Market

RENDER Price Soars 48%, But Whale Activity Declines

RENDER price has surged 48% in the last month, solidifying its position as the largest artificial intelligence coin by market cap at $4.1 billion. It now leads over its closest competitors, TAO, FET, and WLD, reflecting growing interest in the AI-focused asset.

However, despite this impressive rally, declining whale activity and weakening trend indicators suggest potential challenges ahead. Whether RENDER can sustain its upward momentum or face a reversal depends on how market confidence evolves in the coming days.

Whales Are Not Accumulating RENDER

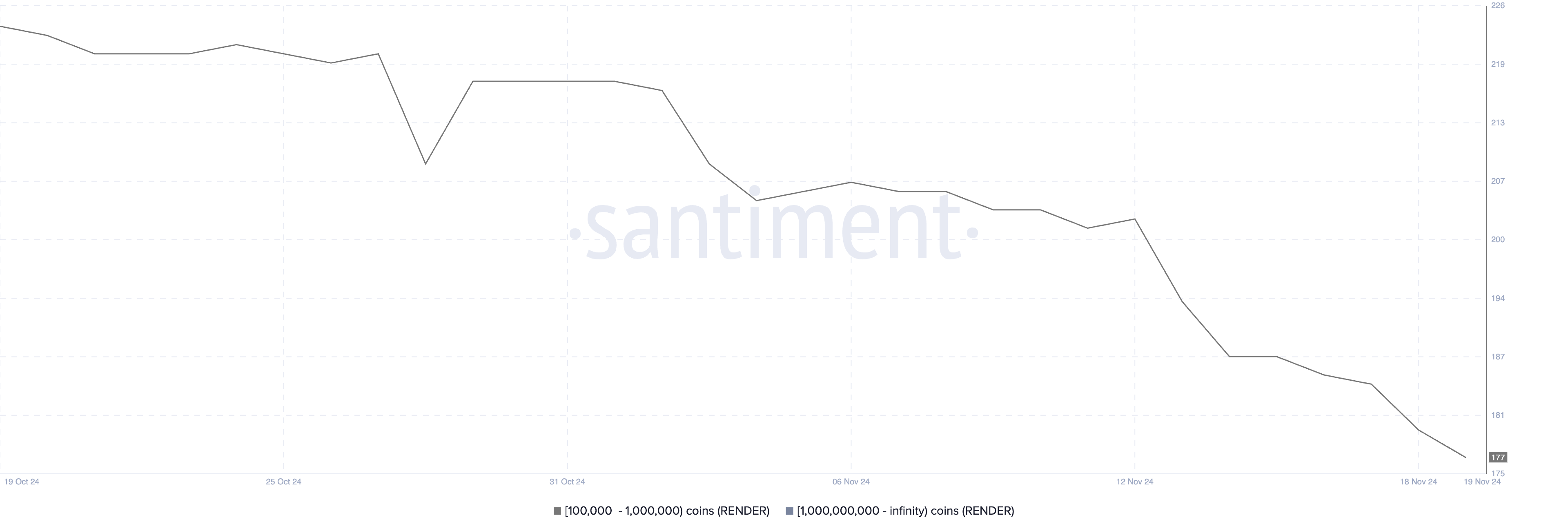

RENDER is struggling to attract whale interest, as the number of holders with balances between 100,000 and 1,000,000 coins has dropped sharply since the beginning of November.

This figure started at 218 on November 1 and has fallen to 177, marking a significant decline in large holders despite recent market activity.

This trend is notable because whales often play a crucial role in driving and sustaining price momentum. Even with RENDER price surging 48% in the past month, the continued decline in whale numbers suggests a lack of confidence among major investors.

This could indicate that the recent rally may face challenges in maintaining its upward trajectory without strong support from large holders.

