Market

Is a Bull Rally Near?

Cardano’s ADA price is above $0.42 but struggles to secure $0.500 as support. This crucial psychological level could act as a recovery rally trigger.

With the changing market conditions, it seems likely that ADA could note a surge after overcoming this barrier.

Cardano Holders Should Take Note

Cardano’s price has tended to react to investors’ actions, which places ADA in a good spot. This is because not only is the altcoin primed for a rally, but investors can also take profits.

This is derived from the Market Value to Realized Value (MVRV) ratio. This metric assesses investor profit or loss.

Cardano’s 30-day MVRV sits at -10.24 %, signaling losses and potentially prompting accumulation. Historically, ADA recovery occurs within the -7% and -17% MVRV range, labeling it an accumulation opportunity zone.

The broader market cues are also supporting a bullish outcome. For instance, the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are both positive at the moment. RSI is currently above the neutral line at 50.0, sitting in the bullish zone, while MACD is sustaining its bullish crossover.

RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. MACD, on the other hand, identifies momentum trends by comparing short and long-term moving averages.

Combining this with the potential accumulation at the hands of ADA investors, a rally could occur.

Read More: How To Buy Cardano (ADA) and Everything You Need To Know

ADA Price Prediction: Reclaim $0.500

Cardano’s price trading at $0.462 is just under the resistance of $0.468 after bouncing off the support at $0.428.

To secure the ADA rally, the $0.518 barrier would need to be flipped into support. This could help Cardano’s price escape the three-week-long consolidation and continue its rise to $0.600, marking a 25% rally.

Read More: Cardano (ADA) Price Prediction 2024 / 2025 / 2030

On the other hand, if the breach fails, Cardano’s price could likely remain consolidating. However, if the support of $0.420 is lost, the bullish thesis would be invalidated. This would leave ADA vulnerable to a fall to $0.400.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BNB Breaks Below $605 As Bullish Momentum Fades – What’s Next?

The crypto market just got a shock as BNB plunged below the crucial $605 support level, sending ripples of concern across trading circles. This sudden breakdown comes after weeks of bullish dominance, leaving investors scrambling to answer one critical question: Is this a temporary dip or the start of a major trend reversal?

With weakening momentum and key technical indicators flashing red, BNB charts are telling a worrisome story. The once-steady uptrend now faces its toughest test as the token struggles to maintain its footing in a suddenly bearish market.

Bearish Pressure Builds: Are BNB Sellers Gaining Control?

BNB’s price is facing growing bearish pressure after slipping below the crucial $605 level, signaling a potential shift in market momentum. The failed attempt to hold this key support has allowed sellers to take control, pushing BNB lower and raising concerns about a prolonged decline.

Technical indicators further confirm the increasing strength of sellers. The MACD has turned negative, indicating a loss of upward momentum, while the RSI is trending downward, suggesting that buying pressure is weakening. Additionally, trading volume remains low on attempted rebounds, highlighting a lack of conviction from bulls.

If sellers maintain their grip, BNB could extend its decline toward the next major support zone around $531, which previously served as a short-term bounce level during past corrections. A break below this zone would solidify bearish dominance and cause a deeper decline to $500.

Below $500, the next key level to watch is $454, representing a technical support area. Pushing below this level may trigger an extended sell-off, driving BNB toward other key support levels where traders may look for signs of reversal.

What Needs To Happen For A Rebound

For BNB to stage a meaningful recovery after breaking below $605, the bulls must reclaim key levels and generate strong buying momentum. Its first crucial step is stabilizing above $530, a short-term support zone that could provide the foundation for a reversal. Holding this level would signal that buyers are stepping in, preventing more declines.

A sustained move back above $605 would be the next major confirmation of a recovery. Reclaiming this level as support might shift market sentiment in favor of the bulls and trigger renewed buying interest. Additionally, the Relative Strength Index (RSI) needs to rebound from oversold conditions, while the MACD crossover into bullish territory would reinforce an upside move.

For a stronger bullish outlook, BNB would need to push past $680, a level that previously acted as resistance. Breaking above this zone with increasing volume could confirm a trend reversal toward $724 and $795, marking a full recovery from recent losses.

Market

Pi Network Struggles, On Track for New All-Time Low

Pi Network continues to struggle in the market as its price remains on a downward trajectory. Despite earlier optimism, investors have been increasingly skeptical of the coin, contributing to a prolonged downtrend.

The uncertainty around its value suggests Pi Network may be headed for a new all-time low (ATL).

