Market

These Altcoins Can Hit New All-Time Highs in September 2024

Many altcoins have struggled to maintain a bullish outlook for much of this cycle, resulting in only a few reaching new all-time highs (ATH).

However, as the third quarter of the year enters its final month, some altcoins are beginning to show signs of potentially surpassing their previous peaks. This analysis highlights the top four altcoins with the potential to achieve new ATHs and the reasoning behind this optimistic outlook.

Kaspa (KAS)

Kaspa (KAS), a cryptocurrency operating on the Proof-of-Work (PoW) consensus mechanism like Bitcoin (BTC), leads the list of altcoins with potential for new all-time highs. Currently trading at $0.16, KAS has been setting new ATHs since June, up until August 1.

Looking ahead to September, BeInCrypto anticipates that KAS will maintain its upward momentum, potentially surpassing $0.20. On the daily chart, KAS has been oscillating between $0.15 and $0.17 for the past 22 days, indicating that the $0.15 level has become a crucial support point for the cryptocurrency.

Additionally, the Money Flow Index (MFI) for KAS is currently at 24.38, indicating an oversold condition. The MFI measures the flow of liquidity in and out of an asset and helps determine whether a cryptocurrency is overbought or oversold. A reading of 80.00 or above suggests an overbought condition, while a reading of 20.00 or below indicates an oversold state, potentially signaling a buying opportunity.

KAS is approaching the oversold level, which suggests that a significant bounce could be on the horizon. Historical data shows that whenever KAS reaches an MFI reading similar to the current level, it often climbs to a new all-time high (ATH).

If this pattern holds, KAS could potentially reach $0.21 or higher in September. However, this prediction could be invalidated if the broader crypto market experiences another downturn, in which case KAS might drop to $0.14.

Binance Coin (BNB)

Ranked as the 4th most valuable cryptocurrency, Binance Coin (BNB) was the first major altcoin from the 2021 bull market to reach a new all-time high in June. In September, BNB could rally to another high, driven by the potential release of former Binance CEO Changpeng Zhao (CZ) from prison.

Currently priced at $540.26, BNB is 24.95% below its all-time high. On the weekly chart, BNB has formed a symmetrical triangle, a pattern that emerges when two trendlines — one sloping downward and the other upward — converge at a point.

A symmetrical triangle can signal either a bullish or bearish outcome, so it’s crucial to consider other indicators. In BNB’s case, BeInCrypto focuses on the 50-day Exponential Moving Average (EMA), which measures the trend direction over a specific period and could provide insight into the coin’s next move.

Read more: What Are Altcoins? A Guide to Alternative Cryptocurrencies

When the price of a cryptocurrency trades above its 50-day Exponential Moving Average (EMA), the trend is bullish; if it trades below, the trend is bearish. Despite BNB’s recent decline, it currently trades above the 50 EMA (blue), which could support the possibility of a new all-time high (ATH).

If buying pressure for BNB increases in September, it might once again outperform other top 10 altcoins and potentially reach a new ATH, possibly around $750. However, this outcome could be jeopardized if CZ’s release is delayed or if market interest in BNB wanes.

Brett (BRETT)

Regarded as “PEPE’s best friend” but built on the Base Layer-2 network, BRETT is part of the altcoins that could hit a new ATH in September. The meme coin currently trades at $0.081 and hit its ATH of $0.19 in June.

On the 4-hour chart, BRETT has formed an ascending triangle, a technical pattern that tends to be bullish. An ascending triangle arises from the convergence of a horizontal trendline and a rising one drawn along swing lows and highs.

As prices fluctuate along these highs and lows, cryptocurrencies often encounter resistance, as BRETT did with its drop from $0.10 to $0.081. However, this reversal might be temporary, suggesting that a significant rally could be imminent, potentially pushing the token toward $0.20.

However, if BRETT does not experience significant accumulation in September, this bullish forecast could be nullified. In that scenario, the price might drop to $0.079.

Mantra (OM)

Mantra’s (OM) position as one of the top Real World Assets (RWA) altcoins is a key reason it makes this list. OM’s all-time high of $1.42 happened on July 22, but it has since dropped 37% from that height.

