Market

Nigeria’s EFCC Takes Down Crypto Crime Operation

The Economic and Financial Crimes Commission (EFCC), a law enforcement agency in Nigeria, busted a major crypto crime ring with hundreds of potential criminals. Among them, 53 individuals have been officially charged.

The police were only able to recover around $200,000 in assets, but they’ve identified nearly $3 million in various other deposits. Given the global spread of the crime, It’s uncertain how much money this operation made in total or where these assets have been laundered.

EFCC Busts Crypto Criminals

According to reports, these scammers ran several different operations, but they all fell under the broad umbrella of crypto crimes. These suspects were arrested with 739 other members last December, and all pled not guilty.

“The Lagos Zonal Directorate of the EFCC, on February 3, 2025, arraigned [53 defendants] before separate Federal High Courts sitting in Ikoyi, Lagos. They were arraigned on separate charges bordering on alleged cybercrimes, cyber-terrorism, impersonation, possession of documents containing false pretenses, and identity theft, among others,” it read.

Last year, Nigeria won international notoriety for being tough on crypto crime, and the EFCC is maintaining that reputation. Specifically, the country arrested two Binance executives for suspicious trading activity, sparking a diplomatic incident with the US. Eventually, it dropped the charges, but only after months of negotiation.

Law enforcement reportedly only seized over $200,000 in assets. This might seem small compared to some of the major scams in today’s crypto market, but the depth of the crime is still under investigation.

For instance, over 500 local SIM cards, mobile phones, laptops, and several cars were seized from the syndicate’s seven-story base in Lagos.

The vast number of resources suggests that the amount of money stolen could potentially be billions. However, given the global spread of the crime, it would be challenging to track all the stolen assets.

The EFCC claimed that these crypto criminals were a very diverse and multinational group. It contained at least 792 members from five or more countries, not counting Nigeria. Over a nine-month period, they deposited $1.5 million in a bank account and sent $2.39 million to two launderers using P2P transactions.

However, there could be dozens or even hundreds of unknown associates whose funds haven’t been traced. The EFCC accused these crypto criminals of activities that “seriously destabilize the economic and social structure” of Nigeria. It’s clear why.

Still, their capture proves an encouraging point. Law enforcement agencies around the world are learning to pursue crypto criminals, and their methods are improving. These groups can’t evade capture forever.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Receives a Record $2 Billion Investment from Abu Dhabi

Binance announced today that MGX, a sovereign wealth fund from Abu Dhabi, invested $2 billion in the company. The transaction happened entirely using stablecoins.

This is both the largest investment ever made in a crypto-related business and the largest investment ever made using cryptoassets. Binance didn’t specify which stablecoin was used, but the UAE has favored Tether products in the past.

MGX Makes Record Binance Investment

The United Arab Emirates has recently been positioning itself as a crypto hub, and Abu Dhabi is a particular region of interest. MGX, an Abu Dhabi-based Web3 fund that has already made massive AI investments, has today announced a record investment in Binance.

Changpeng “CZ” Zhao, former CEO of Binance, also shared this news on X (formerly Twitter).

“MGX, an Abu Dhabi sovereign wealth fund, invests $2 billion in Binance for a minority stake. The transaction will be 100% in crypto (stablecoins), marking it the largest investment transaction done in crypto to date. This is also the first institutional investment Binance has taken. Onwards,Build!” CZ wrote.

Binance, the world’s largest crypto exchange, also corroborated these claims with its own press release. This MGX investment isn’t Binance’s first entanglement with Abu Dhabi, as the firm considered setting up a headquarters there.

However, in 2023, CEO Richard Teng scrapped its UAE license application, signaling a shift away from the nation.

Since then, however, interest has shifted back. The firm’s press release claimed that roughly one-fifth of its workforce is based in the UAE, for example.

Teng called the development a “significant milestone” and said Binance is “committed to working with regulators worldwide.” This MGX investment will likely increase economic ties in the region.

“We are excited to announce the first-ever institutional investment in Binance by MGX. This is a significant step in advancing digital asset adoption and reinforcing blockchain’s role in global finance,” Binace annouced on X.

