Market

Justin Sun Invests $30 Million in Trump-Backed World Liberty Financial (WLFI)

Justin Sun, founder of Tron, has invested $30 million in World Liberty Financial (WLFI), a DeFi platform backed by Donald Trump.

Despite Trump’s endorsement, the platform had struggled to attract investors, selling far fewer WLFI tokens than initially projected. However, Sun’s investment could potentially boost the project.

A Much-Needed Boost for Trump’s World Liberty Financial (WLFI)?

World Liberty Financial launched in September 2024, offering decentralized borrowing and lending services. Governance of the platform is driven by the WLFI token. The token became available for sale exclusively to non-US investors and accredited US investors.

However, the token’s non-transferable nature and limited access contributed to slow sales. Before Sun’s investment, the project had just $21 million raised. This is far short of its $300 million target.

The Tron founder confirmed the transaction earlier today, on November 25. Blockchain data from Etherscan revealed that $30 million worth of WLFI tokens were purchased by Sun’s wallet associated with HTX (formerly Huobi).

“The US is becoming the blockchain hub, and Bitcoin owes it to @realDonaldTrump! TRON is committed to making America great again and leading innovation,” Justin Sun wrote on X (formerly Twitter).

The WLFI “gold paper” highlights that a portion of token sale proceeds will go to a company owned by Donald Trump.

However, this arrangement would only generate profits for Trump’s company after exceeding $30 million in sales—a milestone reached after Sun’s investment.

World Liberty Financial is led by a mix of Trump associates, cryptocurrency entrepreneurs, and financial experts. The platform is also supported by Donald Trump and his three sons, further tying its identity to the Trump brand.

We’re honored to have the support of @justinsuntron and @trondao! Together, we’re driving innovation, aligning on a vision for a stronger blockchain future, and contributing to the growing ecosystem. Exciting times ahead,” WLFI wrote on X (formerly Twitter).

Meanwhile, Justin Sun’s involvement in World Liberity Financial marks another unconventional move in his portfolio. Last week, he paid $6.2 million for the viral art piece Comedian—a banana duct-taped to a wall.

The purchase caused a ripple effect in crypto markets, driving up the price of the Banana Gun token by 16%. The token, however, doesn’t have any link to the art.

Earlier this year, Sun also moved his EIGEN tokens from the EigenLayer liquid restaking protocol to the HTX exchange. His bold investments continue to draw attention across both the art and cryptocurrency sectors.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Market

Strategic Move for Trump Family in Crypto

Energy infrastructure platform Hut 8 Corp has partnered with US President Donald Trump’s sons, Eric Trump and Donald Trump Jr., to launch American Bitcoin Corp.

The company is dedicated to industrial-scale Bitcoin mining and developing a strategic reserve.

All You Need to Know about American Bitcoin

American Bitcoin’s leadership team includes Mike Ho as executive chair, Matt Prusak as CEO, and Eric Trump as CSO. The Board of Directors comprises Mike Ho, Asher Genoot (also Hut 8 CEO), Justin Mateen, and Michael Broukhim.

According to the announcement, Hut 8 holds an 80% ownership stake in American Bitcoin. This follows the contribution of its ASIC miners to American Data Centers Inc., a company formed by investors including the Trump brothers.

Subsequently, they renamed and relaunched the entity as American Bitcoin. As a new subsidiary focused on industrial-scale Bitcoin mining, this move aims for an efficiency of 50+ EH/s (exahashes per second). Meanwhile, Hut 8 remains the key infrastructure partner, consolidating financials under its brand.

Eric Trump, co-founder and chief strategy officer of American Bitcoin, expressed enthusiasm about the collaboration. He also emphasized the synergy between Hut 8’s operational excellence and shared passion for decentralized finance (DeFi) as a foundation for significant future growth.

“…By combining Hut 8’s proven operational excellence in data centers with our shared passion for Bitcoin and decentralized finance, we are poised to strengthen our foundation and drive significant future growth,” an excerpt in the announcement read, citing Eric Trump.

Donald Trump Jr. highlighted their longstanding commitment to Bitcoin, noting their conviction in Bitcoin personally and through their businesses. He reiterated the opportunity presented by mining Bitcoin under favorable economics and the potential for investors to participate in Bitcoin’s growth through this new platform.