RENDER BBTrend Is Still Positive

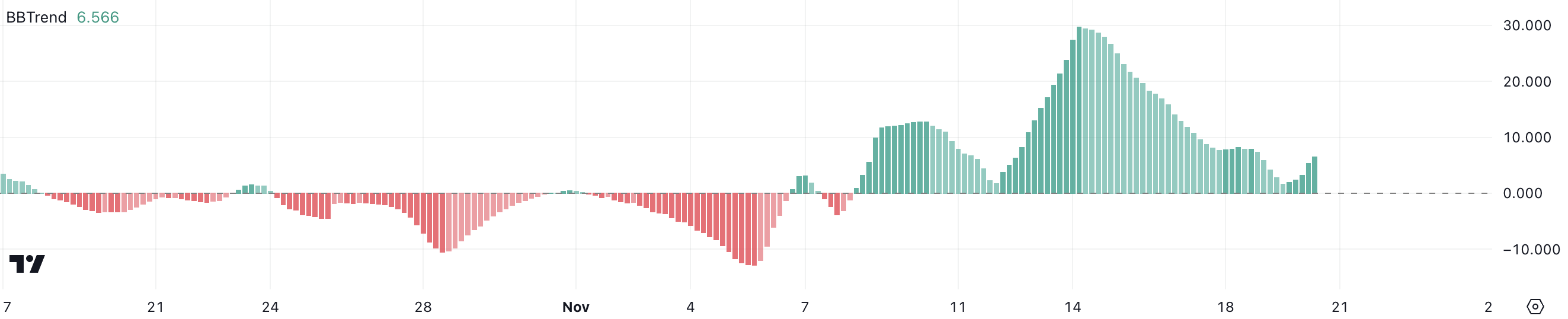

BBTrend for RENDER is currently around 6.4, recovering from a recent low of 1.7 on November 19.

While it reached a three-month high of 29.7 on November 14, the indicator has since dropped significantly, reflecting a loss of momentum after its peak.

BBTrend measures the strength and direction of a trend by analyzing Bollinger Bands, with positive values indicating an uptrend and negative values signaling a downtrend.

Although BBTrend for RENDER has been positive since November 8 and is now showing signs of recovery, it remains far below the mid-November highs. This suggests that while the uptrend is not over, its current strength is relatively weak, indicating potential hesitation in sustaining further price increases.

RENDER Price Prediction: Back To The $5 Soon?

RENDER’s EMA lines currently indicate a bullish setup, with short-term lines above long-term ones and the price trading above all of them.

If the uptrend gains momentum again, RENDER price could test the resistance at $8.29, with the potential to rise further to $9.47, marking its highest price since May and establishing RENDER as the biggest artificial intelligence coin in the market.

On the downside, metrics like BBTrend and whale activity point to weakening confidence. If the trend reverses, RENDER may test supports at $6.3 and $5.8, and if those fail to hold, the price could drop as low as $5.0.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HyperLiquid Responds to JELLY Crisis Amid Community Backlash

HyperLiquid provided some key updates following yesterday’s JELLY incident, detailing its main takeaways and security upgrades. Although HYPE’s price crashed yesterday, it has been slowly stabilizing today.

However, lingering criticisms remain about HyperLiquid’s actions during the crisis. It responded quickly to non-illegal activities that threatened itself but remained comparatively passive in the face of February’s Bybit hack.

HyperLiquid Responds to JELLY Crisis

HyperLiquid, a popular DEX, is recovering from the aftermath of a major scandal. Yesterday, HyperLiquid delisted JELLY after a short squeeze nearly caused the firm to take $230 million in losses.

This attracted a wave of condemnation from the community, which feared another FTX-style collapse. Today, HyperLiquid posted a response to the situation:

“Yesterday is a good reminder to stay humble, hungry, and focused on what matters: building a better financial system owned by the people. Users with JELLY long positions at the time of settlement will be refunded by the Foundation. This results in all JELLY traders being settled at a price advantageous to them, except flagged addresses,” it claimed.

