Market

Ripple Unlocks 1 Billion XRP From Escrow

On-chain data recently showed that Ripple carried out its monthly escrow unlock for May. As expected, this has raised concerns about how it could affect the XRP price, especially since Ripple has been accused of manipulating the token’s price.

Ripple Unlocks 500 Million XRP Tokens

Onchain data revealed 500 million XRP tokens were unlocked from Ripple’s escrow on May 1. The crypto firm is known to unlock 1 billion tokens monthly, although it looks to have only unlocked half this time around. The magnitude of these tokens always raises concerns, considering the negative impact they could have on the altcoin’s price if dumped on the market.

Further analysis of the on-chain data shows that Ripple sent 300 million XRP out of the unlocked tokens to an escrowed account (2Not4co2op). Meanwhile, the crypto firm sent the remaining 200 million XRP tokens to another wallet (4vt5x1o91m). Considering that the 200 million XRP tokens weren’t sent to escrow, Ripple may have plans to sell them at some point, although it has yet to do so.

It is also worth mentioning that Ripple received another 500 million XRP tokens from an unknown wallet (ymFZmKxEsF). However, these funds were immediately sent to an escrow account. As such, the community can heave a sigh of relief since most of the XRP tokens Ripple received in the last 24 hours have been sent back to escrow.

Talks About Ripple Dumping On The Market Resurface

Following the latest token unlock, the crypto community has reignited talks about Ripple’s alleged dumping on XRP holders. The question of whether or not Ripple’s XRP sales influence the token’s price has been a long-standing discussion, with notable figures like pro-XRP crypto YouTuber Jerry Hall even accusing Ripple of intentionally suppressing the altcoin’s price with its sales.

On the other hand, people like Ripple’s Chief Technology Officer (CTO) have clarified that the crypto firm’s XRP sales do not impact the crypto token’s price. Moreover, Ripple already discontinued programmatic sales, which means that its transactions cannot affect prices on crypto exchanges.

Ripple also noted in its recent court filing in its ongoing legal battle against the Securities and Exchange Commission (SEC) that it had taken measures to ensure its institutional sales did not violate securities laws. This suggests that Ripple conducts its sales over the counter (OTC) to avoid further scrutiny from the Commission.

At the time of writing, the token is trading at around $0.5, up over 2% in the last 24 hours according to data from CoinMarketCap.

Price rises above $0.51 | Source: XRPUSDT on Tradingview.com

Featured image from The Motley Fool, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Market

Bitcoin Price on The Brink? Signs Point to Renewed Decline

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

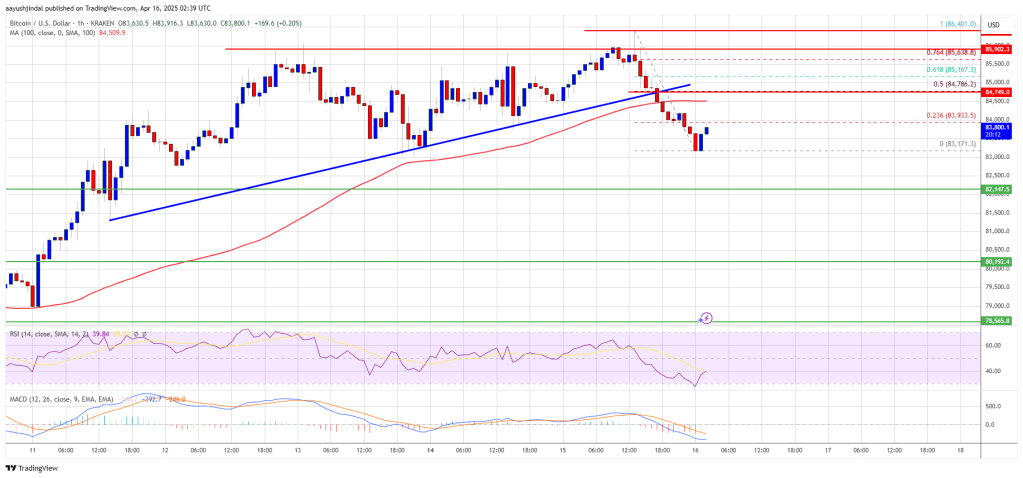

Bitcoin price started a fresh decline from the $86,500 zone. BTC is now consolidating and might continue to decline below the $83,200 support.

- Bitcoin started a fresh decline from the $86,500 zone.

- The price is trading below $85,000 and the 100 hourly Simple moving average.

- There was a break below a connecting bullish trend line with support at $84,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $84,500 zone.

Bitcoin Price Faces Rejection

Bitcoin price started a fresh increase above the $83,500 zone. BTC formed a base and gained pace for a move above the $84,000 and $85,500 resistance levels.

The bulls pumped the price above the $86,000 resistance. A high was formed at $86,401 and the price recently corrected some gains. There was a move below the $85,000 support. Besides, there was a break below a connecting bullish trend line with support at $84,500 on the hourly chart of the BTC/USD pair.

The price tested the $83,200 support. Bitcoin price is now trading below $85,000 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $84,000 level and the 23.6% Fib retracement level of the downward move from the $86,401 swing high to the $83,171 low.

The first key resistance is near the $84,500 level. The next key resistance could be $84,750 and the 50% Fib retracement level of the downward move from the $86,401 swing high to the $83,171 low.

A close above the $84,750 resistance might send the price further higher. In the stated case, the price could rise and test the $85,500 resistance level. Any more gains might send the price toward the $86,400 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $85,000 resistance zone, it could start another decline. Immediate support on the downside is near the $83,500 level. The first major support is near the $83,200 level.