Pi Network Witnesses Outflows

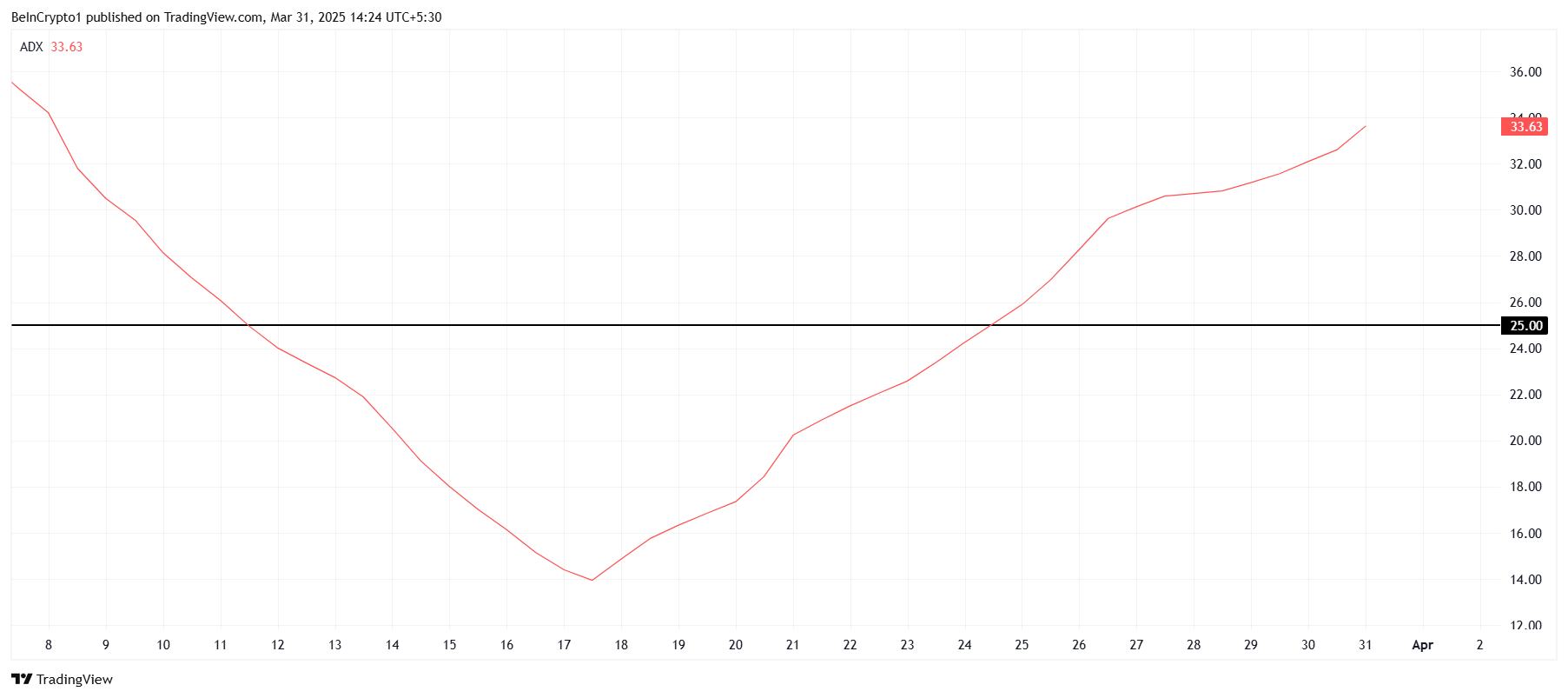

The ADX (Average Directional Index) has recently crossed the 25.0 threshold, indicating that the current bearish trend is gaining momentum. This is a concerning signal for Pi Network’s price, as the rising bearishness suggests that it will be increasingly difficult for the cryptocurrency to recover in the short term. With the ADX pointing towards sustained negative market forces, the pressure on Pi Network’s price will likely intensify as the token nears its previous ATL.

The growing strength of the bearish trend is compounded by investor uncertainty, with many questioning the token’s long-term viability. This uncertainty can lead to further selling and a lack of fresh buying support, making it even harder for Pi Network to find a solid foundation for recovery.

