Market

Legendary trader predicts 6,400% price rally for new altcoin taking on Solana (SOL) and Cardano (ADA)

A renowned trader is predicting a significant 6,400% price surge for Rexas Finance (RXS), a new altcoin challenging both Solana (SOL) and Cardano (ADA) in the crypto market. Rexas Finance, focusing on real-world asset (RWA) tokenization, aims to revolutionize how investors access and trade assets such as real estate, commodities, and more. Currently in its presale, the RXS token is priced at $0.06. The competition is fierce as ADA and SOL are well-established, but Rexas Finance seems to be positioning itself as a strong contender.

Rexas Finance: Bridging real-world assets and blockchain

Rexas Finance is already transforming the way people invest in real-world assets. Through its innovative platform, users can buy and sell fractional ownership of high-value assets such as real estate, gold, and art, making it possible for anyone to own assets with just one click. Rexas Finance also offers tools like the Rexas Token Builder, which simplifies the process of tokenizing real-world assets. This allows users to issue digital tokens representing a proportional share of any asset, creating more liquidity and market access.

The platform’s QuickMint Bot further enhances user experience, enabling even non-expert users to mint tokens seamlessly. Unlike Solana and Cardano, which focus more on digital assets, Rexas Finance integrates blockchain into real-world applications, effectively merging traditional finance with the future of decentralized technology.

Rexas Launchpad and real estate focus

The Rexas Launchpad allows new projects to raise funds through token offerings, giving investors early access to tokens that could see massive appreciation. Stage 1 through 3 of Rexas Finance’s presale sold out swiftly, raising $2.75 million. The fourth stage has seen the price double to $0.06 per token and cross the $3.6 million mark. Investors entering during this phase could see a 3.3x return on their investment upon launch. This momentum is creating serious competition for Solana and Cardano, both of which lack direct exposure to real-world assets.

Rexas Finance’s core focus on real estate makes it unique in the market. The Rexas Estate function allows investors to own fractional shares of property across the globe, from luxurious apartments in New York to beachfront homes in Europe. This form of investment not only provides potential rental income but also allows investors to benefit from the appreciation of real estate values without the burdens of full ownership. The ease of this process attracts a wide range of investors, making Rexas Finance a more attractive option than Solana and Cardano for those interested in real-world asset tokenization.

AI integration and future growth

Beyond real estate, Rexas Finance is incorporating advanced AI features such as the Rexas AI Shield, which offers enhanced security for tokenized assets, and Rexas GenAI, an AI-driven tool that provides investment insights. These tools simplify decision-making and offer users a more secure, efficient way to manage their assets.

Furthermore, the platform’s ongoing $1M Giveaway adds to the excitement surrounding the token’s presale, with 20 lucky winners receiving $50,000 in USDT. Rexas Finance is already listed on CoinMarketCap, adding visibility and credibility. The platform’s ability to tokenize assets like real estate and commodities, coupled with its advanced tools, is rapidly gaining attention. As the presale progresses, the 6400% price surge seems increasingly plausible, making it a strong competitor to SOL and ADA in the expanding crypto market.

⭐️ Milestone Alert! ⭐️

Rexas Finance has successfully raised $4.2 Million! 🚀

Thank you for your support! 👍

Buy Now: https://t.co/tNJAsvAL8G#RexasFinance $RXS #ETH pic.twitter.com/z7cNsBliMQ

— Rexas Finance (@rexasfinance) October 22, 2024

Final thoughts

The legendary trader’s prediction of a 6400% rally for Rexas Finance (RXS) reflects the platform’s strong positioning against established players like Solana and Cardano. With its focus on real-world asset tokenization, Rexas Finance is set to transform how investors access and trade assets. As the presale continues and the platform gains more visibility, Rexas Finance is likely to become a major force in the crypto market, leaving ADA and SOL to compete in an evolving environment where real-world applications hold the most promise.

For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Win $1 Million Giveaway: https://bit.ly/Rexas1M

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

Market

Solana Rallies Past Bitcoin—Momentum Tilts In Favor of SOL

Solana started a fresh increase from the $120 support zone. SOL price is now consolidating and might climb further above the $142 resistance zone.

- SOL price started a fresh increase above the $125 and $132 levels against the US Dollar.

- The price is now trading above $130 and the 100-hourly simple moving average.

- There is a connecting bullish trend line forming with support at $137 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could start a fresh increase if it clears the $142 resistance zone.

Solana Price Gains Over 5%

Solana price formed a base above the $120 support and started a fresh increase, like Bitcoin and Ethereum. SOL gained pace for a move above the $125 and $132 resistance levels.

The pair even spiked toward the $145 resistance zone. A high was formed at $143.06 and the price is now retreating lower. There was a move below the 23.6% Fib retracement level of the upward move from the $135 swing low to the $143 high.

Solana is now trading above $130 and the 100-hourly simple moving average. There is also a connecting bullish trend line forming with support at $137 on the hourly chart of the SOL/USD pair. The trend line is close to the 76.4% Fib retracement level of the upward move from the $135 swing low to the $143 high.