HyperLiquid also detailed a few security measures that it will take to avoid another incident similar to the JELLY squeeze. For one thing, it implemented more stringent token delistings and open interest caps.

Most importantly, the platform made significant tweaks to its liquidation protocols, putting several guard rails on the main cause of the turmoil.

So far, it’s unclear whether HyperLiquid’s measures will be able to stave off another JELLY incident. If nothing else, HYPE’s rebound today reflects restored community sentiment.

Less than a week ago, HYPE was seeing strong bullish momentum, but yesterday’s events caused a notable crash. However, the altcoin managed to tick back up today, avoiding further losses.

The crypto community has been strongly criticizing how the exchange handles the situation. The concern centers around a simple question: Is Hyperliquid truly a decentralized exchange? Delisting a token and seizing investor funds goes against the central ethos of DeFi.

ZachXBT, the renowned crypto sleuth, was particularly frustrated by the company’s actions. Months ago, he identified a potential North Korean security breach, which the firm denied.

However, HyperLiquid acted quickly to neutralize the JELLY trades, proving that it has the capacity for that sort of rapid response.

“HyperLiquid has recently seen illicit flows [and] said it’s decentralized, so it cannot do anything. Now, HyperLiquid made a centralized decision to quickly close the position at an arbitrary price for an entity using the protocol as intended. If something like that could be done for JELLY, it likely should have been done for both,” ZachXBT stated.

Ultimately, HyperLiquid has time to reflect and update its strategies from the JELLY incident. Yesterday’s events rattled the whole crypto community, but catastrophe was avoided.

Hopefully, the platform can act in good faith to protect user funds and its decentralized ethos.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Onyxcoin (XCN) Nears Oversold After a 30% Monthly Drop

Onyxcoin (XCN) has been under heavy selling pressure, dropping more than 11% in the last seven days and over 30% in the past month. Multiple indicators now reflect this sustained weakness, with momentum and trend signals leaning decisively bearish.

The RSI is nearing oversold levels, while the ADX shows the downtrend is gaining strength. Unless buyers step in soon, XCN could face deeper losses before any meaningful recovery attempt takes shape.

Onyxcoin RSI Is Almost Reaching Oversold Levels

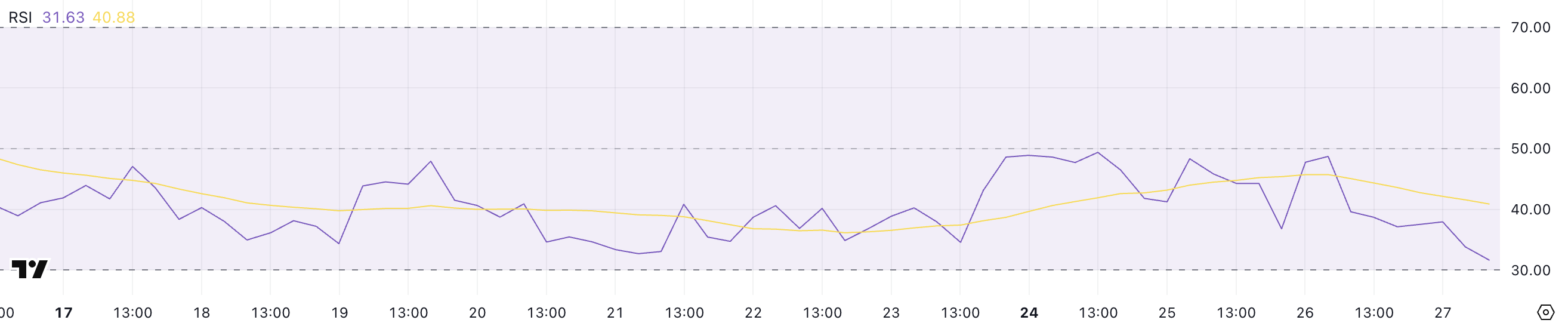

Onyxcoin’s Relative Strength Index (RSI) has dropped sharply to 31.63, down from 48.72 just a day earlier. This significant decline brings it closer to the oversold threshold and highlights the growing bearish momentum.