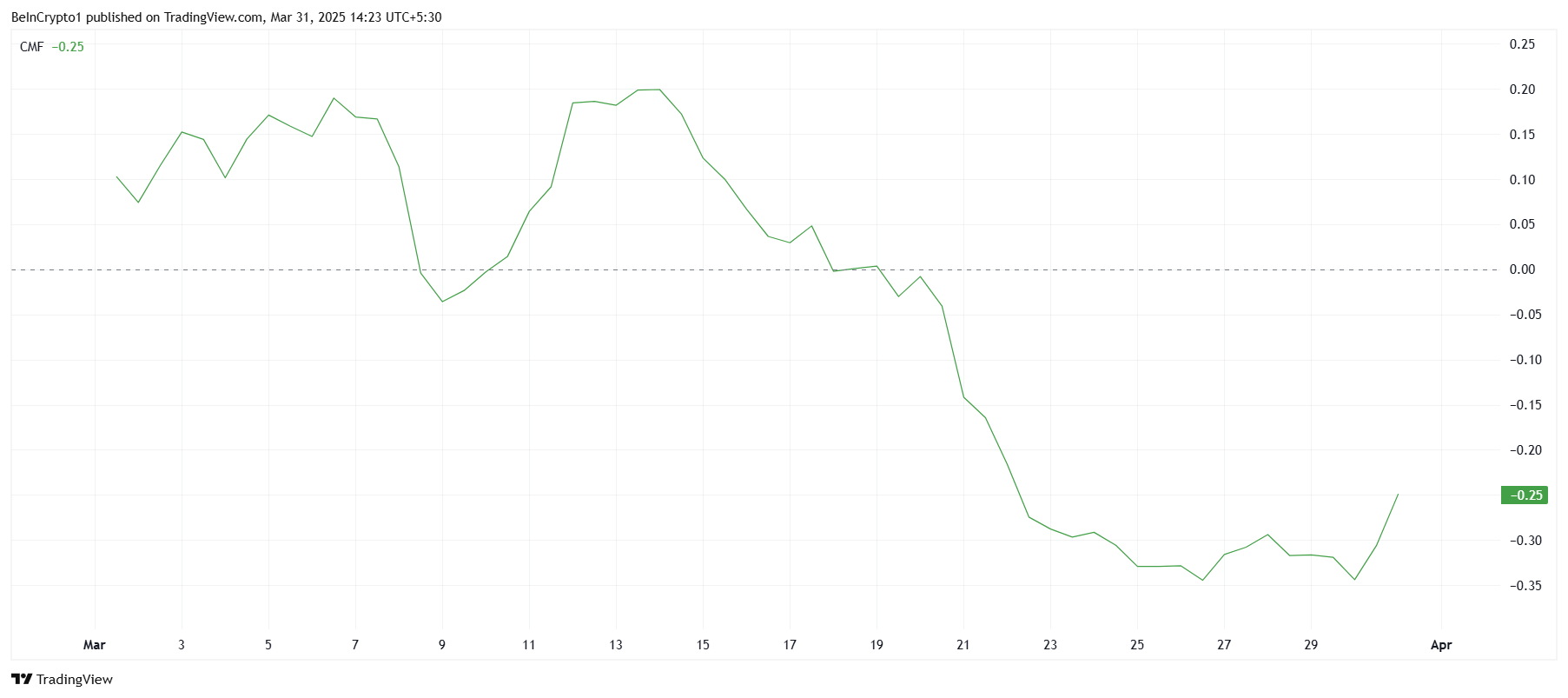

Pi Network’s macro momentum also paints a grim picture for the altcoin. The Chaikin Money Flow (CMF) indicator, which measures the volume of money flowing into and out of a coin, has been deeply negative. Although there has been a slight uptick, the indicator remains in the negative zone, signaling that investors are still reluctant to buy into the token.

The slight increase in CMF reflects minor capital inflows, but this could be short-lived if the skepticism persists. With investors hesitating and outflows continuing, Pi Network’s price faces significant challenges. The current trend suggests that more outflows could occur if the coin reaches a new ATL.

PI Price Nears New Low

Pi Network is currently trading at $0.70, just above its ATL of $0.62. The altcoin saw a 12.8% decline over the past 24 hours after failing to reclaim $0.87 as support. This failure to regain previous support levels shows the continued lack of investor confidence.

If the bearish trend persists, Pi Network is likely to fall through the $0.62 support level, potentially dropping to $0.50. A new ATL could be set as the market sentiment continues to weigh heavily on the price, leading to further losses for existing investors.

