Market

Is There More Room for Gains?

Dogecoin (DOGE) price is up 10% in the last 24 hours, catching the eye of traders with increased activity. The recent surge in trading volume and trend indicators like ADX reflect growing interest in the market. This bullish momentum is further supported by the positioning of DOGE’s EMA lines, pointing to a potential continuation of the uptrend.

If this strength holds, DOGE could soon test key resistance levels, with room for further gains. However, a reversal could lead to a retest of support zones, making it an important time to watch for trend changes.

DOGE Daily Volume Recently Crossed $ 2 Billion

DOGE’s daily trading volume recently spiked to $2.27 billion, the highest since August 5. It has since settled slightly, now sitting at $2.12 billion. Such a surge in volume indicates heightened activity, drawing the attention of traders and investors alike.

This uptick in volume can signal potential shifts in the market trend, making it a key metric for assessing buying or selling pressure.

Tracking trading volume is crucial because it provides insight into the strength behind price movements. The recent surge in DOGE’s volume appears to correlate with its price increase, from $0.10 to $0.134 between October 10 and October 18.

Higher trading volumes often indicate a stronger market conviction, and in this case, it suggests that the price rise has significant backing. The increase in activity supports the notion that investors have confidence in the current trend, potentially pushing DOGE towards further gains.

Read more: How To Buy Dogecoin (DOGE) and Everything You Need To Know

Dogecoin’s Current Uptrend Is Strong

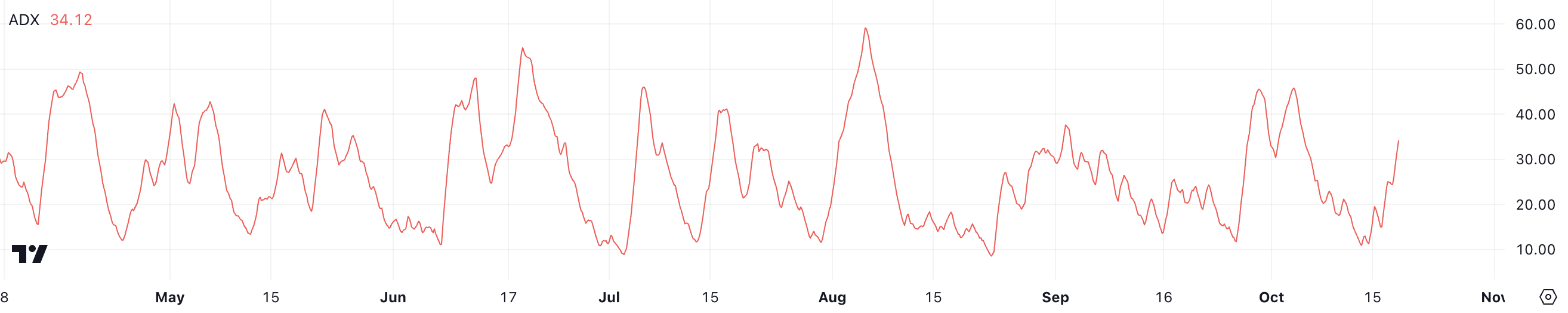

DOGE’s ADX currently sits at 34.12, climbing from just 13 just four days ago. This substantial increase indicates that DOGE’s market trend is gaining significant strength. The ADX, or Average Directional Index, helps measure the intensity of a trend, whether bullish or bearish, without considering its direction.

The sharp rise in DOGE’s ADX suggests that the market is experiencing a period of strong conviction, with the trend picking up substantial momentum. Such a rapid shift implies that investor sentiment has shifted notably, creating an environment ripe for further price action.

The ADX is a powerful tool for identifying the strength of trends. It ranges from 0 to 100, with values below 20 typically signaling a weak or non-existent trend, while values above 25 indicate a well-defined and strengthening trend.

