Market

It Leads AI Crypto Market with Bullish Momentum

FET is establishing itself as the dominant force in the AI cryptocurrency space, outperforming its competitors in both market cap and trading volume. With 75% of addresses in profit and a recent golden cross signaling strong bullish momentum, FET may be on the verge of a significant rally.

As it approaches key resistance levels, the potential for new all-time highs becomes increasingly possible.

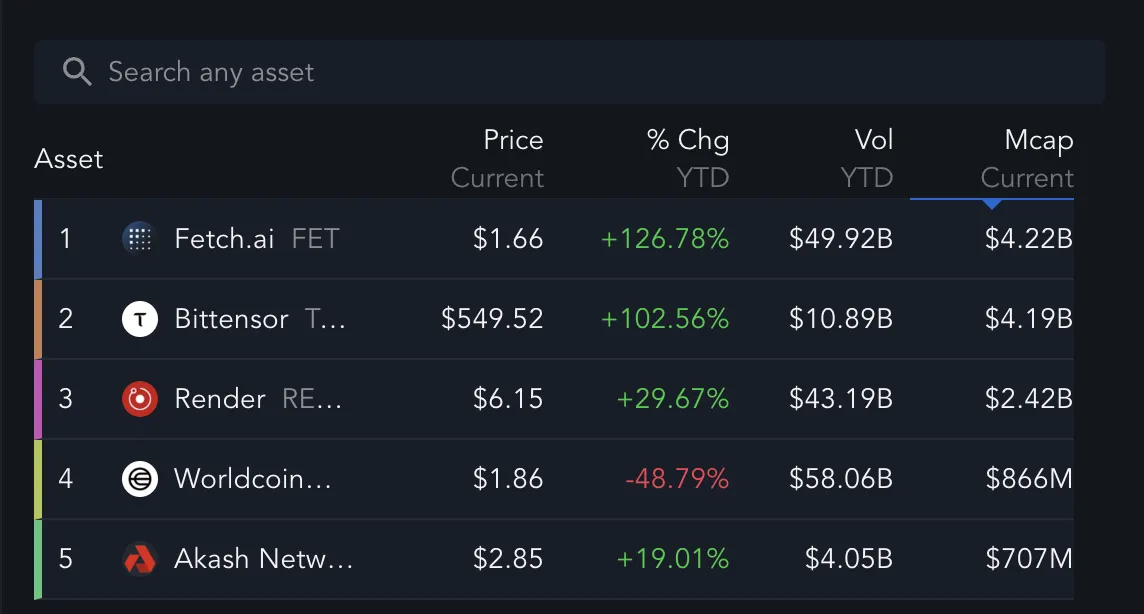

FET Is Outpacing Its AI Competitors

FET is positioning itself as the frontrunner in the artificial intelligence cryptocurrency sector, with several factors solidifying its dominance. At present, FET holds the largest market capitalization among AI-related coins, sitting at $4.22 billion.

While Bittensor follows closely behind with a market cap of $4.19 billion, FET lead becomes even more pronounced when comparing it to the rest of the field. Combined, Render, Worldcoin, and Akash Network don’t even match FET’s market cap.

In 2024, FET recorded an astonishing trading volume of $49.92 billion, which is more than 4.5x that of Bittensor, its closest competitor. This discrepancy in volume is crucial because it indicates the level of market interest and liquidity flowing through FET.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

Moreover, FET year-to-date (YTD) price surged by an impressive 126.78%, outpacing not only Bittensor, which posted a strong but comparatively lower 102.56%. Higher volume often reflects stronger demand and wider participation, all of which play into FET price favor.

Investors and traders are clearly gravitating toward FET, which could create a positive feedback loop where its liquidity, visibility, and relevance in the market only continue to grow. This could also establish FET as the leading AI coin in the market, making it even more dominant.

