Market

MANTRA’s OM Token Crashes 90% Amid Insider Dump Allegations

The MANTRA (OM) token suffered a catastrophic price collapse on April 13, plummeting over 90% in under an hour and wiping out more than $5.5 billion in market capitalization.

The sudden crash, which took OM from a high of $6.33 to below $0.50, has drawn comparisons to the infamous Terra LUNA meltdown, with thousands of holders reportedly losing millions.

Why did MANTRA (OM) Crash?

Multiple reports suggest that the trigger is a large token deposit linked to a wallet allegedly associated with the MANTRA team. Onchain data shows a deposit of 3.9 million OM tokens to OKX, sparking concerns about a possible incoming sell-off.

Given that the MANTRA team reportedly controls close to 90% of the token’s total supply, the move raised immediate red flags about potential insider activity and price manipulation.

The OM community has long expressed concerns around transparency. Allegations have surfaced over the past year suggesting the team manipulated the token’s price through market makers, changed tokenomics, and repeatedly delayed a community airdrop.

When the OKX deposit was spotted, fears that insiders might be preparing to offload were amplified.

Reports also indicate that MANTRA may have engaged in undisclosed over-the-counter (OTC) deals, selling tokens at steep discounts — in some cases at 50% below market value.

As OM’s price rapidly declined, these OTC investors were thrown into losses, which allegedly sparked a mass exodus as panic selling took hold. The chain reaction triggered stop-loss orders and forced liquidations on leveraged positions, compounding the collapse.

The MANTRA team has denied all allegations of a rug pull and maintains that its members did not initiate the sell-off.

In a public statement, co-founder John Patrick Mullin said the team is investigating what went wrong and is committed to finding a resolution.

The project’s official Telegram channel was locked during the fallout, which added to community frustration and speculation.

“We have determined that the OM market movements were triggered by reckless forced closures initiated by centralized exchanges on OM account holders. The timing and depth of the crash suggest that a very sudden closure of account positions was initiated without sufficient warning or notice,” wrote MANTRA founder JP Mullin.

If OM fails to recover, this would mark one of the largest collapses in crypto history since the Terra LUNA crash in 2022.

Thousands of affected holders are now demanding transparency and accountability from the MANTRA team, while the broader crypto community watches closely for answers.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network Price Rise To $1 is Now In The Hands Of Bitcoin

Pi Network’s price has shown signs of recovery in recent days, reaching a two-week high after a notable uptrend.

However, despite this progress, the cryptocurrency’s growth appears heavily dependent on external factors, particularly Bitcoin’s price movements. As a result, its future direction remains closely tied to the crypto king’s performance.

