Market

Key Support Levels to Monitor

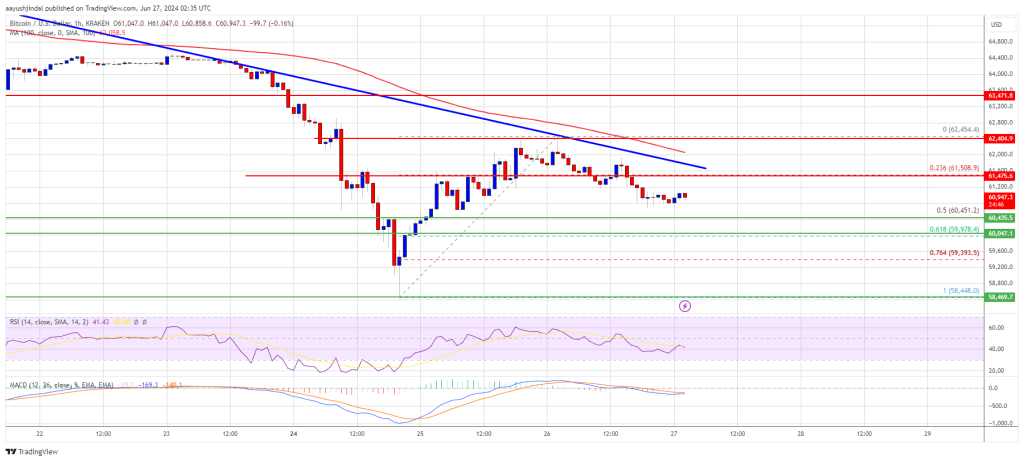

Bitcoin price failed to recover above the $62,500 resistance zone. BTC is showing bearish signs and might decline again below the $60,000 support.

- Bitcoin struggled to recover above the $62,200 and $62,500 levels.

- The price is trading below $62,000 and the 100 hourly Simple moving average.

- There is a major bearish trend line forming with resistance at $61,850 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair might start another decline unless there is a close above the $62,000 resistance zone.

Bitcoin Price Remains At Risk

Bitcoin price started a recovery wave above the $61,200 zone. BTC even attempted a move above the $62,000 resistance zone. However, the bears were active near the $62,500 zone.

A high was formed at $62,454 and the price is now moving lower. There was a move below the $61,500 level. The price declined below the 23.6% Fib retracement level of the upward move from the $58,448 swing low to the $62,454 high.

Bitcoin price is trading below $62,000 and the 100 hourly Simple moving average. There is also a major bearish trend line forming with resistance at $61,850 on the hourly chart of the BTC/USD pair.

The price is now stable above the 50% Fib retracement level of the upward move from the $58,448 swing low to the $62,454 high. If there is another increase, the price could face resistance near the $61,500 level. The first key resistance is near the $61,850 level and the trend line.

The next key resistance could be $62,000. A clear move above the $62,000 resistance might start a steady increase and send the price higher. In the stated case, the price could rise and test the $62,500 resistance. Any more gains might send BTC toward the $63,500 resistance in the near term.

More Losses In BTC?

If Bitcoin fails to climb above the $62,000 resistance zone, it could start another decline. Immediate support on the downside is near the $60,450 level.

The first major support is $60,000. The next support is now forming near $59,500. Any more losses might send the price toward the $58,500 support zone in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $60,500, followed by $60,000.

Major Resistance Levels – $62,000, and $62,500.

Market

Canary Capital Aims to Launch TRON-Focused ETF

Canary Capital has filed a Form S-1 registration with the US Securities and Exchange Commission (SEC) to launch a spot exchange-traded fund (ETF) focused on Tron (TRX).

The proposal, submitted on April 18, is the first of its kind to offer investors exposure to TRX’s market performance while also providing staking rewards. This sets the fund apart from previous spot crypto ETF proposals.