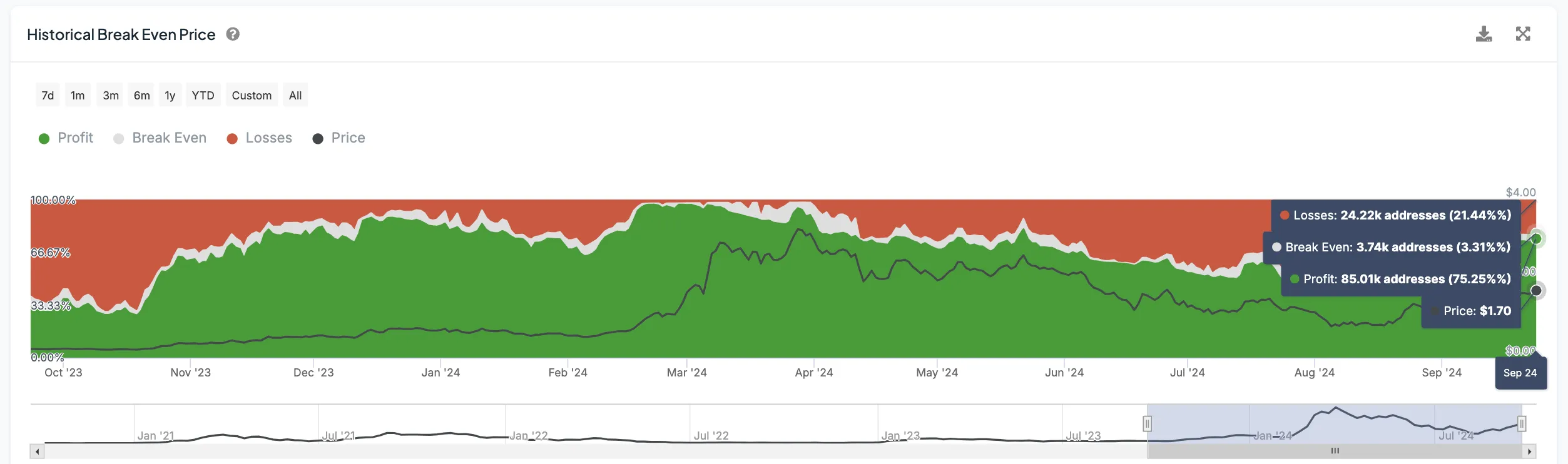

FET Profitable Addresses Could Drive a New Price Surge

At present, around 75.25% of all FET addresses are in profit, which means roughly 85,010 addresses are seeing gains at the current price of $1.70. Meanwhile, about 21.44%, or 24,220 addresses, are experiencing losses, and a small fraction, 3.31%, or 3,740 addresses, are at break-even.

This distribution suggests that the majority of FET holders are confident in the asset’s future, having already seen positive returns on their positions. When a large proportion of holders are in profit, it typically signals strong market sentiment and potential for further upward momentum as more investors are encouraged to enter the market.

Historically, a similar proportion of addresses in profit during an uptrend for FET led to an explosive price surge, where it skyrocketed by over 500% in just one month. This past performance suggests that when so many holders are already in profit, it creates conditions ripe for rapid price appreciation, particularly if demand continues to grow.

With the current percentage of addresses in profit, FET price could be setting up for another significant rally, drawing comparisons to previous bull runs in its price history.

FET Price Prediction: A New All-Time High Soon?

FET recently formed a golden cross, a bullish technical pattern where the shorter-term exponential moving average (EMA) crosses above the longer-term EMA. This pattern is often seen as a sign of building upward momentum, typically followed by further price appreciation. In FET’s case, the different EMA lines on the chart show a bullish alignment, with shorter-term EMAs positioned above longer-term ones.