DOGE’s current ADX value of 34 places it comfortably in the “strong trend” territory, signaling that recent price action is not just a brief spike but part of a sustained movement. Considering that DOGE’s price has already surged by 10% in the last 24 hours, the growing ADX adds credibility to the rally, suggesting that there is considerable momentum supporting the price action.

Although the current ADX is strong, it remains well below the levels seen during recent price spikes, such as between September 26 and September 28, when DOGE’s price surged by 30% and ADX reached almost 45. This suggests that there is still room for further strengthening and that the ADX could continue to rise if the uptrend persists.

If the current momentum continues, the ADX could easily climb higher, further validating the strength of the current trend and opening the door for more potential gains.

DOGE Price Prediction: Back To $0.17 In October?

DOGE’s EMA lines are currently in an uptrend, with the short-term EMAs positioned above the long-term EMAs and a considerable gap between them. This setup indicates a strong and healthy upward momentum.

Exponential Moving Averages (EMAs) are a type of moving average that gives more weight to recent price data, making them highly responsive to the latest market conditions.

They are used to identify trends, with shorter-term EMAs reacting quickly to price changes while longer-term EMAs move more gradually. When short-term EMAs are above the long-term ones, it typically signals an uptrend, suggesting that buyers have the upper hand and that momentum is building.

Read more: Dogecoin (DOGE) Price Prediction 2024/2025/2030

If DOGE’s current uptrend continues and strengthens, DOGE price could potentially test the $0.14 level and even challenge the resistance at $0.175—its highest price since May. This movement would represent a roughly 30% increase from current levels, showing the strength of the upward trend indicated by the EMA lines.

The significant distance between the short-term and long-term EMAs suggests that the bullish momentum has been building steadily, supporting the case for a continued push higher.

However, if the uptrend were to falter and reverse, DOGE would likely revisit key support zones at $0.12 and possibly even dip to $0.098, representing a potential 26% correction. The gap between the EMA lines would begin to narrow, signaling a weakening trend, and such a scenario could indicate a shift in market sentiment towards the bearish side.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Technical Analyst Warns Ripple’s XRP Price Could drop 50%

Veteran market analyst Peter Brandt has issued a gloomy year-end forecast for XRP, suggesting the asset may struggle to maintain its momentum despite recent gains.

On April 18, Brandt shared his updated analysis on X (formerly Twitter), projecting two possible scenarios for XRP’s market capitalization by year’s end.

Cautionary Outlook for XRP Despite Recent Surge

The first scenario places XRP’s market cap around $116.67 billion, while the second offers a more bearish outlook of just above $60 billion.

Essentially, both figures imply a decline from XRP’s current valuation of roughly $2.09 per token at a market capitalization of $121 billion.

Brandt’s analysis is based on a technical pattern he previously identified on XRP’s price chart.

According to him, the formation resembles a classic head-and-shoulders setup—a pattern that often signals a trend reversal. If this plays out, XRP could fall as low as $1.07.

He added then that a move below $1.90 would confirm the pattern and likely trigger a steep correction of more than 50%. However, a break above $3 could invalidate the bearish outlook.

“XRP is forming a textbook H&S pattern. So, we are now range bound. Above 3.000 I would not want to be short. Below 1.9 I would not want to own it,” Brandt explained.

This cautious forecast follows a remarkable surge in XRP’s price since late 2024.

Following Donald Trump’s return to the White House, the token rallied over 300%, reaching a high of $3.28 before pulling back to its current level.

This price performance has led many investors to believe that the Trump administration’s friendlier stance toward digital assets could help the asset continue its rally.

One major catalyst was the Securities and Exchange Commission’s (SEC) decision to drop several lawsuits against crypto companies, including Ripple.

That shift reduced regulatory uncertainty and sparked renewed interest in XRP, culminating in the launch of exchange-traded funds (ETFs) focused on the product.

Adding to the momentum, Ripple launched its own stablecoin, RLUSD, aiming to tap into a growing segment of the digital asset market.

Still, Brandt’s warning suggests that XRP’s recent rally may not be sustainable if bearish pressure intensifies.

