Market

Hyperliquid Surpasses $1 Trillion in Perps Trading Volume

Decentralized perpetual exchange (DEX) Hyperliquid (HYPE) has reached a significant milestone, surpassing $1 trillion in total perpetual contract (perps) trading volume.

This achievement comes despite a broader market downturn, where major sectors have posted losses. While there has been slight growth today, it remains minimal, highlighting the market’s challenges.

Hyperliquid Dominates Perps Market

According to data from DeFiLlama, Hyperliquid perps’ cumulative trading volume has surged to $1.1 trillion. This rise in activity highlights its growing appeal among traders.

Furthermore, as reported by Dune Analytics, weekly volumes have ranged between $40 billion and $50 billion. In fact, the platform now commands over 60% of the market share among perps platforms, solidifying its position as a powerhouse in decentralized finance (DeFi).

Besides its market dominance, Hyperliquid has made headlines for being central to a major development. As BeInCrypto reported, the platform gained widespread attention after a whale trader opened a 40x leverage BTC short position worth $423 million, triggering a “whale hunt.”

Nonetheless, the developments have not done much for the platform’s native token, HYPE. Instead, it has been underperforming, maintaining a consistent downtrend.

Over the past day, it has depreciated by 3.4%. At press time, it traded at $12.9, marking lows not seen since December 2024. Moreover, the platform has faced increased scrutiny following concerns about potential money laundering.

Analyst Forecasts: Will HYPE Reach $100?

Despite these struggles, an analyst predicted that HYPE could reach $50-$100, citing its status as the leading crypto DEX and its high-throughput Layer 1 blockchain.

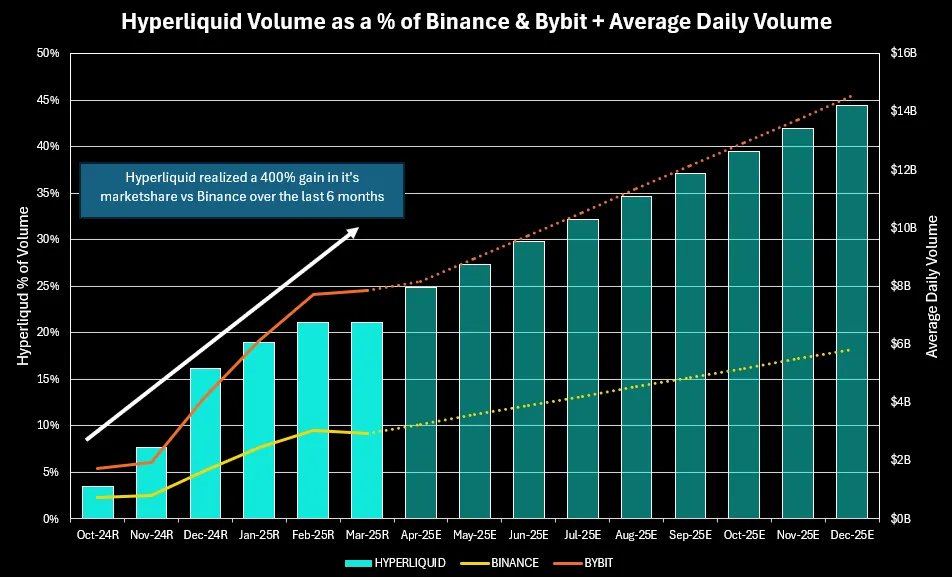

In the latest X (formerly Twitter), he highlighted Hyperliquid’s impressive growth. The platform averages $6.7 billion in daily volume, a significant increase from $1.1 billion in October. This surge has increased its market share relative to Binance, jumping from 2% to 9% in just six months.

“If Hyperliquid can maintain just a fraction of its growth rate, we could see it reach ~20% of Binance’s volumes by the end of the year,” the post read.

According to the analyst, this expansion could significantly boost the HYPE token’s valuation.

“If Hyperliquid is able to reach 20% of Binance’s volume, I think we could easily see $40-50 HYPE with the uptick in earnings and a slight multiple expansion,” he said.

He also highlighted several factors that could fuel Hyperliquid’s continued success. The recent addition of native spot Bitcoin (BTC) trading, coin margin functionality, and the possibility of launching a delta-neutral stablecoin are seen as major catalysts for future growth.

