Market

How Trump’s Tariffs Impact Crypto and Bitcoin’s Potential

Trump’s tariff policies shook the crypto market last week. Though countries like Mexico and Canada achieved a one-month postponement, tariffs on China have already been enacted.

BeInCrypto spoke with Kristian Haralampiev, Structured Products Lead at Nexo, to understand why Trump’s tariffs caused markets to panic, what the crypto markets should expect 30 days from now, and the areas where the industry could find opportunities.

Trump Tariff Announcements Shake Crypto Market

In the first week of February, US President Trump announced that he would impose a 25% tariff on imports from Canada and Mexico and a 10% tariff on Chinese goods. Additionally, he applied a 10% levy on Canadian energy resources.

These announcements triggered widespread reactions across traditional and crypto markets. Though these tariffs were said to be effective this Tuesday, global financial markets began selling off the prior weekend in preparation.

Though cryptocurrency markets are not inherently tied to trade deficits in the same way equities might be, they still took a significant hit. Following Trump’s tariffs announcements, the total crypto market capitalization contracted by approximately 8% in just one day– falling to about $3.2 trillion.

Bitcoin dropped to a minimum of $91,281, while Ethereum fell as low as $2,143. These fluctuations resulted in billions being wiped from the market. According to Coinglass, total liquidations exceeded $2.23 billion in a 24-hour period. No digital asset went unharmed.

A day before the executive orders were to take effect, Trump agreed to suspend the tariffs against Mexico and Canada for one month. However, China and the US did not reach a negotiation, and the US’s 10% levy on Chinese imports went into effect.

The crypto markets responded favorably to these postponements. XRP, which had dropped by over 25% in response to Trump’s tariff announcements, quickly jumped up 6% after news of the 30-day pause. Meanwhile, Bitcoin surged to $102,599, fueled by renewed investor optimism.

However, several questions remain about what will happen to the crypto market one month from now, when the threat of tariffs is again on the table.

Tariffs’ Impact on Economy Dynamics

Tariffs are taxes on imports or exports that governments use to achieve strategic goals such as trade deals or to reduce trade deficits.

Regarding Trump’s tariffs, the US imports more goods from Canada, Mexico, and China than it exports, meaning it faces a trade deficit with all three countries.

The connection between trade deficits and tariffs is important because of the potential consequences for equities and cryptocurrencies. Tariffs can increase the prices of imported goods, potentially leading to inflation as these costs are passed on to consumers.

In turn, higher costs may decrease consumer demand for those goods, resulting in reduced imports and lower profits for foreign companies, potentially leading them to withdraw from the US market.

Consequently, tariffs could raise foreign goods prices, decrease import volumes, and diminish corporate profits, incentivizing investors to reduce their equity holdings, seek less risky investments, and lower their exposure to cryptocurrency.

The cryptocurrency market’s decline following Trump’s announcements illustrates this phenomenon.

While cryptocurrency and equity markets sometimes exhibit independent behavior, significant events can create broader market disruptions, impacting seemingly unrelated assets due to prevailing market sentiment.

A Possible Opportunity for Crypto

Amidst considerable market volatility, a JPMorgan Chase survey of institutional trading clients found that 51% predict inflation and tariffs will be the dominant forces shaping global markets in 2025. The survey also highlighted market volatility as a major concern, cited by 41% of respondents, a significant increase from 28% in 2024.

However, some industry experts have pointed to a silver lining.

According to Haralampiev, Trump tariff policies, while likely to create volatility in cryptocurrency markets, may also present opportunities for Bitcoin’s long-term rise.

“The introduction of steep tariffs, particularly on Chinese imports, would likely disrupt global tradeflows, increase production costs, and contribute to inflationary pressures. Historically, such economic shifts have driven investors toward alternative assets that serve as hedges against currency devaluation and macroeconomic uncertainty. Cryptocurrencies, particularly Bitcoin, have increasingly been viewed as having this potential, hinting at bullish signals for the asset class,” Haralampiev told BeInCrypto.