Pi Network Could Keep The Uptrend Going

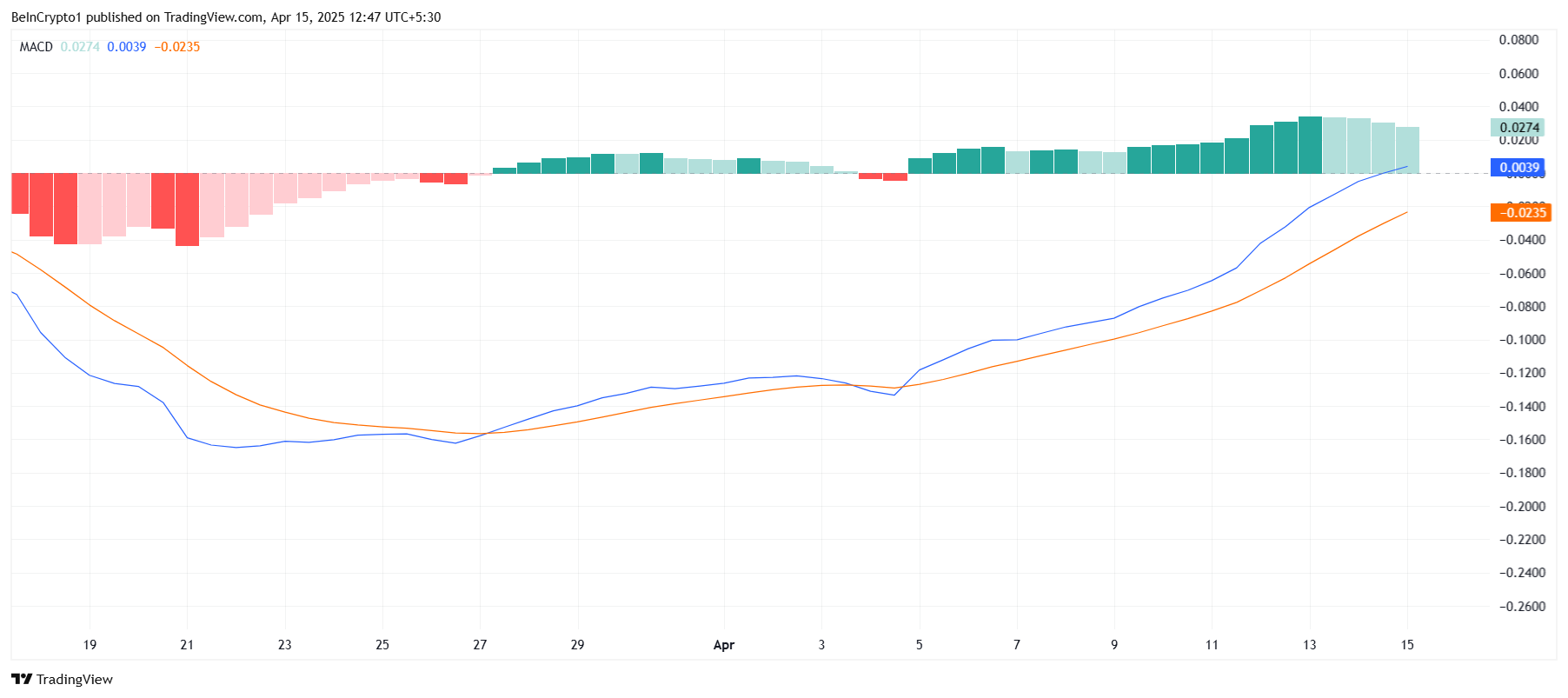

The Moving Average Convergence Divergence (MACD) indicator suggests that while Pi Network’s bullish momentum is beginning to fade, it has not yet reversed course. The indicator remains in positive territory, signaling that there is still potential for continued upward movement. The MACD is far from a bearish crossover, which could suggest that Pi still has room to rise in the short term.

Despite a slight weakening in bullish momentum, the overall outlook for Pi Network remains positive. The current trend still shows that there is enough strength for the altcoin to maintain its uptrend and push higher, particularly if market conditions support its growth.

Pi Network has shown a strong correlation with Bitcoin, standing at 0.84. This suggests that Pi closely follows the movements of Bitcoin, with its price trajectory highly influenced by the performance of the crypto market leader. As Bitcoin holds steady above $85,000, it could act as a strong catalyst for Pi’s price growth.

Given Bitcoin’s ongoing strength, Pi Network has the potential to experience a similar upward movement, especially if BTC continues to see positive price action. Pi’s dependence on Bitcoin’s market performance is evident, and any sustained rise in Bitcoin could trigger a corresponding rise in Pi Network’s value.

PI Price is Aiming At $1

Pi Network is currently trading at $0.74, up by 26% over the past five days. To maintain this positive momentum, Pi must hold above the $0.70 support level. A bounce off this level would allow the altcoin to continue its rise and potentially test the next resistance level at $0.87.

If Pi successfully breaches $0.87, it could open the door for further gains, with a potential move toward $1.00. The market sentiment and Bitcoin’s continued strength could fuel this upward momentum, bringing Pi closer to its key target. A break above this resistance would signify the start of a more substantial rally.

However, should Bitcoin experience a decline, Pi Network may follow suit. A drop through the $0.70 support level could lead Pi to test the $0.60 mark, and a further fall through this point would likely bring the price down to $0.51. This would invalidate the bullish outlook and signal a potential reversal in Pi’s price trend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Consolidation Hints at Strength—Is a Move Higher Coming?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started a fresh increase above the $1,620 zone. ETH is now consolidating gains and might aim for more gains above $1,680.

- Ethereum started a decent increase above the $1,600 and $1,620 levels.

- The price is trading above $1,625 and the 100-hourly Simple Moving Average.

- There is a new connecting bullish trend line forming with support at $1,625 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh increase if it clears the $1,680 resistance zone.

Ethereum Price Eyes More Gains

Ethereum price formed a base above $1,520 and started a fresh increase, like Bitcoin. ETH gained pace for a move above the $1,580 and $1,600 resistance levels.

The bulls even pumped the price above the $1,650 zone. A high was formed at $1,690 and the price recently started a downside correction. There was a move below the $1,640 support zone. The price dipped below the 50% Fib retracement level of the upward move from the $1,562 swing low to the $1,690 high.

However, the bulls were active near the $1,620 zone. Ethereum price is now trading above $1,625 and the 100-hourly Simple Moving Average. There is also a new connecting bullish trend line forming with support at $1,625 on the hourly chart of ETH/USD.

On the upside, the price seems to be facing hurdles near the $1,660 level. The next key resistance is near the $1,680 level. The first major resistance is near the $1,690 level. A clear move above the $1,690 resistance might send the price toward the $1,750 resistance.