The next support is now near the $82,200 zone. Any more losses might send the price toward the $81,500 support in the near term. The main support sits at $80,800.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $83,200, followed by $82,200.

Major Resistance Levels – $84,750 and $85,500.

Market

3 US Crypto Stocks to Watch Today: CORZ, MSTR, and COIN

Crypto US stocks are showing mixed performance today, with Core Scientific (CORZ), MicroStrategy (MSTR), and Coinbase (COIN) in focus.

CORZ is down -0.84% in the pre-market and remains one of the worst performers in the sector this year. Meanwhile, MSTR is gaining momentum after a fresh $285 million Bitcoin purchase, pushing its 5-day gains to 16%. COIN is up +0.88% pre-market as it heads into its Q1 2025 earnings report on May 8, trying to recover from a steep YTD decline.

Core Scientific (CORZ)

Core Scientific (CORZ) is down -0.84% in pre-market trading, continuing its recent underperformance. Despite broader strength across crypto-related equities, the stock has struggled to attract buyers.

The company operates one of the largest Bitcoin mining businesses in North America. It provides infrastructure, hosting, and self-mining services through its network of data centers.

CORZ is down nearly 50% year-to-date, making it one of the worst performers among crypto stocks. In contrast, peers like Marathon Digital (MARA) and Coinbase (COIN) have held up much better.

While others benefit from diversification or stronger narratives, Core Scientific remains tied to mining economics—an area hit by rising costs and thinning margins, but that it could have a rebound as BTC rebuilds momentum.

Strategy (MSTR)

MicroStrategy (MSTR) closed yesterday up 3.82%, pushing its year-to-date return to 7.54%. The stock has shown strong momentum alongside Bitcoin’s recent price recovery, with MSTR price up 16% in the last 5 days.

The company, led by Michael Saylor, is best known for its aggressive Bitcoin accumulation strategy. While it originally focused on enterprise software, it has since become heavily tied to BTC’s performance.

Strategy recently purchased an additional $285 million worth of Bitcoin, adding 3,459 BTC to its balance sheet. This brings its total holdings to 531,644 BTC.

The move reinforces the firm’s position as the largest corporate holder of Bitcoin, effectively turning it into a leveraged BTC play for investors.

Coinbase (COIN)

Coinbase (COIN) is trading up +0.88% in the pre-market, showing signs of continued short-term strength. The move comes ahead of a key earnings update.

The company operates one of the largest cryptocurrency exchanges in the US, offering trading, custody, and staking services. Coinbase is set to report its Q1 2025 earnings on May 8, which could be a major catalyst for the stock.

COIN is up 12% over the last five days, attempting to rebound after falling nearly 29% year-to-date.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethena Labs Leaves EU Market Over MiCA Compliance

Ethena Labs is officially closing its German branch and EU operations after a previous MiCA application rejection. For the past month, the firm has been preparing to withdraw from this market.

Although the exit was anticipated, ENA reacted notably, with the altcoin falling over 7% after today’s announcement.

Ethena Labs Failed MiCA Effort

Ethena Labs has been facing continued regulatory difficulties in Europe. In late March, German authorities rejected Ethena’s application for MiCA compliance.

At the time, the firm suggested that this was a minor setback and that it would focus on other markets. Today, it announced that its German branch is winding down altogether.

“We have agreed with BaFin to wind down all activities of Ethena GmbH and will no longer be pursuing the MiCAR authorization in Germany. All whitelisted… users previously interacting with Ethena GmbH have at their request been onboarded with Ethena (BVI) Limited instead. As a result, Ethena GmbH no longer has any direct customers,” it claimed.

The statement further claimed that Ethena GmbH, the German branch, “has not conducted any mint or redeem activity” since the regulators’ MiCA ruling.

Specifically, regulators banned all sales of the USDe stablecoin, putting serious restrictions on the firm. In other words, this outcome is fairly expected. Ethena (BVI) Limited has taken over the German branch’s users.

The network’s governance token, ENA, has seen notable price swings around its MiCA efforts. In Early March, when Ethena Labs was reportedly on track to receive regulatory approval, ENA broke out of multi-month lows and nearly reached $2.5 billion in mark cap.

However, since the rejection, ENA saw continued bearish pressure, which was exacerbated by the macroeconomic conditions across the market. Today’s announcement drove further decline.

MiCA, the European Union’s new stablecoin regulations, have presented difficulties for several firms besides Ethena. For example, Tether’s stablecoins were delisted from EU exchanges when MiCA took effect, prompting serious changes to its business.

Several other issuers have been racing to fill the gap left by these firms by achieving compliance. Most recently, major centralized exchanges such as Crypto.com and OKX have achieved the license, further strengthening their grasp over the EU market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market18 hours ago

Market18 hours agoCan Pi Network Avoid a Similar Fate?

-

Ethereum22 hours ago

Ethereum22 hours agoSEC Delays Decision On Staking For Grayscale’s Ethereum ETFs

-

Market21 hours ago

Market21 hours agoXRP Price Could Regain Momentum—Is a Bullish Reversal in Sight?

-

Market23 hours ago

Market23 hours agoTrump’s Tariffs Spark Search for Jerome Powell’s Successor

-

Market16 hours ago

Market16 hours agoPi Network Price Rise To $1 is Now In The Hands Of Bitcoin

-

Market22 hours ago

Market22 hours agoBitcoin ETFs End Dry Spell with Fresh Capital

-

Market20 hours ago

Market20 hours agoCardano Buyers Eye $0.70 as ADA Rallies 10%

-

Altcoin13 hours ago

Altcoin13 hours agoWhispers Of Insider Selling As Mantra DAO Relocates Nearly $27 Million In OM To Binance