Market

Top Crypto News From Latin America

BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup includes stories about El Salvador’s Bitcoin adoption anniversary, the Cardano Foundation’s alliance with the Entre Rios province of Argentina, and more.

El Salvador Celebrates 3 Years of Bitcoin Adoption

In June 2021, El Salvador’s President Nayib Bukele announced plans to adopt Bitcoin as legal tender. On September 7, the country officially became the first in the world to enact the “Bitcoin Law,” making BTC a legal currency.

Currently, El Salvador remains the only nation where Bitcoin is legal tender. Over the past three years, the value of Bitcoin has fluctuated significantly, dropping to $16,464 by the end of 2022 after reaching an all-time high of $73,079 in March.

Since adopting Bitcoin, El Salvador has accumulated 5,772.76 BTC worth $411 million. Additionally, President Bukele won re-election for a second term, continuing to lead the country.

Read more: Who Owns the Most Bitcoin in 2024?

Paraguayan Congresswoman Proposes a Bill to Regulate Bitcoin Mining

Paraguayan Deputy María Constancia Benítez de Benítez introduced a bill to regulate Bitcoin mining in Paraguay. Titled “That regulates cryptomining in the Republic of Paraguay,” the proposal aims to create a secure legal and economic environment for cryptocurrency mining.

Benítez highlighted that mining could boost the country’s economic development. The bill highlights that Paraguay can harness its substantial hydroelectric energy production capacity for mining operations.

The bill has been presented to the Chamber of Deputies. Several committees, including those on economic and financial affairs, legislation and codification, industry, commerce and tourism, budget, drug trafficking prevention, science and technology, and energy and mining, will now review it.

Read more: Is Crypto Mining Profitable in 2024?

Latam Trading Platform BTR Shutdown as Users Allege Ponzi Scheme

The BTR crypto trading platform has allegedly ceased operations, sparking accusations from its users of an exit scam. What was initially seen as a temporary glitch has quickly escalated into a significant scandal.

Investors from Venezuela and other parts of Latin America had entrusted substantial sums of money to the BTR platform. Now, they find themselves in a precarious situation.

Many were drawn by promises of high returns and the perceived stability of the project. However, the lack of transparency and evasive responses from BTR’s administrators have fueled suspicions of a deliberate exit scam.

“#BTR the pyramid scheme has fallen. Its users report that there is no longer access to the website, there are no withdrawals, there are no official announcements from its CEO,” pseudonymous trader from Venezuela said.

Read more: 15 Most Common Crypto Scams To Look Out For

Bitcoin Embassy Bar in Mexico Closes in July, Leaves Crypto Networking Legacy

The Bitcoin Embassy Bar, a central hub for blockchain projects and Bitcoin initiatives, will close its doors at the end of July. This venue has been an ideal space for the crypto community in Mexico to network and collaborate.

Lorena Ortiz, the bar’s founder, announced on social media that the closure is due to health issues she faced earlier this year. However, she emphasized that while the physical location is closing, the “Bitcoin Embassy Bar” concept remains alive.

The community reacted swiftly, praising the bar’s efforts to educate people about cryptocurrency. Many expressed their appreciation for their experiences as consumers and exhibitors at the venue. Others encouraged the continuation of the project, optimistic that the business aspect and concept could be revived.

Read more: Best Crypto Community To Join for Beginners

Cardano Foundation Seals Alliance with Entre Rios Province of Argentina

The Cardano Foundation, a non-profit organization dedicated to promoting and developing the Cardano blockchain, has allied with the Entre Ríos province of Argentina. The agreement, signed at the Entre Ríos House in Buenos Aires, marks a milestone in their collaboration, which began with the Cardano Foundation delegation’s visit to the province in March.

Entre Ríos has been selected as a key jurisdiction to lead the adoption of blockchain technologies in the region. The agreement includes plans to advance digital identity solutions in the initial phase and facilitate access to Web3 knowledge. This joint initiative represents a significant effort to modernize and digitize processes in Entre Ríos, using decentralized technology as a foundation.

Read more: Who Is Charles Hoskinson, the Founder of Cardano?

Strike CEO Jack Mallers Seeks to Increase Investment in El Salvador

Jack Mallers, CEO of the payment platform Strike, announced plans to boost investment in El Salvador. Last year, Strike moved its headquarters to El Salvador and expanded Bitcoin payments to 65 countries.

