Market

Paul Atkins SEC Confirmation Vote

The US Senate will decide tomorrow the fate of Paul Atkins, President Donald Trump’s nominee to lead the SEC (Securities and Exchange Commission).

The cloture vote, scheduled for 11:30 AM ET, April 10, will end the debate, followed by a confirmation vote that could reshape financial oversight.

Will Paul Atkins Be Confirmed As SEC Chair?

After serving as SEC Commissioner between 2002 and 2008, Atkins is poised to replace Gary Gensler as chair of the commission. His predecessor stepped down on January 20 amid a contentious tenure and returned to MIT, where he now focuses on AI and fintech.

As the clock ticks toward the vote, investors are bracing for a potential shift toward deregulation and a seismic jolt to the crypto market.

The Senate Banking Committee advanced Atkins’ nomination on April 3 in a razor-thin 13-11 vote, split along party lines. Republicans rallied behind his vision of a leaner SEC, while Democrats, led by Senator Elizabeth Warren, decried his past record and ties to Wall Street.

“Mr. Atkins championed policies that fueled the 2008 financial crisis,” Warren charged.

This remark came during his March 27 confirmation hearing, pointing to his 2004 vote to loosen capital rules for firms like Lehman Brothers.

Ahead of the hearing, the SEC Chair nominee disclosed $327 million in assets. Among them were up to $6 million in crypto, holding stakes in Anchorage Digital and Off the Chain Capital, and up to $500,000 in call options.

Nevertheless, with Republicans holding a 53-47 Senate majority, Atkins’ confirmation seems likely.

What Paul Atkins As SEC Chair Means for Crypto Investors

If confirmed, Atkins would take the SEC’s reins at a pivotal moment. He promised to reset priorities and return common sense to an agency he claims has strayed under Gensler’s enforcement-heavy leadership.

“Mr. Atkins affirmed his commitment to an SEC that works transparently, with industry and consumer input…emphasized that digital assets are a top priority this year…addressed debanking and committed to end this undemocratic practice for good…,” Coinbase CLO Paul Grewal reported.

Known for his light-touch regulatory philosophy, Atkins has criticized “overly politicized and burdensome” rules that choke capital formation. Senate Banking Committee Chairman Tim Scott praised Atkins as a leader who will “promote capital formation and provide clarity for digital assets,” a nod to his potential to ease compliance burdens.

A deregulated SEC could spark more IPOs (initial public offerings), expanding options for retail and institutional investors.

Yet, critics warn that Atkins’ pre-2008 tenure could leave markets exposed if economic headwinds return. This refers to when he resisted tighter oversight.

“Paul Atkins dismissed calls for stronger regulations before the 2008 crash—then told Senator Warren he STILL thinks he was right. Even after millions lost their homes, jobs, and savings. This is who Trump wants to run the SEC,” wrote Accountable.US.

Nevertheless, no sector will gain more than crypto if Atkins takes the helm. A vocal advocate for digital assets since advising the Chamber of Digital Commerce, Atkins has pledged “a firm regulatory foundation” for an industry battered by Gensler’s crackdowns.

His confirmation could set the tone for new opportunities, including altcoin ETFs (exchange-traded funds) in the US or a rollback of hard-won protections.

Altcoin-based exchange-traded funds, such as spot Solana (SOL) and XRP ETFs, would unlock institutional investment and mainstream adoption for these tokens.

“SEC has delayed decisions on +60 crypto ETF applications including: Ripple (XRP), Solana (SOL), Litecoin (LTC), and Dogecoin (DOGE). Approvals hinge on the confirmation of President Trump’s SEC chair nominee, Paul Atkins,” Block News noted.

Markets at a Crossroads: Innovation vs Protection

However, the stakes are high. Atkins’ past consulting for the collapsed FTX exchange has drawn scrutiny. Senator Warren questioned his judgment on digital asset oversight.

A lighter regulatory touch might bolster innovation and embolden fraudsters in the $2 trillion crypto market. Such an outcome would leave retail investors to bear the risk.

Beyond crypto, Atkins’ agenda could redraw the lines of market oversight. He has called current disclosures “inefficient” and signaled skepticism toward environmental, social, and governance (ESG) mandates, potentially sidelining sustainable investors.

Enforcement would likely narrow to retail fraud, including penny stock scams, rather than broad regulatory sweeps. While such a shift could ease pressures on companies, it would loosen scrutiny of bad actors.

The outcome remains a cliffhanger as senators prepare to cast their votes today.

If confirmed, Atkins will be the next SEC chair as early as 7:00 PM today and assume office by mid-April. He would then serve out Gensler’s term until June 5, 2026, with a possible re-nomination thereafter.

