Market

SOL Price Pops 10%, Can Solana Bulls Regain Strength?

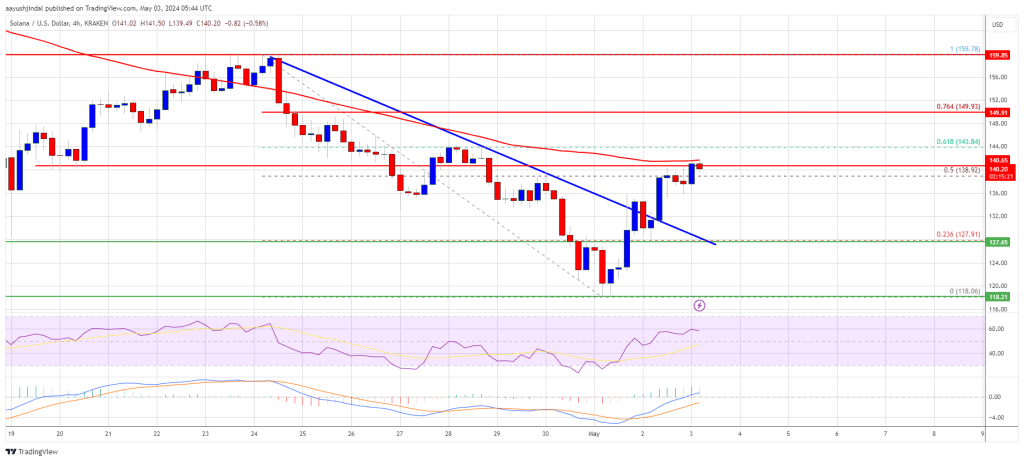

Solana started a recovery wave from the $120 zone. SOL price is rising and might accelerate higher if there is a close above the $142 resistance.

- SOL price recovered higher and tested the $140 resistance against the US Dollar.

- The price is now trading below $142 and the 100 simple moving average (4 hours).

- There was a break above a key bearish trend line with resistance at $132 on the 4-hour chart of the SOL/USD pair (data source from Kraken).

- The pair could start another decline if it stays below $142 and $150.

Solana Price Faces Resistance

Solana price extended losses below the $150 and $140 support levels. SOL tested the $120 zone and recently started an upside correction, like Bitcoin and Ethereum.

There was a decent increase above the $125 and $130 levels. The price climbed above the 23.6% Fib retracement level of the downward wave from the $160 swing high to the $118 low. There was a break above a key bearish trend line with resistance at $132 on the 4-hour chart of the SOL/USD pair.

It even spiked above the $140 zone and the 100 simple moving average (4 hours), but there is no hourly close. The bears are currently active near the 50% Fib retracement level of the downward wave from the $160 swing high to the $118 low.

Source: SOLUSD on TradingView.com

Solana is now trading below $142 and the 100 simple moving average (4 hours). Immediate resistance is near the $142 level. The next major resistance is near the $150 level. A successful close above the $150 resistance could set the pace for another major increase. The next key resistance is near $160. Any more gains might send the price toward the $175 level.

Another Decline in SOL?

If SOL fails to rally above the $142 resistance, it could start another decline. Initial support on the downside is near the $132 level.

The first major support is near the $128 level, below which the price could test $120. If there is a close below the $120 support, the price could decline toward the $105 support in the near term.

Technical Indicators

4-Hours MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

4-Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $132, and $128.

Major Resistance Levels – $142, $150, and $175.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Market

Solana Meme Coins Resurge with Rising Trade Volume

After months of decline, Solana meme coins are regaining bullish momentum. Daily trade volumes are increasing dramatically, and most of the leading tokens are posting notable price gains.

The increasing network activity is also helping Solana to recover after a 12-month low. Most recently, pump-and-dump schemes and tariff chaos rocked the meme coin sector, but speculative assets are regaining momentum as macroeconomic fears start to cool down.

Are Solana Meme Coins On the Rise Again?

Solana meme coins have been a popular sector of the crypto ecosystem, but a few controversies have taken bites out of the market in recent months.

