Market

Solana Airdrops, Jito Unlocks, and others

This week in crypto promises to be eventful, with major developments expected to shape market sentiment. Ecosystems like Solana, Jito, Ethena, and Jupiter are set to make headlines with key updates.

These updates from various decentralized finance (DeFi) and blockchain projects are likely to influence investor behavior and market dynamics.

First in line is a possible Solana announcement expected to break on Thursday, December 5. The network is expected to make a few major announcements, and rumors suggest that they will be related to some airdrops.

It remains unknown what the Solana announcement will entail. However, several Solana-based projects have huge upcoming developments, positioning them as likely candidates for the anticipated Solana-related announcement.

For example, there is a confirmed Wise Monkey (MONKY) airdrop for Floki Inu (FLOKI, TokenFi (TOKEN), and ApeCoin (APE) holders. The snapshot date for APE holders was November 29, whereas FLOKI holders’ snapshot date will be December 15. Distribution is based on token holdings.

The announcement comes ahead of Wise Monkey’s launch of the MONKY token on December 12, 2024. Elsewhere, Rectoverso (RESO), a DeFi platform built on the Solana blockchain, is also planning an IDO (initial DEX offering), according to a contributor. Other candidates include the Qubic ecosystem, which suggested an ongoing collaboration with Solana.

“This month, we’ll be unveiling a huge update about the Qubic and Solana launch, alongside a special reveal of Imporium — a new initiative that will revolutionize our ecosystem,” Qubic shared.

Qubic is a utility token on the Stellar (XLM) blockchain. It aims to support decentralized applications (dApps) for various real-world challenges in the web3 domain.

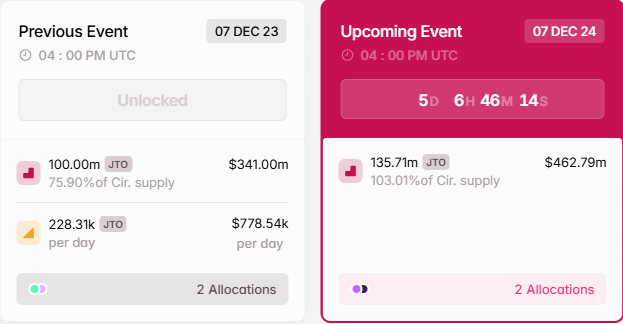

Jito (JTO) Token Unlock

On December 7, the Jito Network will unlock 135.71 million JTO tokens valued at approximately $462 million at current rates. The tokens constitute 103.01% of its circulating supply, which could dampen the market and cause a price drop. As BeInCrypto reported, the tokens will be allocated to core contributors and investors. Unlike core contributors, investors may cash in for early gains.

The Jito Network is a major contributor to the Solana ecosystem through its JitoSOL liquid staking pool and its collection of MEV products.

Ethena Lab’s BlackRock-Backed Stablecoin

Another top crypto news this week is the release of USDtb, Ethena Lab’s new stablecoin backed by BlackRock’s BUIDL fund. The synthetic dollar protocol and tokenization platform Securitize submitted a joint proposal to feature Ethena’s USDtb stablecoin in Spark’s $1 billion Tokenization Grand Prix.

“Approval of USDtb as a backing asset for USDe and an eligible asset for the Reserve Fund, with the potential for allocation as a backing asset of USDe on Day 1 of USDtb’s launch next week [this week],” a paragraph in the forum discussion read.

With this proposal, they seek to onboard real-world assets (RWAs) to decentralized finance (DeFi) by offering liquidity to selected participants.

D.O.G.E Proposals From Musk and Ramaswamy

In addition, this week, Elon Musk and Vivek Ramaswamy will present key proposals for the Department of Government Efficiency (D.O.G.E). Musk plans to rein in defense spending as part of his Trump-appointed mission to find ways to slash government spending.

“Elon Musk is right. The Pentagon, with a budget of $886 billion, just failed its 7th audit in a row. It has lost track of billions. Last year, only 13 senators voted against the Military Industrial Complex and a defense budget full of waste and fraud. That must change,” said Bernie Sanders, an American politician and activist who is the senior United States senator from Vermont.

Meanwhile, Ramaswamy alluded to halting or increasing defense spending, arguing against reflexively increasing the magnitude. Both Coinbase CEO Brian Armstrong and Gemini co-founder Cameron Winklevoss have rallied behind the proposal.

Jupiter’s Revised Airdrop Proposal Voting

Jupiter’s revised airdrop proposal will also be voted on this week. The Solana-based decentralized exchange (DEX) aggregator plans to airdrop approximately $860 million of JUP in January, marking the second round of the airdrop. Community members expect the vote to proceed.

