Market

How Token Launch Frenzy Is Delaying 2025 Altcoin Season

The arrival of an altcoin season is often tied to Bitcoin’s performance. As money flows out of BTC and into altcoins, this triggers a rise in altcoin prices.

However, this cycle is delayed by factors beyond Bitcoin. One such factor is the recent surge in token generation events (TGEs).

Rise in TGEs – A Boon or a Bane?

In the past four and a half months, 45 new tokens have launched, with most failing to provide decent returns. Many tokens launched in 2025 failed to sustain growth post-listing, raising the question of whether this trend is driven by bearish macroeconomic conditions or the lack of fundamental value in these tokens. This is turning altcoins into speculative assets driven by momentum.

Talking to BeInCrypto, Vincent Liu, CIO of Kronos Research, shed light on this question.

“Relentless token launches, especially meme coins, diluted liquidity and fragmented investor attention. Simultaneously, macro headwinds like rising interest rates and a global shift to risk-off sentiment throttled speculative capital. Tokens lacking utility, clear roadmaps, or sustainable ecosystems were quickly repriced in line with growing investor skepticism,” Liu explained.

One of the few successful launches with strong ROI has been Solayer (LAYER). Since its February launch, LAYER has posted an 88% rise and is currently trading just under $2.00.

Altcoin Season Delayed, But Narratives Continue to Grow

The altcoin season index currently stands at 16, indicating Bitcoin’s dominance. Rapid token launches and post-listing failures are contributing to the delay.

However, Liu noted that niche categories like AI-linked tokens continue to show strong demand despite the broader market conditions.

“While a full-fledged altcoin season hasn’t materialized, niche categories like AI-integrated meme coins and emerging tech narratives have shown signs of strength. Many token launches still suffer from inflated valuations and weak fundamentals, diluting capital and stalling broader momentum. Yet AI-linked narratives continue to attract attention not just from crypto natives, but also from traditional finance. Altcoin season isn’t gone, it’s simply evolving,” Liu said.

Despite the delay, the potential for an altcoin season remains. However, 75% of the top 50 altcoins would need to outperform Bitcoin to signal a true shift, which is not the case at the moment.

Are Market Makers Feeding TGE Hype?

Arthur Cheong, founder and CEO of DeFiance Capital, recently raised concerns over TGEs. He highlighted the risk of projects and market makers working together to inflate token prices artificially. This can distort market behavior and undermine investor confidence.

“You don’t know whether the price is a result of organic demand and supply or simply due to projects and market makers colluding to fix the price for other objectives. Absolutely bizarre that CEXs are turning a blind eye to this and altcoin markets are becoming more and more like a lemon market where confidence gets lesser,” Cheong tweeted.

Responding to this, Vincent Liu suggested that there needs to be reforms in the way that token launches are approached.

“…the issue of artificially inflated token prices before launch presents a growing concern. While these short-term surges might attract initial attention, they often undermine long-term investor confidence. To mitigate this, the industry must champion greater transparency around partner agreements, listing criteria, and pre-launch disclosures. Clear communication about a project’s structure, roadmap, and market cap expectations is essential to building a sustainable and trustworthy ecosystem,” Liu said.

Liu believes addressing this problem requires collaboration from market makers, centralized exchanges (CEXs), and investors.

“By conducting thorough research into the fundamentals of new projects, investors can protect themselves from significant losses and identify valuable tokens in the long run,” Liu concluded.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dogecoin Defies Bullish Bets During Dogeday Celebration

On April 20, Dogecoin enthusiasts worldwide united to mark Dogeday, a community-driven holiday celebrating the world’s most recognizable meme coin.

While the festivities showcased the coin’s loyal fanbase and cultural relevance, the celebration failed to spark any meaningful market movement.

