Market

Polkadot 2.0 to Launch in Q1 2025 As Development in Final Phase

Polkadot 2.0, the latest upgrade to the Polkadot network, will launch in Q1 2025. An early testnet version of the blockchain is already available on the Kusama network.

The launch period was confirmed earlier today by Parity Technologies, the developers behind Polkadot.

Polkadot 2.0 Will Introduce Much-Needed Scalability to the Blockchain

Polkadot 2.0 represents a significant upgrade of the Polkadot network, introducing technical advancements to enhance scalability, flexibility, and accessibility for developers.

According to Parity Technologies, the upgrade will have three key features – Async Backing, Agile Coretime, and Elastic Scaling.

The first two features have been successfully implemented in the network. The team is currently working on Elastic Scaling ahead of its Q1 2025 launch.

“Last part of Polkadot 2.0 is Elastic Scaling. Projects will be able to add multiple Cores for one task, shorten block production time or add on-demand Cores if they have throughput problems,” Polkadot executive Emil Kietzman wrote on X (formerly Twitter).

These features will reduce the block time from 12 seconds to 6 seconds, increasing transaction throughput. DApps and other projects on Polkadot 2.0 will be able to access network resources on-demand, moving away from the traditional parachain slot auction model.

Most importantly, Elastic Scaling will allow the network to scale dynamically as needed. These enhancements on Polkadot 2.0 could potentially lower developers’ entry barriers.

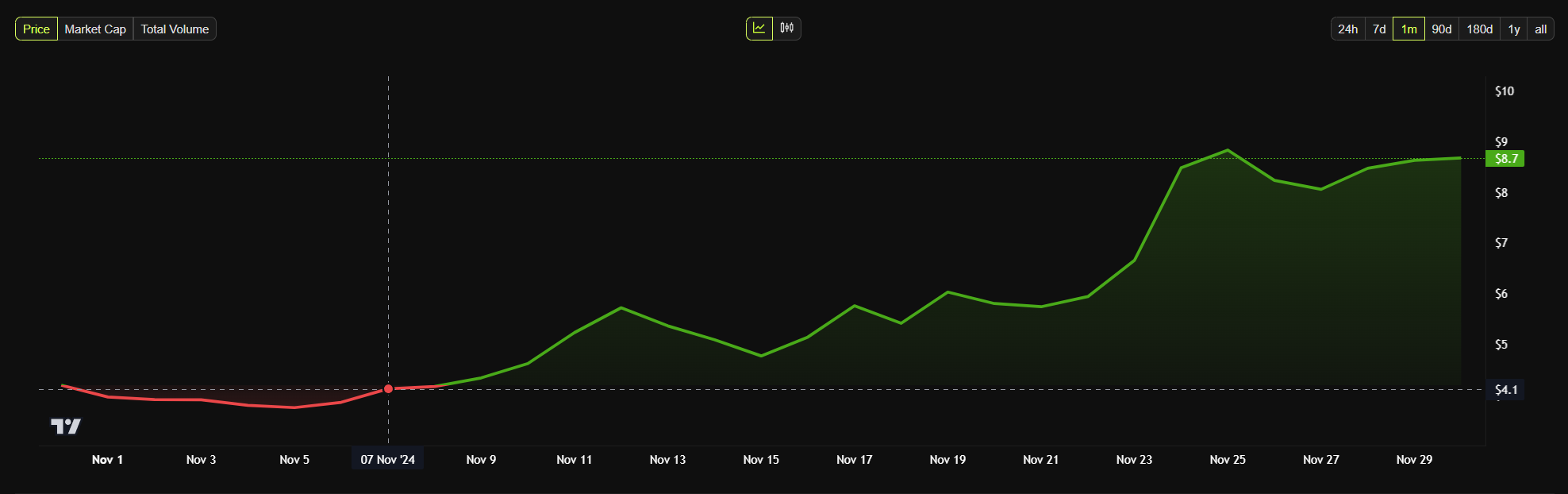

DOT has seen a significant rally in November, surging over 100%. The network’s high staking returns have attracted new users in 2024. According to an earlier CoinGecko report, Polkadot is among the top three blockchains that provide the highest staking yields.

Furthermore, the network’s interoperability has received wider praise from developer communities. Another report earlier this year named Polkadot as one of the leading blockchains in development and community engagement.

Despite these recognitions, the network has suffered extensively in the past few years due to the lack of scalability. As a result, the number of core developers on the network has gradually decreased.

Polkadot 2.0 can potentially change this and introduce much-needed scalability and accessibility to the blockchain. A successful launch can bring more DApps to the ecosystem and drive DOT’s market prospects.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Today’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

A long-time supporter of XRP who is not afraid to speak his mind has issued stunning predictions concerning the future value of the cryptocurrency. His assertions have both interested and confused investors.