Canary Capital’s TRX ETF Could Test SEC Stance on Staking Assets

The filing designates BitGo Trust Company as the custodian for TRX holdings and appoints Canary Capital as the fund’s sponsor.

Justin Sun, the founder of Tron, weighed in on the development, encouraging US investors to act promptly. He emphasized TRX’s potential for long-term growth and suggested institutional interest would likely surge if the ETF is approved.

“US VCs should start buying TRX — and fast. Don’t wait until it’s too late. TRX is a price that only moves one way: up,” Sun said on X.

According to BeInCrypto data, TRX is currently the ninth-largest crypto by market capitalization, valued at approximately $22.94 billion.

Moreover, Tron’s blockchain has gained strong traction in stablecoin settlements, ranking second only to Ethereum. Its efficiency in processing fast and low-cost transactions has made it a preferred choice for Tether’s USDT, based on data from DeFiLlama.

While the proposal has created a buzz in the market, questions remain over its chances of gaining regulatory approval. The inclusion of staking within the ETF is a bold move, but the SEC has historically opposed similar features in other crypto funds.

The SEC has flagged staking services within investment products as potential unregistered securities, leading to increased scrutiny.

Due to this, past Ethereum ETF proposals were forced to remove staking components to align with regulatory expectations.

Nonetheless, several firms, including Grayscale, continue to push for altcoin ETFs that incorporate staking or offer broader asset exposure.

Still, regulatory uncertainty clouds the Canary TRX ETF proposal, especially in light of past controversies involving Justin Sun. The network has also faced allegations of being used by illicit actors, claims it has publicly denied.

If approved, Canary Capital’s ETF would mark a historic milestone by combining exposure to TRX with staking rewards. This structure could attract both retail and institutional investors seeking yield alongside market performance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Consolidation About To Reach A Bottom, Wave 5 Says $5.85 Is Coming

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP is still in consolidation mode after hitting a new seven-year high in January 2025. This consolidation has seen the price drop slowly, but steadily, losing around 40% of its value since then. Currently, bulls seem to have created support for the altcoin at $2, as this level continues to hold even through crashes. Thus, it has created the expectation that the bottom could be close for the XRP price, and this could serve as a bounce-off point.

XRP Price Consolidation Could Be Over Soon

Taking to X (formerly Twitter), crypto analyst Dark Defender revealed that the consolidation that the XRP Price has been stuck in for months now is coming to an end. The analyst used the monthly chart for the analysis, calling out an end and a bottom for the XRP price. According to him, this is actually the “Final Consolidation” for XRP, suggesting that this is where a breakout would start from.

Related Reading

With the consolidation expected to come to an end soon, the crypto analyst highlights what could be next for the altcoin using the 5-Wave analysis. Now, in total, these five waves are still very bullish for the price and could end up marking a new all-time high.

For the first wave, Dark Defender calls it the Impulsive Wave 1, which is expected to begin the uptrend. This first wave is expected to push the price back to $3 before the second wave starts, and this second wave is bearish.

The second wave would trigger a crash from $3 back toward $2.2, providing the setup for the third wave. Once the third wave begins, this is where the crypto analyst expects the XRP price to hit a new all-time high. The target for Wave 3 puts the XRP price as high as $5, clearing the 2017 all-time high of $3.8.

Next in line is the fourth wave, which is another bearish wave. This wave will cause at least a 30% crash, according to the chart shared by the crypto analyst, taking it back toward the $3 territory once again. However, just like the second bearish wave, the fourth bearish wave is expected to set up the price for a final and more explosive Wave 5.

Related Reading

Once the fifth wave is in action, a brand-new all-time high is expected to happen, with the price rising over 100% from the bottom of the fourth wave. The target for this, as shown in the chart, is over $6.

As for the crypto analyst, the major targets highlighted during this wave action are $3.75 and $58.85. Then, for major supports and resistances, supports are $1.88 and $1.63, while resistances lie at $2.22 and $2.30.

