Market

Redstone (RED) Shows Mixed Market Signals: Will It Hit $1?

Redstone (RED) has experienced a volatile week, climbing 25% over the past seven days despite pulling back 20% in the last three days.

This mixed performance reflects the current uncertainty surrounding RED’s price action. Technical indicators point to a market caught between consolidation and lingering bearish sentiment. While momentum indicators like RSI and ADX suggest weakening trend strength and growing indecision, price action continues to hold above key support levels.

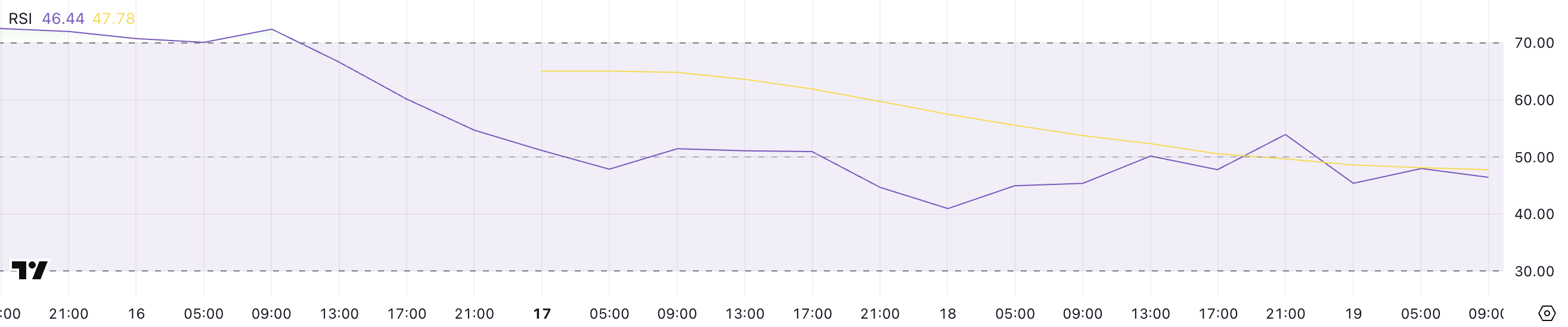

RED RSI Has Been Neutral For The Past Two Days

Redstone’s RSI (Relative Strength Index) has slipped to 46.44, down from 53.93 just a day ago. This recent decline suggests that bearish pressure has been increasing, pulling momentum away from the bulls.

For the past two days, RSI has been hovering around the 50 level, which typically signals indecision in the market, as neither buyers nor sellers have had clear control.

However, the move below 50 today signals that bearish momentum is starting to tilt the scales.

The RSI is a momentum oscillator that measures the speed and change of price movements. It typically ranges from 0 to 100. Values above 70 often indicate overbought conditions, while readings below 30 suggest oversold conditions.

The 50 mark acts as a midline that traders watch to gauge shifts in momentum—above 50 imply a bullish bias, while below 50 leans bearish.

Redstone’s RSI is now sitting at 46.44 after hovering near 50, which could mean the market is gradually tipping in favor of sellers as Redstone tries to establish itself as one of the most relevant leaders in the Oracle sector.

This shift may indicate further downside potential unless bulls regain control and push RSI back above 50 to reestablish bullish momentum.

