Market

The Future of Blockchain: Experts Share Insights on Privacy and Transparency

The allure of anonymity has always been a significant draw in the blockchain ecosystem. Early adopters touted the ability to conduct transactions in secrecy, far from the prying eyes of centralized institutions and regulators.

However, as blockchain evolves, the industry faces a critical question – Is anonymity still paramount, or is it a fading aspect amidst growing demands for transparency?

Why Blockchain Transparency is Important?

The blockchain sector is undergoing a transformation. Enhanced regulatory scrutiny and advancements in blockchain analytics are slowly demystifying the once-opaque crypto ecosystem.

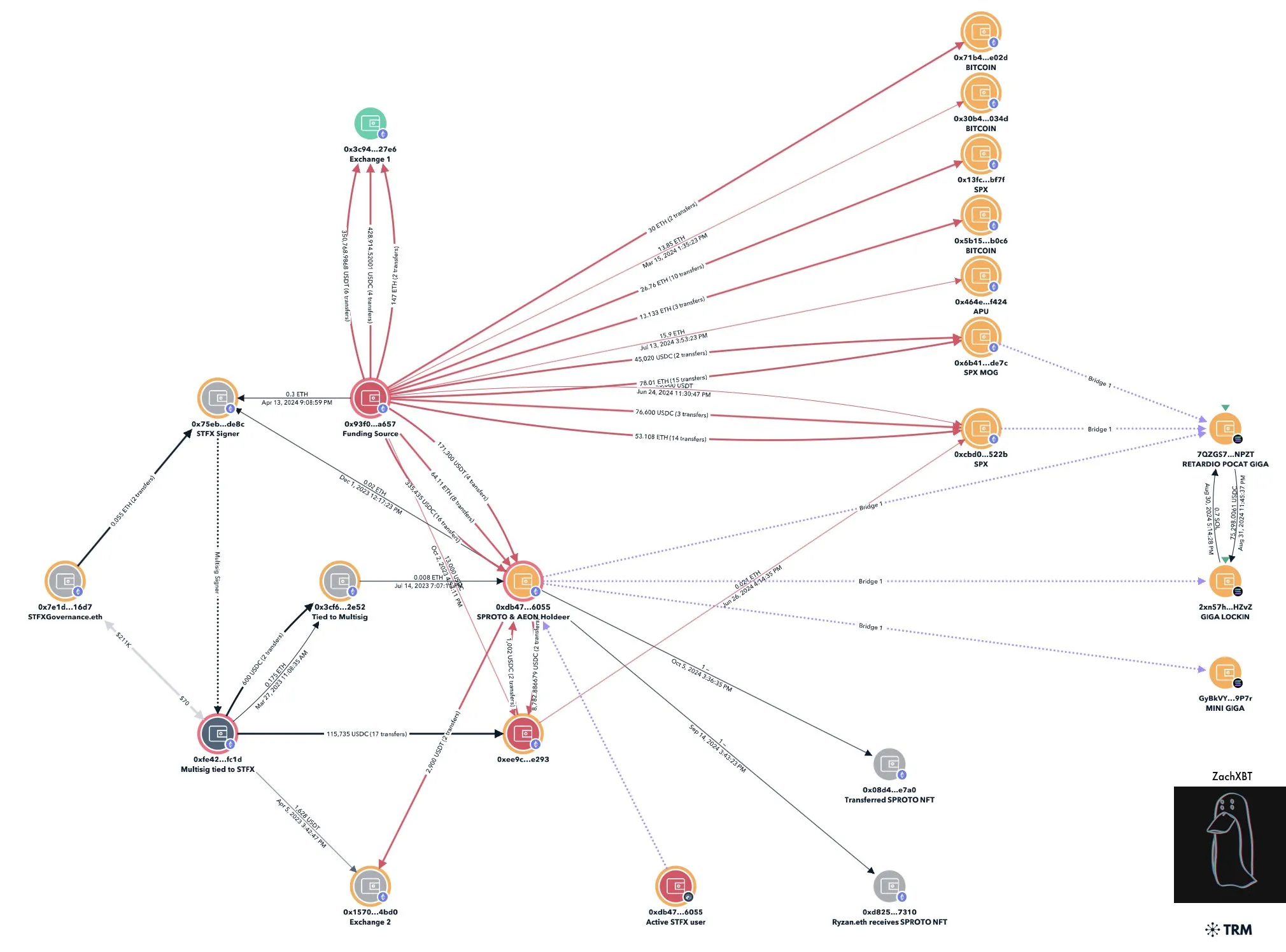

A revelation by the on-chain detective ZachXBT, who exposed the crypto holdings of a meme coin trader, Murad, highlights this shift. This exposure ignited debates about the ethics of revealing such information and whether such acts undermine the foundational privacy promised by blockchain.

Read more: Who Is ZachXBT, the Crypto Sleuth Exposing Scams?

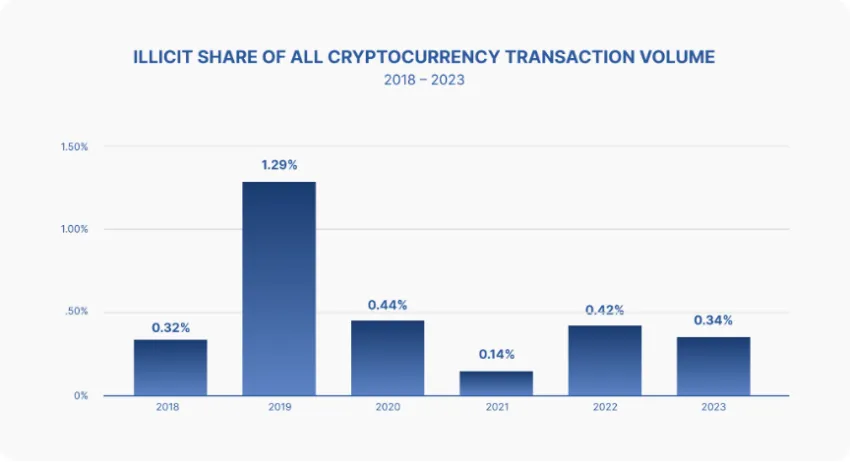

Despite concerns, many argue that transparency is crucial for combating fraud, money laundering, and other illicit activities within the crypto space.

The call for greater oversight is partly driven by the increasing incidents of crypto-related frauds and hacks. According to an Immunefi report, over $412 million was lost to such incidents in the third quarter of 2024 alone. Moreover, year-to-date, the total reached $1.3 billion across 169 incidents by September 2024.

These security breaches and the utilization of cryptocurrency in illegal activities fuel the debate over blockchain’s dual nature—offering freedom yet potentially facilitating unlawful acts.

Need For a Balanced Approach