From a technical standpoint, OM has formed a falling wedge pattern on the daily chart. This pattern is characterized by two descending trendlines that connect the asset’s highs and lows. Typically, traders consider a falling wedge bullish because the narrowing lines suggest that sellers might be losing momentum.

If buyers take advantage of this potential seller exhaustion, a significant rally could ensue. For OM, a breakthrough of the 38.2% Fibonacci level could signal the start of a surge toward a new all-time high. Still, the 61.8% golden ratio at $1.15 might pose resistance to the price.

Read more: How to Invest in Real-World Crypto Assets (RWA)?

If OM breaks past the $1.15 resistance level, its price could potentially surpass $1.42 in September, making it one of the altcoins to hit a new all-time high (ATH). However, the bullish scenario could be invalidated if the token drops below the falling wedge’s lowest point again. If that occurs, the price might tumble to $0.62.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network, Grayscale’s Altcoin Shake-Up

This week in crypto recorded several key events across various ecosystems that will continue shaping the industry.

From major partnerships to investment decisions and scam allegations, the following is a comprehensive roundup of crypto news this week.

Mantra Crash: From Billion-Dollar Hype to Fragile Liquidity

This week in crypto Mantra’s powering token lost $90% of its value amid allegations of insider dealing and liquidity fragility. Once hailed as a rising star in the RWA (real-world asset) narrative, OM’s collapse wiped out over $5.5 billion in value.

Reports revealed a disturbing pattern of concentrated wallet activity and low liquidity pools, which made OM highly vulnerable to sudden exits.

On-chain sleuths identified one trader whose aggressive selling triggered a cascade of liquidations. This highlights the risks of low-float, high-hype tokens in an illiquid market environment.

“This was due to an entity(s) on the Binance perpetuals market. That’s what triggered the entire cascade. The initial drop below $5 was triggered by a ~1 million USD short position being market-sold. This caused over 5% of slippage in literal microseconds. That was the trigger. This seems intentional to me. They knew what they were doing,” the analyst stated.

Pi Network: From Chainlink Buzz to Transparency Fears

Pi Network recorded strong optimism this week as its native Pi Coin surged by double digits. BeInCrypto attributed the surge to the announcement of a key integration with Chainlink.

They pitched this strategic collaboration as a gateway to real-world utility. Specifically, it positioned Pi closer to the broader DeFi and smart contract ecosystem. However, the euphoria proved short-lived.

Market sentiment quickly soured as analysts began comparing Pi Network and the recently collapsed OM token.

Allegations suggest that, like the OM token, Pi coin lacks full clarity around circulating supply, wallet distribution, and centralized control. To some, these are potential red flags in an increasingly regulation-sensitive industry.

“The OM incident is a wake-up call for the entire crypto industry, proof that stricter regulations are urgently needed. It also serves as a huge lesson for the Pi Core Team as we transition from the Open Network to the Open Mainnet,” wrote Dr Altcoin.

Pi coin reversed gains within days, falling 18% from its weekly high. At the time of writing, PI was trading at $0.6112, up by a modest 0.7% in the past 24 hours, per CoinGecko.

Grayscale’s Altcoin Shake-Up: 40 Tokens Under Review

This week in crypto also showed that institutional investor interest in altcoins is heating up again, with Grayscale leading the charge.

The digital asset manager unveiled its updated list of assets under consideration for the second quarter (Q2) 2025. BeInCrypto reported that the list featured zero altcoins across sectors such as DePIN, AI, modular blockchains, and restaking. Among the notable tokens being eyed are SUI, STRK, TIA, JUP, and MANTA.

The update reflects Grayscale’s growing thesis around emerging crypto trends, particularly as the firm seeks to expand beyond its core Bitcoin and Ethereum products.

This announcement follows a broader strategic overhaul from three weeks ago when Grayscale reshuffled its top 20 list of altcoins by market exposure. Several older names were dropped at the time, while newer narratives like Solana-based DePIN and Ethereum restaking plays were pushed to the forefront.

