Market

Senator Lummis Backs Coinbase in Fight Against SEC Overreach

US Senator Cynthia Lummis has filed an amicus curiae brief in the case Coinbase vs Securities and Exchange Commission (SEC) in the US Court of Appeals for the Second Circuit.

Lummis is pushing back against what she describes as the SEC’s “legislation-by-enforcement” strategy under the Biden administration.

Lummis Takes Stand Against SEC’s Overreach

Senator Lummis argued that the SEC’s aggressive enforcement actions under former Chair Gary Gensler have been overreaching.

She criticized the SEC for secretly reinterpreting laws, including the Howey Test, which determines what constitutes an investment contract without transparent public input. She asserts that these changes demand compliance from digital asset exchanges without any formal legislative framework from Congress.

“The SEC’s approach under the Biden administration was to aggressively reinterpret case law governing Howey and investment contracts, keep those interpretations secret, and then demand compliance from digital asset exchanges.Such an approach is un-American. It is the job of Congress to provide a legislative framework that clearly draws the line between a security and a commodity,” said Lummis.

She insists that Congress has the constitutional authority to pass laws clarifying whether a digital asset is a security or a commodity.

Lummis further expressed concerns about the SEC’s expansion of its regulatory reach over digital assets, using a strained reading of securities laws drafted nearly a century ago. The SEC has attempted to redefine “investment contracts” in a way that could capture a broad range of digital assets—assets that do not fit the traditional definition of securities intended by Congress.

This, according to Lummis, threatens innovation in the growing digital asset industry. It also runs counter to ongoing efforts in Congress to create a thoughtful, clear regulatory framework.

Lummis’ brief highlights the issue of fundamental separation of powers raised by the SEC’s actions. In 2021, Gary Gensler himself acknowledged that Congress, not the SEC, should address the regulatory questions surrounding digital assets.

The senator’s legal challenge in Coinbase vs SEC is designed to clarify the scope of the SEC’s authority. She argues that the court should halt the SEC’s expansion of power before it stifles innovation and creates legal uncertainty.

With pending lawsuits across the country, the Second Circuit’s decision could provide much-needed clarity on the SEC’s authority.

Moreover, the latest development comes as Coinbase won a partial victory in its legal battle with the SEC. The US Court of Appeals found that the SEC had insufficiently reasoned its denial of Coinbase’s petition.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

