Market

Rexas Finance presale skyrockets to new heights, steals the hype from Toncoin and Tron

In an increasingly crowded cryptocurrency landscape, a few projects are rising to the top, capturing the imagination and capital of investors. One such project is Rexas Finance (RXS), whose presale has seen an incredible surge in interest and investment, making waves across the crypto community. While big names like Toncoin (TON) and Tron (TRX) have long enjoyed their moments in the spotlight, it seems Rexas Finance is now stealing the hype. Thanks to its unique approach to real-world asset (RWA) tokenization, Rexas Finance is quickly becoming a favorite among investors looking for a project with real-world utility and long-term growth potential.

The Rise of Rexas Finance

Rexas Finance has differentiated itself from many of the other projects in the crypto space by addressing real-world problems rather than focusing solely on speculative gains. Its platform allows users to tokenize real-world assets such as real estate, commodities, art, and intellectual property, making these typically illiquid assets more accessible and tradable. Tokenization breaks down large, valuable assets into smaller digital units, or tokens, which can be bought, sold, or traded on the blockchain. This opens up previously inaccessible investment opportunities to a much broader audience. Traditionally, only institutional investors or wealthy individuals could afford to invest in high-value assets like commercial real estate or fine art. With Rexas Finance, investors can now own fractional shares of these assets, giving them a chance to participate in markets that were previously out of reach.

Why Rexas Finance is Gaining Traction

The concept of real-world asset (RWA) tokenization is not entirely new, but Rexas Finance stands out due to its seamless, user-friendly platform and the security that blockchain technology offers. Investors are drawn to the project because of its practical applications in the real world. Unlike many projects that are built purely on speculation, Rexas Finance is focused on solving real-world problems, which gives it staying power in the volatile crypto market.

Here are some key factors contributing to Rexas Finance’s skyrocketing success in its presale phase:

At the heart of Rexas Finance’s appeal is its ability to tokenize real-world assets, making it possible for people to own fractional shares of valuable assets. Whether it’s real estate, gold, or fine art, Rexas Finance is opening the doors to a broader pool of investors, providing liquidity to traditionally illiquid markets. This ability to solve tangible problems in asset accessibility and liquidity is something many other cryptocurrencies, including Toncoin and Tron, simply don’t offer.

-

Investor Confidence in RWA Tokenization

The global market for real-world assets is enormous, with real estate alone valued at over $379 trillion. Even tokenizing a fraction of this market could unlock trillions of dollars in value. Investors see this as a major opportunity, and Rexas Finance is positioning itself as a leader in this space. With blockchain technology providing security and transparency, investors are confident that Rexas Finance’s platform will deliver on its promises.

The momentum of Rexas Finance’s presale has been nothing short of remarkable. Raising over $200,000 on its first day, the presale has already caught the attention of both retail and institutional investors. With RXS tokens priced at $0.03 in the initial phase, early investors have the potential to see significant returns, with the token price set to rise in subsequent stages of the presale. The projected price of $0.20 by the end of the presale represents a 566% increase, creating a sense of urgency among those looking to get in on the ground floor.

Rexas Finance has developed a robust tokenomics model that incentivizes early participation while ensuring long-term growth. With a total supply of 1 billion RXS tokens, 42.5% is allocated for the presale, giving investors a significant opportunity to enter at a favorable price. Additionally, 22.5% of tokens are reserved for staking, encouraging long-term holding and contributing to the stability and sustainability of the project.

-

Focus on Security and Transparency

Rexas Finance is not just about accessibility; it’s also about security. By leveraging blockchain technology, the platform ensures that all transactions are transparent and secure. The use of smart contracts adds an additional layer of trust, as all trades and transactions are executed automatically, reducing the risk of human error or fraud. This focus on security gives investors peace of mind, something that’s often missing in more speculative crypto projects.

Rexas Finance Steals the Hype from Toncoin and Tron

While Toncoin (TON) and Tron (TRX) have long been popular among crypto investors, their focus has been primarily on decentralized applications (dApps) and blockchain infrastructure. Toncoin, initially developed by the Telegram team, focuses on enabling decentralized communications and services. Meanwhile, Tron has positioned itself as a competitor to Ethereum by building a high-performance blockchain for dApps and smart contracts.

