Market

Stellar (XLM) Price Nears Death Cross; Recovery Looks Uncertain

Stellar (XLM) has been experiencing a prolonged downtrend for nearly three months. Despite some attempts at recovery, the altcoin faces significant hurdles ahead.

This is due to a potential breakout above the $0.325 resistance looking increasingly unlikely. Given current market conditions, the price may continue to struggle.

Stellar Faces A Death Cross

Stellar’s price action is currently being influenced by the approaching Death Cross, a bearish signal in technical analysis. The 200-day Exponential Moving Average (EMA) is closing in on crossing over the 50-day EMA, which would mark the second Death Cross for Stellar this year. The previous crossover occurred in April 2024, and this new cross could further signal weakening price momentum for the altcoin.

The potential Death Cross suggests a shift toward more sustained selling pressure. This could prevent any breakout above the $0.30 level and potentially push the price lower.

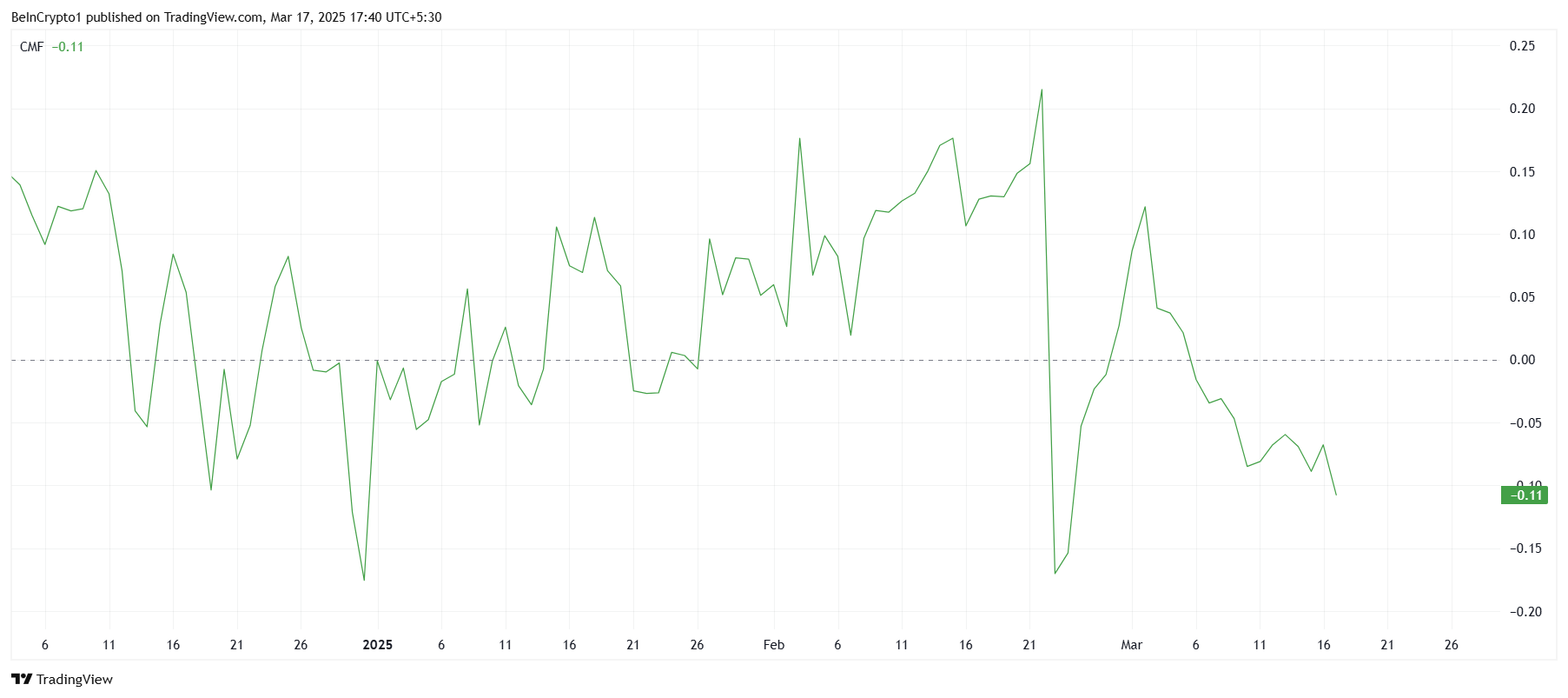

The overall macro momentum of Stellar is also reflecting a bearish outlook. The Chaikin Money Flow (CMF) indicator, which tracks the accumulation and distribution of assets, shows a sharp downtick this month. Currently, well below the zero line, this suggests that outflows are dominating inflows, indicating that investors are pulling their money out of XLM.

