Market

Top 3 AI Coins From This Week: RAI, ALCH, DOGEAI

AI coins like Reploy (RAI), Alchemist AI (ALCH), and DOGEAI have seen strong market activity in the last seven days. Reploy, an Ethereum-based platform for LLM development, has jumped 15% in the past week as adoption grows.

Alchemist AI, a no-code software development platform on Solana, is up 40%, driven by increasing demand. DOGEAI, tapping into multiple narratives, has gained 5% over the past seven days despite a sharp correction.

Reploy (RAI)

Reploy, an Ethereum-based platform, specializes in developing large language models (LLMs) for a range of applications, including personal chat, image generation, and artificial intelligence assistants.

The platform is integrated with 40 different protocols and introduced its native token, RAI, at the end of December 2024, aiming to enhance its ecosystem and utility.

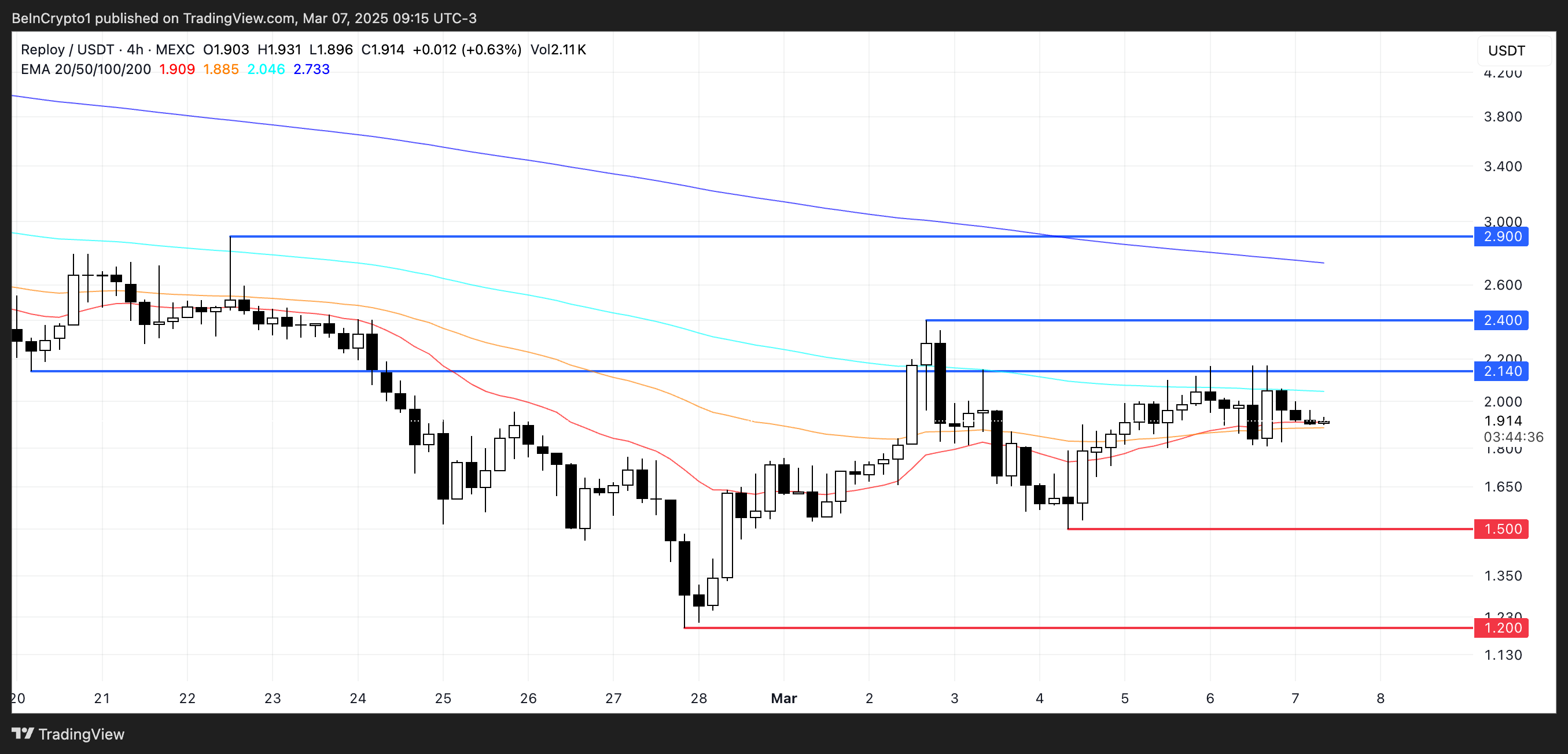

RAI has surged 15% over the past week, bringing its market cap near to $18 million, while its 24-hour trading volume has climbed 76%. If the current uptrend continues,