On the upside, the price is facing resistance near the $142 level. The next major resistance is near the $145 level. The main resistance could be $150. A successful close above the $150 resistance zone could set the pace for another steady increase. The next key resistance is $155. Any more gains might send the price toward the $165 level.

Pullback in SOL?

If SOL fails to rise above the $142 resistance, it could start another decline. Initial support on the downside is near the $138.50 zone. The first major support is near the $137 level and the trend line.

A break below the $137 level might send the price toward the $132 zone. If there is a close below the $132 support, the price could decline toward the $125 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $137 and $132.

Major Resistance Levels – $142 and $145.

Market

Bitcoin Price Breakout In Progress—Momentum Builds Above Resistance

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price is slowly moving higher above the $86,500 zone. BTC is gaining pace and might continue higher in the near term.

- Bitcoin found support at $84,200 and started a recovery wave.

- The price is trading above $85,500 and the 100 hourly Simple moving average.

- There was a break above a connecting bearish trend line with resistance at $85,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $88,000 zone.

Bitcoin Price Eyes Steady Increase

Bitcoin price remained stable above the $83,200 level and started a fresh increase. BTC was able to climb above the $84,200 and $85,000 resistance levels.

There was a break above a connecting bearish trend line with resistance at $85,000 on the hourly chart of the BTC/USD pair. The bulls were able to pump the price above the $86,500 resistance. It even spiked above $87,000. A high is formed near $87,562 and the price might continue to rise unless there is a move below the 23.6% Fib retracement level of the upward move from the $84,007 swing low to the $87,562 high.

Bitcoin price is now trading above $86,500 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $87,500 level. The first key resistance is near the $88,000 level.

The next key resistance could be $88,800. A close above the $88,800 resistance might send the price further higher. In the stated case, the price could rise and test the $89,500 resistance level. Any more gains might send the price toward the $90,000 level.

Downside Correction In BTC?

If Bitcoin fails to rise above the $88,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $87,000 level. The first major support is near the $86,750 level.

The next support is now near the $86,000 zone. Any more losses might send the price toward the $85,750 support or the 50% Fib retracement level of the upward move from the $84,007 swing low to the $87,562 high in the near term. The main support sits at $84,850.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $86,750, followed by $86,000.

Major Resistance Levels – $87,500 and $88,000.