The RSI has now remained below the neutral 50 mark for the past 12 consecutive days, signaling that bearish sentiment has been dominant throughout this period.

This ongoing weakness suggests that sellers continue to control the market, and the latest drop may indicate a deepening of the current downtrend.

The RSI is a momentum oscillator that measures the speed and change of price movements on a scale from 0 to 100. Readings above 70 typically suggest an asset is overbought and may be due for a correction, while values below 30 indicate oversold conditions that could lead to a potential rebound.

XCN’s current RSI of 31.63 puts it just above oversold territory, which means a bounce is possible—but far from guaranteed. If bearish pressure persists and the RSI dips below 30, it could signal panic selling or capitulation.

On the other hand, a quick recovery in RSI above 40 could hint at fading selling pressure and the early signs of a trend reversal.

XCN ADX Shows The Downtrend Is Getting Stronger

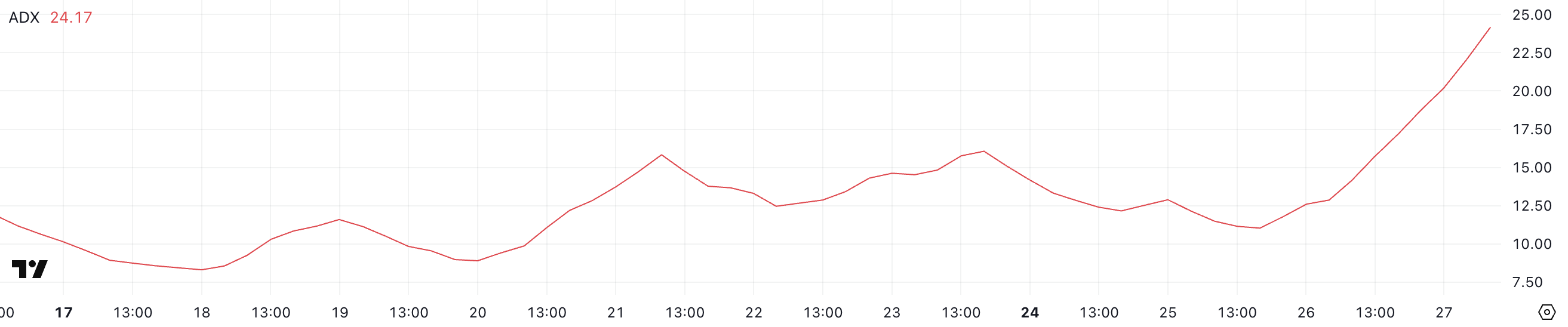

Onyxcoin Average Directional Index (ADX) has surged to 24.17, up from 12.86 just a day ago, signaling a rapid increase in trend strength.

The ADX measures the intensity of a trend, regardless of its direction, and this sharp rise suggests that the current downtrend is gaining traction.

With XCN’s price already moving lower, the strengthening ADX reinforces the idea that bears are firmly in control, and the downward momentum may continue in the near term.

The ADX operates on a scale from 0 to 100, with readings below 20 typically indicating a weak or non-existent trend. Values between 20 and 25 point to a trend that may be starting to build, while anything above 25 signals a strong, established trend.

XCN’s current ADX at 24.17 is right on the edge of this critical threshold, suggesting that the downtrend is transitioning from early-stage to potentially stronger territory.

If the ADX continues rising above 25 while the price stays in decline, it would confirm that sellers are driving a more powerful move lower, and any bullish reversal attempt could face strong resistance.

Onyxcoin Correction Could Continue

Onyxcoin EMA lines are currently aligned in a bearish formation, suggesting that the downtrend may persist in the short term.

If the bearish momentum continues, XCN could retest the support level at $0.0083, a critical zone that previously acted as a floor.

