Market

Robinhood Brings Crypto Transfers to Europe

Robinhood has launched crypto transfer services in Europe, enabling customers to move cryptocurrencies in and out of its app. This move highlights the American financial services company’s dedication to expanding its product offerings and strengthening its global presence in the crypto market.

Speculation arose that the retail investing platform is exploring the stablecoin market, but Robinhood has firmly denied this claim.

Robinhood Enables Crypto Transfers in Europe

Customers in the European Union can now deposit and withdraw over 20 digital currencies, including BTC, ETH, SOL, and USDC, via Robinhood’s platform. They can also self-custody assets instead of storing their holdings with third parties.

With the launch of the service, European customers can receive 1% of the value of tokens deposited on the platform back in the form of the equivalent cryptocurrency they transfer into Robinhood, a limited-time marketing strategy.

This development comes barely a year after Robinhood Crypto forayed into the EU market. The venture allowed customers to buy and sell cryptocurrencies. However, they could not move them away from the platform to another third party or their own self-custodial wallet. The latest development changes that.

Read more: How to Buy and Sell Crypto on Robinhood: A Step-by-Step Guide

Robinhood’s move to bring crypto transfers to Europe acknowledges the region’s potential to become an attractive market for digital currencies. Its general manager and vice president, Johann Kerbrat, cited crypto-friendly regulations adopted in Europe’s 27-member bloc. In his opinion, things could be better once Markets in Crypto-Assets (MiCA) are in full effect.

This regulatory clarity has allowed companies like Circle to obtain an Electronic Money Institution (EMI) license, enabling them to offer dollar- and euro-pegged crypto tokens under the MiCA framework.

Amid this environment, there was speculation that Robinhood was exploring stablecoin launches alongside Revolut, but the retail investing platform has denied these claims. The firm put out the speculation, citing no “immediate plans” to launch its own stablecoin.”

“On our side, we don’t have any imminent plan. It’s always kind of funny in my position to see where people think we’re going to move next,” Kerbrat said in an interview with a news site.

Rumors notwithstanding, Tether’s USDT dominance in the stablecoin market could face significant competition as sector regulation improves in the EU. As BeInCrypto reported in July, Circle’s USDC stablecoin leads regulated stablecoins with a $23 billion volume, effectively challenging reserve-backed stablecoin First Digital USD’s (FDUSD) 14% market share.

USDC’s main market rival in the stablecoin market, Tether’s USDT, is not EMI-licensed. Its CEO, Paolo Ardoino, is still unconvinced by MiCA’s expectation of 60% backing in bank cash.

Also read: What Is Markets in Crypto-Assets (MiCA)? Everything You Need To Know

These developments highlight the potential of the MiCA framework to shift the balance in favor of compliant stablecoins.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Paul Atkins Confirmed as SEC Chair, Crypto Rules to Ease

The US Senate has confirmed Paul Atkins as the new chair of the Securities and Exchange Commission. Senators approved the appointment on Wednesday with a 52-44 vote.

Atkins is expected to shift the agency’s approach to financial oversight. He plans to ease regulatory requirements, scale back corporate disclosure rules, and continue the commission’s new pro-crypto stance.

SEC Has a Pro-Crypto Chair

Since last week’s Senate hearing, there have been some doubts about Paul Atkins’ appointment. This was largely due to his significant crypto exposure as an investment leader.

However, the Senate has decided today with a tight vote.

The leadership change follows a period of major transition at the agency. Mark Uyeda, who served as acting chair after Gensler’s departure, launched a fast-paced overhaul of crypto policy.

“Confirmed, 52-44: Confirmation of Executive Calendar #61 Paul Atkins to be a Member of the Securities and Exchange Commission for the remainder of the term expiring June 5, 2026,” wrote the Senate Cloakroom.

Under Uyeda, the SEC dismissed several major enforcement actions tied to digital assets. The agency also declared that certain crypto sectors — including stablecoins, proof-of-work mining, and meme coins fall outside its jurisdiction.

Some of these areas have financial links to the Trump family. Their ventures include meme coin projects and connections to World Liberty Financial, a firm backing its own stablecoin.

Atkins is expected to formalize these regulatory shifts and oversee any new standards that may follow from pending legislation.

“Atkins may have made history tonight as the first SEC commissioner to get confirmed by the Senate three times. Once in 2002, then again in 2003, and now in 2025,” wrote Eleanor Terrett.

The SEC has already begun loosening several other rules. Uyeda delayed implementation deadlines for policies introduced during Gensler’s term.

He also revised rules on shareholder proposals, making it harder for activists to force issues onto corporate ballots.

The agency withdrew its defense of rules that required companies to disclose climate-related risks and emissions.

