Market

THORWallet CEO Explains Why DeFi is Here to Stay

In an interview with BeInCrypto, Marcel Robert Harmann, the Founder and CEO of THORWallet, shares his journey from the early days of crypto to building a successful wallet. Despite the noise created by trends like meme coins and NFTs, Harmann’s belief in the transformative potential of decentralized finance (DeFi) remains steadfast, even as the industry faces challenges with regulation and reputation.

Harmann also delves into the complex relationship between crypto and traditional finance, particularly when it comes to regulation, privacy, and the future of financial services. He discusses how THORWallet is bridging the gap between DeFi and CeFi, offering users a seamless experience while adhering to the core principles of decentralization and transparency.

Reflecting on Crypto Journey: How Marcel Harmann’s View of the Crypto Industry Has Evolved

Those early days were definitely tough in terms of the hours worked, but looking back, it was all worth it. It was hard work, but it didn’t feel like a burden—I was driven to achieve and to build.

Four years later, we’re still here, profitable and growing. The average lifespan of a crypto startup is usually less than 12 months, so we’ve managed to defy the odds.

My view on crypto has remained the same. The industry still excites me, but I think you really need to cut through the noise. There’s a lot of distraction, like the NFT hype, which has lost value over time except for a few select projects. Then, there are meme coins—just noise.

They’re mostly money grabs from people who don’t fully understand the mechanics behind them. With any fast-growing market, especially one involving large amounts of money, scams are inevitable. It’s just part of the industry.

The key is to stay focused, stick to your core principles, and not get distracted by the noise. Crypto, in my view, is still a paradigm shift, particularly for the financial industry, and my belief in its potential hasn’t changed.

Views on the Balance Between Regulation, Criminality, and Reputation in Crypto

I believe that proper regulation is essential, but it needs to be implemented in the right way and at the right time. For example, MiCA (the Markets in Crypto-Assets Regulation) isn’t inherently bad. However, recently, we’ve seen instances of over-regulation, even in Switzerland.

Switzerland is traditionally less regulated than the EU, but even here, we’ve seen regulatory overreach, particularly concerning stablecoins. This led to pushback from the industry, and after a lot of pressure and education towards regulators, the regulations were softened, which is a positive outcome.

In essence, good regulation is beneficial, but over-regulation can stifle innovation. Currently, the first part of crypto, like MiCA, is regulated, and DeFi (decentralized finance) is still in the process of being addressed. In my opinion, true DeFi protocols don’t necessarily need regulation.

However, regulators must verify if protocols are genuinely decentralized to protect users. They need to ensure that users are engaging with a non-custodial, decentralized technology and not a protocol with a centralized team behind the scenes that could tamper with the code—like in the case of a rug pull, where access to the admin key could allow manipulation.

Risks to Retail Investors

Some protocols claim to be decentralized but aren’t truly so, which poses a risk to retail investors. Regulators must assess whether DeFi protocols are genuinely decentralized. If they are and are built on a blockchain like Ethereum, they cannot shut down as long as the blockchain exists.

However, when users move assets from DeFi to traditional finance, regulators need to oversee the on- and off-ramp processes. The blockchain ensures full transparency, making it possible to trace the origin of funds and verify they are not involved in illicit activity.

So, I’m comfortable with where we’re heading in terms of regulation as long as it’s done the right way. But I do worry, particularly about the European Union, either not fully understanding the technology or, in some cases, deliberately trying to undermine DeFi altogether.

How Recent Crypto Trends, Like Bitcoin ETFs and Meme Coin Cycles, Have Shaped Blockchain Adoption

These cycles are overall more net positive. For example, Bitcoin ETFs bring institutional adoption, offering a stamp of approval from larger companies that say, “Yes, Bitcoin is here to stay” as an asset class.

This is a good thing overall. However, with meme coins and NFTs, it’s harder to say whether they’re net positive or not. While they attract a lot of new users, a lot of money is extracted from those who believe they can get rich quickly, but in the end, it’s just like a casino—where the house always wins.

Personally, I don’t focus on these trends. They will bring in more users, sure, but those who enter crypto and end up buying things like Trump coin, for example, often leave with a bad taste. They may not return for years.

It’s like when people first connected to the internet and got viruses from downloading an MP3. They were so burned by the experience that they didn’t touch the internet again for a while. Eventually, though, they came back once they understood it better.