However, both of these projects lack the real-world applicability that Rexas Finance brings to the table. While Toncoin and Tron are respected for their technological innovations, they do not provide the same tangible benefits to everyday investors that Rexas Finance does through real-world asset tokenization. This distinction has allowed Rexas Finance to capture a significant portion of the crypto market’s attention, stealing the hype from these well-known projects.

The Future of Rexas Finance

With the crypto market evolving and investors looking for projects with real-world applications, Rexas Finance is well-positioned for sustained growth. The platform’s ability to tokenize real-world assets not only democratizes investment but also brings much-needed liquidity to traditionally illiquid markets. As more people recognize the potential of RWA tokenization, Rexas Finance could become a dominant player in this emerging sector.

As the presale progresses and Rexas Finance continues to hit new milestones, the project is set to rise even further in prominence. For investors looking for the next big opportunity, RXS offers both short-term gains through the presale and long-term growth potential as it disrupts the world of asset management.

Conclusion

Rexas Finance (RXS) is rapidly gaining momentum, appealing to investors with its unique approach to real-world asset tokenization. While well-established projects like Toncoin (TON) and Tron (TRX) have their strengths, Rexas Finance is stealing the spotlight by offering tangible solutions that appeal to both retail and institutional investors. With a strong presale performance, real-world utility, and a well-thought-out tokenomics model, Rexas Finance is set to become a major player in the crypto space, offering investors the chance to be part of something truly revolutionary.

For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

Market

Pi Network, Grayscale’s Altcoin Shake-Up

This week in crypto recorded several key events across various ecosystems that will continue shaping the industry.

From major partnerships to investment decisions and scam allegations, the following is a comprehensive roundup of crypto news this week.

Mantra Crash: From Billion-Dollar Hype to Fragile Liquidity

This week in crypto Mantra’s powering token lost $90% of its value amid allegations of insider dealing and liquidity fragility. Once hailed as a rising star in the RWA (real-world asset) narrative, OM’s collapse wiped out over $5.5 billion in value.

Reports revealed a disturbing pattern of concentrated wallet activity and low liquidity pools, which made OM highly vulnerable to sudden exits.

On-chain sleuths identified one trader whose aggressive selling triggered a cascade of liquidations. This highlights the risks of low-float, high-hype tokens in an illiquid market environment.

“This was due to an entity(s) on the Binance perpetuals market. That’s what triggered the entire cascade. The initial drop below $5 was triggered by a ~1 million USD short position being market-sold. This caused over 5% of slippage in literal microseconds. That was the trigger. This seems intentional to me. They knew what they were doing,” the analyst stated.

Pi Network: From Chainlink Buzz to Transparency Fears

Pi Network recorded strong optimism this week as its native Pi Coin surged by double digits. BeInCrypto attributed the surge to the announcement of a key integration with Chainlink.

They pitched this strategic collaboration as a gateway to real-world utility. Specifically, it positioned Pi closer to the broader DeFi and smart contract ecosystem. However, the euphoria proved short-lived.

Market sentiment quickly soured as analysts began comparing Pi Network and the recently collapsed OM token.

Allegations suggest that, like the OM token, Pi coin lacks full clarity around circulating supply, wallet distribution, and centralized control. To some, these are potential red flags in an increasingly regulation-sensitive industry.

“The OM incident is a wake-up call for the entire crypto industry, proof that stricter regulations are urgently needed. It also serves as a huge lesson for the Pi Core Team as we transition from the Open Network to the Open Mainnet,” wrote Dr Altcoin.

Pi coin reversed gains within days, falling 18% from its weekly high. At the time of writing, PI was trading at $0.6112, up by a modest 0.7% in the past 24 hours, per CoinGecko.

Grayscale’s Altcoin Shake-Up: 40 Tokens Under Review

This week in crypto also showed that institutional investor interest in altcoins is heating up again, with Grayscale leading the charge.

The digital asset manager unveiled its updated list of assets under consideration for the second quarter (Q2) 2025. BeInCrypto reported that the list featured zero altcoins across sectors such as DePIN, AI, modular blockchains, and restaking. Among the notable tokens being eyed are SUI, STRK, TIA, JUP, and MANTA.

The update reflects Grayscale’s growing thesis around emerging crypto trends, particularly as the firm seeks to expand beyond its core Bitcoin and Ethereum products.