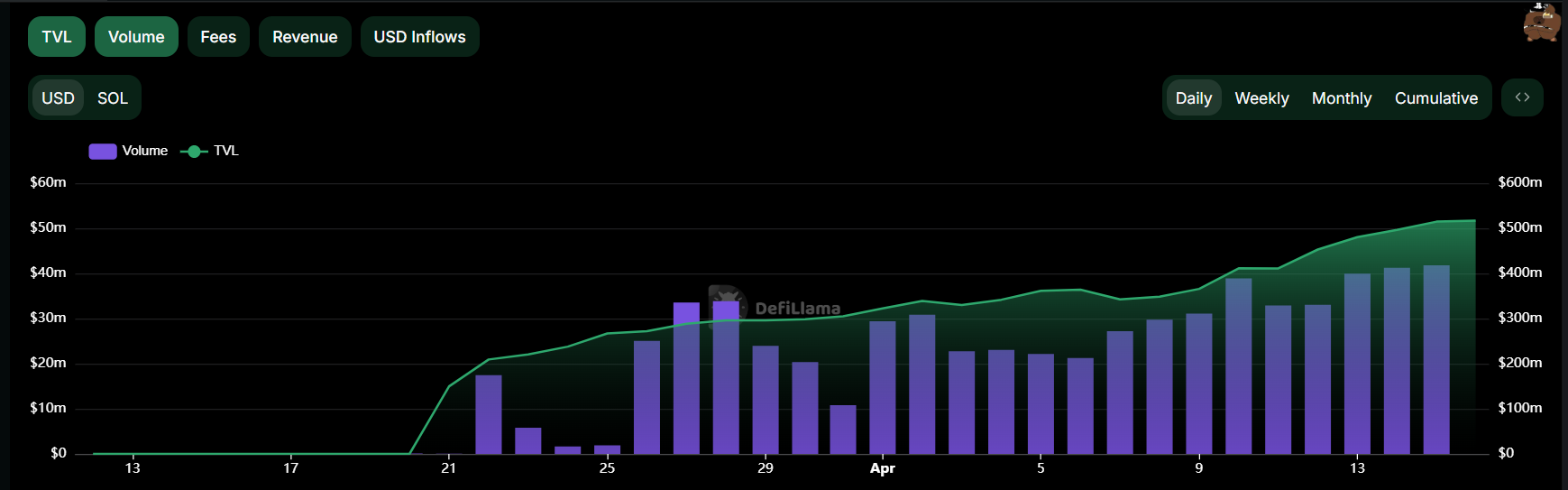

In addition to pump-and-dumps and the Argentinian LIBRA scandal damaging these assets’ reputations, tariff-related chaos helped draw investors away from these meme assets. Despite this, however, volume is picking back up:

“Meme trading platform Axiom’s daily trading volume exceeded $100 million for the first time on April 14, accounting for about 50% of the market share of Solana Meme trading platform. The number of trading users reached 26,800, a record high,” claimed Colin Wu.

Axiom may represent half of the trading for these assets, but it isn’t the only site with heightened volumes. Pump.fun recently launched Pumpswap, a new decentralized exchange that quickly captured 14% of Solana’s DEX market.

Trading volumes are spiking on PumpSwap, with daily trading volume surging by 50% on Tuesday, April 15.

Data from DefiLlama shows that DEX trading on Solana is starting to recover after a massive drop in March. In other words, Solana meme coins’ growth isn’t isolated to either of these platforms either.

These stats have a long way to go before they recover their all-time high from January, but these signs of regrowth are still very promising.

Additionally, individual Solana meme coins are making huge strides in price performance. In the last week, eight of the ten largest assets in this category posted double-digit gains.

One of the two losers this week was TRUMP, which has been adversely impacted by tariff chaos and the latest token unlock. Nonetheless, it managed to achieve a 4.5% price jump. Most of the top ten had gains of over 20% during this period.

This increased network activity is also reflected in Solana’s price. Last week, it began recovering from a 12-month low and has since rocketed up with 20% price gains.

For now, it seems like Solana meme coins are eyeing a real comeback, at least for the short term. However, another macroeconomic shock could see these risk assets reacting more severely than the wider market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

China’s De-Dollarization Boosts Bitcoin’s Global Role in 2025

China’s recent directive for its state-owned banks to decrease reliance on the US dollar has amplified a growing trend among countries seeking alternatives to the dominant reserve assets. In some instances, Bitcoin has emerged as a viable competitor.

BeInCrypto spoke with experts from VanEck, CoinGecko, Gate.io, HashKey Research, and Humanity Protocol to understand Bitcoin’s rise as an alternative to the US dollar and its potential for greater influence in global geopolitics.

The Push for De-Dollarization

Since the 2008 global financial crisis, China has gradually reduced its reliance on the US dollar. The People’s Bank of China (PBOC) has now instructed state-owned banks to reduce dollar purchases amid the heightened trade war with US President Donald Trump.