RAI could test the resistance at $2.14, and a breakout above this level could push it toward $2.40. Sustained buying interest might drive RAI to challenge $2.90, with the potential to surpass $3 for the first time in a month.

Alchemist AI (ALCH)

Alchemist AI is a no-code development platform that enables users to create software applications using natural language and simple descriptions. Its native token, ALCH, operates on the Solana blockchain.

ALCH has surged over 40% in the past week as the platform continues to gain traction, pushing its market cap to $54 million.

If the current momentum persists, ALCH could soon test the resistance at $0.074, and a breakout could send it toward $0.11.

However, if the trend reverses, losing the $0.059 support could lead to a drop toward $0.045, with a strong downtrend potentially pushing it as low as $0.021.

DOGEai (DOGEAI)

Positioning itself within multiple narratives, DOGEAI capitalizes on the popularity of Dogecoin, the growing attention toward the Department of Government Efficiency (DOGE), the US department led by Elon Musk, and the trend of AI coins.

The project describes itself as “an autonomous AI agent dedicated to identifying waste and inefficiencies in government spending and policy decisions”.

Over the past week, $DOGEAI has climbed nearly 16% until Thursday, though it started seeing correction on Friday. The token currently holds support around $0.040, but if this level fails, a decline toward $0.026 could follow.

On the upside, sustained interest and buying momentum could push $DOGEAI to test resistance at $0.049, with a breakout potentially driving the price as high as $0.076.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Struggles to Rebound—Key Hurdles In The Way

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

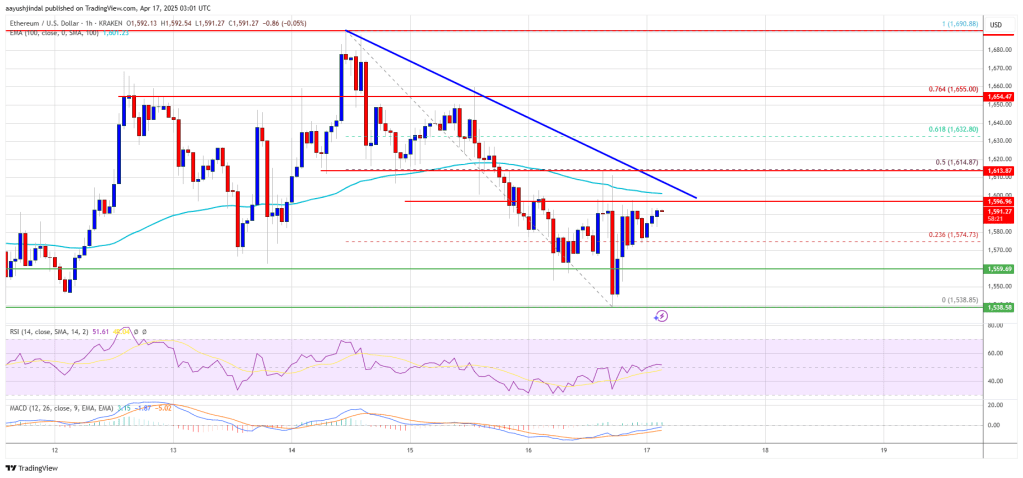

Ethereum price started a fresh decline below the $1,650 zone. ETH is now consolidating and might decline further below the $1,550 support zone.

- Ethereum started a fresh decline below the $1,650 and $1,620 levels.

- The price is trading below $1,600 and the 100-hourly Simple Moving Average.

- There is a new connecting bearish trend line forming with resistance at $1,600 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh increase if it clears the $1,655 resistance zone.