His first moves, whether clarifying crypto rules or unwinding Gensler’s legacy, will signal whether the SEC tilts toward Wall Street or Main Street.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

ETH Retail Traders Boost Demand Despite Institutional Outflows

Leading altcoin Ethereum has seen its price climb 5% over the past week, riding the wave of a broader market recovery. This price growth has reignited demand for the altcoin, particularly among US-based ETH retail traders, as indicated by on-chain data.

However, institutional investors appear to remain skeptical. They continue to pull their capital from ETH-backed funds, signaling their lack of confidence in any near-term price rebound.

Retail Interest in Ethereum Grows as Coinbase Premium Signals Buying Surge

The increase in retail interest is evident in ETH’s Coinbase Premium. It has moved back above zero, signaling heightened buying activity from US investors. At press time, this is at 0.016.

ETH’s Coinbase Premium Index measures the difference between the coin’s prices on Coinbase and Binance. When its value climbs above zero, it suggests significant buying activity by US-based investors on Coinbase.

Conversely, when it declines and dips into the negative territory, it signals less trading activity on the US-based exchange.

ETH’s Coinbase Premium Index reflects bullish sentiment in the market, as traders are willing to pay a premium to purchase the coin on Coinbase. In the short term, this can drive up the altcoin’s value, as it signals growing investor interest.

However, institutional investors in the US remain cautious. This is evident in the ongoing outflows from US-based spot ETH exchange-traded funds (ETFs), marking the altcoin’s seventh consecutive day of withdrawals.

The continued exit of institutional capital stands in stark contrast to the growing enthusiasm among retail traders. This divergence suggests that while US retail investors are increasingly optimistic about ETH’s short-term prospects, institutional players are more cautious, possibly due to macroeconomic uncertainty.

ETH Shows Strong Capital Inflows, But Bearish Sentiment Could See Price Drop

ETH’s Balance of Power (BoP) is positive at press time, reflecting today’s market recovery. This indicator, which measures buying and selling pressures, is in an upward trend at 0.57.

A positive BoP like this indicates more capital inflow into ETH than outflow, signaling an accumulation trend. If this continues, it could push the altcoin’s price to $2,114.

However, if market sentiment turns bearish and ETH retail traders reduce their demand for the altcoin, it could lose recent gains and drop to $1,395.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

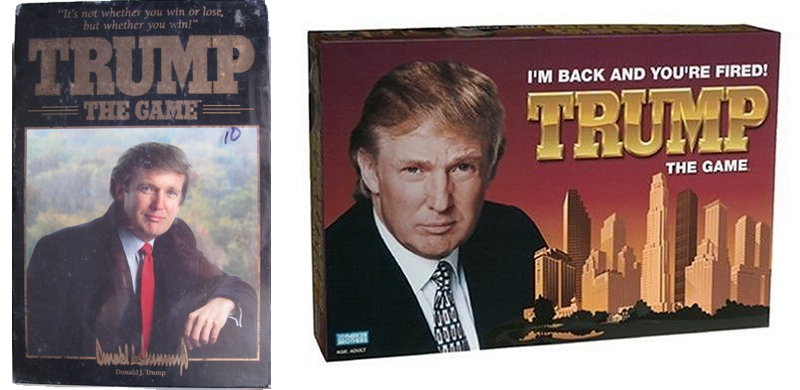

Trump Family Plans Crypto Game Inspired by Monopoly

Donald Trump’s broader circle and business avenue is reportedly planning to launch a crypto game based on Monopoly this month. Trump is a longtime fan of the game, launching an officially licensed spinoff in 1989.

Bill Zanker, who helped Trump launch NFTs and his TRUMP meme coin, is spearheading development. However, the community response is skeptical, as very little information about the crypto element is public.

Trump Is Launching a Crypto Monopoly Spinoff

The intersection of blockchain and gaming has a wide variety of uses, from Tap-to-Earn tokens to NFT use cases and more. A surprising addition to this space is coming soon, as a new report claims that Trump’s family will launch a crypto game loosely based on Monopoly soon.

The exact details are somewhat hazy, but reporters have managed to identify a few key facts. This Monopoly game is being spearheaded by Bill Zanker, a longtime Trump associate who worked with him to launch his NFTs in 2023 and was also involved in the TRUMP token.

It’s unclear when the two renewed their partnership, but the game is set to release this month. Anonymous sources claimed that players will earn in-game cash, which is presumably where the crypto element comes in.

Both developers quoted directly compared this game to Monopoly, and its rules will likely match up. Further reports suggest that Zanker is looking to buy the IP rights for the 1980s Trump Monopoly spinoff board game.

