Market

Strategy and Metaplanet Buy Bitcoin Despite Recession Fears

Despite recent chaos and fears of a recession, public companies Strategy and Metaplanet are doubling down on new Bitcoin purchases. Strategy purchased BTC worth $285 million, while Metaplanet spent $26.3 million.

Metaplanet’s activity is particularly noteworthy because Japan’s 30-year treasury yields are soaring. For public companies in Japan, conventional economic practice is to pull back from the dollar, but committing to Bitcoin is a bold strategy.

Strategy (formerly MicroStrategy) is one of the world’s largest Bitcoin holders, and it’s been going through a chaotic period. In recent weeks, it has alternated between massive BTC purchases and abrupt acquisition pauses, prompting a great deal of speculation.

Today, however, its Chair, Michael Saylor, announced a major new Bitcoin buy at $285 million:

“Strategy has acquired 3,459 BTC for ~$285.8 million at ~$82,618 per bitcoin and has achieved BTC Yield of 11.4% YTD 2025. As of 4/13/2025, Strategy holds 531,644 BTC acquired for ~$35.92 billion at ~$67,556 per bitcoin,” Saylor claimed via social media.

A lot of this chaos is due to fears of a US recession, which has made the price of Bitcoin swing wildly. When Bitcoin was down, it prompted speculation that MicroStrategy may have to dump its assets.

However, since BTC has started to recover, Michael Saylor’s firm is back on the market.

Critically, Strategy isn’t alone in its Bitcoin acquisitions. Metaplanet is a Japanese firm with substantial BTC holdings and ambitions to acquire even more.

Two days before Strategy made its own major purchase, Metaplanet CEO Simon Gerovich announced a similar investment:

“Metaplanet has acquired 319 BTC for ~$26.3 million at ~$82,549 per bitcoin and has achieved BTC Yield of 108.3% YTD 2025. As of 4/14/2025, we hold 4525 BTC acquired for ~$386.3 million at ~$85,366 per bitcoin,” Gerovich claimed.

Metaplanet’s commitment here is particularly noteworthy because it contradicts near-term macroeconomic headwinds. The global market is filled with risk-averse behavior right now, and Japan’s 30-year bond yields surged to the highest level in over two decades.

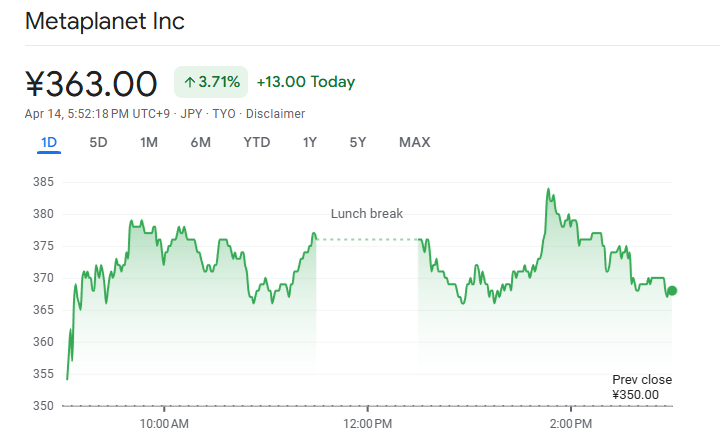

Despite this clear signal, the Japanese Metaplanet is continuing to make major Bitcoin investments. The latest purchases also had a positive impact on the company’s stock market. It’s currently up by 3% today, after suffering notable losses the past month.

In short, major corporate Bitcoin holders like Strategy and Metaplanet aren’t interested in tapering off yet. Despite the recent chaos, there is serious confidence that BTC will either gain in price or represent a stable store of value.

Either way, when public firms like this publicly take a bullish stance, it can shore up confidence across the entire market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

New USDi Stablecoin Pegged to US Inflation Metrics

A group of veteran derivatives and FX traders in the US are launching USDi, a stablecoin designed to adjust its price in line with inflation. Its value will change regularly based on Consumer Price Index (CPI) data and the performance of Treasury Inflation-Protected Securities (TIPS).