EMAs are used to smooth out price data and identify trends more clearly. Unlike simple moving averages, EMAs give greater weight to recent price movements, making them more responsive. Traders commonly track multiple EMAs, such as the 20, 50, 100, and 200-day lines, to assess trend strength and direction. In FET’s case, these EMAs are showing a clear upward trajectory, reinforcing the bullish outlook.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

If this uptrend holds, FET could test key resistance levels at $1.86 and $2.28. A break above these levels would strengthen the bullish case, potentially leading to further resistance points at $2.70 and $3.48. Surpassing these could push FET toward a new all-time high, signaling a strong bullish move.

But if the uptrend weakens and FET’s price reverses, support levels at $1.24 and $1.00 could become critical. Should bearish sentiment continue, the price could fall further, potentially reaching $0.80. These key levels will determine whether FET can maintain its bullish momentum or if a deeper correction is on the horizon.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Wormhole (W) Jumps 10%—But Is a Pullback Coming?

Wormhole (W) surged nearly 12% on Thursday after the project unveiled its official product roadmap. The project’s one-year anniversary has sparked speculative interviews.

However, technical data shows buyers and sellers locked in a fierce battle, as momentum indicators suggest a weakening trend. The DMI, Ichimoku Cloud, and EMA structures all reflect market indecision, with no clear direction confirmed just yet.

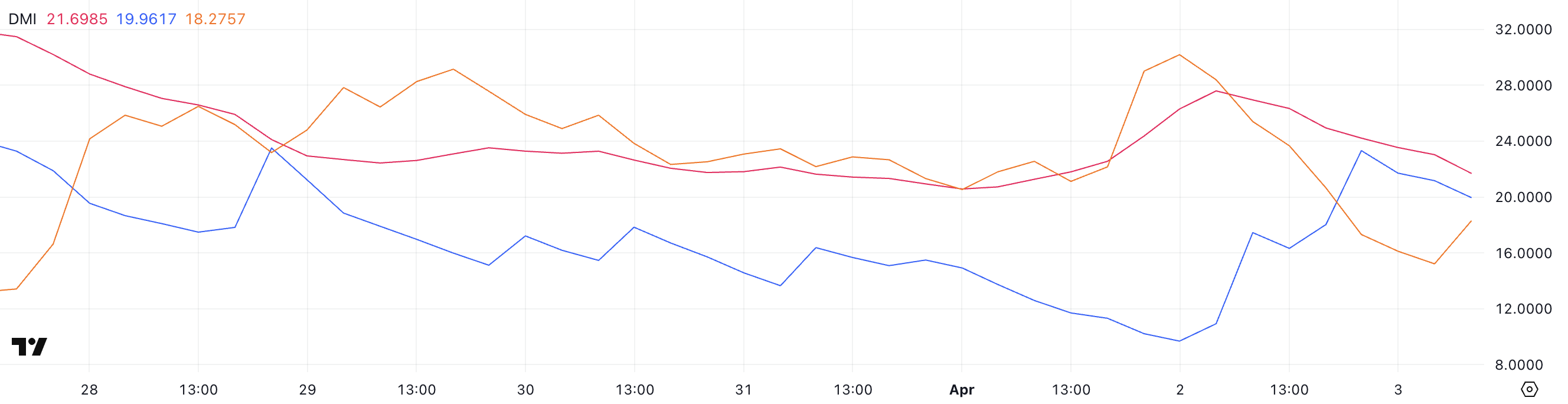

Wormhole DMI Chart Shows Market Indecision

Wormhole’s DMI chart shows its ADX (Average Directional Index) has dropped to 21.69 from 27.59 just a day earlier, signaling that the recent trend may be losing strength.

The ADX is a key indicator used to measure the strength—not the direction—of a trend. Generally, values below 20 suggest a weak or non-existent trend, while values above 25 indicate a strong trend.

With ADX now hovering near the threshold, it suggests that the bullish momentum seen in recent days could be fading.

Looking deeper, the +DI (Positive Directional Indicator) has fallen to 19.96 after peaking near 24 earlier, though it had surged from 9.68 the previous day.

