Market

Polymarket Faces Ban in France as US Election Betting Ends

According to a report from The Big Whale, the National Gaming Authority (ANJ), France’s gambling regulator, is preparing to block the prediction markets platform Polymarket.

Polymarket, the decentralized platform that allows users to bet on the outcome of political events, sports, and other occurrences using cryptocurrency, has gained popularity in recent months, especially with bets surrounding the US presidential election. More than $3.2 billion was reportedly wagered on the platform during this high-stakes period, with a record-breaking $294 million in volume on November 5 alone.

France Users May No Longer Access Polymarket

According to The Big Whale, a French website that covers the crypto industry, the ANJ’s impending ban comes after a French trader placed a $30 million bet on a Trump victory, reportedly attracting the regulator’s scrutiny.

The trader’s wager positioned him to make approximately $19 million in profits, a sum that has intensified concerns over Polymarket’s compliance with French gambling laws. A source close to the ANJ stated that despite Polymarket’s use of blockchain and cryptocurrency, its activities are akin to gambling, making it subject to restrictions under French law.

“We are aware of this site and we are currently examining its operation as well as its compliance with French gambling legislation,” The Big Whale reported, citing an ANJ spokesperson.

Read more: What is Polymarket? A Guide to The Popular Prediction Market

Legal expert William O’Rorke from ORWL Avocats explained that although Polymarket does not specifically target French users, its activities fall squarely under gambling regulations.

“Polymarket involves betting money on uncertain outcomes, which aligns with the legal definition of gambling,” O’Rorke noted.

Against this backdrop, the ANJ is well within its mandate to block the platform’s access in France. Accordingly, the French regulator may enforce the ban by blocking Polymarket’s domain name in France. It amy also pressure third-party players, like media outlets and online directories, to limit access to Polymarket links.

However, French users may still circumvent this by using virtual private networks (VPNs). This is because Polymarket’s crypto-based infrastructure allows for relatively anonymous participation.

France’s looming ban is not the first regulatory roadblock Polymarket has encountered. In 2022, the US Commodity Futures Trading Commission (CFTC) fined Polymarket $1.4 million for failing to register as a designated contract market. The CFTC also challenged Kalshi’s operations due to questions about betting on political events.

Polymarket’s Fate After US Elections

Meanwhile, the US election was a significant catalyst for Polymarket. It drove the platform to new heights in user engagement and bet volume. Polymarket’s election-related markets have been featured on major financial platforms, including Bloomberg, highlighting the platform’s appeal to mainstream finance.

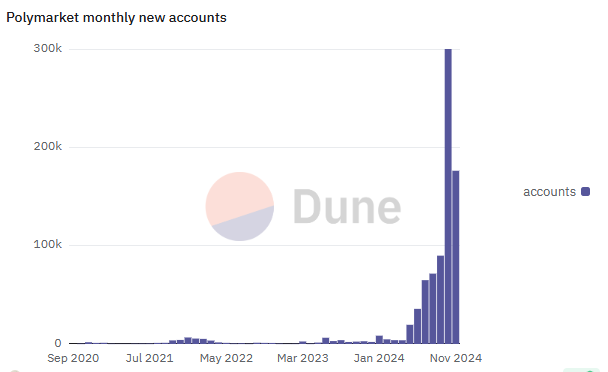

As BeInCrypto reported, Polymarket’s election betting topped $3 billion, reflecting unprecedented participation. The platform, however, faces a crossroads in its path forward. Following the climax of the US election on Wednesday, data from Dune Analytics shows a steep decline in Polymarket’s activity.

Daily active addresses and transaction volumes, which soared in the election lead-up, have notably dwindled as election-related betting winds down. For instance, Polymarket’s open interest, a key indicator of active betting engagement, dropped from $350 million to $268 million after the polls closed. Similarly, monthly new accounts have also dropped by over 41% between October and November.

Against this backdrop, Polymarket may need to diversify its market offerings or potentially embrace a new model to maintain user interest. This is considering election-related activity comprised the majority of the prediction market’s volume.

Rumors are circulating about a potential move toward a decentralized governance token, which could distribute control over Polymarket’s operations to its community. This shift would reduce the liability of the central authority by decentralizing decision-making, though it remains theoretical, with no clear timeline.

Read More: How To Use Polymarket In The United States: Step-by-Step Guide

Polymarket’s fast ascent and regulatory challenges highlight broader industry tensions between innovation and compliance. With election predictions no longer a draw and an impending ban in France, Polymarket’s future remains uncertain.