Founder Michael Ashton aims to offer an asset that maintains purchasing power by minimizing exposure to inflation risk. However, with intense competition in the stablecoin market, USDi will need strong early traction to carve out its place.

A Stablecoin To Beat Inflation?

Stablecoins are in the spotlight right now, with friendly US regulation spurring a potential boom in trading volumes. Given the current pro-regulatory environment in the US and growing adoption, many new players are innovating.

Today, derivatives trader Michael Ashton announced USDi, a stablecoin built to fight inflation.

“The riskless asset doesn’t actually currently exist, and that’s inflation-linked cash. Holding cash is an option on future opportunities, and the cost of that option is inflation. If you create inflation-linked cash, that’s the end of the risk line,” Ashton claimed.

Investors have been using crypto to hedge against inflation for years, but USDi is a novel approach to the problem. Ashton joined two co-founders, an FX veteran, and a technical specialist, to create the firm USDi Partners LLC.

USDi is a stablecoin that is correlated with the dollar but isn’t pegged to it. Instead, it will loosely orbit the dollar, but its value will fluctuate alongside US inflation.

That prospect may seem convoluted, but a simple system defines the stablecoin’s value. Essentially, Ashton claimed that USDi would rise in accordance with regular CPI reports, calculating the total inflation since a predetermined start date.

This date is December 2024, so it’s still quite close to the dollar. Today, for example, USDi’s price is $1.00863.

The novel stablecoin is inspired by the Treasury Inflation-Protected Securities (TIPS), a government bond designed to protect against inflation. Since CPI reports only happen once per month, Ashton will adjust USDi’s price in accordance with more frequent data used by TIPS investors.

To maintain this system, Ashton will manage a fund that acts as the stablecoin’s reserves. USDi Partners will mint and burn tokens according to the daily level of inflation, plus a small transaction fee.

Only accredited investors can partake in the initial launch, but USDi Partners hasn’t announced an official release date.

In short, USDi seems like a unique approach to the crypto economy, but the stablecoin market is full of competition. Ideally, Ashton and his co-founders will be able to get some early traction to get this project off the ground.

If it proves successful, it can help demonstrate the versatility of crypto’s practical applications.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Eyes $90,000, But Key Resistance Levels Loom

