Market

Pi Token Eyes $2 Comeback as Bullish Momentum Grows

Pi Network’s PI token officially launched on February 20, marking a major milestone for the crypto project. However, the long-awaited launch triggered a wave of sell-offs as early adopters rushed to cash in on their holdings.

The selling pressure triggered a decline in PI’s value, which fell to a low of $0.60 by February 21. Despite the initial crash, PI has rebounded, showing renewed bullish momentum.

PI Soars 173% from Post-Launch Low

PI currently trades at $1.64, noting a 173% hike from its post-launch low. This triple-digit rally has been fueled by the resurgence in demand for the altcoin over the past few days.

A potential Binance listing partly drives this demand. As of February 22, 212,000 votes had been cast on whether PI should be launched on the exchange, with more than 86% in favor. As the voting process nears its conclusion, investors anticipate Binance will list the altcoin, potentially driving its price higher.

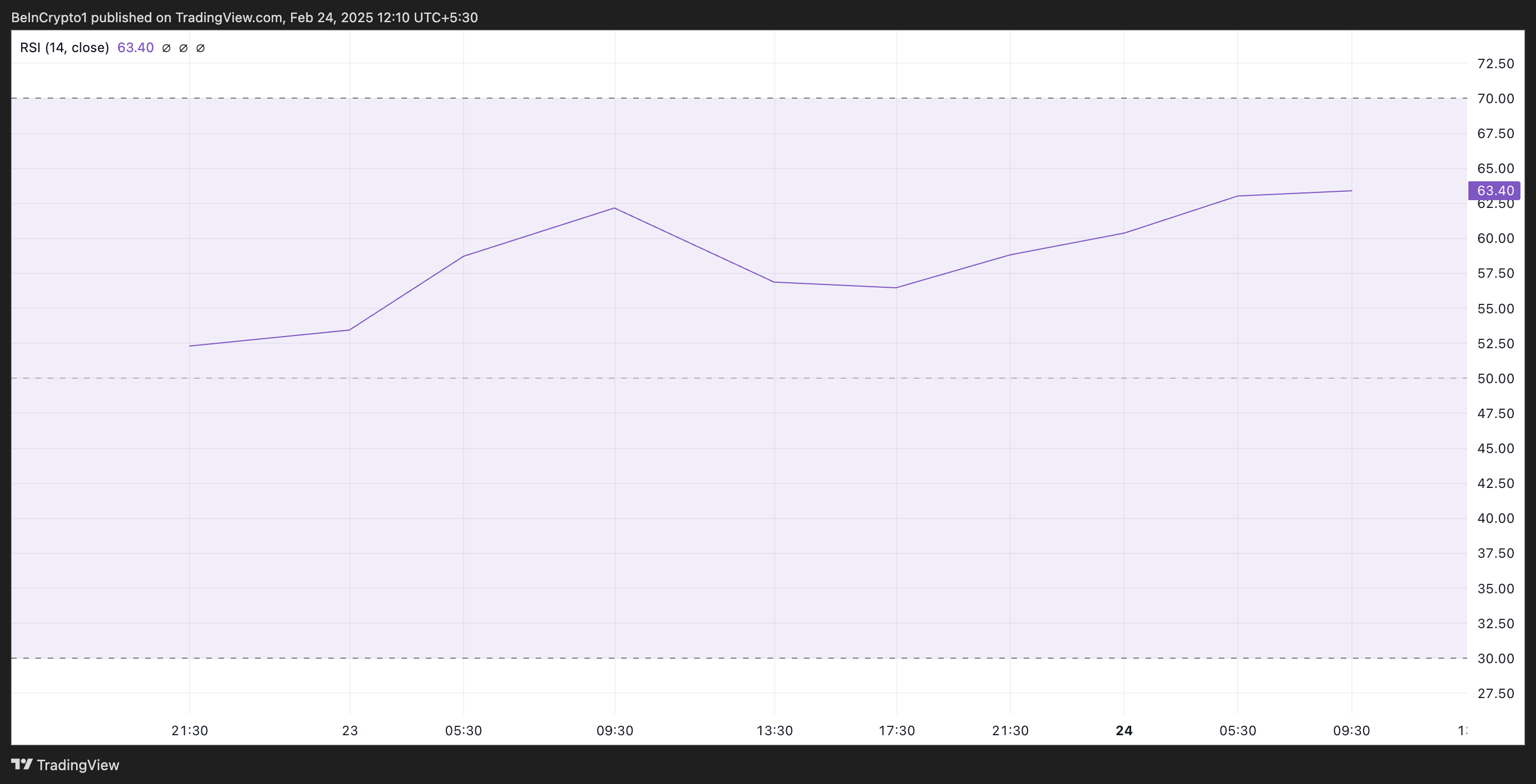

PI’s high demand is reflected by its rising Relative Strength Index (RSI). As of this writing, this key momentum indicator, assessed on a four-hour chart, is in an upward trend at 63.40.