Meanwhile, the -DI (Negative Directional Indicator) climbed to 18.27 after dropping to 15.21 earlier, following a sharp decline from 30.18 yesterday. This narrowing gap between +DI and -DI—combined with a weakening ADX—suggests uncertainty and potential indecision in price action.

With a $137.64 million token unlock on the horizon, this shift could hint at a cooling bullish impulse and the risk of renewed selling pressure if supply outweighs demand.

Ichimoku Cloud Shows Mixed Signals

Wormhole’s Ichimoku Cloud chart shows a mixed outlook. Price action is attempting to break through resistance but still faces notable headwinds.

The Tenkan-sen (blue line) has recently flattened and is closely aligned with the Kijun-sen (red line), signaling indecision or a potential pause in momentum.

Typically, when these lines are flat and close together, it indicates consolidation rather than a clear trend continuation or reversal.

Meanwhile, the Kumo (cloud) remains thick and red ahead, reflecting strong overhead resistance and a bearish long-term bias.

The price is hovering near the lower edge of the cloud but has yet to make a decisive move above it—suggesting that bullish momentum is tentative at best.

For a confirmed trend reversal, a clean break above the cloud with bullish crossovers would be needed. Until then, the chart points to a market still trying to find direction, especially ahead of a major token unlock event that could further impact sentiment and price action.

Will Wormhole Reclaim $0.10 In April?

Wormhole, which builds solutions around interoperable bridges, continues to see its EMA setup reflect a bearish structure. Short-term moving averages are still positioned below the longer-term ones, an indication that downward pressure remains dominant.

However, one of the short-term EMAs has started to curve upward, hinting at a possible shift in momentum as buyers begin to step in. This early uptick could signal the beginning of a trend reversal, though confirmation is still pending.

If bullish momentum gains traction, Wormhole may attempt to break the nearby resistance at $0.089. A successful breakout could open the door for a move toward higher resistance levels at $0.108 and even $0.136.

Conversely, failure to clear $0.089 could reinforce bearish control, pushing the price back to test support at $0.079.

A break below that level could expose W to further downside toward $0.076, $0.073, and potentially below $0.07—marking uncharted territory for the token.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ripple Shifts $1B in XRP Amid Growing Bearish Pressure

XRP is under pressure, down nearly 6% in the past 24 hours and teetering just above the $2 mark as bearish momentum builds. A $1.02 billion unlock from Ripple’s escrow has sparked fresh concerns about oversupply, with tokens moved to operational wallets possibly poised for distribution.

At the same time, network activity has collapsed 87% since mid-March and technical indicators like DMI and EMA lines suggest growing downside risk. With weakening trend strength and fading demand, XRP may struggle to hold key support levels unless a catalyst revives bullish sentiment.

Ripple Wallet Activity Sparks Fears

Onchain data shows that Ripple has unlocked 500 million XRP—worth around $1.02 billion—from its escrow account.

The tokens were moved from the “Ripple (27)” escrow address to two operational wallets, “Ripple (12)” and “Ripple (13),” potentially positioning them for distribution or sale.

While the escrow account still holds another 500 million XRP, the movement of such a large amount into accessible wallets often raises concerns about increased market supply. If Ripple sells a portion of these tokens, it could create short-term selling pressure on XRP’s price.

From a technical standpoint, XRP’s DMI chart is flashing bearish signals. The ADX, which measures trend strength, has sharply declined to 26.68 from 42.45 just two days ago, suggesting the recent trend is weakening.

Meanwhile, the +DI has dropped to 12.91, down from 22 yesterday—indicating a decline in bullish momentum. At the same time, the -DI has surged to 27.43 from 15.64, pointing to rising bearish pressure.

This shift in directional strength, combined with the large token unlock, suggests XRP may face further downside unless demand quickly absorbs the incoming supply.

