Market

Paraguay Fights Illegal Miners, and More

BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup includes stories about Paraguay’s intensified efforts against illegal Bitcoin miners, the growth of cryptocurrency users in Mexico, and more.

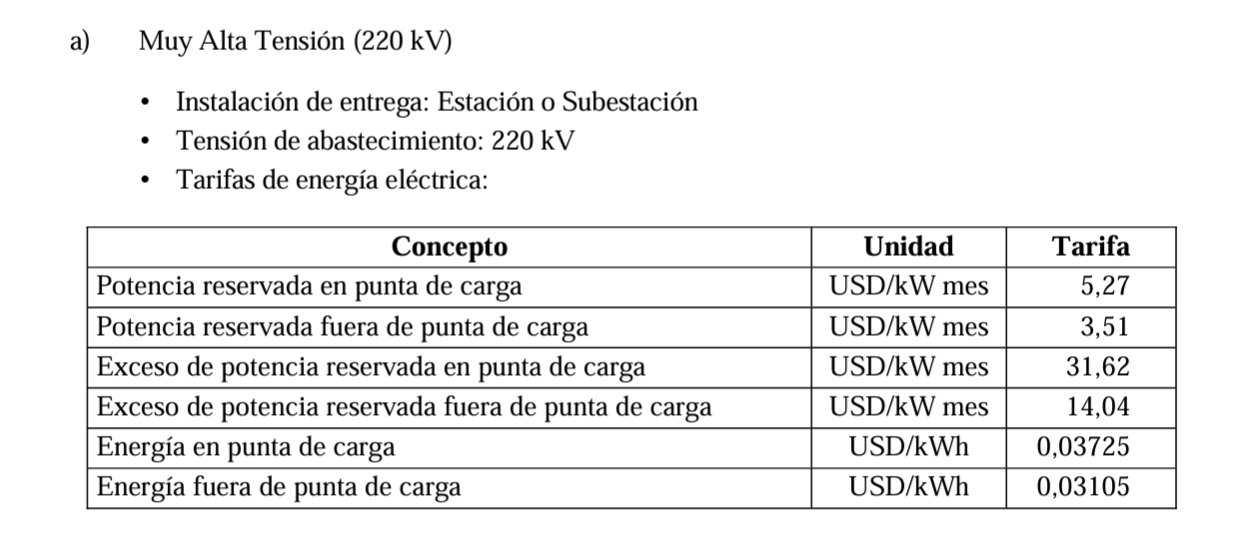

Paraguay Raises Electricity Rates for Bitcoin Miners

Paraguay’s National Electricity Administration (ANDE) has increased electricity rates for cryptocurrency mining companies by 9 to 16 percent. This measure aims to curb losses from illegal mining activities, estimated to cost the country up to 14 billion guaraníes (over $185,000).

On June 26, ANDE issued Resolution 49238, updating electricity tariffs. Hugo Fernández, ANDE’s commercial manager, informed the newspaper Última Hora about intensified efforts against illegal cryptocurrency mining. He revealed that 72,823 KVA (kilovolt-ampere) have been intervened this year. Most energy thefts affect the electrical system.

“The intervention represented a monthly loss of G. 14,720,458,825 for the institution, in terms of unregistered active energy, which added to the intervention costs and fine, must be paid by the person responsible for the theft of electric energy. This fact damages the proper functioning of the electric system”, Fernández explained.

Read more: Is Crypto Mining Profitable in 2024?

In early June, national deputy María Constancia Benítez de Benítez presented a bill titled “That regulates cryptomining in the Republic of Paraguay,” aiming to regulate Bitcoin mining. She acknowledged that mining presents an opportunity for the country’s economic development.

BeInCrypto CEO Alena Afanaseva Will Speak at Blockchain Rio 2024

The highly anticipated Blockchain Rio 2024 will take place from July 24 to 25 at EXPOMAG in Rio de Janeiro. This year’s event will feature more than 300 experts from the new economy, including BeInCrypto CEO Alena Afanaseva. She will discuss global trends in the new economy and the educational role of media outlets.

Other confirmed participants include Ariel Scaliter, co-founder and CTO of Agrotoken, and Daniela Barbosa, director of the Hyperledger Foundation. João Aragão Pereira, technology and innovation specialist at Microsoft, and pro-crypto Senator Carlos Portinho will also attend. They will present their expertise in different areas, from digital finance to energy and agriculture.

Read more: Top Crypto Events in 2024

Agrotoken, Microsoft, and Hyperledger have joined the Drex pilot platform consortium to highlight the importance of advanced blockchain applications. Blockchain Rio 2024 will also feature workshops, hackathons, knowledge trails, networking areas, Rio Digital Arts gallery, and immersive experiences. The business fair will provide a platform for companies to showcase their solutions, making new connections and potential collaborations among attendees.