An asset’s RSI measures its overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a correction. On the other hand, values under 30 suggest that the asset is oversold and may witness a rebound.

PI’s RSI reading of 63.40 signals strong bullish momentum. This means that buying pressure outweighs selling activity among market participants, and if the trend continues, the altcoin’s price will continue to grow.

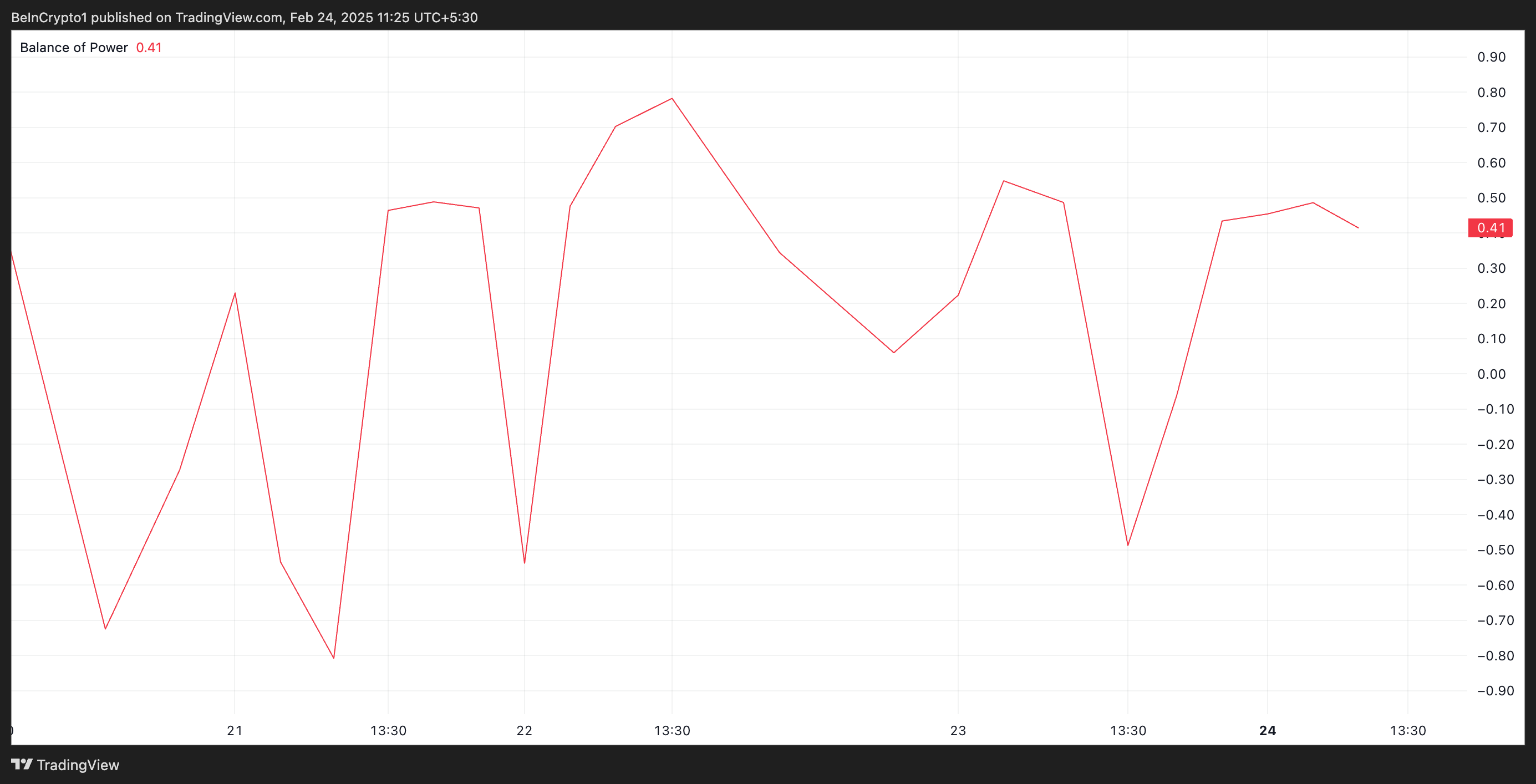

Moreover, readings from PI’s Balance of Power (BoP) support this bullish outlook. As of this writing, it returns a positive value of 0.41.