XRP Network Activity Collapses 87%

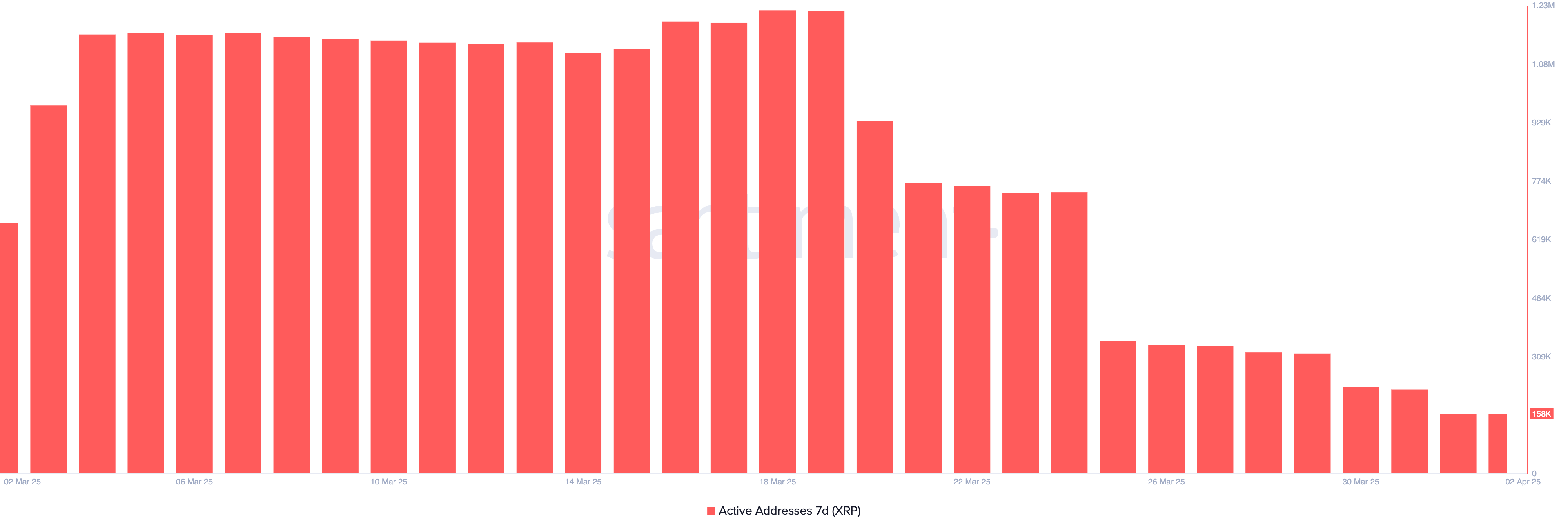

XRP’s network activity surged to record highs in March, with 7-day active addresses reaching an all-time peak of 1.22 million on March 18.

However, that momentum quickly faded, with the number now plummeting to just 158,000—an 87% drop in less than three weeks.

This dramatic reversal suggests that the recent spike in engagement may have been short-lived or event-driven rather than indicative of sustained adoption or growing user demand.

Tracking 7-day active addresses is a key on-chain metric, offering insight into how frequently a token’s network is being used. High activity can signal strong user interest and utility, often aligning with price support or rallies.

On the other hand, sharp declines in active addresses—like what XRP is now experiencing—can signal waning demand, decreasing network usage, and potential selling pressure.

With such a steep drop in activity, XRP’s price may struggle to find an upside unless new catalysts reignite user engagement.

XRP Faces Strong Downtrend, But Eyes Rebound If Key Levels Break

XRP’s EMA structure clearly reflects a strong ongoing downtrend, with short-term moving averages positioned well below the long-term ones and a wide gap between them—signaling persistent bearish momentum.

Unless bulls step in soon, XRP price may be on track to test support around $1.90, a key level that has held in the past.

A break below it could expose the asset to further downside toward $1.77.