“A vote on whether this will happen is starting soon, and I believe it will proceed The snapshot has already been taken, and there will be a vesting with a 75% fee if you choose to claim instantly,” a Solana DeFi maxi said recently.

The optimism comes as the minimum vote threshold to pass the vote has already surpassed. Passing the proposal would mean two more airdrops of 700 million JUP tokens each.

Gala Film Launch

Also, on December 5, the Gala ecosystem will launch its FILM token. The token launch comes after Gala Film rewrote the playbook for the web3 era. With it, it built a free platform that enhances the watching experience for fans. It also empowers filmmakers to create anything their imagination can manage.

“Gala Film’s revolutionary plan is fueled by a single upcoming GalaChain token: FILM. And we’re pleased to announce that an official date has been slated for its release. FILM is coming on December 5th, 2024,” Gala said.

Gala Film is an ecosystem built atop the web3 infrastructure of GalaChain, with a vision centered around FILM, the platform’s official reward and utility token. Users collect FILM as a reward for multiple levels of participation. The token will also help boost promising projects and unlock exclusives. Community members will harness it to fund a future of decentralized video content and usher in a new creative era.

Beyond these events, crypto markets must also brace for the impact of US economic data this week, which is expected to spur volatility.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Price Rises 13% But Fails to Break $136 Resistance

Solana (SOL) has climbed 13% over the past seven days, showcasing strong short-term performance. While momentum indicators like the RSI and EMA lines remain supportive, recent price action suggests that bullish strength may be stalling just below a key breakout point.

At the same time, the sharp drop in BBTrend indicates weakening trend strength and fading volatility, often a sign of incoming consolidation or market indecision. With technicals at a crossroads, SOL’s next move will likely depend on whether buyers can regain control or if a broader pullback begins to unfold.

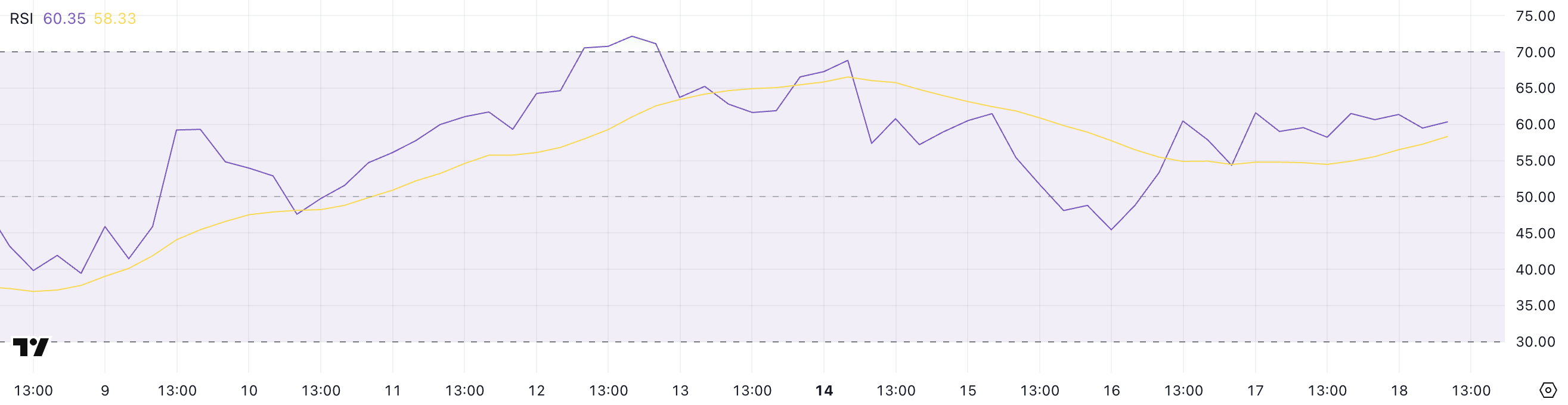

SOL RSI Rises Sharply, but Pause in Momentum Signals Caution

Solana’s Relative Strength Index (RSI) is currently at 60.35, marking a noticeable rise from 45 just two days ago.

This jump signals growing bullish momentum, although the RSI has remained stable since yesterday, suggesting that upward pressure may be easing for now.

The increase reflects renewed buying interest in recent sessions, pushing SOL closer to overbought territory but not quite there yet. This leveling off could indicate that the market is taking a breather before deciding its next move.

The RSI is a momentum oscillator that measures the speed and magnitude of price movements, ranging from 0 to 100. Values above 70 typically indicate that an asset is overbought and may be due for a pullback, while readings below 30 suggest oversold conditions, potentially signaling a buying opportunity.