China is among many nations seeking to lessen its dependence on the dollar. Russia, like its southern neighbor, has received an increasing number of Western sanctions– especially following its invasion of Ukraine.

The United States, the European Union, the United Kingdom, and other allies imposed unprecedented international sanctions on Russia, targeting its central bank and major financial institutions and restricting access to the Society for Worldwide Interbank Financial Telecommunication (SWIFT) for some financial institutions.

In response, Russia halted trading of US dollars and euros on the Moscow Stock Exchange (MOEX). Recently, BeInCrypto also reported that Russia has been quietly using Bitcoin for international trade to bypass sanctions.

Furthermore, Rosneft, a major Russian commodities producer, has issued RMB-denominated bonds, indicating a shift towards RBM, the Chinese currency, and a move away from Western currencies due to sanctions.

This global shift away from predominant reserve currencies is not limited to countries affected by Western sanctions. Aiming to increase the Rupee’s international use, India has secured agreements for oil purchases in Indian Rupee (INR) and trade with Malaysia in INR.

The country has also pursued creating a local currency settlement system with nine other central banks.

As more nations consider alternatives to the US dollar’s dominance, Bitcoin has emerged as a functional monetary tool that can serve as an alternative reserve asset.

Why Nations Are Turning to Bitcoin for Trade Independence

Interest in using cryptocurrency for purposes beyond international trade has also grown. In a notable development, China and Russia have reportedly settled some energy transactions using Bitcoin and other digital assets.

“Sovereign adoption of Bitcoin is accelerating this year as demand grows for neutral payments rails that can circumvent USD sanctions,” Matthew Sigel, Head of Digital Assets Research at VanEck, told BeInCrypto.

Two weeks ago, France’s Minister of Digital Affairs proposed using the surplus production of EDF, the country’s state-owned energy giant, to mine Bitcoin.

Last week, Pakistan announced similar plans to allocate part of its surplus electricity to Bitcoin mining and AI data centers.

Meanwhile, on April 10, New Hampshire’s House passed HB302, a Bitcoin reserve bill, by a 192-179 vote, sending it to the Senate. This development makes New Hampshire the fourth state, after Arizona, Texas, and Oklahoma, to have such a bill pass a legislative chamber.

If HB302 is approved by the Senate and signed into law, the state treasurer could invest up to 10% of the general fund and other authorized funds in precious metals and specific digital assets like Bitcoin.

According to industry experts, this is only the beginning.

VanEck Predicts Bitcoin to Become a Future Reserve Asset

Sigel predicts Bitcoin will become a key medium of exchange by 2025 and, ultimately, one of the world’s reserve currencies.

His forecasts suggest Bitcoin could settle 10% of global international trade and 5% of global domestic trade. This scenario would lead to central banks holding 2.5% of their assets in BTC.

According to him, China’s recent de-dollarization will prompt other nations to follow suit and lessen their reliance on the US dollar.

“China’s de-dollarization efforts are already having second- and third-order effects that create opportunities for alternative assets like Bitcoin. When the world’s second-largest economy actively reduces its exposure to US Treasuries and promotes cross-border trade in yuan or through mechanisms like the mBridge project, it signals to other nations—especially those with strained ties to the West—that the dollar is no longer the only game in town,” Sigel said.

For Zhong Yang Chan, Head of Research at CoinGecko, these efforts could prove catastrophic for the United States’ dominance.

“Broader de-dollarization efforts by China, or other major economies, will threaten the status of the dollar’s global reserve currency status. This could have [a] profound impact on the US and its economy, as this would lead to nations reducing their holdings of US treasuries, which the US relies on to finance its national debt,” he told BeInCrypto.

However, the strength of the US dollar and other dominant currencies has already shown signs of weakening.

A General Wave of Currency Decline

Sigel’s research shows that the four strongest global currencies—the US dollar, Japanese yen, British pound, and European euro—have lost value over time, particularly in cross-border payments.

The decline of these currencies creates a void where Bitcoin can gain traction as a key alternative for international trade settlements.

“This shift isn’t purely about promoting the yuan. It’s also about minimizing vulnerability to US sanctions and the politicization of payment rails like SWIFT. That opens the door for neutral, non-sovereign assets—especially those that are digitally native, decentralized, and liquid,” Sigel added.

This lack of national allegiance also sets Bitcoin apart from traditional currencies.