Investor Forecasts 50-Fold Return On XRP

As per the Alpha Lions Academy founder Edoardo Farina, an investment of $1,000 in XRP today can increase to more than $50,000 in the future. The estimate is based on the altcoin crossing Farina’s desired price target of $100 per token, from its current value of around $2.

“Buying $1,000 worth right now is really buying over $50,000 in the future when $XRP hits $100+”, Farina tweeted recently.

Farina previously revealed he will not sell any of his XRP holdings until the price reaches at least $100 per token. He terms the coin as sitting at the hub of what he refers to as a “multi-generational pump” and points out its potential function within the international finance system.

XRP @ $2

Buying $1,000 worth right now is really buying over $50,000 in the future when $XRP hits $100+

50x return

— EDO FARINA 🅧 XRP (@edward_farina) April 18, 2025

Minimum Holdings Suggestion Sparks Skepticism

According to reports, Farina urges retail investors to own a minimum of 1,000 XRP tokens. He asserts that such an amount is the minimum one needs in order to take advantage of the use and greater adoption of XRP in the future.

Such opinions regarding the issue have been unequivocal. Farina has reportedly said that individuals who have fewer than 1,000 XRP tokens “don’t care enough about their financial success” and called possessing less than that amount “insanity.”

Though these comments represent Farina’s individual investment strategy, they echo a developing perception among XRP enthusiasts that the asset is undervalued and poised for strong growth if regulatory clarity increases and more businesses embrace it.

Doubters Challenge The Life-Changing Assertions

Not everyone shares Farina’s positive perspective. Doubters have raised issues with his assertion that $1,000 in XRP today may be worth $50,000 someday.

One critic pointed out that even if XRP hits $100 and converts $1,000 into $50,000, this may not be sufficient for early retirement. The remark points out that what appears to be a good return may not necessarily be the life-altering wealth many investors expect.

Questions also arise regarding if XRP will ever hit the $100 level, and if so, how long it would take to arrive there.

Price Target Timeline Indicates Long Way To Go

The journey to $100 looks long for XRP, which is currently trading at about $2. It would need a nearly 5,000% rise from where it is now to reach $100.

Featured image from Pexels, chart from TradingView

Market

Technical Analyst Warns Ripple’s XRP Price Could drop 50%

Veteran market analyst Peter Brandt has issued a gloomy year-end forecast for XRP, suggesting the asset may struggle to maintain its momentum despite recent gains.

On April 18, Brandt shared his updated analysis on X (formerly Twitter), projecting two possible scenarios for XRP’s market capitalization by year’s end.

Cautionary Outlook for XRP Despite Recent Surge

The first scenario places XRP’s market cap around $116.67 billion, while the second offers a more bearish outlook of just above $60 billion.

Essentially, both figures imply a decline from XRP’s current valuation of roughly $2.09 per token at a market capitalization of $121 billion.

Brandt’s analysis is based on a technical pattern he previously identified on XRP’s price chart.

According to him, the formation resembles a classic head-and-shoulders setup—a pattern that often signals a trend reversal. If this plays out, XRP could fall as low as $1.07.

He added then that a move below $1.90 would confirm the pattern and likely trigger a steep correction of more than 50%. However, a break above $3 could invalidate the bearish outlook.

“XRP is forming a textbook H&S pattern. So, we are now range bound. Above 3.000 I would not want to be short. Below 1.9 I would not want to own it,” Brandt explained.

This cautious forecast follows a remarkable surge in XRP’s price since late 2024.

Following Donald Trump’s return to the White House, the token rallied over 300%, reaching a high of $3.28 before pulling back to its current level.

This price performance has led many investors to believe that the Trump administration’s friendlier stance toward digital assets could help the asset continue its rally.

One major catalyst was the Securities and Exchange Commission’s (SEC) decision to drop several lawsuits against crypto companies, including Ripple.

That shift reduced regulatory uncertainty and sparked renewed interest in XRP, culminating in the launch of exchange-traded funds (ETFs) focused on the product.

Adding to the momentum, Ripple launched its own stablecoin, RLUSD, aiming to tap into a growing segment of the digital asset market.

Still, Brandt’s warning suggests that XRP’s recent rally may not be sustainable if bearish pressure intensifies.

Ripple Not Rushing Into IPO Despite Industry Trend

Amid renewed attention on XRP’s performance, Ripple CEO Brad Garlinghouse has addressed growing speculation about the company going public.

In a recent video shared on X, Garlinghouse made it clear that Ripple does not plan to file for an IPO in 2025.

He emphasized that the company is not actively seeking external funding because it remains financially stable and is prioritizing product development and business expansion.

“Will we IPO in 2025? I think that’s a definitive no…We’ve said there’s no imminent plans to go public,” Garlinghouse stated.

While the company isn’t moving forward with an IPO this year, Garlinghouse didn’t completely close the door.