This announcement follows a broader strategic overhaul from three weeks ago when Grayscale reshuffled its top 20 list of altcoins by market exposure. Several older names were dropped at the time, while newer narratives like Solana-based DePIN and Ethereum restaking plays were pushed to the forefront.

The expansion into 40 coins signals Grayscale’s recognition of renewed retail and institutional appetite for differentiated assets. However, inclusion in the list does not guarantee a fund launch. It only indicates Grayscale’s active research.

XRP and SWIFT Partnership: Breaking Down the Rumors

There was speculation this week about a possible partnership between Ripple’s XRP and banking giant SWIFT in crypto.

This narrative was based on a misinterpreted document. A series of cryptic social posts exacerbated the speculation, which some took as confirmation of collaboration between the global payments network and the XRP ledger.

However, BeInCrypto’s in-depth reporting sank the rumors. While Ripple has long pursued banking institutions and SWIFT has shown openness to blockchain innovations, there is no verified partnership between the two.

SWIFT’s public-facing projects around tokenization and digital asset settlement do not include XRP.

Despite the debunking, the rumors sparked an important conversation about XRP’s long-term positioning. The token remains a top-10 asset and a favorite among retail investors banking on utility-driven price appreciation.

With Ripple’s legal battles with the SEC nearing resolution and international CBDC partnerships in the works, the project is far from irrelevant.

US Dollar Dives: What the DXY Crash Means for Bitcoin

The US Dollar Index (DXY) hit a three-year low this week, sending ripples through the crypto markets. Historically, a falling DXY has been bullish for Bitcoin, and this week was no different, with BTC reclaiming above the $84,000 range.

The greenback’s weakness reflects growing fears of fiscal deterioration in the US, as rate cuts loom and Treasury debt soars.

However, that is just the surface. The global M2money supply has been quietly increasing again, especially across Europe and Asia. This reignites the liquidity conditions that fueled previous bull runs.

Japan’s 10-year bond yields hit multi-decade highs, forcing the Bank of Japan (BoJ) into increasingly precarious interventions. As Japanese liquidity spills outward, crypto and risk assets have become inadvertent beneficiaries.

This macroenvironment is ideal for Bitcoin. Weakening fiat, rising global liquidity, and crumbling bond market confidence create a perfect storm.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

TRUMP Meme Coin Ignores $307M Unlock, Bearish Trend Holds

The TRUMP meme coin has struggled to regain momentum, dropping nearly 5% over the past seven days and trading below the $10 mark for the last 16 consecutive days. Despite a major $307 million token unlock, the market response has been muted, and technical indicators continue to point toward weakness.

BBTrend has flipped back into negative territory, the Ichimoku Cloud shows sustained bearish pressure, and EMA lines remain tilted to the downside. Overall, TRUMP appears stuck in a broader downtrend, with no clear signs of reversal for now.

TRUMP Momentum Reverses as BBTrend Drops to -6.93

TRUMP’s BBTrend has sharply dropped to -6.93, a notable decline from its recent positive reading of 2.35 just two days ago. Between April 13 and April 16, the BBTrend briefly turned positive, suggesting a short-lived recovery in trend strength.

However, the quick reversal back into negative territory points to renewed weakness and fading momentum.

This sharp swing signals that whatever bullish attempt emerged during the weekend has likely lost traction, with sellers once again gaining control.

The BBTrend, or Bollinger Band Trend, gauges the strength and direction of a price trend by measuring the expansion or contraction of Bollinger Bands.

Positive values typically suggest strong trend formation—whether upward or downward—while negative values reflect contracting volatility and fading trend strength. With TRUMP now sitting at -6.93, the indicator shows that the market may be losing direction and entering a phase of uncertainty or potential downside drift.

Unless BBTrend shifts back into positive territory soon, TRUMP meme coin could face increased pressure and continued instability in the short term.

TRUMP Remains Bearish Below the Ichimoku Cloud With No Sign of Reversal

TRUMP meme coin is currently trading below the Ichimoku Cloud, which signals a bearish outlook according to the indicator.

The price has failed to reclaim the cloud in recent days, and the flat nature of the Senkou Span B (the lower boundary of the cloud) reinforces the idea of strong overhead resistance and weak momentum.