This outflow trend reflects growing bearish sentiment among investors, which tends to exacerbate the asset’s struggle to recover. Without an influx of buying pressure, XLM may find it difficult to regain upward momentum.

XLM Price Aims At Break Out

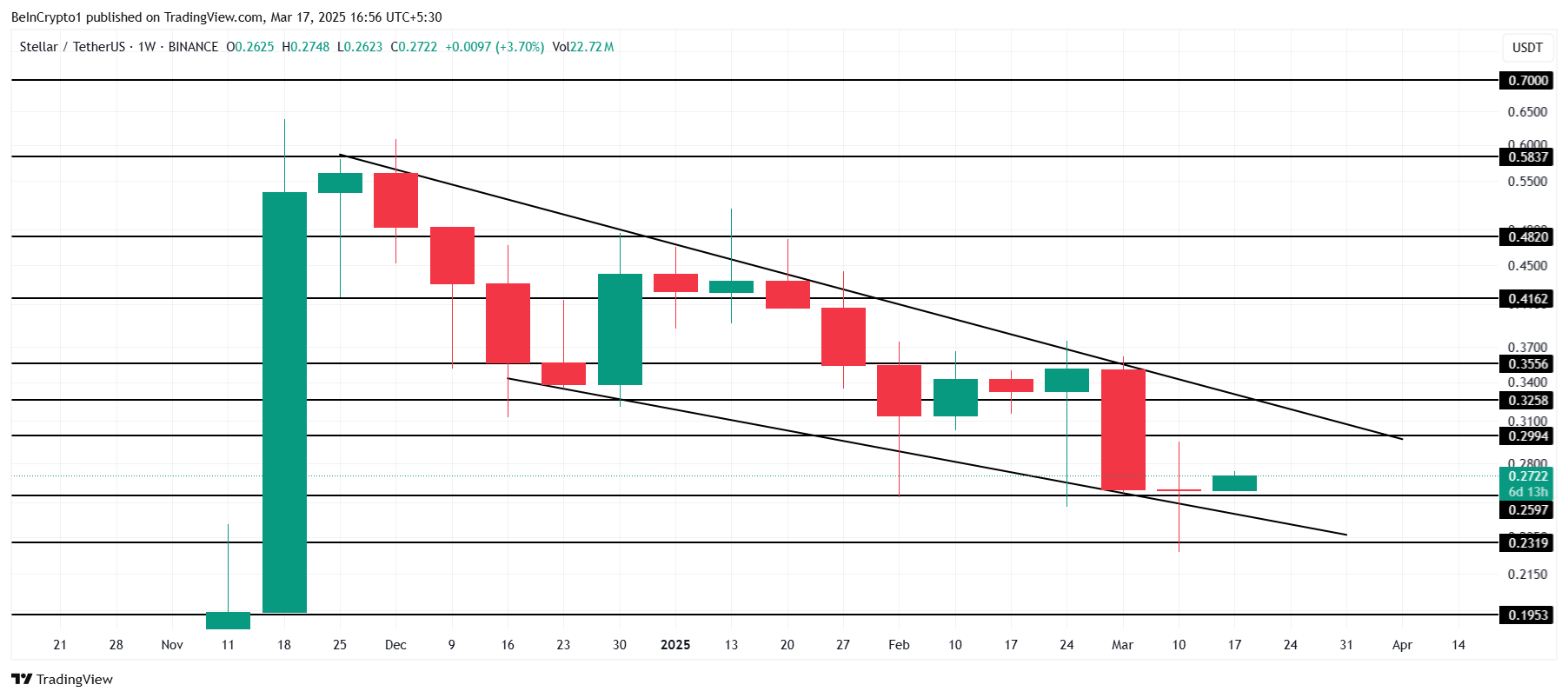

At the time of writing, XLM is trading at $0.272, holding above its support at $0.259. The altcoin has been moving within a descending wedge for the past three months, but given the current market conditions, a breakout from this pattern in the near term seems unlikely. The ongoing Death Cross and bearish market sentiment will likely keep XLM in this range.

As long as XLM remains consolidated under $0.299, it could face further declines. If the altcoin falls below $0.259, it might test $0.231 or lower. The formation of a Death Cross could trigger additional selling pressure, further confirming the bearish outlook for Stellar in the coming days.