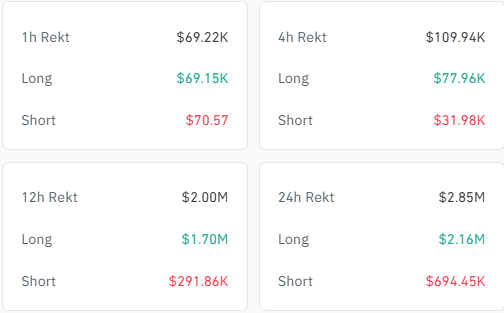

Dogeday Fails to Lift Dogecoin Price as Traders Face $2.8 Million in Liquidations

Instead of riding a wave of positive sentiment, Dogecoin was the worst-performing asset among the top 20 cryptocurrencies during the past day.

According to data from BeInCrypto, the token dropped over 2.5% during the reporting period compared to the muted performance of the general market.

This disappointing performance led to roughly $2.8 million in liquidations, with traders betting on an upward price movement losing more than $2 million, per Coinglass figures.

However, even with the lackluster price action, Dogecoin’s relevance in the crypto ecosystem remains undeniable. Launched in 2013 as a parody of Bitcoin, DOGE has grown far beyond its meme origins.

The digital asset is now the ninth-largest cryptocurrency by market capitalization, currently valued at approximately $22.9 billion, according to CoinMarketCap.

Much of its growth can be attributed to high-profile endorsements. Tesla CEO and presidential advisor Elon Musk has repeatedly voiced support for Dogecoin, as has billionaire entrepreneur Mark Cuban. Their backing helped shift public perception of DOGE from a joke to a legitimate digital asset and payment option.

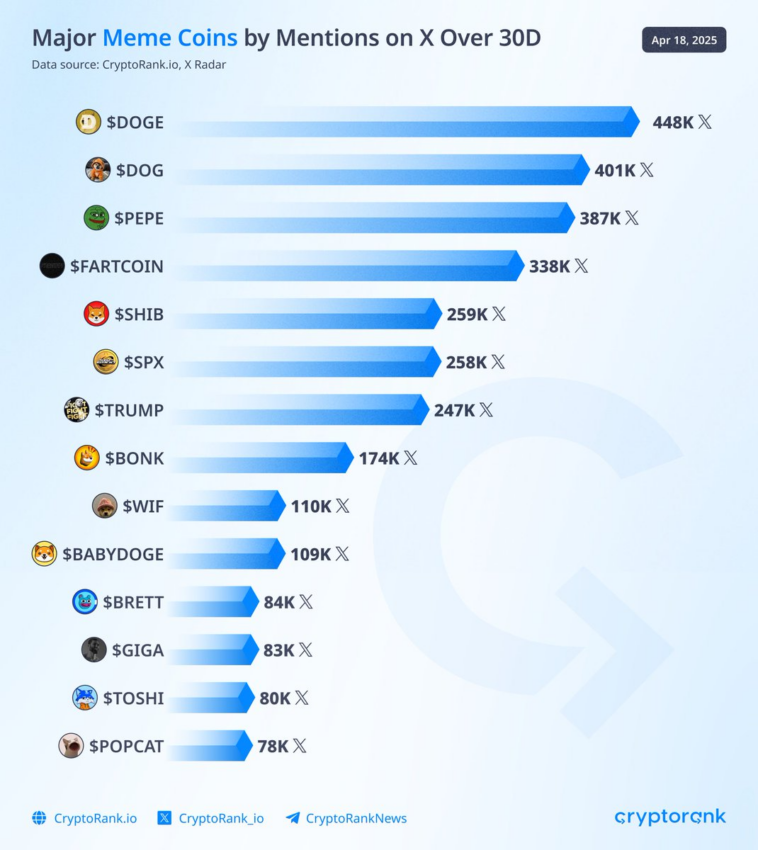

On social media, Dogecoin continues to lead the memecoin narrative. According to CryptoRank, it was the most mentioned memecoin ticker on X (formerly Twitter) in the past month. This visibility continues to fuel both community engagement and investor interest.

