Market

Pump.fun Social Media Hacked to Promote Fake PUMP Token

Pump.fun’s X (formerly Twitter) account suffered a hack this morning, promoting a fake governance token. One wallet was able to gain over $135,000 in one minute by manipulating its price jump.

The platform denied that it would launch its own token, but enthusiasts still jumped at the chance to be scammed. In this environment, it’s very important to remain cautious and levelheaded.

Pump.fun, the popular meme coin launchpad, has persistently denied rumors that it would launch its own token. Still, its users and supporters are eager to believe that such a launch would take place, to the extent that many fell for a scam.

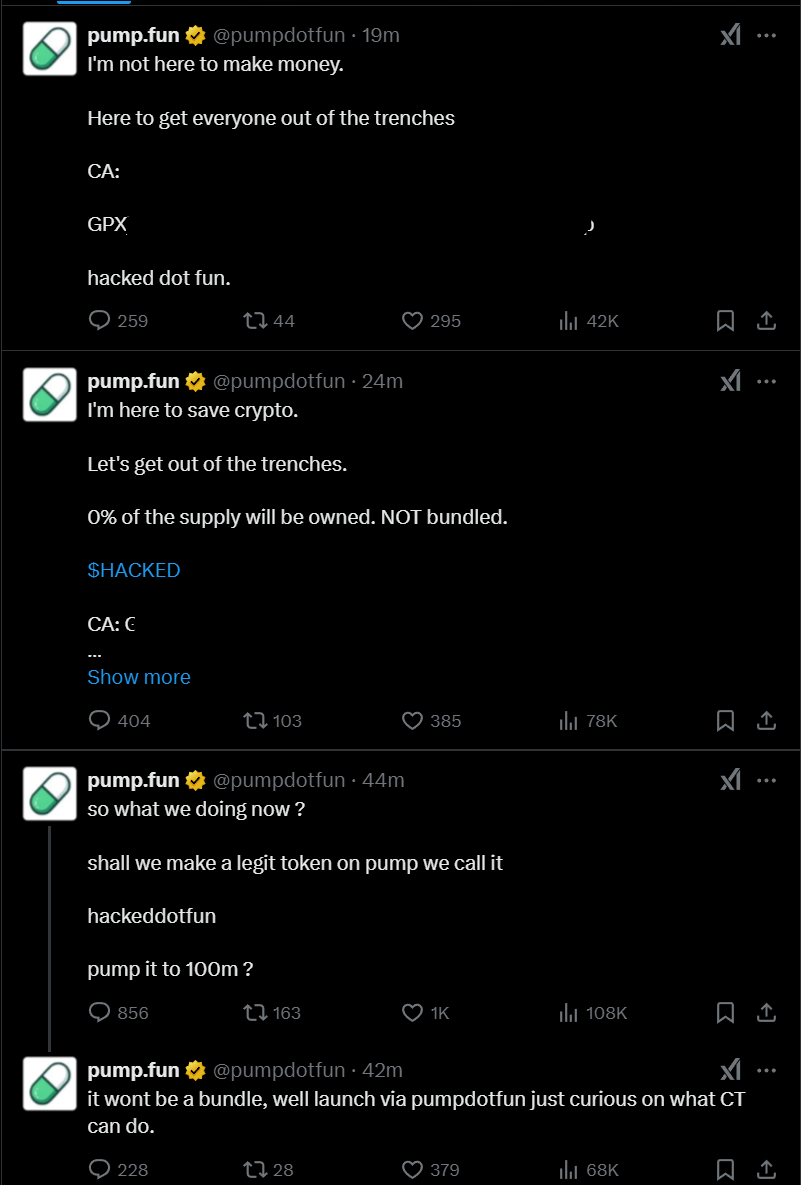

This morning, a hack targeted Pump.fun’s X account, claiming that a new investment opportunity was available:

“Introducing PUMP, the official Pump.fun governance token, where democracy has never been this degen. We will also be rewarding our OG degens,” the fake post read. It also included a link with purchasing information.

The company’s account was still active while the fake social media content was live, and some responses to fans from this window were still live at the time of this writing.

This has led some community members to speculate that the token is legit, but there’s clear evidence against it.