In an interview with BeInCrypto, Alex Pruden, Executive Director at Aleo Foundation, countered this perspective. He highlighted the misuse of traditional financial systems in crimes.

“The traditional financial system is used for illegal activities all the time. 99% of money laundering and sanctions evasion actually happens through large financial institutions (who don’t catch it until after the crime has been perpetrated). Does that mean we should ban banks and payment processors? Of course not, because these institutions provide benefits to everyone else. The key is finding the right balance,” Pruden told BeInCrypto.

Supporting this, a Crypto Information Sharing and Analysis Center (ISAC) report notes that cash is used far more frequently than crypto in illegal activities. The report challenged the notion that crypto is predominantly the currency of criminals.

Read more: Anonymity vs. Pseudonymity: Understanding the Key Differences

Moreover, purists and privacy advocates contend that an extreme move towards openness erodes the core values of blockchain. Pruden emphasized the importance of privacy.

“Real-world financial transactions between parties are often predicated on a notion of confidentiality. And this confidentiality/privacy is essential for businesses to function. For example, businesses transacting with one another may not want the contents of that transaction public to competitors. Likewise, individual financial transactions on public blockchains are at risk from surveillance, data mining, and cyberattacks,” Pruden stated.

Contrary to Pruden’s view, Adrian Brink, co-founder of Namada, argues that blockchain was never truly about privacy.

“I don’t think that blockchain was built on the promise of privacy at all. Bitcoin doesn’t offer any privacy guarantees. The potential for de-anonymization was there from the beginning,” Brink told BeInCrypto.