Mallers noted El Salvador’s improvements and expressed the company’s intention to support more local projects and enhance the country’s crypto ecosystem, stating, “Chicago does not change as much as El Salvador changes.”

He emphasized that investing in El Salvador is a “good investment” in any area, whether technology or land. Strike is licensed as a digital asset provider and receives government support for its products and services.

“This country has been great. To come back and see all the changes is amazing. We see El Salvador improving and want to invest more to support and bring benefits here,” Mallers said.

Read more: A Guide to Crypto Payrolls: Exploring Salary Payments in Web3

As the Latin American crypto scene grows, these stories highlight the region’s increasing influence in the global market. From El Salvador’s bursting Bitcoin economy to Argentina’s new partnerships, LATAM is positioning itself as a key player in the tech world. Stay tuned for more updates and insights in next week’s roundup.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PayPal Adds Support for Solana and Chainlink

PayPal has expanded its cryptocurrency offerings in the US by adding support for Solana (SOL) and Chainlink (LINK).

These tokens join PayPal’s existing lineup, which includes Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), and its native stablecoin, PYUSD.

PayPal’s Crypto Expansion Highlights Rising Demand for Solana and Chainlink

Both Solana and Chainlink play critical roles in the blockchain space. Solana supports fast, low-cost transactions and is widely used in decentralized finance (DeFi), gaming, and Web3 applications.

Chainlink, on the other hand, is essential for enabling smart contracts to access real-world data through decentralized oracles.

According to BeInCrypto data, the two assets currently rank among the top fifteen cryptocurrencies by market capitalization. This makes them strategic additions to PayPal’s crypto offering.

May Zabaneh, PayPal’s Vice President of Blockchain and Digital Currencies, explained that the update reflects strong user demand for more crypto options.

According to Zabaneh, the goal is to give users greater flexibility and more ways to interact with digital assets across PayPal’s ecosystem.

“Since we initially made cryptocurrencies available on PayPal and Venmo, we’ve been listening to our users about what they want to do with crypto on our platforms. One piece of feedback we’ve heard is to make additional tokens available that align with our mission of revolutionizing payments,” Zabaneh stated.

Meanwhile, PayPal’s latest move comes as the company strengthens its presence in the digital asset space. With over 434 million active users and a 45% share of the global online payments market, PayPal is in a strong position to influence how mainstream users engage with crypto.

Moreover, industry experts see this integration as a logical next step. Max Hamilton, an investment researcher at Foresight Ventures, noted that legacy companies like PayPal enjoy deep trust, regulatory experience, and extensive networks. These advantages make them well-positioned to incorporate crypto without losing ground to newer competitors.

“Established giants like [PayPal] wield an unparalleled advantage in distribution, a moat built over decades of customer acquisition, merchant relationships, and regulatory compliance And we continue to see them co-opting crypto offerings into their ecosystems so as to not be displaced by them,” Hamilton stated.

PayPal first entered the crypto space in 2020, allowing users to buy and hold Bitcoin and Ethereum.

Since then, the company has deepened its involvement in the emerging sector by launching PYUSD, a dollar-pegged stablecoin, on Ethereum in 2023.

In 2024, it expanded PYUSD to the Solana network. This move helped boost the stablecoin’s circulating supply to $733 million as of press time.

Earlier this year, the company revealed plans to embed PYUSD more deeply into its ecosystem. This includes enabling merchants to accept it for payments and expanding use cases across its platforms.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Onyxcoin (XCN) Price Nears Death Cross After 50% Decline

Onyxcoin (XCN) has experienced a significant downturn in recent weeks, with its price falling nearly 50% over the past month.

Currently trading at $0.0090, the altcoin’s performance has sparked concerns among holders as it faces the possibility of a major bearish move, including a potential Death Cross.