In other words, as economic tensions escalate, Bitcoin’s ascent will accelerate.

“All of this could become a tailwind for Bitcoin and leading cryptocurrencies, as their decentralized nature could be viewed as an attractive proposition for investors. If inflation remains high, demand for assets that serve as a hedge —such as Bitcoin— could increase, especially if the US government keeps signaling a willingness to incorporate digital assets into its broader economic strategy,” Haralampiev added.

Even though Bitcoin could hedge against the inflation created by tariffs, these policies would also generate significant supply chain disruptions.

Trump’s 10% levies on China, which are already in effect, create significant uncertainty given the role of Chinese imports in activities like cryptocurrency mining.

Following Trump’s tariff announcements, the share prices of Bitcoin mining companies MARA, Riot Platforms, and Hut 8 declined, with losses exceeding 8% in some cases. These losses made sense, given that Chinese companies dominate the industrial Bitcoin mining equipment market.

American Bitcoin mining companies rely heavily on Chinese-manufactured Integrated Circuits for Specific Applications (ASIC) equipment, which is used to optimize the mining process. Bitmain and MicroBT are among the main suppliers.

“The US mining industry relies heavily on specialized mining hardware from China, meaning higher tariffs could significantly increase equipment costs. This would temporarily squeeze profit margins for miners and potentially slow mining expansion in the short term. Should tariffs drive up costs in the short term, US-based miners could look to further optimize operations, embrace emerging technologies like immersion cooling, or seek partnerships with domestic hardware manufacturers to maintain competitiveness,” Haralampiev explained.

Haralampiev also suggested that this disruption to a key part of the cryptocurrency mining supply chain should be a wake-up call to the industry.

The Need for Domestic Manufacturers

The crypto industry has long recognized the need for increased domestic Bitcoin mining in the United States to lessen dependence on foreign suppliers. This reliance on overseas products has been criticized for hindering decentralization and weakening supply chain resilience.

Some industry players have already taken initiatives to enhance efficiency in the Bitcoin mining field. Last June, Auradine, a Silicon Valley-based Bitcoin miner manufacturer, strategically partnered with virtual power plant providers CPower and Voltus.

Auradine is an American company that develops ASIC units engineered in the United States. These units help miners optimize electricity consumption, offering a competitive advantage. Auradine aims to provide performance and integration through this partnership without relying on third-party components.

Yet, several projects like Auradine are needed to compete with established Chinese suppliers and fulfill the demand for manufacturing equipment required for Bitcoin mining.

“By making foreign mining equipment more expensive, tariffs could encourage investment in domestic mining technology and energy-efficient solutions. The US already has a competitive advantage in renewable energy sources, particularly in states like Texas, which have abundant wind and solar power,” Haralampiev said.

The United States will need to implement a similar strategy for artificial intelligence (AI) development.

US Reliance on Outsourced Semiconductors

The United States and China are in a tight-knit race to dominate AI technologies. Semiconductors play an important in this race. These small but crucial components play a significant role in determining global technological leadership.

Semiconductors are fundamental to modern technology, forming the basis of virtually all electronic devices. They enable the development of increasingly powerful and energy-efficient systems that drive innovation across industries.

These components are critical for expeditiously and accurately processing massive datasets, particularly in AI and data analytics. They power applications from predictive analytics to natural language processing, enabling data-driven insights and decision-making.

According to data from the Observatory of Economic Complexity, in 2022, the United States ranked as the world’s third-largest importer of semiconductor devices, with imports totaling $16.6 billion. The leading suppliers of these imports were Vietnam ($4.57 billion), Malaysia ($2.13 billion), Thailand ($1.66 billion), South Korea ($1.54 billion), and China ($962 million).

US semiconductor imports increased by 13% in value during early 2023 despite ongoing efforts to boost domestic production, according to Trade Finance Global. This increase demonstrates the nation’s continued dependence on foreign chip suppliers.

With Trump enacting tariffs on China, investors are also worried about their impact on semiconductor imports.