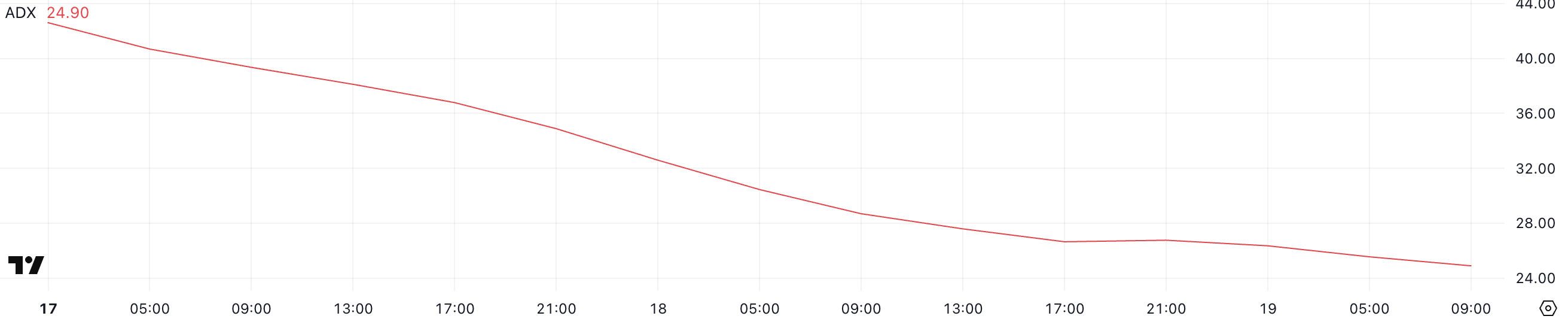

Redstone ADX Shows The Current Downtrend Is Fading Away

Redstone’s ADX (Average Directional Index) has dropped significantly to 24.9, down from 42.6 just two days ago. This sharp decline suggests a noticeable weakening in the strength of the current trend.

Previously, with ADX at 42.6, the market experienced strong directional movement, but the drop to the current level implies that the momentum behind that trend is fading.

Despite this, Redstone is still maintaining its position within a broader downtrend, indicating that bearish conditions have not yet reversed but may be losing steam.

The ADX is a technical indicator used to quantify the strength of a trend without indicating its direction. Typically, ADX values above 25 suggest a strong trend, while values below 20 often indicate a weak or non-trending market.

Readings between 20 and 25 are generally considered a gray area, where the trend might be losing conviction. With Redstone’s ADX now sitting at 24.9, it points to a market where the downtrend is still present but lacks the strong momentum it recently had.

This weakening trend could lead to potential price stabilization or even a short-term bounce, but as long as the downtrend structure remains intact, caution is warranted.

Will Redstone Rise Above $1 In The Next Days?

Redstone’s EMA (Exponential Moving Average) lines continue to suggest that the asset is in a consolidation phase. Its price action is moving sideways rather than trending strongly in either direction.

A key support level has been identified at $0.65, which is currently acting as a floor for price movement. If this support is tested and broken, Redstone could potentially fall further, with downside targets around $0.50.

Conversely, if the price starts to build bullish momentum, Redstone could attempt to break through resistance at $0.77. A successful breakout above this level could open the path toward $0.90 and $0.95, with the possibility of finally reclaiming the $1 mark for the first time since March 3, potentially making it one of the most trending altcoins in the market.

In Redstone’s case, the EMA lines reflecting sideways movement point to indecision among market participants. For now, the $0.65 support is pivotal – holding it could give bulls room to stage a rally while losing it could invite stronger selling pressure.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

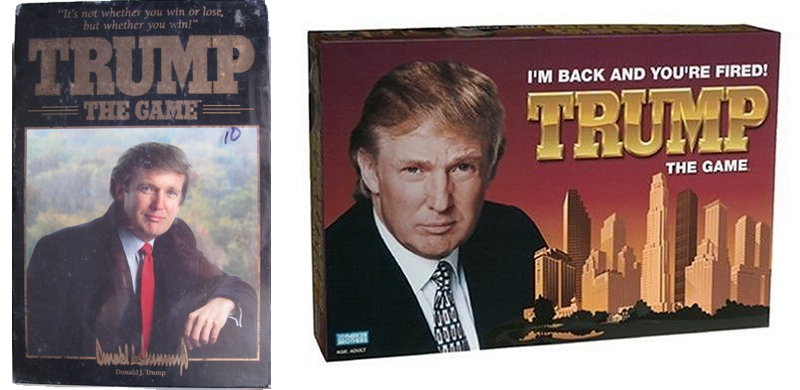

Trump Family Plans Crypto Game Inspired by Monopoly

Donald Trump’s broader circle and business avenue is reportedly planning to launch a crypto game based on Monopoly this month. Trump is a longtime fan of the game, launching an officially licensed spinoff in 1989.

Bill Zanker, who helped Trump launch NFTs and his TRUMP meme coin, is spearheading development. However, the community response is skeptical, as very little information about the crypto element is public.

Trump Is Launching a Crypto Monopoly Spinoff

The intersection of blockchain and gaming has a wide variety of uses, from Tap-to-Earn tokens to NFT use cases and more. A surprising addition to this space is coming soon, as a new report claims that Trump’s family will launch a crypto game loosely based on Monopoly soon.

The exact details are somewhat hazy, but reporters have managed to identify a few key facts. This Monopoly game is being spearheaded by Bill Zanker, a longtime Trump associate who worked with him to launch his NFTs in 2023 and was also involved in the TRUMP token.

It’s unclear when the two renewed their partnership, but the game is set to release this month. Anonymous sources claimed that players will earn in-game cash, which is presumably where the crypto element comes in.