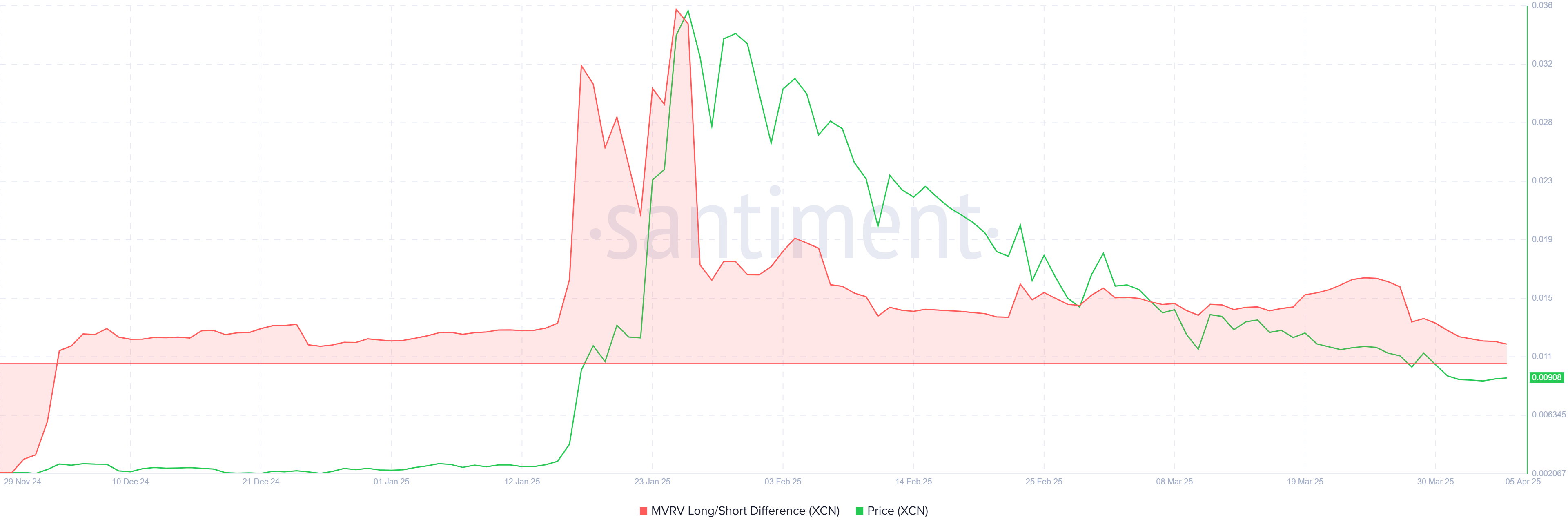

Onyxcoin Investors Are Losing Profits

The MVRV Long/Short Difference, a key metric for understanding investor sentiment, has dropped to a 4-month low. This indicates that long-term holders (LTHs) are losing profitability, with the indicator barely above the zero line.

If this metric continues to decline and crosses into negative territory, it would suggest that short-term holders (STHs) are now the ones profiting, further fueling the bearish sentiment around Onyxcoin.

In addition, the decrease in the MVRV Long/Short Difference reflects the lack of confidence from LTHs, who have previously been the main supporters of the altcoin. As these holders become less profitable, the chances of selling pressure mounting increase, which could worsen the current downtrend.

Onyxcoin’s technical indicators are also signaling further challenges. The Exponential Moving Averages (EMAs) are nearing a Death Cross, a bearish event that occurs when the 200-day EMA crosses below the 50-day EMA. If the downtrend continues, the likelihood of this crossover becomes higher, which would indicate that selling pressure is dominating.

A Death Cross is generally viewed as a signal for further price decline and a continuation of the bearish trend. The growing concern is that if the Death Cross is confirmed, Onyxcoin could face a significant correction, potentially dropping lower.

XCN Price Continues To Fall

Onyxcoin’s price is currently sitting at $0.0090, having experienced a significant 50% decline over the last month. If the downward momentum persists, XCN could fall to the $0.0083 support level, further extending its losses.

Given the current bearish indicators, it is more likely that XCN could test lower support levels, with a potential drop to $0.0070 if the $0.0083 support fails to hold. This would mark another leg down in the altcoin’s struggle to regain upward momentum.

However, if Onyxcoin manages to reverse its trend and breach the $0.0100 barrier, it could potentially climb toward $0.0120, invalidating the bearish outlook.

This scenario would require significant buying pressure and a shift in investor sentiment, something that may become more plausible if the market conditions improve.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Transaction Fees Hit Lowest Level Since 2020

Ethereum’s transaction fees have dropped to their lowest point over four years, marking a significant shift in on-chain activity.