Read more: Top 7 Privacy Coins in 2024

Experts Claim Zero Knowledge Proof is the Solution

This tension between privacy and transparency raises pivotal questions about the future of blockchain. Can it remain decentralized and secure while compromising on anonymity? Or is privacy still essential to protect users and uphold the technology’s principles?

William Wendt, Head of Ecosystem at Oasis, told BeInCrypto that privacy isn’t a binary choice.

“Often, this issue of privacy vs. transparency is looked at through a binary lens. Either a blockchain is fully transparent or fully anonymous. However, this is not the case. Privacy is a spectrum, and different dApps and users will have different preferences for what level of privacy/transparency they will need,” Wendt said.

According to all three experts, a promising solution lies in zero-knowledge technology, which offers a way for transparency and privacy to coexist. Zero-knowledge proofs (ZKPs) allow for the verification of transactions without revealing underlying data, thus maintaining user privacy while ensuring compliance with laws.

“Historically, transparency was seen as a mechanism to enforce compliance, but it doesn’t have to come at the cost of user privacy. Cryptographic solutions like ZK proofs (ZKP) enable a system where transactions can be “correct by construction” in terms of the law, without revealing the underlying data. This protects user privacy and creates a user interface closer to a bank account/payment app than most Web3 applications today,” Pruden noted.

Brink also supports this nuanced approach, emphasizing that the need for privacy varies by context.

“What you need to share with your local government is going to be different from what you want to share with the world. The key issue is primarily self-sovereignty. We’re moving towards a world where technologies like zero-knowledge cryptography empower users with the choice of what to share. Privacy can coexist with transparency, but the architecture must be thoughtfully designed,” Brink told BeInCrypto.

Read more: What are Zero-Knowledge Proofs? Securing Growth for Web3 Apps

Zero-knowledge cryptography addresses privacy concerns and also meets regulatory requirements, offering a balanced solution that protects individual privacy and fulfills transparency obligations. This technology proves compliance with anti-money laundering (AML) and Know Your Customer (KYC) regulations without disclosing personal information, providing a win-win scenario for all stakeholders.

Due to heightened interest, the zero-knowledge sector is growing. According to data from CoinGecko, the total market capitalization of zero-knowledge coins stands at nearly $13.5 billion.

In conclusion, while blockchain was initially celebrated for its privacy features, the changing environment suggests that both transparency and privacy are necessary for its future. The ongoing development of zero-knowledge cryptography and similar technologies may hold the key to maintaining blockchain’s founding principles while adapting to new regulatory environments.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Nears $80,000; Fuels Death Cross Potential

Bitcoin’s recent price action has shown some concerning signs. The crypto king has failed to break through key resistance levels, leaving it vulnerable to further declines.

As Bitcoin inches closer to testing the $80,000 support level, the potential for a Death Cross looms, increasing bearish sentiment in the market.

