Market

The AI-Powered Trading Bot Anyone Can Use

Editorial Note: The following content does not reflect the views or opinions of BeInCrypto. It is provided for informational purposes only and should not be interpreted as financial advice. Please conduct your own research before making any investment decisions.

The market for cryptocurrencies is certainly full of potential, and at the same time, it can be quite overwhelming as well. Especially for a new entrant, the trends might just be a bit too much changing, coupled with technical jargon.

But what if there was a way to make crypto trading a reality for everybody just by making the process simple? Meet AlgosOne: an AI-driven platform that automates the analysis process and executes successful trades so people of any experience level can confidently partake in the crypto market.

The AlgosOne AI works with a high-power blend of algorithms, including machine and deep learning, to analyze large-scale market data. These include historical patterns, price movements in real-time, news events, and even sentiment on social media.

After studying all the critical areas, AlgosOne points out potentially profitable situations that human traders may fail to notice or analyze due to their limited information-handling abilities. Fueled by state-of-the-art algorithms and a large GPT-4 model that can support up to 500 pages of data within a few minutes, AlgosOne never rests and is always on the lookout for successful trades for you automatically.

Moreover, AlgosOne is not just about stating where trends lie. It goes a step further in customizing a trading strategy to fit what you specifically require. During the registration process, you define your risk settings and investment goals.

That information is then used in defining a customized trading strategy that sees to it that trades are in your comfort zone and toward your financial goals. This way, it is not just throwing in trades but following a data-driven approach optimized for your success.

AlgosOne does it all, from catching emerging trends to predicting a market upsurge: it does all this with unsurpassed accuracy. The testament to the trades the AlgosOne AI suggests is the remarkable 80% success rate that it offers. To see this trading success rate yourself, AlgosOne lets you try out its platform through a 14-day risk-free trial.

AlgosOne’s AI doesn’t operate with a one-size-fits-all approach. It recognizes that different investors have varying levels of experience, risk tolerance, and trading goals. To cater to this

diversity, AlgosOne offers three distinct trading methods, each designed to empower you on your path to success:

- Fully Automated Trading

Ideal for newbies or for anybody who simply does not feel like spending hours reading the market and always wants to capture the perfect trading opportunities. In this, the AI is constantly on the lookout for a successful trade, and as soon as it finds one, it executes the trade. The user will only receive a notification of the trade, and that’s it.

One check that the AI runs before executing a trade is the verification of your selected risk settings. If you select low in the risk settings, then the AI will go for low-leveraged 1x or 2x trades. However, if your risk settings are set high, then the AI will go for 50x, 75x, and even 100x leveraged trades. Holistically, this process allows you to just sit back, relax, and watch your portfolio grow without having to keep an eye on the market from time to time.

- 1-Click Approval Trades

The 1-Click Approval Trades technique is meant for those who are looking to balance automation with control. AlgosOne AI scans the markets, identifies where there is potential for a trade, and then highlights this for you by clearly stating the entry and exit points.

You can approve the trade with just one click if it suits your strategy, or just decline in case you like waiting for a better opportunity to present itself. It empowers you to use the power of AI to make informed decisions while still being in control of your trades.

- Trading Bank Trades

Looking to supercharge your returns? AlgosOne’s innovative Trading Bank Trades are designed to maximize your profits. This feature utilizes referral credits, which you can earn by referring friends to the platform. These credits are then used to execute additional automated trades on top of your daily tier limit. You can find your daily limits in the detailed table below by clicking here.

AlgosOne has recently introduced its innovative approach to wealth accumulation through its savings accounts.

The key to AlgosOne savings accounts lies in their hands-off approach to investing The magic secret about AlgosOne savings accounts is that they are hands-off investments. No more waiting for signals from discord groups and manually putting in those trades or regrets of missing out on golden opportunities.

With AlgosOne’s savings account, all your profits will be used for even more trades and they will keep on compounding with every trade. The withdrawal time is about 12 to 36 months, so you can have an impressive and sizable investment portfolio.