With Solana’s RSI at 60.35, the asset is approaching bullish territory but hasn’t yet entered an extreme zone.

This positioning suggests that while recent momentum is positive, SOL could face some short-term consolidation or resistance before continuing higher—unless strong buying interest resumes and pushes the RSI closer to overbought levels.

SOL Trend Strength Weakens as BBTrend Falls Below 6

Solana’s BBTrend indicator is currently at 5.69, a significant drop from the 17.5 reading observed just four days ago.

This sharp decline suggests that volatility around SOL’s price has cooled notably, and the strength of the prior trend is weakening.

While BBTrend doesn’t signal direction on its own, the drop indicates that the strong movement, likely bullish, has lost momentum, and SOL may be entering a phase of consolidation or uncertainty.

BBTrend, short for Bollinger Band Trend, measures the strength of a price trend based on the expansion or contraction of Bollinger Bands.

Higher values suggest a strong, directional move (either up or down), while lower values point to weaker trends and reduced volatility. With BBTrend now at 5.69, Solana is in a much less volatile environment, which often precedes a breakout or a reversal.

For now, this reading signals that the recent momentum is fading. Unless volatility picks up again, SOL’s price may remain range-bound in the short term.

Golden Cross Looms for SOL, But $136 Barrier Still Holding Strong

Solana’s EMA lines continue to reflect a bullish structure, with the short-term average trending above the long-term one—suggesting that positive momentum remains intact.

A potential golden cross is also forming, which, if confirmed, would further reinforce the bullish outlook.

However, despite this favorable setup, Solana price has struggled to break through the $136 resistance level over the past few days, indicating that buyers may be losing steam at this key threshold.

Tracy Jin, COO of MEXC told BeInCrypto:

“Amid widespread volatility, Solana has stood out with notable strength. A combination of favorable technical setups and institutional tailwinds — such as the launch of the first spot Solana ETFs in North America — has helped drive a short-term rally. The token’s reclaim of leadership in decentralized exchange activity and rising total value locked further support the bullish case.”

If SOL manages to push above $136 with strong volume, it could open the path toward the next targets at $147 and potentially higher. But if the current momentum fades and the price reverses, a test of support at $124 becomes likely.

About Solana next moves, Jin told BeInCrypto:

“Despite recent gains, SOL’s near-term outlook remains sensitive to broader liquidity conditions. Any deterioration in market confidence — whether from macro shocks or renewed volatility in Bitcoin — could cap upside potential.”

A breakdown below that could accelerate losses toward $112, and in the event of a deeper correction, SOL could even revisit the $95 region.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network Roadmap Frustrates Users Over Missing Timeline

Pi Network released its Mainnet Migration Roadmap today. The roadmap lays out a three‑phase plan to move tens of millions of Pioneers who are still waiting to be moved to the open network. It also introduces new rewards, such as referral bonuses.

However, unlike most project roadmaps, Pi network didn’t provide any estimated date or timeline. This lack of clarification has frustrated early adopters who still await key rewards and clarity on rollout pacing.

Pi Network’s Three‑Phase Migration Plan

According to the roadmap, Pi Network will first complete initial migrations for Pioneers already in the queue. This batch covers verified base mining rewards, Security Circle contributions, lockup commitments, utility‑app usage rewards, and confirmed Node rewards for some operators.

After clearing the first wave, the team will tackle second migrations, adding all referral mining bonuses linked to KYC‑verified team members. Pi says these referral rewards will follow once the current queue finishes.

Finally, the network will move into ongoing periodic migrations—potentially monthly or quarterly—to process any remaining bonuses and rewards.

The cadence “is to be determined,” the roadmap notes.

Community Concerns and Critical Gaps

A thorough observation reveals several gaps and potential concerns in the roadmap.

For one, the plan never discloses how many Pioneers remain in the queue or the network’s daily migration capacity. Without those figures, users can’t predict when their own migration will occur.

Node operators report that some “confirmed Node rewards” have landed, but criteria for qualification remain opaque. Early node runners worry they may miss out without clear benchmarks.

Many Pioneers say they have tapped their claim buttons daily since migration opened yet still lack basic mining rewards. They question whether those base rewards and deferred referral bonuses will ever arrive in phase two.

Also, the roadmap admits the UI’s “Transferable Balance” underestimates actual migrated amounts to save resources. Users fear this pessimistic display could erode trust if their true balances remain hidden.

“I thought we were mining all of these PI coins this whole time? I thought the security circles were the Consensus Mechanism. It kinda seems to me like there isn’t a blockchain, and never was one. What kind of “Blockchain protocol” would “Require” all tokens to be minted at genesis?” one community member wrote.

Crucially, Pi offers no audit or error‑resolution process for users who spot mismatches in their historical mining data.