A breakdown below this level would likely expose the token to further downside, potentially causing it to fall to $0.0051, its lowest price since January 17.

The current EMA structure highlights weakening bullish pressure and increasing vulnerability to additional selling.

However, there’s still a path to recovery if Onyxcoin can regain the strong momentum it showed at the end of January, when it was one of the most talked-about altcoins in the market.

A reversal could take XCN back to test the resistance at $0.014, and a successful breakout above that would signal renewed bullish strength.

If buyers push further, price targets at $0.020 and even $0.026 will become relevant—levels not seen since mid-February.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance To List MUBARAK, BROCCOLI, BANANAS31, and Tutorial

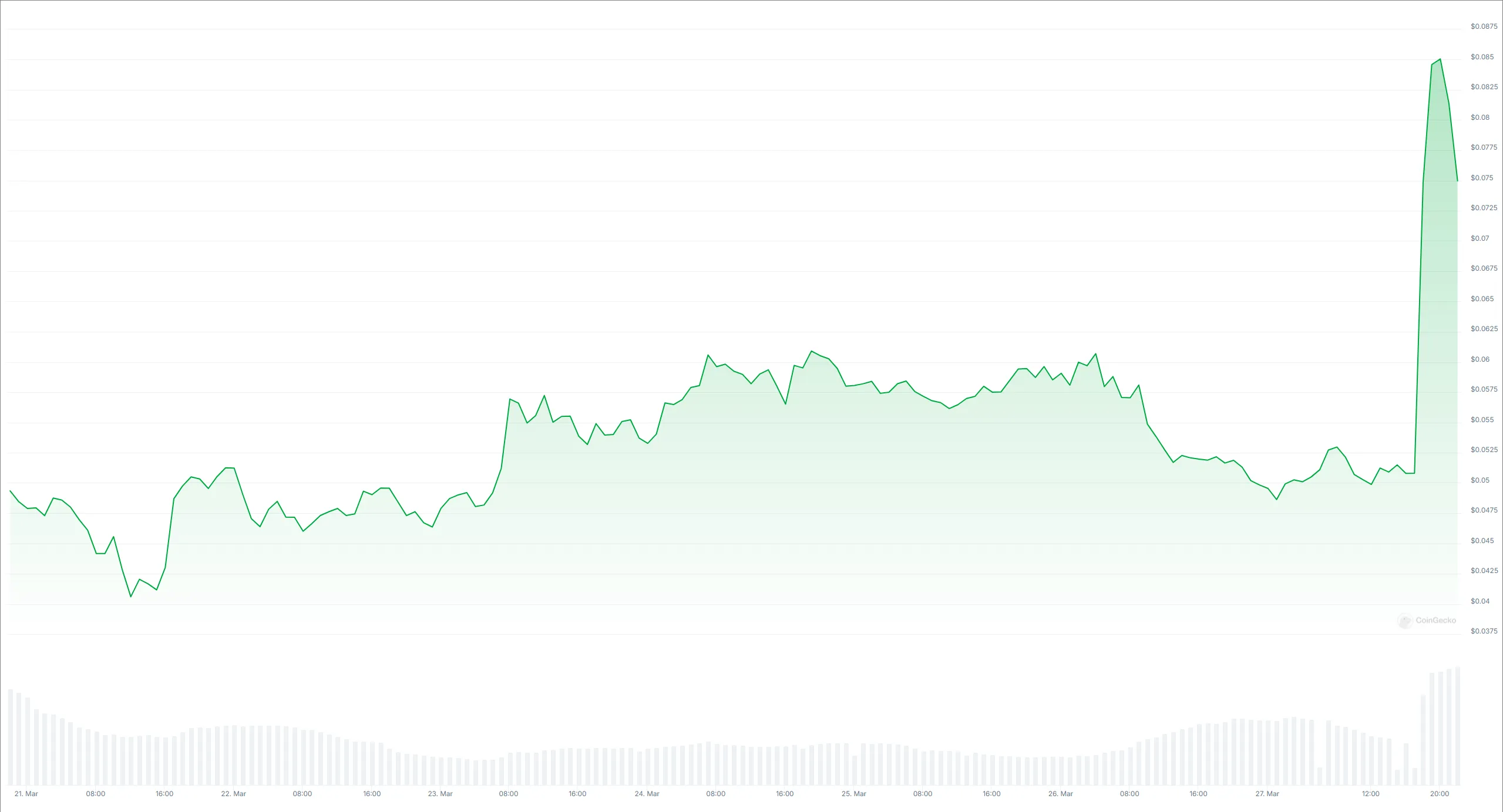

Binance announced the results of its first community listing vote. The exchange will list four meme coins tomorrow. It was expected to launch only two, and the value of BROCCOLI, Tutorial, and BANANAS31 rallied.

However, Bananas for Scale only had a small gain, and Mubarak actually experienced a sharp decline. This may reveal fatigue in the meme coin space or a saturation of CZ-related assets.

Binance, the world’s largest crypto exchange, is trying out a new solution to determine token listings. After the vote to list Pi Network, the firm introduced a vote-based system for listings and delistings.

Binance’s first listing vote began last week, and today, the company announced the winners:

“Following the Vote to List results and completion of due diligence, Binance will list Mubarak (MUBARAK), CZ’S Dog (BROCCOLI714), Tutorial (TUT), and Banana For Scale (BANANAS31) and open trading for the following spot trading pairs at 2025-03-27 21:00 (UTC),” Binance claimed via press release.

At first, Binance claimed that only two of nine candidates in the first vote would get listings, but four of them are receiving this treatment. Typically, tokens spike when they are listed on Binance, and today, that trend largely continued.