Similarly, Genoot described the launch of American Bitcoin as a pivotal evolution in their platform strategy. By establishing a standalone entity for mining operations, Hut 8 aims to align each business segment with its respective cost of capital. Specifically, they would create two focused yet complementary companies.

Meanwhile, this venture is part of the Trump family’s broader engagement in the crypto industry. World Liberty Financial, the crypto venture linked to the Trump family, recently launched USD1. US treasuries, dollars, and cash equivalents back the stablecoin. The venture aims to facilitate secure cross-border transactions for investors and institutions.

Furthermore, reports indicate that the Trump family is discussing acquiring a stake in Binance.US. This is the American arm of the world’s largest cryptocurrency exchange, Binance. Given the family’s growing involvement in the sector, such an investment could significantly influence the crypto market.

These initiatives reflect the Trump family’s commitment to positioning the US at the forefront of the crypto industry. It also aligns with President Donald Trump’s ambition to establish the US as a global leader in digital assets.

“While people are worrying about the daily price action, President Trump and Eric Trump are building the infrastructure to take crypto to the next level,” crypto investor Gordon noted.

BeInCrypto data shows BTC was trading for $82,199 as of this writing. It is down by over 1.13% in the last 24 hours, unmoved by news of American Bitcoin. However, this could change once US markets open.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Don’t Fall for These Common Crypto Scams

ZachXBT, a well-known blockchain investigator, recently shared two key “minimum checks” on Telegram to avoid crypto scams.

He emphasized that users must accept full financial responsibility if they take risks in these situations and added that recovering lost funds would be extremely difficult.

Evaluating a Project’s Credibility is Crucial

ZachXBT highlighted two critical scenarios: depositing funds into forked DeFi protocols on newly launched EVM chains and getting scammed by projects with few smart followers on Kaito.

“If you make either of these decisions, it is your own personal choice to risk funds, and I will NOT help you,” ZachXBT stressed.

Many newly launched DeFi protocols on EVM chains are replicas of existing ones. Their teams often do not create original code but instead, fork from established protocols. This process requires minimal technical skills yet introduces significant security risks.

A recent incident highlighted the risks in the DeFi space. The DeFi protocol SIR.trading was reportedly hacked, leading to an estimated loss of $350,000. Despite the project’s documentation promoting it as a “new DeFi protocol for safer leveraged trading,” it acknowledged the risks related to smart contract vulnerabilities.

This case illustrates how new DeFi protocols often become targets for hackers. Additionally, in late March, the DeFi lending protocol Abracadabra suffered a loss of approximately $13 million due to an exploit involving collateralized tokens.

The second situation ZachXBT warned about involves getting “rugged” (falling victim to a rug pull) by projects with few smart followers on Kaito. Kaito is an AI-powered analysis tool that measures real community interest. He advised that checking followers’ numbers and quality is a basic step to avoid falling for projects that use fake engagement or empty marketing hype.

Investor Xero agreed with ZachXBT, stating that Kaito can be a credibility assessment tool.

“Kaito has become an amazing security and reputation tool that I value over others. It can help you identify an impersonator or a new rug project fast. If a 40k+ follower project isn’t connecting with real smart followers, it’s not legit,” Investor Xero commented.

Other Emerging Crypto Scams

In addition to ZachXBT’s warnings, several new scam tactics have recently been flagged.

Investor Jerome warned about a scheme that exploits browsers’ automatic download function to trick users into downloading malicious software.

Another method involves scammers creating and sending small transactions. They would be often as little as 0.001 tokens—using fake wallet addresses that closely resemble legitimate ones. Their goal is to deceive users into copying and pasting the fraudulent address when making future transactions.

Additionally, Microsoft has identified StilachiRAT, a new remote access trojan specifically designed to target cryptocurrency wallets and login credentials.