But maybe the most compelling feature of AlgosOne Savings Accounts is their unwavering commitment to long-term growth. First of all, they are registered with the EU to ensure the reliability and security of the platform.

Secondly, they have established the AlgosOne Reserve Fund for anyone who suffers losses due to any error or hacking attack. Lastly, the upcoming Algosone is going to launch its own token, which will further strengthen the whole community and project for long-term success.

For a limited time, you can try out AlgosOne yourself through a two-week risk-free trial!

AlgosOne isn’t just about making trading easier. It is going to tokenize its AI and the users have the possibility to own part of the AI core. With the tokenization of the platform, it is going to bring the AI ownership to its users.Here’s how the AlgosOne token empowers you:

- Let your tokens work for you! AlgosOne plans to distribute regular dividends from its profits to token holders. This means you can earn a steady stream of passive income simply by holding onto your tokens. (Note: The specific frequency of these dividends is not publicly available yet. Be sure to check the AlgosOne website for the latest information.)

- The AlgosOne token has a limited supply. With increasing value across different sale stages (pre-sale, public rounds), the token might hold the potential for significant growth.

Visit the AlgosOne website today to learn more about the AI app that is advancing constantly. You can use the 14-day free trial and see how the AI works.

Disclaimer

This article is sponsored content and does not represent the views or opinions of BeInCrypto. While we adhere to the Trust Project guidelines for unbiased and transparent reporting, this content is created by a third party and is intended for promotional purposes. Readers are advised to verify information independently and consult with a professional before making decisions based on this sponsored content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

What to Expect on May 7

The highly anticipated Pectra upgrade will launch on the Ethereum (ETH) mainnet on May 7, 2025, after overcoming a series of technical challenges and delays in the testnet phase.

Ethereum developers announced the date during the All Core Developers Consensus (ACDC) meeting on April 3, 2025.

Pectra Upgrade Countdown Begins

The upgrade was initially slated for a tentative mainnet launch on April 30. However, Ethereum developers have postponed the launch by one week.

“We’ll go ahead and lock in May 7 for Pectra on mainnet,” Ethereum Foundation researcher Alex Stokes said.

In preparation for this, Stokes confirmed that client releases will be made available by April 21, ensuring that all users have the necessary updates and tools ahead of the mainnet launch. On April 23, a detailed blog post outlining the Pectra mainnet will be published.

The Pectra upgrade will introduce 11 Ethereum Improvement Proposals (EIPs) to enhance various aspects of the network. Notably, three EIPs are dedicated to improving the validator experience.

The first is EIP-7251. This will increase the staking limit for validators from 32 ETH to 2,048 ETH per validator. This change aims to enhance capital efficiency for large stakers and staking pools.

“This simplifies the staking experience, allowing users to manage multiple validators under one node instead of several,” an analyst remarked.

Moreover, EIP-7002 introduces execution-layer triggerable withdrawals, giving validators more control. Meanwhile, EIP-6110 reduces the deposit processing delay from about 9 hours to just 13 minutes.

The upgrade will also include EIP-7702, a major step toward account abstraction. It allows Externally Owned Accounts (EOAs) to gain smart contract functionality while maintaining simplicity. This enables features like transaction batching, gas sponsorship (where third parties pay fees), passkey-based authentication, spending controls, and asset recovery mechanisms.

Finally, the upgrade increases blob capacity through EIP-7691. In addition, EIP-7623 helps manage the increased bandwidth requirements. These updates aim to make Ethereum more scalable, efficient, and user-friendly.

It is worth noting that the road to the mainnet launch has not been without hurdles. Two previous tests on the Holesky and Sepolia test networks failed to finalize properly. However, Pectra achieved full finalization on the Hoodi testnet on March 26, marking a significant milestone toward the successful deployment of the upgrade.

Despite the technical progress, ETH continues to face market challenges.

Data from BeInCrypto shows that ETH dropped 4.8% over the past week, with weekly losses extending to 17.1%. At the time of writing, the altcoin was trading at $1,822, reflecting a small daily gain of 0.8%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Futures and Illinois Lawsuit Relief

Coinbase filed with the US Commodity Futures Trading Commission (CFTC) to launch futures contracts for Ripple’s XRP token.