A Call for US-based Innovation

Similar to his argument regarding Bitcoin mining, Haralampiev contends that the United States must significantly increase efforts to onshore semiconductor manufacturing.

“By strategically investing in local semiconductor manufacturing and mining hardware production, the U.S. could reduce its reliance on Chinese imports and make its crypto-mining industry more self-sufficient,” he said.

By doing so, tariffs would have less of an impact.

“The US is also looking at advancements in AI, which means its semiconductor industry will eventually catch up in terms of cost-production, where it could currently lack, solidifying the country’s dominance in both mining infrastructure and chip production,” Haralampiev added.

Though Trump has not made any announcements about semiconductor production, he has announced other AI-related initiatives.

Last month, Trump announced Stargate, a $500 billion joint venture between Oracle, SoftBank, and OpenAI, to build massive data centers and infrastructure that support AI development.

However, it is presently unclear how much the federal government will contribute to this massive sum and how much will come from Stargate’s constituent companies.

Weathering the Storm

While Trump’s tariff policies have generated concern, Haralampiev views them as part of a recurring pattern of similar past events in US history.

“This transition aligns with a broader historical cycle of globalization vs. isolationism, where economies shift between prioritizing global integration and domestic self-reliance,” he told BeInCrypto.

He also noted that crypto-related industries have weathered comparable challenges and ultimately prevailed.

“Bitcoin mining has historically proven to be highly adaptable in the face of policy shifts, such as China’s mining ban in 2021, which saw a rapid relocation of mining infrastructure to North America and Central Asia,” Haralampiev added.

Future economic scenarios are uncertain, but their potential impact on cryptocurrency markets is clear. Whether that impact is positive or negative will depend on how these scenarios develop.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Early Investors Continue To Sell As Price Holds Above $2

XRP has struggled to secure growth in recent days, with the altcoin failing to maintain key support levels. Despite an attempted price rally, XRP has been unable to break through the $2.32 level, leaving the price hovering just above $2.00.

Those who bought during XRP’s three-week bull run are now facing losses after the failed breach of crucial barriers.

