Market

These Are Today Trending Altcoins: HAMMY, Notcoin, PEPE

Contrary to the performance earlier in the week, several cryptos have slowed down the initial bullish momentum they had. As a result, most of today’s trending altcoins today, November 15, have seen their prices decline.

However, out of the top three, according to CoinGecko, one has gone against the broader trend. This analysis reveals why these altcoins are trending and what’s next for their values. The top three are SAD HAMSTER (HAMMY), Pepe (PEPE), and Notcoin (NOT).

SAD HAMSTER (HAMMY)

SAD HAMSTER has emerged as one of today’s trending altcoins, primarily due to a significant price surge. Over the past 24 hours, HAMMY’s price has skyrocketed by 39%. This remarkable rally followed a post from Elon Musk, who expressed support for a campaign aimed at raising $3 million for hamster health.

This development sparked a wave of buying pressure for HAMMY, which is $0.40 at press time. Further, the daily chart shows that the Bull Bear Power (BBP) has risen to the highest level since September.

When the BBP falls, it means bears are in control, and selling pressure is intense. However, since the reading jump, bulls are putting a lot of pressure on the price. If that continues, HAMMY’s price could rally to the highest level of the wick at $0.55.

On the other hand, if profit-taking increases, this might not happen. Should that be the case, SAD HAMSTER’s price could sink to $0.29.

Pepe (PEPE)

PEPE, the frog-themed meme coin, is also part of today’s trending altcoins due to the recent Coinbase and Robinhood listing. While the price reacted positively to that development on November 13, the last 24 hours have seen the value tank by 13%.

This price drop may be attributed to the broader market decline and increased selling pressure. From a technical standpoint, BeInCrypto also noted that PEPE’s overbought condition contributed to the drawdown.

For instance, the Relative Strength Index (RSI), which measures momentum, has jumped above 70.00, reinforcing the thesis that the altcoin is overbought. Assuming the RSI reading is less than 30.00, it would have been deemed oversold.

Considering the current outlook, the cryptocurrency’s price could drop to $0.000015. But if buying pressure comes into play again, the trend might change, and PEPE could bounce to $0.000026.

Notcoin (NOT)

Like Pepe, Notcoin is trending because of a double-digit decline. In the last 24 hours, NOT’s price has decreased by 12% and trades at $0.0073. This price action contradicts the altcoin’s performance some days back when its value rose by 25%.

On the daily chart, the Notcoin price attempted to rise toward $0.010, but resistance at $0.0076 prevented this. Trading volume around the Telegram-based token has also declined, indicating a drop in market interest.

If this remains the same, the altcoin’s value might decrease to $0.0066. However, this prediction might be invalidated if buying pressure rises. If that happens, the Notcoin could rise to $0.010.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BANK Token Surges 150% After Binance Futures Listing

Lorenzo Protocol’s native token, BANK, has recorded a 150% price surge within six hours of its official launch.

The token’s rapid climb follows its listing on multiple platforms, including Binance’s Alpha Market and the launch of a BANKUSDT perpetual contract on Binance Futures with up to 50x leverage.

What is the New BANK Token on Binance Futures?

The Token Generation Event (TGE) for BANK took place today, April 18, via Binance Wallet, in partnership with PancakeSwap. Lorenzo Protocol raised $200,000 through the sale of 42 million BANK tokens—2% of the total supply—priced at $0.0048 each.

The token is now trading on PancakeSwap, Bitget, and CoinEx. Following its debut, BANK reached a market cap of approximately $22 million.

BANK is the governance and utility token for Lorenzo Protocol, a DeFi platform focused on enhancing Bitcoin liquidity.

The protocol allows users to earn yield on BTC without giving up custody. It uses financial primitives like Liquid Principal Tokens (LPTs) and Yield-Accruing Tokens (YATs).

According to its claims, BANK holders can stake their tokens to receive veBANK, which provides governance rights and a share of future emissions.

Also, Lorenzo Protocol is built on a Cosmos-based Ethermint appchain. It enables BTC restaking and interoperability with Bitcoin’s Layer 1. The design supports on-chain issuance and settlement of BTC-backed assets.

The listing of the BANK/USDT perpetual contract on Binance Futures adds further momentum to the token. Binance Futures is a derivatives platform that allows users to trade perpetual contracts with high leverage.

Binance has historically preferred new tokens on the BNB chain for early futures trading. BANK’s sharp price increase and rapid market integration highlight strong early interest in Lorenzo Protocol’s approach to BTC-based DeFi infrastructure.