The expansion into 40 coins signals Grayscale’s recognition of renewed retail and institutional appetite for differentiated assets. However, inclusion in the list does not guarantee a fund launch. It only indicates Grayscale’s active research.

XRP and SWIFT Partnership: Breaking Down the Rumors

There was speculation this week about a possible partnership between Ripple’s XRP and banking giant SWIFT in crypto.

This narrative was based on a misinterpreted document. A series of cryptic social posts exacerbated the speculation, which some took as confirmation of collaboration between the global payments network and the XRP ledger.

However, BeInCrypto’s in-depth reporting sank the rumors. While Ripple has long pursued banking institutions and SWIFT has shown openness to blockchain innovations, there is no verified partnership between the two.

SWIFT’s public-facing projects around tokenization and digital asset settlement do not include XRP.

Despite the debunking, the rumors sparked an important conversation about XRP’s long-term positioning. The token remains a top-10 asset and a favorite among retail investors banking on utility-driven price appreciation.

With Ripple’s legal battles with the SEC nearing resolution and international CBDC partnerships in the works, the project is far from irrelevant.

US Dollar Dives: What the DXY Crash Means for Bitcoin

The US Dollar Index (DXY) hit a three-year low this week, sending ripples through the crypto markets. Historically, a falling DXY has been bullish for Bitcoin, and this week was no different, with BTC reclaiming above the $84,000 range.

The greenback’s weakness reflects growing fears of fiscal deterioration in the US, as rate cuts loom and Treasury debt soars.

However, that is just the surface. The global M2money supply has been quietly increasing again, especially across Europe and Asia. This reignites the liquidity conditions that fueled previous bull runs.

Japan’s 10-year bond yields hit multi-decade highs, forcing the Bank of Japan (BoJ) into increasingly precarious interventions. As Japanese liquidity spills outward, crypto and risk assets have become inadvertent beneficiaries.

This macroenvironment is ideal for Bitcoin. Weakening fiat, rising global liquidity, and crumbling bond market confidence create a perfect storm.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

TRUMP Meme Coin Ignores $307M Unlock, Bearish Trend Holds

The TRUMP meme coin has struggled to regain momentum, dropping nearly 5% over the past seven days and trading below the $10 mark for the last 16 consecutive days. Despite a major $307 million token unlock, the market response has been muted, and technical indicators continue to point toward weakness.

BBTrend has flipped back into negative territory, the Ichimoku Cloud shows sustained bearish pressure, and EMA lines remain tilted to the downside. Overall, TRUMP appears stuck in a broader downtrend, with no clear signs of reversal for now.

TRUMP Momentum Reverses as BBTrend Drops to -6.93

TRUMP’s BBTrend has sharply dropped to -6.93, a notable decline from its recent positive reading of 2.35 just two days ago. Between April 13 and April 16, the BBTrend briefly turned positive, suggesting a short-lived recovery in trend strength.

However, the quick reversal back into negative territory points to renewed weakness and fading momentum.

This sharp swing signals that whatever bullish attempt emerged during the weekend has likely lost traction, with sellers once again gaining control.

The BBTrend, or Bollinger Band Trend, gauges the strength and direction of a price trend by measuring the expansion or contraction of Bollinger Bands.

Positive values typically suggest strong trend formation—whether upward or downward—while negative values reflect contracting volatility and fading trend strength. With TRUMP now sitting at -6.93, the indicator shows that the market may be losing direction and entering a phase of uncertainty or potential downside drift.

Unless BBTrend shifts back into positive territory soon, TRUMP meme coin could face increased pressure and continued instability in the short term.

TRUMP Remains Bearish Below the Ichimoku Cloud With No Sign of Reversal

TRUMP meme coin is currently trading below the Ichimoku Cloud, which signals a bearish outlook according to the indicator.

The price has failed to reclaim the cloud in recent days, and the flat nature of the Senkou Span B (the lower boundary of the cloud) reinforces the idea of strong overhead resistance and weak momentum.

The Tenkan-sen (blue line) remains below the Kijun-sen (red line), further supporting the ongoing bearish trend. Short-term price action continues to lag behind longer-term averages.

Additionally, the cloud ahead is thin and flat, suggesting that volatility may remain low and that the current trend lacks strength.

