Market

Sony, Metaplanet Pivot to Crypto Amid Yen Fall

Sony and Metaplanet, two giants in Japan, have fastened their grip on crypto in 2024. This comes as the country battles with a dwindling currency and government officials issue warnings.

Cryptocurrency adoption in Japan is growing, with firms venturing into the space to offer alternative options for customers.

With a $103 billion valuation, Sony has forayed into the crypto scene by acquiring digital asset trading services provider Amber Japan. According to a press release, the firm will change its name to S.BLOX.

Amber Japan operates the “WhaleFin” cryptocurrency trading service. The acquisition will provide an easier-to-use service and deliver more supported currencies and functions for the app. WhaleFin confirmed the development in a Monday announcement.

“Going forward, as a member of the Sony Group, we will work to create new added value in cryptocurrency trading services by collaborating with the group’s diverse businesses,” reads the release.

In hindsight, Amber Japan experienced financial troubles ever since the collapse of FTX in 2022. Its parent company, Amber Group, had to undergo a debt-to-equity transaction with Fenbushi Capital before Sony Group expressed interest. Sony leverages partnerships and acquisitions to enhance its venture into Web3. This new deal marks its foray into the crypto scene.

As a Japanese multi-industry conglomerate, Sony is not alone. Reports indicate that investment firm Metaplanet is also advancing its status in the crypto industry.

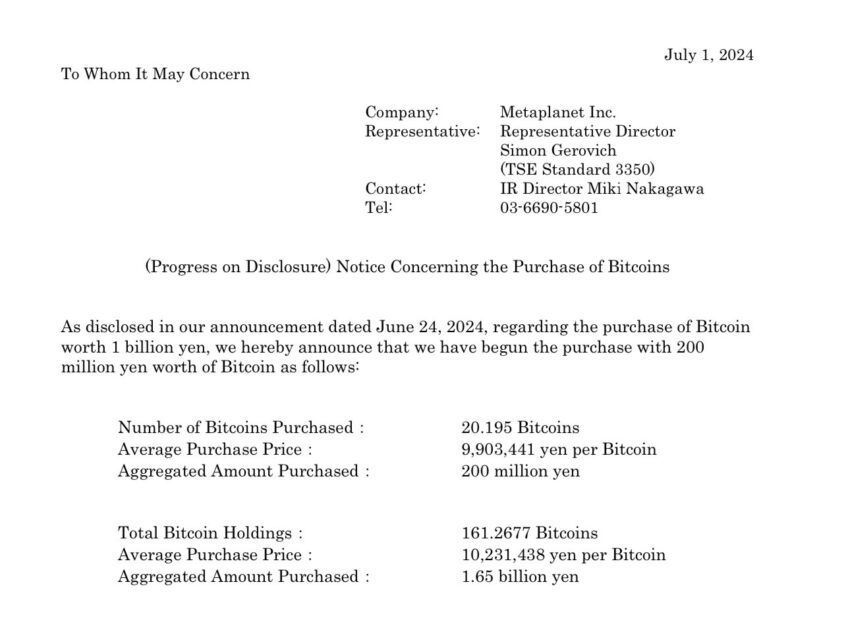

By adding 20.195 BTC worth $1.02 million on Monday, Metaplanet becomes Japan’s biggest corporate holder of Bitcoin. Like MicroStrategy, Metaplanet has progressively increased its Bitcoin coffers since April 2024. It disclosed a $1.6 million BTC purchase on June 11 and committed to $6 million more on June 24 sought from bond issuance.

Read more: Who Owns the Most Bitcoin in 2024?

According to the report, the firm’s basic policy is to hold Bitcoin for the long term. The report cited its commitment to reduce exposure to Yen, Japan’s local currency. The firm also wants to offer Japanese investors access to crypto with a preferential tax structure.

Japan Pivots to Crypto as Japanese Yen Falls

Sony and Metaplanet’s moves point to growing crypto adoption in Japan. This comes at a time when the country’s officials are concerned about a falling currency. Amid the major devaluation of the Japanese Yen and some monetary policies by the Bank of Japan (BOJ), the crypto landscape in the country has changed significantly.

Reuters reported on June 27 that Japan’s Finance Minister Shunichi Suzuki and Chief Cabinet Secretary Yoshimasa Hayashi expressed concerns about sharp declines in the Yen.

“A weak yen is among factors that push up inflation, so we will closely watch the currency’s moves in guiding monetary policy,” BOJ Deputy Governor Shinichi Uchida said in a meeting.