Also, Binance claimed that MGX made this $2 billion investment entirely in stablecoins. Last August, Tether launched a stablecoin pegged to the UAE’s currency, and Abu Dhabi subsequently recognized USDT as an Accepted Virtual Asset.

Binance’s announcements have been surprisingly light on the exact details of its future relationship with MGX.

However, they were very clear that it was a big deal. This marks the largest-ever investment in a crypto firm and the largest investment paid entirely in cryptocurrency. Wherever the partnership goes from here, it has already made history.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

AI Agents Thrive Without Crypto: Tokenization Not Required

The artificial intelligence sector is witnessing a rapid surge in the development and deployment of AI agents, but for crypto and Web 3, not all is as it seems.

Most of these AI agents are free and open-source, challenging the notion that tokenized models are necessary for AI evolution.

Non-Tokenized AI Agents Outpace Crypto Solutions in Popularity

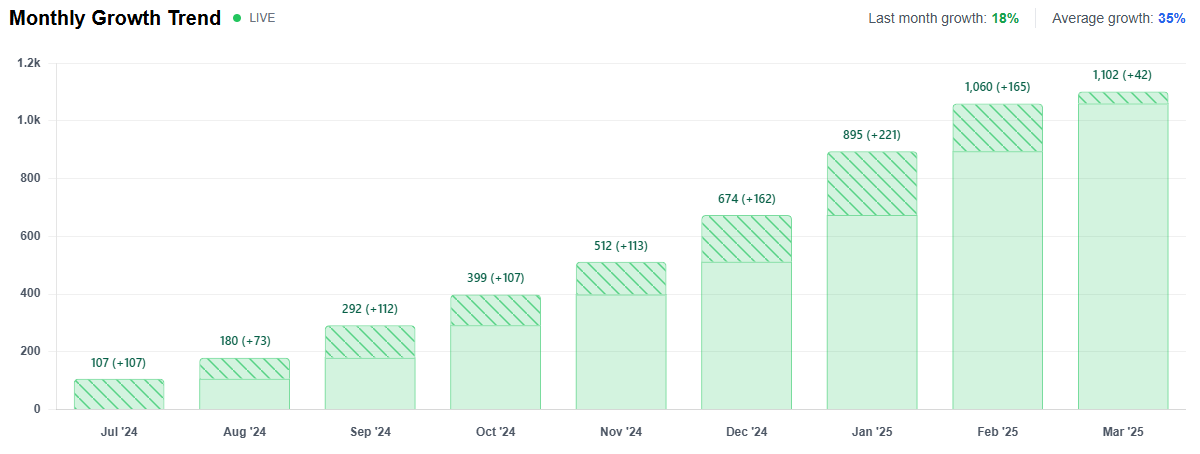

Data from the AI Agents Directory indicates an average monthly increase of 35% in the number of AI agents. However, despite the growing interest, Web3-based artificial intelligence solutions still account for a minimal fraction (3%) of the overall AI agent ecosystem.

Further, data shows that users and developers’ most sought-after AI agents do not include any from the Web3 sector. This highlights the lack of mainstream traction for crypto-integrated AI solutions.

Hitesh Malviya, an analyst and popular figure on X, echoed this sentiment in a post.

“If you look outside the crypto echo chamber, you’ll find that we do have a solid ecosystem of free and better AI agents—and they don’t have tokens, nor might they ever need one. So, what we’re trading in the name of agents is nothing but memes—a value we created out of thin air, like we always do,” Hitesh observed.

The emergence of tools like Manus, ChatGPT Operator, and n8n has made it easier than ever for individuals and businesses to develop and deploy their own tailored AI agents. These platforms allow users to create AI-powered solutions without needing a native token.

This reinforces the idea that tokenization on blockchain is not an essential component of AI agent functionality. Meanwhile, the debate surrounding AI agent tokens has also drawn criticism from industry insiders. On-chain detective ZachXBT recently slammed AI agent tokens, saying 99% are scams.

The blockchain sleuth’s concerns align with broader skepticism regarding tokenized AI projects. Many have been accused of leveraging AI hype without delivering substantive technological advancements.

Similarly, a recent survey of Solana (SOL) ecosystem founders revealed widespread skepticism about the utility of AI agents. As BeInCrypto reported, most Solana developers see AI agents as overhyped.