For the bearish thesis to be invalidated, XLM would need to breach $0.299 and push past the $0.325 resistance level. A successful breakout above $0.355 could signal a reversal and allow the altcoin to move beyond the current downtrend, but such a scenario would require a shift in market sentiment and investor confidence.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Mantra’s OM Token Surges 25% After Token Burn Announcement

After suffering a historic price collapse, Mantra’s OM is making a remarkable comeback. The altcoin plunged over 90% on April 13, falling from $6.30 to under $0.50 in hours.

However, it has bounced back with a 25% gain over the past 24 hours. OM is currently the market’s top gainer and is poised to extend its gains in the short term.

OM Leads Market Gains With a 25% Jump

The sudden resurgence in investor interest in OM comes after an April 15 X post from Mantra CEO John Patrick Mullin, announcing plans to burn the team’s token allocation.

While plans for the token burn are still being finalized, Mullin’s announcement has calmed market fears and revived bullish sentiment among some traders. This renewed confidence has prompted increased OM accumulation, driving the token’s price up by over 25% in the past 24 hours.

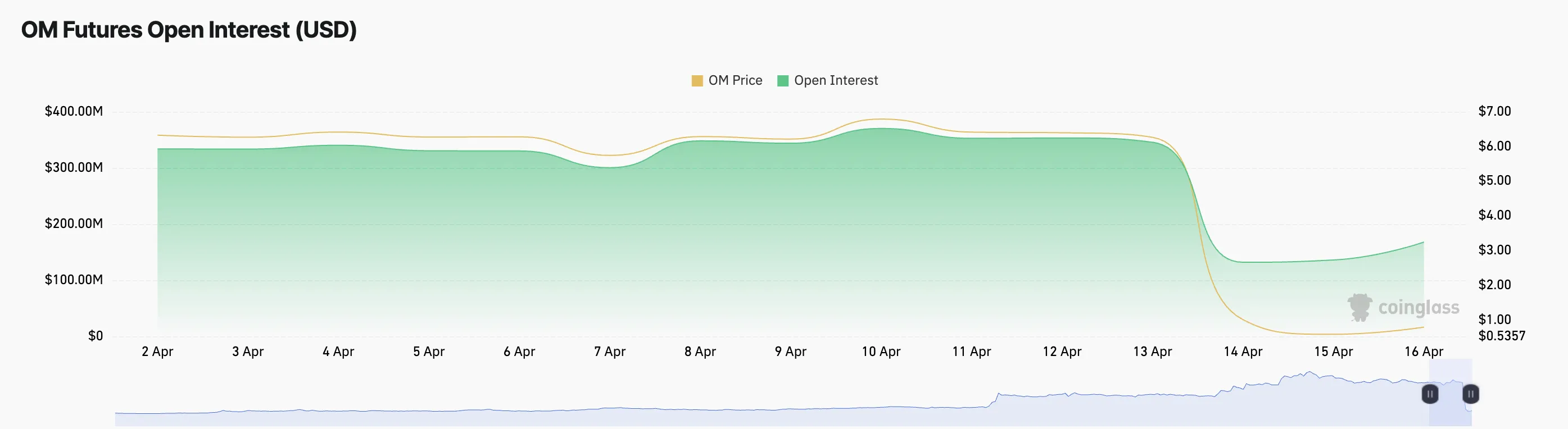

Key on-chain and market metrics support the rebound narrative. For example, the token’s open interest has risen sharply by 9%, indicating a surge in fresh capital entering OM positions in the past 24 hours.

As of this writing, this stands at $156.74 million. When an asset’s open interest climbs alongside its price like this, it signals that new money is entering the market and that traders are opening fresh positions in the direction of the uptrend.

