Market

Tornado Cash Sanctions Overturned; TORN Token Spikes 400%

A US federal appeals court struck down sanctions imposed by the Treasury Department on Tornado Cash. This popular crypto-mixing service enables users to anonymize their cryptocurrency transactions through smart contracts.

The ruling, delivered by the Fifth Circuit Court of Appeals, marks a significant victory for decentralized technology proponents and privacy advocates. At the same time, it reignites debates about how to regulate the use of blockchain tools in connection with criminal activities.

Treasury Department’s Sanctions Against Tornado Cash Overturned

The Treasury’s Office of Foreign Assets Control (OFAC) had sanctioned Tornado Cash in 2022. According to the agency, the platform was a key tool for illicit actors, including North Korea’s Lazarus Group, to launder stolen funds.

However, the court ruled that OFAC overstepped its authority. It emphasized that the immutable smart contracts underpinning Tornado Cash cannot be considered property under the International Emergency Economic Powers Act (IEEPA).

The appellate court’s decision hinged on the nature of Tornado Cash’s smart contracts. These are autonomous lines of code designed to function without human intervention.

These contracts, deployed on the Ethereum blockchain, are unalterable and accessible to anyone. The court found that such contracts do not meet the legal definition of “property” because they cannot be owned, controlled, or restricted.

“The immutable smart contracts at issue are not property because they are not capable of being owned,” the court wrote.

The court further noted that while sanctions might block certain individuals from using Tornado Cash, the technology’s decentralized nature ensures that no one, including North Korean hackers, can be entirely prevented from accessing it. Paul Grewal, Coinbase’s Chief Legal Officer, hailed the ruling.

“This is a historic win for crypto and all who cares about defending liberty…These smart contracts must now be removed from the sanctions list and US persons will once again be allowed to use this privacy-protecting protocol. Put another way, the government’s overreach will not stand… No one wants criminals to use crypto protocols, but blocking open source technology entirely because a small portion of users are bad actors is not what Congress authorized. These sanctions stretched Treasury’s authority beyond recognition, and the Fifth Circuit agreed.” Grewal wrote on X (formerly Twitter),

Grewal also emphasized the importance of distinguishing between tools and their misuse. Of note, Coinbase, a leading cryptocurrency exchange, was among the entities that sued the government over the sanctions.

Broader Implications for Crypto Regulation

The ruling exposes the challenges of applying existing legal frameworks to decentralized technologies. Crypto-mixing services like Tornado Cash occupy a legal gray area, prompting calls for scrutiny by US lawmakers.

They are neither traditional financial (TradFi) institutions nor entities capable of being controlled by a central authority. Critics of the ruling argue that it could embolden bad actors to exploit blockchain technology further.

“If you think Tornado Cash has been used by good people for worthwhile purposes then make your case…If privacy protects good people it’s good, if it protects bad people it’s bad. The vast majority of people that Tornado Cash has protected are doing bad,” one user on X quipped.

Some lawmakers have previously pressed the Treasury to adopt stricter measures against crypto mixers. In 2022, members of Congress highlighted concerns about their role in facilitating money laundering and funding terrorism. A bipartisan push aimed to ensure that tools like Tornado Cash, often associated with criminal networks, face regulatory scrutiny.

However, privacy advocates argue that targeting the tools rather than the actors undermines the principles of decentralization and privacy. Bill Hughes, a lawyer at ConsenSys, applauded the court’s nuanced understanding of the issue but highlighted a key issue. He cautioned that regulatory risks remain.

“This does NOTmean that the rest of Tornado Cash is out of bounds for Treasury/OFAC too. The issue was about smart contracts with no admin key,” Hughes wrote.

This means that the court’s decision does not shield Tornado Cash from other legal challenges, particularly those concerning its founders. As BeInCrypto reported, they face accusations of facilitating money laundering. Moreover, the broader debate over how to regulate decentralized technologies remains unresolved.

Following the ruling, however, Tornado Cash’s native token, TORN, is up almost 400% to trade for $17.63 as of this writing.

This surge reflects investor optimism about the protocol’s potential resurgence and its implications for decentralized finance (DeFi) projects.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Forget XRP At $3, Analyst Reveals How High Price Will Be In A Few Months

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP may have spent the past few weeks struggling to hold above the $2 level, but one analyst believes the recent price action is only in its early stages of a much larger surge. For those who think $3 is a reasonable target, this outlook predicted that the real move could take the altcoin far beyond that mark and possibly much sooner than expected.