Ripple Not Rushing Into IPO Despite Industry Trend

Amid renewed attention on XRP’s performance, Ripple CEO Brad Garlinghouse has addressed growing speculation about the company going public.

In a recent video shared on X, Garlinghouse made it clear that Ripple does not plan to file for an IPO in 2025.

He emphasized that the company is not actively seeking external funding because it remains financially stable and is prioritizing product development and business expansion.

“Will we IPO in 2025? I think that’s a definitive no…We’ve said there’s no imminent plans to go public,” Garlinghouse stated.

While the company isn’t moving forward with an IPO this year, Garlinghouse didn’t completely close the door.

He noted that Ripple is evaluating whether going public would benefit the business in the long run. However, such a move isn’t a current priority.

“You have to ask yourself, okay, how does Ripple benefit from being a public company? And is it a high priority for us?” he said.

Moreover, Garlinghouse also hinted that the regulatory landscape—especially under new leadership at the SEC—could influence Ripple’s future decisions.

His comments come as several crypto firms, including Kraken and Ciecle, reportedly prepare for IPOs. For now, though, Ripple appears comfortable staying private until conditions become more favorable.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SUI Ranks 5th in DEX Volume, But Rally Lacks Strength

SUI blockchain has been gaining traction in recent weeks, and its market cap is now approaching $7 billion. Fueled by meme coin activity and rising DeFi engagement, the network has seen a notable jump in DEX volume and technical momentum.

While indicators like RSI and EMA lines show early signs of a potential trend shift, overall strength remains mixed. SUI sits at a key crossroads—supported by short-term excitement but still needing stronger confirmation to challenge top-tier chains.

SUI Surges to 5th in DEX Volume, But Still Trails Top Chains

SUI’s recent surge in DEX activity has grabbed attention, largely fueled by growing interest in meme coins and speculative trading on its ecosystem. Over the past seven days, SUI’s DEX volume hit $2.1 billion, marking a 4.49% increase and continuing its steady upward trend.

This momentum has helped SUI outperform other ecosystems, most notably surpassing Arbitrum in the past 24 hours to become the fifth-largest chain by DEX volume.

However, despite the short-term gains, SUI still trails well behind top-tier networks like Base, BNB Chain, Ethereum, and Solana in total DEX activity.

These established ecosystems continue to dominate in terms of liquidity, user base, and overall transaction volume.

While SUI’s rise is notable, especially given its relatively new position in the DeFi ecosystem, it will need to sustain this growth and diversify beyond meme coin hype to truly challenge the leading players.

For now, it remains an exciting underdog with momentum—but not yet a major contender.

SUI Momentum Rebuilds, But Trend Remains Weak

SUI’s RSI is now at 51.86, up from 35.22 just three days ago. This suggests buying pressure has returned after a short-term dip, helping stabilize price action.

The Relative Strength Index (RSI) measures momentum on a scale from 0 to 100. Readings above 70 are considered overbought, while those below 30 indicate oversold conditions.

Sitting near the midpoint, SUI’s RSI points to neutral momentum. It hasn’t crossed above 70 in almost a month, showing that bullish strength has remained limited.

Meanwhile, SUI’s DMI (Directional Movement Index) shows that its ADX is down to 9 from 14.79 just two days ago. The ADX measures trend strength, and anything below 20 signals a weak or nonexistent trend.

The +DI is at 15.83 while the -DI is at 13.15, meaning buyers have a slight edge—but the low ADX suggests that edge isn’t strong. There’s no clear trend dominating the market right now.

Together, the RSI and DMI suggest that SUI is in a consolidation phase. Buyers are showing some activity, but not enough to build a strong, sustained trend—at least for now.

EMA Setup Still Bearish, But SUI Bulls Show Signs of Life

SUI’s EMA lines are still showing a bearish setup, with short-term averages sitting below the long-term ones. However, the gap between them has narrowed, and a potential golden cross may be forming.

