Market

SEC Likely to Approve Multiple Altcoin ETFs by Q2 2025

The SEC declared today that proof-of-work cryptoassets are not bound by securities regulations. Based on this clarity and the commissions latest actions, BeInCrypto analysts predict that the SEC will approve multiple altcoin ETFs together by the end of Q2 2025

Meanwhile, Caroline Crenshaw, an anti-crypto SEC Commissioner, made another statement of public dissent today. She claimed that this ruling is full of loopholes, but it’s doubtful that these objections can stop a dedicated pro-crypto agenda.

SEC is Laying the Groundwork to Approve more ETFs

In a press release today, the Commission decided that proof-of-work cryptoassets are not considered securities under US law. Like Bitcoin, the entire asset class should be considered commodities. The SEC’s decision here could have huge implications for altcoin ETFs.

“It is the [SEC’s] view that mining activities do not involve the offer and sale of securities [and] that participants in mining activities do not need to register transactions with the Commission under the Securities Act or fall within one of the Securities Act’s exemptions from registration,” the SEC’s statement claimed.

This regulatory clarity could change the odds of ETF approval for a few proof-of-work (PoW) cryptoassets. For example, Litecoin, which falls in this category, was already very likely to receive approval.

With this ruling, more asset managers might be inclined to offer ETFs for other PoW coins, like Monero or Kaspa.

However, this trend also goes beyond PoW cryptoassets in general. The SEC has been systematically declaring several assets to be commodities.

For example, in February, it declared that meme coins are not securities. This potentially clearly the regulatory roadblock for Dogecoin ETFs.

SEC Wants Paul Atkins to Join Under a Clean Slate

In other words, the SEC could be declaring all these assets to not be securities as a way of laying foundations for any future ETF applications. When viewed through this angle, even a few apparent setbacks could be the groundwork for future gains.

Case in point, the Comission delayed ETF applications for Solana and XRP last week. However, the CFTC has since approved futures trading on both assets, boosting their ETF odds.

Meanwhile, the Commission also dropped its landmark lawsuit against Ripple, which hinged on the supposition that XRP is a security.

So, all of these decisions are collectively removing any regulatory hurdles that can restrict altcoin funds from entering the institutional markets.

Next week, the Senate will reportedly begin confirmation hearings on Paul Atkins, Trump’s pick to be the next SEC Chair. By the time those applications meet another deadline, Atkins could be seated.

It’s likely that Atkins will have an easy decision to approve a bunch of different altcoin ETFs, as Mark Uyeda and Hester Peirce are already clarifying securities and commodities debate.

“Donald Trump’s pick for SEC chair Paul Atkins will face the Senate Banking Committie next Thursday for his nomination hearing. Trump’s pick for OCC, Jonathan Gould, will also have his hearing,” wrote Eleanor Terrett.

Crenshaw Speaks Out Once Again

Given the current regulatory trends and SEC actions, BeInCrypto projects that the Comission is preparing to approve several altcoin ETFs during Q2 2025.

However, not everyone on the Commission is prepared to go along with it. Caroline Crenshaw, a Commissioner who recently broke ranks to publicly dissent with the SEC’s pro-crypto turn, criticized today’s decision too.

“Buried in the footnotes, the statement reveals its true limitation: one actually would have to conduct a Howey analysis to know if a specific mining arrangement constitutes an investment contract. For the sake of investors, other market participants, and the markets themselves, I hope that readers do not mistake it for something more than it is,” she said.

Crenshaw asserted that the SEC’s argument is full of several other serious loopholes, and doesn’t actually guarantee that PoW tokens are free from securities laws.

She said that today’s decision is the tenth such “non-binding interpretation” in nine weeks, although she stopped short of directly accusing her colleagues of making biased rulings to favor the crypto industry.

Still, Crenshaw’s time at the SEC is running out. If nobody wishes to test these loopholes, it’s functionally the same as if they did not exist.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 Altcoins to Watch in the Third Week of April 2025

The crypto market’s volatility continues, compounded by the absence of bullish signals from broader financial markets. While altcoins are becoming less dependent on external developments, they are increasingly relying on internal network progress to drive price movement.