Multi-Stage Price Path With $10 To $20

The $3 price level has become the psychological and technical battleground for bullish XRP investors this cycle, serving as the most active price point. Earlier in January, the token briefly surged past this level, coming within striking distance of its all-time high of $3.40, before a wave of selling pressure triggered a pullback.

Related Reading

Since then, XRP has seen price corrections that pushed it as low as $1.65 on April 7. Yet, the outlook is once again tilting bullish. XRP has rebounded above $2 and is building a strong base to support another run toward $3. If the current momentum continues to gain traction, reclaiming $3 is not only likely, it could happen within a matter of weeks.

One of the boldest predictions comes from a trader known as BarriC, who has laid out a roadmap that extends far beyond the $3 threshold. In a recent post on social media platform X, he forecasted that XRP, now trading near $2.20, will break $3 soon. But his outlook doesn’t stop there. He predicted that by May, the sentiment surrounding XRP could shift so drastically that $5 would be seen as the new “cheap” price for XRP.

Taking things a step further, the analyst noted that if the broader crypto market transitions into a full-blown altcoin season, XRP could establish a new short-term trading range between $10 and $20 within the next few months.

Utility Run Scenario Places “Cheap” XRP Closer To $1,000

Perhaps the most striking part of BarriC’s analysis comes from what he describes as a “utility run.” This utility run is a scenario where XRP’s real-world use cases as a bridge cryptocurrency start to gain adoption and reflect in its price. Under such conditions, the term “cheap XRP” would apply to prices below $1,000.

Related Reading

At the time of writing, XRP is trading at $2.14, up by 1.4% in the past 24 hours. As ultra-bullish as it might seem, the analyst’s price prediction isn’t surprising, as the cryptocurrency has been subjected to similar bullish outlooks in the past few days.

Beyond bullish price targets, a few analysts now believe that XRP will flip both Ethereum and Bitcoin in the coming months. One such example is analyst Axel Rodd, who cited the breakdown in Bitcoin dominance as a reason why XRP will flip Bitcoin. Similarly, analysts at Standard Chartered recently predicted that the altcoin will flip Ethereum in market cap by 2028.

Featured image from Adobe Stock, chart from Tradingview.com

Market

XRP Early Investors Continue To Sell As Price Holds Above $2

XRP has struggled to secure growth in recent days, with the altcoin failing to maintain key support levels. Despite an attempted price rally, XRP has been unable to break through the $2.32 level, leaving the price hovering just above $2.00.

Those who bought during XRP’s three-week bull run are now facing losses after the failed breach of crucial barriers.