Bitcoin’s Appeal: A Non-Sovereign Alternative

Unlike fiat money or central bank digital currencies (CBDCs), Bitcoin doesn’t respond to any one nation, which makes it appealing to some countries.

For Terence Kwok, CEO and Founder of Humanity Protocol, recent geopolitical tensions have heightened this belief.

“Trust in traditional financial infrastructure is eroded during geopolitical standoffs. Bitcoin, with its transparent ledger and decentralized governance, offers a compelling alternative for value storage and peer-to-peer settlement, especially where neutral, non-sovereign options are preferable. In that sense, geopolitical tension can inadvertently catalyze innovation and adoption in decentralized finance,” Kwok told BeInCrypto.

Because Bitcoin’s supply is limited, it provides a more secure option for nations whose local currency loses value through inflation.

“Bitcoin, due to its scarcity and decentralized nature, is completely different from the centralized fiat currency system and is not affected by changes in monetary policy. Therefore, it can be used as a hedging tool to cope with the depreciation of fiat currencies or geopolitical risks. Especially in the context of rising inflation or challenges to the dominance of the US dollar, allocating some Bitcoin can help diversify investment risks and provide investors with more robust asset protection,” Kevin Guo, Director of HashKey Research, added to the conversation.

For these same reasons, experts don’t expect Bitcoin to replace fiat currencies fully but rather provide a vital alternative for certain cases.

A Replacement or an Alternative?

While Bitcoin offers several advantages over traditional currencies, Gate.io’s Kevin Lee doesn’t foresee its eventual adoption causing a complete overhaul of the currency reserve system.

“Bitcoin is increasingly being recognized for its unique technological characteristics, such as fixed supply, decentralized governance, and borderless accessibility. However, I don’t believe it is meant to replace [the] traditional fiat system, but rather an alternative to it for various business use cases, particularly for diversification and long-term value preservation strategies,” Lee told BeInCrypto.

Guo agreed with this last point, adding that Bitcoin will be more appealing case-by-case.

“Countries may selectively adopt Bitcoin based on their own economic needs, but its application areas are mainly concentrated in niche markets such as cross-border remittances, circumventing sanctions, and hedging inflation,” he said.

Bitcoin must first address several of its shortcomings before it can become truly competitive in the long run.

What Challenges Still Face Bitcoin’s Wider Adoption?

Due to its relatively new status and lack of full development, Bitcoin suffers from shortcomings that prevent mass adoption.

“As with any emerging asset class, Bitcoin faces inherent challenges, including market volatility, evolving regulatory frameworks, infrastructure maturity, and cyclical hypes. These factors may impact its short-term adoption pace,” Lee explained.

To that point, Kwok added:

“Bitcoin’s price swings make it less viable for day-to-day transactions or as a primary reserve asset today. Furthermore, if major powers enforce strict capital controls or implement hostile crypto policies, it could slow down adoption despite broader macro trends in its favor.”

Meanwhile, there’s the competitive advantage of stablecoins, which currently dominate cross-border payments.

“Crypto assets represented by US dollar stablecoins (such as USDT and USDC) are rapidly occupying the main market of cross-border payments and blockchain transactions. Stablecoins have low volatility due to their peg (mostly to the US dollar), making them the preferred tool for international transactions and fund transfers, while Bitcoin is more often used as a store of value or speculative asset,” Guo, Director of HashKey Research told BeInCrypto.

The Bitcoin network has also experienced problems that have exacerbated global demand.

Bitcoin Network Under Strain

Since the beginning of the year, Bitcoin has experienced a significant slowdown in network activity, despite the asset’s bullish performance.

“The usage rate of the Bitcoin network is declining, and its on-chain transaction fees have dropped to the lowest point since 2012, indicating that network activity is gradually decreasing,” Guo said.

Recent data confirms this. The number of Bitcoin transactions has fallen significantly since the last quarter of 2024. Bitcoin registered over 610,684 transactions in November, but that number dropped to 376,369 in April, according to Glassnode data.

The number of Bitcoin active addresses paints a similar picture. In December, the network had nearly 891,623 addresses. Today, that number stands at 609,614.

This decline suggests reduced demand for its blockchain in terms of transactions, usage, and adoption, meaning fewer people are actively using it for transfers, business, or Bitcoin-based applications.

Meanwhile, the Bitcoin network must also ensure its infrastructure is efficient enough to meet global demand.

Can Bitcoin Scale for Global Use?