The Kumo (cloud) does not show signs of expansion, meaning a strong breakout in either direction is not imminent.

For now, with TRUMP stuck below the cloud and no clear bullish crossover between the Tenkan-sen and Kijun-sen, the bias remains tilted to the downside unless a decisive shift in momentum takes place.

TRUMP Faces Bearish Pressure Despite $307 Million Unlock

Despite a substantial $307.64 million token unlock, TRUMP meme coin has shown little reaction, with sentiment and price action remaining largely unchanged.

The EMA lines continue to point toward a bearish trend, as the short-term averages remain positioned below the long-term ones—reflecting sustained downside pressure.

If this trend persists, TRUMP could soon retest a key support zone, which may determine whether the token stabilizes or sees deeper losses. The lack of a bullish response to the unlock adds to concerns that market confidence is currently weak.

However, a trend reversal could shift the outlook. If buyers regain control and momentum builds, TRUMP meme coin could make a move toward resistance levels, with potential targets around $8.39 and $8.79.

A breakout above those would open the door for further gains toward $10.67, and if the bulls continue strongly, even a move to $12 is possible.

Still, with the EMAs tilted to the downside and no immediate sign of recovery, the burden remains on bulls to reverse the trend and reignite upward momentum.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Price Rises 13% But Fails to Break $136 Resistance

Solana (SOL) has climbed 13% over the past seven days, showcasing strong short-term performance. While momentum indicators like the RSI and EMA lines remain supportive, recent price action suggests that bullish strength may be stalling just below a key breakout point.

At the same time, the sharp drop in BBTrend indicates weakening trend strength and fading volatility, often a sign of incoming consolidation or market indecision. With technicals at a crossroads, SOL’s next move will likely depend on whether buyers can regain control or if a broader pullback begins to unfold.

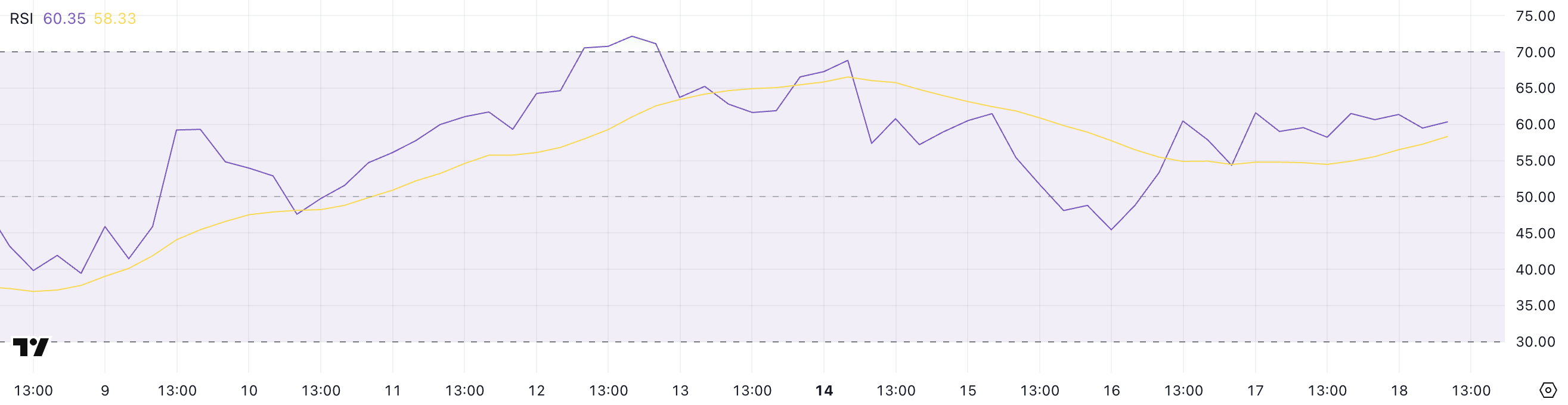

SOL RSI Rises Sharply, but Pause in Momentum Signals Caution

Solana’s Relative Strength Index (RSI) is currently at 60.35, marking a noticeable rise from 45 just two days ago.

