Market

New USDi Stablecoin Pegged to US Inflation Metrics

A group of veteran derivatives and FX traders in the US are launching USDi, a stablecoin designed to adjust its price in line with inflation. Its value will change regularly based on Consumer Price Index (CPI) data and the performance of Treasury Inflation-Protected Securities (TIPS).

Founder Michael Ashton aims to offer an asset that maintains purchasing power by minimizing exposure to inflation risk. However, with intense competition in the stablecoin market, USDi will need strong early traction to carve out its place.

A Stablecoin To Beat Inflation?

Stablecoins are in the spotlight right now, with friendly US regulation spurring a potential boom in trading volumes. Given the current pro-regulatory environment in the US and growing adoption, many new players are innovating.

Today, derivatives trader Michael Ashton announced USDi, a stablecoin built to fight inflation.

“The riskless asset doesn’t actually currently exist, and that’s inflation-linked cash. Holding cash is an option on future opportunities, and the cost of that option is inflation. If you create inflation-linked cash, that’s the end of the risk line,” Ashton claimed.

Investors have been using crypto to hedge against inflation for years, but USDi is a novel approach to the problem. Ashton joined two co-founders, an FX veteran, and a technical specialist, to create the firm USDi Partners LLC.

USDi is a stablecoin that is correlated with the dollar but isn’t pegged to it. Instead, it will loosely orbit the dollar, but its value will fluctuate alongside US inflation.

That prospect may seem convoluted, but a simple system defines the stablecoin’s value. Essentially, Ashton claimed that USDi would rise in accordance with regular CPI reports, calculating the total inflation since a predetermined start date.

This date is December 2024, so it’s still quite close to the dollar. Today, for example, USDi’s price is $1.00863.

The novel stablecoin is inspired by the Treasury Inflation-Protected Securities (TIPS), a government bond designed to protect against inflation. Since CPI reports only happen once per month, Ashton will adjust USDi’s price in accordance with more frequent data used by TIPS investors.

To maintain this system, Ashton will manage a fund that acts as the stablecoin’s reserves. USDi Partners will mint and burn tokens according to the daily level of inflation, plus a small transaction fee.

Only accredited investors can partake in the initial launch, but USDi Partners hasn’t announced an official release date.

In short, USDi seems like a unique approach to the crypto economy, but the stablecoin market is full of competition. Ideally, Ashton and his co-founders will be able to get some early traction to get this project off the ground.

If it proves successful, it can help demonstrate the versatility of crypto’s practical applications.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hedera Under Pressure as Volume Drops, Death Cross Nears

Hedera (HBAR) has lost its $7 billion market cap as bearish momentum builds. Trading volume is down 25% in the last 24 hours to $203 million. Key technical indicators are weakening, pointing to growing pressure on the current trend.

The BBTrend has dropped below 10, the RSI is now under 50, and a potential death cross looms on the EMA lines. Unless buying pressure returns soon, HBAR could face deeper corrections in the near term.

Hedera BBTrend Is Still Positive, But Going Down

Hedera’s BBTrend has dropped to 5.84, falling sharply from 11.99 just two days ago. The BBTrend, or Bollinger Band Trend indicator, measures the strength of a trend based on how far the price deviates from its average range.

Readings above 10 typically signal a strong and active trend, while lower values suggest weakening momentum or consolidation.

With BBTrend now sitting below the 10 threshold, it may indicate that Hedera’s recent bullish momentum is losing strength.

The lower reading suggests price volatility is decreasing, which could mean the asset is entering a sideways phase or preparing for a potential pullback.

Unless BBTrend picks up again, HBAR might struggle to sustain upward movement in the short term.