Another key development is the evolution of Hyperliquid’s Layer 1 blockchain ecosystem. The platform has attracted over 50 projects and holds over $2.3 billion in USDC and BTC deposits.

The analyst added that Hyperliquid has a strong potential to establish itself as the third most used blockchain, following Ethereum (ETH) and Solana (SOL), within the next few years.

“Given ETH and SOL are worth $230 billion and $75 billion, respectively what does that make Hyperliquid’s potential L1 valuation? Even at 15-25% of ETH or SOL, that adds another $10-50 to the token price. $50 for the perps/spot/stablecoin product + another $50 for the L1 and $100 HYPE seems possible,” he predicted.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

ZachXBT Warns of Rising North Korean Influence in Crypto

ZachXBT, a notorious sleuth in the crypto industry, has identified an “eye-opening” level of North Korean participation in the space. He claims that several decentralized protocols owe nearly all their trade volume to the DPRK.

ZachXBT discovered this network while trying to freeze transactions from the recent Bybit hack. He worries that the industry may not be capable of solving the problem, inviting anti-crypto regulations.

Extreme Level of North Korean Money Laundering Through Crypto

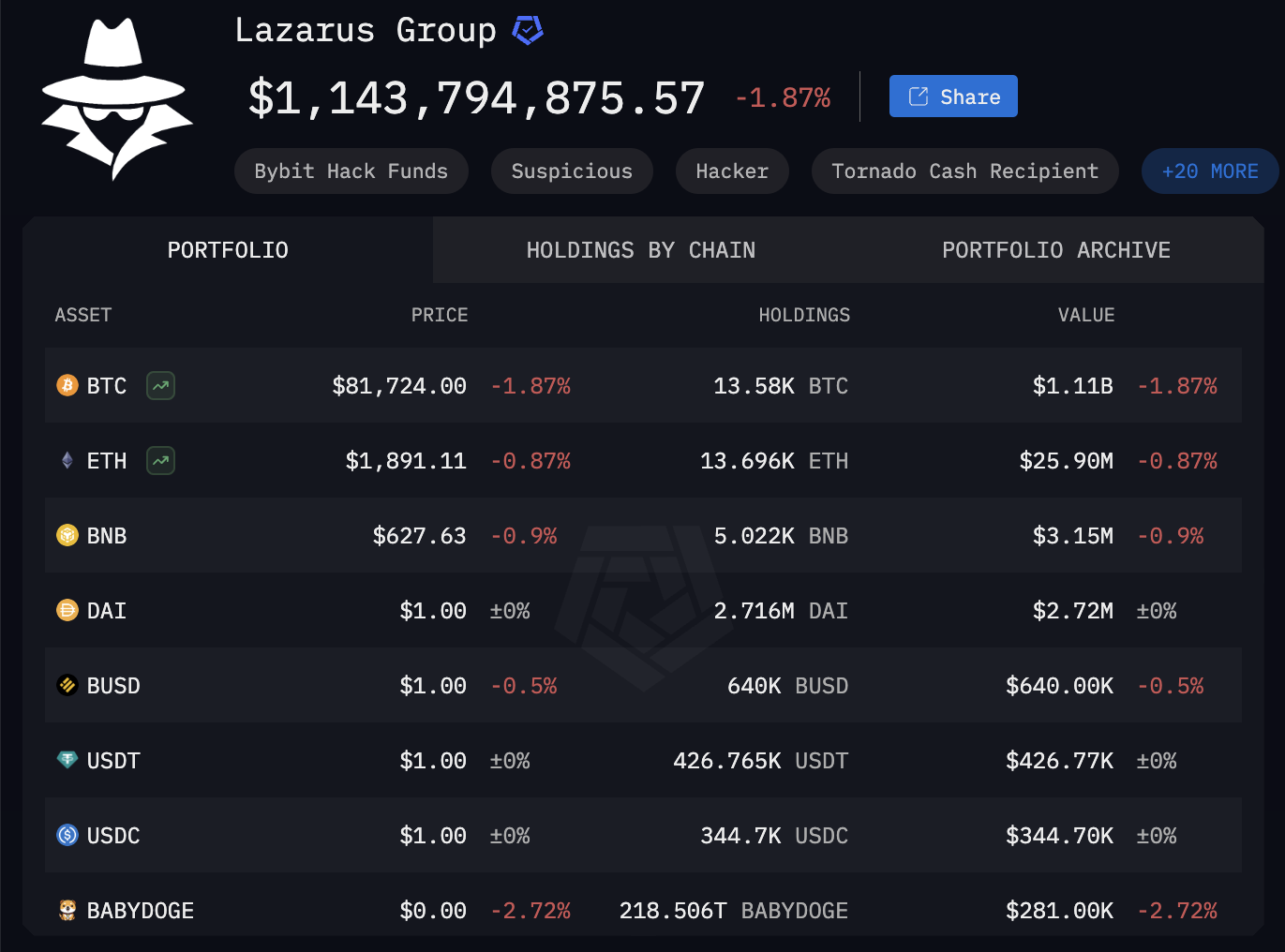

ZachXBT recently identified the North Korean Lazarus Group as the perpetrators of the Bybit hack. Although the group successfully laundered the stolen money, ZachXBT has persisted in trying to freeze assets and described an “eye-opening” network of North Korean activity in the DeFi space.

“Several ‘decentralized’ protocols have recently had nearly 100% of their monthly volume/fees from the DPRK. Centralized exchanges end up being worse, as when illicit funds flow through them, a few take multiple hours to respond when it only takes minutes to launder,” ZachXBT claimed via Telegram.

ZachXBT has pursued North Korean hacker activities on many occasions, and previously criticized Circle for its slow response in preventing money laundering.

The Bybit hack, the largest heist in crypto history, has highlighted the epidemic nature of the problem. THORChain and OKX were both criticized for facilitating Lazarus’ Bybit laundering.

Other data suggests that ZachXBT’s concerns about North Korean crypto networks are well-founded. Recent data from Arkham Intelligence suggests that North Korea is now the third-largest national crypto holder, behind the US and UK.

Although on-chain analysis can prove that North Korea has these assets, it’s practically impossible to speculate what exactly the country is doing with them.

The nation has been growing closer to Russia, which openly advocates for using crypto to evade sanctions. However, experts have only been able to speculate what North Korea is buying.