A golden cross occurs when a short-term EMA crosses above a long-term one, often seen as a bullish signal. If this plays out, SUI could gain momentum and push toward the $2.28 resistance level.

Breaking above that could open the path toward $2.41 and $2.54. If bullish momentum builds further, SUI blockchain could even test the $2.83 level—its highest since early March.

But if the market fails to hold current levels and selling pressure returns, a correction could begin. In that case, it might fall back to test the $2.02 support.

Losing that support could bring deeper downside, potentially pushing SUI toward $1.71. For now, price action is at a critical point, with both breakout and breakdown scenarios on the table.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

5 Crucial Red Flags Investors Missed

The collapse of the MANTRA (OM) token has left investors reeling, with many facing significant losses. As analysts comb through the causes of the collapse, many questions remain.

BeInCrypto consulted industry experts to identify five critical red flags behind MANTRA’s downfall and reveal strategies investors can adopt to steer clear of similar pitfalls in the future.

MANTRA (OM) Crash: What Investors Missed and How to Avoid Future Losses

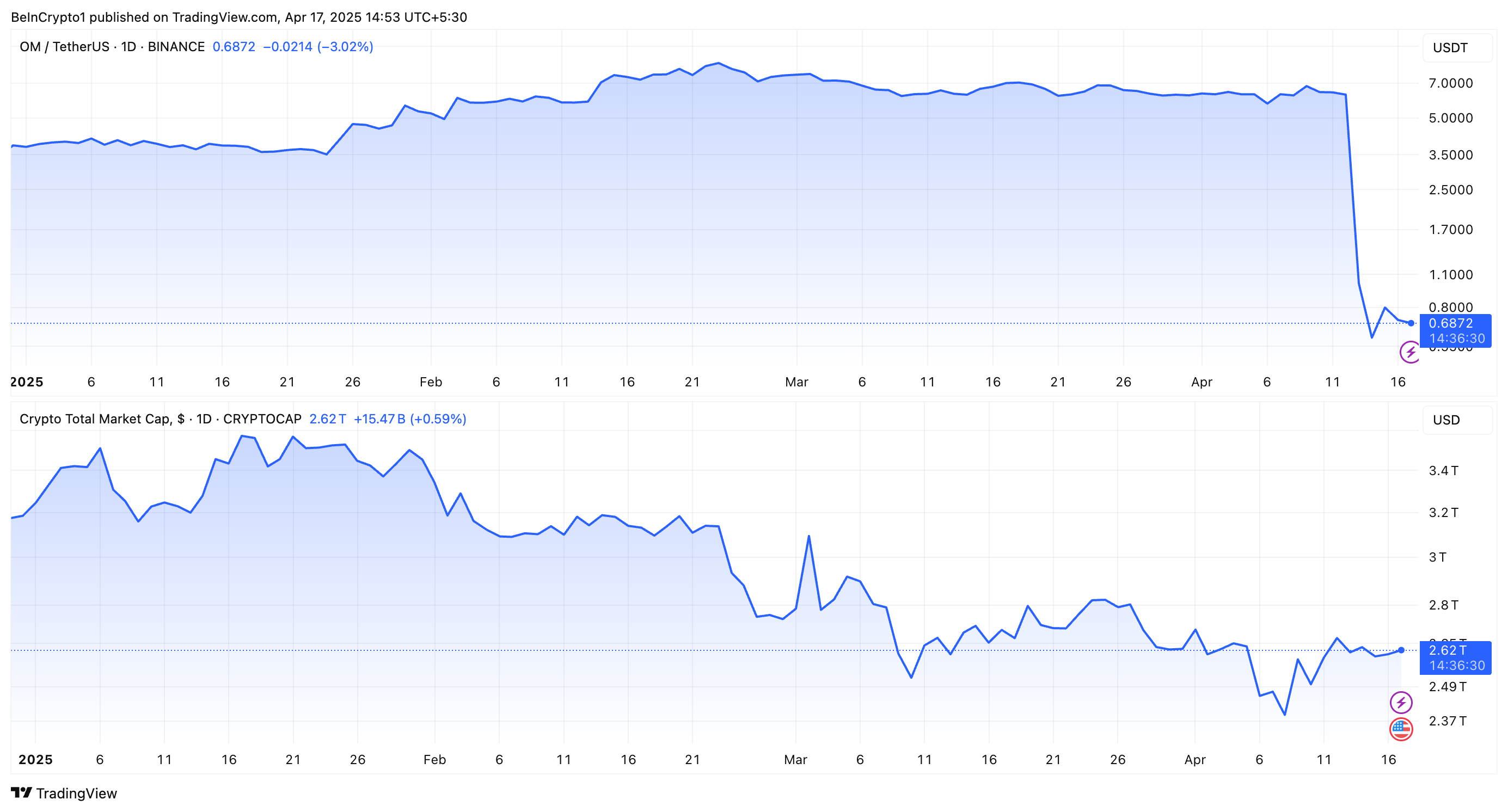

On April 13, BeInCrypto broke the news of OM’s 90% crash. The collapse raised several concerns, with investors accusing the team of orchestrating a pump-and-dump scheme. Experts believe that there were many early signs of trouble.

Yet, many overlooked the risks associated with the project.