This jump signals growing bullish momentum, although the RSI has remained stable since yesterday, suggesting that upward pressure may be easing for now.

The increase reflects renewed buying interest in recent sessions, pushing SOL closer to overbought territory but not quite there yet. This leveling off could indicate that the market is taking a breather before deciding its next move.

The RSI is a momentum oscillator that measures the speed and magnitude of price movements, ranging from 0 to 100. Values above 70 typically indicate that an asset is overbought and may be due for a pullback, while readings below 30 suggest oversold conditions, potentially signaling a buying opportunity.

With Solana’s RSI at 60.35, the asset is approaching bullish territory but hasn’t yet entered an extreme zone.

This positioning suggests that while recent momentum is positive, SOL could face some short-term consolidation or resistance before continuing higher—unless strong buying interest resumes and pushes the RSI closer to overbought levels.

SOL Trend Strength Weakens as BBTrend Falls Below 6

Solana’s BBTrend indicator is currently at 5.69, a significant drop from the 17.5 reading observed just four days ago.

This sharp decline suggests that volatility around SOL’s price has cooled notably, and the strength of the prior trend is weakening.

While BBTrend doesn’t signal direction on its own, the drop indicates that the strong movement, likely bullish, has lost momentum, and SOL may be entering a phase of consolidation or uncertainty.

BBTrend, short for Bollinger Band Trend, measures the strength of a price trend based on the expansion or contraction of Bollinger Bands.

Higher values suggest a strong, directional move (either up or down), while lower values point to weaker trends and reduced volatility. With BBTrend now at 5.69, Solana is in a much less volatile environment, which often precedes a breakout or a reversal.

For now, this reading signals that the recent momentum is fading. Unless volatility picks up again, SOL’s price may remain range-bound in the short term.

Golden Cross Looms for SOL, But $136 Barrier Still Holding Strong

Solana’s EMA lines continue to reflect a bullish structure, with the short-term average trending above the long-term one—suggesting that positive momentum remains intact.

A potential golden cross is also forming, which, if confirmed, would further reinforce the bullish outlook.

However, despite this favorable setup, Solana price has struggled to break through the $136 resistance level over the past few days, indicating that buyers may be losing steam at this key threshold.

Tracy Jin, COO of MEXC told BeInCrypto:

“Amid widespread volatility, Solana has stood out with notable strength. A combination of favorable technical setups and institutional tailwinds — such as the launch of the first spot Solana ETFs in North America — has helped drive a short-term rally. The token’s reclaim of leadership in decentralized exchange activity and rising total value locked further support the bullish case.”

If SOL manages to push above $136 with strong volume, it could open the path toward the next targets at $147 and potentially higher. But if the current momentum fades and the price reverses, a test of support at $124 becomes likely.

About Solana next moves, Jin told BeInCrypto:

“Despite recent gains, SOL’s near-term outlook remains sensitive to broader liquidity conditions. Any deterioration in market confidence — whether from macro shocks or renewed volatility in Bitcoin — could cap upside potential.”

A breakdown below that could accelerate losses toward $112, and in the event of a deeper correction, SOL could even revisit the $95 region.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Fee Plunges To 5-Year Low—Is This A Bottom Signal?

-

Market22 hours ago

Market22 hours agoEthereum Price Fights for Momentum—Traders Watch Key Resistance

-

Altcoin22 hours ago

Altcoin22 hours agoExpert Predicts Pi Network Price Volatility After Shady Activity On Banxa

-

Market17 hours ago

Market17 hours agoBitcoin Price Gears Up for Next Leg Higher—Upside Potential Builds

-

Market20 hours ago

Market20 hours agoIs XRP’s Low Price Part of Ripple’s Long-Term Growth Strategy?

-

Altcoin23 hours ago

Altcoin23 hours agoAnalysts Predict XRP Price to Hit $6 as Wave 2 Correction Nears End

-

Altcoin18 hours ago

Altcoin18 hours agoHashKey Launches First XRP Tracker Fund With Ripple’s Backing

-

Market21 hours ago

Market21 hours agoXRP Price Weakens—Further Losses on The Table?