Stable currency moves are manageable, but a rapid single-sided move tends to affect the country’s economy. When a currency’s value falls, investors may look for alternative assets to protect their wealth or seek higher returns. In this scenario, some investors may turn to Bitcoin as a store of value.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

For example, Metaplanet said it made BTC a reserve asset to reduce its exposure to risk arising from Japan’s debt burden and the resulting volatility in the yen.

In the same scenario, as the US dollar slips lower ahead of the week’s key employment report, MicroStrategy founder Michael Saylor has issued a bullish urge on BTC. He says to sell the USD and buy Bitcoin. At the time of writing, Bitcoin price is trading at $62,813.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Market Lost $633 Billion in Q1 2025, CoinGecko Finds

According to CoinGecko’s quarterly report, the overall crypto market cap fell 18.6% in Q1 2025. Trading volume on centralized exchanges also fell 16% compared to the previous quarter.

This report identified a few positive trends, but most of them contained at least one significant downside. Despite the market euphoria in January, recession fears are taking a very serious toll.

Crypto Suffered Heavy Losses in Q1

The latest CoinGecko report shows just how bearish the first quarter of the year has been. Although the crypto market started January with a major bullish cycle, macroeconomic factors have heavily impacted market sentiment for the past two months.

According to this report, crypto’s total market cap fell 18.6% in Q1 2025, a staggering $633.5 billion. Investor activity fell alongside token prices, as daily trading volumes fell 27.3% quarter-on-quarter from the end of 2024. Spot trading volume on centralized exchanges fell 16.3%, which CoinGecko at least partially attributes to the Bybit hack.

The report mostly focused on concrete numbers, but it pointed to a few specific events that impacted crypto. Markets hit a local high around Trump’s inauguration, thanks to market euphoria over possible friendly policies.

His TRUMP meme coin fueled a brief frenzy in Solana meme coin activity, but this quickly slumped. The LIBRA scandal had a further dampening impact.

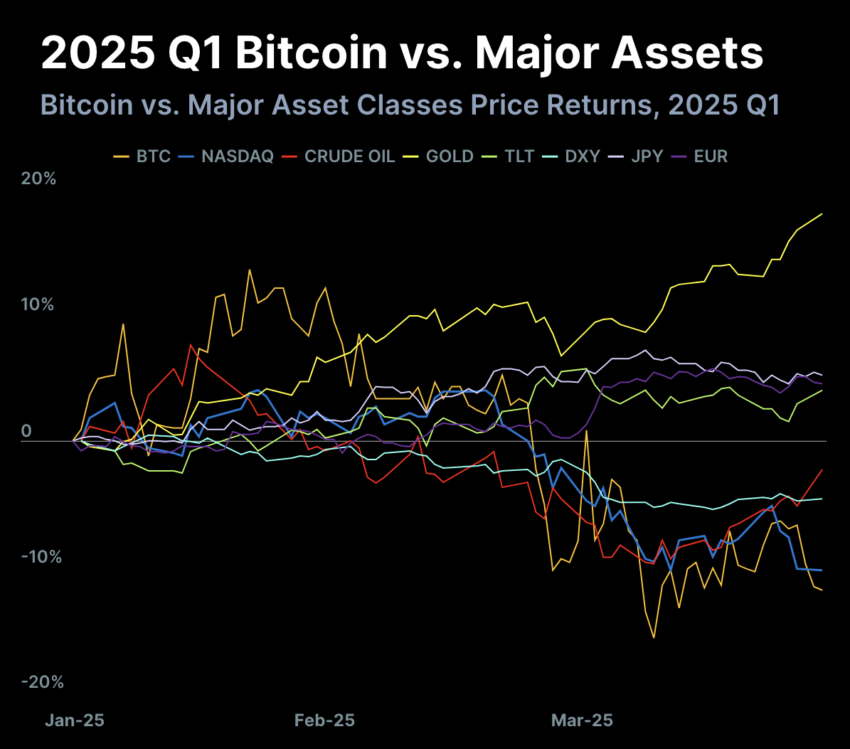

Bitcoin increased its dominance in Q1 2025, accounting for 59.1% of crypto’s total market cap. It hasn’t maintained that share of the market since 2021, symbolizing how much more stable it’s been than altcoins.

Nevertheless, BTC also fell 11.8% and was outperformed by gold and US Treasury bonds.

This data point is especially worrying because Trump’s tariffs have wrought havoc on Treasury yields. Even so, the report clearly shows that the rest of crypto suffered even more. Ethereum’s entire 2024 gains vanished in Q1 2025, and multichain DeFi TVL fell 27.5%. C

ountless other areas saw similar results, but they’re too numerous to easily summarize.

That is to say, almost every quantifiable positive development came with at least one major caveat. Solana dominated the DEX trade, but its TVL declined by over one-fifth.