Its long-term viability may depend on how well it adapts to evolving regulatory landscapes and whether it can maintain popularity beyond election season peaks.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

A16z Calls for Crypto Custody Reform to Empower RIAs

Andreessen Horowitz (a16z) calls on the US SEC (Securities and Exchange Commission) to modernize its custody regulations for crypto assets.

The crypto VC (venture capital) advocates a principles-based framework where Registered Investment Advisers (RIAs) can self-custody digital assets under defined conditions.

A16Z Asks SEC To Empower RIAs

The crypto VC wrote a detailed article responding to the SEC’s request for information on investment adviser custody. It outlined a path forward that balances investor protection with the realities of managing blockchain-based assets.

“We submitted our response to the SEC’s request for information about IA custody. We are excited to see the SEC take steps towards offering guidance for crypto. Advisory clients deserve for their assets to be safeguarded, so we welcome concrete advice from the Commission,” Scott Walker, Chief Compliance Officer at a16z, announced the firm’s submission on X (Twitter).

He noted that crypto custody presents unique risks and that RIAs need clearer guidance to maneuver those challenges responsibly.

In a16z’s view, existing custody rules designed for traditional securities fall short when applied to crypto. RIAs often find that third-party custodians either do not support the full range of digital asset features or are unavailable.

This compels advisers to weigh legal uncertainty against fiduciary duties. This is particularly true when preserving the economic and governance rights embedded in many tokens. Such rights include protocol voting, staking, and yield generation.

The firm has proposed a five-principle framework solution to reflect crypto’s unique characteristics.

Principles To Empower RIAs, A16Z Shares

Central to its approach is the idea that custody rules should focus on what protections are provided rather than who provides them.

- Eligibility Based on Protections, Not Legal Status

A16z argues that legal status, such as being a federally chartered bank, should not determine eligibility to custody crypto assets. Instead, the SEC should recognize any custodian. This includes state-chartered trust companies or even unregistered entities that can meet strict safeguarding requirements.

Those requirements include annual technical and financial audits, proper asset segregation, encrypted key management, disaster recovery plans, and strong disclosure practices.

The firm emphasizes that crypto custodians must be able to prevent unauthorized transfers. They should also maintain verifiable ownership records and avoid jurisdictions where assets might be swept into bankruptcy estates.

- Substantive Safeguards for Custodians

Another major tenet of the proposal is that RIAs should not be forced to choose between asset security and client value. Due to technical constraints or compliance concerns, current custodians often limit access to staking or governance features.

- Enable Exercise of Crypto Rights

A16z contends that RIAs should have permission to exercise those rights on behalf of clients. In cases where a custodian cannot support them, temporarily self-custody assets to unlock those features should not be considered a regulatory breach.

- Best Execution Flexibility

The firm also calls for greater flexibility in how RIAs pursue best execution. Transferring crypto to a trading venue for optimal pricing should not constitute a withdrawal from custody. This, however, is contingent on the adviser taking appropriate steps to vet the platform’s security and integrity.

- Self-Custody as a Last Resort

A16z maintains that third-party custody should remain the default. However, the crypto VC believes RIAs should self-custody when no viable alternatives exist or when doing so is necessary to fulfill their fiduciary responsibilities.

Such arrangements would be subject to the same auditing and disclosure standards as third-party custodians.

“Registered Investment Advisers investing in crypto assets have suffered from both a lack of regulatory clarity and limited viable custodial options. What the industry needs is a principles-based approach to solve this critical issue for professional investors,” the firm wrote in its post.

As the SEC grapples with crypto’s place in the regulatory arena, a16z’s comprehensive proposal may offer a roadmap for reform that protects investors while unlocking the full potential of tokenized finance.

Meanwhile, this report comes only months after the US SEC SEC announced Staff Accounting Bulletin (SAB) No. 122. This move effectively canceled the previous guidance under SAB 121, which discouraged banks from holding Bitcoin in custody.

The move allowed banks and traditional financial (TradFi) institutions to offer crypto services without significant regulatory hurdles.

Similarly, a landmark decision only a month ago allowed banks to offer crypto custody and stablecoin services without prior approval, streamlining digital asset integration.

However, amid the push for banks and RIAs to gain more crypto flexibility, strong risk management controls remain essential, aligning with the Office of the Comptroller of the Currency’s (OCC) regulatory guidelines.