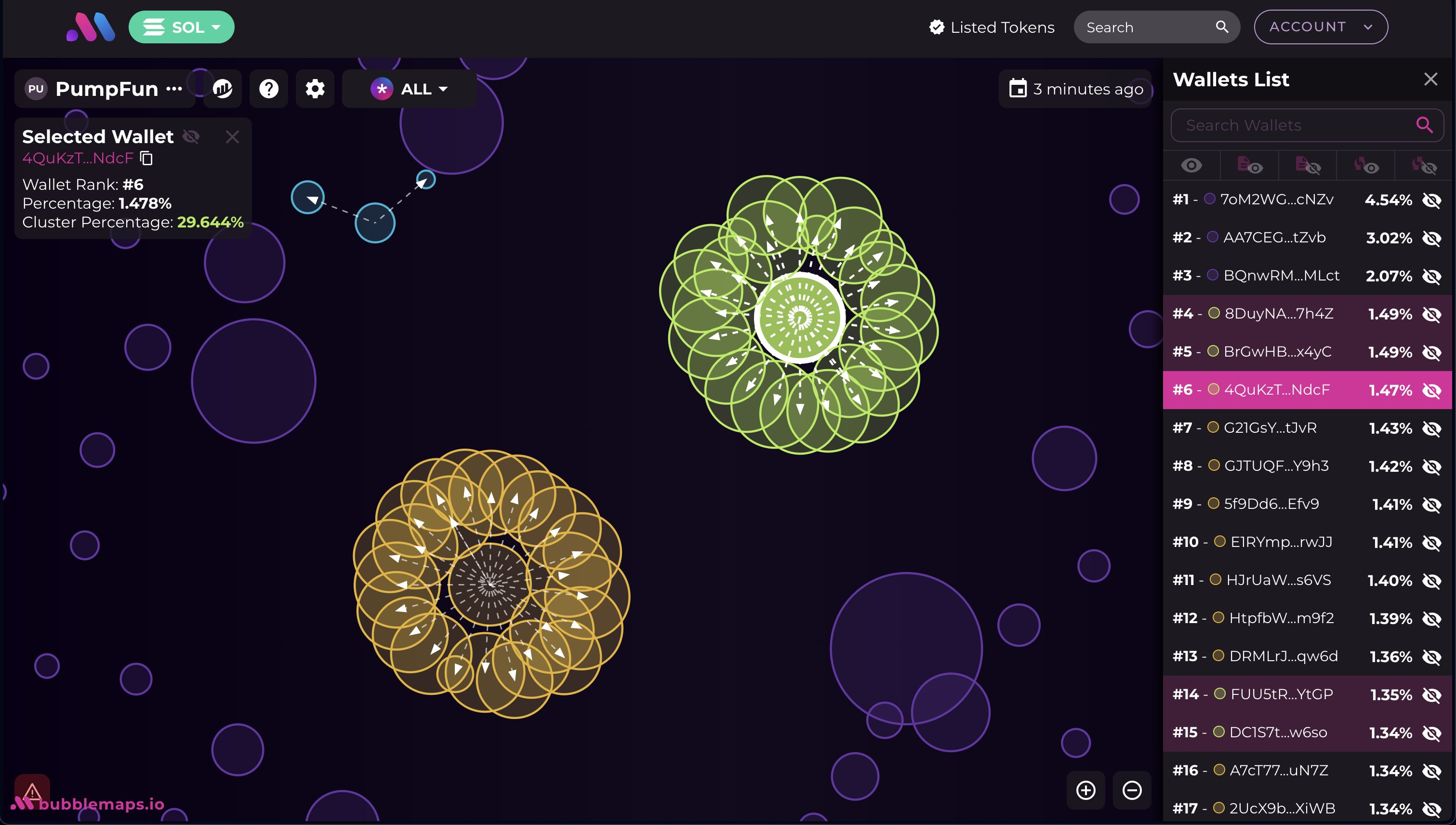

Bubblemaps noted that the fake PUMP tokens are heavily bundled, with two clusters holding over 60% of the supply. Yet, some traders have capitalized on the hack.

One user spent $5,532 in SOL to buy the fake token and offloaded the entire supply at a higher price one minute later. This netted the user over $135,000 in profits.

This Pump.fun social media hack is hardly an isolated incident. It’s becoming a common tactic for scammers. Myanmar’s current head of state was hacked last week, as were former leaders from Brazil and Malaysia.

Today’s incident is part of a broader trend. Hackers are seemingly targeting high-profile social media accounts to quickly shill and rug pull fake tokens.

At the time of reporting, the account still looks to be compromised. Hackers have seemingly deleted the original post and are now promoting a ‘hackeddotfun’ token.

Meme coin traders should remain very cautious. Recent reports suggest that most Pump.fun users already lose money in general trading.

So, hacks like these make the environment even more treacherous. If a project seems too good to be true, it very well might be.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MELANIA Crashes to All-Time Low Amid Insiders Continued Sales

A wave of heavy sell-offs linked to the team behind the Melania meme coin (MELANIA) has raised fresh concerns about insider activity within the project.

These activities have contributed to the token’s value dropping to an all-time low, a staggering 97% down from its all-time high on Trump’s inauguration day back in January.

Heavy Insider Selling Sends MELANIA to Historic Low

On April 19, on-chain analyst EmberCN reported that wallets tied to the project offloaded nearly 3 million MELANIA tokens.

