to its circulating supply.

This was the case for ETH in March when it saw a spike in its circulating supply. According to data from Ultrasound Money, 74,322.37 coins have been added to ETH’s circulating supply in the past 30 days.

Usually, when an asset’s supply spikes like this without a corresponding demand to absorb it, it increases the downward pressure on its price. This puts ETH at risk of extending its decline in April.

What’s Next for Ethereum? Expert Says Inflation May Not Be a Major Concern

In an exclusive interview with BeInCrypto, Gabriel Halm, a Research Analyst at IntoTheBlock, noted that ETH’s current inflationary trends “may not be a major red flag” to watch out for in April.

Halm said:

“Even though Ethereum’s supply has recently stopped being deflationary, its annualized inflation rate is still only 0.73% over the last month, which is still dramatically lower than pre-Merge levels and lower than that of Bitcoin. For investors, this moderate level of inflation may not be a major red flag, provided that network usage, developer activity, and institutional adoption remain robust.”

Moreover, regarding whether Ethereum’s declining network activity has played a significant role in its recent price struggles, Halm suggested that its impact may be overstated.

“Historically, from September 2022 to early 2024, Ethereum’s supply remained deflationary, yet the ETH/BTC pair still trended lower. This suggests that macroeconomic and broader market forces can play a far more significant role than token supply changes alone.”

On what ETH holders should anticipate this month, Halm said:

“Ultimately, whether Ethereum dips or rallies in April will likely depend more on market sentiment and macro trends than on its short-term supply dynamics. Still, it’s essential to keep an eye on network developments that could spur renewed activity and reinforce ETH’s leading position in the broader crypto landscape.”

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Faces Community Backlash and Boycott Calls

Controversies surrounding token listings, the depegging of the FDUSD stablecoin, and allegations of unethical behavior have raised a crucial question: Is Binance losing its credibility?

These issues threaten to erode trust and challenge Binance’s standing in the crypto industry.

Binance Struggles to Meet the Standard

One of Binance‘s most pressing issues is the poor performance of the tokens listed on the exchange. As BeInCrypto reported earlier, 89% of the tokens listed on the platform in 2025 recorded negative returns.

Even more concerning, another report reveals that most of the tokens listed in 2024 also experienced negative performance.

Listing on Binance was once considered a “launchpad” for new projects. However, it no longer guarantees success.

A prime example is the ACT token, a meme coin listed on the exchange that quickly plummeted. Earlier this week, Wintermute—a major market maker—dumped a large amount of ACT, exerting strong downward pressure on its price and raising concerns about the transparency of Binance’s listing process.

Such criticism has led the community to believe Binance prioritizes listing fees over users’ interests.

Connection to FDUSD

The FDUSD stablecoin has also become a focal point of controversy, with Binance at its center. FDUSD lost its peg, dropping to $0.89 after reports surfaced that its issuing company had gone bankrupt.

Wintermute, one of the largest FDUSD holders outside of Binance, withdrew 31.36 million FDUSD from the exchange at 11:15 AM UTC. This move is believed to have exacerbated the depegging situation, sparking panic in the market.

More concerning, a community member claimed that some Binance employees leaked internal information about the FDUSD incident so they could select whale chat groups.

If true, this would severely damage Binance’s reputation and raise major questions about the platform’s transparency and ethics.

Overall, the community’s dissatisfaction is growing, with many users calling for a boycott of the exchange. Such negative reactions are shaking user confidence in the platform, which was once considered a symbol of credibility in the crypto space.

“Binance today caused massive liquidations on alts listed on their exchange. I warned you all yesterday about their very dirty tactics, specifically GUN. I refuse to use Binance #BoycottBinance,” wrote popular crypto YouTuber Jesus Martinez.

These accusations stem from a central issue that Binance prioritizes profits over user interests. Over the past few months, the community has constantly criticized its listing strategy, arguing that the exchange focuses on “shitcoins” to collect high listing fees without considering project quality.

Although the exchange recently introduced a community voting mechanism to decide on listings, this might not be enough to silence the criticism.

As a Tier-1 exchange, the company is evaluated based on trading volume, security, regulatory compliance, and community trust. However, recent events suggest that the exchange is struggling to maintain these standards.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoCardano (ADA) Downtrend Deepens—Is a Rebound Possible?

-

Altcoin23 hours ago

Altcoin23 hours agoAnalyst Forecasts 250% Dogecoin Price Rally If This Level Holds

-

Market23 hours ago

Market23 hours agoXRP Price Under Pressure—New Lows Signal More Trouble Ahead

-

Market14 hours ago

Market14 hours agoBitcoin’s Future After Trump Tariffs

-

Altcoin19 hours ago

Altcoin19 hours agoBinance Issues Key Announcement On StakeStone TGE; Here’s All

-

Market18 hours ago

Market18 hours agoIP Token Price Surges, but Weak Demand Hints at Reversal

-

Altcoin18 hours ago

Altcoin18 hours agoMovimiento millonario de Solana, SOLX es la mejor opción

-

Market21 hours ago

Market21 hours agoEthereum Price Recovery Stalls—Bears Keep Price Below $2K