The move comes after a positive development for the crypto derivatives market in the US, reflecting shifting regulatory ties in the country.

Coinbase Files for XRP Futures Trading With CFTC

Coinbase Derivatives has submitted a filing to self-certify XRP futures. It will provide a regulated, capital-efficient means for market participants to gain exposure to XRP. The new contract could go live as soon as April 21.

“We’re excited to announce that Coinbase Derivatives has filed with the CFTC to self-certify XRP futures – bringing a regulated, capital-efficient way to gain exposure to one of the most liquid digital assets. We anticipate the contract going live on April 21, 2025,” read the announcement.

Meanwhile, the official filing indicates that the XRP futures contract will be a monthly cash-settled and margined contract trading under the symbol XRL.

Each contract represents 10,000 XRP and will be settled in US dollars. Trading will be available for the current month and two subsequent months. As a protective measure, trading will be temporarily halted if the spot XRP price moves more than 10% within an hour.

The Coinbase Exchange also confirmed that it has engaged with Futures Commission Merchants (FCMs) and other market participants. Both references reportedly expressed support for the launch.

However, Coinbase is not the first US-based exchange to introduce regulated XRP futures. In March, Chicago-based Bitnomial launched what it advertised as the country’s first CFTC-regulated XRP futures contract.

For Coinbase, however, the boldness comes after the CFTC eased key regulatory hurdles for crypto derivatives trading. As BeInCrypto reported, this signaled a more accommodating stance towards the sector.

“Pursuant to Commodity Futures Trading Commission (“CFTC” or “Commission”) Regulation 40.2(a), Coinbase Derivatives, LLC (the “Exchange” or “COIN”) hereby submits for self-certification its initial listing of the XRP Futures contract to be offered for trading on the Exchange…,” an excerpt in the filing indicated.

This suggests that the commodities regulator’s shift, revoking previous crypto-related guidelines, may boost institutional confidence. For XRP, this development bolsters confidence in the asset’s previously contentious status following Ripple’s recent regulatory breakthrough.

“Coinbase Derivatives’ filing with the CFTC to self-certify XRP futures aims to legitimize XRP trading by offering a regulated, capital-efficient product for investors,” one user remarked.

The futures contract might also help the odds of XRP ETF approval. Recently, the SEC delayed several applications to create one, and its status is in limbo.

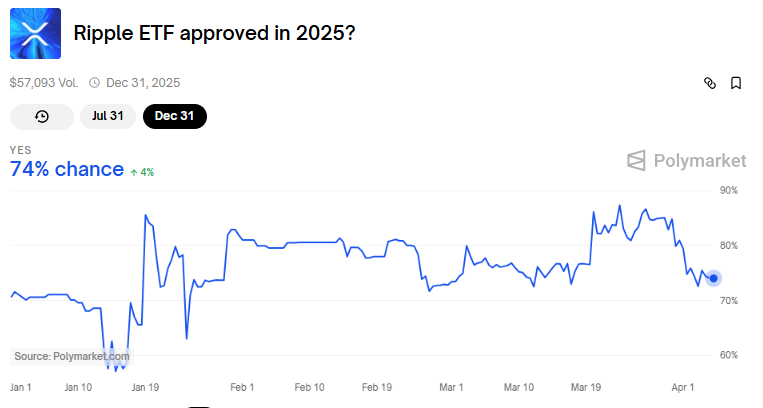

Data on Polymarket shows bettors see a 74% chance for XRP ETF approval in 2025 and a more modest 34% by July 31.

Regulatory and Legal Developments Favor Coinbase

Elsewhere, the timing of this filing aligns with recent favorable regulatory developments for Coinbase. Reports suggest Illinois intends to drop its lawsuit against the exchange over its staking services.

Up to 10 states filed a lawsuit against Coinbase in June 2023 alleging that its staking program constituted unregistered securities offerings.

This recent development makes Illinois the fourth state to withdraw legal action against Coinbase. Vermont, South Carolina, and Kentucky also dismissed their cases on March 13, 27, and 31, respectively.