In return, the team received approximately 9,009 SOL, valued at around $1.2 million. The tokens were sold through unilateral liquidity provisions added to the MELANIA/SOL trading pair on Meteora.

This transaction is part of a broader pattern. In the past three days, the MELANIA team reportedly moved 7.64 million tokens, worth about $3.21 million, from both liquidity and community wallets.

The team systematically added these tokens to the same liquidity pool and sold them for SOL within a pre-defined price range. Out of the total, they sold 2.95 million tokens just hours before EmberCN’s disclosure.

“In the past 3 days, the $MELANIA project team has continued to transfer out 7.643 million $MELANIA tokens ($3.21M) from liquidity and community addresses, then added them to MELANIA/SOL one-sided liquidity on Meteora, selling $MELANIA within a set range for SOL. Of which, 2.95 million $MELANIA tokens were sold 7 hours ago for 9,009 SOL,” EmberCN stated.

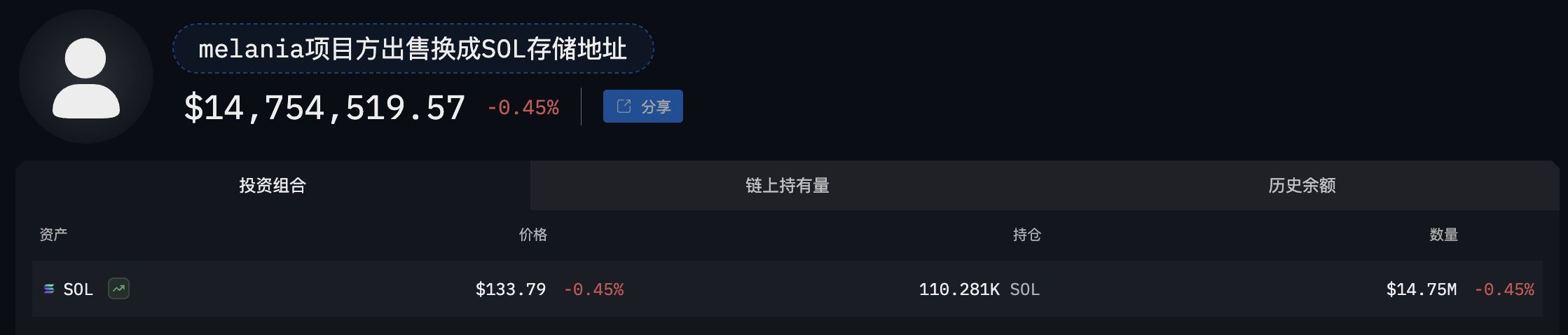

EmberCN further pointed out that the project’s team has sold over 23 million MELANIA tokens in the past month. The tokens were worth approximately $14.75 million.

These repeated sell-offs have added weight to concerns over internal dumping—suspicions that first emerged in March.

At the time, blockchain analytics firm Bubblemaps reported unusual movements of over $30 million in MELANIA tokens. Originally part of the community allocation, the tokens appeared to be gradually transferred to exchanges without explanation.

The firm linked these transactions to Hayden Davis, a co-founder of the meme coin. Davis previously worked on another controversial token, LIBRA, which briefly surged after Argentine President Javier Milei endorsed it, then quickly collapsed.

Bubblemaps also revealed that wallets tied to the MELANIA team control roughly 92% of the token’s total supply. Critics argue that this level of centralization raises red flags over potential market manipulation.

As a result of these concerns, MELANIA has seen its price collapse. After reaching a high of over $13 earlier this year, the token has dropped by over 96% to an all-time low of $0.38, according to data from BeInCrypto.

However, the steep decline reflects both internal turmoil and broader weakness in the meme coin sector. Investor appetite for high-risk tokens appears to be fading amid global uncertainty and a more cautious market sentiment

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Market

Charles Schwab Plans Spot Crypto Trading Rollout in 2026

Charles Schwab, one of the largest brokerage firms in the United States, is preparing to launch a spot cryptocurrency trading platform within the next year.

This marks a major move by one of the most trusted names in traditional finance and shows that demand for crypto investment options continues to climb.

Charles Schwab Eyes Crypto Expansion

During a recent earnings call, Schwab CEO Rick Wurster said the firm is optimistic about upcoming regulatory changes that could allow it to fully enter crypto trading.

“Our expectation is that with the changing regulatory environment, we are hopeful and likely to be able to launch direct spot crypto and our goal is to do that in the next 12 months and we’re on a great path to be able to do that,” Wurster explained.

This move would allow the company to offer direct access to spot crypto trading and place it in direct competition with major players like Coinbase and Binance.

While the company already offers crypto-related products such as Bitcoin futures and crypto ETFs, the addition of direct trading would significantly expand its crypto portfolio. According to the CEO, engagement on these products has grown rapidly in recent months.