The only way to reverse the bearish outlook is for investors to change their approach and capitalize on low prices. Increased inflows could potentially drive Pi Network’s price back above $0.87, and if it surpasses the $1.00 level, it would reclaim critical support and signal a possible recovery for the altcoin.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Mining Faces Tariff Challenges as Hashrate Hits New ATH

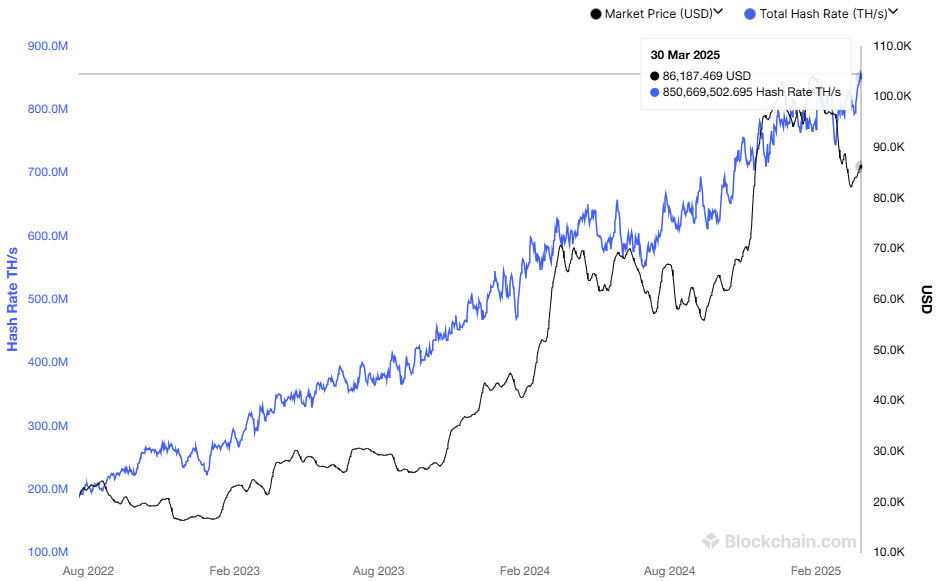

The Bitcoin mining industry is becoming increasingly competitive as the network’s hashrate reaches an all-time high (ATH). At the end of March 2025, Bitcoin’s hashrate hit 850 million TH/s.

However, alongside this impressive growth, the industry is struggling with rising production costs and new tariff barriers, particularly in the US. These factors are putting significant pressure on mining companies and could reshape the sector’s future.

Hashrate Surges, Mining Costs Soar

Bitcoin’s hashrate measures the total computing power used by miners to secure the network and validate transactions. It is expressed in terahashes per second (TH/s), representing the number of hash calculations the network performs every second.

According to Blockchain.com, Bitcoin’s hashrate surpassed 850 million TH/s in March. This increase reflects a rise in miners joining the network and growing confidence in Bitcoin’s value and security.

“Each time the network gets stronger, Bitcoin becomes harder to attack, harder to ignore, and more justified in commanding a higher valuation. This isn’t just code. It’s economic gravity. Bitcoin has become the most secure monetary network humanity has ever seen. And it’s only getting stronger.” — Thomas Jeegers, CFO & COO of Relai commented.

Despite this surge in hashrate, mining profits are not rising accordingly. According to a report from Macromicro, the cost of mining one Bitcoin has doubled since early 2024, now reaching $87,000. The main drivers behind this increase are rising electricity prices and the high operational costs of specialized mining hardware (ASICs).

With Bitcoin’s price fluctuating, many mining companies risk operating at a loss unless they optimize their efficiency. This challenge is particularly severe for smaller miners, who lack the scale advantages or access to cheap electricity that larger firms enjoy.