However, the cases remain active in Alabama, California, Maryland, New Jersey, Washington and Wisconsin.

These legal retreats coincide with the US SEC’s (Securities and Exchange Commission) February decision to abandon its federal lawsuit against Coinbase. BeInCrypto reported that this development marked a broader shift in the regulatory approach under the current administration.

“Regulators are losing steam, and Coinbase is stacking quiet courtroom wins. Staking’s future in the US might just be back on track,” a user commented.

Illinois’ decision to drop its lawsuit comes as the state advances a Bitcoin strategic reserve bill. Specifically, Illinois State Representative John M. Cabello introduced House Bill 1844 (HB1844), highlighting Bitcoin’s potential as a decentralized, finite digital asset.

“A strategic bitcoin reserve aligns with Illinois’ commitment to fostering innovation in digital assets and providing Illinoisans with enhanced financial security,” the bill read.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dogecoin (DOGE) Bleeds Further—Fresh Weekly Lows Test Investor Patience

Dogecoin started a fresh decline from the $0.180 zone against the US Dollar. DOGE is consolidating and might struggle to recover above $0.1680.

- DOGE price started a fresh decline below the $0.1750 and $0.170 levels.

- The price is trading below the $0.1680 level and the 100-hourly simple moving average.

- There was a break below a key bullish trend line forming with support at $0.170 on the hourly chart of the DOGE/USD pair (data source from Kraken).

- The price could extend losses if it breaks the $0.1550 support zone.

Dogecoin Price Dips Again

Dogecoin price started a fresh decline after it failed to clear $0.180, like Bitcoin and Ethereum. DOGE dipped below the $0.1750 and $0.1720 support levels.

There was a break below a key bullish trend line forming with support at $0.170 on the hourly chart of the DOGE/USD pair. The bears were able to push the price below the $0.1620 support level. It even traded close to the $0.1550 support.

A low was formed at $0.1555 and the price is now consolidating losses. There was a minor move above the 23.6% Fib retracement level of the downward move from the $0.180 swing high to the $0.1555 low.

Dogecoin price is now trading below the $0.170 level and the 100-hourly simple moving average. Immediate resistance on the upside is near the $0.1650 level. The first major resistance for the bulls could be near the $0.1680 level. It is near the 50% Fib retracement level of the downward move from the $0.180 swing high to the $0.1555 low.

The next major resistance is near the $0.1740 level. A close above the $0.1740 resistance might send the price toward the $0.180 resistance. Any more gains might send the price toward the $0.1880 level. The next major stop for the bulls might be $0.1950.

Another Decline In DOGE?

If DOGE’s price fails to climb above the $0.170 level, it could start another decline. Initial support on the downside is near the $0.160 level. The next major support is near the $0.1550 level.

The main support sits at $0.150. If there is a downside break below the $0.150 support, the price could decline further. In the stated case, the price might decline toward the $0.1320 level or even $0.120 in the near term.

Technical Indicators

Hourly MACD – The MACD for DOGE/USD is now losing momentum in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for DOGE/USD is now above the 50 level.

Major Support Levels – $0.1600 and $0.1550.

Major Resistance Levels – $0.1680 and $0.1740.

-

Market19 hours ago

Market19 hours agoBitcoin’s Future After Trump Tariffs

-

Market24 hours ago

Market24 hours agoIP Token Price Surges, but Weak Demand Hints at Reversal

-

Altcoin22 hours ago

Altcoin22 hours agoJohn Squire Says XRP Could Spark A Wave of Early Retirements

-

Market22 hours ago

Market22 hours ago10 Altcoins at Risk of Binance Delisting

-

Market20 hours ago

Market20 hours agoEDGE Goes Live, RSR Added to Roadmap

-

Regulation18 hours ago

Regulation18 hours agoUS Senate Banking Committee Approves Paul Atkins Nomination For SEC Chair Role

-

Altcoin23 hours ago

Altcoin23 hours agoMovimiento millonario de Solana, SOLX es la mejor opción

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Trading In ‘No Man’s Land’, Breakout A ‘Matter Of Time’?