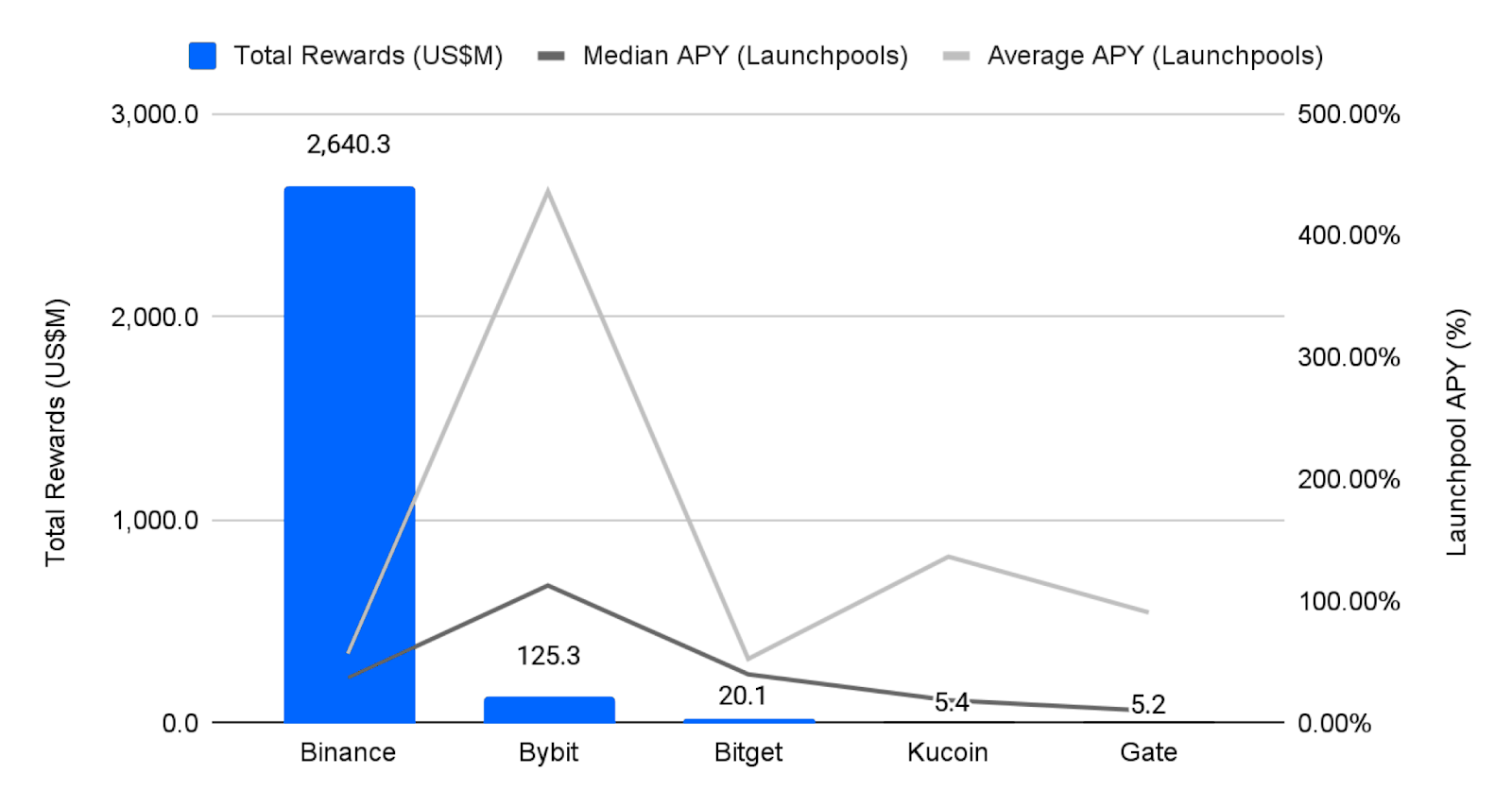

Binance Managed 94% of All Crypto Airdrops and Staking Rewards

A new report shows that Binance almost has a monopoly in the CEX market in terms of crypto airdrop distribution and staking rewards. In 2024, the exchange received $2.6 billion of a total of $2.7 billion in rewards, amounting to 94% of the entire market segment.

In an exclusive press release shared with BeInCrypto, Binance also revealed that it’s making substantial changes to its airdrop services to improve user experience and make participation easier.

Binance Leads the Market in Crypto Airdrops

Binance, the world’s largest crypto exchange, has become the go-to platform for airdrops and staking rewards. It launched the HODLer airdrop program less than a year ago, providing many new projects with a comprehensive platform to reward early adopters.

In the past year, the exchange has become synonymous with the latest airdrops, as most users are accessing their rewards through the platform.

Based on this impressive performance in the airdrop sector, Binance has substantially upgraded a few of its services. The platform has revamped its Launchpool and BNB Earn pages, making it easier for users to both track and participate in airdrops.

“With these upgrades, we’re making it easier than ever for users to unlock the full potential of BNB and participate in high-quality token launches. The redesigned Binance Launchpool and BNB pages reflect our commitment to user education, simplicity, and maximizing rewards,” said Jeff Li, VP of Product at Binance.

The updated BNB page will give Binance users key benefits, such as real-time information on airdrops across its platforms, including Launchpool, Megadrop, and HODLer Airdrops.

Users will also see features like trading fee discounts, VIP perks, and a historical rewards section. These improvements are designed to help the firm maintain its significant dominance while continuing to focus on integrity.

Hopefully, these improvements will allow the firm to maintain its significant dominance while maintaining its usual integrity. Last month, Binance Research identified some systemic problems with airdrops in general, and the exchange seems particularly concerned with its reputation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network Price Falls To Record New Low Amid Weak Inflows

Pi Network (PI) has experienced a significant downtrend recently, with price declines that have left many holders facing losses.

The altcoin has failed to break free from this negative momentum, and the market conditions continue to worsen. As a result, investors are losing confidence, and the price may continue to drop further.

Pi Network Continues To Suffer

The Chaikin Money Flow (CMF) continues to show bearish signs, remaining well below the zero line. This indicates that the network is suffering from outflows, meaning that investors are moving their funds out of Pi Network. Despite a bullish start, Pi failed to sustain interest, leading many holders to sell off their positions.

The outflow trend is concerning for investors, as the lack of positive momentum suggests a prolonged downtrend. The market sentiment remains bearish, with sellers outweighing buyers. As the CMF stays in the negative zone, it signals that Pi Network’s price could struggle to find stability in the short term.

The Ichimoku Cloud, a widely used technical indicator, is hovering well above the candlesticks, signaling that the bearish trend is gaining strength. This indicates that there is little upward momentum in the market, and Pi Network is likely to face more downward pressure.

Additionally, broader market conditions are still negative, which suggests that Pi Network may fail to recover in the immediate future. With bearish technical indicators and a lack of support from investors, the outlook for Pi Network remains grim for now.

PI Price Hits A New Low

Pi Network is currently priced at $0.61, having formed a new all-time low of $0.60 after dropping by nearly 14% over the last 24 hours. The altcoin continues to struggle under the weight of negative sentiment and is not showing signs of reversal in the near term.

Based on the ongoing outflows and bearish technical indicators, Pi Network will likely continue its decline. It could fall further to $0.50, potentially forming new all-time lows. The current market conditions suggest that recovery is unlikely without a significant shift in sentiment.