The BoP measures the strength of buyers against sellers by analyzing price movements within a given period. As with PI, when the indicator’s value is positive, buyers have more control. This indicates strong upward momentum and hints at the potential for further price gains.

PI Holds Strong Above Trendline: Can It Reach a New High?

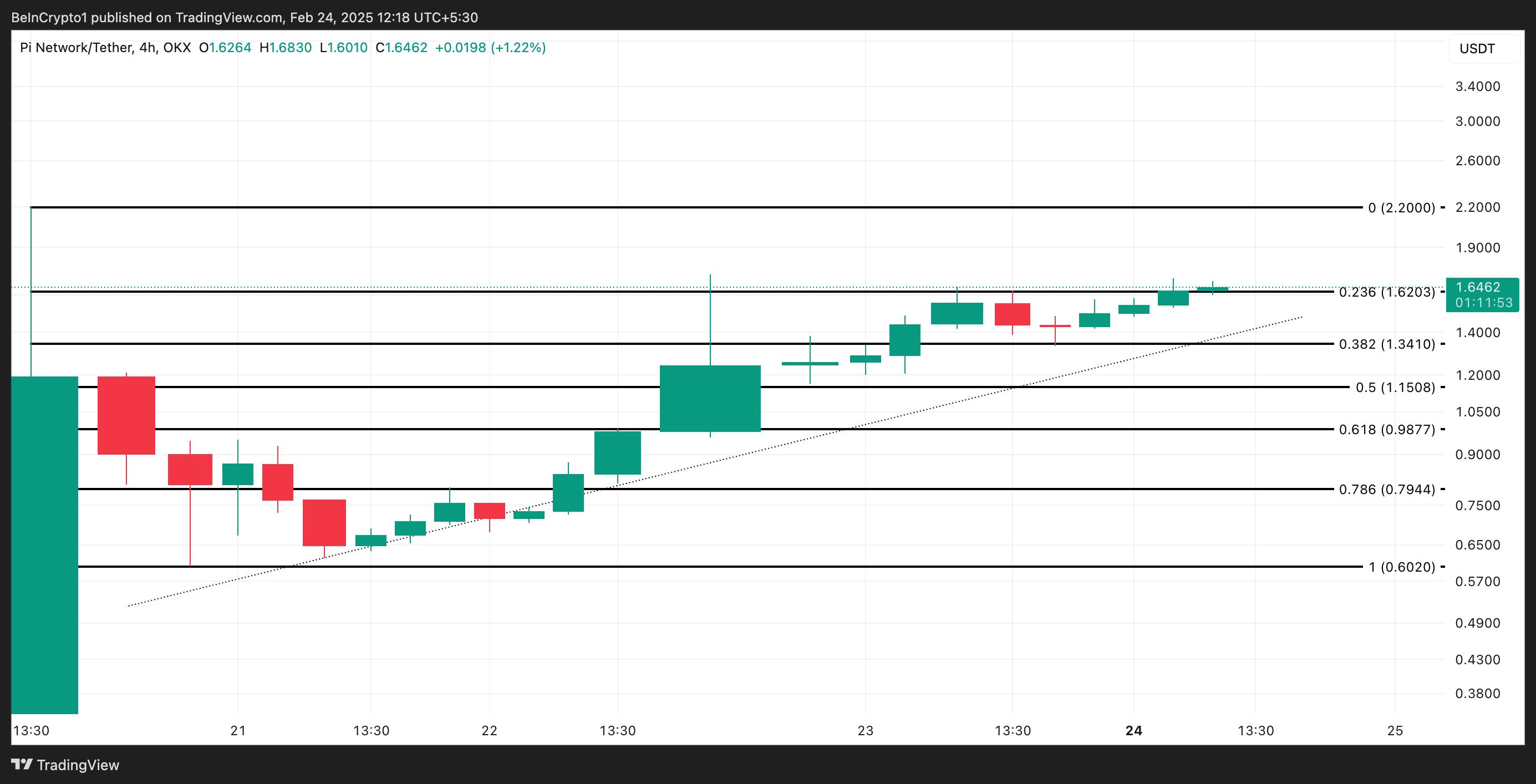

PI has traded above an ascending trend line since February 20, confirming the resurgence in the bullish activity around the altcoin.

