Market

NinjaTrader Could Become Part of Kraken in $1.5 Billion Deal

Cryptocurrency exchange Kraken is reportedly in advanced talks to acquire NinjaTrader, a futures trading platform, in a deal valued at approximately $1.5 billion.

The move highlights Kraken’s strategy to expand its user base and diversify into a wider range of asset classes.

Is Kraken About to Make a $1.5 Billion Move into Futures Trading?

Neither Kraken nor NinjaTrader has officially confirmed the negotiations. However, sources close to the situation told The Wall Street Journal that the deal could be finalized as early as March 20.

“A deal would allow Kraken to offer crypto futures and derivatives in the US thanks to NinjaTrader’s registration as a so-called Futures Commission Merchant,” WSJ reported.

US-based NinjaTrader would reportedly continue to operate as an independent platform within Kraken’s broader portfolio of trading and payment solutions. Kraken is also expected to play a key role in accelerating NinjaTrader’s expansion into new international markets, including the UK, continental Europe, and Australia. As per WSJ’s report,

“The deal would help Kraken build on the company’s goals to work across several asset classes, including plans for equities trading and payments.”

For context, NinjaTrader is an advanced futures trading platform. It allows users to trade various financial instruments, including index futures, commodity futures, and cryptocurrency futures.

The platform is renowned for its trading simulation feature, sophisticated charting tools, real-time analytics, and customizable trading interfaces. These features have earned it a user base of 1.9 million customers. Financial data from Growjo revealed that NinjaTrader Group generates annual revenue of approximately $55.3 million.

Meanwhile, Kraken has long been a prominent player in the crypto exchange arena. The exchange recently reported a revenue of $1.5 billion and adjusted earnings of $380 million for 2024.

Additionally, Kraken has also climbed to third place in Kaiko’s Q1 2025 exchange rankings. This marked a notable improvement from seventh place the previous year. This rise reflects Kraken’s growing dominance among the 44 largest centralized cryptocurrency exchanges.

As part of its efforts to enhance offerings and solidify its market position, Kraken also introduced a new colocation service on March 17. Designed to provide clients with ultra-fast execution, the service aims to boost trading performance and scalability while ensuring fair and transparent access to global crypto markets.

Furthermore, Kraken is reportedly seeking to go public as early as the first quarter of next year. This development follows the US SEC dropping its lawsuit against the exchange, clearing a major regulatory hurdle.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Key Indicators Suggest Short-Lived Gains

Stellar’s XLM token has climbed 6% over the past week as the broader crypto market shows signs of recovery. At press time, the altcoin trades at $0.28.

However, a key momentum indicator is flashing warning signals, suggesting the rally may be short-lived. Should XLM holders brace for decline?