ZachXBT worries that North Korea has exposed how broken the crypto space is. He called KYT “completely flawed and easily evadable,” and said KYC is “just a honeypot for regular users” due to breaches and “useless in the majority of cases.”

Overall, it’s clear that North Korea is deeply embedded in the crypto space. Given the country’s reputation, it’s likely that these large proceeds from the crypto industry directly fund its military.

“This industry is unbelievably cooked when it comes to exploits/hacks. Sadly, I don’t know if the industry is going to fix this itself unless the government forcibly passes regulations that hurt our entire industry,” ZachXBT added.

Hopefully, the crypto community can find its own solutions and avoid harmful regulation and inevitable government overreach.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Analyst Reveals Next Major Support

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto analyst MadWhale has raised the possibility of the XRP price experiencing a breakdown below the crucial $2 support level. The analyst also revealed the next major support if XRP drops below this support level.

XRP Price Could Drop To $1.90 If It Loses $2 Support

In a TradingView post, MadWhale predicted that the XRP price could drop to the major support at $1.90 if it loses the psychological $2 level. He noted that XRP has demonstrated a classic triple-top formation, with each successive peak showing weaker momentum. In line with this, the analyst asserted that a break below the 42 threshold appears imminent as XRP nears a formidable resistance zone.

Related Reading

MadWhale further stated that the downward move is expected to extend to at least $1.9, representing an 18% decline. The analyst added that such a price decline aligns with the primary target and a key daily support level. Crypto analyst Ali Martinez had also suggested that XRP could drop to as low as $1.2 if it loses the $2 support.

The analyst revealed that the XRP price was forming a head-and-shoulders pattern on the weekly chart, which puts the $2 support level in the spotlight. His accompanying chart showed that the crypto could drop to $1.2 if it breaks below $2. However, despite this bearish outlook, other crypto analysts, such as Egrag Crypto, have highlighted some positive aspects of the XRP price.

Egrag Crypto stated that the XRP price’s dominance was showing tremendous strength and predicted that if it successfully closed above Fib 0.5, it could soon rally to the Fib 0.888 level. Crypto analyst Dark Defender predicted that XRP could rally to a new all-time high (ATH) if it continues to hold the crucial support levels at $2.04 and $2.22.