Hedera Is Losing Bullish Momentum

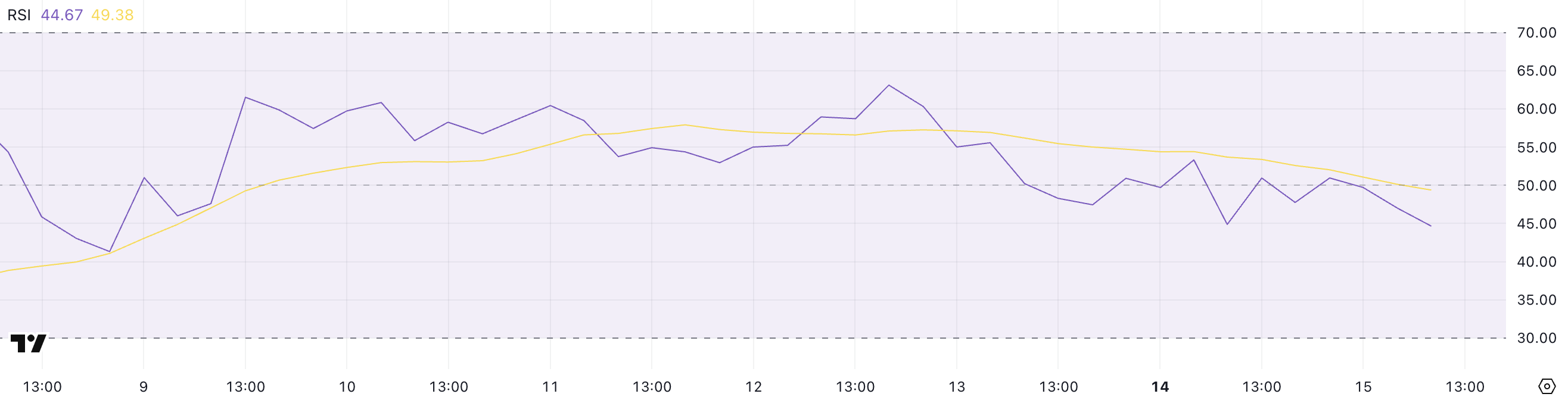

Hedera’s RSI is currently at 44.67, down from 63.12 just three days ago, signaling a notable loss in bullish momentum. The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and magnitude of recent price changes.

It ranges from 0 to 100, with values above 70 typically indicating overbought conditions and values below 30 suggesting the asset is oversold.

With RSI now below the neutral 50 mark, it suggests that sellers are gaining more control. An RSI around 44.67 points to weakening demand and could mean that HBAR is entering a consolidation phase or facing mild downward pressure.

If the RSI continues to fall, it could lead to a deeper correction unless buyers step back in.

Will Hedera Fall Below $0.15?

Hedera’s EMA lines are signaling a potential death cross, a bearish formation that could lead to increased downside pressure. If this pattern is confirmed, Hedera price may first test two nearby support levels at $0.156 and $0.153.

These levels have recently acted as short-term cushions, and losing them could trigger a sharper drop.

A breakdown below both supports could open the way toward $0.124, especially if selling momentum accelerates. On the flip side, if HBAR can regain strength and push above the $0.168 resistance, it could shift sentiment back in favor of the bulls.

A breakout there may lead to further gains toward $0.178 and potentially $0.20 if the uptrend builds enough momentum.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Jumps 20% as DEX Volume and Fees Soar

Solana (SOL) is up 20% over the past seven days, supported by strong technical indicators and rising on-chain activity. Its Ichimoku Cloud and BBTrend charts both point to bullish momentum, with trend strength and volatility on the rise.

At the same time, Solana is reclaiming the top spot in DEX volume and dominating protocol fee rankings across major DeFi apps. With a recent golden cross on the EMA lines, SOL now looks set to test key resistance levels if momentum holds.