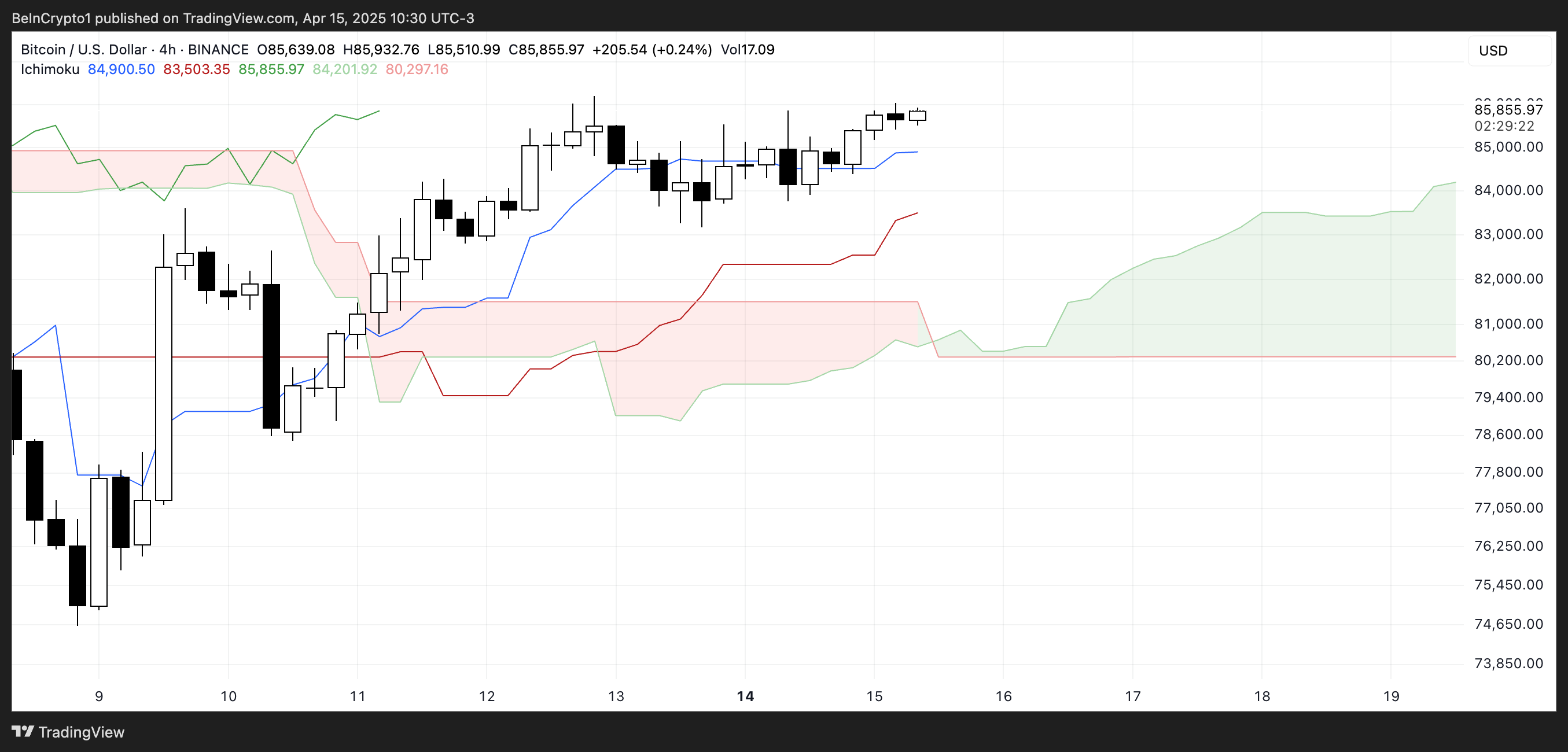

Bitcoin (BTC) is up 9% over the past week and is currently trying to establish support above the key $88,000 level. Momentum indicators like the DMI and Ichimoku Cloud are showing clear bullish signals, with buyers firmly in control.

If this trajectory continues, BTC could soon test higher resistances near $88,000 and potentially aim for $90,000 and beyond. However, analysts warn that renewed uncertainty around Trump’s trade tariffs could disrupt the rally and trigger a pullback toward the $81,000 support zone.

Bitcoin DMI Show Buyers In Full Control

Bitcoin’s DMI chart shows a notable rise in trend strength, with the ADX climbing to 29.54 from 24.07 yesterday.

This increase suggests growing momentum behind the current move, pushing the ADX close to the 30 threshold—widely seen as confirmation of a strong, sustained trend.

A rising ADX doesn’t indicate direction on its own, but when paired with directional indicators, it helps identify the prevailing force in the market.

Looking at those directional indicators, the +DI is currently at 23.47 and has remained steady between 21 and 23 over the past two days.

Meanwhile, the -DI has dropped sharply to 9.45 from 16.65, signaling a significant decline in bearish pressure.

This widening gap between bullish and bearish momentum points to buyers taking control, and if the ADX continues to rise above 30, it could validate a new bullish phase for BTC.

BTC Ichimoku Cloud Shows A Clear Bullish Structure

Bitcoin’s Ichimoku Cloud chart continues to lean bullish, with price holding firmly above both the Tenkan-sen (blue line) and Kijun-sen (red line).