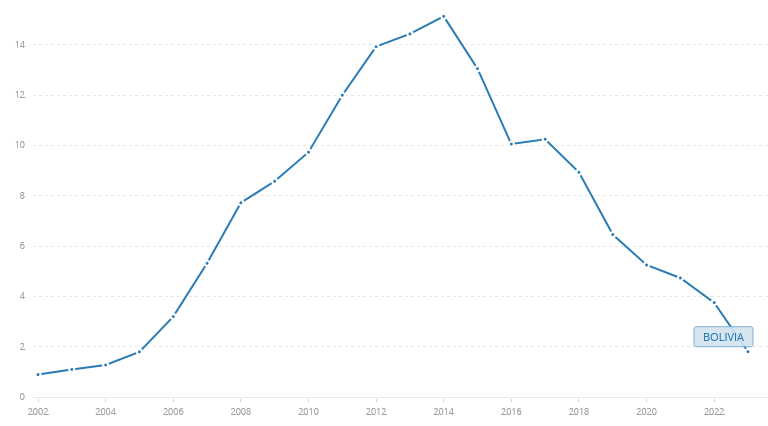

Bolivian President Lifts Cryptocurrency Ban Amid Dollar Shortage

In response to an economic crisis marked by a shortage of dollars and fuel, Bolivia has lifted its ban on using cryptocurrencies as a means of payment. President Luis Arce announced this decision to mitigate the impact of dwindling foreign currency reserves caused by a decline in gas exports, the country’s primary income source until 2021. Arce believes this move could significantly benefit the Bolivian economy by attracting foreign capital and modernizing its financial system.

From a macroeconomic perspective, allowing cryptocurrencies could attract foreign investment, as these digital assets enable fast and secure global transactions. This potential for seamless international trade might encourage both individual and corporate investors to diversify their assets in emerging markets like Bolivia, bypassing traditional currency restrictions.

Bolivia, which receives substantial remittances from citizens abroad, stands to gain from this policy shift. Cryptocurrencies provide a quicker and cheaper method for transferring money, reducing transaction costs and increasing the inflow of dollars into the country.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

The adoption of cryptocurrencies could also boost e-commerce by enabling local businesses to sell products and services internationally without traditional banking barriers. This expansion would help diversify Bolivia’s revenue sources beyond gas exports.

Overall, Bolivia’s decision to embrace cryptocurrencies could mark a shift in addressing its economic challenges, offering new opportunities for investment, commerce, and financial stability.

3.1 Million Mexicans Now Own Crypto, Report Reveals

A recent report from Sherlock Communications reveals that cryptocurrency adoption is on the rise in Mexico, with over 3.1 million holders, equivalent to 2.5% of the population. Previously, the consultancy identified Brazil and Argentina as the regional leaders.

The growth potential for crypto adoption in Mexico is significant, partly due to the $63 billion remittance market with the United States. A single exchange, Bitso, processed $4.3 billion last year.

“Legislators and authorities have been silent on the tax status of cryptocurrencies, and so far, no tax regulation in Mexico makes reference on the subject. Certain interpretations apply tax provisions and make applicable income tax rates of 30% to 35%, 16% VAT on each transfer within the country (but 0% if the buyer is outside Mexico) and 10% capital gains,” Sherlock Communications stated.

Read more: Who Owns the Most Bitcoin in 2024?

In addition, the report noted some companies have been instrumental in increasing the adoption of cryptocurrencies in Mexico. Among them, the following stand out: Bitso, Volabit, Coinbase, Ripple, Banco Azteca, Banxico, Telefónica, Helium, Etherfuse, investment firms Exponent Capital, Lvna Capital and GBM, ConsenSys Academy and BIVA.

Sherlock Communications argues that there are factors driving the use of cryptoassets in Mexico, such as the central bank’s digital currency (CBDC) working the country, 40% of companies in the country seek to use blockchain technology, the Fintech Law, and even, crypto sympathy from legislators in Mexico.

“Blockchain enjoys an excellent reputation in Latin America. Latin Americans see the technology as having positive consequences in areas beyond the business field and financial sectors. In the region, 61% of respondents in this sample agree that blockchain technology can transform the way governments keep records,” the report read.

As the Latam crypto scene grows, these stories highlight the region’s increasing influence in the global market. From Bolivia’s recent efforts to rising adoption of digital assets in Mexico, Latin America is positioning itself as a key player in the tech world. Stay tuned for more updates and insights in next week’s roundup.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Recovery Stalls—Bears Keep Price Below $2K

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price attempted a recovery wave above the $1,880 level but failed. ETH is now trimming all gains and remains below the $1,880 resistance zone.

- Ethereum failed to stay above the $1,850 and $1,880 levels.

- The price is trading below $1,850 and the 100-hourly Simple Moving Average.