XRP Holders Are Facing Challenges

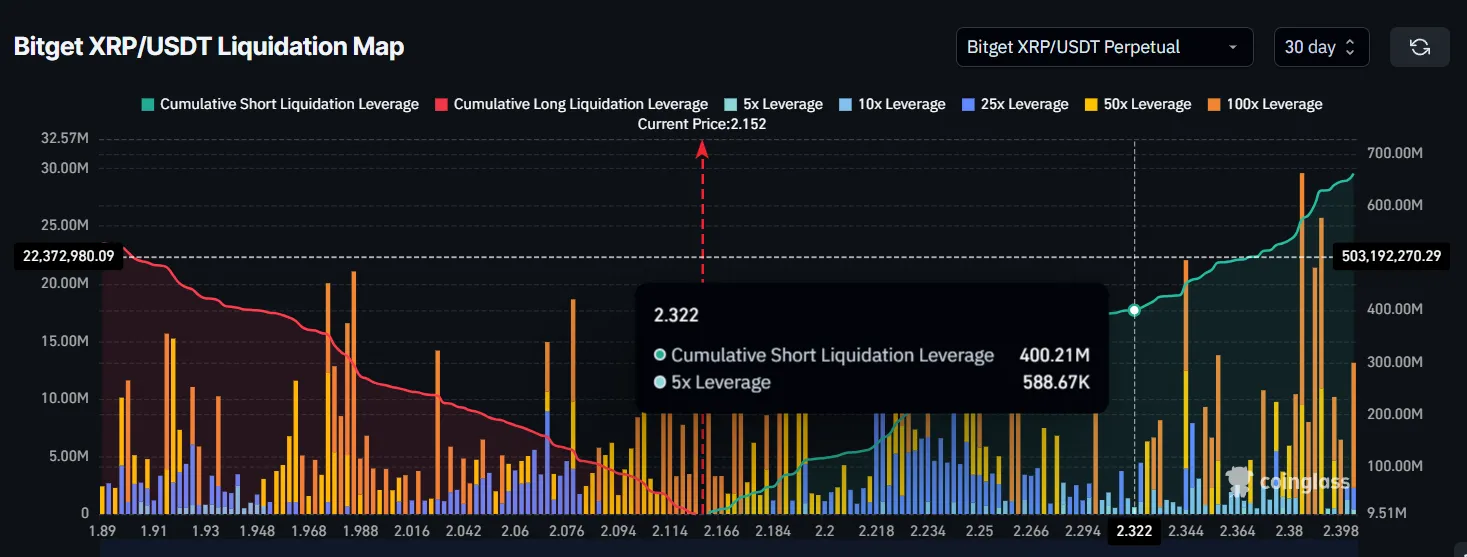

The liquidation map shows that a significant amount of short positions—around $400 million worth—are at risk of liquidation should XRP’s price rise to $2.32. However, even with XRP trading at $2.15, just 8% away from the threshold of $2.32, the potential for liquidations does not appear imminent.

The behavior of XRP’s investors suggests that these liquidations may not take place in the short term. This is because XRP holders are primarily leaning towards selling over HODLing at the moment.