In 2018, Lightning Labs launched the Lightning Network to reduce the cost and time required for cryptocurrency transactions. Currently, the Bitcoin network can only handle around seven transactions per second, while Visa, for example, handles around 65,000.

“If expansion solutions (such as the Lightning Network) fail to become popular, Bitcoin’s ability to process only about 7 transactions per second will be difficult to support global demand. At the same time, as Bitcoin block rewards are gradually halved, the decline in miners’ income may threaten the long-term security of the network,” Guo, Director of HashKey Research explained.

While the confluence of geopolitical shifts and Bitcoin’s inherent characteristics undeniably create a space for its increased adoption as an alternative to the US dollar and even a potential reserve asset, significant hurdles remain.

Achieving mainstream Bitcoin adoption hinges on overcoming scalability, volatility, regulatory hurdles, stablecoin competition, and ensuring network security.

The unfolding panorama suggests Bitcoin will carve out an important role in the global financial system, though a complete overhaul of established norms seems unlikely in the immediate future.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

New USDi Stablecoin Pegged to US Inflation Metrics

A group of veteran derivatives and FX traders in the US are launching USDi, a stablecoin designed to adjust its price in line with inflation. Its value will change regularly based on Consumer Price Index (CPI) data and the performance of Treasury Inflation-Protected Securities (TIPS).

Founder Michael Ashton aims to offer an asset that maintains purchasing power by minimizing exposure to inflation risk. However, with intense competition in the stablecoin market, USDi will need strong early traction to carve out its place.

A Stablecoin To Beat Inflation?

Stablecoins are in the spotlight right now, with friendly US regulation spurring a potential boom in trading volumes. Given the current pro-regulatory environment in the US and growing adoption, many new players are innovating.

Today, derivatives trader Michael Ashton announced USDi, a stablecoin built to fight inflation.

“The riskless asset doesn’t actually currently exist, and that’s inflation-linked cash. Holding cash is an option on future opportunities, and the cost of that option is inflation. If you create inflation-linked cash, that’s the end of the risk line,” Ashton claimed.

Investors have been using crypto to hedge against inflation for years, but USDi is a novel approach to the problem. Ashton joined two co-founders, an FX veteran, and a technical specialist, to create the firm USDi Partners LLC.

USDi is a stablecoin that is correlated with the dollar but isn’t pegged to it. Instead, it will loosely orbit the dollar, but its value will fluctuate alongside US inflation.

That prospect may seem convoluted, but a simple system defines the stablecoin’s value. Essentially, Ashton claimed that USDi would rise in accordance with regular CPI reports, calculating the total inflation since a predetermined start date.

This date is December 2024, so it’s still quite close to the dollar. Today, for example, USDi’s price is $1.00863.

The novel stablecoin is inspired by the Treasury Inflation-Protected Securities (TIPS), a government bond designed to protect against inflation. Since CPI reports only happen once per month, Ashton will adjust USDi’s price in accordance with more frequent data used by TIPS investors.

To maintain this system, Ashton will manage a fund that acts as the stablecoin’s reserves. USDi Partners will mint and burn tokens according to the daily level of inflation, plus a small transaction fee.

Only accredited investors can partake in the initial launch, but USDi Partners hasn’t announced an official release date.

In short, USDi seems like a unique approach to the crypto economy, but the stablecoin market is full of competition. Ideally, Ashton and his co-founders will be able to get some early traction to get this project off the ground.

If it proves successful, it can help demonstrate the versatility of crypto’s practical applications.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoIs The XRP Price Mirroring Bitcoin’s Macro Action? Analyst Maps Out How It Could Get To $71

-

Market20 hours ago

Market20 hours agoBitcoin Price Eyes Bullish Continuation—Is $90K Within Reach?

-

Altcoin20 hours ago

Altcoin20 hours agoExpert Urges Pi Network To Learn From The OM Crash Ahead Of Open Mainnet Transition

-

Market18 hours ago

Market18 hours agoTrump’s Tariffs Spark Search for Jerome Powell’s Successor

-

Market16 hours ago

Market16 hours agoXRP Price Could Regain Momentum—Is a Bullish Reversal in Sight?

-

Market22 hours ago

Market22 hours agoMANTRA (OM) Charts Look Worse than LUNA – No Buying Activity

-

Market13 hours ago

Market13 hours agoCan Pi Network Avoid a Similar Fate?

-

Market19 hours ago

Market19 hours agoCoinGecko Conduct Survey on AI and Proof of Personhood