Solana Indicators Paint A Bullish Picture

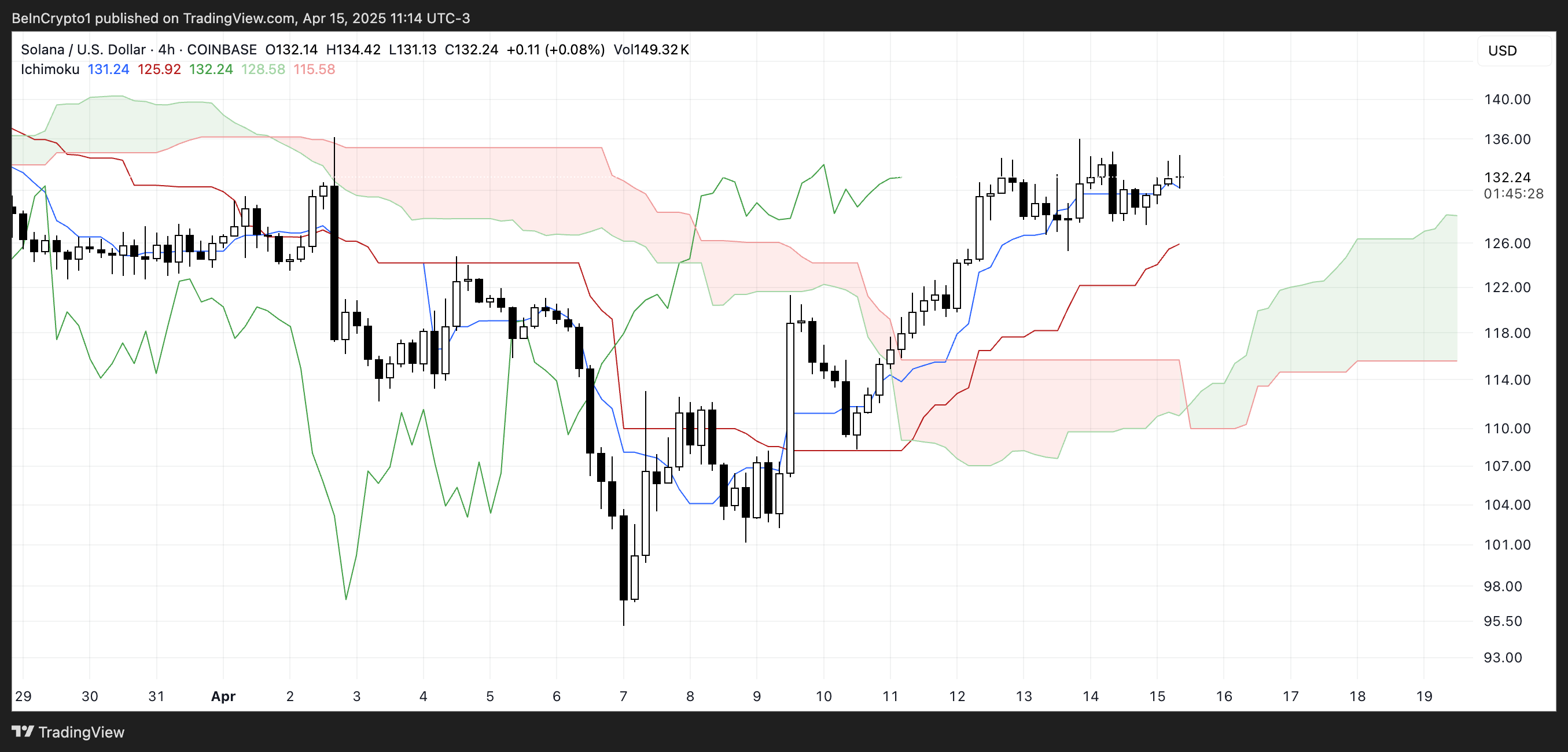

Solana Ichimoku Cloud chart shows a clear bullish structure, with price trading above both the Tenkan-sen and Kijun-sen. This alignment indicates strong short- and medium-term momentum, with buyers maintaining control.

The Kumo ahead is green and steadily expanding, which supports the continuation of the current uptrend. The distance between the price and the cloud also gives the trend some room before any potential weakness sets in.

The Chikou Span is positioned above the cloud and candles, confirming bullish confirmation from past price action. As long as Solana stays above the Kijun-sen and the cloud remains supportive, the trend bias remains upward.