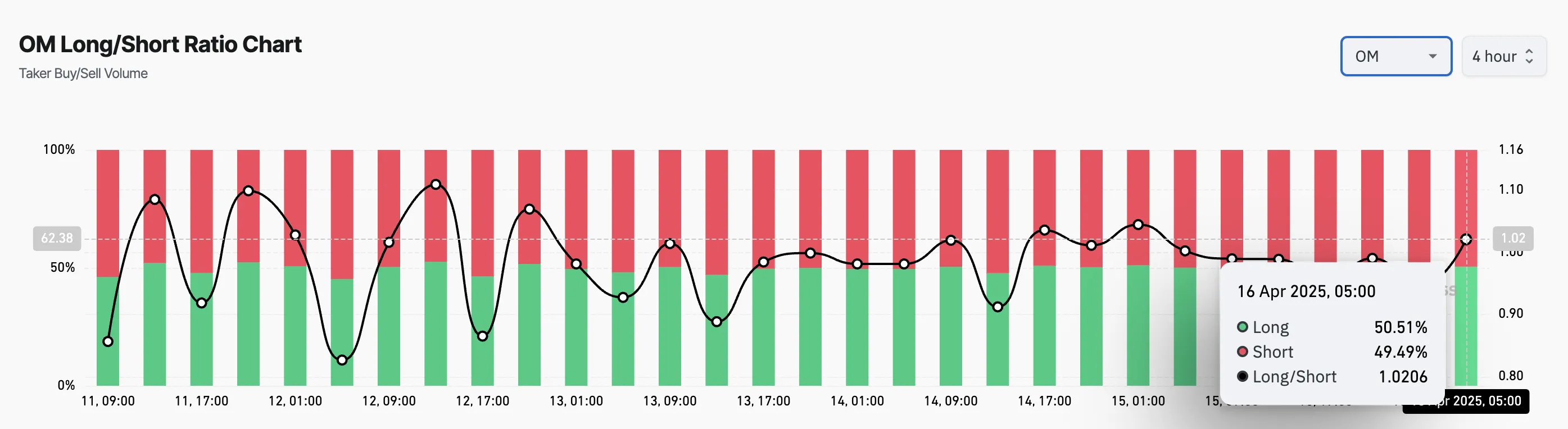

Moreover, OM’s long/short ratio confirms this. As of this writing, it is currently at 1.02, highlighting the preference for long positions among futures traders.

An asset’s long/short ratio measures the proportion of its long positions to short ones in the market.

A ratio above one like this means there are more positions betting on a sustained OM price rally than those opened in favor of a decline.

Next Stop $2.64 or Back to January’s $0.09 Lows?

At press time, OM trades at $0.78, climbing 29% from April 13’s low of $0.50. With the gradual uptick in its buying pressure, the altcoin could maintain its current rally to trade at $2.64.

However, if the bears regain market control and increase the downward pressure on OM, it could extend its decline and fall to $0.09, a low it last reached in January 2024.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BNB Burn Reduces Circulating Supply by $916 Million

Binance co-founder Changpeng Zhao (CZ) announced a major deflationary milestone, confirming the completion of BNB Chain’s 31st quarterly token burn.

In total, 1.57 million BNB, valued at approximately $916 million, was permanently removed from circulation.

BNB Chain Burns $916 Million Worth of Tokens in 31st Quarterly Event

The BNB burn is part of BNB Smart Chain’s long-running commitment to reduce the token’s total supply and potentially bolster long-term value.

According to an official blog post, this quarter’s burn was completed successfully. The remaining total supply of BNB stands at just over 139 million. Former Binance CEO Changpeng Zhao echoed the update with a simple post on X (Twitter).

“$916,000,000 BNB burned,” CZ wrote.

They sent the tokens to a burn address, 0x000…dEaD, making them unrecoverable and effectively reducing the total supply.

The burn occurred under BNB’s Auto-Burn mechanism and marks one of the largest events in the chain’s history. Established under BEP95, BNB’s Auto-Burn system provides transparency and predictability. It adjusts the burn amount based on BNB’s market price and the number of blocks generated on the BNB Smart Chain (BSC) each quarter.

The goal is gradually reducing the token’s circulating supply to 100 million BNB. Once this happens, regular burns will cease.

Deflationary mechanisms are typically bullish, but the market reaction was tepid. BNB’s price slipped 2.11% over the past 24 hours, trading around $578.04 as of this writing.

Impact of BNB Burn on Market Sentiment

The muted response mirrors the aftermath of the 30th burn, suggesting that even billion-dollar reductions in supply are not enough to overcome broader market sentiment or investor fatigue. Meanwhile, community members expressed mixed feelings about the event.

“It actually pains me sometimes to see BNB burns! I know it’s part of the deflationary process… but it still hurts brother CZ,” crypto advocate Shahzad Quadri commented.

Meanwhile, others questioned the utility of such a large burn. Users asked CZ why the BNB chain did not redirect the funds toward marketing efforts.

“It’s not up to me. It was in the whitepaper. A promise is a promise,” CZ replied.

This statement resonated with community leaders, including a MEXC exchange KOL, who responded in a post.

“Saw people wishing it wasn’t burnt. The only way is burning because if it is not burnt, the team won’t be keeping the promise on the whitepaper,” the KOL highlighted.

Changpeng Zhao added a touch of irony, seeming surprised by the size of the burn. Users asked whether this burn was separate from the ongoing gas fee burn introduced under BEP95.

“I have no idea. There are a few different automated burn mechanisms. I learned about this burn on X,” he chimed.