BeInCrypto has analyzed three altcoins to watch, focusing on whether key events could trigger a price shift in the third week of April.

Filecoin (FIL)

FIL price has bounced off the support of $2.26, currently trading at $2.50. This rebound follows the altcoin’s 27% decline at the end of March, and traders are anticipating a recovery. The support level of $2.26 has proven crucial in halting further losses and enabling a potential uptrend.

Upcoming developments, such as the FIP 0097 proposal, could further boost FIL’s price. The transition to FEVM supporting transient storage and aligning with Ethereum’s EIP-1153 promises cleaner contracts, lower costs, and better compatibility. These improvements could drive FIL past the $2.63 resistance level, potentially reaching $2.99.

If FIL fails to break through the $2.63 barrier, the altcoin may fall back to $2.26. Losing this key support would invalidate the bullish outlook, risking a further drop to $2.00. Investors will closely monitor these levels for signs of a reversal or continued decline.

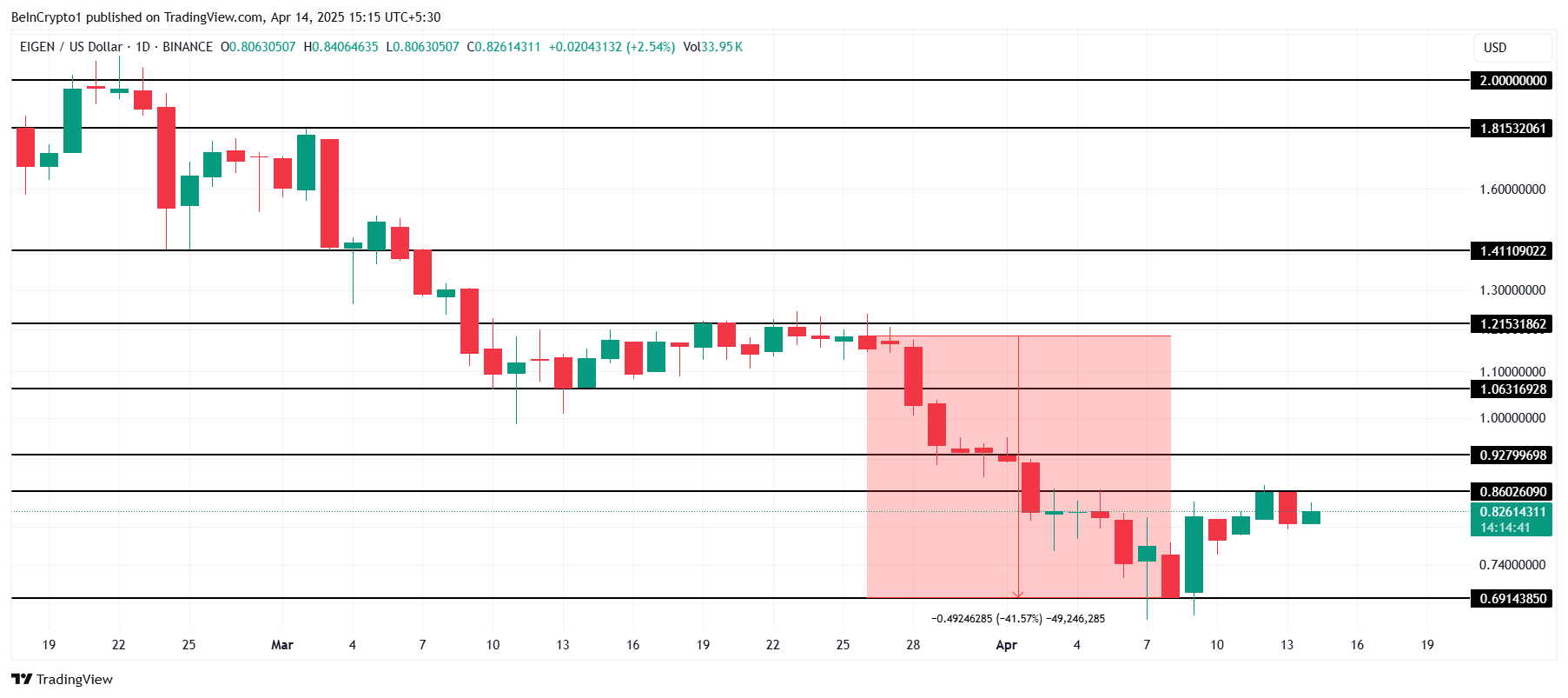

EigenLayer (EIGEN)