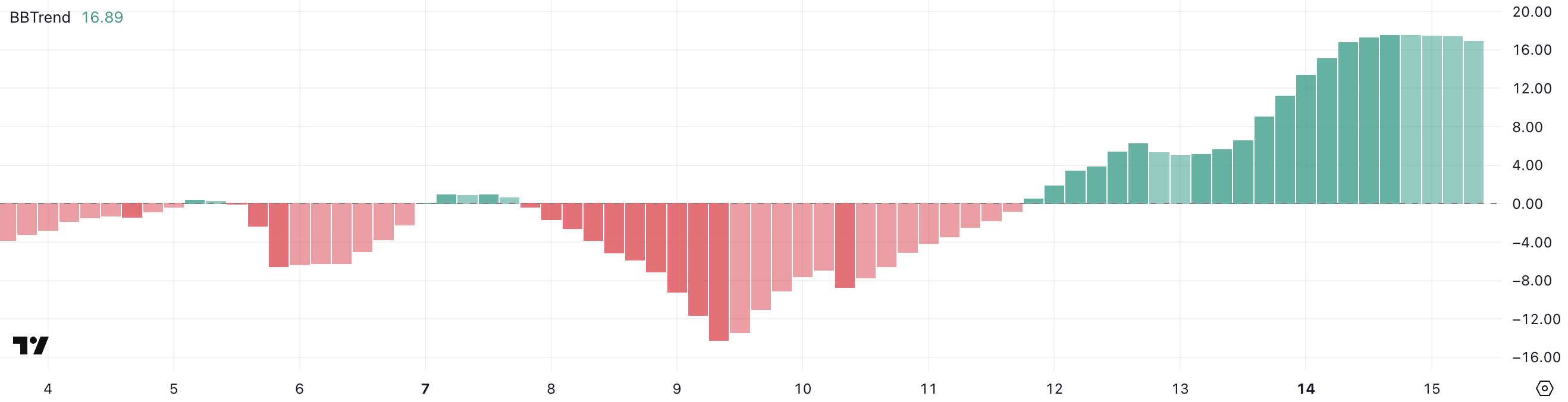

Solana’s BBTrend is currently at 16.89, showing a strong increase from 1.88 two days ago, though slightly down from 17.54 yesterday. This sharp rise indicates that volatility and trend strength have recently expanded significantly.

The BBTrend, or Bollinger Band Trend indicator, measures the strength of a trend based on how far price moves away from its average range. Readings above 10 generally signal a strong trend in motion, while lower values reflect a range-bound or weak market.

With SOL’s BBTrend holding near elevated levels, it suggests the asset is still in a strong trending phase. If it remains high or rises again, it could support further upward movement—but a steady decline might hint at a slowing trend or consolidation ahead.

SOL Volumes and Apps Are On The Rise

Solana is firmly reestablishing its dominance in the decentralized exchange (DEX) space, pulling ahead of Ethereum and BNB in daily volume.

Over the past 24 hours, Solana recorded $2.5 billion in DEX activity, marking a 14% increase over the last seven days. That growth outpaces Base’s 10% and contrasts sharply with the declines seen on Ethereum (-3%) and BNB (-9%).

More impressively, Solana’s seven-day DEX volume has surpassed the combined volume of Base, BNB, and Arbitrum.

Beyond trading volume, Solana is also leading in protocol revenue generation. Among the top eight non-stablecoin protocols ranked by fees, five are directly built on Solana: Pump, Axiom, Jupiter, Jito, and Meteora.

Pump stands out in particular, generating $2.73 million in fees in just the past 24 hours and $15 million across the past week.

Can Solana Break Above $150 In The Next Weeks?

Solana’s EMA lines recently formed a golden cross, a bullish signal that often marks the start of a new uptrend.

This crossover suggests momentum is shifting in favor of buyers, with the potential for Solana price to soon test key resistance levels.

If the current trend holds, Solana could challenge resistance around the $136 zone. A breakout there may open the path toward higher levels such as $147, $160, and even $180 if bullish pressure intensifies.

However, if momentum fades, Solana may face a pullback toward the $124 support zone. A break below that could trigger deeper downside moves, potentially revisiting $112 or even $95 if selling pressure accelerates.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Meme Coins Resurge with Rising Trade Volume

After months of decline, Solana meme coins are regaining bullish momentum. Daily trade volumes are increasing dramatically, and most of the leading tokens are posting notable price gains.

The increasing network activity is also helping Solana to recover after a 12-month low. Most recently, pump-and-dump schemes and tariff chaos rocked the meme coin sector, but speculative assets are regaining momentum as macroeconomic fears start to cool down.

Are Solana Meme Coins On the Rise Again?

Solana meme coins have been a popular sector of the crypto ecosystem, but a few controversies have taken bites out of the market in recent months.

In addition to pump-and-dumps and the Argentinian LIBRA scandal damaging these assets’ reputations, tariff-related chaos helped draw investors away from these meme assets. Despite this, however, volume is picking back up:

“Meme trading platform Axiom’s daily trading volume exceeded $100 million for the first time on April 14, accounting for about 50% of the market share of Solana Meme trading platform. The number of trading users reached 26,800, a record high,” claimed Colin Wu.