Both developers quoted directly compared this game to Monopoly, and its rules will likely match up. Further reports suggest that Zanker is looking to buy the IP rights for the 1980s Trump Monopoly spinoff board game.

In other words, this IP question could present a possible difficulty if Monopoly’s owners don’t license another spinoff to Trump. Even if the crypto game doesn’t bear any Monopoly branding, Hasbro could sue if the gameplay is substantially similar.

So far, the online crypto community’s response has been incredulous. Users called Trump’s crypto-themed Monopoly spinoff a “joke,” an attempt to “max extract” value from his supporters, and called developers “the largest manipulators ever.”

Even if retail investors have potential upside, there seems to be a narrow window for gains.

“Are we about to witness another Trump family rug? Apparently, Trump’s a big fan of Monopoly. Zanker claims it’s not a MONOPOLY GO! clone — but confirmed the game is real and set to launch end of April. Incoming circus or giga pump?” said one user.

It’s difficult to determine the potential impact of this game on crypto, as we have basically no information about its tokenomics. For example, in Monopoly, users have to spend in-game currency to play.

Will that be a major component of Trump’s version? Will the in-game currency include the TRUMP meme coin? How will users extract value? These details will likely remain unanswered until an official announcement.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Forget XRP At $3, Analyst Reveals How High Price Will Be In A Few Months

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP may have spent the past few weeks struggling to hold above the $2 level, but one analyst believes the recent price action is only in its early stages of a much larger surge. For those who think $3 is a reasonable target, this outlook predicted that the real move could take the altcoin far beyond that mark and possibly much sooner than expected.

Multi-Stage Price Path With $10 To $20

The $3 price level has become the psychological and technical battleground for bullish XRP investors this cycle, serving as the most active price point. Earlier in January, the token briefly surged past this level, coming within striking distance of its all-time high of $3.40, before a wave of selling pressure triggered a pullback.

Related Reading

Since then, XRP has seen price corrections that pushed it as low as $1.65 on April 7. Yet, the outlook is once again tilting bullish. XRP has rebounded above $2 and is building a strong base to support another run toward $3. If the current momentum continues to gain traction, reclaiming $3 is not only likely, it could happen within a matter of weeks.

One of the boldest predictions comes from a trader known as BarriC, who has laid out a roadmap that extends far beyond the $3 threshold. In a recent post on social media platform X, he forecasted that XRP, now trading near $2.20, will break $3 soon. But his outlook doesn’t stop there. He predicted that by May, the sentiment surrounding XRP could shift so drastically that $5 would be seen as the new “cheap” price for XRP.

Taking things a step further, the analyst noted that if the broader crypto market transitions into a full-blown altcoin season, XRP could establish a new short-term trading range between $10 and $20 within the next few months.

Utility Run Scenario Places “Cheap” XRP Closer To $1,000

Perhaps the most striking part of BarriC’s analysis comes from what he describes as a “utility run.” This utility run is a scenario where XRP’s real-world use cases as a bridge cryptocurrency start to gain adoption and reflect in its price. Under such conditions, the term “cheap XRP” would apply to prices below $1,000.

Related Reading

At the time of writing, XRP is trading at $2.14, up by 1.4% in the past 24 hours. As ultra-bullish as it might seem, the analyst’s price prediction isn’t surprising, as the cryptocurrency has been subjected to similar bullish outlooks in the past few days.

Beyond bullish price targets, a few analysts now believe that XRP will flip both Ethereum and Bitcoin in the coming months. One such example is analyst Axel Rodd, who cited the breakdown in Bitcoin dominance as a reason why XRP will flip Bitcoin. Similarly, analysts at Standard Chartered recently predicted that the altcoin will flip Ethereum in market cap by 2028.

Featured image from Adobe Stock, chart from Tradingview.com

Market

XRP Early Investors Continue To Sell As Price Holds Above $2

XRP has struggled to secure growth in recent days, with the altcoin failing to maintain key support levels. Despite an attempted price rally, XRP has been unable to break through the $2.32 level, leaving the price hovering just above $2.00.

Those who bought during XRP’s three-week bull run are now facing losses after the failed breach of crucial barriers.