Another one of the key altcoins to watch before April ends, the EIGEN price is poised to breach the $0.86 resistance this week, driven by the upcoming Slashing upgrade. The upgrade will introduce a free marketplace where Operators can earn rewards for their work, and AVSs can launch verifiable services.

If EIGEN capitalizes on the momentum from the Slashing upgrade, it could surpass the $0.86 and $0.92 resistance levels. With continued upward movement, the altcoin could reach $1.00 and beyond. Investors are closely monitoring the effects of this update on price performance.

However, if EIGEN fails to breach $0.86, the price may fall back to the support level of $0.69. This would invalidate the bullish outlook and delay the recovery from the 41.5% losses incurred at the end of March.

OFFICIAL TRUMP (TRUMP)

TRUMP price recently hit an all-time low of $7.14 but has since recovered to $8.33. Despite this recovery, the likelihood of a continued rally is uncertain due to the upcoming token unlock on April 18. This event could create additional selling pressure on the altcoin in the coming days.

The first token unlock in three months, set to release 40 million TRUMP worth $331 million, will flood the market. This unlock will also initiate the daily release of 492,000 TRUMP tokens. Investors are concerned that this increased supply may further weigh on the price.

The surge in supply could prove bearish for TRUMP, which is already facing low demand. This may push the price back down to $7.14 or lower, potentially creating a new all-time low. However, if the price breaches $9.11, the bearish outlook would be invalidated, and recovery could occur.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Tether Deploys Hashrate in OCEAN Bitcoin Mining Pool

Tether is deploying its existing and future hashrate on OCEAN, a decentralized Bitcoin mining protocol. It will focus on delivering high-performance operations to undeveloped areas, particularly in Africa.

Tether is showing increased commitment to keeping the Bitcoin ecosystem sustainable. This initiative also builds on the company’s previous investments in Africa.

Tether and OCEAN Team Up

Tether, the world’s leading stablecoin issuer, has been diversifying its interests lately. It’s preparing to make major internal changes, investing in a few different sectors, and considering a major stablecoin launch.

Today, Tether is working to advance decentralized mining infrastructure by deploying both its existing and future hashrate on OCEAN.

“As a company committed to financial freedom and open access, we see supporting decentralization in Bitcoin mining as essential to the network’s long-term integrity. Deploying hashrate to OCEAN aligns with both our mining investments and our broader mission to fortify Bitcoin against centralizing forces,” said Paolo Ardoino, CEO of Tether.

OCEAN is a decentralized Bitcoin mining pool, and despite the naming similarities, it’s not related to the popular AI token. It was founded by Bitcoin Core developer Luke Dashjr in response to centralization fears in BTC mining.

Tether’s hashrate will be able to help OCEAN in a few key ways. Critically, it highlights Tether’s commitment to the long-term viability of Bitcoin, as it is a major holder.

The company will deploy this hashrate through OCEAN’s DATUM Gateway service, which helps miners create high-performance operations in low-bandwidth areas.

Most notably, Tether will prioritize rolling out these services in rural and underdeveloped regions, particularly in Africa. This reflects Tether’s growing business commitments in the continent.

Tether obviously has self-interested reasons to deploy its hashrate on OCEAN, as it benefits from potential stablecoin users in new regions.

Moreover, the firm cast Bitcoin’s independence as a key motivator in itself. Tether is a major component of the global crypto economy, and it recognizes the importance of BTC beyond its desire to custody the asset.

In short, this operation gives a few insights into Tether’s plans for the future. By deploying hashrate on OCEAN, Tether is working to strengthen Bitcoin’s network and put more of the world on the blockchain.