Currently, it’s far-fetched to project whether the exchange will list this newly launched token. However, Binance’s new community voting on token listing has offered positive hopes for small market cap projects.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Asia’s First XRP Investment Fund is Here, Backed by Ripple

HashKey Capital has launched the HashKey XRP Tracker Fund, the first fund in Asia focused exclusively on tracking the performance of XRP.

The fund is now open to professional investors. Ripple is backing the initiative as an early investor.

Institutional Interest in XRP Investment Continues to Grow

According to HashKey, XRP offers a faster and more cost-effective alternative to traditional cross-border payment systems. The new tracker fund aligns with HashKey Capital’s goal of connecting conventional finance with digital asset markets.

The fund allows investors to subscribe using either cash or in-kind contributions. Investors can redeem or subscribe to shares on a monthly basis.

CF Benchmarks, known for its role in global ETF markets, will provide the fund’s benchmark.

“XRP stands out as one of the most innovative cryptocurrencies in today’s market, attracting global enterprises who use it to transact, tokenize, and store value. With the first XRP Tracker Fund available in the region, we simplify access to XRP, catering to the demand for investment opportunities in the very best digital assets,” said Vivien Wong, Partner at HashKey Capital.

Most recently, Ripple acquired prime brokerage platform Hidden Road for $1.25 billion. It was one of the largest acquisition deals in the crypto and blockchain space.

Earlier today, Hidden Road secured a broker-dealer license from the Financial Industry Regulatory Authority (FINRA).

Meanwhile, XRP continues to gain traction with institutional investors. Standard Chartered recently forecast that XRP could surpass Ethereum by 2028, citing increased demand for efficient cross-border payment solutions and growing disruption in global trade.

“XRP is uniquely positioned at the heart of one of the fastest-growing uses for digital assets – facilitation of cross-border and cross-currency payments. In this way, XRPL is similar to the main use case for stablecoins such as Tether. This stablecoin use has grown 50% annually over the past two years, and we expect stablecoin transactions to increase 10x over the next four years. We think this bodes well for XRPL’s throughput growth, given the similar use cases for stablecoins and XRPL,” Geoff Kendrick, Standard Chartered’s Head of Digital Assets Research, told BeInCrypto.

Interest in XRP ETFs is also increasing. Teucrium Investment Advisors recently received NYSE Arca approval for the Teucrium 2x Long Daily XRP ETF (XXRP), the first leveraged XRP ETF in the United States.

Also, attention is now turning to spot XRP ETFs. Grayscale and 21Shares are both awaiting decisions from the SEC on their XRP-based products.

The SEC has up to 240 days to review the Grayscale XRP Trust and the 21Shares Core XRP Trust, with final deadlines set for October 18 and 19, 2025.

XRP’s price has declined by nearly 20% over the past month, but institutional confidence remains high.

Ripple recently confirmed progress in resolving its long-standing legal battle with the SEC. A joint motion to pause court proceedings was approved, giving both parties 60 more days to finalize a settlement.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