When an asset trades above this pattern, it indicates a strong uptrend, with buyers consistently supporting higher prices. If the uptrend persists, PI could breach the $2 price mark to trade at its all-time high of $2.20.

On the other hand, if demand plummets amid a rise in profit-taking activity, this bullish projection will be invalidated. In that scenario, PI’s value could break below $1.60 and fall to $1.34.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Whales Bought These 3 Coins Recently

Crypto whales bought Optimism (OP), Dogecoin (DOGE), and Worldcoin (WLD) in recent days. OP saw a rise in large holders despite being down 73% over the past year, while DOGE whale wallets climbed to a two-week high as meme coin sentiment shows signs of recovery.

WLD also attracted accumulation, even after a 19% drop in the last 30 days, with whales adding to their positions over the last four days. This shift in on-chain behavior suggests that some big players may be preparing for a potential rebound across these assets.

Optimism (OP)

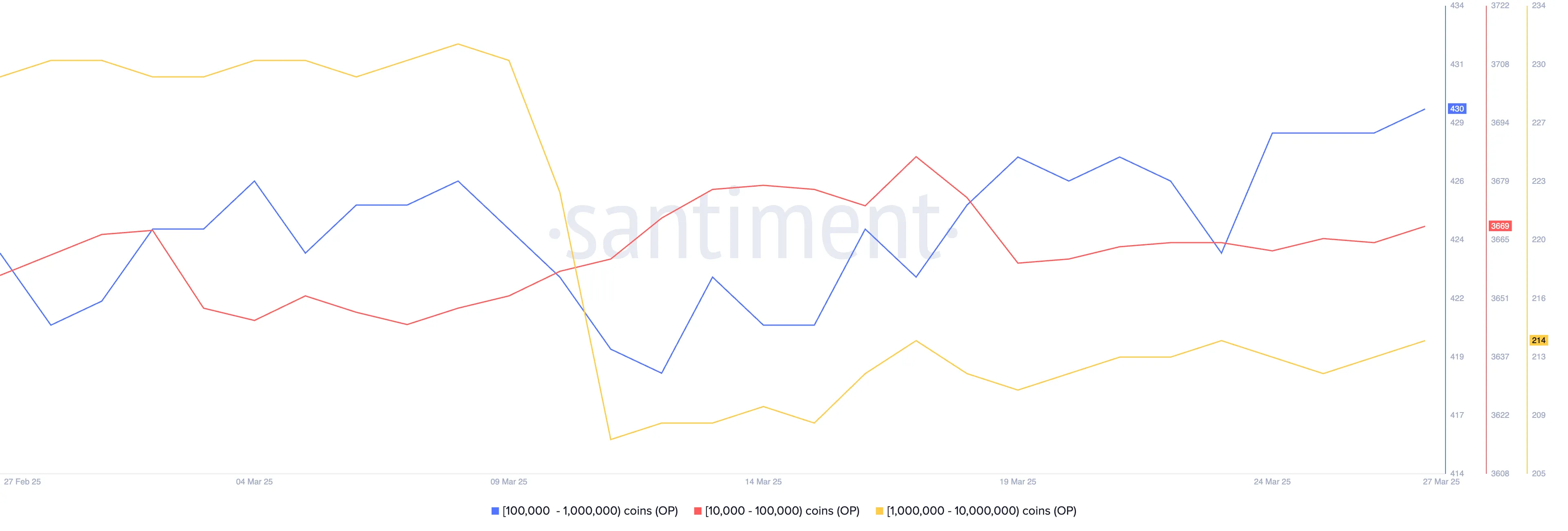

Despite Optimism experiencing a prolonged downtrend and a nearly 73% drop over the past year, on-chain data reveals a subtle but notable shift: the number of wallets holding at least 10,000 OP has increased from 4,303 to 4,313 in the last five days.