XLM Struggles to Hold Gains

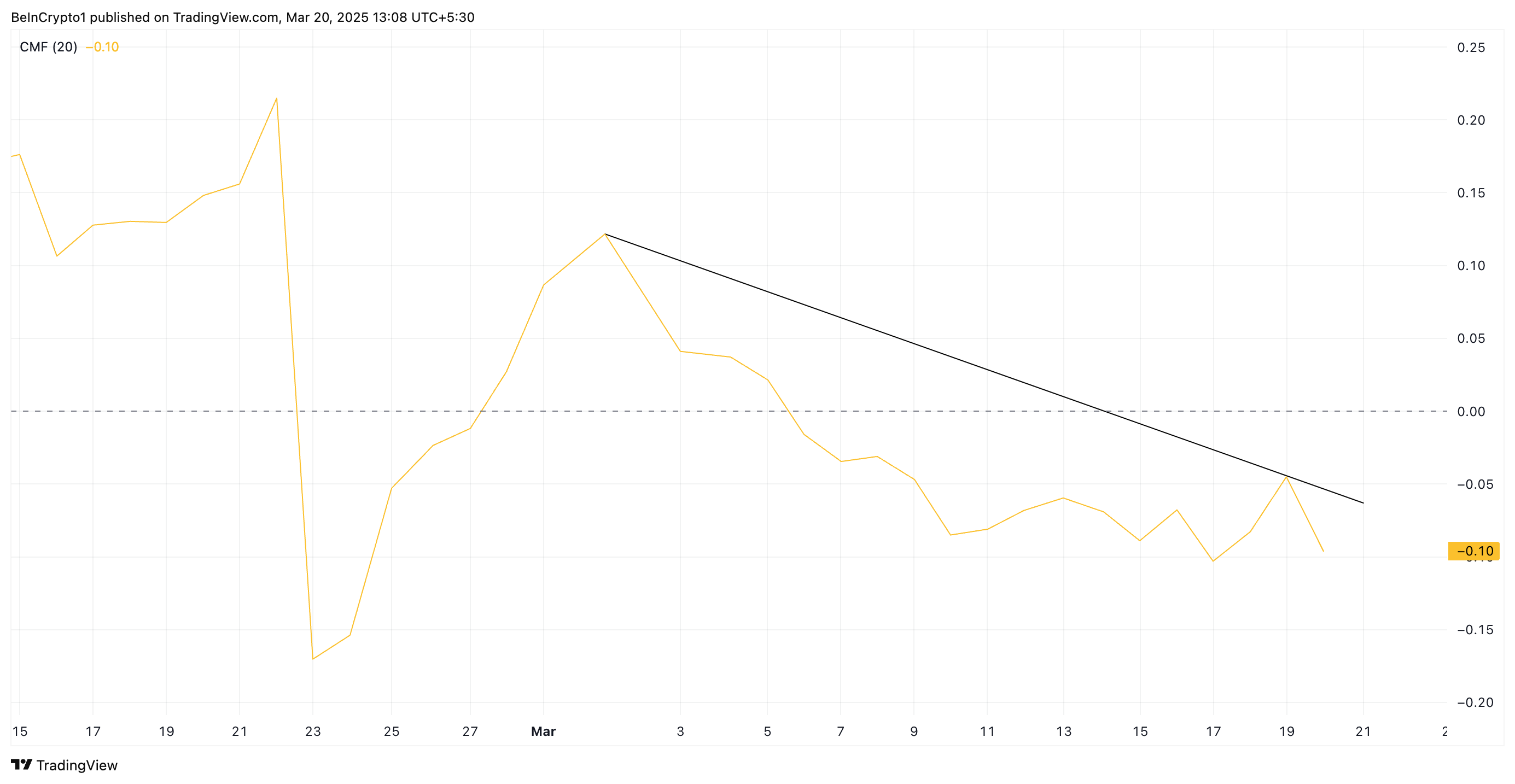

A bearish divergence has emerged with XLM’s Chaikin Money Flow (CMF), indicating weakening buying pressure despite the recent price increase. While XLM’s price has climbed in the past week, its CMF has fallen, remaining below the zero line at -0.10 at press time.

This trend occurs when an asset’s price rises while its CMF declines, signaling that fewer investors are supporting the rally with actual capital inflows. As a result, the uptrend may be unsustainable, increasing the risk of a reversal.

If the divergence persists, XLM’s selling pressure could build up, increasing the likelihood of a price reversal or correction in the near term.