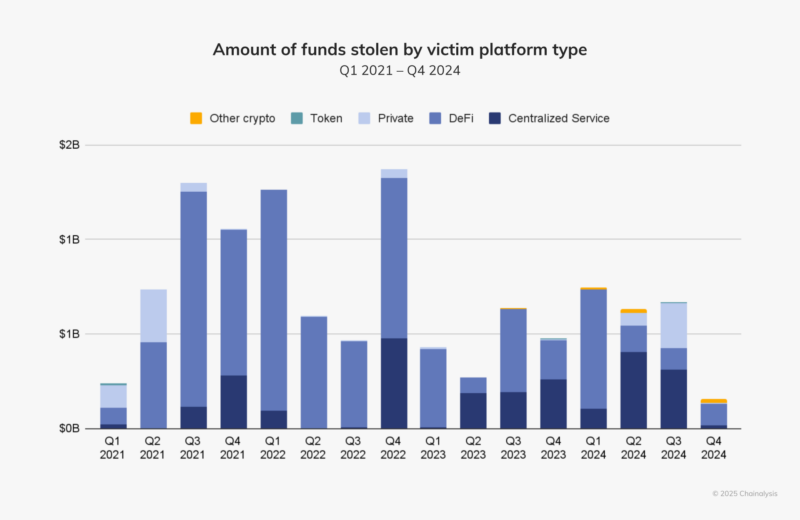

According to a Chainalysis report, from 2021 to 2024, decentralized finance (DeFi) platforms have been the primary targets of crypto hacks.

The report explains that DeFi platforms may be more vulnerable because developers prioritize rapid growth and launch over security measures. This lack of security focus makes them prime targets for hackers.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

This Is How Dogecoin Price Reacted To Elon Musk’s Comment

Dogecoin has faced a series of setbacks recently, including a failed breakout attempt that led to a decline in its price. This downward movement was further exacerbated by a recent comment from Elon Musk, which cast doubt on Dogecoin’s future.

However, despite these challenges, the altcoin is showing some signs of recovery, largely driven by long-term holders (LTHs) who accumulate more DOGE at current low prices.