Market

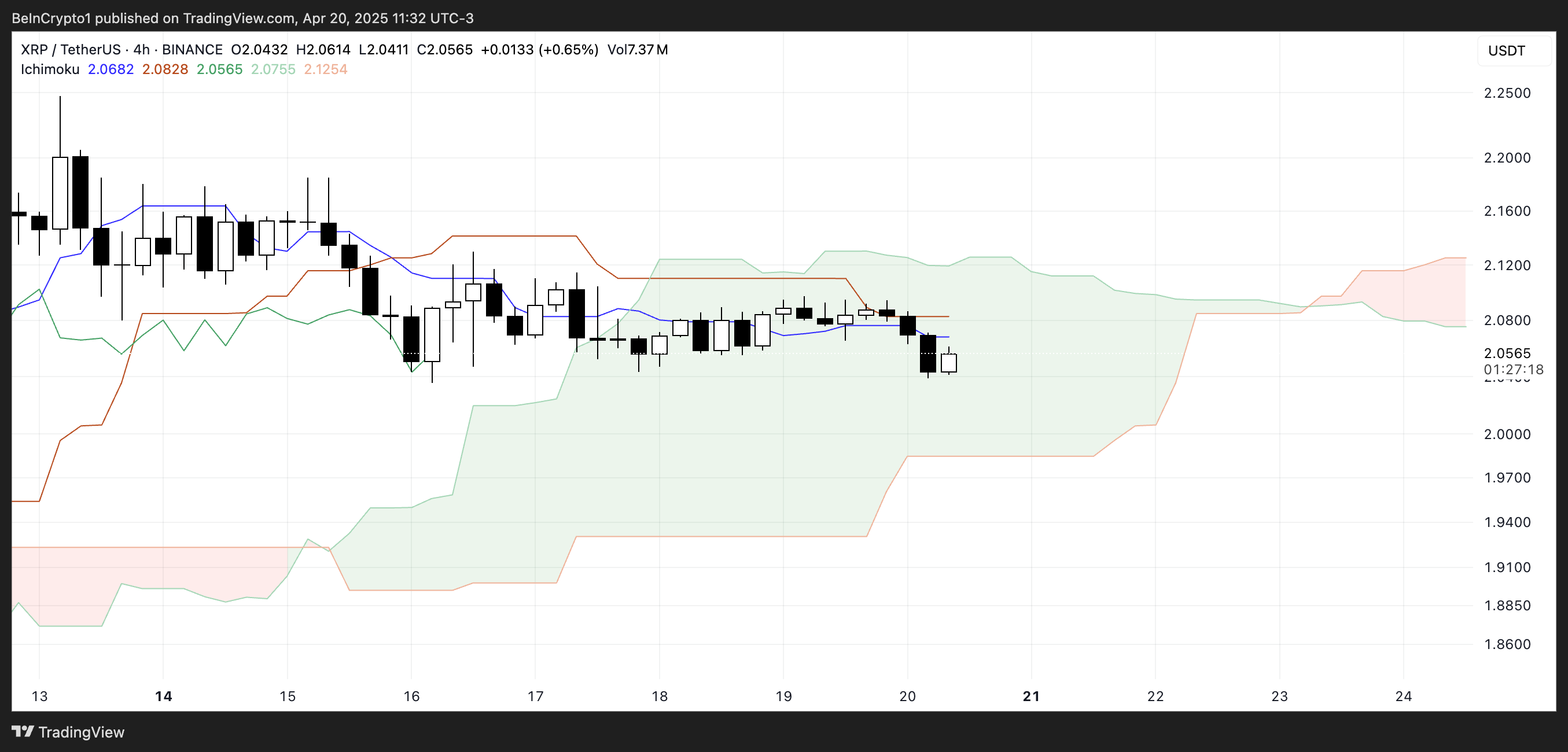

Will XRP Break Support and Drop Below $2?

XRP is down 5% over the past week, struggling to regain momentum as technical indicators flash mixed signals. Its Relative Strength Index (RSI) has dropped below 50, and the price remains stuck within a tight range between key support and resistance levels.

At the same time, the Ichimoku Cloud has shifted from green to red, with a thickening cloud ahead suggesting growing bearish pressure. With volatility compressing and momentum fading, XRP is nearing a critical point where a breakout—or breakdown—seems increasingly likely.

XRP Struggles to Regain Momentum as RSI Drops Below 50

XRP’s Relative Strength Index (RSI) is currently sitting at 44.54, after recovering from an intraday low of 40.67. Just yesterday, it was at 51.30, highlighting increased short-term volatility.

RSI is a momentum indicator that measures the speed and magnitude of recent price changes to evaluate overbought or oversold conditions.

Readings above 70 typically suggest an asset is overbought, while readings below 30 indicate it may be oversold.

With XRP’s RSI at 44.54, it’s currently in neutral territory, showing neither strong buying nor selling pressure.

However, the fact that it hasn’t crossed the overbought threshold of 70 since March 19—over a month ago—signals a lack of sustained bullish momentum. This could mean XRP is still in a consolidation phase, with the market waiting for a clearer direction.

If RSI continues to climb toward 50 and beyond, it may hint at building momentum, but without a breakout above 70, upside could remain limited.

XRP Faces Uncertainty as Bearish Trend Begins to Expand

XRP is currently trading inside the Ichimoku Cloud, signaling market indecision and a neutral trend.

The Tenkan-sen (blue line) has crossed below the Kijun-sen (red line), which is a bearish signal, but with the price still within the cloud, it lacks full confirmation.

The cloud itself acts as a zone of support and resistance, and XRP is now moving sideways within that zone.

Looking ahead, the cloud has shifted from green to red—a sign that bearish momentum may be building. Even more concerning is that the red cloud is widening, which suggests increasing downward pressure in the near future.

A thickening red Kumo often signals stronger resistance overhead and a potential continuation of a bearish trend if the price breaks below the cloud.

Until XRP breaks out decisively in either direction, the market remains in a wait-and-see phase, but the growing red cloud tilts the bias toward caution.

XRP Compression Zone: A Breakout Could Send Price to $2.50 — Or Much Lower

XRP price is currently trading within a tight range, caught between a key support level at $2.05 and resistance at $2.09. This narrow channel reflects short-term uncertainty, but a decisive move in either direction could set the tone for what’s next.

If the $2.05 support fails, the next level to watch is $1.96. A break below that could trigger a steep drop toward $1.61, which would mark the first close below $1.70 since November 2024—a bearish signal that could accelerate selling pressure.

Recently, veteran analyst Peter Brandt warned that a major correction could hit XRP soon.

On the flip side, if bulls regain control and push XRP above the $2.09 resistance, the next target lies at $2.17. A breakout beyond that could open the door to a move toward $2.50, a price level not seen since March 19.

For that to happen, XRP would need a clear resurgence in momentum and buying volume.

Until then, the price remains trapped in a narrow zone, with both upside and downside potential on the table.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoUniswap Founder Urges Ethereum To Pursue Layer 2 Scaling To Compete With Solana

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Consolidates In Symmetrical Triangle: Expert Predicts 17% Price Move

-

Market20 hours ago

Market20 hours agoToday’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

-

Market14 hours ago

Market14 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Market18 hours ago

Market18 hours agoMELANIA Crashes to All-Time Low Amid Insiders Continued Sales

-

Altcoin23 hours ago

Altcoin23 hours agoWhat’s Up With BTC, XRP, ETH?

-

Market19 hours ago

Market19 hours agoCharles Schwab Plans Spot Crypto Trading Rollout in 2026

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Accumulators At A Crucial Moment: ETH Realized Price Tests Make-Or-Break Point