XRP Holders Are Facing Challenges

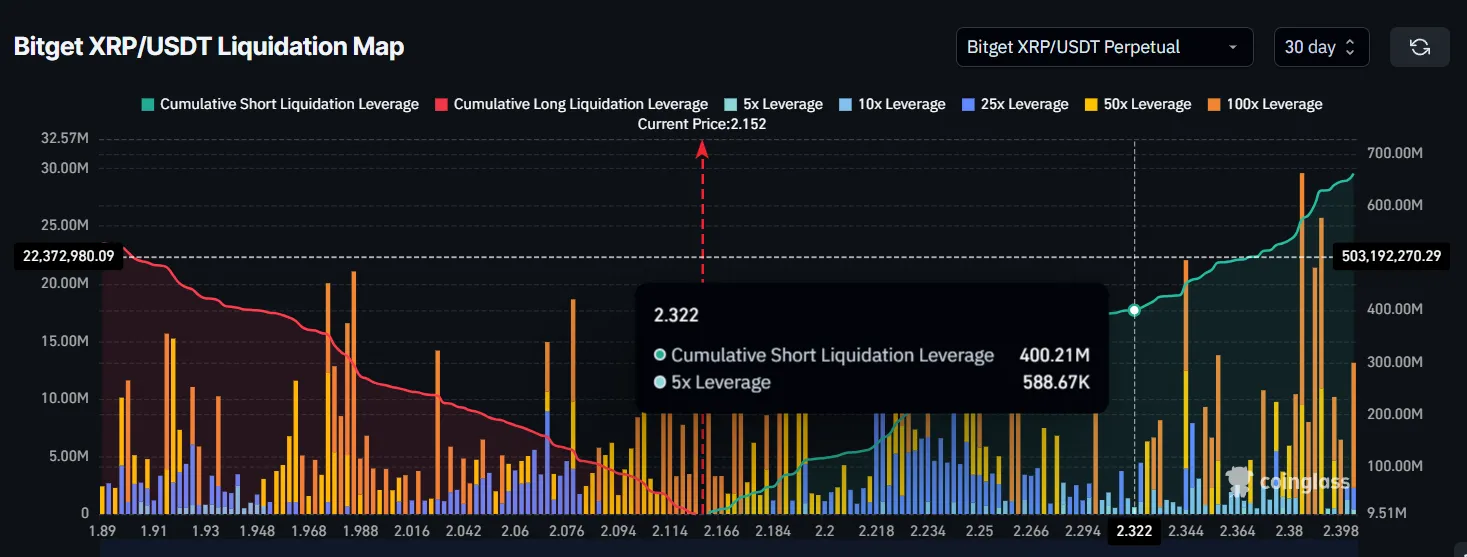

The liquidation map shows that a significant amount of short positions—around $400 million worth—are at risk of liquidation should XRP’s price rise to $2.32. However, even with XRP trading at $2.15, just 8% away from the threshold of $2.32, the potential for liquidations does not appear imminent.

The behavior of XRP’s investors suggests that these liquidations may not take place in the short term. This is because XRP holders are primarily leaning towards selling over HODLing at the moment.