This positioning suggests that both short-term and medium-term momentum remains in favor of buyers.

The flat nature of the Kijun-sen could act as a strong support area, while the rising Tenkan-sen shows buyers are still active on smaller timeframes.

Looking ahead, the Kumo (cloud) is green and steadily rising, which reinforces a positive outlook for the coming sessions. The price is well above the cloud, indicating the trend is bullish and also firmly established.

There’s also a clear gap between the current candle and the cloud, suggesting that the market has room to retrace without shifting the overall structure.

As long as the price stays above the Kijun-sen and the cloud remains green, the bullish trend remains technically intact.

Will Bitcoin Break Above $90,000 Soon?

If Bitcoin price maintains its current momentum, it could soon challenge the resistance at $88,839, with $90,000 as a psychological milestone.

Should the uptrend remain strong, further targets lie at $92,920 and potentially $98,484, marking a continuation of the bullish structure.

However, crypto analyst and Coin Bureau founder Nic Puckrin warns that this momentum could be short-lived. He notes that renewed uncertainty around Trump’s trade tariffs might weigh on BTC:

“The caveat here is that all this positive momentum could disappear in a puff of smoke if there’s any backpedalling on tariffs or an unexpected shock announcement – which we all know is always a possibility. In fact, we continue to have constant back-and-forth on tariffs: exemptions on electronics turned out to be temporary, the details of when tariffs will come in are lacking, and so on,” Puckrin told BeInCrypto.

He also defends that the $81,000 support could be tested again:

“This, perhaps, explains why Bitcoin is, once again, in a “wait and see” pattern, with low liquidations at under $200 million pointing to uncertainty in the market. If we don’t see any external shocks, $88,000-$90,000 is the next range to watch, with liquidity pool clusters at this level suggesting we will see an uptick of volatility here. However, a short-term correction to re-test support at $81,000 would be healthy and, as long as BTC remains above this threshold, would even point to a sustainable price recovery,”

Overall, it looks like the current macroeconomic factors are priced in. Yet, the market is cautious about sudden surprises, as Trump’s recent tariffs went beyond any conventional economic trend and disrupted almost every global financial market.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Axiom Leads Solana Trading Bots

The meme coin market is full of surprises, as new trends emerge with every passing day, and the past few days have not disappointed. As the demand for trading bots grows, Solana, being a hotspot for meme coins, has noted the emergence of Axiom as the next big thing.

BeInCrypto has analyzed two other meme coins for investors to watch as they attempt to recover their recent losses.

Animecoin (ANIME)

- Launch Date – January 2025

- Total Circulating Supply – 5.53 Billion ANIME

- Maximum Supply – 10 Billion ANIME

- Fully Diluted Valuation (FDV) – $195.39 Million

ANIME’s price surged by 31% in the last 24 hours, trading at $0.019. The meme coin is now approaching the $0.020 resistance, which it failed to secure in the previous month. This resistance level is crucial for continuing its recent momentum and sustaining upward movement.

If ANIME maintains its current bullish momentum and flips $0.020 into support, it could target the next resistance level at $0.023. A successful breach of this level would indicate a strong uptrend and potentially lead to further price increases, attracting additional investor interest.

However, if broader market conditions fail to support this bullish outlook, ANIME could face a decline. A drop below the $0.017 support would suggest a reversal, with the possibility of the price falling to $0.015, invalidating the bullish thesis and signaling a potential further downturn.

Brett (BRETT)

- Launch Date – May 2023

- Total Circulating Supply – 9.91 Billion BRETT

- Maximum Supply – 10 Billion BRETT

- Fully Diluted Valuation (FDV) – $375.52 Million

Another one of the meme coins to watch, BRETT, has shown significant growth, posting a 46% increase in the last seven days. This strong performance has brought the meme coin to $0.036 despite the dominance of other meme coins in the market. BRETT’s price action shows potential for further growth if key resistance levels are breached.

