Market

Kraken’s Major Questions Defense Dismissed in SEC Legal Battle

The legal battle between the US Securities and Exchange Commission (SEC) and crypto exchange Kraken took a major turn on January 24, 2025.

In a setback for Kraken, a California federal judge has ruled partly in favor of the SEC.

Kraken’s ‘Major Questions’ Defense Rejected in SEC Lawsuit

The judge allowed Kraken’s “fair notice” and “due process” defenses to proceed but dismissed its “major questions doctrine” defense.

The SEC sued Kraken, accusing it of offering unregistered securities through its exchange services. Kraken raised eighteen defenses in response. The SEC sought to dismiss several of them, including the “major questions doctrine” defense.

This defense argues that government agencies can’t regulate large sectors of the economy unless Congress has given them specific authority. Kraken claimed the SEC did not have clear authority over cryptocurrencies.

However, Judge William Orrick disagreed. He ruled that while cryptocurrency is growing, it doesn’t have the same economic impact as areas like energy or student loans. He also said the SEC’s actions were based on established securities laws, not an expansion of authority.

“The SEC is not asserting a “transformative expansion in its regulatory authority” or a “highly consequential power beyond what Congress could reasonably be understood to have granted it,” the court noted.

Nevertheless, Kraken’s “fair notice” defense remains intact. The crypto exchange argues it was not clearly told that its actions violated the law. It claims it didn’t know that certain digital assets on its platform could be considered “investment contracts” under the Howey test, a Supreme Court ruling that defines securities.

Judge Orrick agreed that Kraken had a plausible argument and allowed this defense to proceed.

“I have already determined that the major questions doctrine is not implicated in this case, at least under the current facts, and GRANT the motion to dismiss it. But Kraken is entitled to proceed with the other two defenses, which are plausibly alleged,” the judge wrote.

This ruling is a key moment in the ongoing regulatory scrutiny of the crypto industry, especially as companies like Coinbase and Binance are also fighting the SEC’s authority over crypto assets. The SEC’s attempt to apply traditional securities laws to cryptocurrencies has faced legal challenges.

The SEC first sued Kraken in November 2023 for operating as an unregistered securities exchange, broker, dealer, and clearing agency. According to the SEC’s complaint, Kraken has made hundreds of millions of dollars unlawfully facilitating the buying and selling of “crypto asset securities,” since September 2018.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Rallies Past Bitcoin—Momentum Tilts In Favor of SOL

Solana started a fresh increase from the $120 support zone. SOL price is now consolidating and might climb further above the $142 resistance zone.

- SOL price started a fresh increase above the $125 and $132 levels against the US Dollar.

- The price is now trading above $130 and the 100-hourly simple moving average.

- There is a connecting bullish trend line forming with support at $137 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could start a fresh increase if it clears the $142 resistance zone.

Solana Price Gains Over 5%

Solana price formed a base above the $120 support and started a fresh increase, like Bitcoin and Ethereum. SOL gained pace for a move above the $125 and $132 resistance levels.

The pair even spiked toward the $145 resistance zone. A high was formed at $143.06 and the price is now retreating lower. There was a move below the 23.6% Fib retracement level of the upward move from the $135 swing low to the $143 high.

Solana is now trading above $130 and the 100-hourly simple moving average. There is also a connecting bullish trend line forming with support at $137 on the hourly chart of the SOL/USD pair. The trend line is close to the 76.4% Fib retracement level of the upward move from the $135 swing low to the $143 high.

On the upside, the price is facing resistance near the $142 level. The next major resistance is near the $145 level. The main resistance could be $150. A successful close above the $150 resistance zone could set the pace for another steady increase. The next key resistance is $155. Any more gains might send the price toward the $165 level.

Pullback in SOL?

If SOL fails to rise above the $142 resistance, it could start another decline. Initial support on the downside is near the $138.50 zone. The first major support is near the $137 level and the trend line.

A break below the $137 level might send the price toward the $132 zone. If there is a close below the $132 support, the price could decline toward the $125 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $137 and $132.

Major Resistance Levels – $142 and $145.

Market

Bitcoin Price Breakout In Progress—Momentum Builds Above Resistance

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price is slowly moving higher above the $86,500 zone. BTC is gaining pace and might continue higher in the near term.

- Bitcoin found support at $84,200 and started a recovery wave.

- The price is trading above $85,500 and the 100 hourly Simple moving average.

- There was a break above a connecting bearish trend line with resistance at $85,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $88,000 zone.