XRP Holders Are Facing Challenges

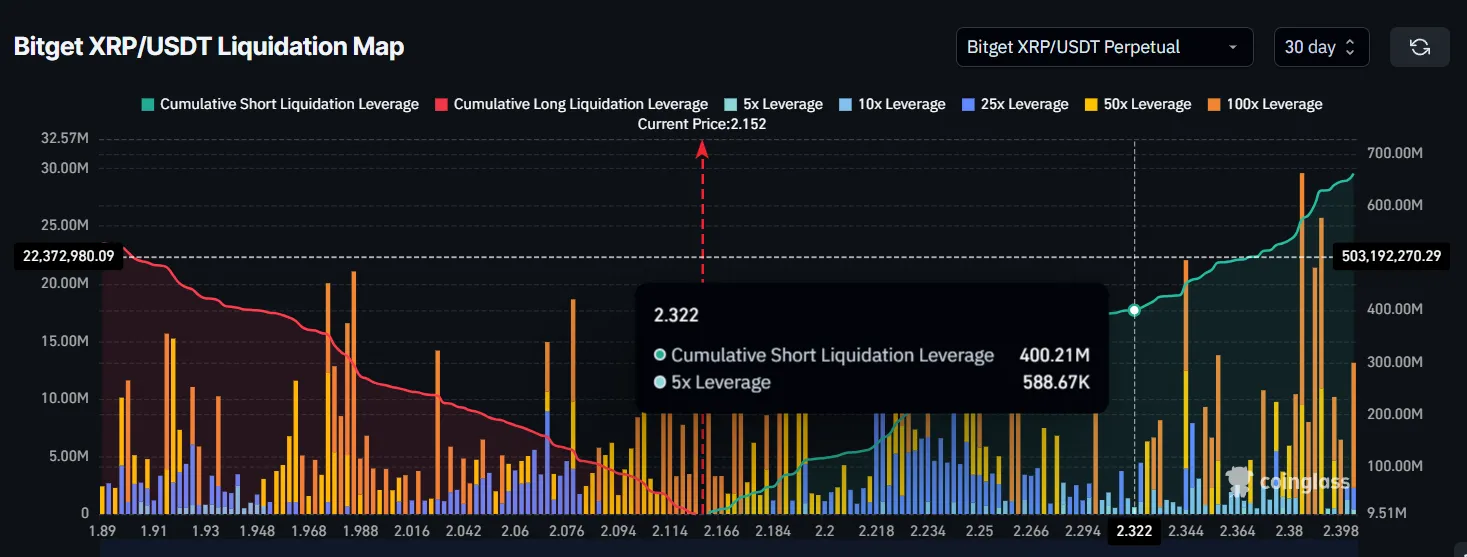

The liquidation map shows that a significant amount of short positions—around $400 million worth—are at risk of liquidation should XRP’s price rise to $2.32. However, even with XRP trading at $2.15, just 8% away from the threshold of $2.32, the potential for liquidations does not appear imminent.

The behavior of XRP’s investors suggests that these liquidations may not take place in the short term. This is because XRP holders are primarily leaning towards selling over HODLing at the moment.

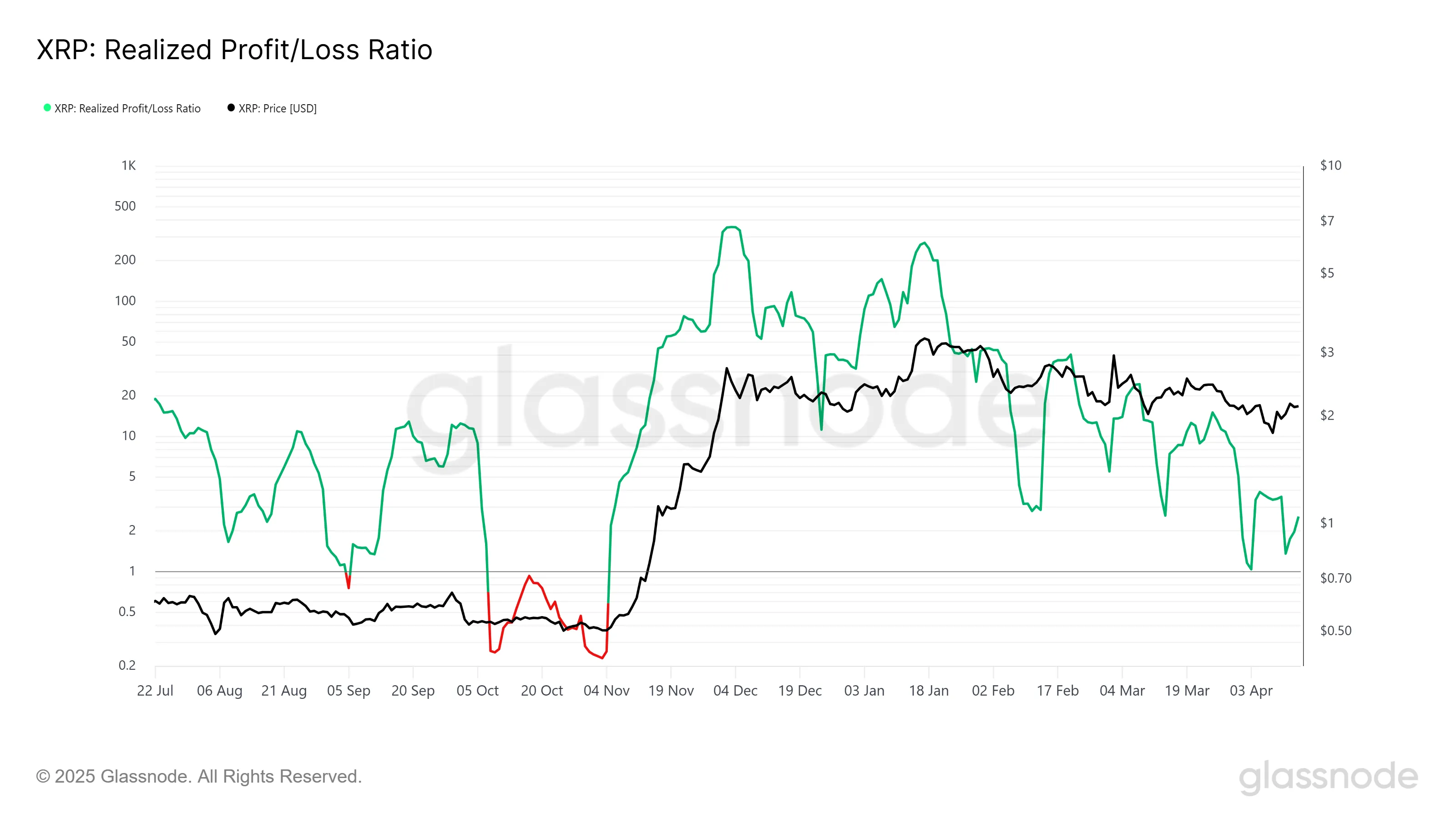

XRP’s overall momentum is showing signs of weakening, as reflected by the Realized Profit/Loss ratio. This indicator suggests that realized profits are declining and may soon turn into losses. The supply being sold likely originated from purchases made during XRP’s November 2024 bull run when the price surged to $2.