1. MANTRA Red Flag: OM Tokenomics

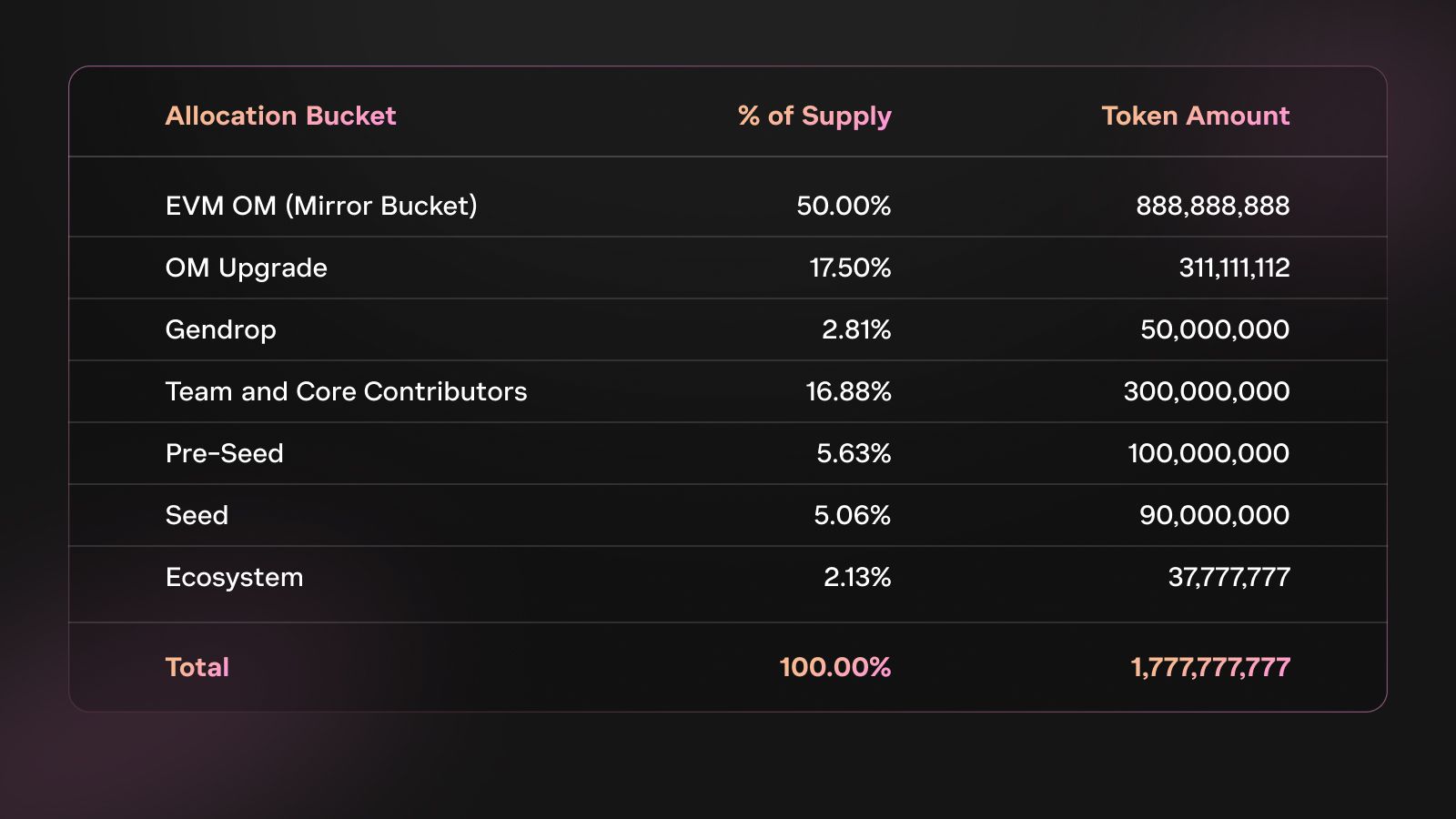

In 2024, the team changed OM’s tokenomics after a community vote in October. The token migrated from an ERC20 token to the native L1 staking coin for the MANTRA Chain.

In addition, the project adopted an inflationary tokenomic model with an uncapped supply, replacing the previous hard cap. As part of this transition, the total token supply was also increased to 1.7 billion.

However, the move wasn’t without drawbacks. According to Jean Rausis, co-founder of SMARDEX, tokenomics was a point of concern in the OM collapse.

“The project doubled its token supply to 1.77 billion in 2024 and shifted to an inflationary model, which diluted its original holders. Complex vesting favored insiders, while low circulating supply and massive FDV fueled hype and price manipulation,” Jean Rausis told BeInCrypto.

Moreover, the team’s control over the OM supply also raised centralization concerns. Experts believe this was also a factor that could have led to the alleged price manipulation.

“About 90% of OM tokens were held by the team, indicating a high level of centralization that could potentially lead to manipulation. The team also maintained control over governance, which undermined the project’s decentralized nature,” said Phil Fogel, co-founder of Cork.

Strategies to Protect Yourself

Phil Fogel acknowledged that a concentrated token supply isn’t always a red flag. However, it’s crucial for investors to know who holds large amounts, their lock-up terms, and whether their involvement aligns with the project’s decentralization goals.

Moreover, Ming Wu, the founder of RabbitX, also argued that analyzing this data is essential to uncover any potential risks that could undermine the project in the long term.

“Tools like bubble maps can help identify potential risks related to token distribution,” Wu advised.

2. OM Price Action

2025 has been marked as the year of significant market volatility. The broader macroeconomic pressures have weighed heavily on the market, with the majority of the coins experiencing steep losses. Yet, OM’s price action was relatively stable until the latest crash.

“The biggest red flag was simply the price action. The whole market was going down, and nobody cared about MANTRA, and yet its token price somehow kept pumping in unnatural patterns – pump, flat, pump, flat again,” Jean Rausis disclosed.

He added that this was a clear sign of a potential issue or problem with the project. Nevertheless, he noted that identifying the differentiating price action would require some technical analysis know-how. Thus, investors lacking the knowledge would have easily missed it.

Despite this, Rausis highlighted that even the untrained eye could find other signs that something was off, ultimately leading to the crash.

Strategies to Protect Yourself

While investors remained optimistic about OM’s resilience amid a market downturn, this ended up costing them millions. Eric He, LBank’s Community Angel Officer, and Risk Control Adviser emphasized the importance of proactive risk management to avoid OM-style collapses.