An upside break above the $1,750 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $1,800 resistance zone or even $1,880 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $1,660 resistance, it could start a downside correction. Initial support on the downside is near the $1,620 level. The first major support sits near the $1,610 zone and the 61.8% Fib retracement level of the upward move from the $1,562 swing low to the $1,690 high.

A clear move below the $1,610 support might push the price toward the $1,575 support. Any more losses might send the price toward the $1,550 support level in the near term. The next key support sits at $1,500.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,610

Major Resistance Level – $1,660

Market

Can Pi Network Avoid a Similar Fate?

Following Mantra’s catastrophic OM token crash, analysts urge the Pi Core Team (PCT) to adopt greater transparency and caution.

These remarks follow Pi Network’s recent transition to the full Open Mainnet phase.

Pi Network Advised to Prioritize Transparency Post-Mainnet

The warning comes after OM’s price plummeted more than 90% in under an hour, wiping out over $5.5 billion in market capitalization.

Following this crash, there is widespread fear across the crypto industry of similar events occurring in projects undergoing key phases of development and token unlocking. Among such projects is Pi Network, which recently transitioned to Open Mainnet.

Dr Altcoin, a crypto analyst and advocate for decentralized ethics, relates the OM incident to the Pi Network and calls for stricter regulation.

“The OM incident is a wake-up call for the entire crypto industry, proof that stricter regulations are urgently needed. It also serves as a huge lesson for the Pi Core Team as we transition from the Open Network to the Open Mainnet,” he tweeted.

Some users defended Pi Network’s fundamentals, highlighting its utility-focused roadmap and avoidance of speculative hype. However, Dr Altcoin doubled down on concerns over a lack of transparency.

“One thing is clear about the PCT, they are not transparent,” he added.

Still, the broader Pi community remains optimistic. The account Pi Open Mainnet, presented as a pioneer, posted a rebuttal citing reasons Pi may avoid OM’s fate. It highlighted Pi’s slow token release strategy and absence of large early-sell events as elements central to that confidence.

“Massive community (35M+ pioneers), steady unlocks, growing utility (.pi domains, dapps), and a clean track record,” they wrote.

Indeed, Pi’s ecosystem is expanding. The integration with Chainlink, new fiat on-ramps, and Pi Ads are creating what the team calls a “virtuous cycle” of adoption and utility, according to Pi Open Mainnet 2025, a senior pioneer’s account.

“These advancements form a virtuous cycle for Pi Network. Easier fiat ramps bring in more users (Pi’s community is already ~60M strong), Pi Ads drive more apps & utility, and Chainlink integration adds trust and interoperability. More users →more utility,” it stated.

With a community reportedly approaching 60 million, many believe the project has a strong user-driven foundation, unlike OM’s more centralized dynamics.

Is This Enough to Prevent OM-Like Fate?

However, not everyone is convinced this will be enough. Mahidhar Crypto, a Pi Coin validator, urged users to withdraw Pi coins from centralized exchanges (CEXs) to prevent price manipulation.

“We have seen what happened to OM—how market makers dumped on users…When you deposit your Pi Coins on CEX, the Market makers will use bots to create artificial buy/sell walls to manipulate prices or Liquidity,” they warned.

This aligns with recent concerns about collusion between market makers and CEXs. Mahidhar also called for the Pi Core Team to scrutinize KYB-verified businesses and avoid listing Pi derivatives on CEXs, citing the risks of leveraged trading on still-maturing assets.

Further fanning skepticism is on-chain behavior tied to OM. Trading Digits, a technical analysis firm, pointed out that the “Pi Cycle Top” indicator, a pattern often signaling market tops, had triggered twice for OM since 2024, the most recent being just two months before its collapse.

“Coincidence or bound to happen?” the firm posed.

Will Pi follow a disciplined, utility-first path, or could it fall into the same traps that triggered OM’s downfall?

BeInCrypto data shows Pi Network’s PI coin was trading for $0.74% as of this writing, down by 1.36% in the last 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoAnalyst Predicts Dogecoin Price Rally To $0.29 If This Level Holds

-

Market20 hours ago

Market20 hours agoMENAKI Leads Cat Themed Tokens

-

Market14 hours ago

Market14 hours agoBinance Futures Causes a Brief Crash For Story (IP) and ACT

-

Market23 hours ago

Market23 hours agoSolana Futures Traders Eye $147 as SOL Recovers

-

Market19 hours ago

Market19 hours agoTether Deploys Hashrate in OCEAN Bitcoin Mining Pool

-

Market18 hours ago

Market18 hours ago3 Altcoins to Watch in the Third Week of April 2025

-

Market17 hours ago

Market17 hours agoCardano (ADA) Eyes Rally as Golden Cross Signals Momentum

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum Price Threatened With Sharp Drop To $1,400, Here’s Why