The same will happen with crypto—people may be burned, but they will return when they understand the real value.

DeFi vs. CeFi

That being said, I believe there are genuine projects building a truly decentralized financial system that will exist alongside the traditional financial system. Projects like Compound and the first wave of DeFi protocols were the first iteration to showcase true financial innovation.

Then you have projects like ThorWallet, which is building a Web3 neo-bank. With ThorWallet, you can have your own bank in your pocket, and interact with DeFi protocols while also incorporating CeFi parts for convenience, like easy on- and off-ramping. This is the kind of true innovation that will drive the future of finance.

In the end, there are real builders who are focused on creating a better financial system, and this mission remains unchanged. The core of DeFi is freedom of finance, just like the internet’s core is freedom of information. Despite all the noise and distractions, the true innovators will just keep building.

How Broader Developments in Crypto Impacted ThorChain and ThorWallet

Overall, the vision for ThorWallet hasn’t changed; if anything, it’s been confirmed. The vision has always been clear, and it’s something I present whenever I pitch.

ThorWallet aims to provide all the financial services a person needs, but based on open, fair, and transparent DeFi technology, with decentralized services and products. We’re talking about holding, sending, and receiving assets, but also trading, savings accounts, lending, borrowing, and even perpetual contracts. While most people may not need the latter, it exists and could be beneficial if used properly.

When it comes to perpetual contracts, the reality is that most people use them for speculation. However, they can also be used for hedging and other strategies.

The point is that we now have many financial services that are fully transparent, immutable, and accessible by anyone with a mobile phone and an internet connection. You don’t need a passport, and no one can tell you that you’re not allowed to open a bank account. It’s full freedom of finance, and that vision remains unchanged—it’s only been reinforced over time.

Of course, we’ve adapted as we’ve gone along, particularly when it comes to our partnerships. We’ve become more discerning in choosing which decentralized protocols we work with, ensuring they’re truly decentralized and not prone to issues like rug pulls. It’s our duty to do the due diligence.

Since regulation in this area is still developing, we handle that responsibility ourselves. We want to ensure that any protocol we expose our users to is trustworthy. Over the years, this process has become more refined and sharper.

The Balance Between Privacy in Crypto and Transparency in TradFi: ThorWallet’s Approach

I think privacy is a fundamental right for everyone. But of course, in cases involving bad actors, there should be a system where, with proper legal procedures, privacy can be lifted to ensure justice is served.

For example, access to financial statements might be necessary in criminal cases, but this should be done through a clear judicial process, like a court order, to prevent unnecessary violations of privacy.

Currently, we’re seeing a global trend where governments treat everyone with suspicion, especially regarding tax fraud. This approach is wrong. Everyone shouldn’t be presumed guilty.

If a country has high tax evasion rates, the focus should be on improving governmental processes, not violating citizens’ privacy. For instance, in Switzerland, I’m more than happy to pay my taxes because I can see the value they bring—public infrastructure, clean lakes, and efficient services.

But in other countries, when taxes are high and public services are poor, it’s harder to accept the amount being taken. That’s why people sometimes try to evade taxes, and this leads to a distorted narrative.

When it comes to DeFi, it’s somewhat pseudo-anonymous. Transactions are transparent, but the addresses are not directly tied to specific individuals, which provides some level of anonymity. However, if you want to off-ramp, KYC and AML are required, which means that, in the end, there’s full visibility regarding who owns what address. So, it’s not entirely private, except in the case of privacy coins.

Using Privacy Protocols

That said, using privacy tools can be perfectly reasonable. For instance, you might want to keep certain transactions private, especially if large sums of money are involved. You might not want the public to know you’re worth millions when you deposit into a lending protocol, for example.

It’s important to approach this calmly and rationally, and there’s no problem as long as it’s explained well.

I’m committed to supporting any chain that I believe is sufficiently decentralized, whether it’s a privacy coin or not—ThorWallet remains fully tech-neutral. I do believe that, eventually, it will be possible to interact with privacy coins in a way that effectively hides your trace.

This is especially useful in cases where privacy is justified. However, the system is still designed to catch bad actors. For example, if someone is depositing $100 million but has reported an income of $100,000, it raises immediate questions.

If the transaction involves a privacy coin, regulators will inquire further. If there’s no solid explanation, the funds may be frozen until the source is clarified, and in some cases, this could lead to uncovering illicit activities like stolen funds.