“The OCC expects banks to have the same strong risk management controls in place to support novel bank activities as they do for traditional ones,” said Rodney E. Hood, the acting Comptroller of the Currency.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BNB Price Eyes Breakout, But $600 Remains A Stubborn Ceiling

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Bitcoin and Global M2 Money Supply: A Misleading Connection?

A financial analyst has publicly criticized the use of global M2 money supply data to predict Bitcoin (BTC) price movements, calling such analyses mathematically unsound and misleading.

The criticism comes amid a surge in the global M2 money supply to an all-time high. Several analysts are forecasting similar trends for BTC.

Is Global M2 Money Data a Reliable Predictor for Bitcoin Price Movements?

The analyst, known as TXMCtrades, shared his thoughts on X (formerly Twitter). He specifically pointed to a chart by macro investor Raoul Pal that compared Bitcoin’s price to global M2.

TXMCtrades argued that charting global M2 daily or weekly is fundamentally flawed due to the inconsistent update frequencies of the underlying data. According to him, doing so distorts the information by amplifying short-term fluctuations instead of providing an accurate, long-term trend.

“People, you can’t create a daily or weekly time series of “Global M2” when the United States is only updating M2 on a weekly basis and all others are monthly!” the post read.

He explained that many countries have yet to update their figures beyond February, creating significant gaps in the dataset. TXMCtrades contended that this inconsistency results in a metric that largely reflects foreign exchange (FX) fluctuations rather than actual money supply dynamics.

“You’re looking at an M2 weighted inverse dollar exchange rate 95% of the time. Be better at math!” he added.

He also highlighted broader concerns about the misuse of global M2. The analyst stressed that China, which constitutes 46% of global M2, is the only major economy with a broad money supply above its post-COVID peak in dollar terms.

“They are currently trying to ease out of an ongoing multi-year debt deflation and doing a pretty shit job of it. Their M2 goes straight up,” TXMCtrades remarked.

Meanwhile, US M2 remains below its 2022 peak. In addition, the analyst emphasized that it is growing at its slowest pace since Bitcoin’s inception, excluding the 2022-2024 period. This suggests that the US is not experiencing rapid money supply growth, which could impact inflation or other economic trends.

This disparity, TXMCtrades argues, further undermines the reliability of global M2 as a predictor of Bitcoin price movements. The analyst also disputed the use of “random offsets” to align global M2 with Bitcoin price movements, a method employed by several analysts.

For instance, Raoul Pal has suggested a 12-week lag between global M2 and Bitcoin’s price. Meanwhile, Colin Talks Crypto proposes a 15.4-week lag. Meanwhile, Mr. Wall Street estimates the lag to be between 10.7 and 15 weeks. Some have even extended the M2 correlation to predict altcoin prices, such as Solana (SOL).

“SOL has been following Global M2 Money Supply (+100 days) its last two legs up. If this continues, SOL is set to pump massively within the next 2 weeks,” analyst Curb posted.

Nonetheless, the analyst stated that offsets are often arbitrary and don’t reflect the actual dynamics of money supply or asset prices.

“Money is money, it doesn’t have a wait time,” he claimed.

The analyst suggested that such models are overfitted to recent historical data and lack a strong foundation for forecasting. Lastly, TXMCtrades called for greater rigor in financial analysis. He urged analysts to “stop proliferating scammy analysis” and adopt more mathematically sound approaches to understanding cryptocurrency price dynamics.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin18 hours ago

Altcoin18 hours agoMantra (OM) Price Pumps As Founder Reveals Massive Token Burn Plan

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Breakout Imminent? Analyst Expects ETH Price Surge To $2,000

-

Bitcoin24 hours ago

Bitcoin24 hours agoChina Liquidates Seized Crypto to Boost Struggling Treasury

-

Altcoin24 hours ago

Altcoin24 hours agoBitcoin & Others Slip As Trump Imposes Up To 245% Tariff On China

-

Market23 hours ago

Market23 hours agoEthereum Price Dips Again—Time to Panic or Opportunity to Buy?

-

Market21 hours ago

Market21 hours agoBNB Burn Reduces Circulating Supply by $916 Million

-

Ethereum23 hours ago

Ethereum23 hours agoDid Ethereum Survive The Storm? Analyst Eyes Breakout Next

-

Market18 hours ago

Market18 hours agoThis Crypto Security Flaw Could Expose Seed Phrases