The Tenkan-sen (blue line) remains below the Kijun-sen (red line), further supporting the ongoing bearish trend. Short-term price action continues to lag behind longer-term averages.

Additionally, the cloud ahead is thin and flat, suggesting that volatility may remain low and that the current trend lacks strength.

The Kumo (cloud) does not show signs of expansion, meaning a strong breakout in either direction is not imminent.

For now, with TRUMP stuck below the cloud and no clear bullish crossover between the Tenkan-sen and Kijun-sen, the bias remains tilted to the downside unless a decisive shift in momentum takes place.

TRUMP Faces Bearish Pressure Despite $307 Million Unlock

Despite a substantial $307.64 million token unlock, TRUMP meme coin has shown little reaction, with sentiment and price action remaining largely unchanged.

The EMA lines continue to point toward a bearish trend, as the short-term averages remain positioned below the long-term ones—reflecting sustained downside pressure.

If this trend persists, TRUMP could soon retest a key support zone, which may determine whether the token stabilizes or sees deeper losses. The lack of a bullish response to the unlock adds to concerns that market confidence is currently weak.

However, a trend reversal could shift the outlook. If buyers regain control and momentum builds, TRUMP meme coin could make a move toward resistance levels, with potential targets around $8.39 and $8.79.

A breakout above those would open the door for further gains toward $10.67, and if the bulls continue strongly, even a move to $12 is possible.

Still, with the EMAs tilted to the downside and no immediate sign of recovery, the burden remains on bulls to reverse the trend and reignite upward momentum.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Price Rises 13% But Fails to Break $136 Resistance

Solana (SOL) has climbed 13% over the past seven days, showcasing strong short-term performance. While momentum indicators like the RSI and EMA lines remain supportive, recent price action suggests that bullish strength may be stalling just below a key breakout point.

At the same time, the sharp drop in BBTrend indicates weakening trend strength and fading volatility, often a sign of incoming consolidation or market indecision. With technicals at a crossroads, SOL’s next move will likely depend on whether buyers can regain control or if a broader pullback begins to unfold.

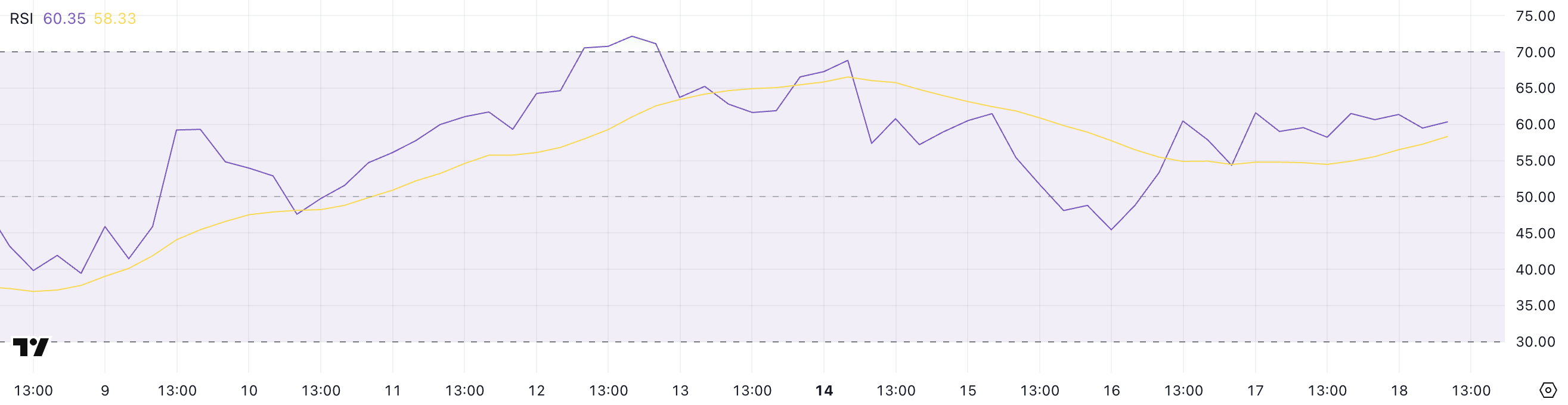

SOL RSI Rises Sharply, but Pause in Momentum Signals Caution

Solana’s Relative Strength Index (RSI) is currently at 60.35, marking a noticeable rise from 45 just two days ago.