The Altcoin Still In Waiting Mode

Crypto analyst CasiTrades stated that the XRP price is holding strong but is still in waiting mode. She added that the bullish structure remains intact, with the altcoin holding above $2.26, which is the key .382 retracement support. The analyst noted that XRP’s price has spent some time flipping the consolidation to support, indicating that markets are setting up for the next move.

Related Reading

The crypto analyst revealed the $2.70 and $3.05 resistance levels and $2.25 support level as the key levels to watch. She remarked that the XRP price needs to flip $2.70 and $3.05 to become support for the confirmation of the next wave up. Meanwhile, CasiTrades suggested that XRP risks dropping to as low as $1.54 if it loses the lower support support at $1.90.

The crypto analyst also mentioned that the price needs to break above $3.40, its current ATH, to confirm a new trend. Until then, the wait for signs of confirmation continues, which she claimed may not be obvious until wave 3 in the market cycle. CasiTrades asserted that key Fib levels have been breached, and the market is on the edge of a breakout.

At the time of writing, the XRP price is trading at around $2.29, down over 2% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Medium, chart from Tradingview.com

Market

Bubblemaps (BMT) Surges 100% After Binance Listing and Airdrop

Binance is listing Bubblemaps (BMT), causing a 100% rally for the newly launched altcoin. The exchange also put BMT in its HODLer Airdrops program, further driving engagement and market interest.

BMT will provide key benefits to Bubblemaps, powering its analysis platform and allowing increased community participation in its research and investigations.

Binance to List and Airdrop Bubblemaps (BMT)

Bubblemaps, a renowned blockchain analytics platform, has been building its BMT token for months now. In January, it announced an upcoming token launch, and Binance hosted the TGE on PancakeSwap one week ago.

Now, Binance is listing BMT and adding it to the HODLer Airdrops program.

“Binance is excited to announce the 12th project on the HODLer Airdrops page – Bubblemaps (BMT). Users who subscribed their BNB to Simple Earn (Flexible and/or Locked) and/or On-Chain Yields products… will get the airdrops distribution. Binance will then list BMT at 2025-03-18 15:00 (UTC) and open trading,” the firm claimed in an announcement.

As the world’s largest crypto exchange, Binance listing always tends to boost token valuations. The exchange has also recently announced a new listing process based on community votes and interest.

At the time of writing, BMT price is up nearly 100% today, and its daily trading volume has surged 230%. Current market sentiment suggests significant hype and speculative around the new token.

Bubblemap’s data analytics tools have been instrumental in investigating crypto crimes, and it’s opening these to community participation. BMT holders will be able to submit cases and vote on on-chain research priorities through the new IntelDesk feature, helping decide new goals.

Meanwhile, BMT is the 12th asset to be in Binance’s HODLer Airdrops program. This program rewards BNB holders by periodically distributing free tokens from new projects.

This is mutually beneficial for both parties; Binance can reward its loyal users, and the exposure gives these new projects a real notoriety boost.

Ultimately, Bubblemaps’ token getting listed on Binance seems like a win for everybody. Sophisticated crypto investigations can be a thankless business, and BMT’s success directly subsidizes the platform’s work.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market15 hours ago

Market15 hours agoCardano (ADA) Bulls Advance as Sellers Lose Grip

-

Market17 hours ago

Market17 hours agoBinaryX Token Swap Drives 41% Price Rally

-

Bitcoin20 hours ago

Bitcoin20 hours agoPi Network, Trump Summit, XRP Commodity

-

Market19 hours ago

Market19 hours agoAre Bitcoin ATMs Becoming Illegal in 2025?

-

Market18 hours ago

Market18 hours agoPancakeSwap (CAKE) Surges 40%, Is the Buying Phase Over?

-

Bitcoin23 hours ago

Bitcoin23 hours agoFrench Banker Warns of Crypto-Induced Crisis

-

Altcoin18 hours ago

Altcoin18 hours agoXRP Price Targets $30 As Analyst Reveals Bullish Double Bottom Breakout

-

Market23 hours ago

Market23 hours agoCan Bulls Push Price to $0.26?