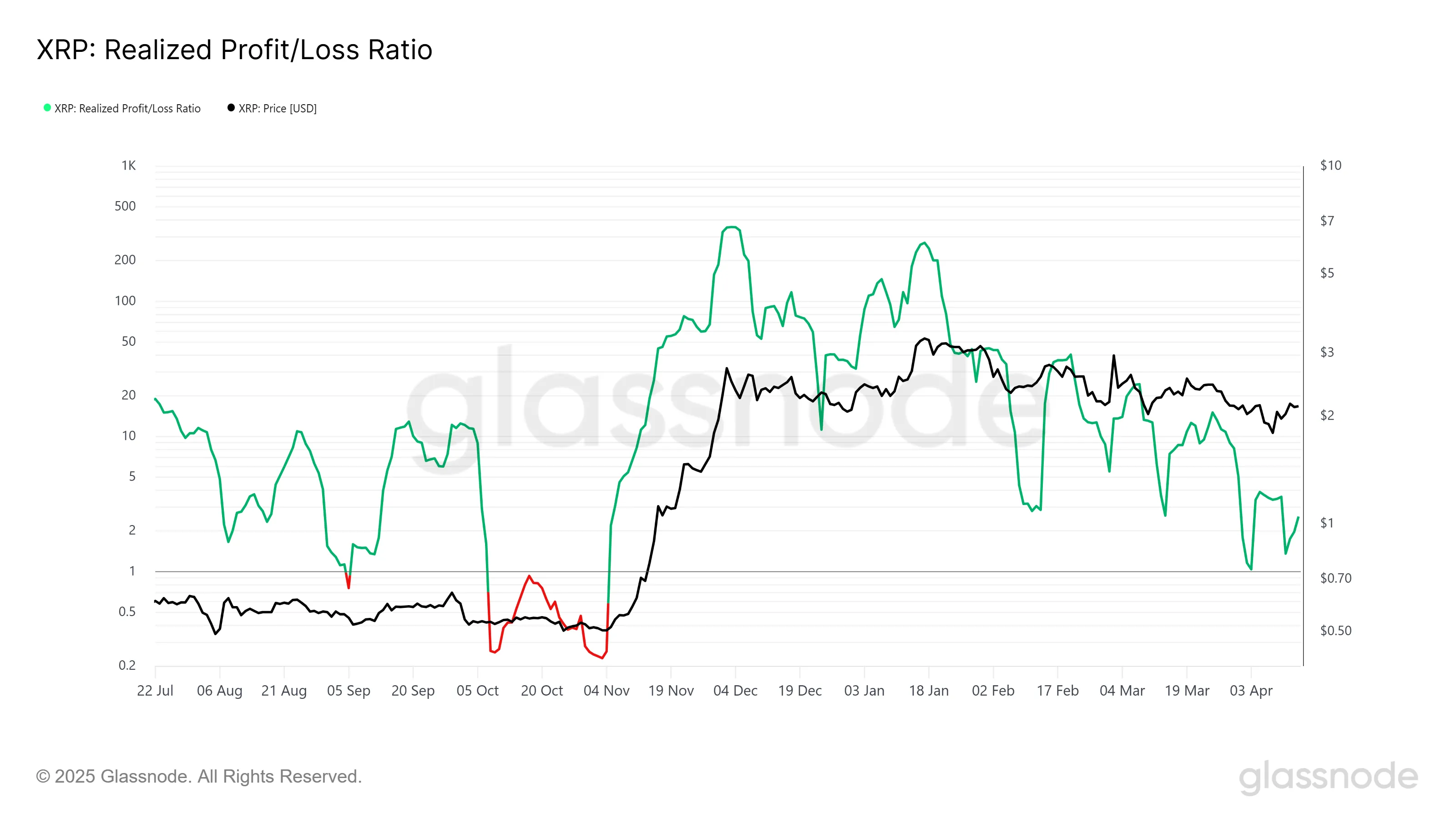

XRP’s overall momentum is showing signs of weakening, as reflected by the Realized Profit/Loss ratio. This indicator suggests that realized profits are declining and may soon turn into losses. The supply being sold likely originated from purchases made during XRP’s November 2024 bull run when the price surged to $2.

XRP formed a new high back in January; however, since then, XRP’s price has dropped back to $2, and many investors who bought at higher levels are now selling to offset losses. This ongoing selling pressure is keeping XRP from experiencing any significant uptick, further dampening bullish sentiment.

XRP Price Looks To Breakout

XRP is currently trading at $2.15, just below the $2.16 local resistance level, which it failed to secure as support earlier this month. The altcoin is consolidating beneath $2.27, a resistance level that has been a point of contention since the end of March. If the price remains above the $2.00 support, it could stabilize at these levels, preventing further losses for investors.

The chances of continued consolidation seem high, as XRP holds above $2.00. This could keep the market relatively stable as investors wait for further signals to confirm the next move. With a lack of major catalysts, the price may fluctuate within this range.

However, should XRP breach the $2.27 resistance and rise toward $2.40, the earlier-mentioned liquidations could trigger a new wave of buying, potentially driving the price upward. This would provide a more bullish outlook and shift the market sentiment.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Omri Ross on How eToro Stands Out in the Crypto Exchange Arena

On the opening day of the 2025 edition of the Paris Blockchain Week, BeInCrypto had the opportunity to interview Omri Ross, Chief Blockchain Officer for eToro. He revealed that despite the current market condition, the firm’s upcoming IPO is still in the pipeline.

We discussed how the company positions itself in the crypto exchange market and how it tackles the security question for its users.

Omri Ross Sheds Light on the Positioning of eToro

eToro has been, for many years, a very innovative player in this market. All areas around are following and creating a social network for trading.

There is the idea that people would like to copy-trade each other and be happy to share information about their portfolios. I think the way, for example, that our popular investors are working together with the community is absolutely fascinating.

I remember, for example, my discussion at some of our client events; we see a lot of the investors are actually being in contact with people who follow them. There is much less distance. There is much more discussion about why they follow specific portfolios.

And eToro also helps with this element. eToro actually creates events where popular investors and customers meet each other. As a platform, we also have an educational element with the eToro Academy. We also do some podcasts together with them. I think this is really innovative and awesome.

In terms of products, you know, our CEO has always been very pro-crypto. We have had Bitcoin trading available at eToro since 2013, so it is fairly early. And for me, it’s always been a pleasure to be in a place where you want to kind of push the funds; you want to bring to, in a regulated way, as many products as possible.

You know, customer protection and personal protection, but we are also trying to see how we can expose our customers to new products and innovations. And I think that that’s pretty unique, and we’re very proud of that.