“First, diversification is key—spreading capital across projects limits single-token exposure. Stop-loss triggers (e.g., 10-20% below buy price) can automate damage control in volatile conditions,” Eric shared with BeInCrypto.

Ming Wu had a similar perspective, emphasizing the importance of avoiding over-allocation to a single token. The executive explained that a diversified investment strategy helps mitigate risk and enhances overall portfolio stability.

“Investors can use perpetual futures as a risk management tool to hedge against potential price declines in their holdings,” Wu remarked.

Meanwhile, Phil Fogel advised focusing on a token’s liquidity. Key factors include the float size, price sensitivity to sell orders, and who can significantly impact the market.

3. Project Fundamentals

Experts also highlighted major discrepancies in MANTRA’s TVL. Eric He pointed out a significant gap between the token’s fully diluted valuation (FDV) and the TVL. OM’s FDV reached $9.5 billion, while its TVL was only $13 million, indicating a potential overvaluation.

“A $9.5 billion valuation against $13 million TVL, screamed instability,” Forest Bai, co-founder of Foresight Ventures, stated.

Notably, several issues were also raised regarding the airdrop. Jean Rausis called the airdrop a “mess.” He cited many issues, including delays, frequent changes to eligibility rules, and the disqualification of half the participants. Meanwhile, suspected bots were not removed.

“The airdrop disproportionately favored insiders while excluding genuine supporters, reflecting a lack of fairness,” Phil Fogel reiterated.

The criticism expanded further as Fogel pointed out the team’s alleged associations with questionable entities and ties to questionable initial coin offerings (ICOs), raising doubts about the project’s credibility. Eric He also suggested that MANTRA was allegedly tied to gambling platforms in the past.

Strategies to Protect Yourself

Forest Bai underscored the importance of verifying the project team’s credentials, reviewing the project roadmap, and monitoring on-chain activity to ensure transparency. He also advised investors to assess community engagement and regulatory compliance to gauge the project’s long-term viability.

Ming Wu also stressed distinguishing between real growth and artificially inflated metrics.

“It’s important to differentiate real growth from activity that’s artificially inflated through incentives or airdrops, unsustainable tactics like ‘selling a dollar for 90 cents’ may generate short-term metrics but don’t reflect actual engagement,” Wu informed BeInCrypto.

Finally, Wu recommended researching the background of the project’s team members to uncover any history of fraudulent activity or involvement in questionable ventures. This would ensure that investors are well-informed before committing to any project.

4. Whale Movements

As BeInCrypto reported earlier, before the crash, a whale wallet reportedly associated with the MANTRA team deposited 3.9 million OM tokens into the OKX exchange. Experts highlighted that this wasn’t an isolated incident.

“Large OM transfers (43.6 million tokens, ~$227 million) to exchanges days prior were a major warning of potential sell-offs,” Forest Bai conveyed to BeInCrypto.

Ming Wu also explained that investors should pay close attention to such large transfers, which often act as warning signals. Moreover, analysts at CryptoQuant also outlined what investors should look out for.

“OM transfers into exchanges amounted to as much as $35 million in just an hour. This represented an alert sign as: Transfers into exchanges are below $8 million in a typical hour (excluding transfers into Binance, which are typically large given the size of the exchange). Transfers into exchanges represented more than a third of the total OM transferred, which indicates a high transfer volume into exchanges,” CryptoQuant informed BeInCrypto.

Strategies to Protect Yourself

CryptoQuant stated that investors need to monitor the flows of any token into exchanges, as it could indicate increasing price volatility in the near future.

Meanwhile, Risk Control Adviser Eric He outlined four strategies to stay up-to-date when it comes to large transfers.

- Chain Sleuthing: Tools like Arkham and Nansen allow investors to track large transfers and monitor wallet activity.

- Set Alerts: Platforms like Etherscan and Glassnode notify investors of unusual market movements.