Moreover, institutional interest in Dogecoin is also on the rise. Major asset managers, including Bitwise, Grayscale, 21Shares, and Osprey, have submitted filings to the US Securities and Exchange Commission (SEC) seeking to launch spot Dogecoin ETFs.

If granted, these financial investment vehicles could become the first exchange-traded funds centered entirely on a meme coin.

Considering this, crypto bettors on Polymarket put the odds of these products’ approval above 55% this year. This optimism reflects a growing belief that Dogecoin could soon secure a place in mainstream financial markets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Tokens Big Players Are Buying

Crypto whales are making bold moves heading into May 2025, and three tokens are standing out: Ethereum (ETH), Artificial Superintelligence Alliance (FET), and Onyxcoin (XCN). All three have seen a noticeable uptick in large-holder accumulation over the last week, signaling growing interest from big players despite recent volatility.

While ETH and XCN are both coming off sharp corrections, whale buying suggests confidence in a potential rebound. Meanwhile, FET is riding renewed momentum in the AI sector, with whale activity accelerating alongside rising prices.

Ethereum (ETH)

The number of Ethereum crypto whales—wallets holding between 1,000 and 10,000 ETH—has been steadily climbing since April 15. Back then, there were 5,432 such addresses.

That number has now risen to 5,460, the highest count since August 2023. At the same time, the concentration of ETH held by these whales is also hitting new highs, signaling growing accumulation by large holders.

While this can be interpreted as confidence in Ethereum’s long-term value, it also raises concerns about centralization and potential selling pressure if whales decide to take profits.

Ethereum price is currently down more than 19% over the last 30 days. If the correction continues, the price could retest support at $1,535. Losing that level might send ETH toward deeper support at $1,412 or even $1,385.

However, if the trend reverses, key resistance zones lie at $1,669 and $1,749—with a potential push toward $1,954 if bullish momentum builds.

In this context, the growing dominance of whales could act as either a stabilizing force or a looming risk, depending on how they respond to market shifts.

Artificial Superintelligence Alliance (FET)