This uptick suggests that some larger investors may be accumulating OP at lower prices, potentially positioning for a long-term reversal.

While OP has struggled to gain traction this cycle—remaining below the $2 mark since early January—this quiet accumulation could be an early sign of growing confidence among more seasoned holders.

If this accumulation translates into renewed bullish momentum, OP may attempt to reclaim key resistance levels, starting with $0.93.

A successful breakout could lead to a push toward $1.06, and if buying pressure accelerates, $1.20 becomes a reasonable upside target.

On the flip side, if selling pressure remains dominant and no meaningful shift in momentum occurs, OP could continue its slide, with $0.74 acting as a key support level. A break below that could send the price below $0.70, reinforcing the downtrend and keeping investors cautious in the near term.

Dogecoin (DOGE)

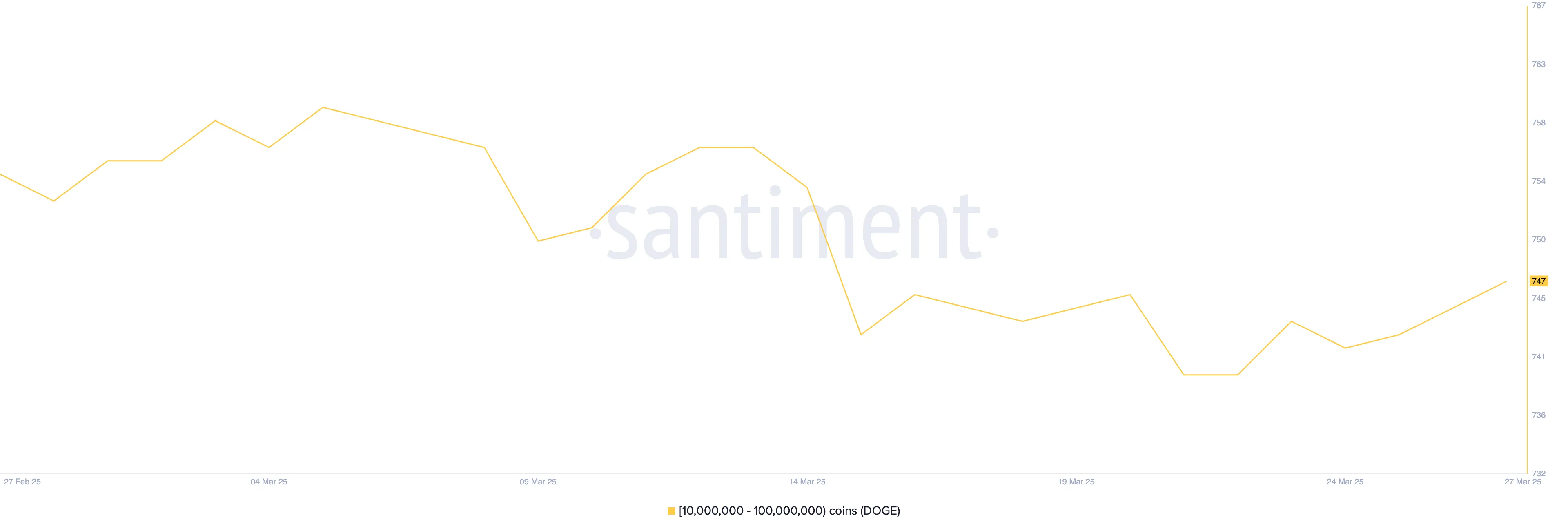

Dogecoin, the largest meme coin by market cap, is seeing renewed interest from large holders. On-chain data reveals that crypto whales bought DOGE over the past week.

Specifically, the number of wallets holding between 10 million and 100 million DOGE rose from 740 to 747—the highest level in two weeks.

This suggests that big players may be positioning ahead of a potential rebound in the meme coin space, anticipating a shift in market sentiment. With DOGE historically responding strongly to meme coin hype, this uptick in whale activity could be a key early signal.

If momentum builds and meme coins stage a broader recovery, DOGE could be one of the biggest beneficiaries. A bullish breakout could send the price to test resistance around $0.19, and if that level is broken, further gains toward $0.22 and even $0.24 may follow.