Bitcoin ETFs saw $1 billion in fresh inflows, but total AUM fell by nearly $9 billion due to price drops. The reports reflect that recession fears are gripping the crypto market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Base Meme Coin Wipes $15 Million After Official Promotion

Coinbase’s Layer 2 network, Base, is facing intense scrutiny after what appears to be a major pump and dump—one that it inadvertently helped fuel. The project’s official Twitter account publicly promoted a meme coin titled “Base is for everyone.”

This triggered a speculative surge, driving the token’s market cap to an estimated $15 to $20 million within hours of launch. The token quickly plummeted near zero in mutes.

Did Base Just Help Fuel a Pump and Dump?

Base’s tweet, which featured promotional imagery and direct links to the meme coin on Zora, created the perception of legitimacy.

Traders piled in, and price charts reflected an explosive rally—followed by an equally sharp collapse.

Within one 4-hour trading window, a green candle representing millions in inflow was immediately reversed by a red candle of equal size, marking a total loss of liquidity and confirming a textbook pump and dump.

The token’s value fell by more than 99%, and trading volumes on Uniswap surged past $13 million during the brief window of activity.

There is massive ongoing outrage against both Coinbase and Base. Crypto influencers have called the incident a failure of due diligence and communications strategy.

Accusations of incompetence and poor risk oversight are spreading fast on social media, while memes mocking the network’s “Base is for everyone” slogan are everywhere.

Base is yet to provide an official response to the incident.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Here’s What Happens If The XRP Price Closes Out This Week Above $2.25

XRP is back trading above, $2, and bullish momentum is gradually creeping back compared to its price action at the end of March and beginning of April. Crypto analyst EGRAG CRYPTO believes this week could highlight a turning point for a full flip into bullish momentum, and how the XRP price closes out the week will be very important.

According to the analyst’s outlook, which was posted on social media platform X, the current XRP candle on the weekly timeframe is hovering just above both $2.10 and the 21-week Exponential Moving Average (EMA). However, he noted that the real confirmation lies with if XRP can manage to close the week with a full-bodied candle above $2.25.

Why Is $2.25 Important For XRP’s Price?

The $2.25 level has now become more than just another short-term resistance. It is what EGRAG considers the final barrier to validating the recovery structure forming after March and April’s sharp retracement. His weekly chart shows XRP climbing out from a significant low after bouncing off the 0.888 Fib extension level and now stabilizing above the yellow 21-week EMA line.

The alignment of XRP’s price above both the $2.10 price level and this moving average adds credibility to the potential of a bullish continuation, but EGRAG makes it clear that a weekly close above $2.25 is the “lock-in” point. From a technical standpoint, this would mark the first full-bodied weekly candle above the 21W EMA since the past four weeks. If achieved, this can be interpreted confirmation that bulls have regained dominance and that a bottom was established on April 7.

Furthermore, it suggests that the April 7 bottom will continue to hold as support going forward. The chart also outlines close price targets at $2.51 and $2.60, with Fibonacci extension levels projecting even higher zones at $2.69 on the way to crossing back above $3.

Failing To Close Above $2.25 Could Reintroduce Unwanted Narratives

EGRAG also issued a cautionary note in case there isn’t a clean breakout. Should XRP fail to close the weekly candle above $2.25, he warned it could trigger a return of bearish narratives, including what he referred to as a possible “tariff issue.” This is referring to the recent tariff back-and-forth between the US and China in the past month, which has unbalanced the investment markets.

A strong rejection could see the XRP price pull back toward the $1.96 Fibonacci level or even lower into the broader support band of around $1.58 to $1.30. The white box region on the chart above would then become the primary battleground for bulls and bears if a close above $2.25 is not secured by the end of the week.

-

Market22 hours ago

Market22 hours ago3 US Crypto Stocks to Watch Today: CORZ, MSTR, and COIN

-

Market21 hours ago

Market21 hours agoBitcoin Price on The Brink? Signs Point to Renewed Decline

-

Market23 hours ago

Market23 hours agoEthena Labs Leaves EU Market Over MiCA Compliance

-

Market19 hours ago

Market19 hours agoXRP Price Pulls Back: Healthy Correction or Start of a Fresh Downtrend?

-

Altcoin19 hours ago

Altcoin19 hours agoRipple Whale Moves $273M As Analyst Predicts XRP Price Crash To $1.90

-

Market20 hours ago

Market20 hours agoEthereum Leads Q1 2025 DApp Fees With $1.02 Billion

-

Market18 hours ago

Market18 hours agoArbitrum RWA Market Soars – But ARB Still Struggles

-

Bitcoin18 hours ago

Bitcoin18 hours agoIs Bitcoin the Solution to Managing US Debt? VanEck Explains