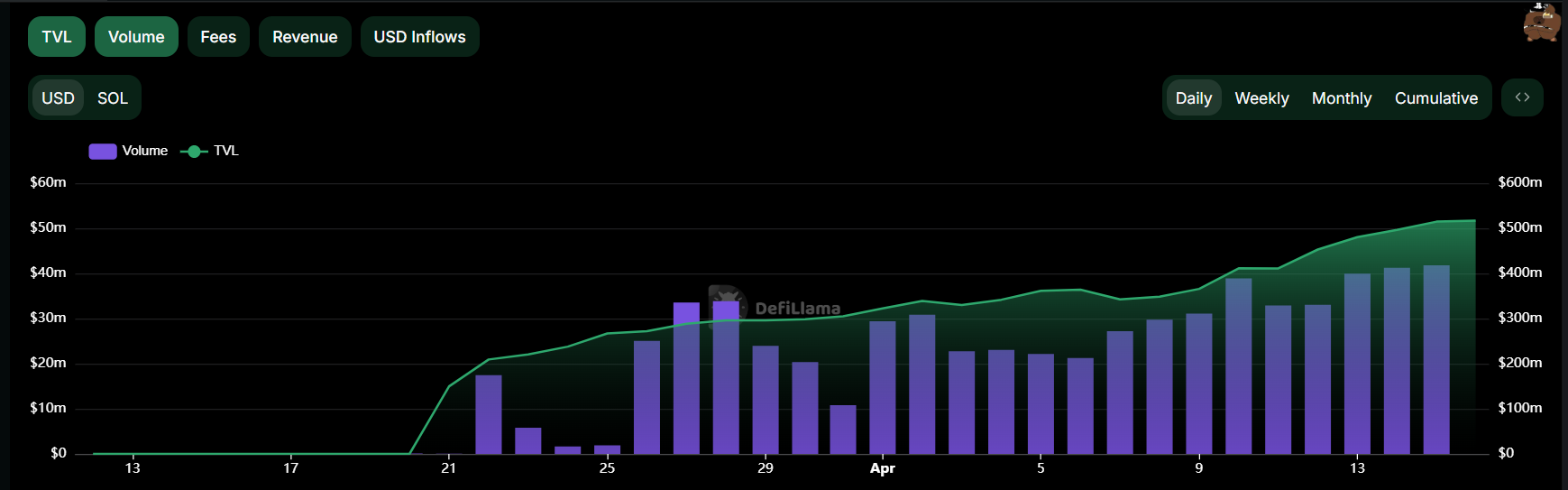

Axiom may represent half of the trading for these assets, but it isn’t the only site with heightened volumes. Pump.fun recently launched Pumpswap, a new decentralized exchange that quickly captured 14% of Solana’s DEX market.

Trading volumes are spiking on PumpSwap, with daily trading volume surging by 50% on Tuesday, April 15.

Data from DefiLlama shows that DEX trading on Solana is starting to recover after a massive drop in March. In other words, Solana meme coins’ growth isn’t isolated to either of these platforms either.

These stats have a long way to go before they recover their all-time high from January, but these signs of regrowth are still very promising.

Additionally, individual Solana meme coins are making huge strides in price performance. In the last week, eight of the ten largest assets in this category posted double-digit gains.

One of the two losers this week was TRUMP, which has been adversely impacted by tariff chaos and the latest token unlock. Nonetheless, it managed to achieve a 4.5% price jump. Most of the top ten had gains of over 20% during this period.

This increased network activity is also reflected in Solana’s price. Last week, it began recovering from a 12-month low and has since rocketed up with 20% price gains.

For now, it seems like Solana meme coins are eyeing a real comeback, at least for the short term. However, another macroeconomic shock could see these risk assets reacting more severely than the wider market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoBitcoin Price Eyes Bullish Continuation—Is $90K Within Reach?

-

Altcoin22 hours ago

Altcoin22 hours agoExpert Urges Pi Network To Learn From The OM Crash Ahead Of Open Mainnet Transition

-

Market15 hours ago

Market15 hours agoCan Pi Network Avoid a Similar Fate?

-

Market18 hours ago

Market18 hours agoXRP Price Could Regain Momentum—Is a Bullish Reversal in Sight?

-

Market17 hours ago

Market17 hours agoCardano Buyers Eye $0.70 as ADA Rallies 10%

-

Market23 hours ago

Market23 hours ago$7 Million Hack Hits Binance-Backed Project

-

Market20 hours ago

Market20 hours agoTrump’s Tariffs Spark Search for Jerome Powell’s Successor

-

Market19 hours ago

Market19 hours agoBitcoin ETFs End Dry Spell with Fresh Capital