Three of the four meme coins did well, including Broccoli, which was named after CZ’s dog.

BROCCOLI rose 65%, and Banana for Scale went up by 11%. Tutorial was the best performer, gaining over 200% in value.

However, Mubarak, an up-and-coming meme coin, actually dropped after Binance announced that it won the vote. It’s still posting net gains from the last 24 hours, but this immediate drop suggests that the news was already priced in.

Despite prominent social media buzz, Mubarak’s price has mostly stagnated in the last ten days, and it was launched 11 days ago. The meme coin market is showing signs of fatigue, and Binance’s vote may not be enough to change it.

Some users on social media have pointed out a simpler explanation. Of the four vote winners, three are either related to or connected to CZ, the former CEO of Binance. This might limit the assets’ broader market appeal.

It’s important not to overstate the case here. Mubarak dropped after the announcement, but it was largely expected to be listed. Indeed, most of the winners were fine, although BANANAS31’s 11% gains are not particularly encouraging.

If Binance keeps holding listing votes as planned, fewer winners and more unique offerings might help stave off investor fatigue.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoMantra (OM) Price Risks Further Drop as Death Cross Nears

-

Altcoin24 hours ago

Altcoin24 hours agoCrypto Price Today: BTC, ETH, SOL, XRP, SHIB, DOGE, LINK, PEPE, ADA

-

Market23 hours ago

Market23 hours agoTop 3 Base Altcoins to Watch Closely This Week

-

Market22 hours ago

Market22 hours agoBitcoin Price Finds Support—But Can It Power Through $90K?

-

Market20 hours ago

Market20 hours agoEthereum Price Consolidates After Pullback—Is a Fresh Move Coming?

-

Altcoin20 hours ago

Altcoin20 hours agoDogecoin Price Eyes 10x Breakout After Elon Musk Ghibli Anime

-

Market19 hours ago

Market19 hours agoTrump’s Expected Signature Could End IRS Regulation on DeFi

-

Altcoin19 hours ago

Altcoin19 hours agoShiba Inu Price Eyes 2x Gains As SHIB Burn Rate Shoots 60,000%