- Track Exchange Flows: Users need to track large flows into centralized exchanges.

- Check Lockups: Dune Analytics helps investors determine if team tokens are being released earlier than expected.

He also recommended focusing on the market structure.

“OM’s crash proved market depth is non-negotiable: Kaiko data showed 1% order book depth collapsed 74% before the fall. Always check liquidity metrics on platforms like Kaiko; if 1% depth is below $500,000, that’s a red flag,” Eric revealed to BeInCrypto.

Additionally, Phil Fogel underlined the importance of monitoring platforms like X (formerly Twitter) for any rumors or discussions about possible dumps. He stressed the need to analyze liquidity to assess whether a token can handle sell pressure without causing a significant price drop.

5. Centralized Exchange Involvement

After the crash, MANTRA CEO JP Mullin was quick to blame centralized exchanges (CEXs). He said the crash was triggered by “reckless forced closures” during low-liquidity hours, alleging negligence or intentional positioning. Yet Binance pointed to cross-exchange liquidations.

Interestingly, experts were slightly divided on how CEXs contributed to OM’s crash. Forest Bai claimed that CEX liquidations during low-liquidity hours worsened the crash by triggering cascading sell-offs. Eric He corroborated this sentiment.

“CEX liquidations played a major role in the OM crash, acting as an accelerant. With thin liquidity—1% depth falling from $600,000 to $147,000—forced closures triggered cascading liquidations. Over $74.7 million was wiped in 24 hours,” he mentioned.

Yet, Ming Wu called Mullin’s explanation “just an excuse.”

“Analyzing the open interest in the OM derivatives market reveals that it was less than 0.1% of OM’s market capitalization. However, what’s particularly interesting is that during the market collapse, open interest in OM derivatives actually increased by 90%,” Wu expressed to BeInCrypto.

According to the executive, this challenges the idea that liquidations or forced closures caused the price drop. Instead, it indicates that traders and investors increased their short positions as the price fell.

Strategies to Protect Yourself

While the involvement of CEXs remains debatable, the experts did address the key point of investor protection.

“Investors can limit leverage to avoid forced liquidations, choose platforms with transparent risk policies, monitor open interest for liquidation risks, and hold tokens in self-custody wallets to reduce CEX exposure,” Forest Bai recommended.

Eric He also advised that investors should mitigate risks by adjusting leverage dynamically based on volatility. If tools like ATR or Bollinger Bands signal turbulence, exposure should be reduced.

He also recommended avoiding trading during low-liquidity periods, such as midnight UTC, when slippage risks are highest.

The MANTRA (OM) collapse is a powerful reminder of the importance of due diligence and risk management in cryptocurrency investments. Investors can minimize the risk of falling into similar traps by carefully assessing tokenomics, monitoring on-chain data, and diversifying investments.

With expert insights, these strategies will help guide investors toward smarter, more secure decisions in the crypto market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market20 hours ago

Market20 hours agoCardano (ADA) Moves Sideways, But Bullish Shift May Be Brewing

-

Altcoin16 hours ago

Altcoin16 hours agoAnalyst Reveals Dogecoin Price Can Reach New ATH In 55 Days If This Happens

-

Market23 hours ago

Market23 hours agoXRP Consolidation About To Reach A Bottom, Wave 5 Says $5.85 Is Coming

-

Altcoin19 hours ago

Altcoin19 hours agoPi Coin Price Soars As Pi Network Reveals Massive Community Reward Plans.

-

Altcoin11 hours ago

Altcoin11 hours agoCardano Bulls Secure Most Important Signal To Drive Price Rally

-

Market16 hours ago

Market16 hours agoBinance Mandates KYC Re-Verification For India Users

-

Market22 hours ago

Market22 hours agoCanary Capital Aims to Launch TRON-Focused ETF

-

Altcoin20 hours ago

Altcoin20 hours agoXRP ETF Approval Could Spark a ‘Perfect Storm’ for Ripple Coin: Expert