Tariff Challenges and Dependence on Chinese Hardware

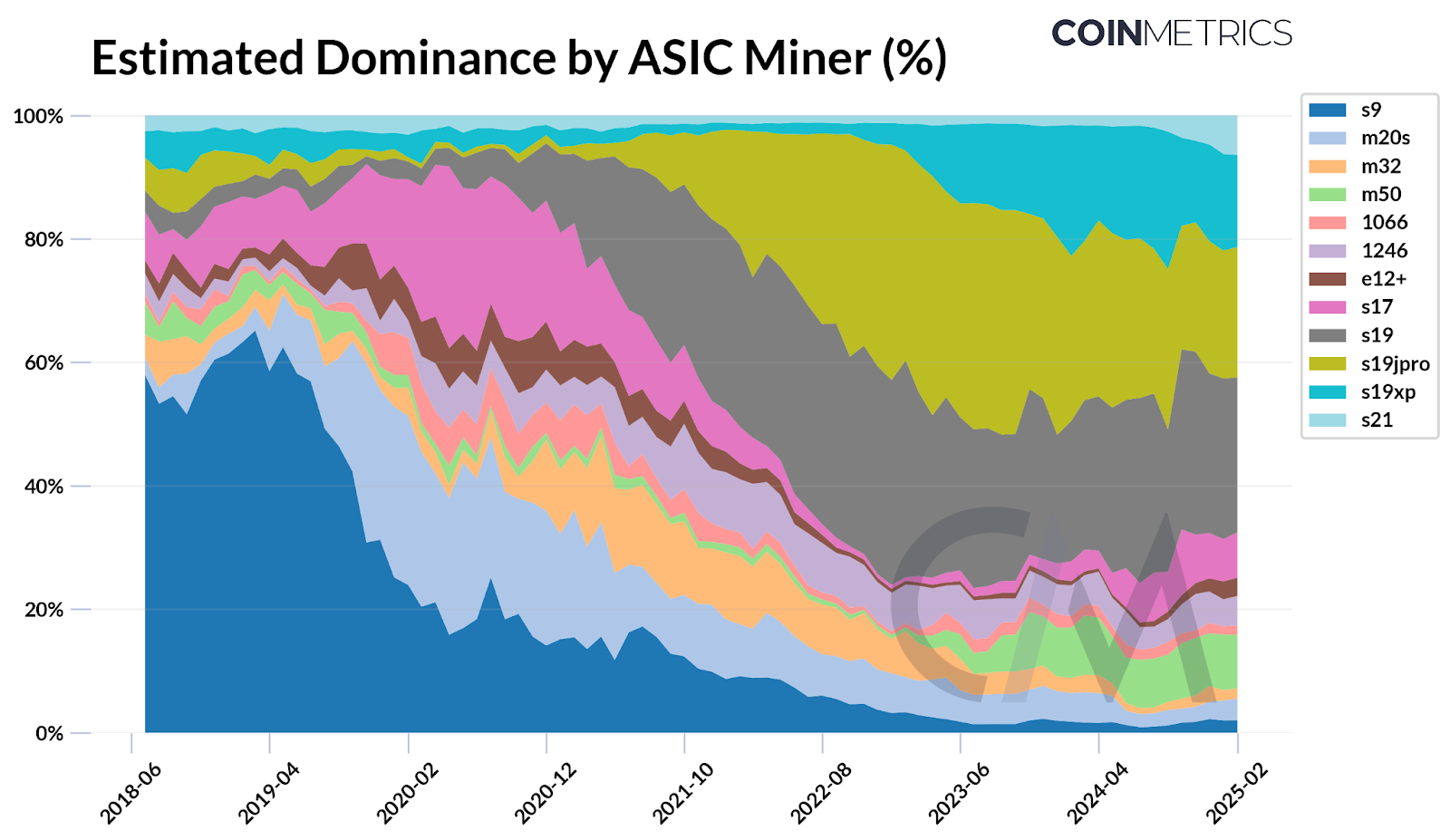

Another major obstacle for Bitcoin miners is trade restrictions, particularly in the US. According to CoinMetrics, ASIC miners produced by Bitmain, a Chinese company, account for approximately 59%–76% of Bitcoin’s total hashrate.

Bitmain has long been a dominant player in mining hardware, with popular models like the Antminer S19 and S21 known for their high efficiency. However, in early 2025, some US mining companies experienced delays in receiving Bitmain shipments due to tighter customs controls and new tariffs on Chinese imports.

“With Bitmain accounting for a majority of Bitcoin’s network hashrate, reliance on a single manufacturer, despite having distributed supply chains, presents a potential risk. Since Bitmain is primarily based in China, its dominance highlights how geopolitical dependencies can affect the stability of mining operations,” CoinMetrics reported.

These tariffs are not new. According to SCMP, the US has imposed duties of up to 27.6% on imported mining equipment from China since 2018.

However, recent measures indicate increasing regulatory scrutiny and trade pressures, further raising import costs for mining hardware. This inflates operational expenses for US-based miners and disrupts supply chains, limiting their ability to scale as global hashrate rises.

Recently, Hut 8 Corp., a Bitcoin mining and high-performance computing infrastructure firm, partnered with Eric Trump and Donald Trump Jr. to establish American Bitcoin Corp.

The company aims to become the largest and most efficient pure-play Bitcoin mining operation globally while building a strong strategic Bitcoin reserve. This move highlights the increasing interest from US institutional investors in the competitive mining industry.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoTop 3 Made in USA Coins to Watch This Week

-

Market23 hours ago

Market23 hours agoSolana (SOL) Price Risks Dip Below $110 as Bears Gain Control

-

Altcoin18 hours ago

Altcoin18 hours agoCardano Price Eyes Massive Pump In May Following Cyclical Patern From 2024

-

Market14 hours ago

Market14 hours agoBitcoin Bears Tighten Grip—Where’s the Next Support?

-

Market13 hours ago

Market13 hours agoEthereum Price Weakens—Can Bulls Prevent a Major Breakdown?