So, there’s no issue with implementing privacy protocols as long as the system remains robust enough to prevent misuse.

Overcoming Challenges in Mass Adoption and Web3 Integration: THORWallet’s Next Big Steps

We’re very close to achieving our goal. For example, with ThorWallet, we aim to simplify complex DeFi technology so that users don’t need to be exposed to it. They should have experience similar to centralized finance (CeFi) apps like Revolut, but in the backend, it will run on a fully decentralized network.

Building a decentralized version of a Revolut app is much more complex, but this is what we’re working on with ThorWallet.

A key issue we’re addressing is the need for gas tokens. Currently, if you want to send USDC on Avalanche, for example, you need AVAX tokens to cover the transaction fees.

This makes it unattractive and difficult to onboard a large number of users. We’re working on abstracting this away so users won’t need to worry about specific gas assets. You could top up your MasterCard without worrying about the gas fees at all, for example. We have several technical solutions in place to achieve this, which will ultimately provide a gasless experience similar to CeFi platforms.

Addressing Latency Issues

Additionally, certain blockchains, like Bitcoin, have latency issues, which are slower than others. But we are finding ways to improve that as well, ensuring a smoother user experience. Once we’ve achieved this, we’ll be ready to onboard 100 million users. That’s why we’re raising growth funds now, as we’re 95% of the way there and ready for the next phase.

You’ll still need to pay transaction fees, but the way it works will be different. For instance, when you perform a swap, the gas fee will be included in the swap fee itself. If you top up your MasterCard, we might cover the gas fee for you since it’s usually very small, often just a few cents.

Another option is to implement a “gas tank” feature, where users can top it up with whatever they prefer—Fiat, USDC, or another asset. This gas tank would be used for any required gas fees on different blockchains, like Base or Avalanche, and users would see a message when their gas tank is running low, prompting them to top it up again.

This could even be a premium feature, where premium users get their gas fees covered by a subscription while other users manage their own gas tanks. Either way, our goal is to make the user experience as seamless as possible.

THORWallet and YouHodler: Competitors or Potential Partners in Bridging DeFi and Traditional Finance?

At this moment, we don’t view YouHodler as a direct competitor. They’re a centralized entity with a strong focus on perpetuals, which is not currently our focus. While they do service blockchain users, and you could argue they are competitors in that sense, they aren’t competing with us directly right now.

That said, I’m aware that they’re now making the transition from CeFi to DeFi, which is really exciting, and that could put them in the competitive space in the future. However, since we don’t yet offer perpetuals (perps) in ThorWallet, this could actually lead to a potential partnership instead.

What’s great about the Web3 space is that its dynamic is different from traditional finance. We’re more open to collaboration here. In fact, I had a discussion yesterday with Ilya, the CEO of YouHodler, about how their upcoming DeFi perpetual protocol could potentially integrate with ThorWallet.

The key in this space is to focus on expanding the overall market rather than competing for what’s already there.

Crypto vs. Traditional Finance: Which Will Have a Bigger Impact in the Long Run?

I believe crypto finance will eventually overtake traditional finance, at least from an IT infrastructure perspective. While the financial products themselves will remain similar, the technology behind them will shift to blockchain.

This switch from the outdated tech stack of traditional finance to the more modern blockchain infrastructure will enable the creation of new financial products that simply weren’t possible before, such as Flash loans. So, in short, I believe crypto finance will surpass traditional finance in the long run.

It reminds me of the managers at Daimler Benz and Audi, maybe about seven years ago. They had their best year yet while laughing at Tesla and electric cars. Fast forward a few years, and Tesla’s stock was worth more than all of Germany’s car producers combined.

Suddenly, every major car manufacturer in Germany was scrambling to make electric cars. They were stubborn at first, but eventually, they had to adopt the new paradigm. This shift in the auto industry is exactly what I see happening with traditional finance and crypto.

Final Thoughts

I had an interesting discussion yesterday regarding the European Union’s new stablecoin initiative, and I want to share my expertise and personal thoughts on it with your audience.

I’m really concerned about what’s happening. There are two types of Central Bank Digital Currencies (CBDCs): wholesale and retail.

Switzerland is focusing on wholesale CBDCs, where only national banks have stablecoins for transactions between banks. This gives them the advantage of immediate settlement, efficiency, and doesn’t disrupt the existing banking hierarchy. In this setup, banks still issue money to retail users, which I think is the correct approach.