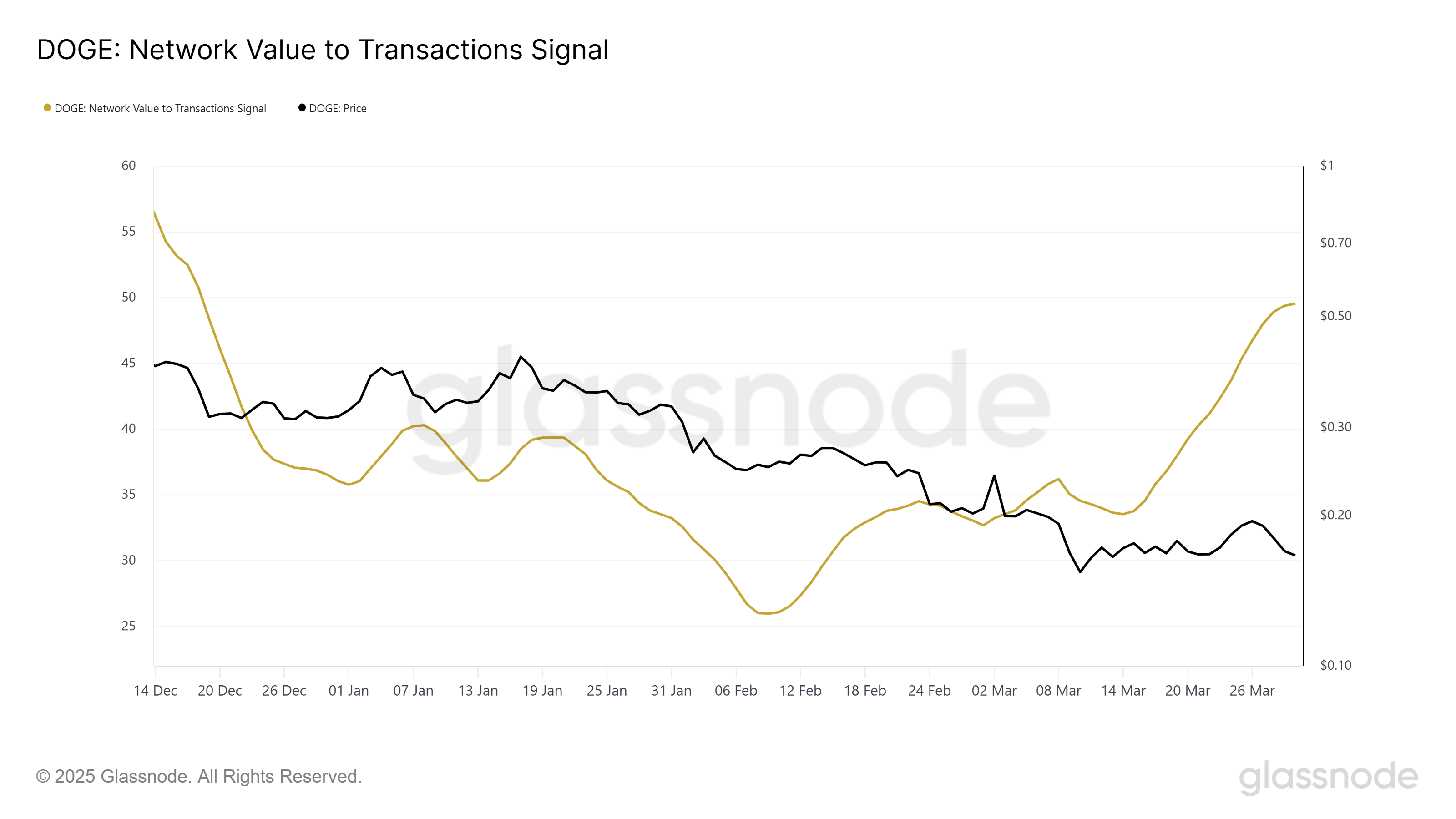

Dogecoin Is Facing Mixed Signals

Dogecoin’s Network Value to Transaction (NVT) ratio has spiked significantly, reaching a three-month high. This suggests that the network’s value does not match the number of transactions, pointing to a possible lack of investor confidence.

Elon Musk’s recent comment regarding DOGE further fueled the discourse surrounding the cryptocurrency. He clarified that the US government does not intend to use Dogecoin in any form, which led to some negative sentiment. This statement dampened expectations for the coin, although it hasn’t completely derailed its market standing.