However, if the current market correction deepens, DOGE may retest support at $0.16, with a possible drop to $0.143 if selling pressure increases.

For now, whale accumulation offers a promising sign—but price direction will likely hinge on whether broader meme coin momentum returns.

Worldcoin (WLD)

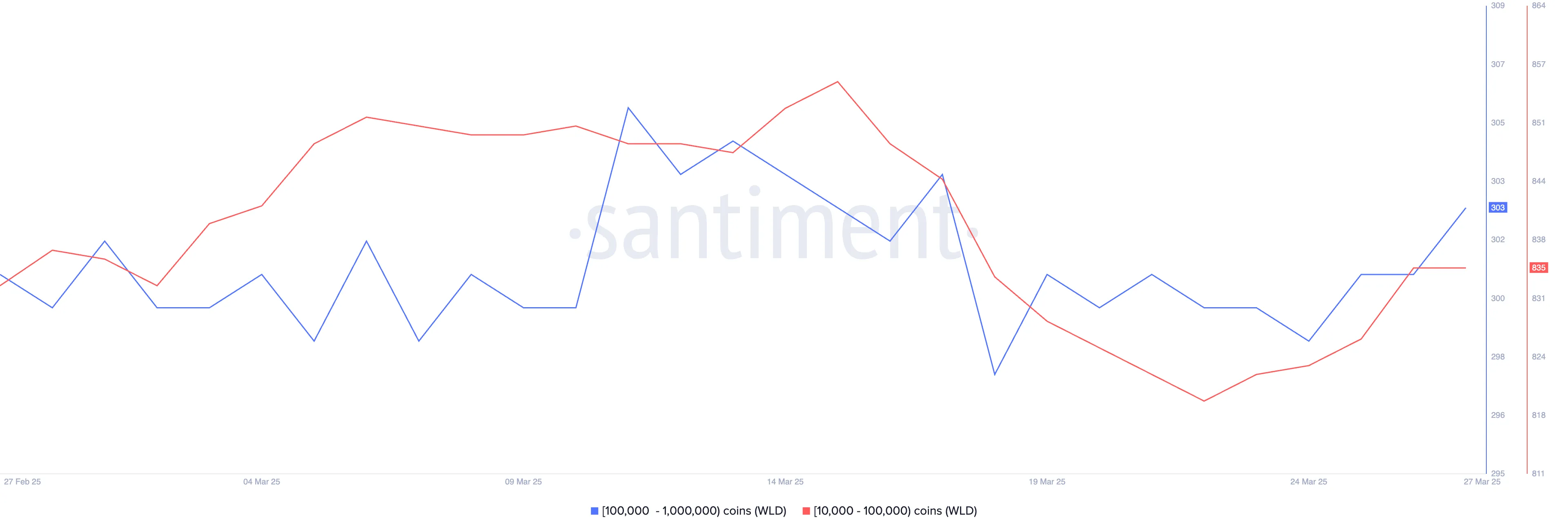

Worldcoin, once one of the most hyped AI-related cryptocurrencies, has struggled to maintain its momentum in recent months, with its price falling nearly 19% over the past 30 days.

Despite this decline, recent on-chain data shows that crypto whales have started accumulating WLD again. Over the last four days, the number of wallets holding between 10,000 and 1,000,000 WLD increased from 1,123 to 1,138.

This accumulation could signal growing confidence that WLD may soon find a bottom.

If buying momentum continues to build, WLD could attempt a short-term recovery. The first key resistance level is $0.91.

A breakout above that could fuel a stronger rally toward $1.25, helping Worldcoin regain some of its lost ground.

However, if bearish sentiment remains dominant, WLD may retest support at $0.80, and a break below that level could send it down further to $0.69.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Trump Pardons BitMEX Founders, Sparking Community Unease

President Trump just issued a pardon for BitMEX’s three founders, who pled guilty to money laundering charges in 2022. Unlike the case of Ross Ulbricht, there was no popular movement for these pardons, sparking community confusion.

Since the pardons went out, Sam Bankman-Fried’s Polymarket odds of receiving a pardon have skyrocketed. However, this has also created a sense of unease, especially with the rampant scams and frauds in crypto today.

Trump Issues BitMEX Pardons

BitMEX is a centralized exchange with a long history in the crypto space, but it has faced its share of controversies. In 2020, it was sued in the US for alleged money laundering.