Wurster revealed that visits to the firm’s crypto-focused content have surged 400%. Of that traffic, 70% came from users who are not yet customers, showing a growing appetite for digital asset investments.

Wurster’s confidence in crypto aligns with the Trump administration’s efforts to introduce a clearer regulatory framework for digital assets. Compared to past years, progress on crypto legislation and oversight has accelerated, especially among key regulatory bodies like the SEC.

If these improvements continue, Schwab could debut its spot crypto trading platform before mid-2026. The firm believes its reputation in traditional finance gives it a strategic advantage in expanding into the crypto space.

Meanwhile, Schwab is already dipping its toes into the sector through its role as custodian for Truth.Fi, an upcoming digital investment platform launched by Trump Media and Technology Group. Truth.Fi plans to offer a mix of Bitcoin, separately managed accounts, and other crypto-linked products.

Indeed, Schwab’s potential entry into the sector has drawn attention from other industry leaders. Asset management firm Bitwise CEO Hunter Horsley described the brokerage firm’s move as a milestone in crypto’s transition to mainstream finance.

Rachael Horwitz, Chief Marketing Officer at Haun Ventures, echoed that sentiment and encouraged Schwab to consider crypto-collateralized lending as a future offering.

“Schwab should implement crypto-collateralized lending as part of its banking services next,” Horwitz said.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Today’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

A long-time supporter of XRP who is not afraid to speak his mind has issued stunning predictions concerning the future value of the cryptocurrency. His assertions have both interested and confused investors.

Investor Forecasts 50-Fold Return On XRP

As per the Alpha Lions Academy founder Edoardo Farina, an investment of $1,000 in XRP today can increase to more than $50,000 in the future. The estimate is based on the altcoin crossing Farina’s desired price target of $100 per token, from its current value of around $2.

“Buying $1,000 worth right now is really buying over $50,000 in the future when $XRP hits $100+”, Farina tweeted recently.

Farina previously revealed he will not sell any of his XRP holdings until the price reaches at least $100 per token. He terms the coin as sitting at the hub of what he refers to as a “multi-generational pump” and points out its potential function within the international finance system.

XRP @ $2

Buying $1,000 worth right now is really buying over $50,000 in the future when $XRP hits $100+

50x return

— EDO FARINA 🅧 XRP (@edward_farina) April 18, 2025

Minimum Holdings Suggestion Sparks Skepticism

According to reports, Farina urges retail investors to own a minimum of 1,000 XRP tokens. He asserts that such an amount is the minimum one needs in order to take advantage of the use and greater adoption of XRP in the future.

Such opinions regarding the issue have been unequivocal. Farina has reportedly said that individuals who have fewer than 1,000 XRP tokens “don’t care enough about their financial success” and called possessing less than that amount “insanity.”

Though these comments represent Farina’s individual investment strategy, they echo a developing perception among XRP enthusiasts that the asset is undervalued and poised for strong growth if regulatory clarity increases and more businesses embrace it.

Doubters Challenge The Life-Changing Assertions

Not everyone shares Farina’s positive perspective. Doubters have raised issues with his assertion that $1,000 in XRP today may be worth $50,000 someday.

One critic pointed out that even if XRP hits $100 and converts $1,000 into $50,000, this may not be sufficient for early retirement. The remark points out that what appears to be a good return may not necessarily be the life-altering wealth many investors expect.

Questions also arise regarding if XRP will ever hit the $100 level, and if so, how long it would take to arrive there.

Price Target Timeline Indicates Long Way To Go

The journey to $100 looks long for XRP, which is currently trading at about $2. It would need a nearly 5,000% rise from where it is now to reach $100.

Featured image from Pexels, chart from TradingView

-

Altcoin20 hours ago

Altcoin20 hours agoAnalyst Reveals Dogecoin Price Can Reach New ATH In 55 Days If This Happens

-

Market20 hours ago

Market20 hours agoBinance Mandates KYC Re-Verification For India Users

-

Altcoin23 hours ago

Altcoin23 hours agoPi Coin Price Soars As Pi Network Reveals Massive Community Reward Plans.

-

Altcoin15 hours ago

Altcoin15 hours agoCardano Bulls Secure Most Important Signal To Drive Price Rally

-

Bitcoin18 hours ago

Bitcoin18 hours agoSwiss Supermarket Chain Welcomes Crypto Payments

-

Market22 hours ago

Market22 hours agoSCR, PLUME, ALT Tokens Unlocking This Week

-

Market23 hours ago

Market23 hours agoRipple Takes Asia By Storm With New XRP Product, Here Are The Recent Developments

-

Market21 hours ago

Market21 hours agoAptos Seeks to Cut Staking Yield by 50% to Spur Network Growth