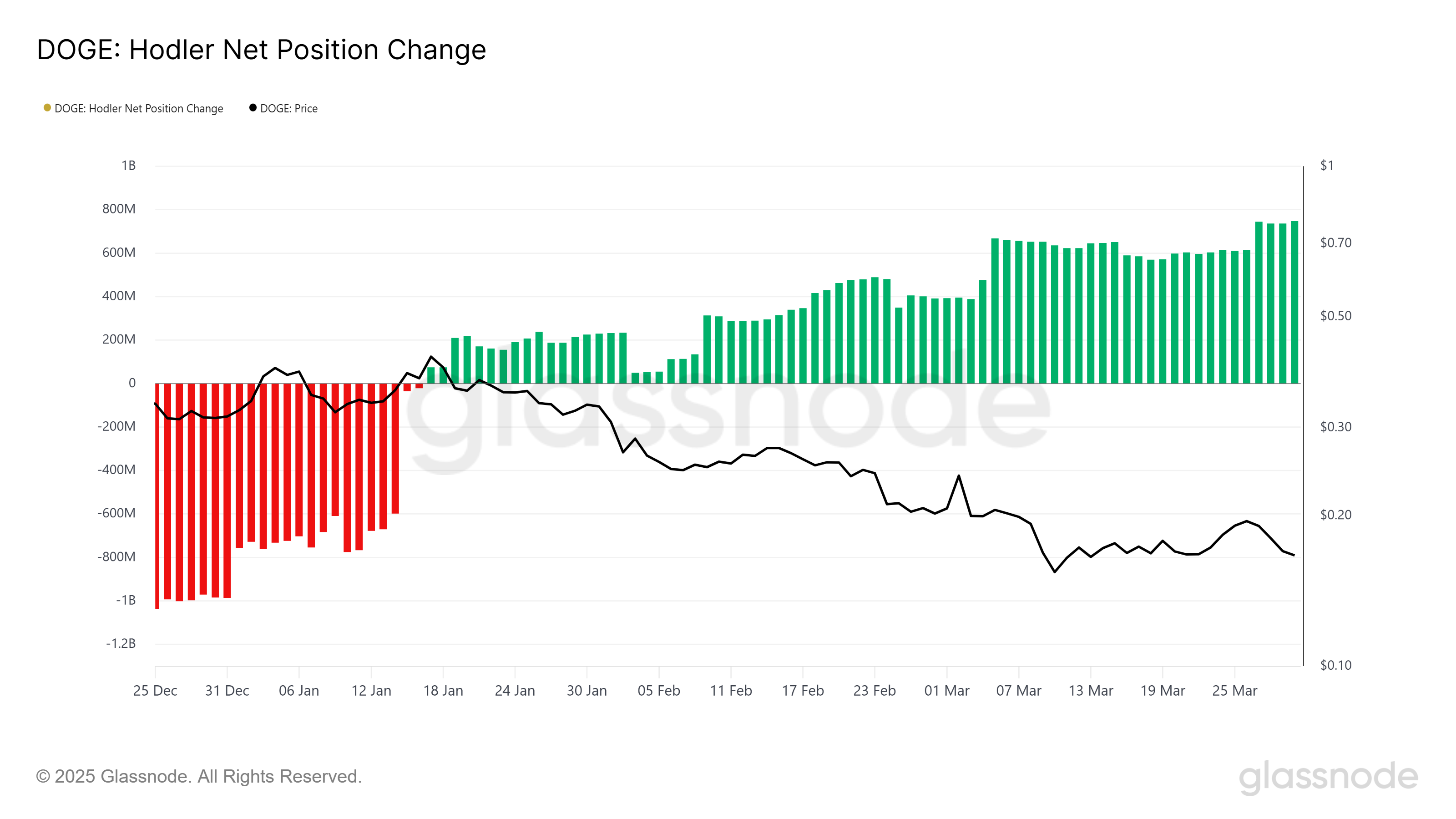

The macro momentum of Dogecoin shows signs of stabilizing, as evidenced by the recent spike in the HODLer Net Position Change. LTHs have been actively accumulating DOGE during the recent dip, which indicates strong conviction among these holders.

This accumulation provides a level of support, potentially helping the coin recover and preventing further price declines. The increased position change suggests that LTHs are confident in the long-term viability of Dogecoin despite recent market turbulence and Musk’s controversial comment.

This continued accumulation by LTHs could lead to a floor forming under Dogecoin’s price, providing a buffer against further bearish pressures. As the market stabilizes and sentiment shifts, these holders could become a driving force that will trigger the next upward movement.

DOGE Price Stumbles, But Can It Recover?

Dogecoin is currently trading at $0.163, with the price just below the support level of $0.164. Over the last five days, the coin has experienced a 16% decline following a failed attempt to break through the $0.198 resistance level. This failure to breach key resistance levels indicates that DOGE may not experience immediate price gains without external catalysts.

Given the current market conditions, it’s likely that Dogecoin will not experience significant declines in the near future. The coin may reclaim $0.164 as support and continue consolidating just below the $0.198 resistance. However, this consolidation could persist until stronger market cues emerge to push the price higher.

The only scenario in which this bullish-neutral outlook would be invalidated is if Musk’s comment causes further damage to DOGE’s price. In that case, the meme coin could dip to $0.147, extending its recent losses. A sustained downturn would signal more negative sentiment in the market and potentially halt Dogecoin’s recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Analyst Eyes $1,200-$1,300 Level As Potential Acquisition Zone – Details

-

Ethereum22 hours ago

Ethereum22 hours agoWhales Accumulate 470,000 Ethereum In One Week – Bullish Momentum Ahead?

-

Bitcoin23 hours ago

Bitcoin23 hours agoGold Keeps Outperforming Bitcoin Amid Trump’s Trade War Chaos

-

Market22 hours ago

Market22 hours ago3 Token Unlocks for April: Parcl, deBridge, Scroll

-

Regulation19 hours ago

Regulation19 hours agoJapan Set To Classify Cryptocurrencies As Financial Products, Here’s All

-

Market19 hours ago

Market19 hours agoTop 3 Made in USA Coins to Watch This Week

-

Market24 hours ago

Market24 hours agoBitcoin (BTC) Whales Accumulate as Market Faces Uncertainty

-

Altcoin23 hours ago

Altcoin23 hours agoAnalyst Reveals Why The XRP Price Can Hit ATH In The Next 90 To 120 Days