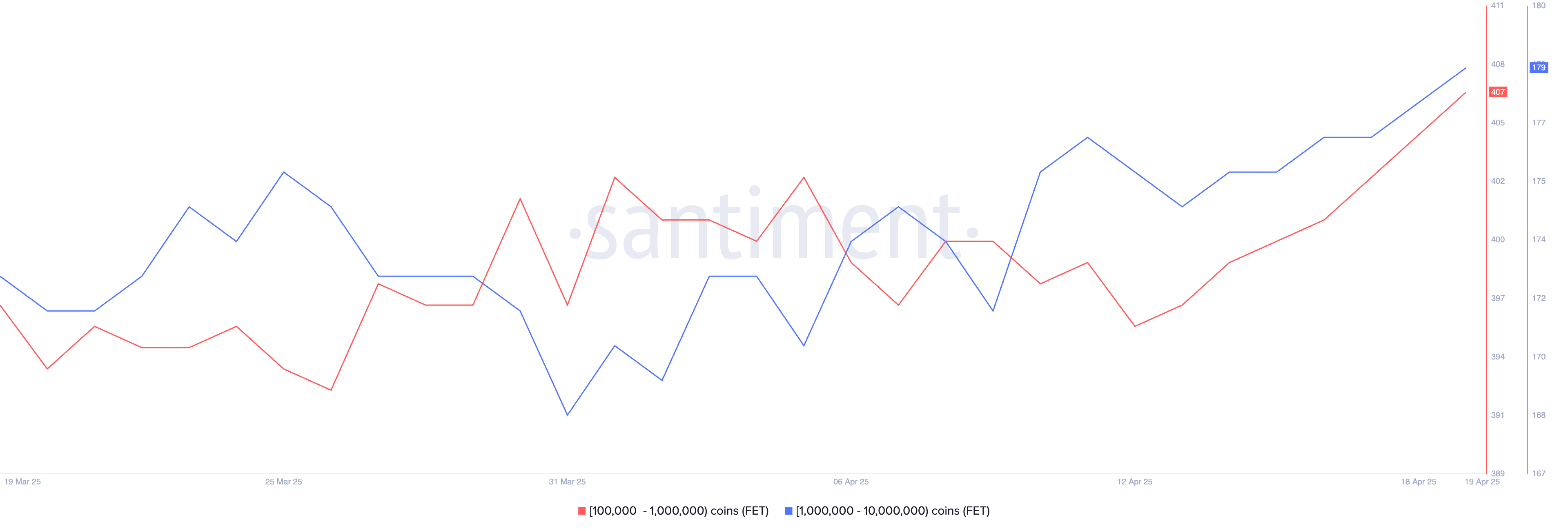

The number of FET whales—wallets holding between 10,000 and 1,000,000 tokens—increased from 572 on April 13 to 586 by April 19.

This steady growth in large holders points to rising confidence among bigger players. It comes at a time when the broader AI crypto narrative is showing signs of a rebound.

Key AI coins like FET, TAO, and RENDER have all increased over 9% in the last seven days, with FET itself gaining more than 8% in the past 24 hours and 13.5% over the week. This suggests a possible comeback for the artificial intelligence narrative in crypto.

If this momentum continues, FET could push toward resistance at $0.659. A clean breakout from that level could open the door to further gains, with $0.77 and $0.82 as the next potential targets.

On the flip side, if the rally stalls, FET might drop back to test support at $0.54. A breakdown below that could send it as low as $0.44.

With whale activity heating up and the AI sector showing renewed strength, FET’s next move could be a key signal for where the narrative heads next.

Onyxcoin (XCN)

Onyxcoin was one of the standout performers in January, but its momentum has faded in recent months. After a strong bounce—up of over 57% in the last 30 days, the token is now correcting, down 19% in the past seven days.

Despite this pullback, accumulation continues. The number of crypto whales holding between 1 million and 10 million XCN has grown from 528 on April 16 to 541, suggesting some large holders may be buying the dip.

If the correction deepens, XCN could lose support at $0.0165. A drop below that may open the door to further declines toward $0.0139 and $0.0123.

But if the trend flips back upward, the token could first test resistance at $0.020. A strong breakout from there might lead to a move toward $0.027. With whale activity on the rise and volatility returning, XCN’s next move could be decisive.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