Its founders, Arthur Hayes, Benjamin Delo, and Samuel Reed, pled guilty to violating the Bank Secrecy Act, but President Trump just pardoned all three in a shocking move.

Trump did little to publicize these pardons, as neither he nor any of the recipients have yet made a public statement regarding the move. These men only faced fines, probation, and house arrest, and all were completely free at the time. Arthur Hayes remains an influential commentator, but he has no further involvement with BitMEX.

To call this move unexpected would be an understatement. Trump has given other crypto-related pardons, like with Ross Ulbricht, to be fair.

However, Ulbricht’s case was a cause célèbre in the community. There were no corresponding vocal calls to issue BitMEX pardons, especially considering the founders’ light sentences.

In short, most of the crypto space’s reactions have been negative. At the time, even government crypto allies like “Crypto Mom” Hester Peirce supported the BitMEX arrests, and money laundering has never been popular in the space. The crypto community is struggling to find a clear motivation for Trump’s pardons other than outright corruption.

“My God, everything is for sale. I think he’ll pardon Sam Bankman-Fried,” said author Jacob Silverman.

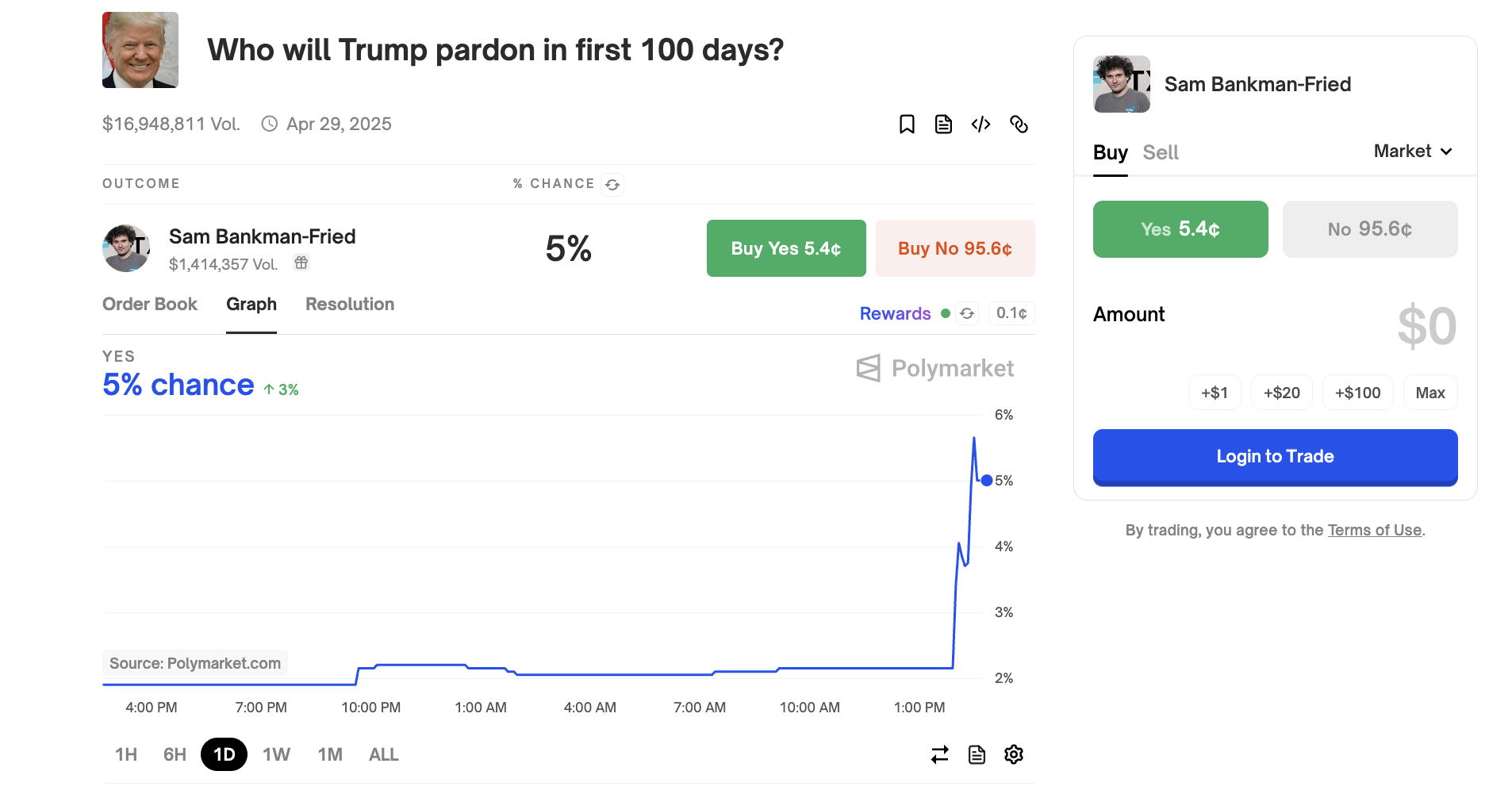

For the last few months, FTX mastermind Sam Bankman-Fried and his family have been lobbying President Trump for a pardon. The community mostly considered this possibility a long shot, especially because Bankman-Fried directly opposed Trump in the 2020 election. Since the BitMEX pardons, Bankman-Fried’s Polymarket odds have shot up:

In short, it doesn’t even look like this will be bullish for the markets. The crypto industry is in an unprecedented wave of scams, and some commentators worry that it could damage industry confidence. If Trump continues issuing pardons without a clear reason, it may embolden bad actors.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Coinbase Users Lost $46 Million to Crypto Scams in March

According to ZachXBT, a Coinbase user lost $34.9 billion to scammers on Thursday, March 27. However, this is not an isolated trend, as Coinbase users have collectively lost more than $46 million to scams in March.

Scammers are targeting the exchange’s user base with a long track record of success. Coinbase customers should be on alert for social engineering attempts

Coinbase Scams are Growing Out of Control

Despite being one of the world’s largest crypto exchanges, Coinbase has been under scrutiny as its users are increasingly falling victim to scams. For over a year, sophisticated social engineering operations have been responsible for massive thefts.