- There was a break below a key bullish trend line with support at $1,865 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $1,865 and $1,890 resistance levels to start a decent increase.

Ethereum Price Fails Again

Ethereum price managed to stay above the $1,800 support zone and started a recovery wave, like Bitcoin. ETH was able to climb above the $1,850 and $1,880 resistance levels.

The bulls even pushed the price above the $1,920 resistance zone. However, the bears are active near the $1,950 zone. A high was formed at $1,955 and the price trimmed most gains. There was a break below a key bullish trend line with support at $1,865 on the hourly chart of ETH/USD.

A low was formed at $1,781 and the price is now consolidating near the 23.6% Fib retracement level of the downward move from the $1,955 swing high to the $1,781 low.

Ethereum price is now trading below $1,850 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,850 level. The next key resistance is near the $1,865 level and the 50% Fib retracement level of the downward move from the $1,955 swing high to the $1,781 low.

The first major resistance is near the $1,920 level. A clear move above the $1,920 resistance might send the price toward the $1,950 resistance. An upside break above the $1,950 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,000 resistance zone or even $2,050 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $1,865 resistance, it could start another decline. Initial support on the downside is near the $1,800 level. The first major support sits near the $1,780 zone.

A clear move below the $1,780 support might push the price toward the $1,720 support. Any more losses might send the price toward the $1,680 support level in the near term. The next key support sits at $1,620.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $1,780

Major Resistance Level – $1,865

Market

Cardano (ADA) Downtrend Deepens—Is a Rebound Possible?

Cardano price started a recovery wave above the $0.680 zone but failed. ADA is consolidating near $0.650 and remains at risk of more losses.

- ADA price failed to recover above the $0.70 resistance zone.

- The price is trading below $0.680 and the 100-hourly simple moving average.

- There was a break below a connecting bullish trend line with support at $0.6720 on the hourly chart of the ADA/USD pair (data source from Kraken).

- The pair could start another increase if it clears the $0.70 resistance zone.

Cardano Price Dips Again

In the past few days, Cardano saw a recovery wave from the $0.6350 zone, like Bitcoin and Ethereum. ADA was able to climb above the $0.680 and $0.6880 resistance levels.

However, the bears were active above the $0.70 zone. A high was formed at $0.7090 and the price corrected most gains. There was a move below the $0.650 level. Besides, there was a break below a connecting bullish trend line with support at $0.6720 on the hourly chart of the ADA/USD pair.

A low was formed at $0.6356 and the price is now consolidating losses near the 23.6% Fib retracement level of the recent decline from the $0.7090 swing high to the $0.6356 low. Cardano price is now trading below $0.680 and the 100-hourly simple moving average.

On the upside, the price might face resistance near the $0.6720 zone or the 50% Fib retracement level of the recent decline from the $0.7090 swing high to the $0.6356 low. The first resistance is near $0.6950. The next key resistance might be $0.700.

If there is a close above the $0.70 resistance, the price could start a strong rally. In the stated case, the price could rise toward the $0.7420 region. Any more gains might call for a move toward $0.7650 in the near term.

Another Drop in ADA?

If Cardano’s price fails to climb above the $0.6720 resistance level, it could start another decline. Immediate support on the downside is near the $0.6420 level.

The next major support is near the $0.6350 level. A downside break below the $0.6350 level could open the doors for a test of $0.620. The next major support is near the $0.60 level where the bulls might emerge.

Technical Indicators

Hourly MACD – The MACD for ADA/USD is losing momentum in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for ADA/USD is now below the 50 level.

Major Support Levels – $0.6420 and $0.6350.

Major Resistance Levels – $0.6720 and $0.7000.

Market

XRP Price Under Pressure—New Lows Signal More Trouble Ahead

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Market23 hours ago

Market23 hours agoBNB Price Faces More Downside—Can Bulls Step In?

-

Market24 hours ago

Market24 hours agoVanEck Sets Stage for BNB ETF with Official Trust Filing

-

Bitcoin23 hours ago

Bitcoin23 hours agoTokenized Gold Market Cap Tops $1.2 Billion as Gold Prices Surge

-

Regulation17 hours ago

Regulation17 hours agoKraken Obtains Restricted Dealer Registration in Canada

-

Bitcoin19 hours ago

Bitcoin19 hours agoLummis Confirms Treasury Probes Direct Buys

-

Altcoin9 hours ago

Altcoin9 hours agoFirst Digital Trust Denies Justin Sun’s Allegations, Claims Full Solvency

-

Altcoin22 hours ago

Altcoin22 hours agoWhat’s Fueling The Shibarium Boost?

-

Altcoin20 hours ago

Altcoin20 hours agoFranklin Templeton Eyes Crypto ETP Launch In Europe After BlackRock & 21Shares