The decline comes as the network faces mounting challenges, including falling market performance and weakening fundamentals.

Ethereum Faces Declining Fees and Inflation Concerns

According to IntoTheBlock, Ethereum’s total transaction fees dropped by nearly 60% in Q1 2025, falling to roughly $208 million as of April 4. The firm noted that this was their lowest level since 2020.

“Total ETH fees decreased to their lowest level since 2020 this quarter, primarily driven by the gas limit increase and transactions moving to L2s,” IntoTheBlock stated.

Several factors have contributed to this decline. The biggest driver is the adoption of Layer-2 networks, especially Coinbase’s Base. Ethereum’s Dencun upgrade, which launched in March 2024, made transactions on these scaling layers much cheaper.

As a result, more users are bypassing Ethereum’s mainnet and shifting to faster, cost-effective alternatives. According to L2Beat, Base currently processes over 80 transactions per second, leading all other Layer-2 networks.

Despite the benefits of lower fees, Ethereum’s underlying metrics are showing signs of strain.

Michael Nadeau, founder of The DeFi Report, flagged a steep drop in ETH burn rates. He noted that ETH burned through major platforms like Uniswap, Tether, MetaMask, and 1inch, which collapsed by more than 95% since November 2024.

Nadeau explained that fading retail enthusiasm and the slower-than-expected scaling from L2s are contributing to Ethereum’s reduced deflationary pressure.

“ETH’s annualized inflation is now 0.75%. We should expect it to continue to rise, exceeding BTC inflation. We should also expect Ethereum’s fundamentals to continue to erode over the next year,” he added.

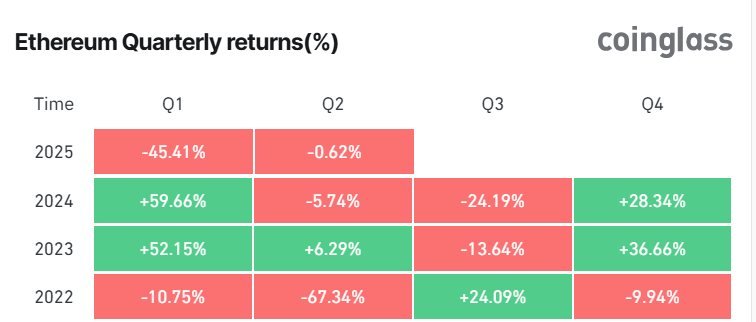

Meanwhile, the network’s financial performance reflects these concerns. ETH’s price fell over 45% in Q1 2025, marking its worst quarterly performance since 2022.

In comparison to Bitcoin, Ethereum has also underperformed, losing 39% of its value against BTC this year. That drop has pushed the ETH/BTC ratio to its lowest point in nearly five years.

Still, long-term investors are not backing down. IntoTheBlock pointed out that Ethereum whales accumulated over 130,000 ETH as the price dipped below $1,800—its lowest since November 2024—signaling strong buy-the-dip sentiment.

Beyond that, industry experts believe the upcoming Pectra upgrade, scheduled for May, could give the asset a fresh start.

According to them, Pectra can help restore confidence and drive renewed growth across the Ethereum ecosystem with its improved wallet functionality and user experience.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoXRP Price Vulnerable To Falling Below $2 After 18% Decline

-

Market22 hours ago

Market22 hours agoWill the SEC Approve Grayscale’s Solana ETF?

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Whales Buy the Dip – Over 130K ETH Added In A Single Day

-

Bitcoin20 hours ago

Bitcoin20 hours agoVitalik’s L2 Roadmap, XRP Unlock and More

-

Altcoin17 hours ago

Altcoin17 hours agoAnalyst Predicts XRP Price To Reach Double Digits By July 21 Cycle Peak

-

Market18 hours ago

Market18 hours agoPEPE Price Breaks Ascending Triangle To Target Another 20% Crash

-

Altcoin18 hours ago

Altcoin18 hours agoPi Network Under Fire As PiDaoSwap Launches NFTs On Binance Chain

-

Market17 hours ago

Market17 hours agoWhy Analysts Believe Q2 is a Great Opportunity to Buy Altcoins