According to ZachXBT, these scammers are showing no signs of stopping:

“It is suspected a Coinbase user was scammed yesterday for $34.9 million. After uncovering this theft, I noticed multiple other suspected thefts from Coinbase users in the past two weeks bringing the total stolen this month to $46 million+. Coinbase has not flagged any of the theft addresses from these victims in compliance tools,” he said via Telegram.

ZachXBT, a prominent crypto sleuth, has been persistently tracking scams against Coinbase users. Over the last few months, he’s identified several big crimes that relied on social engineering instead of outright hacks.

For example, last November, criminals posing as Coinbase Support managed to steal over $6.5 million.

This has reached the point where he claims that Coinbase is in a crisis of fraud and scams. Last month, ZachXBT estimated $150 million in annual losses, and he has now upgraded this to $300 million.

He hasn’t named any of his theories about the culprit or culprits. It could be an organized group, multiple independent actors, or other possibilities.

However, the exchange’s response to these events has been rather underwhelming. ZachXBT claimed that Coinbase has been downright passive about these huge scams, failing to warn users or cooperate with investigators.

In a recent social media post, he accused Coinbase of apathy towards these incidents:

“I have yet to see an incident where Coinbase flagged theft addresses. They are part of the problem, it shows they are not taking care of users,” he claimed.

Overall, given the increasing rate of these scams and the staggering amount of funds lost, Coinbase’s users should certainly be cautious about social engineering threats.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoOnyxcoin (XCN) Nears Oversold After a 30% Monthly Drop

-

Altcoin23 hours ago

Altcoin23 hours agoAnalyst Reveals Why The XRP Price Will Dominate Bitcoin & Ethereum

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin Bet Grows Bigger: The Blockchain Group Snaps Up 580 BTC

-

Market22 hours ago

Market22 hours agoHyperLiquid Responds to JELLY Crisis Amid Community Backlash

-

Market21 hours ago

Market21 hours agoBinance Alpha Lists Ghibli Meme Coins Amid ChatGPT Hype

-

Altcoin21 hours ago

Altcoin21 hours agoDogecoin Cup And Handle Pattern Signals Recovery To $0.4, Here’s How

-

Market20 hours ago

Market20 hours agoWhy BTC Price Stayed Unchanged

-

Market19 hours ago

Market19 hours agoBitcoin Price Stalls at $88K—Can Bulls Overcome Key Resistance?