How many Cryptos are Trading on eToro Right now?

We have more than 100 at the moment, with most of the big ones. However, we still don’t have so many stablecoins, but this is because we sort of see ourselves as a financial institution. We are looking into extending it and looking for ways to sort of allow our customers to reach more elements.

We also have an experimental area where you can experiment with more assets that may not necessarily be mature enough to be without the disclaimers. A big element for us is really how to communicate. On the one hand, we offer a lot of opportunities, but we are also trying to have people explore and understand what they investigate and work closely with regulators.

Is Copy Trading the Key Element of eToro?

100%. Also, many customers come to the discussions that appear on eToro to learn and discuss crypto with other people.

We also have smart portfolios where you follow specific trends and make it easier for people to invest. For example, we have a DeFi portfolio and a MetaMask portfolio. It’s also a very simple way for people to get exposed to a bigger sort of industry, which is also very transparent.

Yeah, so I think there is a lot of innovation around that, but it’s really helping retail [investors] get information and be able to easily, even in fiat, sort of invest in all of that.

Which Asset Category Seems to Have the Most Potential for eToro to Expand?

I would touch upon two subjects in this regard. The first element is we are a multi-asset platform.

One of, I think, the biggest advantages of using eToro is your ability to get exposed to many, many different sorts of asset classes in one place. You can also have the eToro money credit card in some countries that we support. We’re also seeing that when our customers use a larger amount of our products, they really benefit from that. So I think that’s a big part of the element.

I would also mention, in that regard, that a lot of our investors are somehow maybe Gen Z. We really see the potential of people to really follow what happens in the market, where they’re really interested in what happens in the market. Social networks are a big part of that.

You can follow others that you are interested in, you can comment on yourself and engage, as well as the fact that the world is a very interesting place, and things are changing daily. And to know that you can do crypto at eToro if that’s interesting, but also they are like, if they’re interested in oil and gas prices, or any other things, you have that as well. I think this is what is really special, that you can get exposed to a lot of stuff, learn about it, and all in one place.

Is Education the main Drive of how eToro Recruits new Customers?

Not necessarily. We mostly see that part of our goal as a company is to open financial markets for everybody and invest in a simple and transparent place. And for us, education is part of that.

We want to help our customers educate themselves, and with the hope that they choose to stay with us for many, many years to come. So this is a way for us to create a lot of opportunities.

We want to build a longer-term relationship and help customers prosper. Yeah, how we recruit different people really depends. Part of it is related to marketing, brand awareness, and many other aspects.

How eToro Focuses on the Security of the Platform

First, we work with top-net security experts, including ex-secret service people. Some of them are employed by eToro to deal with that element.

Secondly, especially around crypto, I can’t expose too much information because some of it is really classified. However, we work on different layers of security within a customer infrastructure. We try to keep a lot of client assets in what we describe as a “deep vault” with very secure elements. And it’s a big part of our infrastructure. It’s a big part of our discussion.

For any project, we take the fact that customers trust us extremely seriously with the funds. And we feel extremely fortunate for it.

Luckily for us, until today, we never had any issue with that. But there are a lot of elements around it. When you ask about innovation, it’s also one of the reasons why it may take a little bit longer for us to issue new projects; it is also because we take security extremely seriously with every element. That is a major part of the design.

Does eToro Use B2B Solutions For Security?

We think there are good B2B solutions. Again, when we work with vendors, also based on our size, they usually adapt to our requirements.

We work with some vendors who are from a security background, working in secret services, and building really insane secure elements. I learned a lot working with them and with their background. I wish I could tell you more about it, but for me, as an individual and not as a potential sort of employee, I think that it’s very interesting.

Because there are also discussions about the “not your keys, not your money” element. But also, having your own money has its risks. Holding a really large amount of money in some place at home can get ruined or stolen. There are so many risks; you can also have the risk of someone putting a gun to your head.