In other words, this IP question could present a possible difficulty if Monopoly’s owners don’t license another spinoff to Trump. Even if the crypto game doesn’t bear any Monopoly branding, Hasbro could sue if the gameplay is substantially similar.

So far, the online crypto community’s response has been incredulous. Users called Trump’s crypto-themed Monopoly spinoff a “joke,” an attempt to “max extract” value from his supporters, and called developers “the largest manipulators ever.”

Even if retail investors have potential upside, there seems to be a narrow window for gains.

“Are we about to witness another Trump family rug? Apparently, Trump’s a big fan of Monopoly. Zanker claims it’s not a MONOPOLY GO! clone — but confirmed the game is real and set to launch end of April. Incoming circus or giga pump?” said one user.

It’s difficult to determine the potential impact of this game on crypto, as we have basically no information about its tokenomics. For example, in Monopoly, users have to spend in-game currency to play.

Will that be a major component of Trump’s version? Will the in-game currency include the TRUMP meme coin? How will users extract value? These details will likely remain unanswered until an official announcement.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Forget XRP At $3, Analyst Reveals How High Price Will Be In A Few Months

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP may have spent the past few weeks struggling to hold above the $2 level, but one analyst believes the recent price action is only in its early stages of a much larger surge. For those who think $3 is a reasonable target, this outlook predicted that the real move could take the altcoin far beyond that mark and possibly much sooner than expected.

Multi-Stage Price Path With $10 To $20

The $3 price level has become the psychological and technical battleground for bullish XRP investors this cycle, serving as the most active price point. Earlier in January, the token briefly surged past this level, coming within striking distance of its all-time high of $3.40, before a wave of selling pressure triggered a pullback.

Related Reading

Since then, XRP has seen price corrections that pushed it as low as $1.65 on April 7. Yet, the outlook is once again tilting bullish. XRP has rebounded above $2 and is building a strong base to support another run toward $3. If the current momentum continues to gain traction, reclaiming $3 is not only likely, it could happen within a matter of weeks.

One of the boldest predictions comes from a trader known as BarriC, who has laid out a roadmap that extends far beyond the $3 threshold. In a recent post on social media platform X, he forecasted that XRP, now trading near $2.20, will break $3 soon. But his outlook doesn’t stop there. He predicted that by May, the sentiment surrounding XRP could shift so drastically that $5 would be seen as the new “cheap” price for XRP.

Taking things a step further, the analyst noted that if the broader crypto market transitions into a full-blown altcoin season, XRP could establish a new short-term trading range between $10 and $20 within the next few months.

Utility Run Scenario Places “Cheap” XRP Closer To $1,000

Perhaps the most striking part of BarriC’s analysis comes from what he describes as a “utility run.” This utility run is a scenario where XRP’s real-world use cases as a bridge cryptocurrency start to gain adoption and reflect in its price. Under such conditions, the term “cheap XRP” would apply to prices below $1,000.

Related Reading

At the time of writing, XRP is trading at $2.14, up by 1.4% in the past 24 hours. As ultra-bullish as it might seem, the analyst’s price prediction isn’t surprising, as the cryptocurrency has been subjected to similar bullish outlooks in the past few days.

Beyond bullish price targets, a few analysts now believe that XRP will flip both Ethereum and Bitcoin in the coming months. One such example is analyst Axel Rodd, who cited the breakdown in Bitcoin dominance as a reason why XRP will flip Bitcoin. Similarly, analysts at Standard Chartered recently predicted that the altcoin will flip Ethereum in market cap by 2028.

Featured image from Adobe Stock, chart from Tradingview.com

-

Market24 hours ago

Market24 hours agoTether Deploys Hashrate in OCEAN Bitcoin Mining Pool

-

Market23 hours ago

Market23 hours ago3 Altcoins to Watch in the Third Week of April 2025

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Price Threatened With Sharp Drop To $1,400, Here’s Why

-

Market20 hours ago

Market20 hours agoBinance Futures Causes a Brief Crash For Story (IP) and ACT

-

Market22 hours ago

Market22 hours agoCardano (ADA) Eyes Rally as Golden Cross Signals Momentum

-

Market21 hours ago

Market21 hours agoXRP Jumps 22% in 7 Days as Bullish Momentum Builds

-

Market18 hours ago

Market18 hours agoIs The XRP Price Mirroring Bitcoin’s Macro Action? Analyst Maps Out How It Could Get To $71

-

Market15 hours ago

Market15 hours agoBitcoin Price Eyes Bullish Continuation—Is $90K Within Reach?