Bitcoin Price Eyes Steady Increase

Bitcoin price remained stable above the $83,200 level and started a fresh increase. BTC was able to climb above the $84,200 and $85,000 resistance levels.

There was a break above a connecting bearish trend line with resistance at $85,000 on the hourly chart of the BTC/USD pair. The bulls were able to pump the price above the $86,500 resistance. It even spiked above $87,000. A high is formed near $87,562 and the price might continue to rise unless there is a move below the 23.6% Fib retracement level of the upward move from the $84,007 swing low to the $87,562 high.

Bitcoin price is now trading above $86,500 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $87,500 level. The first key resistance is near the $88,000 level.

The next key resistance could be $88,800. A close above the $88,800 resistance might send the price further higher. In the stated case, the price could rise and test the $89,500 resistance level. Any more gains might send the price toward the $90,000 level.

Downside Correction In BTC?

If Bitcoin fails to rise above the $88,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $87,000 level. The first major support is near the $86,750 level.

The next support is now near the $86,000 zone. Any more losses might send the price toward the $85,750 support or the 50% Fib retracement level of the upward move from the $84,007 swing low to the $87,562 high in the near term. The main support sits at $84,850.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $86,750, followed by $86,000.

Major Resistance Levels – $87,500 and $88,000.

Market

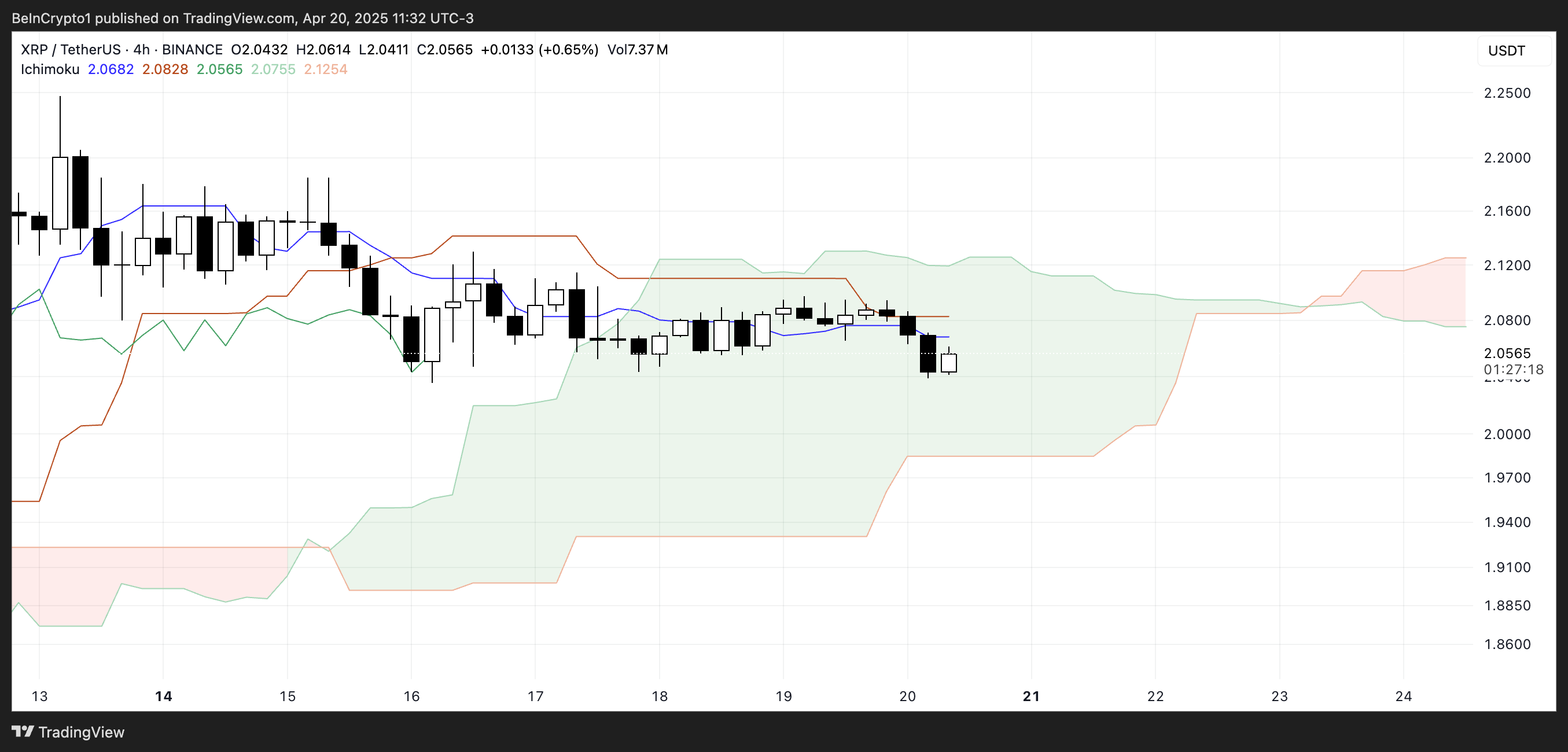

Will XRP Break Support and Drop Below $2?