Eventually, both of these aims can directly benefit the company.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MENAKI Leads Cat Themed Tokens

Meme coins have garnered investors’ interest today more than any other category of crypto assets. Leading the joke tokens was Maneki, who continued the momentum from the previous week.

BeInCrypto has analyzed two other meme coins for investors to watch and the direction in which they are taking.

Maneki (MANEKI)

- Launch Date – April 2024

- Total Circulating Supply – 8.85 Billion MANEKI

- Maximum Supply – 8.85 Billion MANEKI

- Fully Diluted Valuation (FDV) – $25.32 Million

MANEKI price surged by nearly 28% over the last 24 hours, reaching $0.0028. This significant rise marks a continuation of the altcoin’s rally from the previous week.

The meme coin is expected to maintain its upward trajectory, aiming to breach the $0.0036 barrier in the coming days. A successful breach could attract more investors, sparking inflows and potentially propelling the price even higher. This would enhance the altcoin’s visibility and fuel its growing popularity.

However, if MANEKI fails to hold its support at $0.0022, it could fall to $0.0017. A drop to this level would invalidate the bullish outlook and extend the recent losses, halting its upward momentum.

Keyboard Cat (KEYCAT)

- Launch Date – January 2024

- Total Circulating Supply – 10 Billion KEYCAT

- Maximum Supply – 10 Billion KEYCAT

- Fully Diluted Valuation (FDV) – $35.39 Million

KEYCAT’s price saw a modest 11% increase today, reaching $0.0035, continuing its rally from the previous week, which now totals 64%. Despite not performing as well as MANEKI, this consistent upward trend could attract investors’ attention.

The next resistance level for KEYCAT is at $0.0040, and to breach this level, the altcoin will likely need broader market support. If successful, this could propel the meme coin toward $0.0053, solidify the current bullish outlook, and fuel further price action, drawing in more investors.

However, if KEYCAT fails to break through $0.0040, it may drop to $0.0030, with further declines possible if this support is lost. Such a fall would invalidate the bullish thesis and signal a potential reversal in price.

Popcat (SOL) (POPCAT)

- Launch Date – December 2023

- Total Circulating Supply – 979.97 Million POPCAT

- Maximum Supply – 979.97 Million POPCAT

- Fully Diluted Valuation (FDV) – $262.19 Million

POPCAT saw an impressive 115% rise over the past week, positioning it as one of the best-performing tokens. However, despite this surge, the meme coin faced a slight decline in the last 24 hours. The volatility signals a possible shift, though the outlook remains generally positive.

While the recent decline has almost been recovered, POPCAT’s momentum seems to be waning. Currently holding above the $0.244 support, the coin looks poised to bounce back and potentially rise to $0.342. Continued support from the market could allow for a more sustained recovery in price.

However, if POPCAT fails to maintain support at $0.244, the price could fall to $0.205, significantly invalidating the bullish outlook. A break below this support would suggest further price erosion, reversing the recent gains and potentially setting the coin on a downward trajectory.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin21 hours ago

Altcoin21 hours agoMantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

-

Altcoin24 hours ago

Altcoin24 hours agoEthereum Price Eyes Rally To $4,800 After Breaking Key Resistance

-

Market19 hours ago

Market19 hours agoMANTRA’s OM Token Crashes 90% Amid Insider Dump Allegations

-

Altcoin8 hours ago

Altcoin8 hours agoXRP Price Climbs Again, Will XRP Still Face a Death Cross?

-

Market13 hours ago

Market13 hours agoBitcoin’s Price Under $85,000 Brings HODlers Profit To 2-Year Low

-

Market10 hours ago

Market10 hours agoXRP Outflows Cross $300 Million In April, Why The Price Could Crash Further

-

Market9 hours ago

Market9 hours agoFLR Token Hits Weekly High, Outperforms Major Coins

-

Bitcoin8 hours ago

Bitcoin8 hours agoCrypto Outflows Hit $795 Million On Trump’s Tariffs & Market Fear