XRP formed a new high back in January; however, since then, XRP’s price has dropped back to $2, and many investors who bought at higher levels are now selling to offset losses. This ongoing selling pressure is keeping XRP from experiencing any significant uptick, further dampening bullish sentiment.

XRP Price Looks To Breakout

XRP is currently trading at $2.15, just below the $2.16 local resistance level, which it failed to secure as support earlier this month. The altcoin is consolidating beneath $2.27, a resistance level that has been a point of contention since the end of March. If the price remains above the $2.00 support, it could stabilize at these levels, preventing further losses for investors.

The chances of continued consolidation seem high, as XRP holds above $2.00. This could keep the market relatively stable as investors wait for further signals to confirm the next move. With a lack of major catalysts, the price may fluctuate within this range.

However, should XRP breach the $2.27 resistance and rise toward $2.40, the earlier-mentioned liquidations could trigger a new wave of buying, potentially driving the price upward. This would provide a more bullish outlook and shift the market sentiment.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Omri Ross on How eToro Stands Out in the Crypto Exchange Arena

On the opening day of the 2025 edition of the Paris Blockchain Week, BeInCrypto had the opportunity to interview Omri Ross, Chief Blockchain Officer for eToro. He revealed that despite the current market condition, the firm’s upcoming IPO is still in the pipeline.

We discussed how the company positions itself in the crypto exchange market and how it tackles the security question for its users.

Omri Ross Sheds Light on the Positioning of eToro

eToro has been, for many years, a very innovative player in this market. All areas around are following and creating a social network for trading.

There is the idea that people would like to copy-trade each other and be happy to share information about their portfolios. I think the way, for example, that our popular investors are working together with the community is absolutely fascinating.

I remember, for example, my discussion at some of our client events; we see a lot of the investors are actually being in contact with people who follow them. There is much less distance. There is much more discussion about why they follow specific portfolios.

And eToro also helps with this element. eToro actually creates events where popular investors and customers meet each other. As a platform, we also have an educational element with the eToro Academy. We also do some podcasts together with them. I think this is really innovative and awesome.

In terms of products, you know, our CEO has always been very pro-crypto. We have had Bitcoin trading available at eToro since 2013, so it is fairly early. And for me, it’s always been a pleasure to be in a place where you want to kind of push the funds; you want to bring to, in a regulated way, as many products as possible.

You know, customer protection and personal protection, but we are also trying to see how we can expose our customers to new products and innovations. And I think that that’s pretty unique, and we’re very proud of that.

How many Cryptos are Trading on eToro Right now?

We have more than 100 at the moment, with most of the big ones. However, we still don’t have so many stablecoins, but this is because we sort of see ourselves as a financial institution. We are looking into extending it and looking for ways to sort of allow our customers to reach more elements.

We also have an experimental area where you can experiment with more assets that may not necessarily be mature enough to be without the disclaimers. A big element for us is really how to communicate. On the one hand, we offer a lot of opportunities, but we are also trying to have people explore and understand what they investigate and work closely with regulators.

Is Copy Trading the Key Element of eToro?

100%. Also, many customers come to the discussions that appear on eToro to learn and discuss crypto with other people.

We also have smart portfolios where you follow specific trends and make it easier for people to invest. For example, we have a DeFi portfolio and a MetaMask portfolio. It’s also a very simple way for people to get exposed to a bigger sort of industry, which is also very transparent.

Yeah, so I think there is a lot of innovation around that, but it’s really helping retail [investors] get information and be able to easily, even in fiat, sort of invest in all of that.

Which Asset Category Seems to Have the Most Potential for eToro to Expand?

I would touch upon two subjects in this regard. The first element is we are a multi-asset platform.

One of, I think, the biggest advantages of using eToro is your ability to get exposed to many, many different sorts of asset classes in one place. You can also have the eToro money credit card in some countries that we support. We’re also seeing that when our customers use a larger amount of our products, they really benefit from that. So I think that’s a big part of the element.