Risks with CBDCs

However, the European Union, like China, is pushing forward with retail CBDCs, where they would issue digital currency directly to retail users, bypassing banks. This is troubling for two main reasons.

First, the European Union and national banks haven’t exactly excelled at managing their financial systems over the past 20 years, so I’m skeptical of their ability to handle such a monumental shift, especially without working through banks that already have the necessary infrastructure and experience.

Secondly, retail CBDCs mean that governments would have full visibility into every transaction users make. They could monitor your spending habits, and if they didn’t like something, they could block you from the financial system with just a few keystrokes.

This is an incredibly powerful tool, akin to having control over the army—just through financial means. The US Dollar has long been the strongest weapon because of its role in global finance, and we’ve already seen instances where countries like Russia have been cut off from the system. What’s even more concerning is the hypocrisy surrounding these actions, as Russian oligarchs may be blocked in Europe but can still open bank accounts in places like Wyoming. But that’s a different issue.

What worries me about CBDCs is that they would essentially lead us into an observation state, where everything we do financially is visible to the government. This is a dangerous path, especially when it comes to privacy and financial freedom.

It would be a major disruption to individual freedoms, and it should not be adopted. Anyone who’s interested in this topic should really look into it, and politicians need to wake up to the dangers they’re walking toward.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Report Alleges Massive Meme Coin Sniping on Pump.fun

According to a new report from Pine Analytics, token deployers on Pump.fun systematically funded sniper wallets to buy their own meme coins. This impacted over 15,000 token launches on the platform.

These sniper wallets operated primarily during US trading hours, executing standardized, profitable strategies. Unrelated bot activity obscures their behavior, making it extremely difficult to isolate these wallets—and they can readily adapt to new countermeasures.

Snipers Roam Free on Pump.fun Meme Coins

Pump.fun has remained one of the most popular meme coin launchpads on Solana despite persistent controversies and other criticism.

However, Pine Analytics’ new report has uncovered a new controversy, discovering systematic market manipulation on the platform. These snipes include as much as 1.75% of all launch activity on Pump.fun.

“Our analysis reveals that this tactic is not rare or fringe — over the past month alone, more than 15,000 SOL in realized profit was extracted through this method, across 15,000+ launches involving 4,600+ sniper wallets and 10,400+ deployers. These wallets demonstrate unusually high success rates (87% of snipes were profitable), clean exits, and structured operational patterns,” it claimed.

Solana meme coin deployers on Pump.fun follow a consistent pattern. They fund one or more sniper wallets and grant them advance notice of upcoming token launches.

Those wallets purchase tokens in the very first block and then liquidate almost immediately—85% within five minutes and 90% in just one or two swap events.

Pump.fun meme coin developers exploit this tactic to create the appearance of immediate demand for their tokens. Retail investors, unaware of the prior sell‑off, often purchase these tokens after the snipe, giving developers an unfair advantage. This constitutes market manipulation and erodes trust in the platform.

Pine Analytics had to carefully calibrate its methods to identify genuine snipers. Apparently, 50% of meme coin launches on Pump.fun involve sniping, but most of this is probably bots using the “spray and pray” method.

However, by filtering out snipers with no direct links to developer wallets, the firm missed projects that covered their tracks through proxies and burners.

In other words, the meme coin community does not have adequate defenses against systematic abuse on Pump.fun. There are a few possible ways that the platform could flag repeat offenders and sketchy projects, but adaptive countermeasures could defeat them. This problem demands persistent and proactive action.

Unfortunately, it may be difficult to enact such policies. Meme coin sniping is so systematic that Pump.fun could only fight it with real commitment.

Analysts think that building an on-chain culture that rewards transparency over extraction is the best long-term solution. A shift like that would be truly seismic, and the meme coin sector might not survive it.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Leads Blockchain Metrics as SOL Momentum Builds