However, if Pi Network can bounce off the $0.60 level, it might regain some support and climb back to $0.87. This would help recover some of the recent losses and potentially give the altcoin another chance at a bullish move. But, without a strong catalyst, it may struggle to break through the resistance levels.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

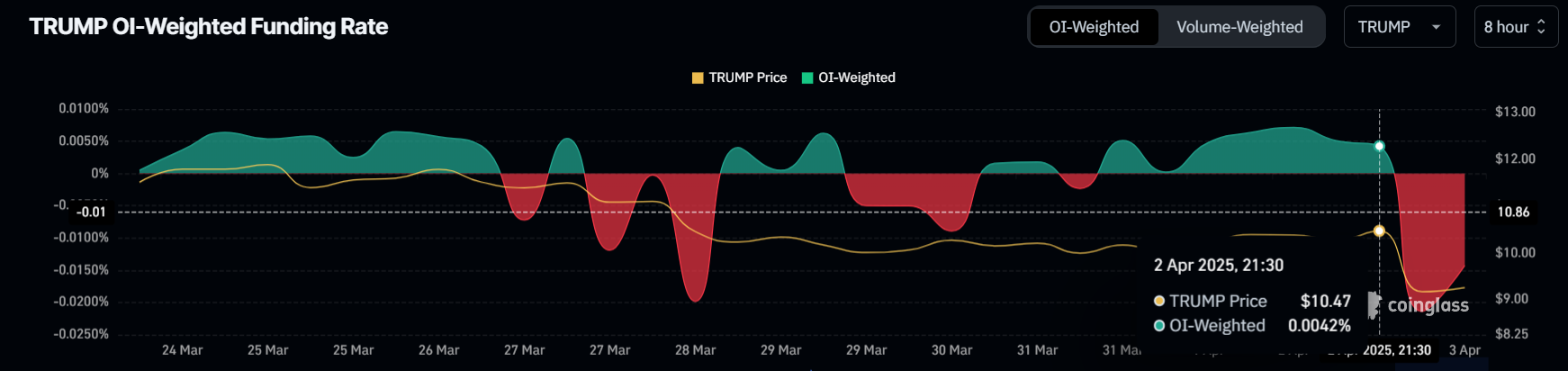

TRUMP Token Hits Record Low Due To Liberation Day Tariffs

TRUMP token has faced a significant downturn, failing to recover after a recent decline. The altcoin’s price has been further pressured by the announcement of US President Donald Trump’s Liberation Day Tariffs.

As a result, bearish sentiment has grown, leading traders to capitalize on the negative market conditions.

Trump’s Announcement Took A Toll

The funding rate for TRUMP turned negative over the last 24 hours, signaling increased bearish activity. Traders are shifting to short contracts, betting that the price will decline further. This shift in sentiment follows the announcement of the tariffs, which, despite being a policy move, had a negative impact on TRUMP’s price.

This negative market reaction highlights traders’ skepticism about the future prospects of TRUMP. While the tariff announcement was meant to stimulate market reactions, it instead spurred fear, driving a wave of sell-offs.

Looking at the broader momentum, technical indicators such as the Relative Strength Index (RSI) reveal that TRUMP is far from recovering its recent losses. The RSI remains firmly in the bearish zone, well below the neutral 50.0 mark. With no signs of reversal or bullish momentum, the token is likely to continue facing declines in the short term.

The oversold conditions are not yet reached either, indicating there is still room for further declines. With the RSI not showing any substantial recovery signals, the current downtrend could persist until market sentiment shifts or a new catalyst sparks renewed interest in the token.

TRUMP Price Suffers

TRUMP’s price hit a new all-time low of $8.97 before recovering slightly to $9.29. Over the last 24 hours, the token has seen a 10% decline. This drop has added to its month-long 45% slide, as the token lost crucial support levels, including $12.57 and $10.29.

The ongoing bearish trend suggests that TRUMP could continue to slide, with the next key support around $8.00. If the broader market conditions remain weak and the bearish sentiment continues to dominate, the price could dip further, reaching new lows before any potential recovery.

However, if TRUMP manages to reclaim $10.29 as support, it could mark the beginning of a recovery attempt. Successfully breaching $12.57 could invalidate the current bearish outlook and signal a potential rally, but this would require a significant shift in investor sentiment and market conditions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoHere’s Why This Analyst Believes XRP Price Could Surge 44x

-

Altcoin23 hours ago

Altcoin23 hours agoHow Will Elon Musk Leaving DOGE Impact Dogecoin Price?

-

Ethereum21 hours ago

Ethereum21 hours agoWhy A Massive Drop To $1,400 Could Rock The Underperformer

-

Altcoin20 hours ago

Altcoin20 hours agoFirst Digital Trust Denies Justin Sun’s Allegations, Claims Full Solvency

-

Ethereum23 hours ago

Ethereum23 hours agoWhales Dump 760,000 Ethereum in Two Weeks — Is More Selling Ahead?

-

Altcoin21 hours ago

Altcoin21 hours agoWill Cardano Price Bounce Back to $0.70 or Crash to $0.60?

-

Market3 hours ago

Market3 hours agoBitcoin’s Future After Trump Tariffs

-

Altcoin15 hours ago

Altcoin15 hours agoBinance Sidelines Pi Network Again In Vote To List Initiative, Here’s All