Bitcoin Investors Are Skeptical

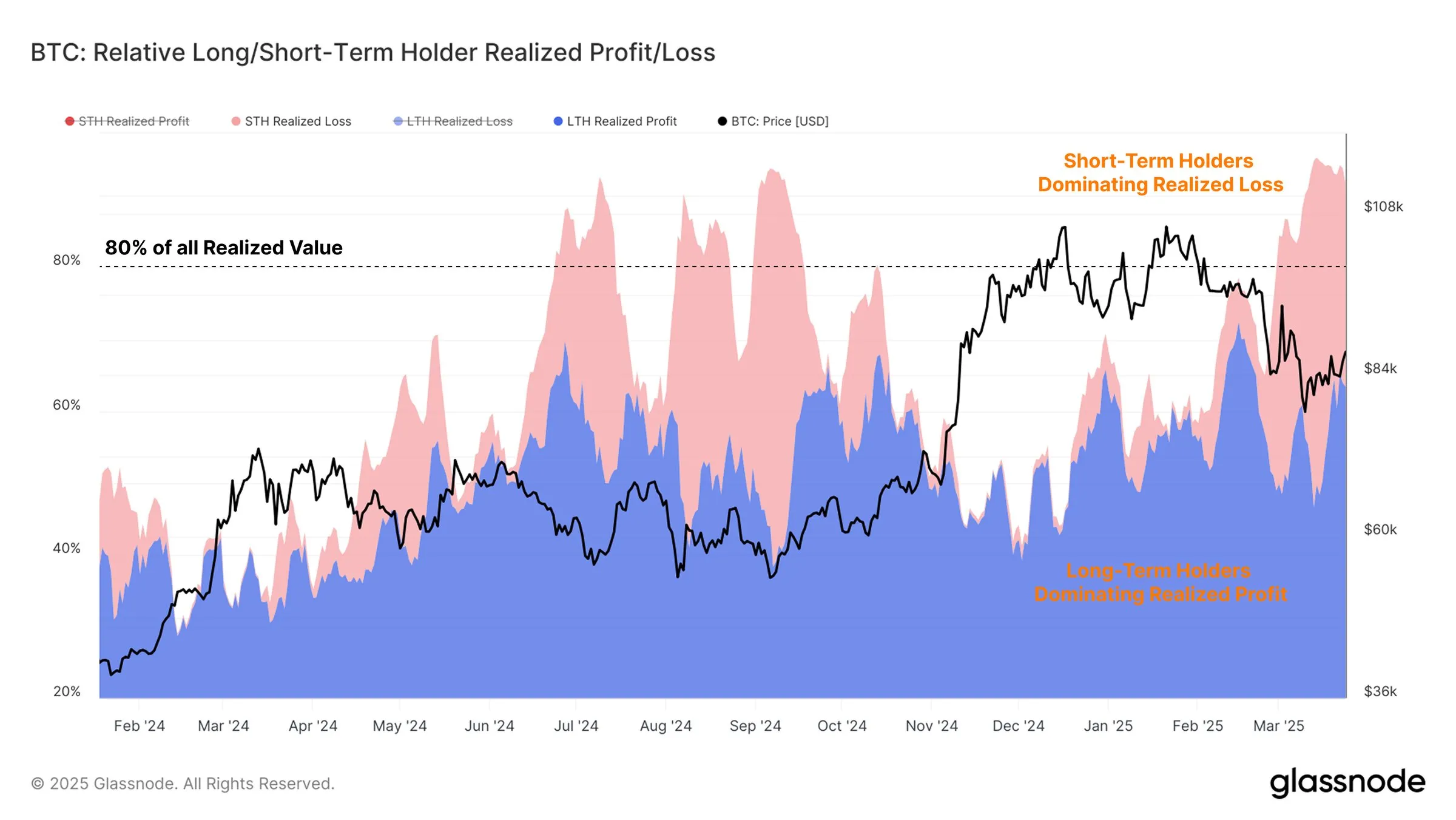

Short-Term Holders (STHs), who buy at higher prices, are primarily responsible for the ongoing losses. These investors have been actively noting losses in response to Bitcoin’s volatile market conditions, reflecting the unpredictable environment that has made it difficult for new investors to navigate.

Meanwhile, Long-Term Holders (LTHs) continue to realize profits, benefiting from their extended market presence. However, the current market conditions show stagnation in new capital inflows, with LTH profits offset by STH losses. This creates weaker demand and resistance, signaling a potential slowdown in price momentum.

Maintaining bullishness in the market typically requires consistent capital inflows, but the market now seems to be lacking that crucial support. The overall sentiment reflects a neutral stance, with both profit-taking and loss-realization balancing out.

The crypto king’s macro momentum is showing additional signs of bearish pressure, particularly with the Exponential Moving Averages (EMAs). The 200-day EMA is less than 3% away from crossing the 50-day EMA, which would result in a Death Cross. This technical pattern has historically signaled significant corrections in price, marking a potential end to Bitcoin’s 18-month-long Golden Cross.

As the EMAs approach this critical point, traders and investors are closely watching for any signs of a correction. The fear of a Death Cross brings further concern to Bitcoin’s price stability. If the 50-day EMA crosses below the 200-day EMA, it could trigger more sell-offs, intensifying the bearish sentiment in the market.

Is BTC Price Primed For Further Decline?