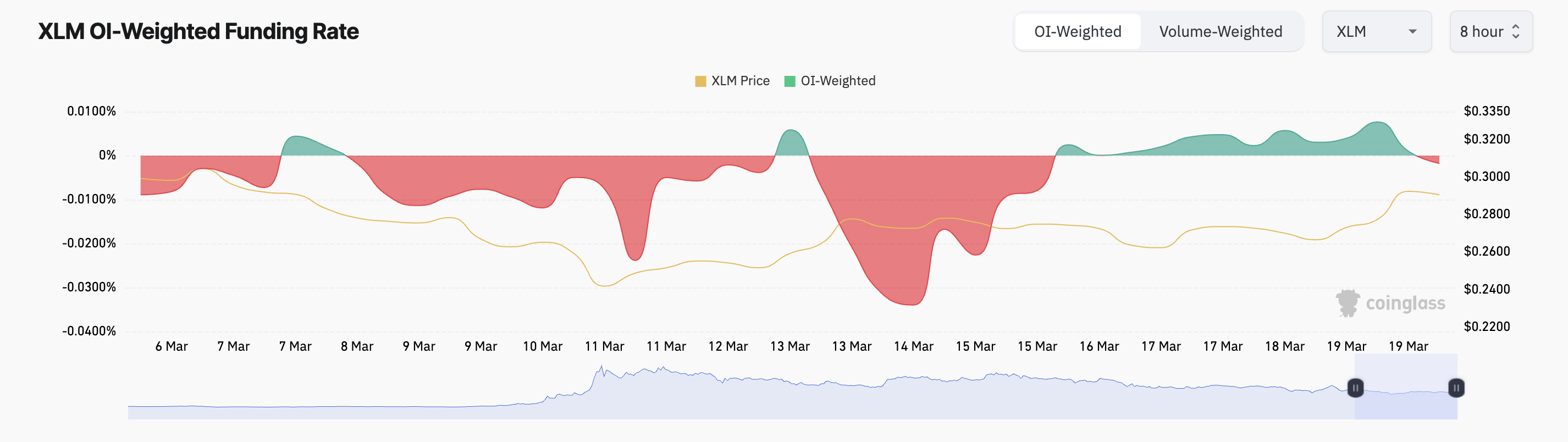

Moreover, XLM’s funding rate has flipped negative for the first time in six days, highlighting the growing bearish bias against the altcoin. At press time, the figure is -0.0018%.

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures contracts, reflecting market sentiment. When it turns negative, short positions are dominant, indicating bearish sentiment as traders increasingly bet on a price decline.

As more traders bet on XLM’s price decline, demand will continue to weaken, and downward pressure on its price will increase.

XLM Down Over 50% Since November—Is a Reversal on the Horizon?

On the daily chart, XLM trades within a descending parallel channel. It has remained within this bearish channel since reaching a three-year peak of $0.63 last November. Now trading at $0.28, the altcoin’s price has since plunged 55%.

With strengthening bearish pressure, XLM risks falling below the channel’s lower trendline. If this happens, the altcoin could trade at $0.23.

Conversely, if XLM accumulation resumes, its price could rally past the resistance at $0.30. If succesful, it could attempt to reach $0.41.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Trump’s Digital Asset Summit Speech Talks Stablecoins

President Trump just gave a brief pre-recorded speech at the Digital Asset Summit, his first such address as a sitting head of state. He focused on past accomplishments and alluded to new stablecoin developments.

Trump implied that he may be helping create more dollar-backed stablecoins in the near future, but he didn’t make a firm commitment. Still, the federal government could use such an asset to provide huge amounts of liquidity to the whole crypto ecosystem.

Trump’s Summit Speech

Since taking office, President Trump has had a huge impact on US crypto policy. Yesterday, it was announced that Trump would speak at the Digital Asset Summit in New York City this morning. Via pre-recorded broadcast, he talked about his existing accomplishments and emphasized his hope for stablecoin regulation:

“I’ve called on Congress to create simple, common-sense rules for stablecoins and market structure. With the right legal framework, institutions large and small will be enabled to invest, innovate, and take part in one of the most exciting technological revolutions in modern history,” he said.

This isn’t Trump’s first experience speaking at a Summit like this; two weeks ago, he hosted a Crypto Summit at the White House. However, this didn’t have a huge impact on markets. Comparatively, he made a huge splash when he spoke before a crowd at the Bitcoin Conference in Nashville. The community hoped that his speech today would build bullish sentiment.

Lately, the crypto community has been desperate for a bullish narrative. Credible fears of a US recession are discouraging investment, and the “Made in USA” assets have suffered from previous disappointments. However, stablecoin regulations may be able to more fully integrate crypto with the US economy and the global economy in general.

“With the dollar-backed stablecoins, you [the community] will help expand the dominance of the US dollar for many, many years to come. It’ll be at the top, and that’s where we want to keep it,” he added.

This clear signal that Trump wants to aid dollar-backed stablecoins, possibly even creating new ones, could be huge. Recently, members of his greater orbit were allegedly in talks with Binance about creating such an asset. By fusing the US economy with these tokens, Trump could provide a huge amount of liquidity for the entire space.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Stablecoins Adoption Challenges: Transparency As A Barrier