However, if XRP manages to reverse the current trend and regain upward momentum, it could climb to challenge resistance at $2.06.

A successful breakout above that level might pave the way for a continued rally toward $2.22.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Battle Between Bulls And Bears Hinges On $1.97 – What To Expect

The crypto market watches with bated breath as XRP teeters at $1.97, a battleground where bullish conviction clashes with bearish determination. After a retreat from recent highs, the digital asset now faces a critical test.

The current standoff mirrors the broader tug-of-war in crypto markets, where sentiment shifts rapidly and key price levels dictate the next major move. For XRP, $1.97 isn’t just another number; it’s a line in the sand. A decisive hold here could reignite upward momentum, while a breakdown may embolden the bears.

Market Sentiment: Fear, Greed, Or Indecision?

According to Grumlin Mystery, a well-known crypto analyst, XRP is likely to experience a further downside in the near future, potentially dropping to $1.96. In his March 30th post on X, he highlighted that a decrease in liquidity within the crypto market is playing a crucial role in weakening XRP’s price stability, driven by the impact of US tariffs and the implementation of Trump’s policy changes.

Grumlin pointed out that restrictive trade policies and economic uncertainty have led to a slowdown in capital flow into riskier assets like cryptocurrencies. With reduced liquidity, market participants have less buying power, making it easier for bears to push prices lower. He warned that if these economic conditions persist, XRP could struggle to find strong support, and a drop below $1.96 could trigger further declines.

This drying up of liquidity has allowed sellers to gain the upper hand, exerting downward pressure on prices. As a result, XRP’s ability to hold support at $1.96 remains uncertain, and unless market conditions improve, a deeper correction could be on the horizon.

Grumlin Mystery further elaborated that a sharp change in Trump’s rhetoric regarding tariffs remains highly unpredictable, making it difficult to gauge its full impact on the financial markets, including cryptocurrencies. While many initially believed that Trump’s stance would be a major positive catalyst for the crypto market, the reality appears to be more complex.

The analyst emphasized that market uncertainty is increasing as traders struggle to anticipate the next move in U.S. economic policy. If Trump maintains or intensifies his tariff approach, it could further tighten liquidity conditions, making it even harder for XRP to sustain bullish momentum.

Possible Scenarios For XRP

If buyers successfully defend the $1.96 level, XRP could see renewed upside momentum. A bounce from this support zone might trigger a rally toward $2.64, where the next resistance lies. A breakout above this level raises the potential to $2.92 or even $3.4, confirming a bullish recovery. Increased trading volume and improving market sentiment would be key indicators of this scenario playing out.

Sellers’ failure to maintain control and XRP’s failure to hold above $1.96 may cause a sharper decline. In this case, the next critical support levels to watch would be $1.70 and $1.34. Breaking below these levels could expose the asset to more losses to $0.93 or lower.

-

Altcoin23 hours ago

Altcoin23 hours agoFirst Digital Trust Denies Justin Sun’s Allegations, Claims Full Solvency

-

Altcoin19 hours ago

Altcoin19 hours agoBinance Sidelines Pi Network Again In Vote To List Initiative, Here’s All

-

Market16 hours ago

Market16 hours agoXRP Price Under Pressure—New Lows Signal More Trouble Ahead

-

Altcoin16 hours ago

Altcoin16 hours agoAnalyst Forecasts 250% Dogecoin Price Rally If This Level Holds

-

Market15 hours ago

Market15 hours agoCardano (ADA) Downtrend Deepens—Is a Rebound Possible?

-

Market7 hours ago

Market7 hours agoBitcoin’s Future After Trump Tariffs

-

Ethereum10 hours ago

Ethereum10 hours agoEthereum Trading In ‘No Man’s Land’, Breakout A ‘Matter Of Time’?

-

Market14 hours ago

Market14 hours agoEthereum Price Recovery Stalls—Bears Keep Price Below $2K