He noted that Ripple is evaluating whether going public would benefit the business in the long run. However, such a move isn’t a current priority.

“You have to ask yourself, okay, how does Ripple benefit from being a public company? And is it a high priority for us?” he said.

Moreover, Garlinghouse also hinted that the regulatory landscape—especially under new leadership at the SEC—could influence Ripple’s future decisions.

His comments come as several crypto firms, including Kraken and Ciecle, reportedly prepare for IPOs. For now, though, Ripple appears comfortable staying private until conditions become more favorable.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SUI Ranks 5th in DEX Volume, But Rally Lacks Strength

SUI blockchain has been gaining traction in recent weeks, and its market cap is now approaching $7 billion. Fueled by meme coin activity and rising DeFi engagement, the network has seen a notable jump in DEX volume and technical momentum.

While indicators like RSI and EMA lines show early signs of a potential trend shift, overall strength remains mixed. SUI sits at a key crossroads—supported by short-term excitement but still needing stronger confirmation to challenge top-tier chains.

SUI Surges to 5th in DEX Volume, But Still Trails Top Chains

SUI’s recent surge in DEX activity has grabbed attention, largely fueled by growing interest in meme coins and speculative trading on its ecosystem. Over the past seven days, SUI’s DEX volume hit $2.1 billion, marking a 4.49% increase and continuing its steady upward trend.

This momentum has helped SUI outperform other ecosystems, most notably surpassing Arbitrum in the past 24 hours to become the fifth-largest chain by DEX volume.

However, despite the short-term gains, SUI still trails well behind top-tier networks like Base, BNB Chain, Ethereum, and Solana in total DEX activity.

These established ecosystems continue to dominate in terms of liquidity, user base, and overall transaction volume.

While SUI’s rise is notable, especially given its relatively new position in the DeFi ecosystem, it will need to sustain this growth and diversify beyond meme coin hype to truly challenge the leading players.

For now, it remains an exciting underdog with momentum—but not yet a major contender.

SUI Momentum Rebuilds, But Trend Remains Weak

SUI’s RSI is now at 51.86, up from 35.22 just three days ago. This suggests buying pressure has returned after a short-term dip, helping stabilize price action.

The Relative Strength Index (RSI) measures momentum on a scale from 0 to 100. Readings above 70 are considered overbought, while those below 30 indicate oversold conditions.

Sitting near the midpoint, SUI’s RSI points to neutral momentum. It hasn’t crossed above 70 in almost a month, showing that bullish strength has remained limited.

Meanwhile, SUI’s DMI (Directional Movement Index) shows that its ADX is down to 9 from 14.79 just two days ago. The ADX measures trend strength, and anything below 20 signals a weak or nonexistent trend.

The +DI is at 15.83 while the -DI is at 13.15, meaning buyers have a slight edge—but the low ADX suggests that edge isn’t strong. There’s no clear trend dominating the market right now.

Together, the RSI and DMI suggest that SUI is in a consolidation phase. Buyers are showing some activity, but not enough to build a strong, sustained trend—at least for now.

EMA Setup Still Bearish, But SUI Bulls Show Signs of Life

SUI’s EMA lines are still showing a bearish setup, with short-term averages sitting below the long-term ones. However, the gap between them has narrowed, and a potential golden cross may be forming.

A golden cross occurs when a short-term EMA crosses above a long-term one, often seen as a bullish signal. If this plays out, SUI could gain momentum and push toward the $2.28 resistance level.

Breaking above that could open the path toward $2.41 and $2.54. If bullish momentum builds further, SUI blockchain could even test the $2.83 level—its highest since early March.

But if the market fails to hold current levels and selling pressure returns, a correction could begin. In that case, it might fall back to test the $2.02 support.

Losing that support could bring deeper downside, potentially pushing SUI toward $1.71. For now, price action is at a critical point, with both breakout and breakdown scenarios on the table.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoCardano (ADA) Moves Sideways, But Bullish Shift May Be Brewing

-

Altcoin18 hours ago

Altcoin18 hours agoAnalyst Reveals Dogecoin Price Can Reach New ATH In 55 Days If This Happens

-

Altcoin21 hours ago

Altcoin21 hours agoPi Coin Price Soars As Pi Network Reveals Massive Community Reward Plans.

-

Market18 hours ago

Market18 hours agoBinance Mandates KYC Re-Verification For India Users

-

Altcoin22 hours ago

Altcoin22 hours agoXRP ETF Approval Could Spark a ‘Perfect Storm’ for Ripple Coin: Expert

-

Market21 hours ago

Market21 hours agoRipple Takes Asia By Storm With New XRP Product, Here Are The Recent Developments

-

Market20 hours ago

Market20 hours agoSCR, PLUME, ALT Tokens Unlocking This Week

-

Altcoin13 hours ago

Altcoin13 hours agoCardano Bulls Secure Most Important Signal To Drive Price Rally