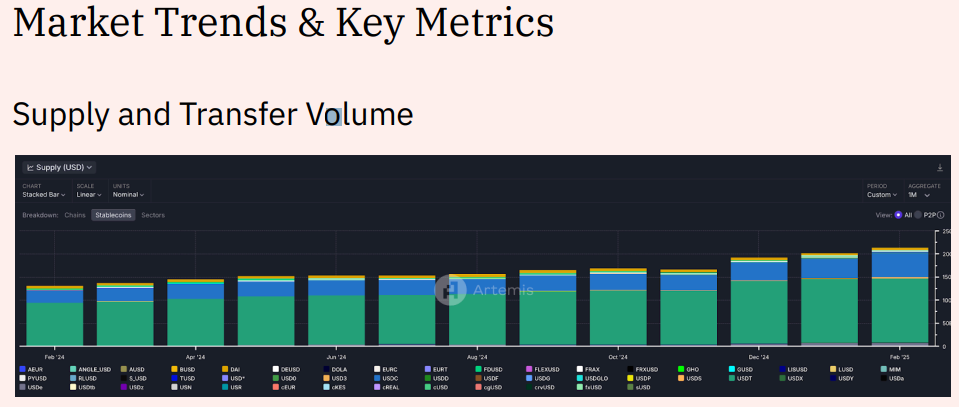

Stablecoins are reshaping digital finance, offering a fast and accessible way to move money across borders. With a total supply of $214 billion and $35 trillion in transfers over the past year, they’re no longer just a niche crypto tool—they’re a growing financial powerhouse.

However, too much transparency is now presenting as a major problem that could impede their wider adoption.

Stablecoins and Transparency: A Hurdle for Mass Adoption

Artemis and Dune Analytics conducted a report on the State of Stablecoins in 2025, exploring supply, adoption, and market trends. Based on the findings, the total stablecoin supply has reached $214 billion, with up to $35 trillion in transfers over the past year.

Their transaction volume has surpassed major payment networks like Visa and Mastercard, proving their growing influence.

However, despite their rapid adoption, transparency presents a key hurdle for stablecoins. While the blockchain’s openness is great for security and trust, it is not always ideal for everyday payments.

“Crypto payments failed for one small reason that needs fixing: When sending USDC, let the recipient see the transaction but not your address. Nobody wants to reveal their wallet for a 10 USDC beer payment,” DeFi researcher Ignas remarked.

Another user likened it to exposing your bank balance whenever you split a bill with friends. In the same way, the dominance of USDT and USDC stablecoins is apparent. Tether’s USDT and Circle’s USDC control most of the market.

Jean Rausis, co-founder of the DeFi platform SMARDEX, finds this concerning.

“The surge in stablecoin wallets shows that investors trust them during market volatility. But most of this growth is happening with centralized stablecoins that carry the same counterparty risks as traditional banks,” Rausis told BeInCrypto.

The crypto executive believes the future lies in decentralized stablecoins backed by assets like Ethereum (ETH) and featuring automated yield mechanisms.

Banks Are Paying Attention to Growing Stablecoin Regulation

The Artemis and Dune report also shows that stablecoins have already surpassed Visa and Mastercard in transaction volume. This traction has effectively attracted the attention of traditional financial institutions.

Against this backdrop, stablecoins are no longer just for crypto traders. Institutional interest is surging, with US banks now allowed to offer stablecoin services. The Bank of America (BoA) is considering launching its stablecoin, which is pending regulatory approval.

However, with greater adoption comes increased scrutiny. Privacy-focused cryptocurrencies like Monero (XMR), which solve the transparency issue by hiding transaction details, have faced legal roadblocks due to concerns over money laundering.

Despite transparency concerns, stablecoins are thriving in countries battling inflation. In places like Nigeria, they are becoming a reliable alternative to unstable local currencies. At the same time, competition is heating up, with new players looking to challenge Tether and Circle’s dominance.

For stablecoins to truly go mainstream, they must balance transparency with privacy. While regulators demand oversight, everyday users do not want to broadcast their financial history. Technologies like zero-knowledge proofs and selective disclosure could offer solutions, allowing users to control what information they share.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoRussian Crypto Exchange Garantex Is Back Under a New Name

-

Regulation23 hours ago

Regulation23 hours agoUS Fed Keeps Interest Rate Unchanged At 4.5%

-

Market22 hours ago

Market22 hours agoFOMC Refuses to Cut Interest Rates, Disappointment Priced In

-

Market21 hours ago

Market21 hours agoADA Whales Fuel Bullish Momentum by Acquiring 190 Million Coins

-

Regulation24 hours ago

Regulation24 hours agoRipple CLO Reveals What Next With Cross Appeal Against SEC

-

Market23 hours ago

Market23 hours agoXCN Traders Shift Focus as Active Addresses Plunge

-

Market20 hours ago

Market20 hours agoTrump to Speak at Digital Asset Summit, First for a President

-

Altcoin20 hours ago

Altcoin20 hours agoAnalyst Reveal When Dogecoin Price Could Hit $1 Based on This Pattern