However, BRETT is now facing resistance at $0.038, a level it failed to breach in March. If the meme coin can successfully break through this barrier, it may rise to $0.042, reaching a new monthly high and signaling continued upward momentum, attracting investor interest.

On the other hand, if BRETT fails to breach $0.038 again, the price could retreat towards $0.030. This would invalidate the current bullish outlook, erasing much of the recent gains and suggesting the meme coin may struggle to maintain its upward momentum in the short term.

Small Cap Corner – Axiom

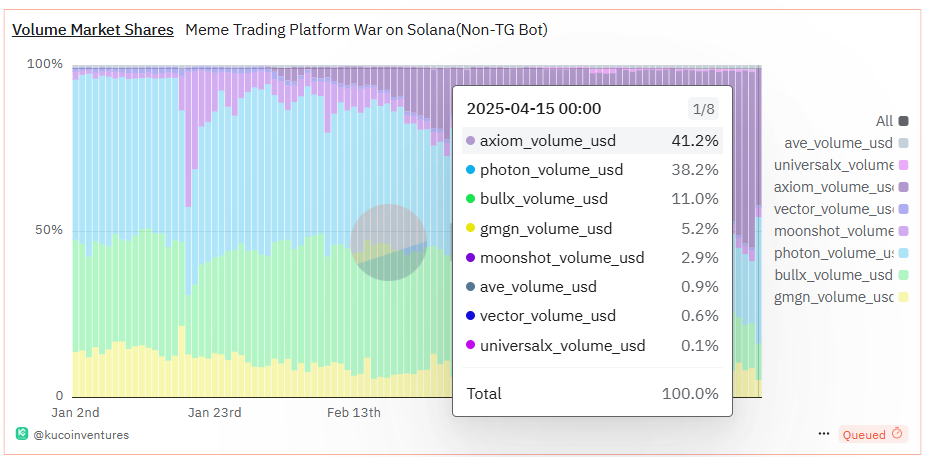

Axiom, although not a meme coin, has caught the attention of meme coin enthusiasts. This Solana-based trading bot recently saw a surge in demand, making it the largest bot on the platform, surpassing established bots like Photon, BullX, and GMGN.

Axiom’s success is impressive, recently surpassing $100 million in daily trading volume and commanding 41% of Solana’s entire trading bot volume. The rise of bots for speculative trading offers a convenient solution, and Axiom adds to this trend with its one-tap functionality for executing complex trades.

The growing reliance on bots for speculative trading, especially when it comes to meme coins, provides an easier path for investors. As meme coin investments are often driven by volatility, Axiom offers a middle ground for users seeking to trade these assets effectively. Given the increasing interest, Q2 could see a surge in trading bots, making it essential for meme coin enthusiasts to explore these tools.

However, speculative trading, particularly with meme coins, carries inherent risks. BeInCrypto strongly advises to DYOR before diving into such investments.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoBinance Futures Causes a Brief Crash For Story (IP) and ACT

-

Market21 hours ago

Market21 hours agoIs The XRP Price Mirroring Bitcoin’s Macro Action? Analyst Maps Out How It Could Get To $71

-

Market24 hours ago

Market24 hours agoXRP Jumps 22% in 7 Days as Bullish Momentum Builds

-

Market22 hours ago

Market22 hours agoOndo Finance (ONDO) Rises 3.5% Following MANTRA Crash

-

Market18 hours ago

Market18 hours agoBitcoin Price Eyes Bullish Continuation—Is $90K Within Reach?

-

Market10 hours ago

Market10 hours agoCan Pi Network Avoid a Similar Fate?

-

Altcoin18 hours ago

Altcoin18 hours agoExpert Urges Pi Network To Learn From The OM Crash Ahead Of Open Mainnet Transition

-

Market13 hours ago

Market13 hours agoXRP Price Could Regain Momentum—Is a Bullish Reversal in Sight?