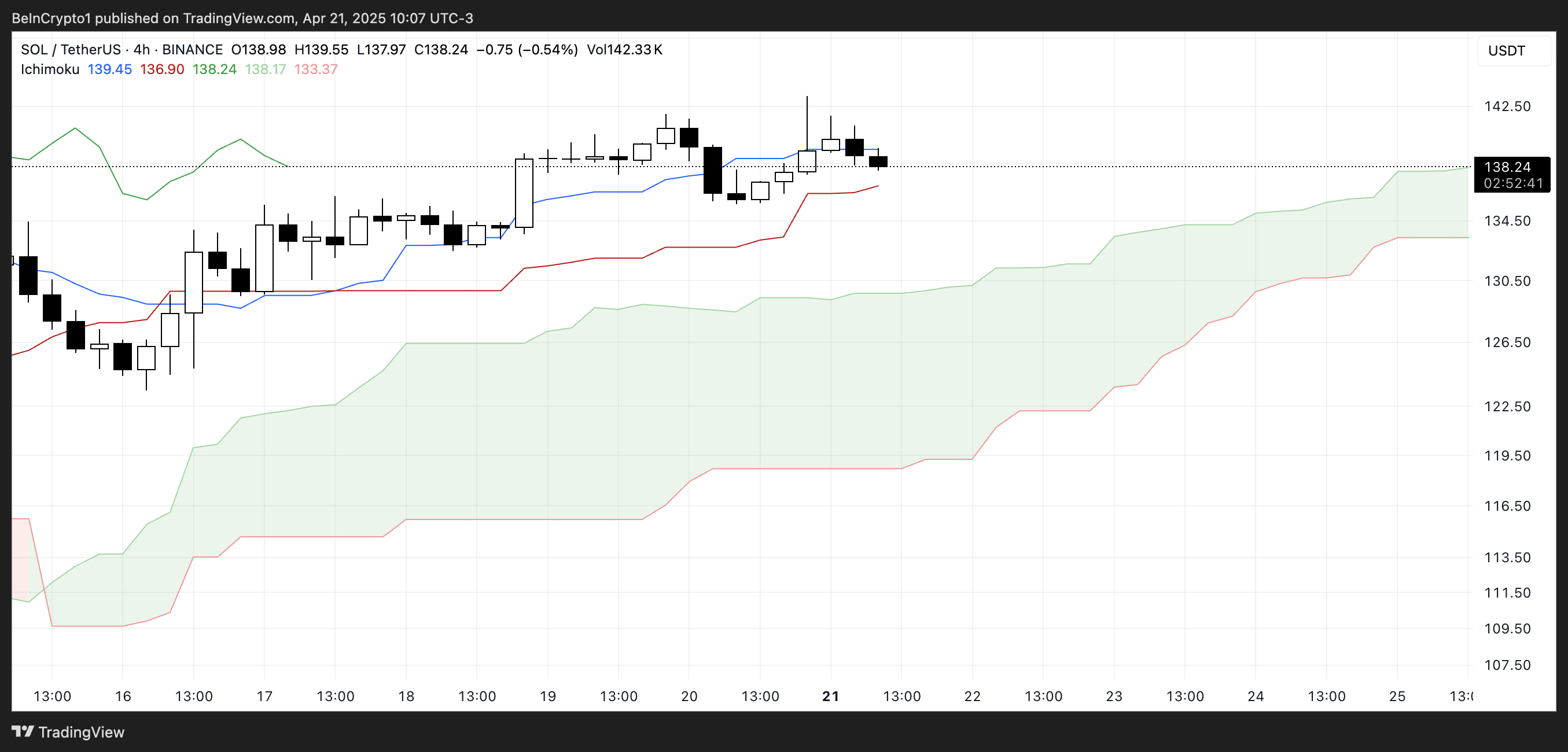

Solana (SOL) continues to show strength across multiple fronts, maintaining a bullish structure on its Ichimoku Cloud chart while gaining momentum in key market metrics. The BBTrend indicator has turned higher again, signaling renewed buying pressure after a brief cooldown.

On-chain activity remains strong, with Solana leading all blockchains in DEX volume and dominating fee generation thanks to the explosive growth of meme coins and launchpad activity. With SOL now trading above a key resistance level, the path is open for further upside—though a loss of momentum could still trigger a retest of lower supports.

Solana Maintains Bullish Structure, but Momentum Faces Key Test

On Solana’s Ichimoku Cloud chart, the price is currently above the Kijun-sen (red base line) but has dipped below the Tenkan-sen (blue conversion line), signaling weakening short-term momentum.

The flattening Tenkan-sen and price behavior suggest possible consolidation or the early stages of a pullback. Still, with the price holding above the Kijun-sen, medium-term support remains intact.

The overall Ichimoku structure remains bullish, with a thick, rising cloud and leading span A well above span B—indicating strong underlying support.