There are many social elements. And when I see the work that is done in the program, I’m very proud and impressed by the seriousness we take about that element. I think that’s part of the value we bring in. You know, being regulated and also really taking the customers’ funds and interests seriously.

What eToro Expects to Achieve During the Paris Blockchain Week?

I’ve been here some years back. And it’s grown so much I’m shocked!

I’ve been here for less than an hour today, and I’m like: “Wow!”. And you can really see the adoption here. Also, the French regulation is getting more into that, which is absolutely amazing.

And being at the Louvre, what else can you ask for? But I would also love to talk to a lot of companies to learn about innovation. Part of my role is building new products at eToro within crypto. But it’s also about talking to a lot of founders and crypto providers and seeing what else we can collaborate on and integrate with eToro. And always learn.

I’m very passionate about this specific market and blockchain. So I’m really looking forward to it. I may also catch up with some old friends that I haven’t seen for a while.

How can one Launch Their Crypto on eToro?

You don’t necessarily have to reach out to anyone. We are obviously following the market very closely.

As I mentioned before, being regulated, we’ve taken our clients’ interests very seriously. Often, our processes may be a bit longer than those of some unregulated blockchain platforms.

First, you’d be invited to talk to me or some of our listing or trading committee members. We’re always excited to hear and learn about your new crypto.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network Price Rise To $1 is Now In The Hands Of Bitcoin

Pi Network’s price has shown signs of recovery in recent days, reaching a two-week high after a notable uptrend.

However, despite this progress, the cryptocurrency’s growth appears heavily dependent on external factors, particularly Bitcoin’s price movements. As a result, its future direction remains closely tied to the crypto king’s performance.