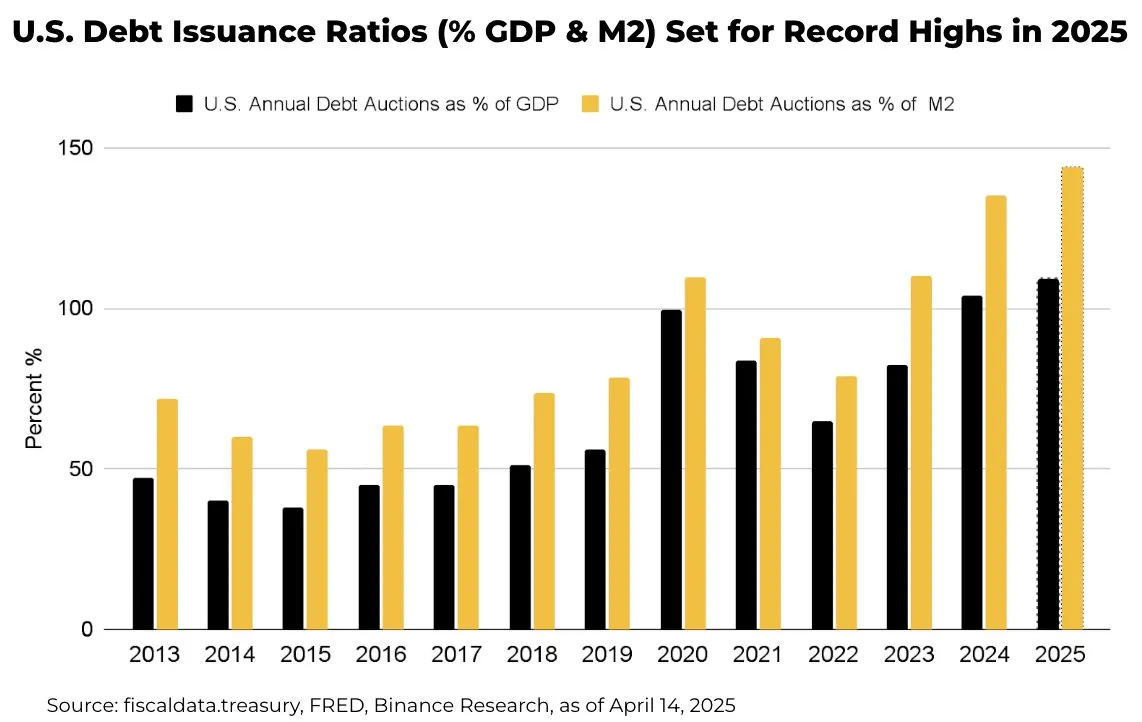

How $31 Trillion in US Bonds Could Impact Crypto Markets in 2025

US Treasury plans to issue over $31 trillion in bonds this year—around 109% of GDP and 144% of M2. This would be the highest recorded level of bond issuance in history. How will it impact the crypto market?

Heavy supply may push yields higher, as Treasury financing needs outstrip demand. Higher yields increase the opportunity cost of holding non‑yielding assets like Bitcoin and Ethereum, potentially drawing capital away from crypto.

US Bonds Might Add to the Crypto Market’s Volatility

The whole narrative potentially boils down to foreign demand for US bonds. Overseas investors hold roughly one‑third of US debt.

Any reduction in appetite—whether due to tariffs or portfolio rebalances—could force the Treasury to offer even steeper yields. Rising yields tend to tighten global liquidity, making risk assets like cryptocurrencies less attractive.

When yields climb, equities and crypto can face selling pressure. For example, during the 2022 bond sell‑off, Bitcoin fell more than 50% alongside Treasury yields spiking. A repeat scenario could test crypto’s appeal.

Meanwhile, the US dollar’s strength could compound headwinds. As yields rise, the dollar typically gains. A stronger dollar makes Bitcoin’s USD‑denominated price more expensive for overseas buyers, dampening demand.

Yet crypto offers unique attributes. In periods of extreme monetary expansion, such as post‑pandemic, investors turned to Bitcoin as an inflation hedge.

Even if higher yields curb speculative flows, crypto’s finite supply and decentralized nature may sustain a baseline of buyer interest.

Technically, Bitcoin’s correlation to yields may weaken if Treasury issuance triggers broader macro volatility. When bond markets are hit by trade or fiscal policy shocks, traders may turn to digital assets to diversify since they don’t move in step.

However, that thesis hinges on continued institutional adoption and favorable regulation.

Crypto’s liquidity profile also matters. Large bond sales often drain bank reserves—tightening funding markets.

In theory, tighter liquidity could boost demand for DeFi protocols offering higher yields than traditional money markets.

Overall, record US debt supply points to higher yields and a stronger dollar—volatility for crypto as a risk asset.

Yet crypto’s inflation‑hedge narrative and evolving technical role in diversified portfolios could temper volatility. Market participants should watch foreign demand trends and liquidity conditions as key indicators for crypto’s next moves.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market15 hours ago

Market15 hours agoEthereum Price Fights for Momentum—Traders Watch Key Resistance

-

Market21 hours ago

Market21 hours agoCrypto Ignores ECB Rate Cuts, Highlighting EU’s Fading Influence

-

Altcoin15 hours ago

Altcoin15 hours agoExpert Predicts Pi Network Price Volatility After Shady Activity On Banxa

-

Market20 hours ago

Market20 hours agoBinance Leads One-Third of the CEX Market in Q1 2025

-

Altcoin19 hours ago

Altcoin19 hours agoDogecoin Price Breakout in view as Analyst Predicts $5.6 high

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Investors Suffer More Losses Than Bitcoin Amid Ongoing Market Turmoil

-

Altcoin18 hours ago

Altcoin18 hours agoTron Founder Justin Sun Reveals Plan To HODL Ethereum Despite Price Drop

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?