“The focus on AI agents distracts from core blockchain innovation. They’re more of a gimmick than a necessity in the space,” one respondent noted.

However, the crypto AI agent sector is not entirely stagnant. Recent reports suggest that new launches within the Web3 space are on the rise again. Despite the criticisms, some developers and investors still see potential in blockchain-integrated AI solutions.

As the AI agent industry grows, experts also examine its impact on the workplace. Discussions among industry leaders suggest that AI agents will play a transformative role in automating tasks, streamlining workflows, and enhancing productivity across various sectors.

The AI agent revolution is moving forward, with or without tokenization. As open-source and non-tokenized AI solutions continue gaining traction, AI-driven automation’s future may depend more on accessibility and practical application rather than speculative token economies.

The market will ultimately decide whether blockchain-based AI agents can carve out a lasting niche or if they will remain overshadowed by their non-tokenized counterparts.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will Bittensor (TAO) Rally? Key Indicators Predict Price Rebound

Bittensor (TAO) price has been facing a tough battle recently. It failed to break out of a descending wedge pattern, resulting in significant losses.

Despite these setbacks, the hope for a recovery remains strong, as several key indicators suggest that a rebound may be on the horizon for the altcoin.

Bittensor Could Be Imitating Its Past

The Relative Strength Index (RSI) for Bittensor is currently recovering from the oversold zone, where it fell for the first time in eight months. This signals a potential turnaround, as the last time TAO entered the oversold region, it managed to bounce back and rally by 60%. Although such a large rally may not be expected this time, the historical pattern suggests that TAO is poised for a recovery.

As the RSI begins to climb back from its lows, investor confidence could start to improve. While the magnitude of the rally may be smaller this time, a return to more neutral or bullish territory is likely, which could help push the price of Bittensor back on an upward trajectory.

Bittensor’s broader macro momentum is also showing signs of potential recovery. The Sharpe Ratio, a key technical indicator, is deeply negative at the moment, but this has historically been a sign of future price recovery. When the Sharpe Ratio reached similar levels in the past, TAO managed to reverse its downtrend, making it a key signal for future upward movement.

As the Sharpe Ratio starts to stabilize, it could indicate that Bittensor’s risk-adjusted returns are improving. This suggests that TAO might be entering a phase where positive returns are more likely, potentially signaling the start of a recovery phase after its recent losses.

TAO Price Set To Bounce Back Soon

TAO recently experienced a significant 45% decline over two weeks, primarily due to its failure to break out of the descending wedge pattern. However, TAO is now trading at $264, having bounced off the lower trend line of this pattern. The altcoin remains stuck under the $300 mark, but it appears poised to breach this resistance in the near future.

If Bittensor can successfully break above the $298 level, it will signal a breakout from the descending wedge pattern. This could trigger a bullish rally, with the price targeting $351. Such a move would confirm the pattern’s completion and open the door for further price increases, marking the start of a recovery phase.

However, if the altcoin fails to break above the $265 barrier, the price could fall back to $229. A drop below this level would invalidate the bullish outlook, even if the descending wedge pattern remains intact. A failure to break through $298 would likely result in more consolidation or further declines.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market17 hours ago

Market17 hours agoOKX Claims Bybit Misled EU Regulators Over Hack

-

Market24 hours ago

Market24 hours agoRipple CTO and Robert Kiyosaki Advise Buying Bitcoin

-

Altcoin17 hours ago

Altcoin17 hours agoTop Analyst Names 3 Conditions For Cardano To Flip Solana

-

Altcoin23 hours ago

Altcoin23 hours agoCBOE Files For Staking In Fidelity’s Ethereum ETF

-

Market22 hours ago

Market22 hours agoXRP Price Face Major Resistance At $2.9, Why This Analyst Believes $20 Is Still Possible

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum Tests Critical MVRV Levels – Failure to Hold $2,060 Could Send ETH To $1,440

-

Altcoin21 hours ago

Altcoin21 hours agoFranklin Templeton Files S-1 For XRP ETF With US SEC

-

Market16 hours ago

Market16 hours agoXRP Bears Continue to Drive Price Down, Risks Further Losses