Pi Network Could Keep The Uptrend Going

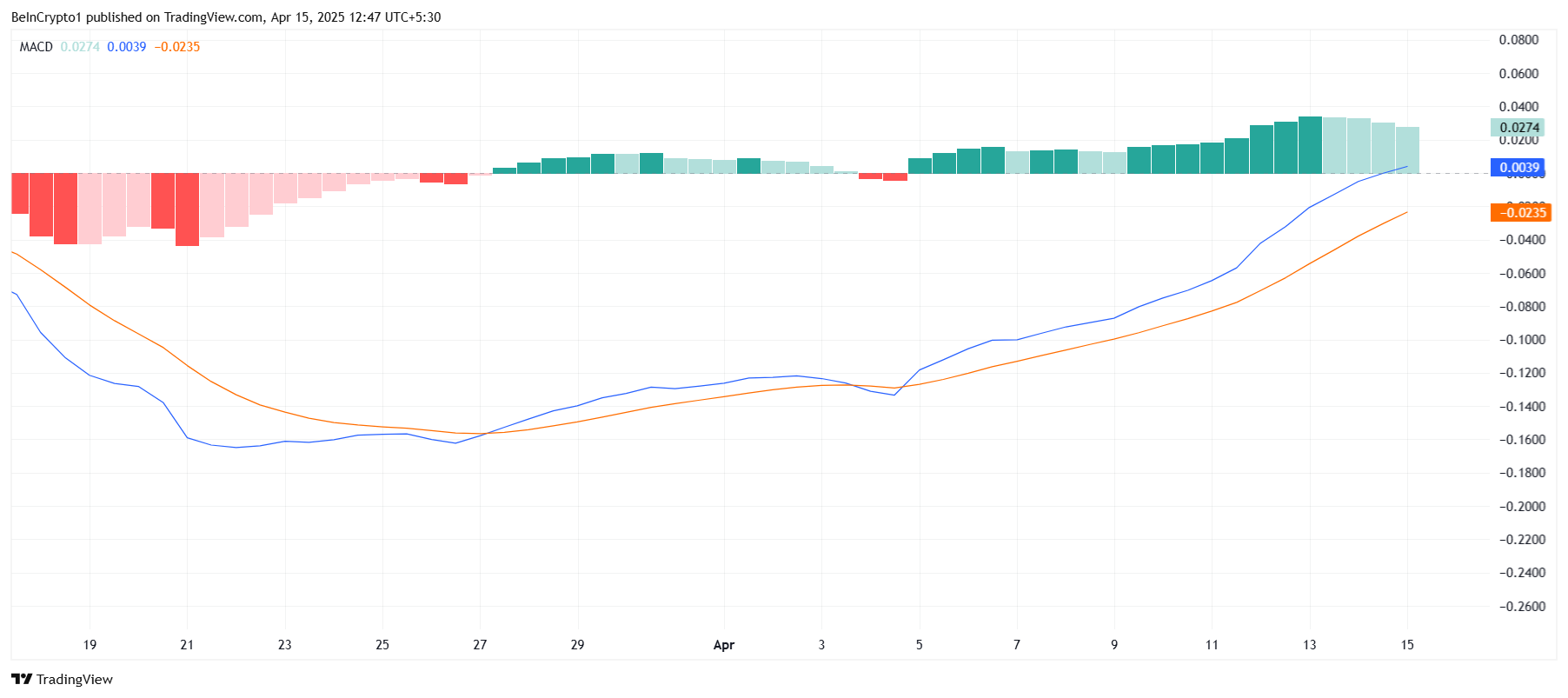

The Moving Average Convergence Divergence (MACD) indicator suggests that while Pi Network’s bullish momentum is beginning to fade, it has not yet reversed course. The indicator remains in positive territory, signaling that there is still potential for continued upward movement. The MACD is far from a bearish crossover, which could suggest that Pi still has room to rise in the short term.

Despite a slight weakening in bullish momentum, the overall outlook for Pi Network remains positive. The current trend still shows that there is enough strength for the altcoin to maintain its uptrend and push higher, particularly if market conditions support its growth.

Pi Network has shown a strong correlation with Bitcoin, standing at 0.84. This suggests that Pi closely follows the movements of Bitcoin, with its price trajectory highly influenced by the performance of the crypto market leader. As Bitcoin holds steady above $85,000, it could act as a strong catalyst for Pi’s price growth.

Given Bitcoin’s ongoing strength, Pi Network has the potential to experience a similar upward movement, especially if BTC continues to see positive price action. Pi’s dependence on Bitcoin’s market performance is evident, and any sustained rise in Bitcoin could trigger a corresponding rise in Pi Network’s value.

PI Price is Aiming At $1

Pi Network is currently trading at $0.74, up by 26% over the past five days. To maintain this positive momentum, Pi must hold above the $0.70 support level. A bounce off this level would allow the altcoin to continue its rise and potentially test the next resistance level at $0.87.

If Pi successfully breaches $0.87, it could open the door for further gains, with a potential move toward $1.00. The market sentiment and Bitcoin’s continued strength could fuel this upward momentum, bringing Pi closer to its key target. A break above this resistance would signify the start of a more substantial rally.

However, should Bitcoin experience a decline, Pi Network may follow suit. A drop through the $0.70 support level could lead Pi to test the $0.60 mark, and a further fall through this point would likely bring the price down to $0.51. This would invalidate the bullish outlook and signal a potential reversal in Pi’s price trend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoMENAKI Leads Cat Themed Tokens

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Price Threatened With Sharp Drop To $1,400, Here’s Why

-

Market16 hours ago

Market16 hours agoBinance Futures Causes a Brief Crash For Story (IP) and ACT

-

Market20 hours ago

Market20 hours agoTether Deploys Hashrate in OCEAN Bitcoin Mining Pool

-

Market19 hours ago

Market19 hours ago3 Altcoins to Watch in the Third Week of April 2025

-

Market17 hours ago

Market17 hours agoXRP Jumps 22% in 7 Days as Bullish Momentum Builds

-

Market23 hours ago

Market23 hours agoSEC Delays Decision on Grayscale Ethereum ETF Staking

-

Market14 hours ago

Market14 hours agoIs The XRP Price Mirroring Bitcoin’s Macro Action? Analyst Maps Out How It Could Get To $71