Given six years of complex records, occasional disputes seem inevitable, but the roadmap remains silent on redress.

All migrations hinge on KYC completion, yet the team omits any scaling targets or timelines for identity verification. A bottleneck here could stall every subsequent phase.

The schedule also ignores how major token unlock events—such as the roughly 108.9 million PI tokens due to release this month—will align with migration waves.

Finally, some Pioneers challenge the project’s foundational narrative. They note that Pi’s statement “all tokens were minted at genesis” contradicts six years of “mining.”

This raises doubts about whether Pi ever operated on a true blockchain protocol.

In the past month, PI price has dipped by over 45%. To sustain momentum and community trust, the team must now supply concrete timelines, transparent criteria, and clear audit paths for its Mainnet migration.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MEME Rallies 73%, BONE Follows

The meme coin market is experiencing a surge in investor interest, helping certain tokens recover from their all-time lows (ATLs). Memecoin (MEME) is one such token that has avoided a new ATL and also posted a significant 73% rise.

BeInCrypto has analyzed two other meme coins that have performed well over the past day, making them important tokens to watch.

Memecoin (MEME)

- Launch Date – November 2023

- Total Circulating Supply – 43.11 Billion MEME

- Maximum Supply – 69 Billion MEME

- Fully Diluted Valuation (FDV) – $135.37 Million

MEME had a rough week, hitting a new all-time low at $0.00137. However, the altcoin rebounded sharply, rising by 38% in the last 24 hours to trade at $0.00196. This surge marks a significant recovery, driven by renewed interest in meme coins.

The recent surge in MEME’s price was fueled by a sudden spike in interest for joke tokens, driving a 73% intraday high. To maintain its gains, MEME must successfully breach and flip the $0.00228 resistance into support, a critical level for sustaining its upward momentum.

If MEME experiences profit-taking from investors, it could reverse course and drop back down to the all-time low of $0.00137. A decline through this level would invalidate the bullish outlook and signal further challenges for the meme coin.

Bone ShibaSwap (BONE)

- Launch Date – July 2021

- Total Circulating Supply – 249.89 Million BONE

- Maximum Supply – 250 Million BONE

- Fully Diluted Valuation (FDV) – $71.67 Million

BONE posted an impressive 18.5% rise over the last 24 hours, trading at $0.285. The altcoin is currently under the key resistance of $0.295. Given the recent momentum, it seems poised to breach this level, signaling a potential upward trajectory for the token in the near future.

Flipping the $0.295 resistance into support would open the door for BONE to target its next major resistance at $0.348. A sustained push above this level could drive further bullish sentiment, propelling the token toward even higher price levels.

However, if BONE fails to breach $0.295, the bullish momentum could fade. A decline from this point could send the meme coin back towards $0.232, invalidating the optimistic outlook. Such a reversal would likely create caution among investors, delaying potential upward movement.

- Launch Date – April 2024

- Total Circulating Supply – 999.96 Million BAN

- Maximum Supply – 1 Billion BAN

- Fully Diluted Valuation (FDV) – $40.54 Million

BAN, a small-cap token, has caught the attention of investors, rising nearly 25% in the last 24 hours to trade at $0.040. This surge highlights the growing interest in the meme coin market, with BAN standing out despite its smaller market capitalization.

Inspired by the infamous banana taped to a wall, BAN gained significant fame after being purchased by Tron’s founder, Justin Sun, for $6.2 million last year. If the token continues its upward momentum, it could breach the $0.045 barrier and potentially flip it into support, securing its gains.

However, failing to break through the $0.045 resistance could lead to a drop back to $0.032. If this occurs, it would invalidate the bullish outlook and erase the recent gains, putting investors on alert for further price declines.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Investors Suffer More Losses Than Bitcoin Amid Ongoing Market Turmoil

-

Market20 hours ago

Market20 hours agoEthereum Price Fights for Momentum—Traders Watch Key Resistance

-

Altcoin20 hours ago

Altcoin20 hours agoExpert Predicts Pi Network Price Volatility After Shady Activity On Banxa

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum Fee Plunges To 5-Year Low—Is This A Bottom Signal?

-

Altcoin23 hours ago

Altcoin23 hours agoTron Founder Justin Sun Reveals Plan To HODL Ethereum Despite Price Drop

-

Market18 hours ago

Market18 hours agoIs XRP’s Low Price Part of Ripple’s Long-Term Growth Strategy?

-

Altcoin21 hours ago

Altcoin21 hours agoAnalysts Predict XRP Price to Hit $6 as Wave 2 Correction Nears End

-

Market19 hours ago

Market19 hours agoXRP Price Weakens—Further Losses on The Table?