XRP is down 5% over the past week, struggling to regain momentum as technical indicators flash mixed signals. Its Relative Strength Index (RSI) has dropped below 50, and the price remains stuck within a tight range between key support and resistance levels.

At the same time, the Ichimoku Cloud has shifted from green to red, with a thickening cloud ahead suggesting growing bearish pressure. With volatility compressing and momentum fading, XRP is nearing a critical point where a breakout—or breakdown—seems increasingly likely.

XRP Struggles to Regain Momentum as RSI Drops Below 50

XRP’s Relative Strength Index (RSI) is currently sitting at 44.54, after recovering from an intraday low of 40.67. Just yesterday, it was at 51.30, highlighting increased short-term volatility.

RSI is a momentum indicator that measures the speed and magnitude of recent price changes to evaluate overbought or oversold conditions.

Readings above 70 typically suggest an asset is overbought, while readings below 30 indicate it may be oversold.

With XRP’s RSI at 44.54, it’s currently in neutral territory, showing neither strong buying nor selling pressure.

However, the fact that it hasn’t crossed the overbought threshold of 70 since March 19—over a month ago—signals a lack of sustained bullish momentum. This could mean XRP is still in a consolidation phase, with the market waiting for a clearer direction.

If RSI continues to climb toward 50 and beyond, it may hint at building momentum, but without a breakout above 70, upside could remain limited.

XRP Faces Uncertainty as Bearish Trend Begins to Expand

XRP is currently trading inside the Ichimoku Cloud, signaling market indecision and a neutral trend.

The Tenkan-sen (blue line) has crossed below the Kijun-sen (red line), which is a bearish signal, but with the price still within the cloud, it lacks full confirmation.

The cloud itself acts as a zone of support and resistance, and XRP is now moving sideways within that zone.

Looking ahead, the cloud has shifted from green to red—a sign that bearish momentum may be building. Even more concerning is that the red cloud is widening, which suggests increasing downward pressure in the near future.

A thickening red Kumo often signals stronger resistance overhead and a potential continuation of a bearish trend if the price breaks below the cloud.

Until XRP breaks out decisively in either direction, the market remains in a wait-and-see phase, but the growing red cloud tilts the bias toward caution.

XRP Compression Zone: A Breakout Could Send Price to $2.50 — Or Much Lower

XRP price is currently trading within a tight range, caught between a key support level at $2.05 and resistance at $2.09. This narrow channel reflects short-term uncertainty, but a decisive move in either direction could set the tone for what’s next.

If the $2.05 support fails, the next level to watch is $1.96. A break below that could trigger a steep drop toward $1.61, which would mark the first close below $1.70 since November 2024—a bearish signal that could accelerate selling pressure.

Recently, veteran analyst Peter Brandt warned that a major correction could hit XRP soon.

On the flip side, if bulls regain control and push XRP above the $2.09 resistance, the next target lies at $2.17. A breakout beyond that could open the door to a move toward $2.50, a price level not seen since March 19.

For that to happen, XRP would need a clear resurgence in momentum and buying volume.

Until then, the price remains trapped in a narrow zone, with both upside and downside potential on the table.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoUniswap Founder Urges Ethereum To Pursue Layer 2 Scaling To Compete With Solana

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Consolidates In Symmetrical Triangle: Expert Predicts 17% Price Move

-

Market19 hours ago

Market19 hours agoToday’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

-

Market13 hours ago

Market13 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Market17 hours ago

Market17 hours agoMELANIA Crashes to All-Time Low Amid Insiders Continued Sales

-

Altcoin22 hours ago

Altcoin22 hours agoWhat’s Up With BTC, XRP, ETH?

-

Market18 hours ago

Market18 hours agoCharles Schwab Plans Spot Crypto Trading Rollout in 2026

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Accumulators At A Crucial Moment: ETH Realized Price Tests Make-Or-Break Point