I would also mention, in that regard, that a lot of our investors are somehow maybe Gen Z. We really see the potential of people to really follow what happens in the market, where they’re really interested in what happens in the market. Social networks are a big part of that.

You can follow others that you are interested in, you can comment on yourself and engage, as well as the fact that the world is a very interesting place, and things are changing daily. And to know that you can do crypto at eToro if that’s interesting, but also they are like, if they’re interested in oil and gas prices, or any other things, you have that as well. I think this is what is really special, that you can get exposed to a lot of stuff, learn about it, and all in one place.

Is Education the main Drive of how eToro Recruits new Customers?

Not necessarily. We mostly see that part of our goal as a company is to open financial markets for everybody and invest in a simple and transparent place. And for us, education is part of that.

We want to help our customers educate themselves, and with the hope that they choose to stay with us for many, many years to come. So this is a way for us to create a lot of opportunities.

We want to build a longer-term relationship and help customers prosper. Yeah, how we recruit different people really depends. Part of it is related to marketing, brand awareness, and many other aspects.

How eToro Focuses on the Security of the Platform

First, we work with top-net security experts, including ex-secret service people. Some of them are employed by eToro to deal with that element.

Secondly, especially around crypto, I can’t expose too much information because some of it is really classified. However, we work on different layers of security within a customer infrastructure. We try to keep a lot of client assets in what we describe as a “deep vault” with very secure elements. And it’s a big part of our infrastructure. It’s a big part of our discussion.

For any project, we take the fact that customers trust us extremely seriously with the funds. And we feel extremely fortunate for it.

Luckily for us, until today, we never had any issue with that. But there are a lot of elements around it. When you ask about innovation, it’s also one of the reasons why it may take a little bit longer for us to issue new projects; it is also because we take security extremely seriously with every element. That is a major part of the design.

Does eToro Use B2B Solutions For Security?

We think there are good B2B solutions. Again, when we work with vendors, also based on our size, they usually adapt to our requirements.

We work with some vendors who are from a security background, working in secret services, and building really insane secure elements. I learned a lot working with them and with their background. I wish I could tell you more about it, but for me, as an individual and not as a potential sort of employee, I think that it’s very interesting.

Because there are also discussions about the “not your keys, not your money” element. But also, having your own money has its risks. Holding a really large amount of money in some place at home can get ruined or stolen. There are so many risks; you can also have the risk of someone putting a gun to your head.

There are many social elements. And when I see the work that is done in the program, I’m very proud and impressed by the seriousness we take about that element. I think that’s part of the value we bring in. You know, being regulated and also really taking the customers’ funds and interests seriously.

What eToro Expects to Achieve During the Paris Blockchain Week?

I’ve been here some years back. And it’s grown so much I’m shocked!

I’ve been here for less than an hour today, and I’m like: “Wow!”. And you can really see the adoption here. Also, the French regulation is getting more into that, which is absolutely amazing.

And being at the Louvre, what else can you ask for? But I would also love to talk to a lot of companies to learn about innovation. Part of my role is building new products at eToro within crypto. But it’s also about talking to a lot of founders and crypto providers and seeing what else we can collaborate on and integrate with eToro. And always learn.

I’m very passionate about this specific market and blockchain. So I’m really looking forward to it. I may also catch up with some old friends that I haven’t seen for a while.

How can one Launch Their Crypto on eToro?

You don’t necessarily have to reach out to anyone. We are obviously following the market very closely.

As I mentioned before, being regulated, we’ve taken our clients’ interests very seriously. Often, our processes may be a bit longer than those of some unregulated blockchain platforms.

First, you’d be invited to talk to me or some of our listing or trading committee members. We’re always excited to hear and learn about your new crypto.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoMENAKI Leads Cat Themed Tokens

-

Market18 hours ago

Market18 hours agoBinance Futures Causes a Brief Crash For Story (IP) and ACT

-

Altcoin23 hours ago

Altcoin23 hours agoCanada Approves Multiple Spot Solana ETFs To Launch This Week

-

Market22 hours ago

Market22 hours agoTether Deploys Hashrate in OCEAN Bitcoin Mining Pool

-

Market21 hours ago

Market21 hours ago3 Altcoins to Watch in the Third Week of April 2025

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Price Threatened With Sharp Drop To $1,400, Here’s Why

-

Market16 hours ago

Market16 hours agoIs The XRP Price Mirroring Bitcoin’s Macro Action? Analyst Maps Out How It Could Get To $71

-

Market20 hours ago

Market20 hours agoCardano (ADA) Eyes Rally as Golden Cross Signals Momentum