1 Year After Bitcoin Halving: What’s Different This Time?

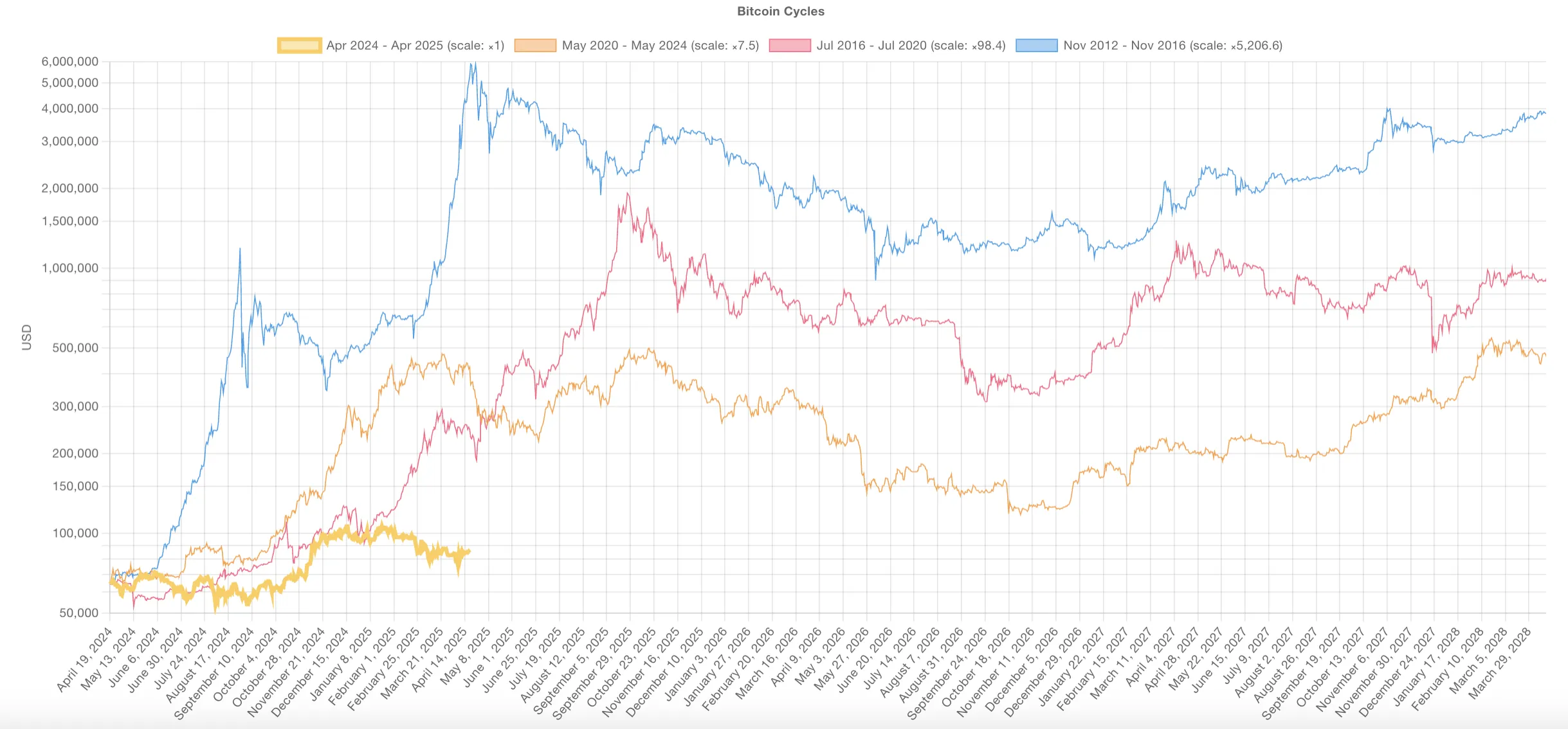

Bitcoin (BTC) is now one year past its most recent halving, and this cycle is shaping up to be unlike any before it. Unlike previous cycles where explosive rallies followed the halving, BTC has seen a far more muted gain, up just 31%, compared to 436% over the same timeframe in the last cycle.

At the same time, long-term holder metrics like the MVRV ratio are signaling a sharp decline in unrealized profits, pointing to a maturing market with compressing upside. Together, these shifts suggest Bitcoin may be entering a new era, defined less by parabolic peaks and more by gradual, institution-driven growth.

A Year After the Bitcoin Halving: A Cycle Unlike Any Other

This Bitcoin cycle is unfolding noticeably differently than previous ones, signaling a potential shift in how the market responds to halving events.

In earlier cycles—most notably from 2012 to 2016 and again from 2016 to 2020—Bitcoin tended to rally aggressively around this stage. The post-halving period was often marked by strong upward momentum and parabolic price action, largely fueled by retail enthusiasm and speculative demand.

The current cycle, however, has taken a different route. Instead of accelerating after the halving, the price surge began earlier, in October and December 2024, followed by consolidation in January 2025 and a correction in late February.

This front-loaded behavior diverges sharply from historical patterns where halvings typically acted as the catalyst for major rallies.

Several factors are contributing to this shift. Bitcoin is no longer just a retail-driven speculative asset—it’s increasingly seen as a maturing financial instrument. The growing involvement of institutional investors, coupled with macroeconomic pressures and structural changes in the market, has led to a more measured and complex response.