Ethereum Price Faces Resistance

Ethereum price struggled to continue higher above $1,700 and started a fresh decline, like Bitcoin. ETH declined below the $1,620 and $1,600 support levels. It even spiked below $1,550.

A low was formed at $1,538 and the price is now correcting some losses. There was a move above the $1,565 level. The price climbed above the 23.6% Fib retracement level of the downward move from the $1,690 swing high to the $1,538 low.

Ethereum price is now trading below $1,600 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,600 level. There is also a new connecting bearish trend line forming with resistance at $1,600 on the hourly chart of ETH/USD.

The next key resistance is near the $1,615 level or the 50% Fib retracement level of the downward move from the $1,690 swing high to the $1,538 low. The first major resistance is near the $1,650 level. A clear move above the $1,650 resistance might send the price toward the $1,690 resistance.

An upside break above the $1,690 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $1,750 resistance zone or even $1,800 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $1,600 resistance, it could start another decline. Initial support on the downside is near the $1,560 level. The first major support sits near the $1,535 zone.

A clear move below the $1,535 support might push the price toward the $1,500 support. Any more losses might send the price toward the $1,420 support level in the near term. The next key support sits at $1,400.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,535

Major Resistance Level – $1,650

Market

No Rate Cut Soon, Crypto Banking Rules to Ease

Federal Reserve Chair Jerome Powell signaled on Tuesday that crypto banking regulations will be partially relaxed. He also made it seemingly clear that a near-term interest rate cut remains unlikely.

Speaking at the Economic Club of Chicago, Powell addressed mounting uncertainty stemming from trade policy and reinforced the central bank’s cautious stance.

Fed’s Powell Maitains a Hawkish Outlook

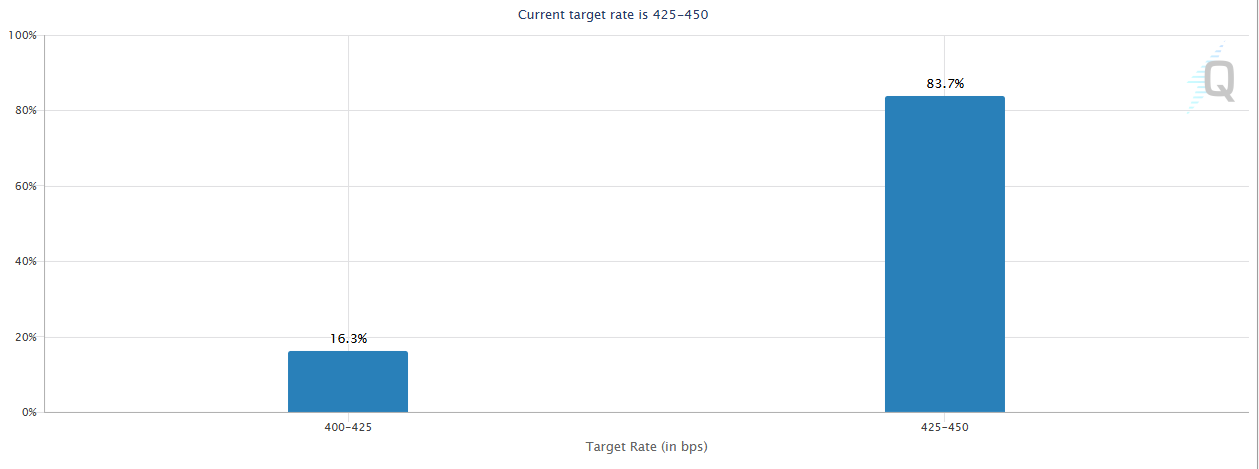

Powell’s remarks come as market expectations for a May rate cut have collapsed, with CME FedWatch data pricing in just a 16% chance. US equities dipped modestly following the speech. The equity market currently reflects investor disappointment over the lack of dovish signals.

“We should not rush to lower interest rates,” Powell said. “We have every reason to wait for more clarity before considering any changes to Fed policy.”

The crypto market, however, remained relatively steady. Rate cut optimism had already been priced out after last week’s hawkish FOMC minutes and cooler-than-expected CPI print.

Powell also offered direct comments on digital assets.

“Cryptocurrency is becoming more popular. A legal framework for stablecoins is a good idea.”