In addition to the quarterly Auto-Burn, BNB implements a real-time burn model that permanently removes a portion of gas fees from circulation. Since its inception, over 259,000 BNB tokens have been burned through this mechanism.

Furthermore, the BNB Pioneer Burn Program continues to cover user losses from accidental token misplacements. It uses quarterly burns to offset such events.

CZ has a personal investment, with 98.6% of his portfolio in BNB as of February. Still, the commitment to scheduled burns and BNB’s critical role across BNB Smart Chain, opBNB Layer 2, and BNB Greenfield blockchain reaffirms the long-term strategy to drive utility, governance participation, and ecosystem growth.

The BNB community is left watching price action, balancing hope in the deflationary model with the reality of market headwinds.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Gold Price Hits New All-Time High Above $3,300 Amid Tariff Turmoil

Gold prices have surpassed $3,300 per ounce, setting a historic high as global markets face heightened volatility.

This surge reflects investor anxiety over economic uncertainty and highlights the significant impact of controversial tariff policies under President Trump. Consequently, experts have issued conflicting forecasts on how this may influence Bitcoin.

What’s Driving Gold to Keep Breaking Records?

At the time of writing, gold has surged past $3,000, reaching a peak of $3,317. That marks a 25% increase since the beginning of the year.

According to a report in The New York Times, the global trade war is the primary force behind gold’s continued rise. Retaliatory tariffs among major economies are clouding the global economic outlook.

The US imposed new tariffs, quickly triggering countermeasures from China, the European Union, and Canada. In response, the White House escalated the situation further.

“While general uncertainty and deteriorating economic vibes are improving interest in gold, most of gold’s price action is around the uncertainty related to tariffs,” Helima Croft, head of global commodity strategy at RBC Capital Markets, said.

In addition, there are growing concerns that tariffs could directly target imported gold. This fear has led to gold stockpiling within the United States.

Business Standard reported that major banks like JPMorgan Chase and HSBC have been moving large quantities of gold from London to New York. JPMorgan alone plans to transport $4 billion worth of gold this month.

Besides the tariff war, macro analyst Zerohedge pointed to another factor—the Senate Budget Resolution for FY2025. This resolution allows the US to increase its budget deficit by up to $5.8 trillion over the next ten years. Zerohedge suggested that Gold is responding to this news.

The price spike reflects fears of currency devaluation due to ballooning deficits.

Goldman Sachs has also raised its year-end gold forecast to $3,700. The bank cited stronger-than-expected central bank demand and rising recession risks.

What Are Analysts Saying About Bitcoin as Gold Hits a New Peak?

While gold shines, Bitcoin, often called “digital gold,” has drawn mixed opinions.

Anthony Papillano, CEO of Professional Capital Management, told CNBC on April 15 that Bitcoin has dropped around 10% since the start of the year, while gold has gained 20%. However, both assets have risen approximately 35% over the past year.

He also outlined reasons why Bitcoin might soon rally like gold. These include the US government’s strategic Bitcoin reserve plans and the younger generation’s growing view of Bitcoin as part of a long-term investment strategy.

“History tells us Bitcoin’s returns will skyrocket past Gold in the coming months,” Papillano predicted.

Supporting this view, several analysts noted that Bitcoin often follows gold’s upward momentum with a lag of about 100 days, especially during increased global liquidity. Additionally, companies purchased more than 95,400 BTC in the first quarter of 2025, showing strong institutional demand.

However, not everyone agrees. Economist Peter Schiff, a long-time Bitcoin critic, offered a contrasting view. He claimed the best trade right now is to sell all Bitcoin and other cryptocurrencies and invest entirely in gold and silver mining stocks.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoTrump Family Plans Crypto Game Inspired by Monopoly

-

Altcoin22 hours ago

Altcoin22 hours agoWhispers Of Insider Selling As Mantra DAO Relocates Nearly $27 Million In OM To Binance

-

Market18 hours ago

Market18 hours agoBitcoin Eyes $90,000, But Key Resistance Levels Loom

-

Market20 hours ago

Market20 hours agoETH Retail Traders Boost Demand Despite Institutional Outflows

-

Altcoin20 hours ago

Altcoin20 hours agoCould Tomorrow’s Canada Solana ETF Launch Push SOL Price to $200?

-

Market22 hours ago

Market22 hours agoForget XRP At $3, Analyst Reveals How High Price Will Be In A Few Months

-

Market23 hours ago

Market23 hours agoXRP Early Investors Continue To Sell As Price Holds Above $2

-

Market14 hours ago

Market14 hours agoSolana (SOL) Jumps 20% as DEX Volume and Fees Soar