Another clear sign of this evolution is the weakening strength of each successive cycle. The explosive gains of the early years have become harder to replicate as Bitcoin’s market cap has grown. For instance, in the 2020–2024 cycle, Bitcoin had climbed 436% one year after the halving.

In contrast, this cycle has seen a much more modest 31% increase over the same timeframe.

This shift could mean Bitcoin is entering a new chapter. One with less wild volatility and more steady, long-term growth. The halving may no longer be the main driver. Other forces are taking over—rates, liquidity, and institutional money.

The game is changing. And so is the way Bitcoin moves.

Nonetheless, it’s important to note that previous cycles also featured periods of consolidation and correction before resuming their uptrend. While this phase may feel slower or less exciting, it could still represent a healthy reset before the next move higher.

That said, the possibility remains that this cycle will continue to diverge from historical patterns. Instead of a dramatic blow-off top, the outcome may be a more prolonged and structurally supported uptrend—less driven by hype, more by fundamentals.

What Long-Term Holder MVRV Reveals About Bitcoin’s Maturing Market

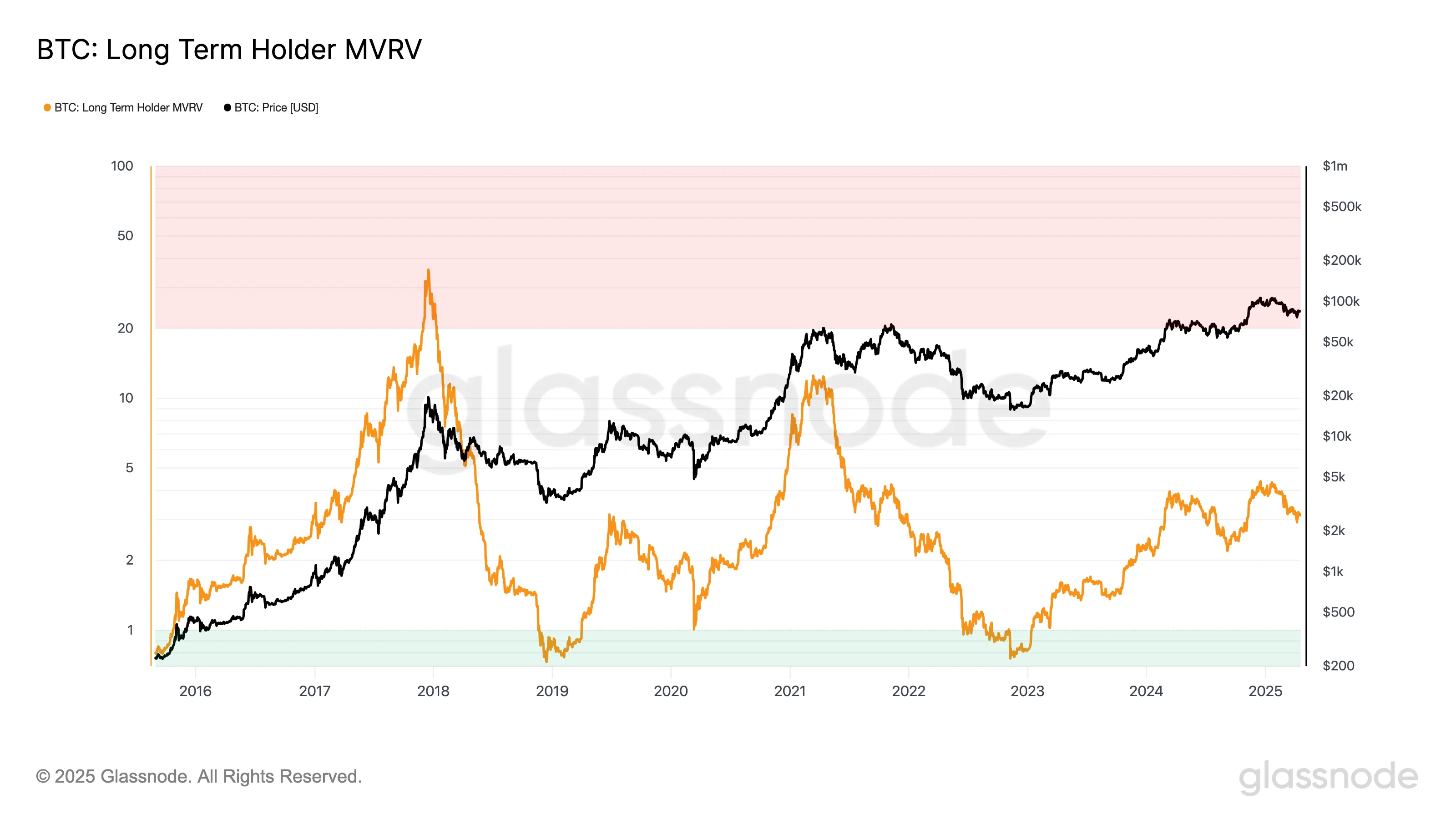

The Long-Term Holder (LTH) MVRV ratio has always been a solid measure of unrealized profits. It shows how much long-term investors are sitting on before they start selling. But over time, this number is falling.

In the 2016–2020 cycle, LTH MVRV peaked at 35.8. That signaled massive paper profits and a clear top forming. By the 2020–2024 cycle, the peak dropped sharply to 12.2. This happened even as Bitcoin price hit fresh all-time highs.

In the current cycle, the highest LTH MVRV so far is just 4.35. That’s a massive drop. It shows long-term holders aren’t seeing the same kind of gains. The trend is clear: each cycle delivers smaller multiples.

Bitcoin’s explosive upside is compressing. The market is maturing.