Atkins will take over a smaller agency. Around 500 staff have accepted voluntary resignations or buyouts. This has been part of the Trump administration’s broader effort to shrink federal agencies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

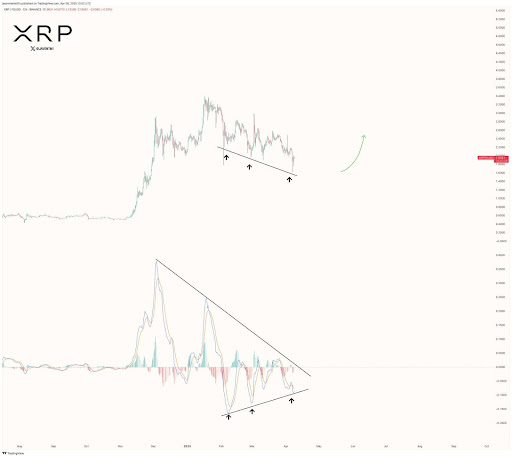

XRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

XRP’s recent recovery has sparked fresh optimism among traders, but what’s happening behind the scenes tells an even more compelling story. This isn’t just a typical bounce; the charts reveal a calculated shift in momentum. Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are beginning to align, suggesting that XRP is approaching a crucial decision zone.

Following the recent downturn in the market, the price is now on a bullish recovery after testing the $1.7 key support level with increasing conviction. If the current momentum continues and resistance zones give way, XRP could be on the verge of a significant breakout. However, failure to build on this momentum could trap the token in another consolidation phase or a deeper retracement.

MACD Signals Brewing Bullish Pressure For XRP

In a recent post on X, crypto analyst Javon Marks pointed out that XRP’s MACD is approaching a critical breaking point, potentially signaling a shift in market momentum. He emphasized that this MACD indicator is showing signs of a bullish crossover, which could mark the start of a strong upward movement.

Coupled with this, Marks highlighted that XRP is currently holding a key Regular Bullish Divergence, where the price has been making lower lows while the MACD is showing higher lows. This indicates a weakening of bearish pressure, setting the stage for a potential reversal.

Marks suggested that this technical setup could be the catalyst for the bulls to take control, potentially leading to a powerful move that breaks through current resistance levels. With this convergence of bullish signals, XRP may be primed for a rally back toward the $3.30+ range, continuing its previous uptrend.

Key Levels to Watch: The Exact Breakout And Rejection Zones That Matter

In order to fully understand the future movements of XRP, it’s crucial to pinpoint the key levels that will either drive the price higher or cause a reversal. Firstly, the breakout zone for the altcoin lies around the $1.97 resistance level.

If the price manages to surpass this threshold with strong volume, it could trigger a surge towards higher levels, including $2.64 and $2.92. This breakout would likely confirm the upward momentum suggested by the MACD and the regular bullish divergence.

On the other hand, a rejection at the $1.97 resistance level might signal a lack of buying interest. Should the asst fail to break above this level, the price could pull back toward lower support levels like $1.7 or even $1.34. A failure to hold these support levels would trigger the potential for a more substantial downturn, with bears regaining control.

Market

SEC Approves Ethereum ETF Options Trading After Delays

After several delays, the SEC approved options trading on BlackRock’s iShares Ethereum ETF. This effort was initiated by Nasdaq last summer, and today was the Commission’s final deadline to confirm or reject it.

Ethereum’s price grew more than 14% today and this bullish development could help sustain these unrelated gains for the foreseeable future.

Ethereum ETF Gets Options Trading

Since the Ethereum ETF first won approval, it’s had a large impact on crypto markets. As the market has matured, several issuers have spent the last few months trying to get options trading approved as well.

After the SEC’s previous delay, the Commission had to make a firm decision by today’s deadline, and it decided to approve these options.

“The Commission is publishing this notice to solicit comments… from interested persons, and is approving the proposed rule change… on an accelerated basis,” the SEC’s release claimed.

Options are financial derivatives that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before a specified expiration date.

In the context of the iShares Ethereum ETF, options trading enables investors to speculate on or hedge against the price fluctuations of BlackRock’s Ethereum Trust without directly transacting in the ETF itself.

Options trading can attract a broader range of investors. This includes institutional players seeking sophisticated instruments to manage risk and exposure in the crypto market.

Nasdaq filed this particular application in the summer of 2024, but it has faced a series of delays. Still, this formal approval aligns fairly well with the market’s expectations.

The price of Ethereum hardly budged after this announcement. The announcement was largely overshadowed by Trump’s tariff pause, which caused gains of over 14%.

That isn’t to say that Ethereum ETF options trading is insignificant, of course. This approval will bring several key advantages to Ethereum, like institutional legitimacy, liquidity, and investor access.

Tariff fears recently pulled over $3 million from the altcoin’s spot ETF market. So, this development might encourage a bullish resurgence.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin19 hours ago

Altcoin19 hours agoShiba Inu Burn Rate Shoots Up 1500%, Can SHIB Price Recover After Bloodbath?

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin Crashes Below $75,000 As Asian Stock Markets Bleed

-

Market23 hours ago

Market23 hours agoBerachain Drops 47% in a Month as Bearish Signals Grow

-

Bitcoin19 hours ago

Bitcoin19 hours agoHow Trump’s Tariffs Threaten Bitcoin Mining in the US

-

Market18 hours ago

Market18 hours agoDogecoin (DOGE) at Risk of More Losses as Market Volatility Spikes

-

Market16 hours ago

Market16 hours agoXRP Price Warning Signs Flash—Fresh Selloff May Be Around the Corner

-

Altcoin16 hours ago

Altcoin16 hours agoBinance To Delist These 7 Crypto Pairs Amid Market Turmoil, Are Prices At Risk?

-

Market22 hours ago

Market22 hours agoBitcoin Price Takes Another Tumble—Is The Floor About to Crack?