Featured image from Dall.E, chart from TradingView.com

Market

Despite an 18% Drop, XRP’s Exchange Supply Hits Lows—Bullish Setup Ahead?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP has been trading under pressure in recent weeks, losing much of the momentum it built during its late 2024 to early 2025 rally. After reaching highs above $3.40, the asset has experienced an 18.3% decline over the past month, reflecting broader market softness.

At the time of writing, XRP trades significantly below its peak at a price of $2.06, with subdued investor activity and falling market participation across both spot and derivatives markets.

Related Reading

XRP On-Chain Activity Slows, But Price Remains Relatively Stable

Amid XRP’s decline, a CryptoQuant analyst known as EgyHash has recently shared his analysis on the altcoin in a post titled, “XRP’s Market Paradox: With Ledger Activity Dipping 80%, Is a Rebound on the Horizon?”

According to EgyHash, XRP’s on-chain and futures market data presents a mixed picture—declining activity but resilience in price. EgyHash noted that XRP Ledger activity has fallen sharply since December, with the percentage of active addresses down by 80%.

Similar declines have been observed in the futures market, where open interest has dropped roughly 70% from its highs, and funding rates have occasionally turned negative.

He added that the Estimated Leverage Ratio, which gauges average user leverage by comparing open interest to coin reserves, has also dropped significantly.

Despite these indicators pointing to weakening momentum, the altcoin’s price has only declined about 35% from its peak. This is a milder correction compared to other assets such as Ethereum, which has fallen roughly 60% over the same period.

Additionally, the altcoin’s Exchange Reserve has continued to decline, reaching levels last observed in July 2023. Lower reserves typically suggest that fewer tokens are available for immediate sale, a factor that can help support prices during market downturns.

According to EgyHash, this trend, along with relatively stable pricing, could indicate growing long-term confidence in the asset.

Institutional Developments Could Strengthen Market Sentiment

While on-chain metrics remain a focus, institutional developments may also play a role in shaping XRP’s future trajectory. Hong Kong-based investment firm HashKey Capital recently announced the launch of the HashKey XRP Tracker Fund—the first XRP-focused investment vehicle in Asia.

Backed by Ripple as the anchor investor, the fund is expected to transition into an exchange-traded fund (ETF) in the future. The initiative is designed to attract more institutional capital into the XRP ecosystem.

HashKey Capital is launching Asia’s first XRP Tracker Fund—with @Ripple as an early investor.

This marks a major step in expanding institutional access to XRP, the third-largest token by market cap. 🧵👇

— HashKey Capital (@HashKey_Capital) April 18, 2025

HashKey Capital has also indicated that this collaboration with Ripple could lead to further projects, including tokenized investment products and decentralized finance (DeFi) solutions.

Related Reading

Vivien Wong, a partner at HashKey, emphasized the strategic value of integrating Ripple’s network with regulated investment infrastructure across Asia.

Although the altcoin faces near-term pressure, long-term developments, including decreasing exchange reserves and rising institutional interest, may support its recovery as the broader market stabilizes.

Featured image created with DALL-E, Chart from TradingView

-

Altcoin21 hours ago

Altcoin21 hours agoEthereum ETFs Record $32M Weekly Outflow; ETH Price Crash To $1.1K Imminent?

-

Market24 hours ago

Market24 hours ago100 Million Tokens Could Trigger Decline

-

Market14 hours ago

Market14 hours agoMEME Rallies 73%, BONE Follows

-

Market13 hours ago

Market13 hours agoPi Network Roadmap Frustrates Users Over Missing Timeline

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Price Stalls In Tight Range – Big Price Move Incoming?

-

Bitcoin18 hours ago

Bitcoin18 hours agoWhat Does This Mean for Altcoins?

-

Altcoin24 hours ago

Altcoin24 hours agoRipple CEO Brad Garlinghouse Drives XRP’s Global Expansion; Know How

-

Market22 hours ago

Market22 hours agoWhy Relying on TVL Could Mislead Your DeFi Strategy