Now, in the current cycle, the highest LTH MVRV reading so far has been 4.35. This stark drop suggests long-term holders are experiencing much lower multiples on their holdings compared to previous cycles, even with substantial price appreciation. The pattern points to one conclusion: Bitcoin’s upside is compressing.

This isn’t just a fluke. As the market matures, explosive gains are naturally harder to come by. The days of extreme, cycle-driven profit multiples may be fading, replaced by more moderate—but potentially more stable—growth.

A growing market cap means it takes exponentially more capital to move the price significantly.

Still, it’s not definitive proof that this cycle has already topped out. Previous cycles often included extended periods of sideways movement or modest pullbacks before new highs were reached.

With institutions playing a larger role, accumulation phases could stretch longer. Therefore, peak profit-taking may be less abrupt than in earlier cycles.

However, if the trend of declining MVRV peaks continues, it could reinforce the idea that Bitcoin is transitioning away from wild, cyclical surges and toward a more subdued but structured growth pattern.

The sharpest gains may already be behind, especially for those entering late in the cycle.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin21 hours ago

Altcoin21 hours agoCardano Bulls Secure Most Important Signal To Drive Price Rally

-

Bitcoin17 hours ago

Bitcoin17 hours agoAnalyst Says Bitcoin Price Might Be Gearing Up For Next Big Move — What To Know

-

Bitcoin24 hours ago

Bitcoin24 hours agoSwiss Supermarket Chain Welcomes Crypto Payments

-

Market23 hours ago

Market23 hours ago5 Crucial Red Flags Investors Missed

-

Altcoin19 hours ago

Altcoin19 hours agoRipple Expands In Asia With Debut XRP Investment Tool

-

Altcoin16 hours ago

Altcoin16 hours agoExpert Reveals Why Consensus 2025 Will Be Pivotal For Pi Network

-

Altcoin13 hours ago

Altcoin13 hours agoUniswap Founder Urges Ethereum To Pursue Layer 2 Scaling To Compete With Solana

-

Market22 hours ago

Market22 hours agoSUI Ranks 5th in DEX Volume, But Rally Lacks Strength