If Solana finds support at the Kijun-sen and climbs back above the Tenkan-sen, the uptrend could regain strength; otherwise, a test of the cloud’s upper boundary may follow.

Meanwhile, Solana’s BBTrend is currently at 6, extending nearly ten days in positive territory after peaking at 17.5 on April 14. The recent increase from 4.26 to 6 suggests renewed bullish momentum following a brief cooldown.

BBTrend, or Bollinger Band Trend, tracks the strength of price movement based on Bollinger Band expansion.

Positive values like the current one point to an active uptrend, and if the BBTrend continues to rise, it could signal stronger momentum and potential for another upward move.

Solana Dominates DEX Volume and Fee Generation as Meme Coins Drive Ecosystem Growth

Solana has once again claimed the top spot among all chains in DEX volume, recording $15.15 billion over the past seven days. The combined total of Ethereum, BNB, Base, and Arbitrum reached $22.7 billion.

In the last 24 hours alone, Solana saw $1.67 billion in volume, largely fueled by its booming meme coin ecosystem and the ongoing launchpad battle between PumpFun and Raydium. Adding to this good momentum, Solana recently surpassed Ethereum in Staking Market Cap.

When it comes to application fees, Solana’s momentum is just as clear. Four of the top ten fee-generating apps over the past week—PumpFun, Jupiter, Jito, and Meteora—are Solana-focused.

Pump leads the pack with nearly $18 million in fees alone.

Solana Breaks Key Resistance as Uptrend Targets Higher Levels, but Risks Remain

Solana has finally broken above its key resistance at $136, flipping it into a new support level that was successfully tested just yesterday.

Its EMA lines remain aligned in a bullish setup, suggesting the uptrend is still intact.

If this momentum continues, SOL price could aim for the next resistance zones at $147 and $152—levels that, if breached, open the door to a potential move toward $179.

The current structure favors buyers, with higher lows and strong support reinforcing the trend.

However, if momentum fades, a retest of the $136 support is likely.

A breakdown below that level could shift sentiment, exposing Solana to deeper pullbacks toward $124 and even $112.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Firms Donated $85 million in Trump’s Inauguration

According to a new report, 15 firms and individuals from the crypto industry donated more than $100,000 to President Trump’s Inauguration, totaling over $85 million.

Almost all of these companies apparently received direct or indirect benefits from Trump’s administration. This includes dropped legal proceedings, lucrative business partnerships, participation in Trump’s Crypto Summit, and more.

Crypto Industry Went All-In on Trump’s Inauguration

Since promising to bring friendlier regulations on the campaign trail, Donald Trump attracted a reputation as the Crypto President.

Trump’s Inauguration festivities included a “Crypto Ball,” and several prominent firms made donations for these events. Today, a report has compiled all crypto-related contributions of over $100,000, revealing some interesting facts.

Since taking office, President Trump and his family have been allegedly involved in prominent crypto controversies, and these donations may be linked to several of them.

For example, eight of the donors, Coinbase, Crypto.com, Uniswap, Yuga Labs, Kraken, Ripple, Robinhood, and Consensys, had SEC investigations or lawsuits against them closed since Trump’s term began.

The commission might have dropped its probe against these companies anyway due to its changing stance on crypto enforcement. However, being in the President’s good books likely helped the process.

Further Alleged Benefits for Donors

In other words, nearly half the firms that made donations to Trump’s Inauguration have seen their legal problems cleared up quickly. This isn’t the only regulation-related benefit they allegedly received.

Circle, for example, recently made an IPO after openly stating that Trump’s Presidency made it possible. Galaxy Digital received SEC approval for a major reorganization, a key step for a NASDAQ listing.

Other donors, such as Crypto.com and ONDO, got more direct financial partnerships with businesses associated with the Trump family.

Previously, Ripple’s CEO, Brad Garlinghouse, anticipated a crypto bull market under Trump. Also, XRP, Solana, and Cardano were all unexpectedly included in the US Crypto Reserve announcement.

All three of these companies made major donations to Trump’s Inauguration.

It seems that most of the firms involved got at least some sort of noticeable benefit from these donations. Donors like Multicoin and Paradigm received invitations to Trump’s Crypto Summit, while much more prominent groups like the Ethereum Foundation got snubbed.

Meanwhile, various industry KOLs and community members have already alleged major corruption in Trump’s crypto connections.

While some allegations might lack substantial proof, the crypto space has changed dramatically under the new administration, for both good and bad.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.