This jump signals growing bullish momentum, although the RSI has remained stable since yesterday, suggesting that upward pressure may be easing for now.

The increase reflects renewed buying interest in recent sessions, pushing SOL closer to overbought territory but not quite there yet. This leveling off could indicate that the market is taking a breather before deciding its next move.

The RSI is a momentum oscillator that measures the speed and magnitude of price movements, ranging from 0 to 100. Values above 70 typically indicate that an asset is overbought and may be due for a pullback, while readings below 30 suggest oversold conditions, potentially signaling a buying opportunity.

With Solana’s RSI at 60.35, the asset is approaching bullish territory but hasn’t yet entered an extreme zone.

This positioning suggests that while recent momentum is positive, SOL could face some short-term consolidation or resistance before continuing higher—unless strong buying interest resumes and pushes the RSI closer to overbought levels.

SOL Trend Strength Weakens as BBTrend Falls Below 6

Solana’s BBTrend indicator is currently at 5.69, a significant drop from the 17.5 reading observed just four days ago.

This sharp decline suggests that volatility around SOL’s price has cooled notably, and the strength of the prior trend is weakening.

While BBTrend doesn’t signal direction on its own, the drop indicates that the strong movement, likely bullish, has lost momentum, and SOL may be entering a phase of consolidation or uncertainty.

BBTrend, short for Bollinger Band Trend, measures the strength of a price trend based on the expansion or contraction of Bollinger Bands.

Higher values suggest a strong, directional move (either up or down), while lower values point to weaker trends and reduced volatility. With BBTrend now at 5.69, Solana is in a much less volatile environment, which often precedes a breakout or a reversal.

For now, this reading signals that the recent momentum is fading. Unless volatility picks up again, SOL’s price may remain range-bound in the short term.

Golden Cross Looms for SOL, But $136 Barrier Still Holding Strong

Solana’s EMA lines continue to reflect a bullish structure, with the short-term average trending above the long-term one—suggesting that positive momentum remains intact.

A potential golden cross is also forming, which, if confirmed, would further reinforce the bullish outlook.

However, despite this favorable setup, Solana price has struggled to break through the $136 resistance level over the past few days, indicating that buyers may be losing steam at this key threshold.

Tracy Jin, COO of MEXC told BeInCrypto:

“Amid widespread volatility, Solana has stood out with notable strength. A combination of favorable technical setups and institutional tailwinds — such as the launch of the first spot Solana ETFs in North America — has helped drive a short-term rally. The token’s reclaim of leadership in decentralized exchange activity and rising total value locked further support the bullish case.”

If SOL manages to push above $136 with strong volume, it could open the path toward the next targets at $147 and potentially higher. But if the current momentum fades and the price reverses, a test of support at $124 becomes likely.

About Solana next moves, Jin told BeInCrypto:

“Despite recent gains, SOL’s near-term outlook remains sensitive to broader liquidity conditions. Any deterioration in market confidence — whether from macro shocks or renewed volatility in Bitcoin — could cap upside potential.”

A breakdown below that could accelerate losses toward $112, and in the event of a deeper correction, SOL could even revisit the $95 region.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Fee Plunges To 5-Year Low—Is This A Bottom Signal?

-

Market22 hours ago

Market22 hours agoEthereum Price Fights for Momentum—Traders Watch Key Resistance

-

Altcoin22 hours ago

Altcoin22 hours agoExpert Predicts Pi Network Price Volatility After Shady Activity On Banxa

-

Market17 hours ago

Market17 hours agoBitcoin Price Gears Up for Next Leg Higher—Upside Potential Builds

-

Market20 hours ago

Market20 hours agoIs XRP’s Low Price Part of Ripple’s Long-Term Growth Strategy?

-

Altcoin20 hours ago

Altcoin20 hours agoShiba Inu Follows Crypto Market Trend With “Shib Is For Everyone” Post, What’s Happening?

-

Bitcoin18 hours ago

Bitcoin18 hours agoWhat Good Friday Options Expiry Means for Bitcoin & Ethereum

-

Altcoin23 hours ago

Altcoin23 hours agoAnalysts Predict XRP Price to Hit $6 as Wave 2 Correction Nears End