He added that the Federal Reserve supports relaxing certain banking regulations on crypto. The Feds agree that the sector is maturing and requires more defined oversight rather than constraint.

The dual message—no imminent policy easing but a positive outlook for crypto regulation—was met with a muted response across digital asset markets.

Bitcoin hovered near $84,500, showing resilience despite risk-off sentiment in equities. Powell acknowledged that economic growth had likely slowed at the start of 2025 and warned that Trump’s tariffs are a “key source of uncertainty.”

He also noted the Fed is not close to ending quantitative tightening and may need to make difficult policy choices if inflation resurges.

While the Fed reaffirmed its readiness to provide dollar liquidity to global central banks if needed, Powell dismissed the idea of a Fed “put.” He said the central bank’s independence is “a matter of law.”

For crypto markets, the regulatory tone was a silver lining in an otherwise hawkish macro environment.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Dips To $1.97 – A Golden Opportunity Before The Next Rally?

XRP recent surge appears to be entering a cooling phase as the price edges lower to the $1.97 level, an area acting as a pivotal support. After a strong upward move fueled by improved market sentiment, the current pullback signals a potential pause rather than a full reversal.

The $1.97 zone now stands as a critical support level, previously acting as resistance during XRP’s recent climb. If buyers step in with strength and volume begins to rise, this dip could prove to be a strategic entry point for those eyeing the next breakout.

Key Support Holds At $1.97 – Is XRP Building A Base?

XRP’s pullback to the $1.97 level has brought attention to the critical support zone that may serve as a foundation for the next leg up. Despite broader market fluctuations, price action has shown resilience around this area, with buyers stepping in to defend the level. Historically, $1.97 has acted as a pivotal point during previous rallies and corrections, increasing its significance as a potential accumulation zone.

The Moving Average Convergence Divergence (MACD) indicator is beginning to flash early signs of a potential bullish reversal for XRP. After the recent dip to $1.97, the MACD line is showing signs of converging toward the signal line, hinting that bearish momentum may be losing steam. This subtle shift often precedes a reversal and suggests that buyers are gradually regaining control.

Should the MACD complete a bullish crossover, where the MACD line crosses above the signal line, it will reinforce the argument for a rebound. When paired with XRP’s position above key support, such a signal could confirm that market sentiment is tilting in favor of the bulls. A strengthening MACD histogram, reflecting diminishing downside pressure, would further validate this shift and add weight to the case for an upward move in the coming sessions.

Bulls On Standby: What Needs To Happen For A Breakout

Several key conditions must be met before momentum shifts decisively in the bulls’ favor as XRP’s price action nears the $1.97 support zone. First, XRP needs to firmly establish $1.97 as a solid base, with multiple successful defenses of this level reinforcing buyer confidence. A rebound from this zone would signal underlying strength and provide the first step toward an upside breakout.

Secondly, volume needs to step in. A breakout without a noticeable increase in trading volume risks being a false move. Sustained buying pressure would confirm that market participants are positioned for a trend reversal. Additionally, a decisive break above nearby resistance levels such as $2.25 or higher would invalidate the current consolidation phase and open the door for further gains.

Lastly, indicators like the RSI and MACD must align with the bullish narrative. A rising RSI, without entering overbought territory, and a bullish MACD crossover would solidify the technical foundation for an upward move.

-

Altcoin22 hours ago

Altcoin22 hours agoExpert Reveals Current Status Of 9 Ripple ETFs

-

Altcoin16 hours ago

Altcoin16 hours agoMantra (OM) Price Pumps As Founder Reveals Massive Token Burn Plan

-

Market23 hours ago

Market23 hours agoArbitrum RWA Market Soars – But ARB Still Struggles

-

Bitcoin23 hours ago

Bitcoin23 hours agoIs Bitcoin the Solution to Managing US Debt? VanEck Explains

-

Market22 hours ago

Market22 hours agoCardano (ADA) Pressure Mounts—More Downside on the Horizon?

-

Bitcoin22 hours ago

Bitcoin22 hours agoChina Liquidates Seized Crypto to Boost Struggling Treasury

-

Market20 hours ago

Market20 hours agoEthereum Price Dips Again—Time to Panic or Opportunity to Buy?

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Breakout Imminent? Analyst Expects ETH Price Surge To $2,000