Bitcoin is currently trading at $82,248, nearing the key psychological support level of $80,000. Despite attempts at a breakout, Bitcoin has failed to move beyond the two-month-long broadening descending wedge pattern. This pattern suggests that Bitcoin could be on the brink of further decline.

If the downward momentum persists, Bitcoin is likely to fall through the $80,000 support level and approach $76,741. This scenario would reinforce the bearish outlook, especially considering the technical indicators and the lack of strong buying support. A breakdown below these levels could signal a deeper correction, with the potential for further declines.

However, this short-term bearish thesis can be invalidated if Bitcoin’s price manages to reclaim $82,761 as support. If Bitcoin breaks through the $85,000 barrier, it could break out of the current pattern, signaling a potential reversal. A strong rally above $86,822 would suggest a resumption of the bullish trend, invalidating the bearish momentum that currently dominates the market.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dogecoin (DOGE) Bulls In Trouble—Can They Prevent a Drop Below $0.15?

Dogecoin started a fresh decline from the $0.1880 zone against the US Dollar. DOGE is declining and might test the $0.150 support zone.

- DOGE price started a fresh decline below the $0.1850 and $0.1750 levels.

- The price is trading below the $0.1750 level and the 100-hourly simple moving average.

- There is a key bearish trend line forming with resistance at $0.170 on the hourly chart of the DOGE/USD pair (data source from Kraken).

- The price could extend losses if it breaks the $0.1620 support zone.

Dogecoin Price Dips Further

Dogecoin price started a fresh decline after it failed to clear $0.200, like Bitcoin and Ethereum. DOGE dipped below the $0.1880 and $0.1820 support levels.

The bears were able to push the price below the $0.1750 support level. It even traded close to the $0.1620 support. A low was formed at $0.1628 and the price is now consolidating losses below the 23.6% Fib retracement level of the downward move from the $0.2057 swing high to the $0.1628 low.

Dogecoin price is now trading below the $0.1750 level and the 100-hourly simple moving average. Immediate resistance on the upside is near the $0.170 level. There is also a key bearish trend line forming with resistance at $0.170 on the hourly chart of the DOGE/USD pair.

The first major resistance for the bulls could be near the $0.1730 level. The next major resistance is near the $0.1770 level. A close above the $0.1770 resistance might send the price toward the $0.1850 resistance.

The 50% Fib retracement level of the downward move from the $0.2057 swing high to the $0.1628 low is also near the $0.1850 zone. Any more gains might send the price toward the $0.1880 level. The next major stop for the bulls might be $0.1950.

More Losses In DOGE?

If DOGE’s price fails to climb above the $0.1770 level, it could start another decline. Initial support on the downside is near the $0.1635 level. The next major support is near the $0.1620 level.

The main support sits at $0.1550. If there is a downside break below the $0.1550 support, the price could decline further. In the stated case, the price might decline toward the $0.1320 level or even $0.120 in the near term.

Technical Indicators

Hourly MACD – The MACD for DOGE/USD is now gaining momentum in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for DOGE/USD is now below the 50 level.

Major Support Levels – $0.1620 and $0.1550.

Major Resistance Levels – $0.1720 and $0.1770.

Market

XRP Price Fate Hangs on $2.00—Major Move Incoming?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Ethereum19 hours ago

Ethereum19 hours agoWhales Accumulate 470,000 Ethereum In One Week – Bullish Momentum Ahead?

-

Market22 hours ago

Market22 hours agoWhale Leverages $27.5 Million PEPE Long on Hyperliquid

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Analyst Eyes $1,200-$1,300 Level As Potential Acquisition Zone – Details

-

Bitcoin20 hours ago

Bitcoin20 hours agoGold Keeps Outperforming Bitcoin Amid Trump’s Trade War Chaos

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum May Have Hit Cycle Bottom, But Pricing Bands Signal Strong Resistance At $2,300

-

Market20 hours ago

Market20 hours agoBitcoin (BTC) Whales Accumulate as Market Faces Uncertainty

-

Altcoin19 hours ago

Altcoin19 hours agoAnalyst Reveals Why The XRP Price Can Hit ATH In The Next 90 To 120 Days

-

Market18 hours ago

Market18 hours ago3 Token Unlocks for April: Parcl, deBridge, Scroll