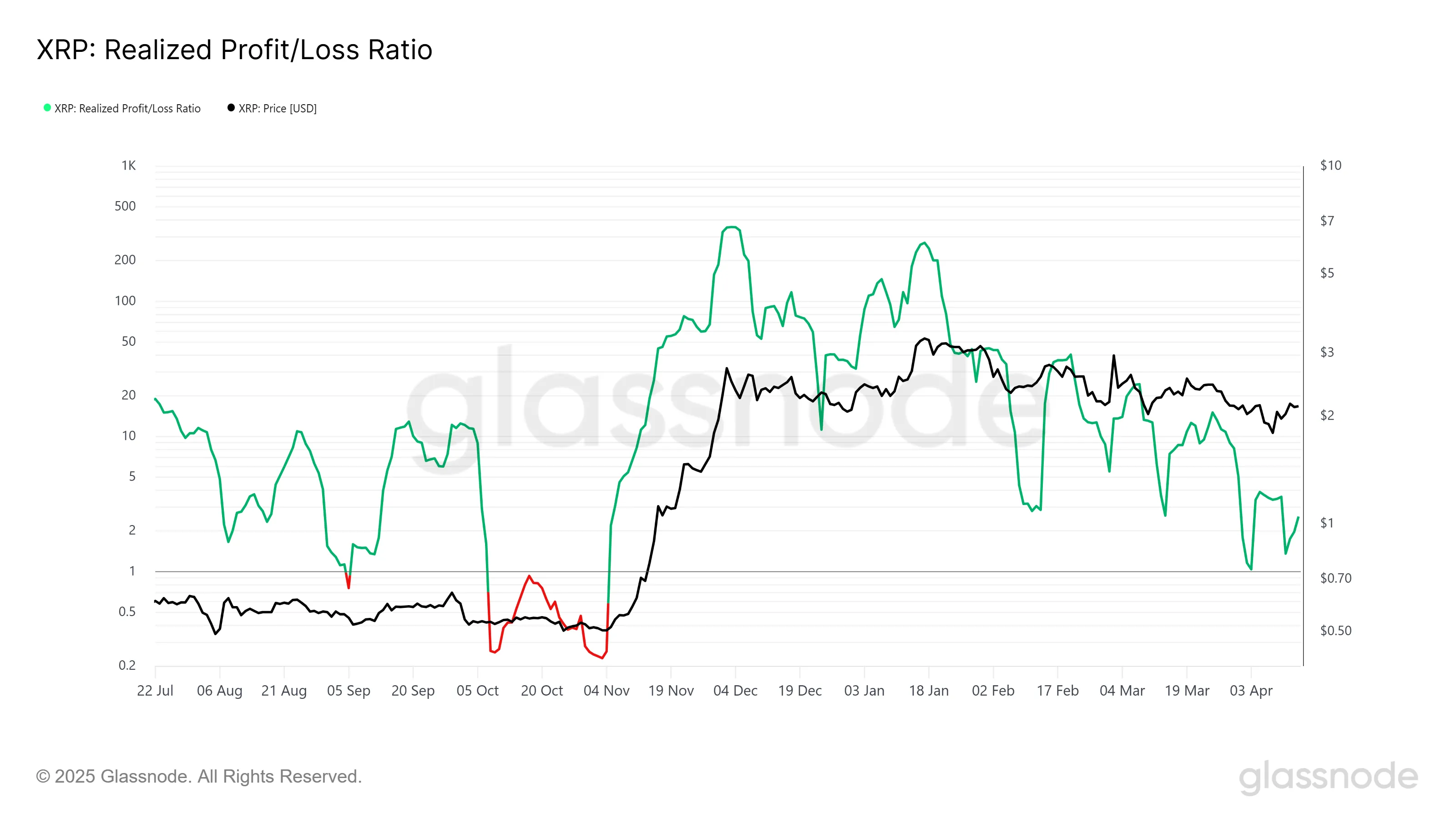

XRP’s overall momentum is showing signs of weakening, as reflected by the Realized Profit/Loss ratio. This indicator suggests that realized profits are declining and may soon turn into losses. The supply being sold likely originated from purchases made during XRP’s November 2024 bull run when the price surged to $2.

XRP formed a new high back in January; however, since then, XRP’s price has dropped back to $2, and many investors who bought at higher levels are now selling to offset losses. This ongoing selling pressure is keeping XRP from experiencing any significant uptick, further dampening bullish sentiment.

XRP Price Looks To Breakout

XRP is currently trading at $2.15, just below the $2.16 local resistance level, which it failed to secure as support earlier this month. The altcoin is consolidating beneath $2.27, a resistance level that has been a point of contention since the end of March. If the price remains above the $2.00 support, it could stabilize at these levels, preventing further losses for investors.

The chances of continued consolidation seem high, as XRP holds above $2.00. This could keep the market relatively stable as investors wait for further signals to confirm the next move. With a lack of major catalysts, the price may fluctuate within this range.

However, should XRP breach the $2.27 resistance and rise toward $2.40, the earlier-mentioned liquidations could trigger a new wave of buying, potentially driving the price upward. This would provide a more bullish outlook and shift the market sentiment.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoMENAKI Leads Cat Themed Tokens

-

Altcoin24 hours ago

Altcoin24 hours agoCanada Approves Multiple Spot Solana ETFs To Launch This Week

-

Market23 hours ago

Market23 hours agoTether Deploys Hashrate in OCEAN Bitcoin Mining Pool

-

Market22 hours ago

Market22 hours ago3 Altcoins to Watch in the Third Week of April 2025

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Price Threatened With Sharp Drop To $1,400, Here’s Why

-

Market19 hours ago

Market19 hours agoBinance Futures Causes a Brief Crash For Story (IP) and ACT

-

Market17 hours ago

Market17 hours agoIs The XRP Price Mirroring Bitcoin’s Macro Action? Analyst Maps Out How It Could Get To $71

-

Market21 hours ago

Market21 hours agoCardano (ADA) Eyes Rally as Golden Cross Signals Momentum